Piper Sandler (PIPR)

Piper Sandler is interesting. Its .― StockStory Analyst Team

1. News

2. Summary

Why Piper Sandler Is Interesting

Tracing its roots back to 1895 and rebranded from Piper Jaffray in 2020, Piper Sandler (NYSE:PIPR) is an investment bank that provides advisory services, capital raising, institutional brokerage, and research for corporations, governments, and institutional investors.

- ROE punches in at 15.8%, illustrating management’s expertise in identifying profitable investments

- Additional sales over the last five years increased its profitability as the 12.2% annual growth in its earnings per share outpaced its revenue

- The stock is trading at a reasonable price if you like its story and growth prospects

Piper Sandler shows some signs of a high-quality business. If you like the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Piper Sandler?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Piper Sandler?

At $326.12 per share, Piper Sandler trades at 16.9x forward P/E. While Piper Sandler features a higher multiple higher than that of financials peers, we think the valuation is justified given its business quality.

Now could be a good time to invest if you believe in the story.

3. Piper Sandler (PIPR) Research Report: Q4 CY2025 Update

Investment banking firm Piper Sandler (NYSE:PIPR) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 33.6% year on year to $666.1 million. Its non-GAAP profit of $6.88 per share was 44.5% above analysts’ consensus estimates.

Piper Sandler (PIPR) Q4 CY2025 Highlights:

- Revenue: $666.1 million vs analyst estimates of $518.2 million (33.6% year-on-year growth, 28.5% beat)

- Pre-tax Profit: $188.8 million (28.3% margin)

- Adjusted EPS: $6.88 vs analyst estimates of $4.76 (44.5% beat)

- Market Capitalization: $5.87 billion

Company Overview

Tracing its roots back to 1895 and rebranded from Piper Jaffray in 2020, Piper Sandler (NYSE:PIPR) is an investment bank that provides advisory services, capital raising, institutional brokerage, and research for corporations, governments, and institutional investors.

Piper Sandler operates primarily as a middle-market focused investment bank, serving clients across several key sectors including healthcare, financial services, energy, consumer, technology, and chemicals. The firm's investment banking division helps corporate clients and financial sponsors navigate mergers and acquisitions, raise capital through equity and debt offerings, and provides restructuring advisory services during challenging times.

For public entities and non-profit organizations, Piper Sandler underwrites municipal bonds, offers financial advisory services, and provides loan placement solutions. A municipal government might engage Piper Sandler to help structure and issue bonds to finance a new school or infrastructure project, with the firm handling the complex process of bringing these securities to market.

The company's institutional brokerage business connects institutional investors with investment opportunities through equity and fixed income sales and trading services. Supporting these efforts, Piper Sandler's research analysts cover approximately 1,000 companies, providing institutional clients with investment insights and recommendations. The firm also offers macro research on global economic trends and policy developments that might impact investment decisions.

Piper Sandler generates revenue primarily through advisory fees from transactions like mergers and acquisitions, underwriting fees from capital raising activities, commissions from trading services, and management fees from its alternative asset management funds in merchant banking and healthcare. With offices throughout the United States and international locations in London, Aberdeen, and Hong Kong, the firm maintains a global presence while operating under various regulatory frameworks.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Piper Sandler competes with other middle-market investment banks such as Jefferies Financial Group (NYSE:JEF), Raymond James Financial (NYSE:RJF), Houlihan Lokey (NYSE:HLI), and Lazard (NYSE:LAZ), as well as the middle-market divisions of larger financial institutions like Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS).

