Parker-Hannifin (PH)

Parker-Hannifin piques our interest. Despite its slow anticipated growth, its extremely profitable operations give it a high margin of safety.― StockStory Analyst Team

1. News

2. Summary

Why Parker-Hannifin Is Interesting

Founded in 1917, Parker Hannifin (NYSE:PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

- Healthy operating margin shows it’s a well-run company with efficient processes, and its profits increased over the last five years as it scaled

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 20.7% over the last five years outstripped its revenue performance

- One pitfall is its absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Parker-Hannifin is close to becoming a high-quality business. The stock is up 227% over the last five years.

Why Should You Watch Parker-Hannifin

High Quality

Investable

Underperform

Why Should You Watch Parker-Hannifin

At $944.18 per share, Parker-Hannifin trades at 30.4x forward P/E. This valuation represents a premium to industrials peers.

Parker-Hannifin could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Parker-Hannifin (PH) Research Report: Q3 CY2025 Update

Industrial machinery company Parker-Hannifin (NYSE:PH) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3.7% year on year to $5.08 billion. Its non-GAAP profit of $7.22 per share was 9% above analysts’ consensus estimates.

Parker-Hannifin (PH) Q3 CY2025 Highlights:

- Revenue: $5.08 billion vs analyst estimates of $4.94 billion (3.7% year-on-year growth, 2.9% beat)

- Adjusted EPS: $7.22 vs analyst estimates of $6.62 (9% beat)

- Adjusted EBITDA: $1.27 billion vs analyst estimates of $1.28 billion (24.9% margin, 1.4% miss)

- Management raised its full-year Adjusted EPS guidance to $30 at the midpoint, a 3.8% increase

- Operating Margin: 20.3%, in line with the same quarter last year

- Free Cash Flow Margin: 13.6%, similar to the same quarter last year

- Organic Revenue rose 5% year on year vs analyst estimates of 2.1% growth (294.7 basis point beat)

- Market Capitalization: $97.96 billion

Company Overview

Founded in 1917, Parker Hannifin (NYSE:PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Initially, the company developed pneumatic brake systems for trucks, trains, buses, and industrial equipment, along with leak-proof fittings for early airplanes. Today, Parker Hannifin is a global motion and control technologies company, providing a variety of products across two main categories: industrial products and aerospace systems.

These products come either standard or custom-engineered and include high-temperature metal seals, valves, fluid connectors, natural gas filters, sensors, and brake control systems. They are typically sold to OEMs and distributors who serve various industries including manufacturing, packaging, processing, and transportation. For the aerospace industry, products are sold to both the commercial and military markets.

Parker-Hannifin primarily generates revenue from the one-time sale of its goods, with the majority of revenue coming from its industrial products segment. The company also delivers aftermarket services for its aerospace products through regional sales organizations, creating additional revenue streams. It goes to market globally through field sales employees and independent distributors.

Due to the many products and industries the company serves, Parker-Hannifin employs a decentralized business model, where its brands are given autonomy. This allows the company to react faster to market changes and stay nimble.

The company utilizes an M&A strategy focused on selective, targeted acquisitions rather than a mass acquisition approach. For instance, Parker purchased Meggitt, an aerospace company, in 2021 for $8.8 billion.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Eaton Corporation (NYSE:ETN), Emerson Electric (NYSE:EMR), Honeywell (NYSE:HON), Danaher (NYSE:DHR), and 3M (NYSE:MMM).

