Reddit (RDDT)

Reddit is in a league of its own. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Reddit

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

- Annual revenue growth of 43.6% over the past three years was outstanding, reflecting market share gains

- Market share will likely rise over the next 12 months as its expected revenue growth of 42.9% is robust

- Platform is difficult to replicate at scale and results in a best-in-class gross margin of 90.5%

Reddit is at the top of our list. This is one of the finest consumer internet stocks in our coverage.

Is Now The Time To Buy Reddit?

High Quality

Investable

Underperform

Is Now The Time To Buy Reddit?

Reddit is trading at $217.95 per share, or 37.1x forward EV/EBITDA. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

If you like the company and believe the bull case, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Reddit (RDDT) Research Report: Q3 CY2025 Update

Online community and discussion platform Reddit (NYSE:RDDT) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 67.9% year on year to $584.9 million. On top of that, next quarter’s revenue guidance ($660 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its GAAP profit of $0.80 per share was 54.2% above analysts’ consensus estimates.

Reddit (RDDT) Q3 CY2025 Highlights:

- Revenue: $584.9 million vs analyst estimates of $550.4 million (67.9% year-on-year growth, 6.3% beat)

- EPS (GAAP): $0.80 vs analyst estimates of $0.52 (54.2% beat)

- Adjusted EBITDA: $236 million vs analyst estimates of $196.5 million (40.3% margin, 20.1% beat)

- Revenue Guidance for Q4 CY2025 is $660 million at the midpoint, above analyst estimates of $638.8 million

- EBITDA guidance for Q4 CY2025 is $280 million at the midpoint, above analyst estimates of $259.8 million

- Operating Margin: 23.7%, up from 2% in the same quarter last year

- Free Cash Flow Margin: 31.3%, up from 22.2% in the previous quarter

- Domestic Daily Active Visitors: 51.6 million, up 3.4 million year on year

- Market Capitalization: $41.4 billion

Company Overview

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit's largest revenue generator is its advertising services, which enable companies to target its engaged user base across subreddits, particularly appealing to brands wanting to reach niche or hard-to-reach audiences. In addition to ads, Reddit offers a subscription service that removes ads and grants access to exclusive features like the "Coins" system, which lets users reward content creators.

After its founding, the company was acquired by Conde Nast in 2006. Reddit eventually became an independent subsidiary of its parent. After funding rounds in August 2019 and August 2021 led by Tencent and Fidelity Investments, respectively, the company went public in March 2024.

4. Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Competitors in the digital community and social news industry include Meta (NASDAQ:META), Snap (NASDAQ:SNAP), and X (privately-owned, formerly Twitter).