5. Revenue Growth

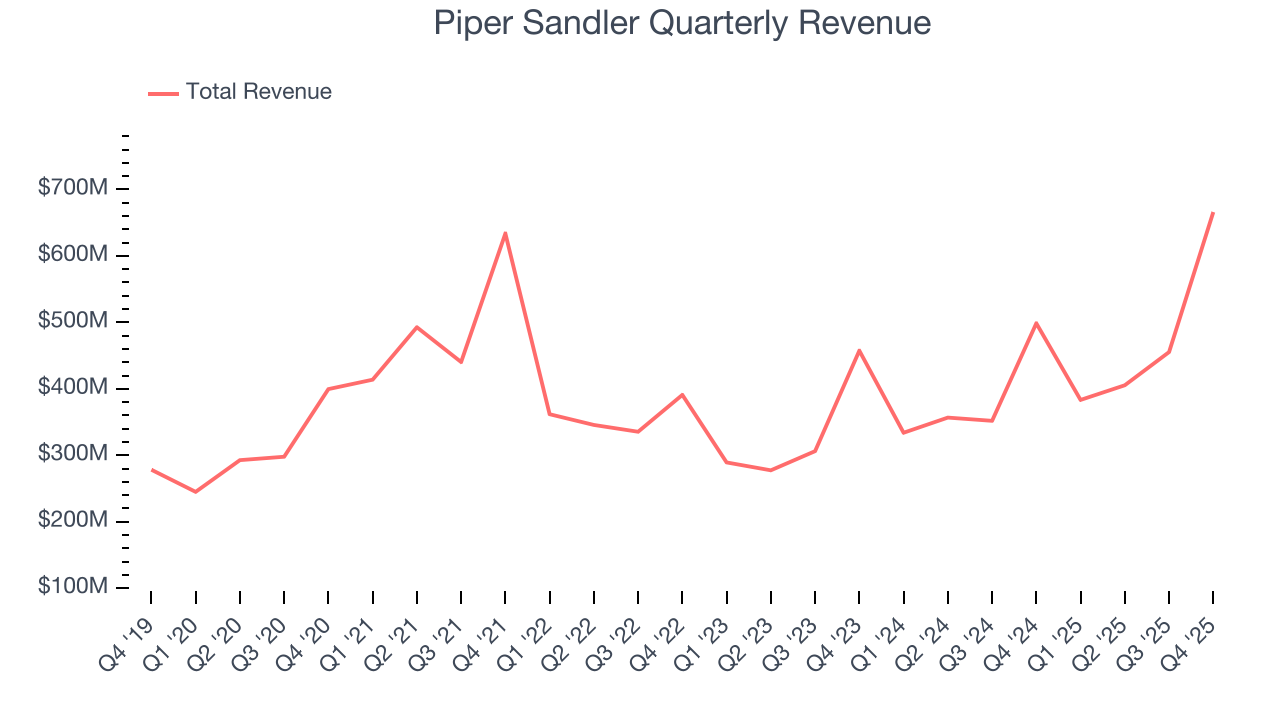

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Piper Sandler grew its revenue at a decent 9.1% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Piper Sandler’s annualized revenue growth of 19.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Piper Sandler reported wonderful year-on-year revenue growth of 33.6%, and its $666.1 million of revenue exceeded Wall Street’s estimates by 28.5%.