5. Revenue Growth

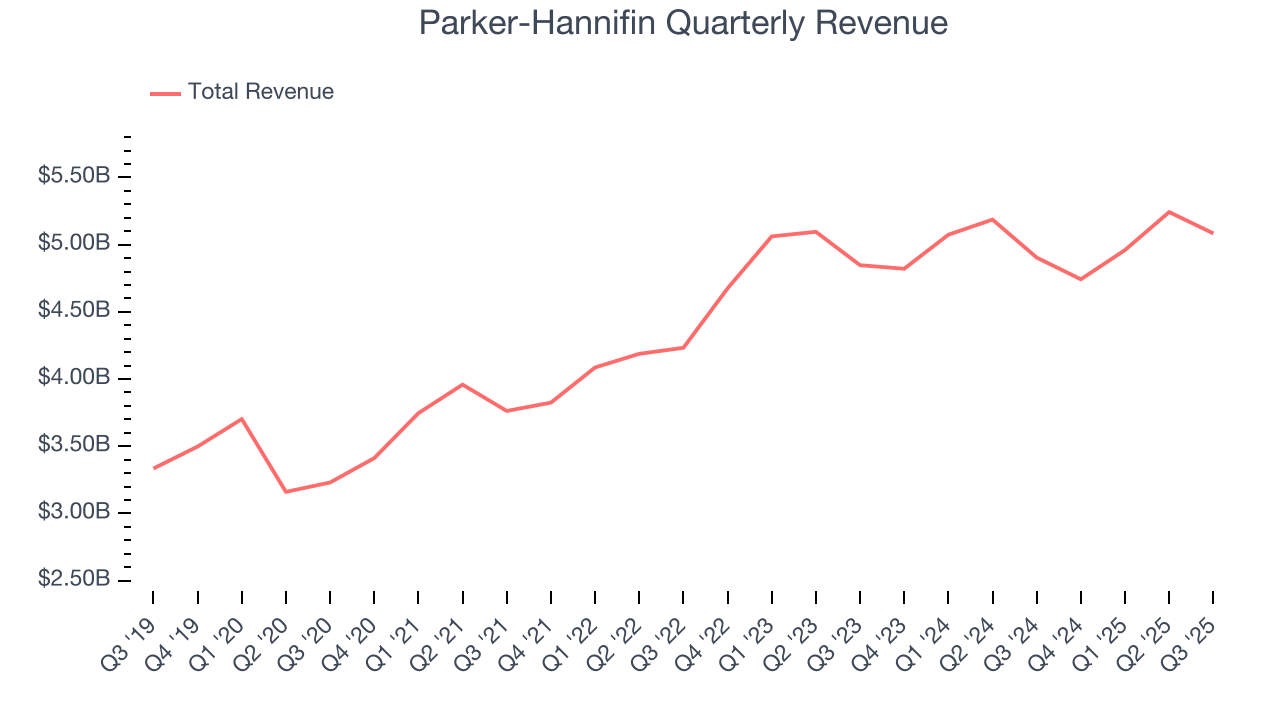

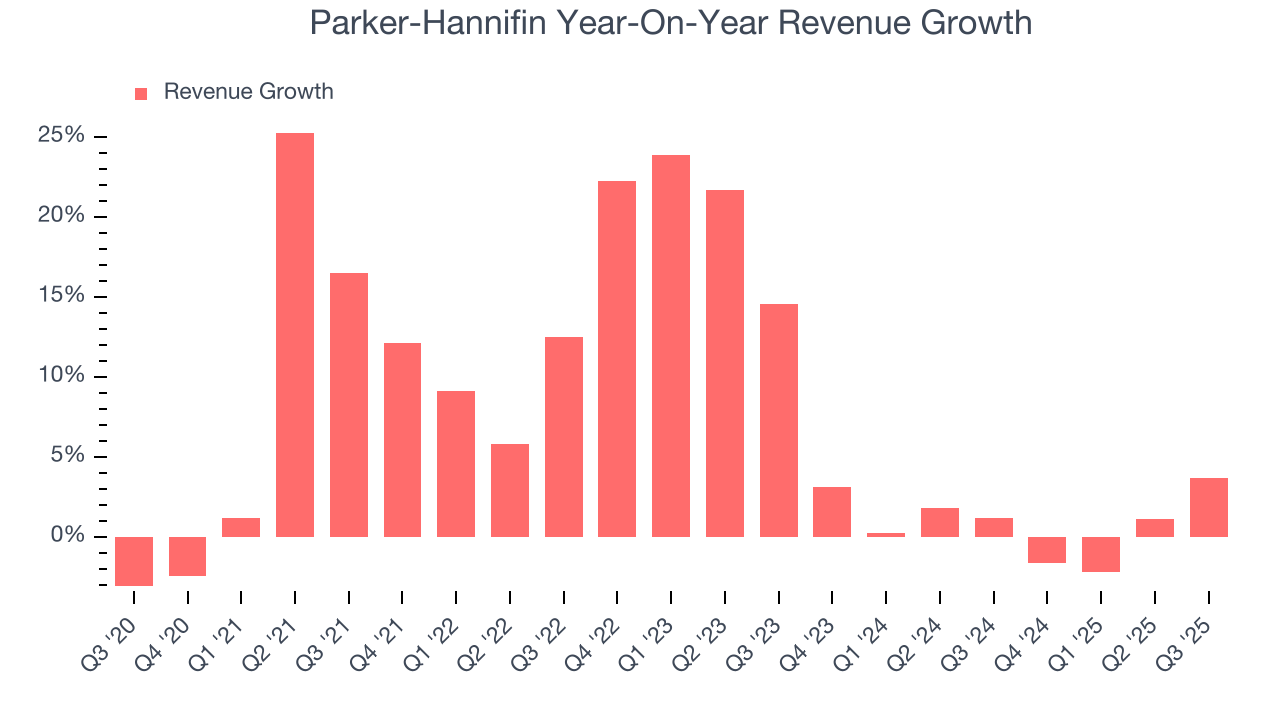

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Parker-Hannifin grew its sales at a decent 8.1% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Parker-Hannifin’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

