Rollins (ROL)

We love companies like Rollins. Its marriage of growth and profitability makes it a financial powerhouse with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why We Like Rollins

Operating under multiple brands like Orkin and HomeTeam Pest Defense, Rollins (NYSE:ROL) provides pest and wildlife control services to residential and commercial customers.

- Offerings are mission-critical for businesses and result in a best-in-class gross margin of 52.3%

- Disciplined cost controls and effective management have materialized in a strong operating margin

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders, and its rising cash conversion increases its margin of safety

Rollins is a standout company. Any surprise this is one of our favorite stocks?

Is Now The Time To Buy Rollins?

High Quality

Investable

Underperform

Is Now The Time To Buy Rollins?

Rollins’s stock price of $56.42 implies a valuation ratio of 50.8x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Are you a fan of the company and its story? If so, we suggest a small position as the long-term outlook seems promising. Keep in mind that its premium valuation could result in rocky short-term stock performance.

3. Rollins (ROL) Research Report: Q4 CY2025 Update

Pest control company Rollins (NYSE:ROL) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 9.7% year on year to $912.9 million. Its non-GAAP profit of $0.25 per share was 6.6% below analysts’ consensus estimates.

Rollins (ROL) Q4 CY2025 Highlights:

- Revenue: $912.9 million vs analyst estimates of $927.7 million (9.7% year-on-year growth, 1.6% miss)

- Adjusted EPS: $0.25 vs analyst expectations of $0.27 (6.6% miss)

- Adjusted EBITDA: $193.7 million vs analyst estimates of $209 million (21.2% margin, 7.3% miss)