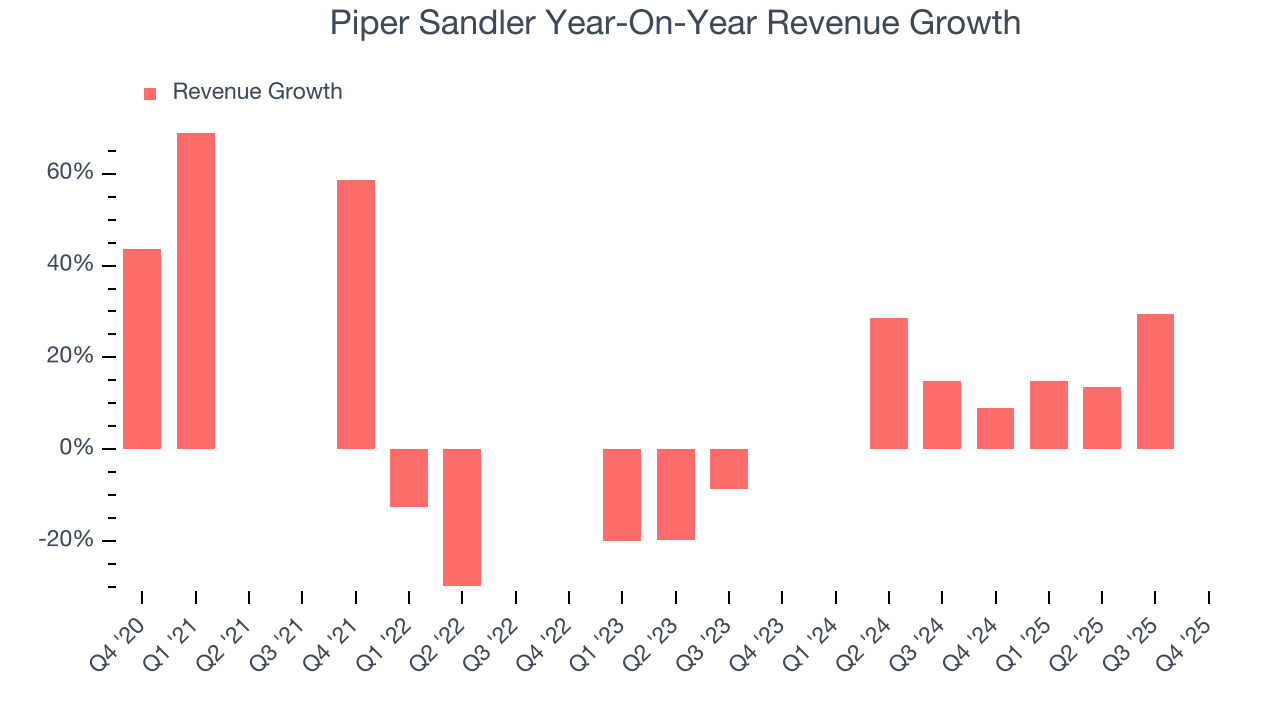

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Piper Sandler’s pre-tax profit margin has fallen by 14.1 percentage points, going from 22.3% to 19.6%. It has also expanded by 10.4 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Piper Sandler’s pre-tax profit margin was 28.3%. This result was 11.9 percentage points better than the same quarter last year.

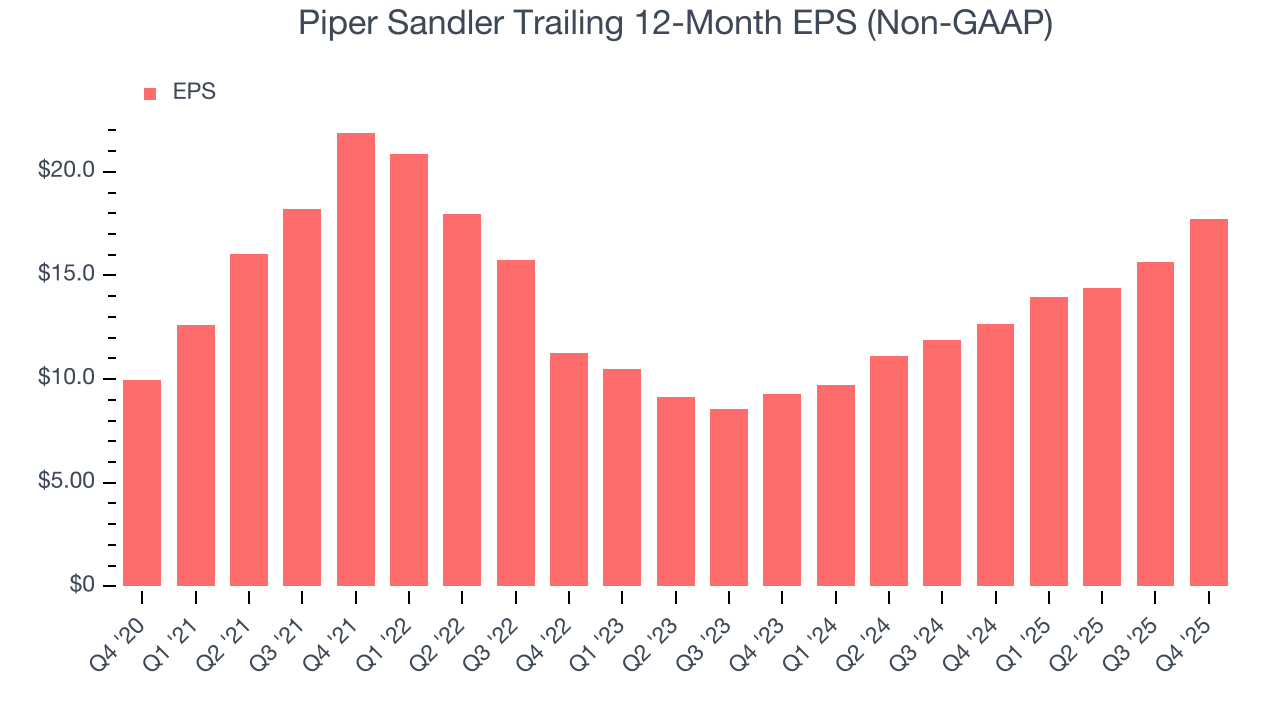

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Piper Sandler’s EPS grew at a decent 12.2% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Piper Sandler, its two-year annual EPS growth of 38.3% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, Piper Sandler reported adjusted EPS of $6.88, up from $4.80 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Piper Sandler’s full-year EPS of $17.74 to grow 3.1%.