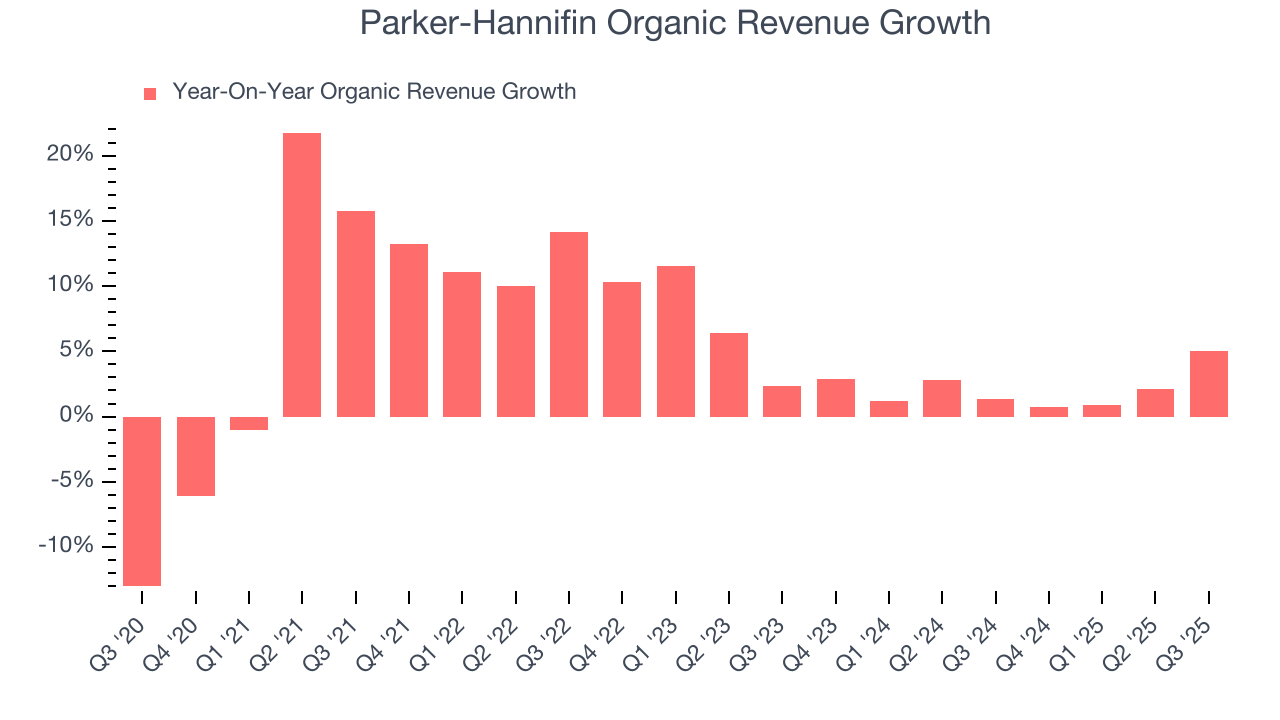

Parker-Hannifin also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Parker-Hannifin’s organic revenue averaged 2.1% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Parker-Hannifin reported modest year-on-year revenue growth of 3.7% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

