RLI (RLI)

RLI is intriguing. Its superior revenue growth and returns on capital show it can achieve fast and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why RLI Is Interesting

Founded in 1965 and named after its original focus on "replacement lens insurance" for contact lens wearers, RLI (NYSE:RLI) is a specialty insurance company that underwrites property, casualty, and surety products through wholesale brokers, independent agents, and carrier partnerships.

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Impressive 13.7% annual revenue growth over the last five years indicates it’s winning market share this cycle

- On a dimmer note, its estimated sales growth of 2.1% for the next 12 months implies demand will slow from its two-year trend

RLI shows some promise. You should keep tabs on this company.

Why Should You Watch RLI

High Quality

Investable

Underperform

Why Should You Watch RLI

At $60.80 per share, RLI trades at 3x forward P/B. The market has high expectations, which are reflected in the premium multiple. This can result in short-term volatility if anything (e.g. a quarterly earnings miss) remotely dampens those hopes.

RLI can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. RLI (RLI) Research Report: Q4 CY2025 Update

Specialty insurance provider RLI (NYSE:RLI) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 6.8% year on year to $465.7 million. Its non-GAAP profit of $0.94 per share was 17.1% above analysts’ consensus estimates.

RLI (RLI) Q4 CY2025 Highlights:

- Net Premiums Earned: $406.4 million vs analyst estimates of $405 million (2.3% year-on-year growth, in line)

- Revenue: $465.7 million vs analyst estimates of $453 million (6.8% year-on-year growth, 2.8% beat)

- Combined Ratio: 82.6% vs analyst estimates of 87.1% (451.7 basis point beat)

- Adjusted EPS: $0.94 vs analyst estimates of $0.80 (17.1% beat)

- Book Value per Share: $19.35 vs analyst estimates of $20.39 (16.6% year-on-year growth, 5.1% miss)

- Market Capitalization: $5.47 billion

Company Overview

Founded in 1965 and named after its original focus on "replacement lens insurance" for contact lens wearers, RLI (NYSE:RLI) is a specialty insurance company that underwrites property, casualty, and surety products through wholesale brokers, independent agents, and carrier partnerships.

RLI focuses on niche markets within the insurance industry, operating through three main segments: Casualty, Property, and Surety. The Casualty segment offers a diverse range of coverages including commercial excess liability, personal umbrella, transportation, management liability, and professional liability insurance. For example, a trucking company might purchase RLI's commercial transportation insurance to protect against liability claims from accidents.

The Property segment specializes in commercial fire, hurricane, earthquake, and marine coverages, primarily through excess and surplus lines. These policies often serve businesses that cannot obtain coverage in the standard insurance market due to unique or higher risk profiles, such as buildings in earthquake-prone areas.

In the Surety segment, RLI provides bonds that guarantee contractual obligations, with particular focus on small to medium-sized contractors. A construction company bidding on a municipal project might need an RLI performance bond to guarantee completion of the work according to specifications.

RLI distributes its products through multiple channels including wholesale and retail brokers, independent agents, and partnerships with other carriers. The company maintains a selective approach to risk, employing strict underwriting guidelines and automated systems to pre-qualify potential insureds. This disciplined approach allows RLI to offer specialized coverage for risks that might be declined by larger, more generalized insurers.

RLI operates through three insurance subsidiaries: RLI Insurance Company, Mt. Hawley Insurance Company (handling excess and surplus lines), and Contractors Bonding and Insurance Company.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

RLI's competitors include major insurance providers such as AIG, Chubb, Liberty Mutual, Travelers, and Zurich, as well as specialty insurers like Arch, Beazley, Berkley, Kinsale, Markel, and RSUI.

