RingCentral (RNG)

RingCentral faces an uphill battle. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think RingCentral Will Underperform

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral (NYSE:RNG) provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

- Offerings struggled to generate meaningful interest as its average billings growth of 3.2% over the last year did not impress

- Estimated sales growth of 4.1% for the next 12 months implies demand will slow from its two-year trend

- Competitive market means the company must spend more on sales and marketing to stand out even if the return on investment is low

RingCentral doesn’t satisfy our quality benchmarks. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than RingCentral

High Quality

Investable

Underperform

Why There Are Better Opportunities Than RingCentral

RingCentral’s stock price of $31.27 implies a valuation ratio of 1x forward price-to-sales. RingCentral’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. RingCentral (RNG) Research Report: Q4 CY2025 Update

Cloud communications provider RingCentral (NYSE:RNG) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 4.8% year on year to $644 million. The company expects next quarter’s revenue to be around $642.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.18 per share was 4.1% above analysts’ consensus estimates.

RingCentral (RNG) Q4 CY2025 Highlights:

- Revenue: $644 million vs analyst estimates of $642.9 million (4.8% year-on-year growth, in line)

- Adjusted EPS: $1.18 vs analyst estimates of $1.13 (4.1% beat)

- Adjusted Operating Income: $146.7 million vs analyst estimates of $147.1 million (22.8% margin, in line)

- Revenue Guidance for Q1 CY2026 is $642.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.87 at the midpoint, beating analyst estimates by 2.1%

- Operating Margin: 6.6%, up from 2.5% in the same quarter last year

- Free Cash Flow Margin: 19.6%, similar to the previous quarter

- Market Capitalization: $2.53 billion

Company Overview

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral (NYSE:RNG) provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

RingCentral's solutions serve a diverse range of industries including financial services, healthcare, education, retail, and technology. The company's flagship offering, RingCentral MVP, integrates team messaging, video meetings, and cloud phone systems into a unified experience that works across smartphones, tablets, PCs, and desk phones. This location-independent approach allows distributed and mobile workforces to communicate with a single identity regardless of where employees are working.

Beyond its core MVP platform, RingCentral offers a comprehensive portfolio including contact center solutions (RingCentral Contact Center and RingCX), video meeting services (RingCentral Video), and event management capabilities following its acquisition of Hopin Events. The company has also expanded into AI with RingSense, which analyzes conversation data to provide insights for sales teams.

RingCentral generates revenue primarily through subscription plans with monthly, annual, or multi-year terms. The company employs both direct sales teams and indirect channels, including partnerships with major telecommunications providers such as AT&T, Vodafone, BT, and Deutsche Telekom. These strategic relationships allow RingCentral to extend its market reach while telecommunications companies can offer cloud communications solutions to their customer bases without developing the technology themselves.

RingCentral emphasizes open platform capabilities, allowing customers and third-party developers to integrate its services with popular business applications like Salesforce, Microsoft 365, Google Workspace, and Zendesk through APIs and SDKs. This integration ecosystem helps businesses streamline workflows and enhance productivity.

4. Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

RingCentral competes with traditional on-premise communications providers like Avaya and Cisco, cloud-based communications companies including 8x8, Nextiva, and Vonage (acquired by Ericsson), and major technology players such as Microsoft Teams, Zoom, and Google. In the contact center space, RingCentral faces competition from Five9, NICE inContact, Genesys, and Twilio.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, RingCentral grew its sales at a 16.3% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. RingCentral’s recent performance shows its demand has slowed as its annualized revenue growth of 6.9% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, RingCentral grew its revenue by 4.8% year on year, and its $644 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

RingCentral’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between RingCentral’s products and its peers.

7. Gross Margin & Pricing Power

For software companies like RingCentral, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

RingCentral’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 71.3% gross margin over the last year. Said differently, RingCentral had to pay a chunky $28.67 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. RingCentral has seen gross margins improve by 1.5 percentage points over the last 2 year, which is solid in the software space.

This quarter, RingCentral’s gross profit margin was 71.5%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