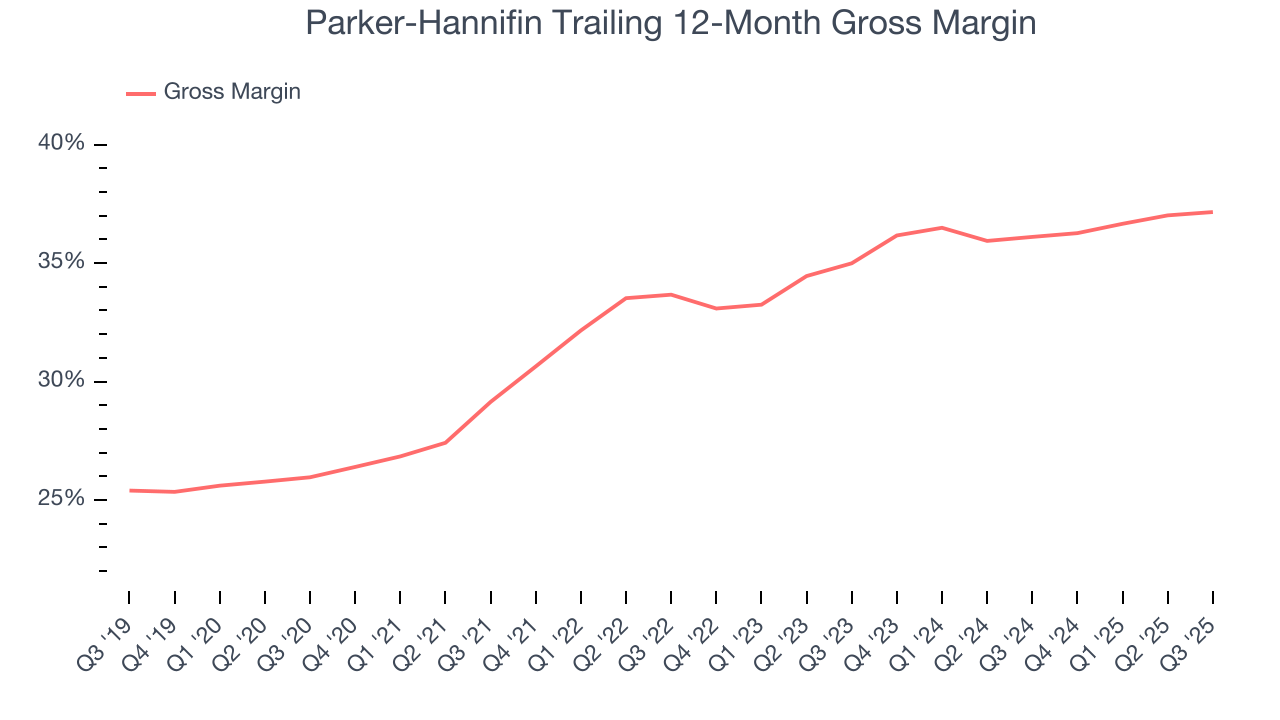

Parker-Hannifin’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 34.5% gross margin over the last five years. Said differently, Parker-Hannifin paid its suppliers $65.48 for every $100 in revenue.

Parker-Hannifin’s gross profit margin came in at 37.5% this quarter, in line with the same quarter last year. On a wider time horizon, Parker-Hannifin’s full-year margin has been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