- Operating Margin: 17.5%, in line with the same quarter last year

- Free Cash Flow Margin: 17.4%, down from 22.1% in the same quarter last year

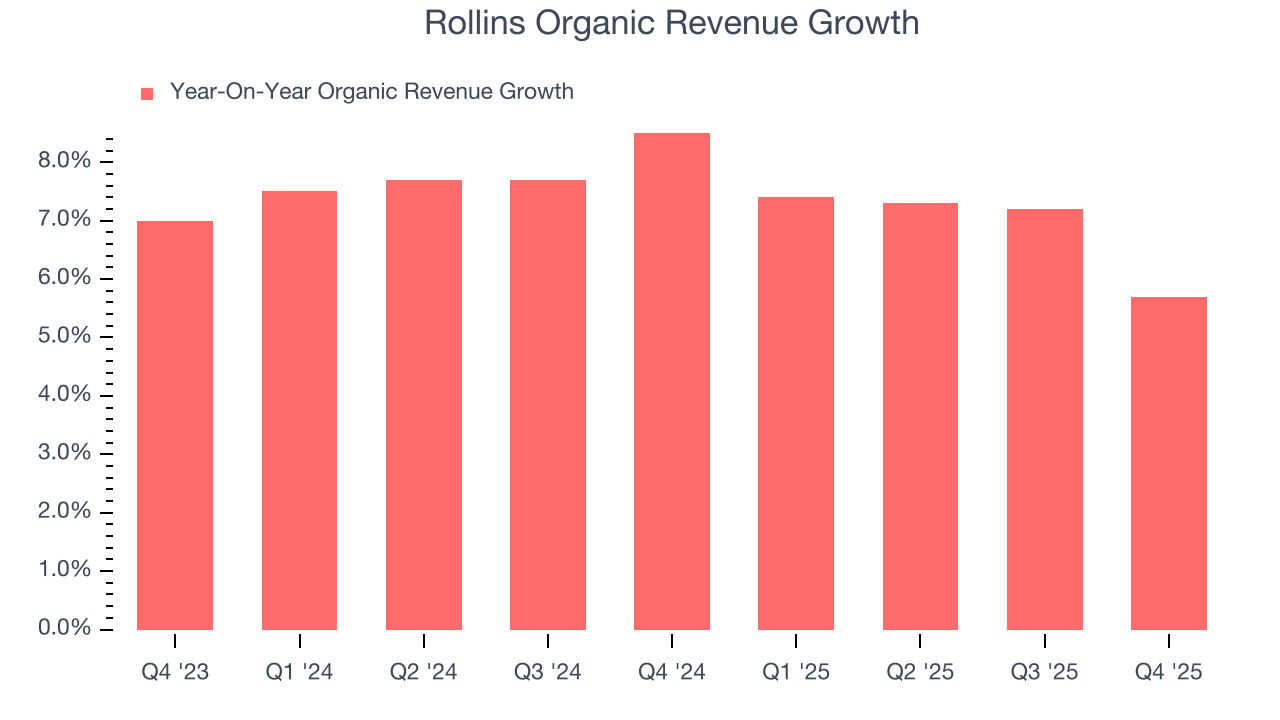

- Organic Revenue rose 5.7% year on year (miss)

- Market Capitalization: $31.26 billion

Company Overview

Operating under multiple brands like Orkin and HomeTeam Pest Defense, Rollins (NYSE:ROL) provides pest and wildlife control services to residential and commercial customers.

The company employs a team of trained technicians and specialists who use integrated and increasingly tech-focused management strategies for pest control. Rollins operates in a fairly fragmented industry--with many local and regional players--and has acted as a consolidator over time. Major acquisitions include Orkin in 1964, HomeTeam Pest Defense in 2008, and Fox Pest Contol in 2023, among others.

Its three service offerings are 1) protecting residential properties from common pests like rodents and insects; 2) workplace pest control for customers in the healthcare, food service, and logistics end markets; and 3) termite protection and ancillary services. The company wins business through a combination of brand recognition, reliable and safe service, and long-term 'do-it-for-me' trends. Generally, the typical homeowner today is busier, less handy, and more willing to pay someone else for everything from car repairs to landscaping to pest control.

Residential services make up the most of its revenue, followed by its commercial services, and then termite services. The company earns its revenue through service contracts, which are made through a combination of direct sales teams, partnerships, and digital and traditional marketing, and the reputation it has built for operating in more than 70 countries for decades.

4. Facility Services

Many facility services are non-discretionary (office building bathrooms need to be cleaned), recurring, and performed through contracts. This makes for more predictable and stickier revenue streams. However, COVID changed the game regarding commercial real estate, and office vacancies remain high as hybrid work seems here to stay. This is a headwind for demand, and facility services companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these companies’ services.

Other large-cap international pest control companies include Ecolab (NYSE:ECL), Reckitt Benckiser Group (LON:RKT), and Spectrum Brand (NYSE:SPB).