5. Revenue Growth

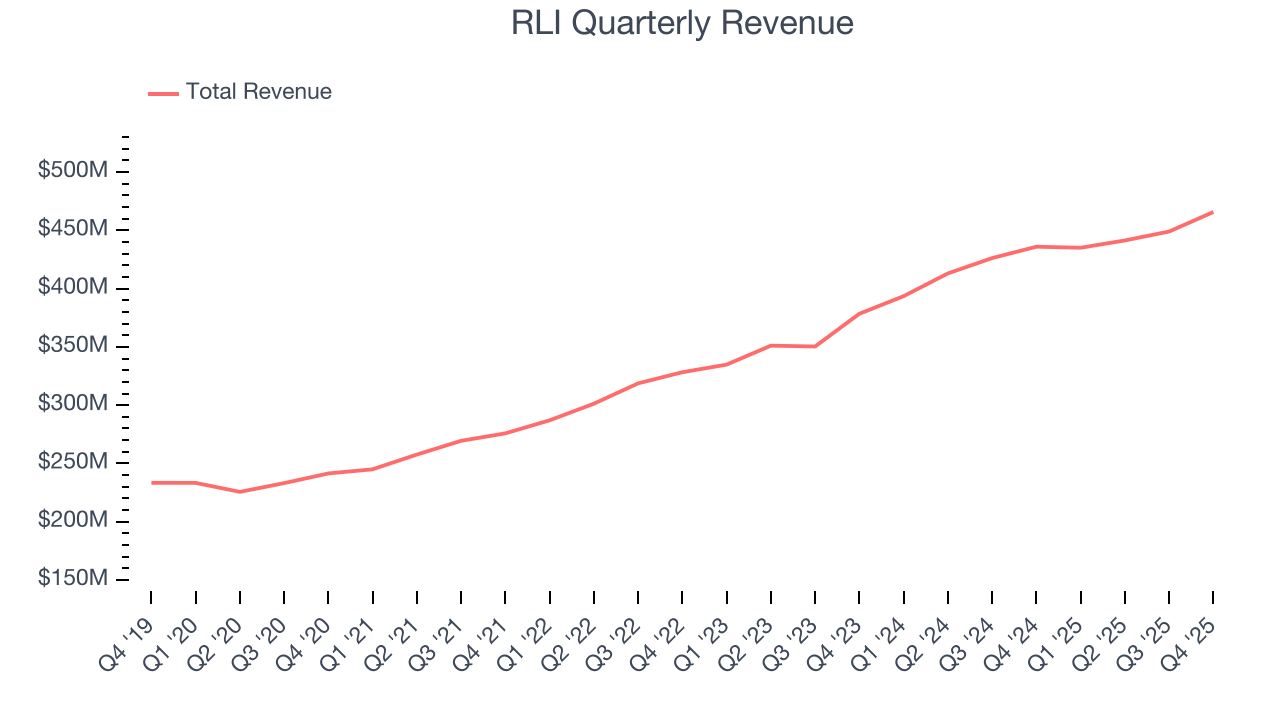

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services. Thankfully, RLI’s 13.9% annualized revenue growth over the last five years was exceptional. Its growth beat the average insurance company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. RLI’s annualized revenue growth of 12.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, RLI reported year-on-year revenue growth of 6.8%, and its $465.7 million of revenue exceeded Wall Street’s estimates by 2.8%.

Net premiums earned made up 91.7% of the company’s total revenue during the last five years, meaning RLI lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

RLI’s net premiums earned has grown at a 13.3% annualized rate over the last five years, better than the broader insurance industry and in line with its total revenue.

When analyzing RLI’s net premiums earned over the last two years, we can see that growth decelerated to 11.7% annually. This performance was similar to its total revenue.

RLI’s net premiums earned came in at $406.4 million this quarter, up 2.3% year on year and in line with Wall Street Consensus estimates.

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio is:

- The costs of underwriting (salaries, commissions, overhead) + what an insurer pays out in claims, all divided by net premiums earned

If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last five years, RLI’s combined ratio has swelled by 8.4 percentage points, going from 86.8% to 83.6%. It has also improved by 3 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

RLI’s combined ratio came in at 82.6% this quarter, beating analysts’ expectations by 416.7 basis points (100 basis points = 1 percentage point). This result was 11.7 percentage points better than the same quarter last year.