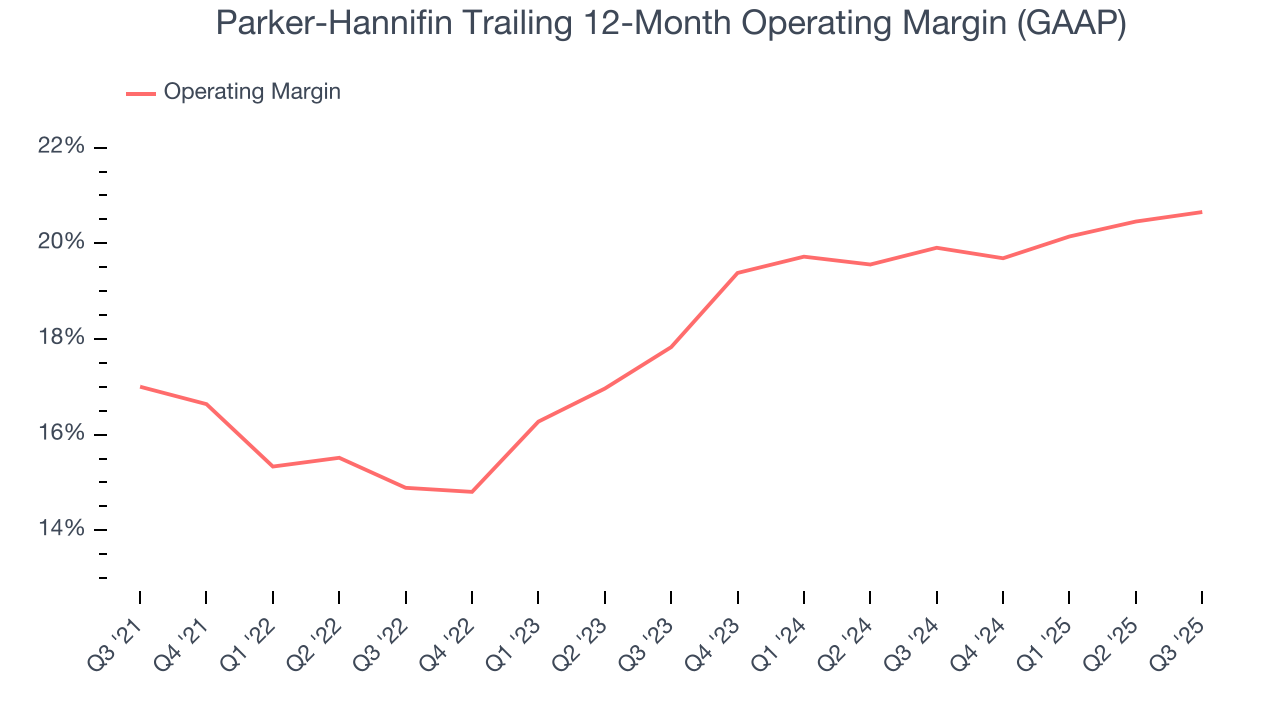

Parker-Hannifin has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.2%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Parker-Hannifin’s operating margin rose by 3.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Parker-Hannifin generated an operating margin profit margin of 20.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

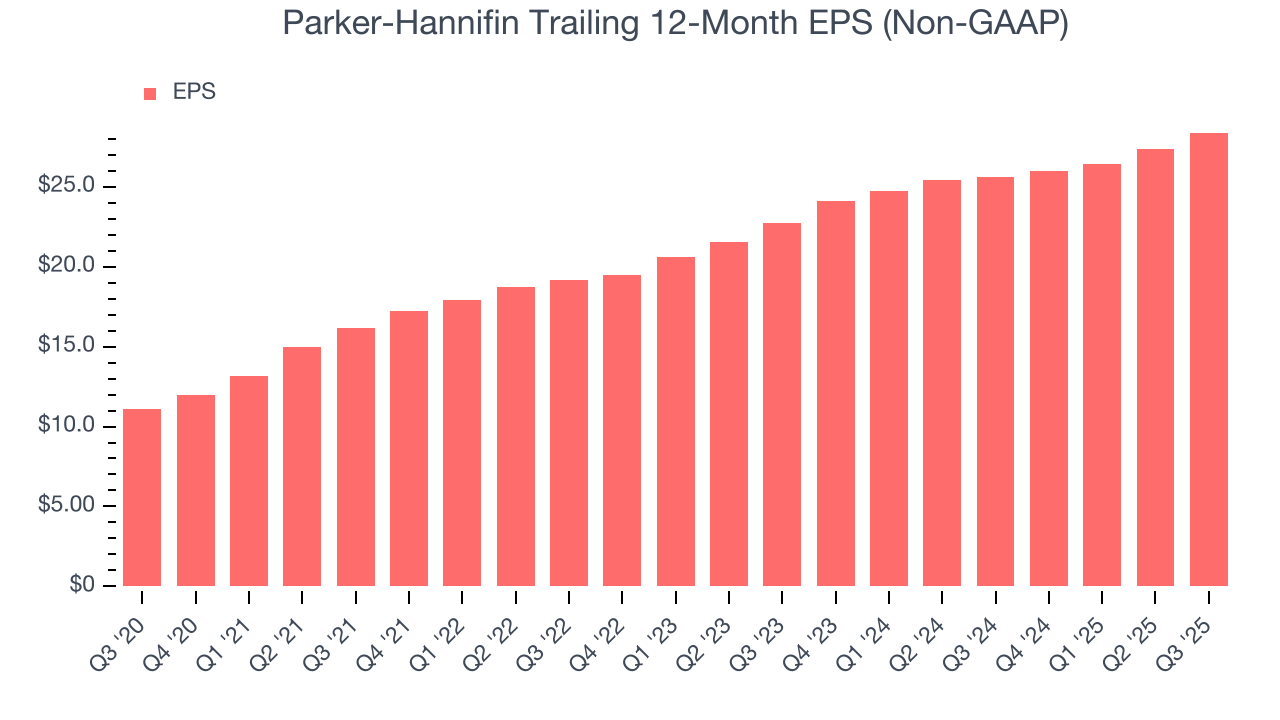

Parker-Hannifin’s EPS grew at an astounding 20.7% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