5. Revenue Growth

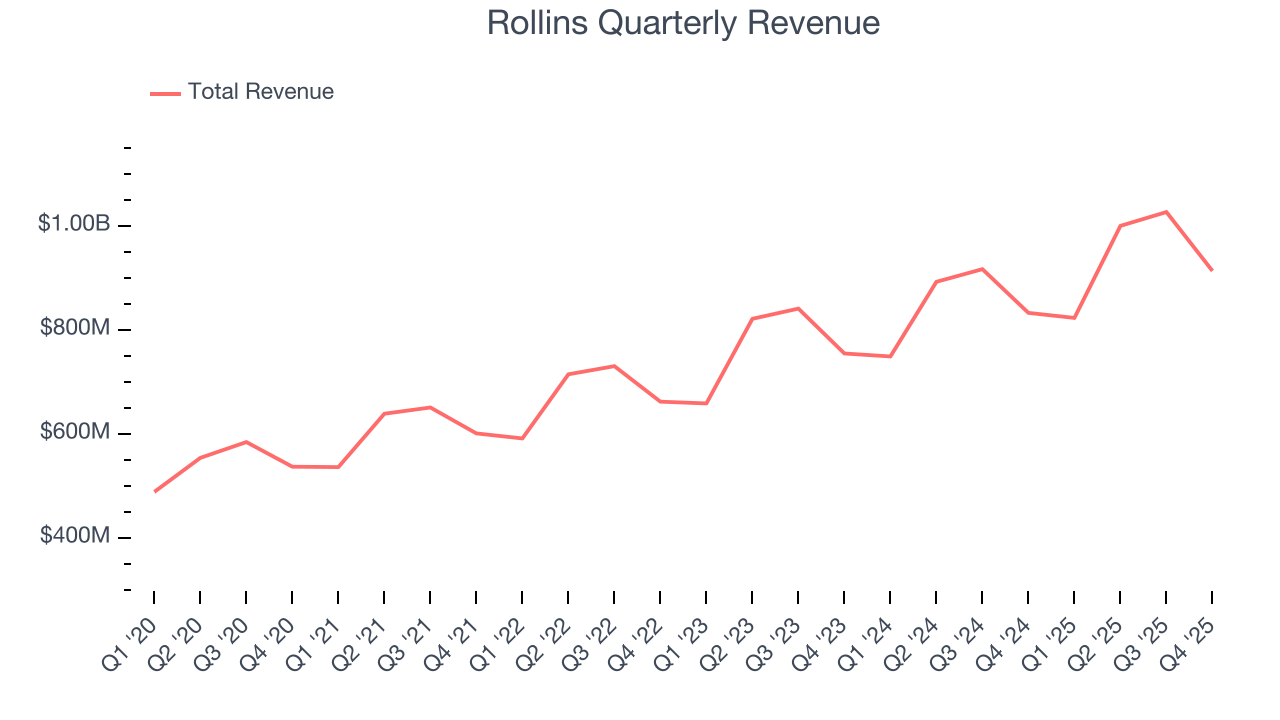

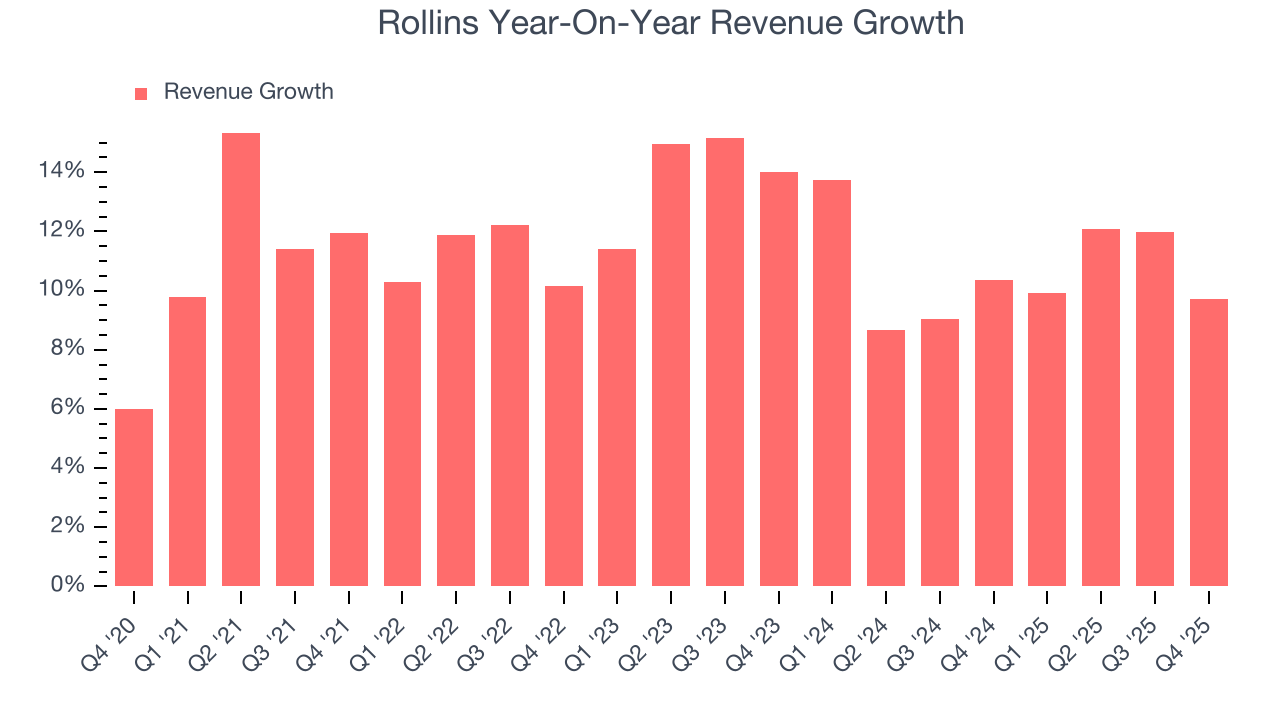

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Rollins’s 11.7% annualized revenue growth over the last five years was impressive. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Rollins’s annualized revenue growth of 10.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Rollins’s organic revenue averaged 7.4% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Rollins’s revenue grew by 9.7% year on year to $912.9 