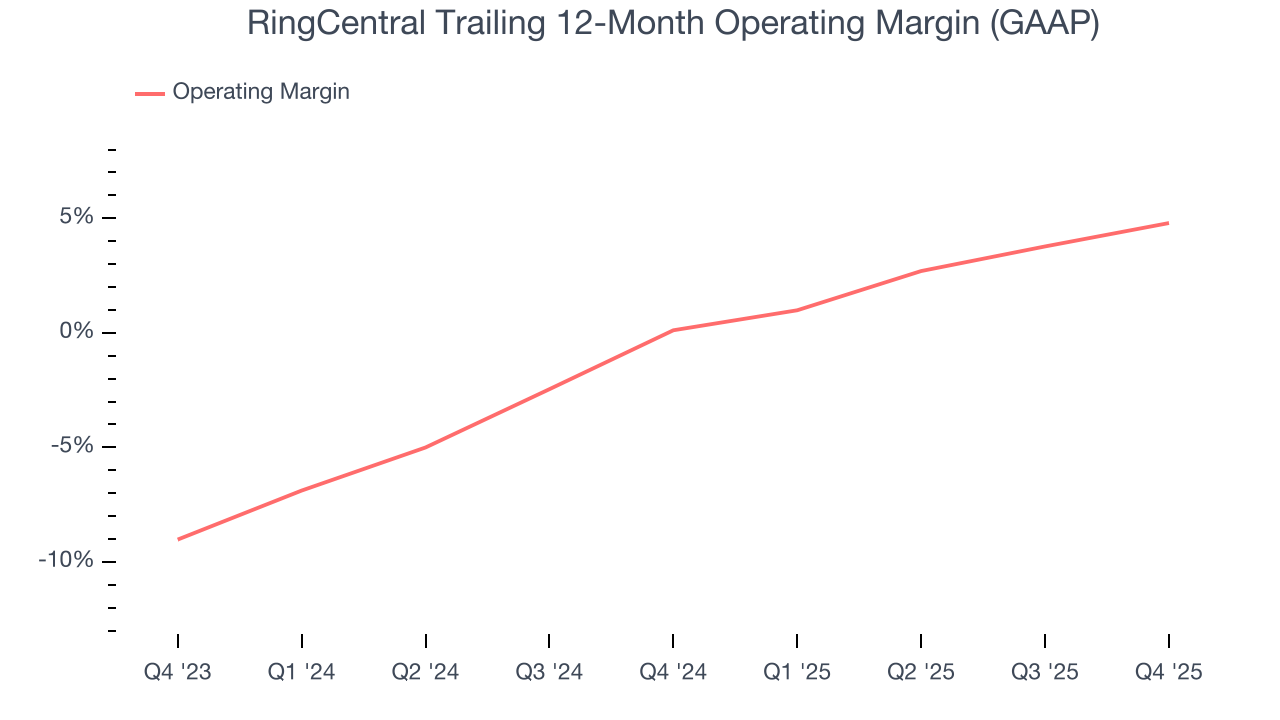

RingCentral has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 4.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, RingCentral’s operating margin rose by 4.7 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, RingCentral generated an operating margin profit margin of 6.6%, up 4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

RingCentral has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.1% over the last year, better than the broader software sector.

RingCentral’s free cash flow clocked in at $126.1 million in Q4, equivalent to a 19.6% margin. This result was good as its margin was 1.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting RingCentral’s free cash flow margin of 21.1% for the last 12 months to remain the same.

10. Balance Sheet Assessment

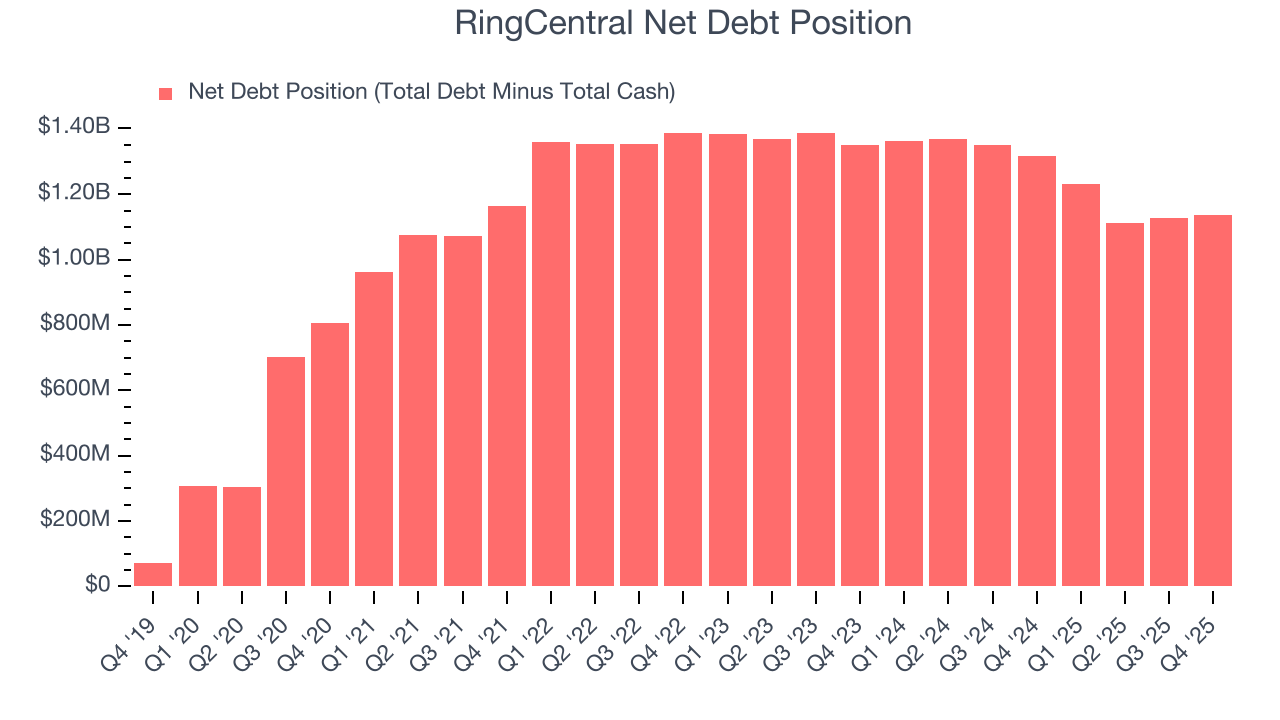

RingCentral reported $132.6 million of cash and $1.27 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $653.1 million of EBITDA over the last 12 months, we view RingCentral’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $57.98 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from RingCentral’s Q4 Results

We were impressed by RingCentral’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3.5% to $30.42 immediately after reporting.

12. Is Now The Time To Buy RingCentral?

Updated: February 19, 2026 at 9:01 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

RingCentral doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its strong free cash flow generation gives it reinvestment options, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

RingCentral’s price-to-sales ratio based on the next 12 months is 1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $33.07 on the company (compared to the current share price of $31.27).