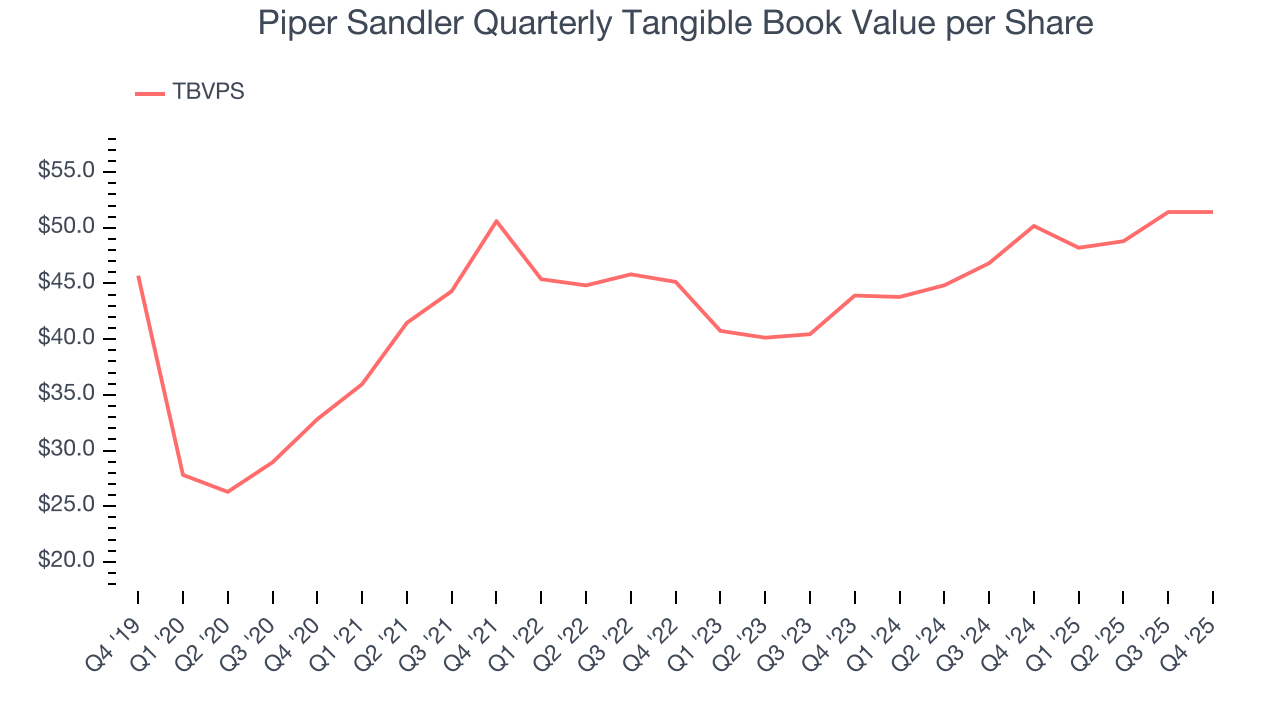

8. Tangible Book Value Per Share (TBVPS)

The balance sheet drives profitability for financial firms since earnings flow from managing diverse assets and liabilities across multiple business lines. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential across their varied operations.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Piper Sandler’s TBVPS grew at a decent 9.4% annual clip over the last five years. TBVPS growth has recently decelerated a bit to 8.2% annual growth over the last two years (from $43.92 to $51.42 per share).

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Piper Sandler has averaged an ROE of 14.6%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Piper Sandler has a decent competitive moat.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Piper Sandler has no debt, so leverage is not an issue here.

11. Key Takeaways from Piper Sandler’s Q4 Results

It was good to see Piper Sandler beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $334.54 immediately after reporting.

12. Is Now The Time To Buy Piper Sandler?

Updated: February 19, 2026 at 11:42 PM EST

Before deciding whether to buy Piper Sandler or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We think Piper Sandler is a good business. First off, its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months. On top of that, Piper Sandler’s expanding pre-tax profit margin shows the business has become more efficient, and its solid ROE suggests it has grown profitably in the past.

Piper Sandler’s P/E ratio based on the next 12 months is 16.9x. When scanning the financials space, Piper Sandler trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $422.67 on the company (compared to the current share price of $326.12), implying they see 29.6% upside in buying Piper Sandler in the short term.