Reddit (RDDT)

Not many stocks excite us like Reddit. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like Reddit

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

- Remarkable 43.6% revenue growth over the last three years demonstrates its ability to capture significant market share

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

- Platform is difficult to replicate at scale and leads to a best-in-class gross margin of 90.5%

Reddit is a top-tier company. This is one of the best consumer internet stocks in the world.

Is Now The Time To Buy Reddit?

High Quality

Investable

Underperform

Is Now The Time To Buy Reddit?

Reddit is trading at $154.25 per share, or 28.1x forward EV/EBITDA. This doesn’t seem like an obvious bargain, but the calm and collected investor can still make money over a long-term holding period.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Reddit (RDDT) Research Report: Q4 CY2025 Update

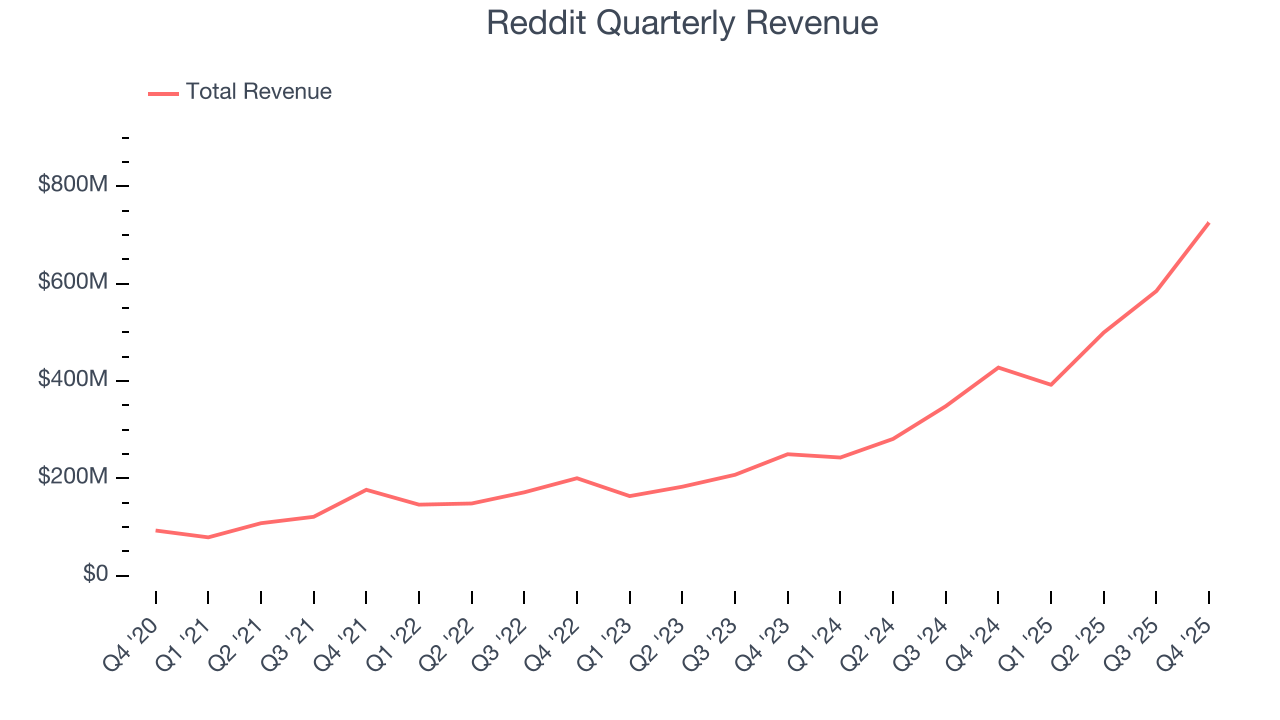

Online community and discussion platform Reddit (NYSE:RDDT) announced better-than-expected revenue in Q4 CY2025, with sales up 69.7% year on year to $725.6 million. On top of that, next quarter’s revenue guidance ($600 million at the midpoint) was surprisingly good and 4.3% above what analysts were expecting. Its GAAP profit of $1.24 per share was 33.1% above analysts’ consensus estimates.