5. Revenue Growth

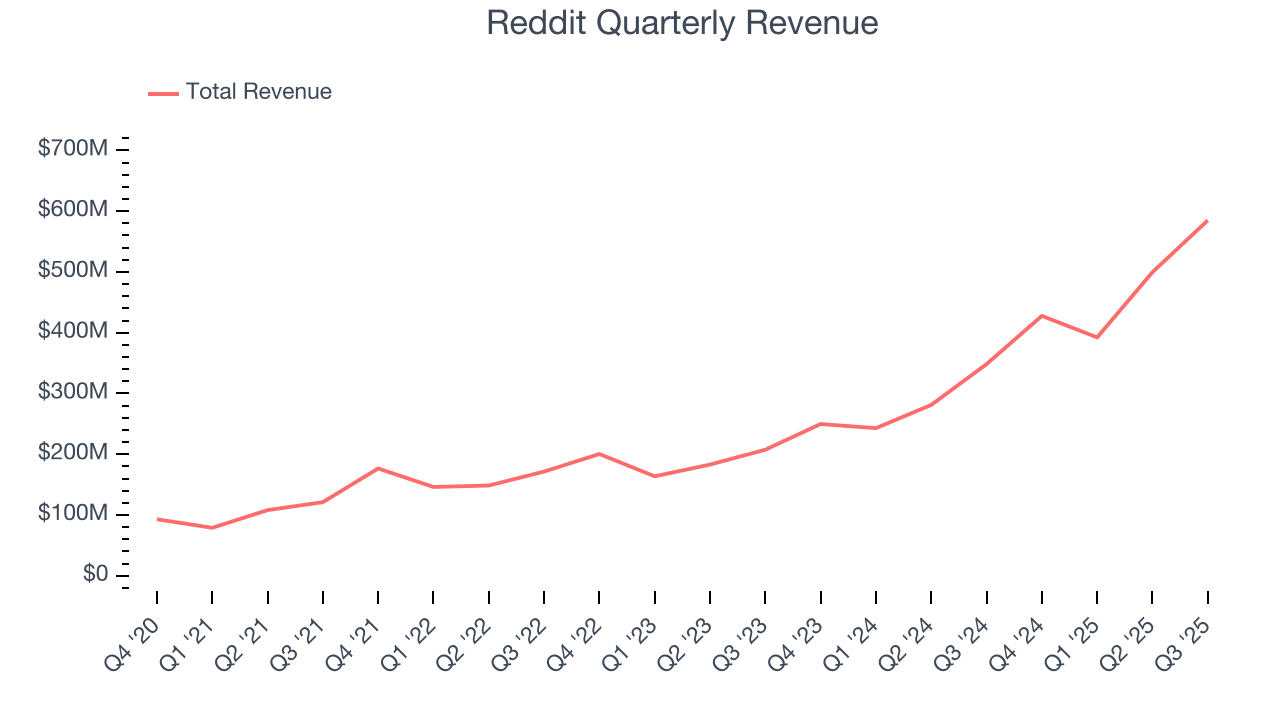

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Reddit grew its sales at an incredible 43.6% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Reddit reported magnificent year-on-year revenue growth of 67.9%, and its $584.9 million of revenue beat Wall Street’s estimates by 6.3%. Company management is currently guiding for a 54.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 42.2% over the next 12 months, similar to its three-year rate. Despite the slowdown, this projection is noteworthy and implies the market sees success for its products and services.

6. Domestic Daily Active Visitors

User Growth

As a social network, Reddit generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Reddit’s domestic daily active visitors, a key performance metric for the company, increased by 32.3% annually to 51.6 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q3, Reddit added 3.4 million domestic daily active visitors, leading to 7.1% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

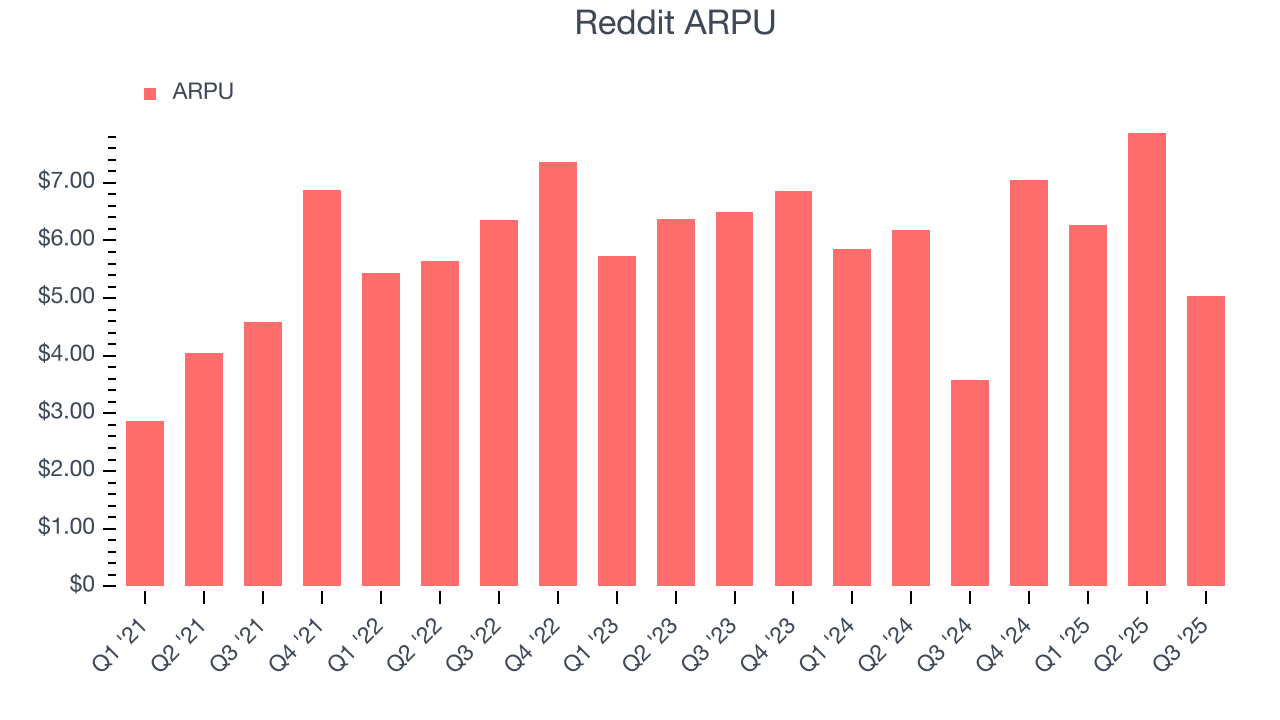

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Reddit’s audience and its ad-targeting capabilities.