8. Earnings Per Share

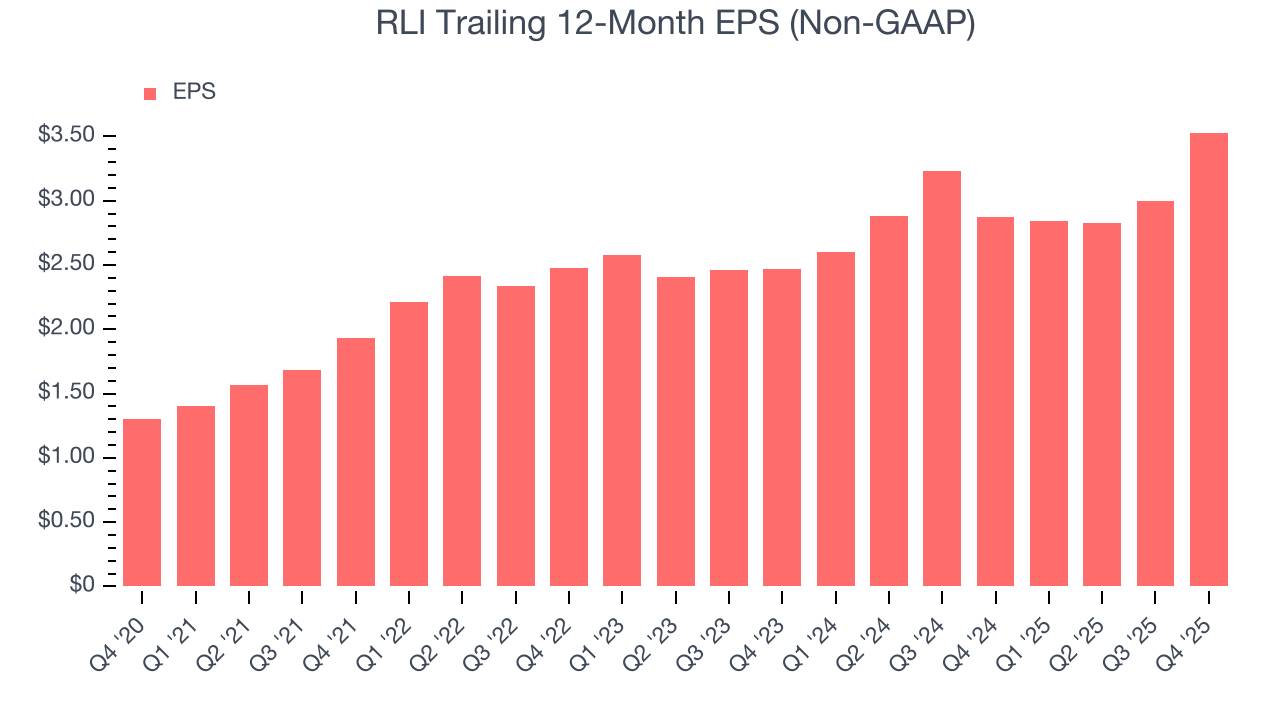

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

RLI’s EPS grew at a spectacular 22.1% compounded annual growth rate over the last five years, higher than its 13.9% annualized revenue growth. However, we take this with a grain of salt because its combined ratio didn’t improve and it didn’t repurchase its shares, meaning the delta came from factors we consider non-core or less sustainable over the long term.

Diving into the nuances of RLI’s earnings can give us a better understanding of its performance. As we mentioned earlier, RLI’s combined ratio improved by 8.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For RLI, its two-year annual EPS growth of 19.5% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, RLI reported adjusted EPS of $0.94, up from $0.41 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects RLI’s full-year EPS of $3.53 to shrink by 16%.

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

RLI’s BVPS grew at a decent 9% annual clip over the last five years. BVPS growth has accelerated recently, growing by 11.8% annually over the last two years from $15.49 to $19.35 per share.