Reddit (RDDT) Q4 CY2025 Highlights:

- Revenue: $725.6 million vs analyst estimates of $667.5 million (69.7% year-on-year growth, 8.7% beat)

- EPS (GAAP): $1.24 vs analyst estimates of $0.93 (33.1% beat)

- Adjusted EBITDA: $327 million vs analyst estimates of $286.5 million (45.1% margin, 14.1% beat)

- Revenue Guidance for Q1 CY2026 is $600 million at the midpoint, above analyst estimates of $575.2 million

- EBITDA guidance for Q1 CY2026 is $215 million at the midpoint, above analyst estimates of $204.9 million

- Operating Margin: 31.9%, up from 12.4% in the same quarter last year

- Free Cash Flow Margin: 36.3%, up from 31.3% in the previous quarter

- Domestic Daily Active Visitors: 52.5 million, up 4.5 million year on year

- Market Capitalization: $28.93 billion

Company Overview

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit's largest revenue generator is its advertising services, which enable companies to target its engaged user base across subreddits, particularly appealing to brands wanting to reach niche or hard-to-reach audiences. In addition to ads, Reddit offers a subscription service that removes ads and grants access to exclusive features like the "Coins" system, which lets users reward content creators.

After its founding, the company was acquired by Conde Nast in 2006. Reddit eventually became an independent subsidiary of its parent. After funding rounds in August 2019 and August 2021 led by Tencent and Fidelity Investments, respectively, the company went public in March 2024.

4. Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Competitors in the digital community and social news industry include Meta (NASDAQ:META), Snap (NASDAQ:SNAP), and X (privately-owned, formerly Twitter).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Reddit grew its sales at an incredible 48.9% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Reddit reported magnificent year-on-year revenue growth of 69.7%, and its $725.6 million of revenue beat Wall Street’s estimates by 8.7%. Company management is currently guiding for a 52.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 34.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and implies the market sees success for its products and services.