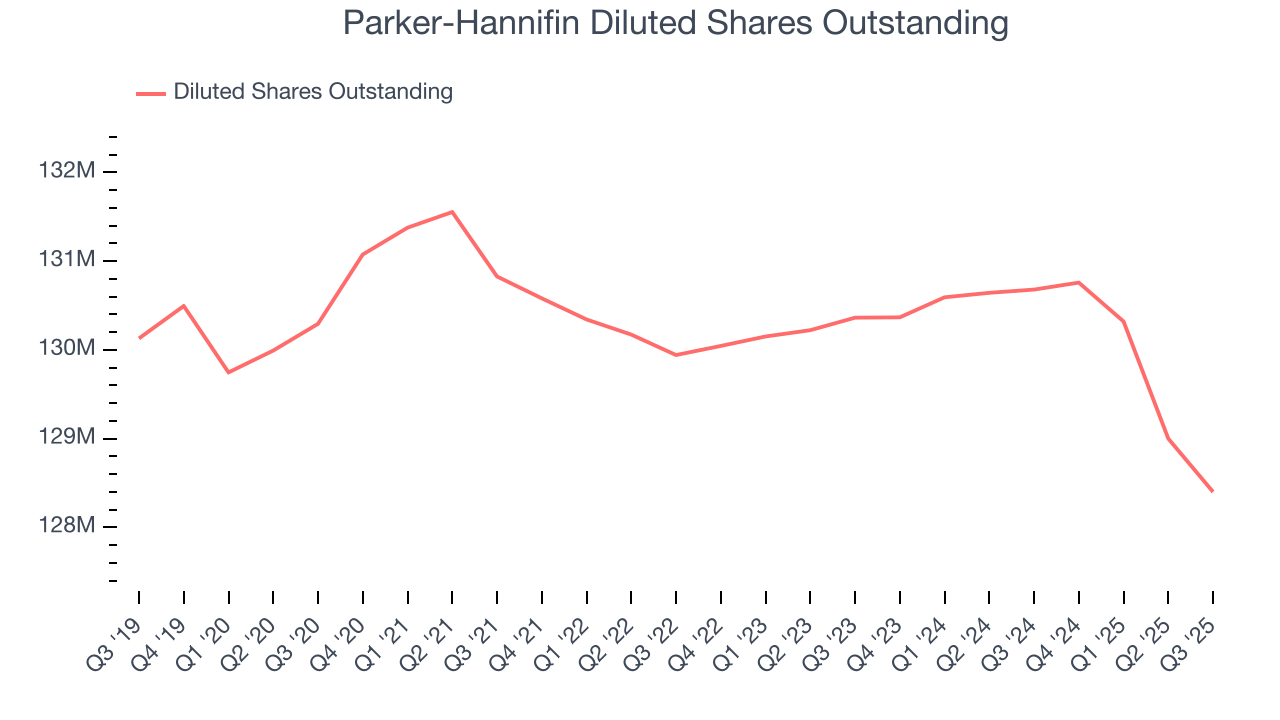

Diving into Parker-Hannifin’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Parker-Hannifin’s operating margin was flat this quarter but expanded by 3.7 percentage points over the last five years. On top of that, its share count shrank by 1.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Parker-Hannifin, its two-year annual EPS growth of 11.7% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Parker-Hannifin reported adjusted EPS of $7.22, up from $6.20 in the same quarter last year. This print beat analysts’ estimates by 9%. Over the next 12 months, Wall Street expects Parker-Hannifin’s full-year EPS of $28.38 to grow 4.1%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