Reddit’s ARPU growth has been mediocre over the last two years, averaging 3.2%. This isn’t great, but the increase in domestic daily active visitors is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Reddit tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Reddit’s ARPU clocked in at $5.04. It grew by 40.8% year on year, faster than its domestic daily active visitors.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For social network businesses like Reddit, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

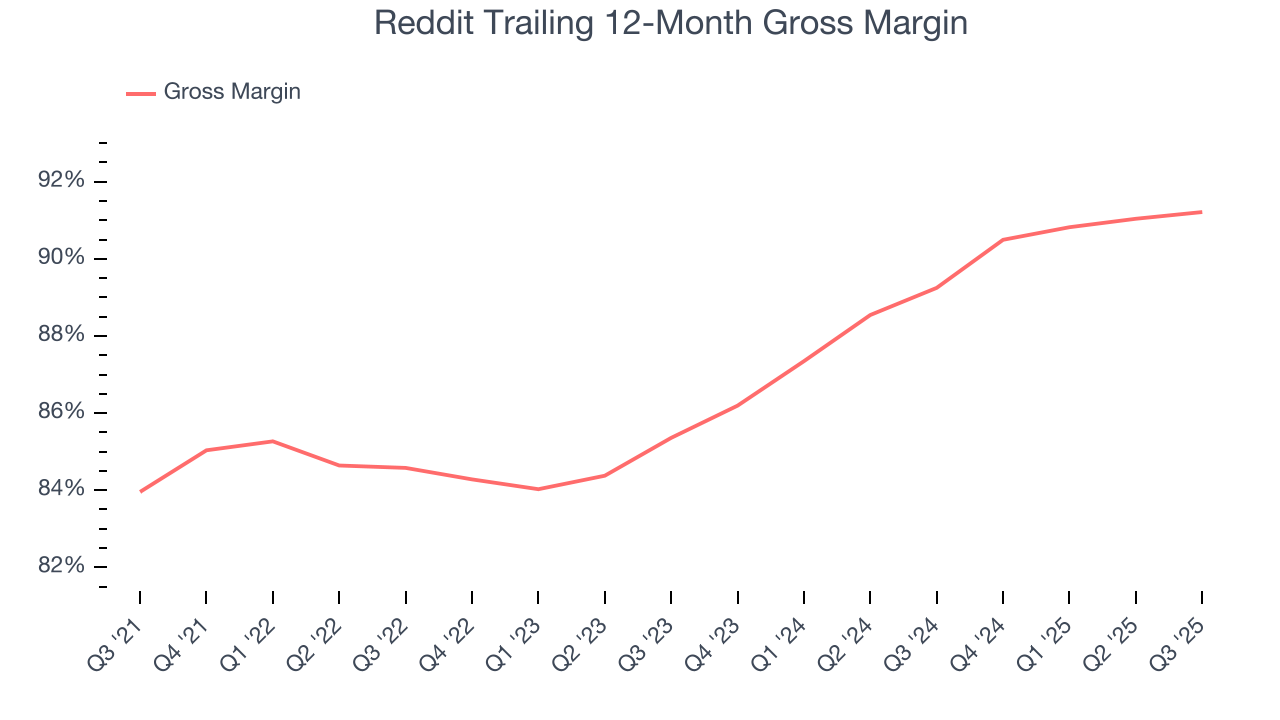

Reddit’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 90.5% gross margin over the last two years. That means Reddit only paid its providers $9.52 for every $100 in revenue.