6. Domestic Daily Active Visitors

User Growth

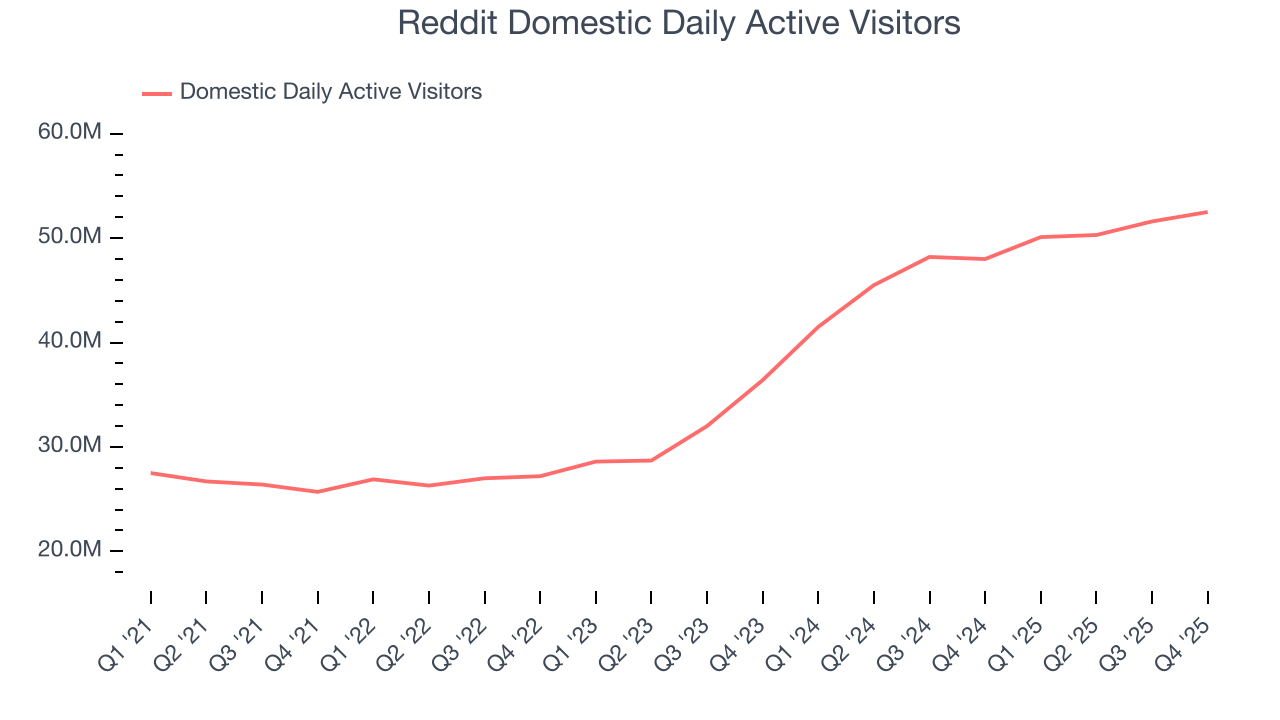

As a social network, Reddit generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Reddit’s domestic daily active visitors, a key performance metric for the company, increased by 29.2% annually to 52.5 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Reddit added 4.5 million domestic daily active visitors, leading to 9.4% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

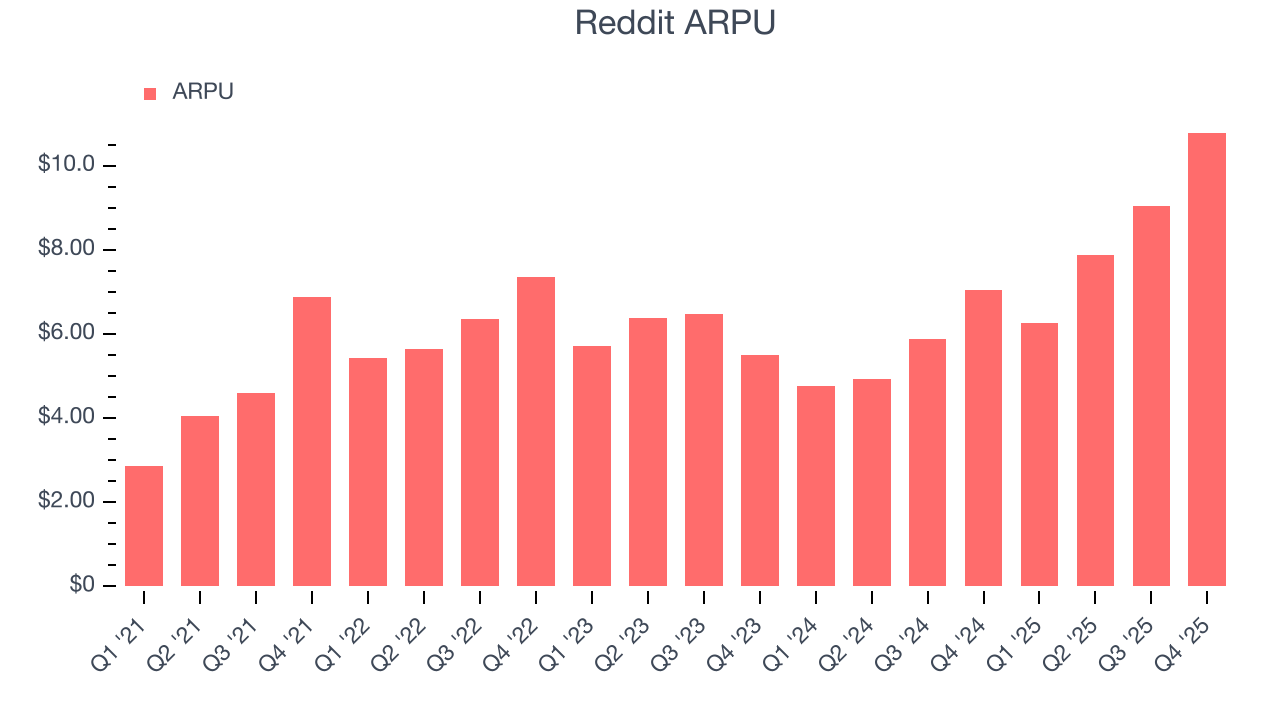

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Reddit’s audience and its ad-targeting capabilities.

Reddit’s ARPU growth has been exceptional over the last two years, averaging 22.1%. Its ability to increase monetization while growing its domestic daily active visitors at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, Reddit’s ARPU clocked in at $10.79. It grew by 53.3% year on year, faster than its domestic daily active visitors.