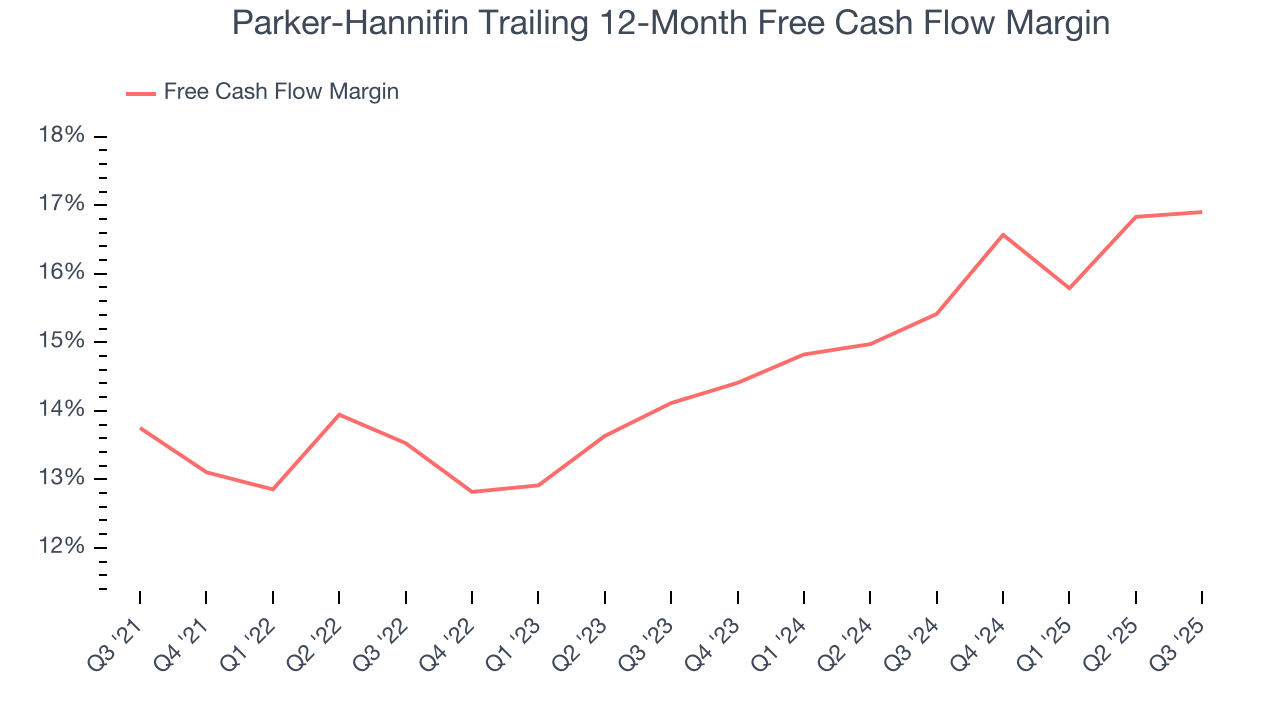

Parker-Hannifin has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 14.8% over the last five years.

Taking a step back, we can see that Parker-Hannifin’s margin expanded by 3.2 percentage points during that time. This is encouraging because it gives the company more optionality.

Parker-Hannifin’s free cash flow clocked in at $693 million in Q3, equivalent to a 13.6% margin. This cash profitability was in line with the comparable period last year but below its five-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

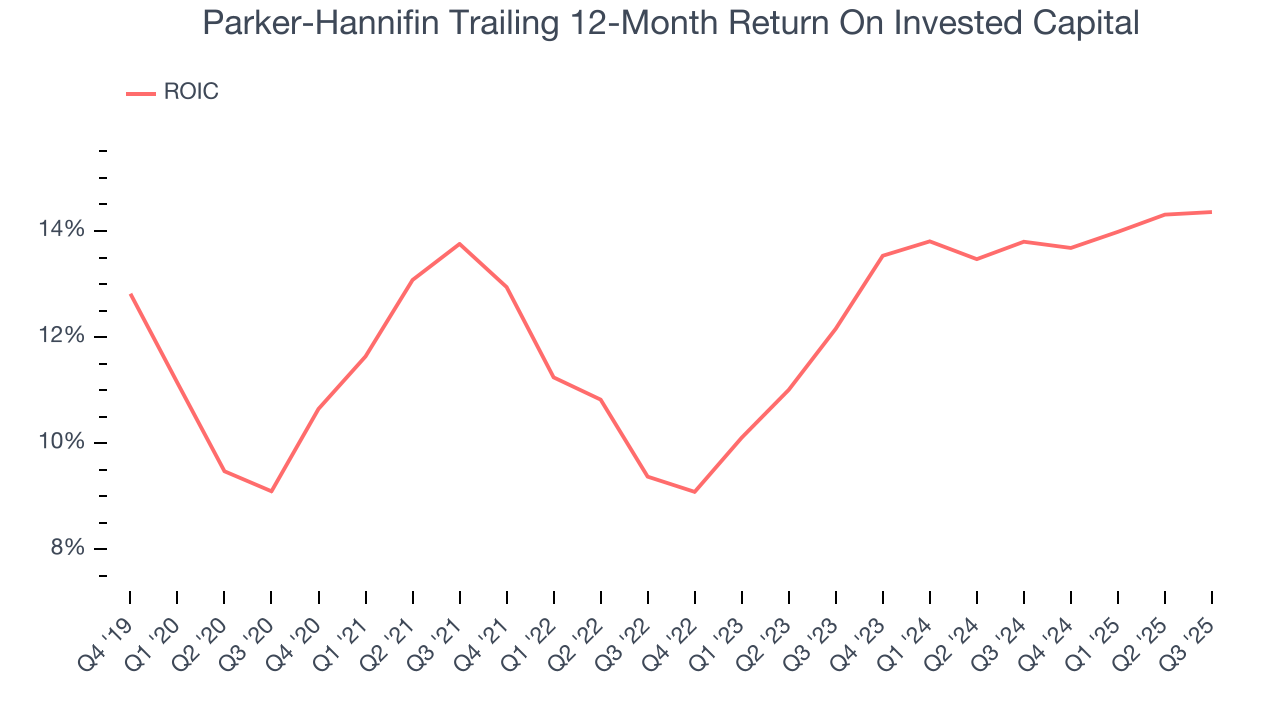

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Parker-Hannifin hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 12.7%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Parker-Hannifin’s ROIC averaged 2.5 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