Over the next 12 months, Consensus estimates call for RLI’s BVPS to grow by 8.8% to $20.39, mediocre growth rate.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

RLI currently has $100 million of debt and $1.78 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

11. Return on Equity

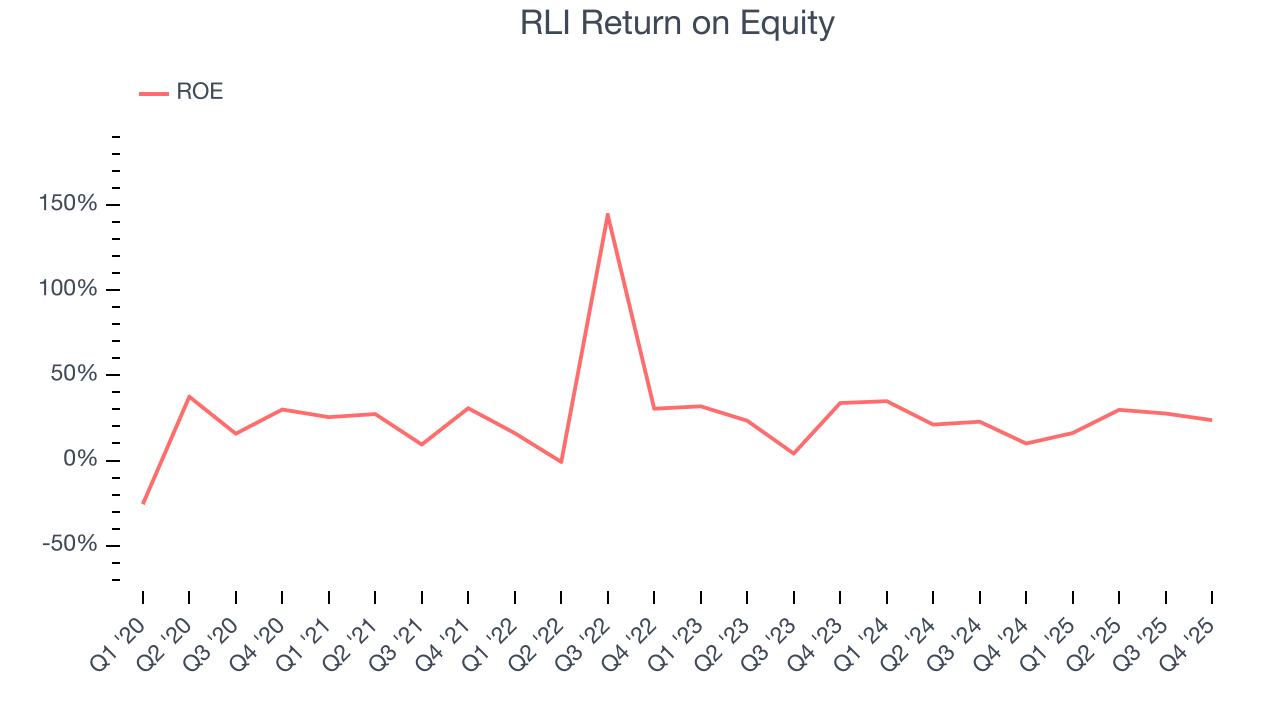

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, RLI has averaged an ROE of 28.1%, exceptional for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This shows RLI has a strong competitive moat.

12. Key Takeaways from RLI’s Q4 Results

It was good to see RLI beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its book value per share missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 1.4% to $58.26 immediately after reporting.

13. Is Now The Time To Buy RLI?

Updated: February 19, 2026 at 11:03 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in RLI.

There’s plenty to admire about RLI. First off, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its stellar ROE suggests it has been a well-run company historically. On top of that, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

RLI’s P/B ratio based on the next 12 months is 3x. This multiple tells us that a lot of good news is priced in. RLI is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $59.75 on the company (compared to the current share price of $60.80).