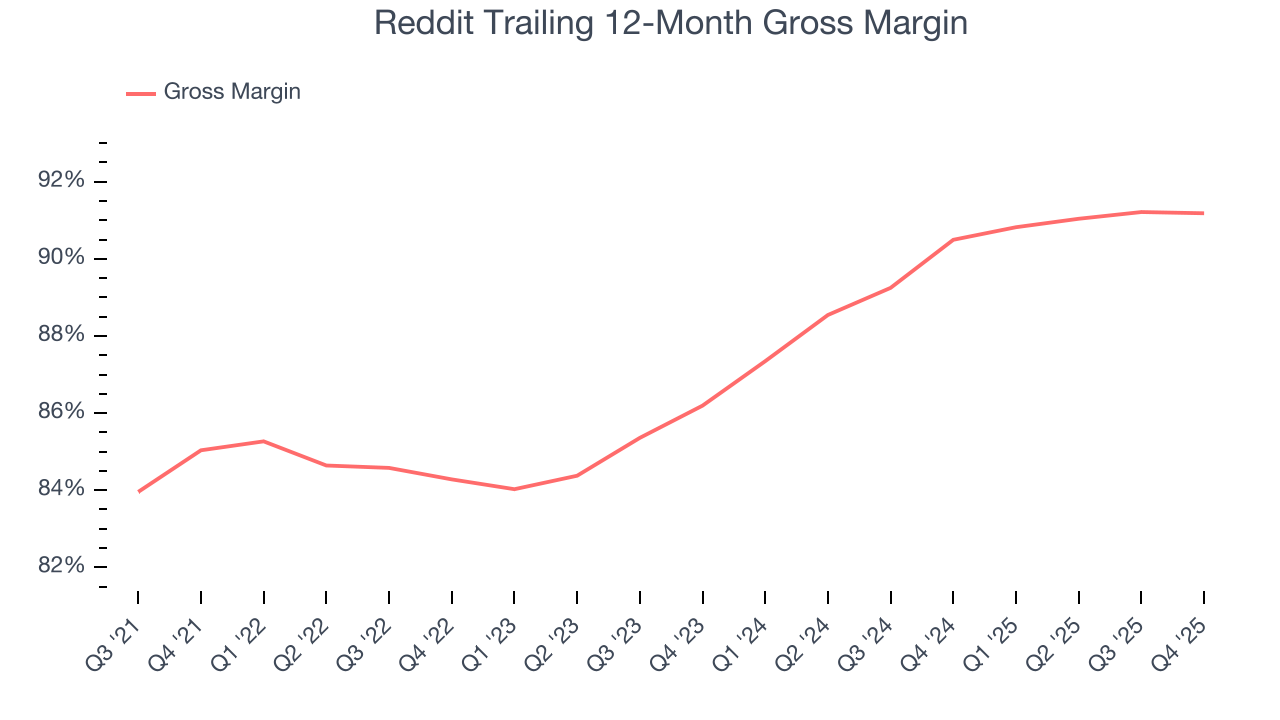

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For social network businesses like Reddit, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

Reddit’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 90.9% gross margin over the last two years. Said differently, roughly $90.93 was left to spend on selling, marketing, and R&D for every $100 in revenue.

This quarter, Reddit’s gross profit margin was 91.9%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