Reddit produced a 91% gross profit margin in Q3, in line with the same quarter last year. Zooming out, Reddit’s full-year margin has been trending up over the past 12 months, increasing by 2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. EBITDA

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

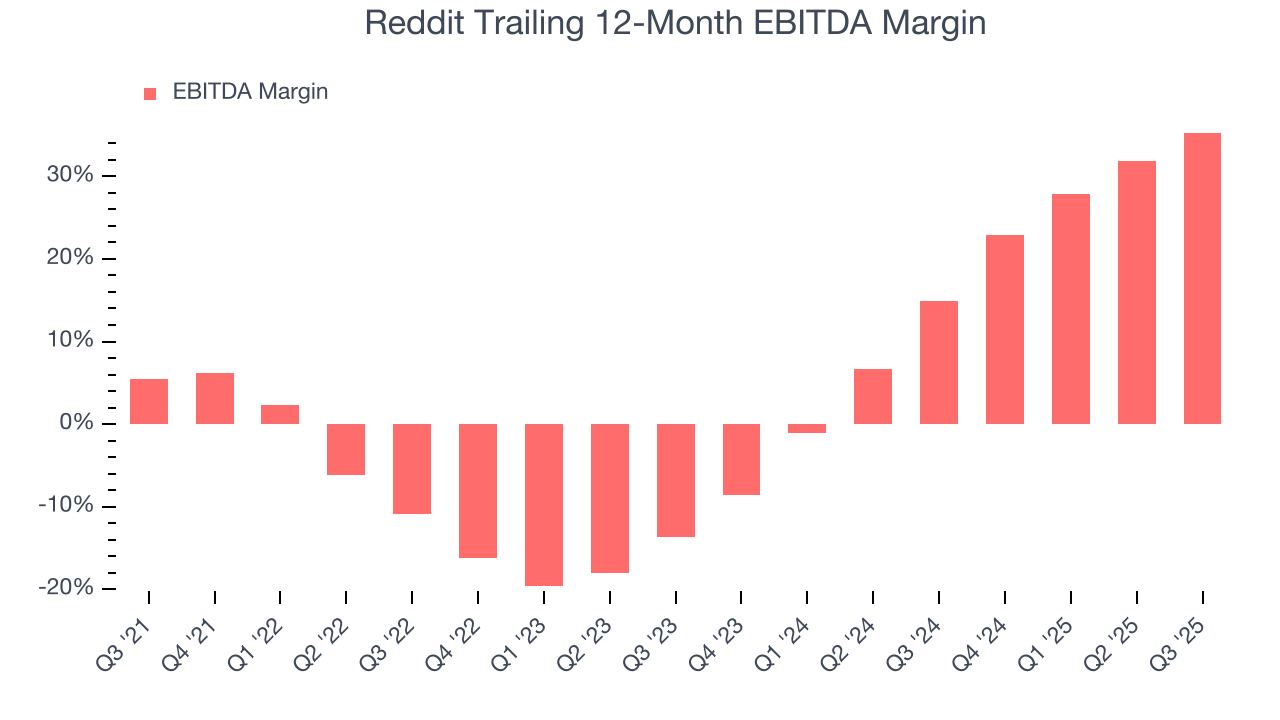

Reddit has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Reddit’s EBITDA margin rose by 46.2 percentage points over the last few years, as its sales growth gave it immense operating leverage.

In Q3, Reddit generated an EBITDA margin profit margin of 40.3%, up 13.3 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