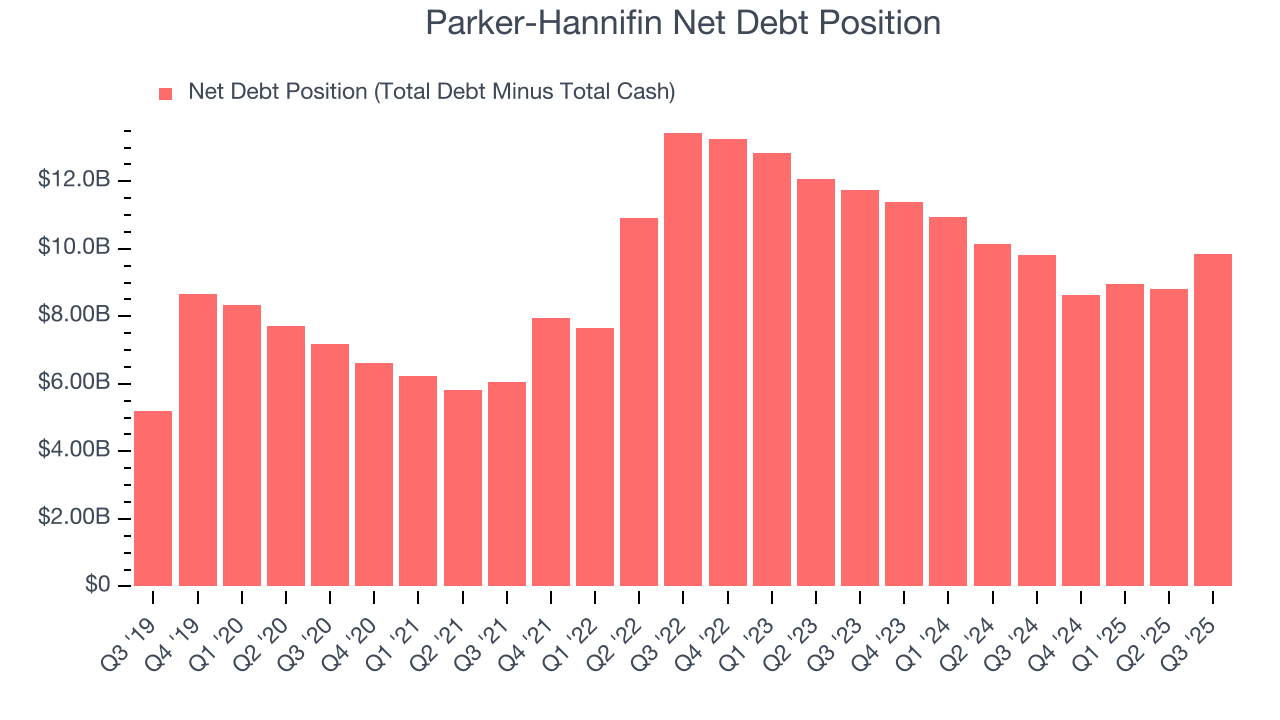

Parker-Hannifin reported $473 million of cash and $10.33 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.11 billion of EBITDA over the last 12 months, we view Parker-Hannifin’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $186.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Parker-Hannifin’s Q3 Results

We were impressed by Parker-Hannifin’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA slightly missed. Zooming out, we think this was a solid print. The stock traded up 5% to $813.01 immediately after reporting.

13. Is Now The Time To Buy Parker-Hannifin?

Updated: January 18, 2026 at 9:05 PM EST

Before deciding whether to buy Parker-Hannifin or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Parker-Hannifin possesses a number of positive attributes. To kick things off, its revenue growth was decent over the last five years. And while its organic revenue growth has disappointed, its impressive operating margins show it has a highly efficient business model. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Parker-Hannifin’s P/E ratio based on the next 12 months is 30.4x. At this valuation, there’s a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $957.91 on the company (compared to the current share price of $944.18).