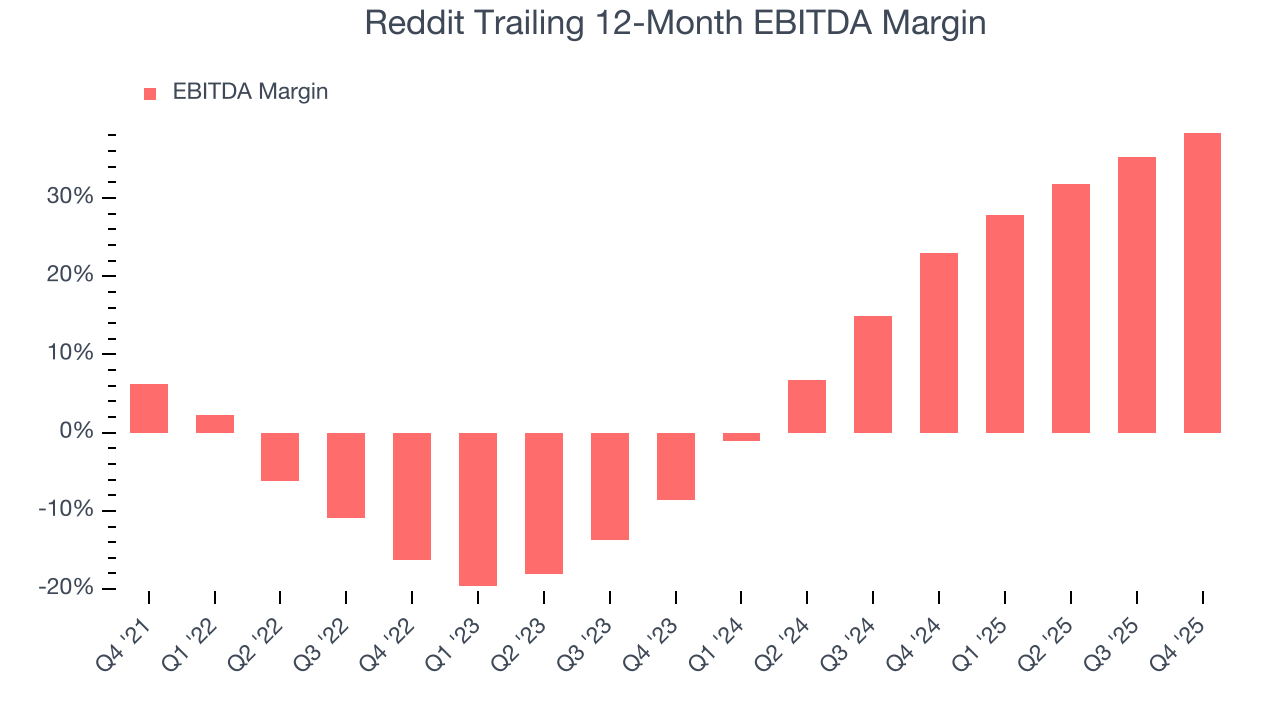

8. EBITDA

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Reddit has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 32.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Reddit’s EBITDA margin rose by 54.6 percentage points over the last few years, as its sales growth gave it immense operating leverage.

In Q4, Reddit generated an EBITDA margin profit margin of 45.1%, up 9 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