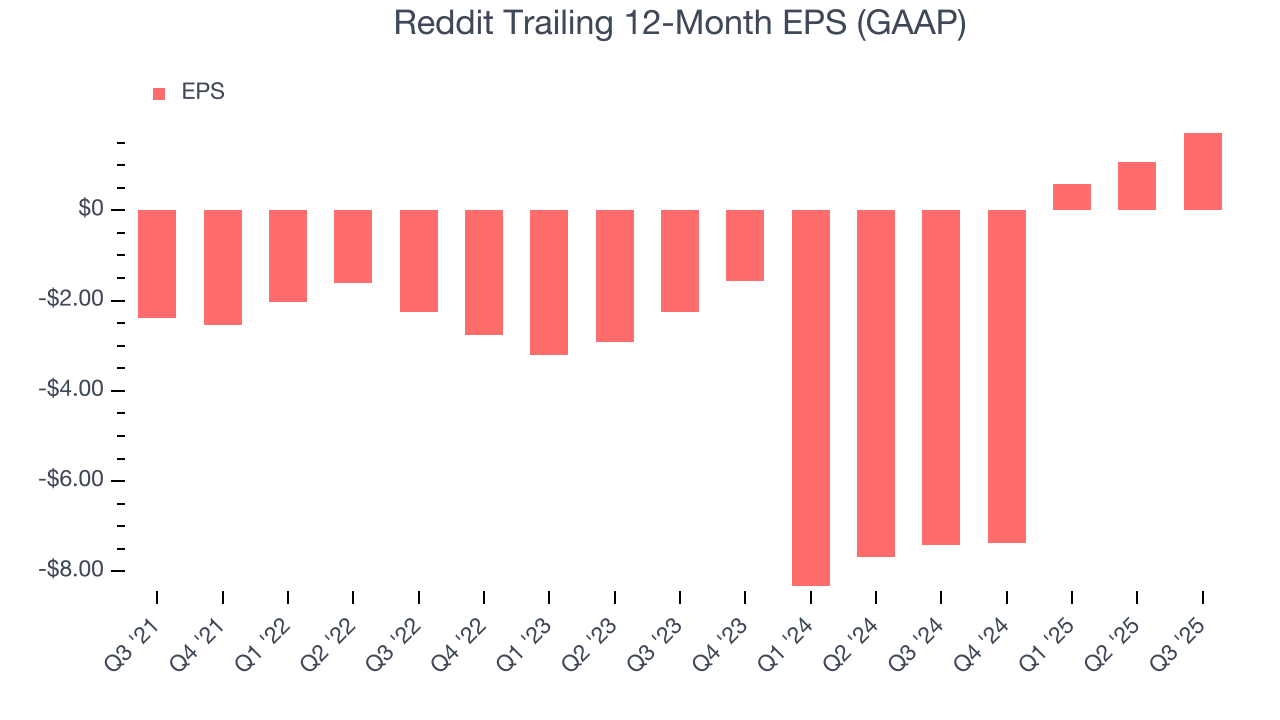

In Q3, Reddit reported EPS of $0.80, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Reddit’s full-year EPS of $1.72 to grow 95.2%.

10. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

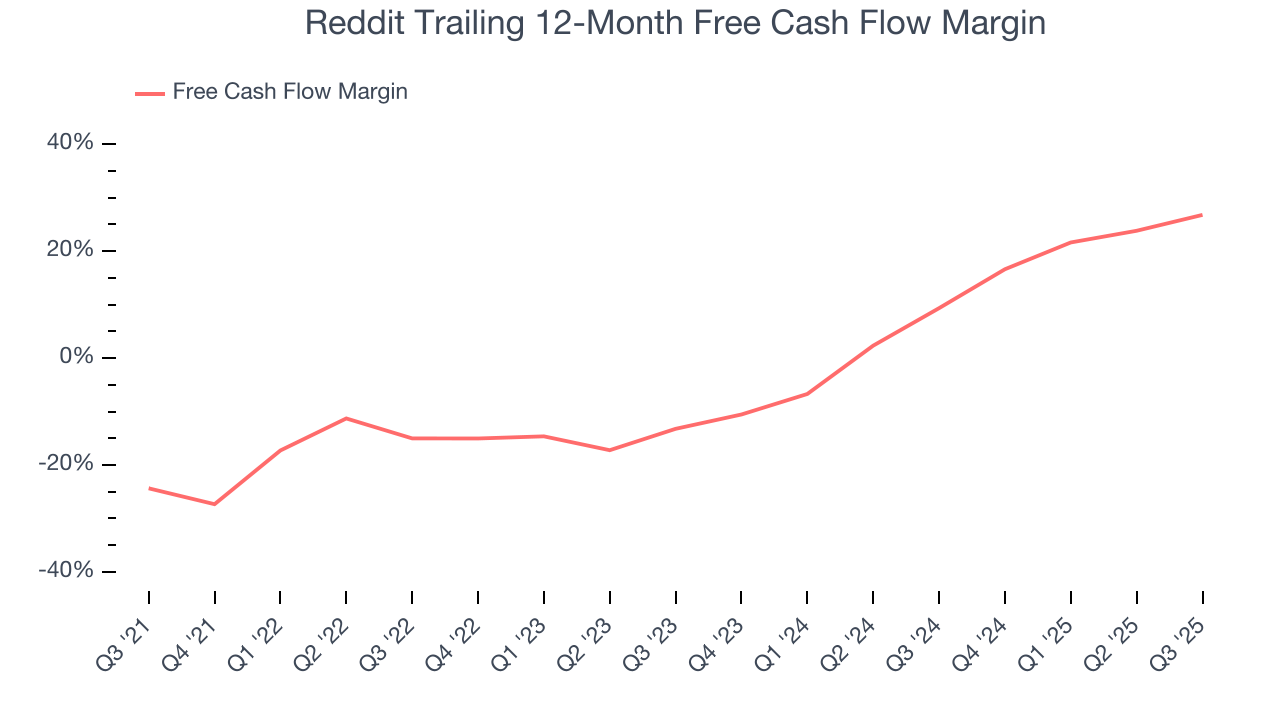

Reddit has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 20.3% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Reddit’s margin expanded by 41.8 percentage points over the last few years. This is encouraging because it gives the company more optionality.