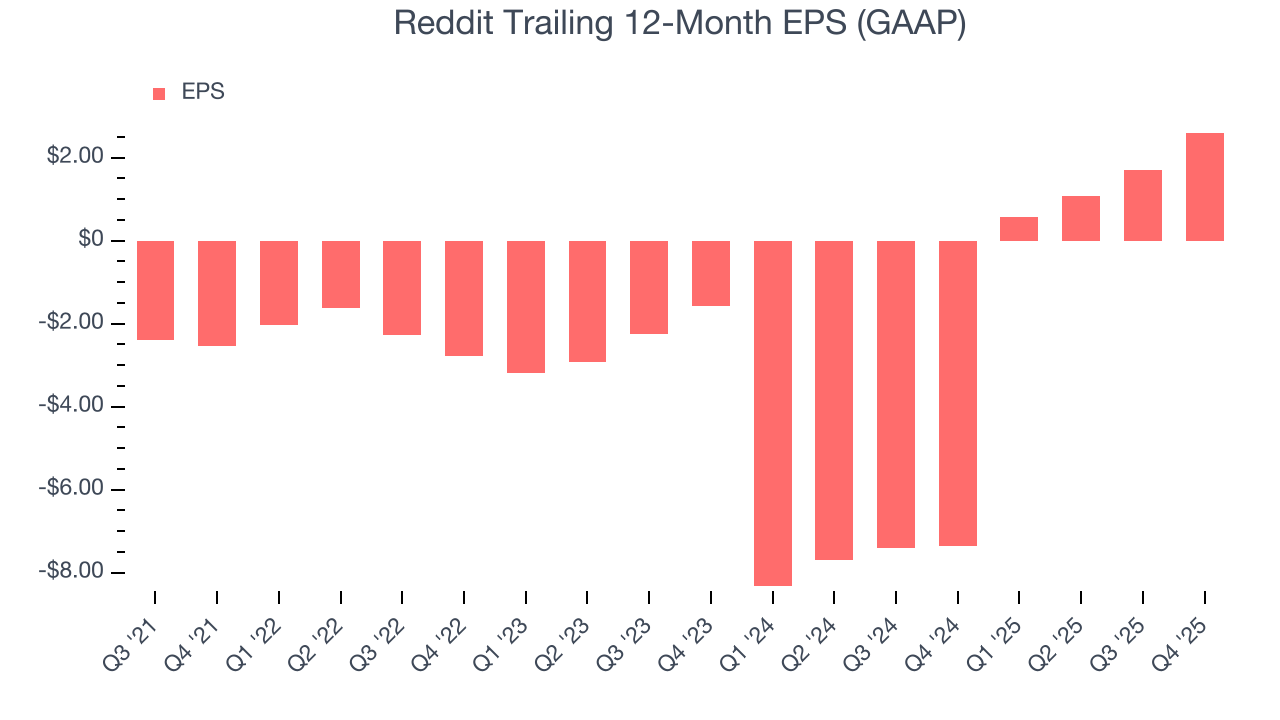

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Reddit’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

In Q4, Reddit reported EPS of $1.24, up from $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Reddit’s full-year EPS of $2.61 to grow 52.9%.

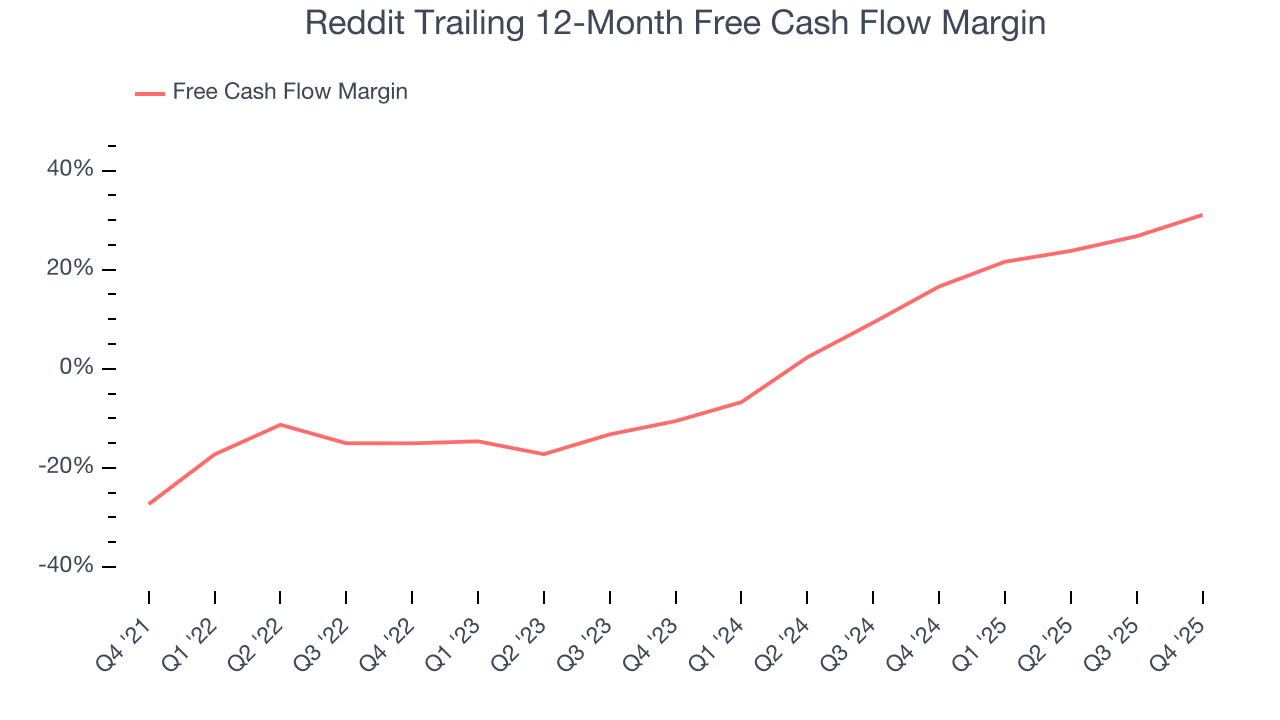

10. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Reddit has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 25.7% over the last two years.