Reddit’s free cash flow clocked in at $183.1 million in Q3, equivalent to a 31.3% margin. This result was good as its margin was 11.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

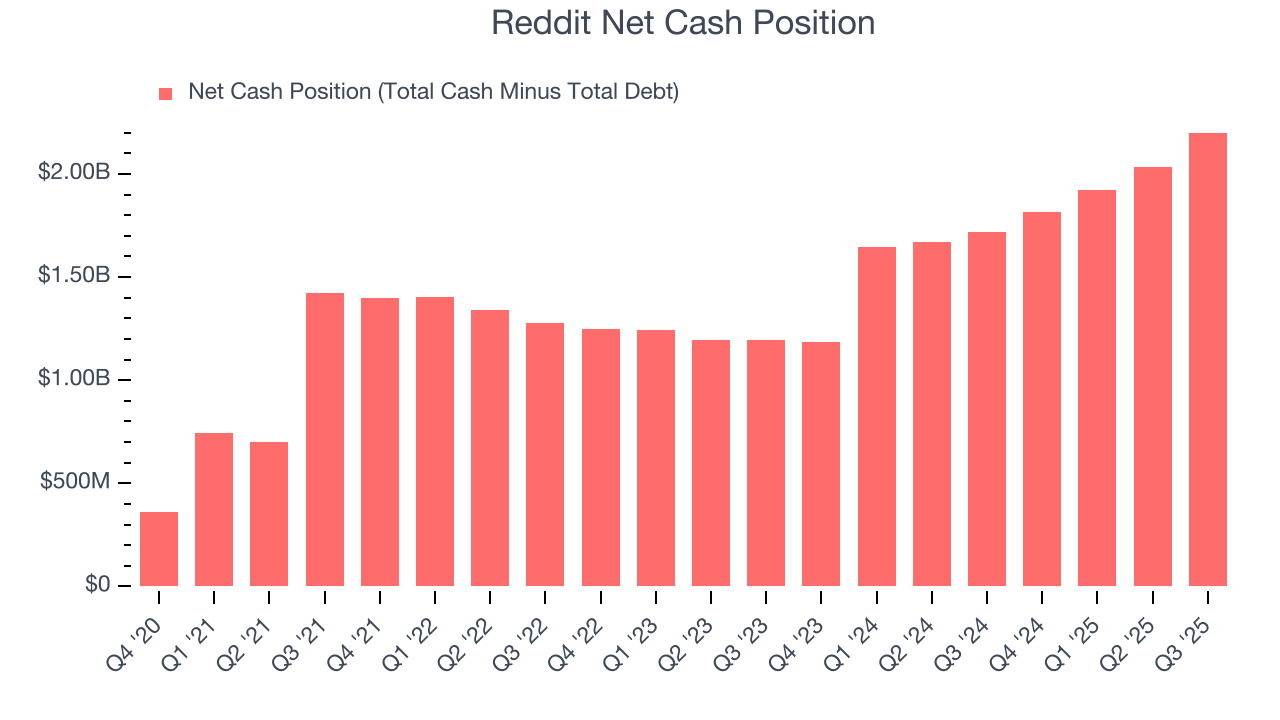

Reddit is a profitable, well-capitalized company with $2.23 billion of cash and $25.03 million of debt on its balance sheet. This $2.2 billion net cash position is 5.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Reddit’s Q3 Results

We were impressed by Reddit’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its number of domestic daily active visitors was in line. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 1% to $216.49 immediately following the results.

13. Is Now The Time To Buy Reddit?

Updated: January 24, 2026 at 10:45 PM EST

Before making an investment decision, investors should account for Reddit’s business fundamentals and valuation in addition to what happened in the latest quarter.

Reddit is truly a cream-of-the-crop consumer internet company. First, the company’s revenue growth was exceptional over the last three years, and analysts believe it can continue growing at these levels. On top of that, its admirable gross margins are a wonderful starting point for the overall profitability of the business, and its impressive EBITDA margins show it has a highly efficient business model.

Reddit’s EV/EBITDA ratio based on the next 12 months is 37.1x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning an elite business, even if it’s expensive. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany high valuations.

Wall Street analysts have a consensus one-year price target of $251.93 on the company (compared to the current share price of $217.95).