Taking a step back, we can see that Reddit’s margin expanded by 46.1 percentage points over the last few years. This is encouraging because it gives the company more optionality.

Reddit’s free cash flow clocked in at $263.6 million in Q4, equivalent to a 36.3% margin. This result was good as its margin was 15.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

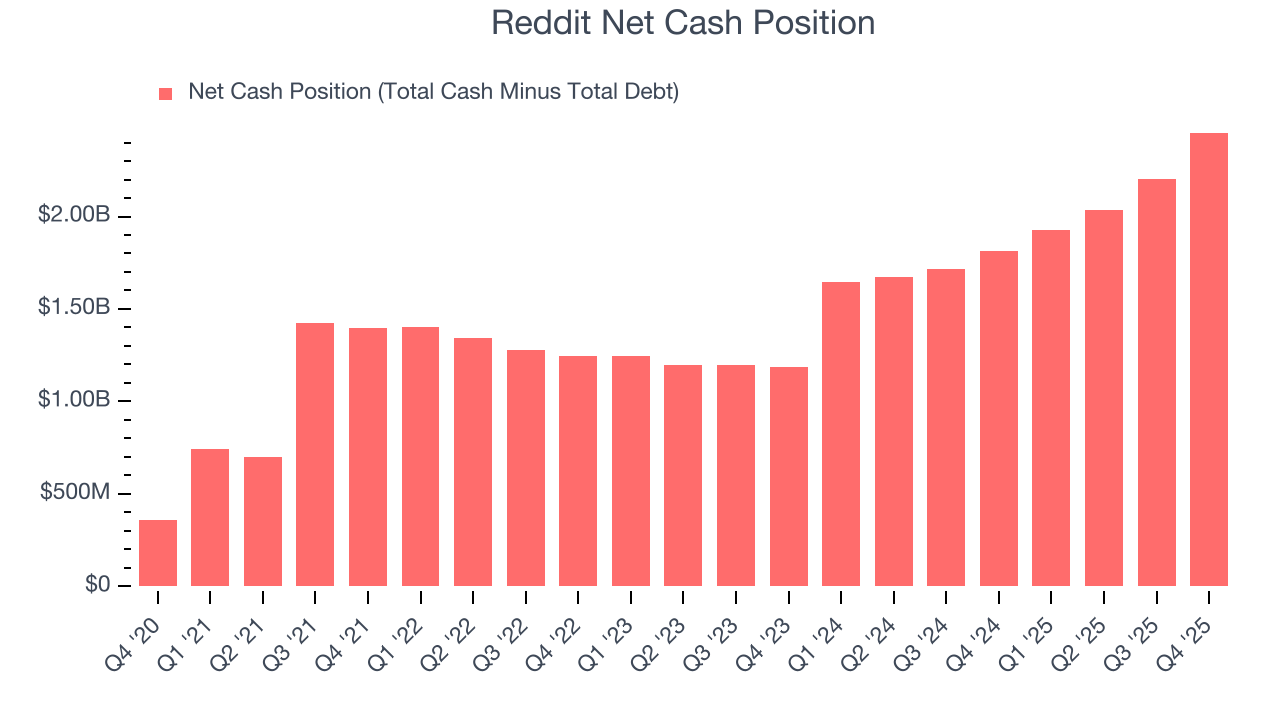

Reddit is a profitable, well-capitalized company with $2.48 billion of cash and $23.21 million of debt on its balance sheet. This $2.45 billion net cash position is 8.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Reddit’s Q4 Results

We were impressed by how significantly Reddit blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Looking ahead, next quarter's guidance for revenue and EBITDA both beat expectations. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $154.47 immediately following the results.

13. Is Now The Time To Buy Reddit?

Updated: February 5, 2026 at 5:26 PM EST

Before making an investment decision, investors should account for Reddit’s business fundamentals and valuation in addition to what happened in the latest quarter.

Reddit is one of the best consumer internet companies out there. First of all, the company’s revenue growth was exceptional over the last three years. On top of that, its admirable gross margins are a wonderful starting point for the overall profitability of the business, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Reddit’s EV/EBITDA ratio based on the next 12 months is 22.4x. Scanning the consumer internet landscape today, Reddit’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $252.39 on the company (compared to the current share price of $154.47), implying they see 63% upside in buying Reddit in the short term.