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, similar to its two-year rate. Still, this projection is commendable and suggests the market sees success for its products and services.

6. Gross Margin & Pricing Power

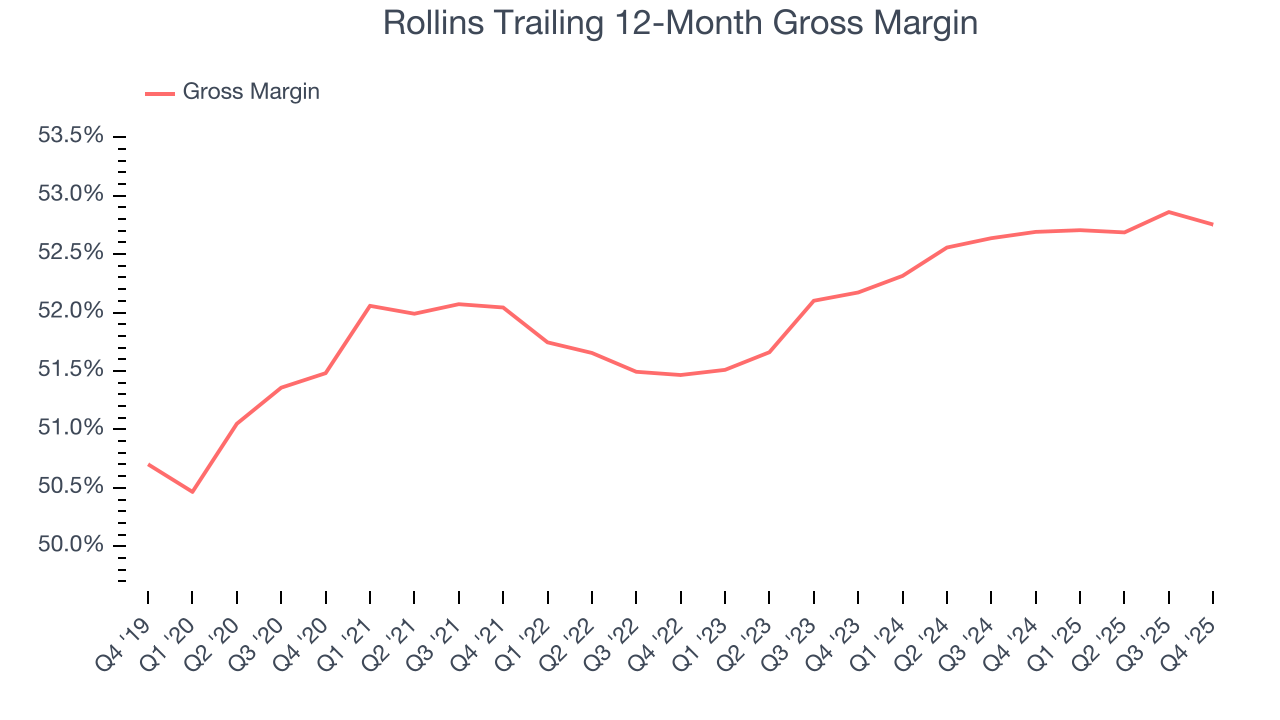

Rollins has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 52.3% gross margin over the last five years. Said differently, roughly $52.28 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Rollins’s gross profit margin was 51%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

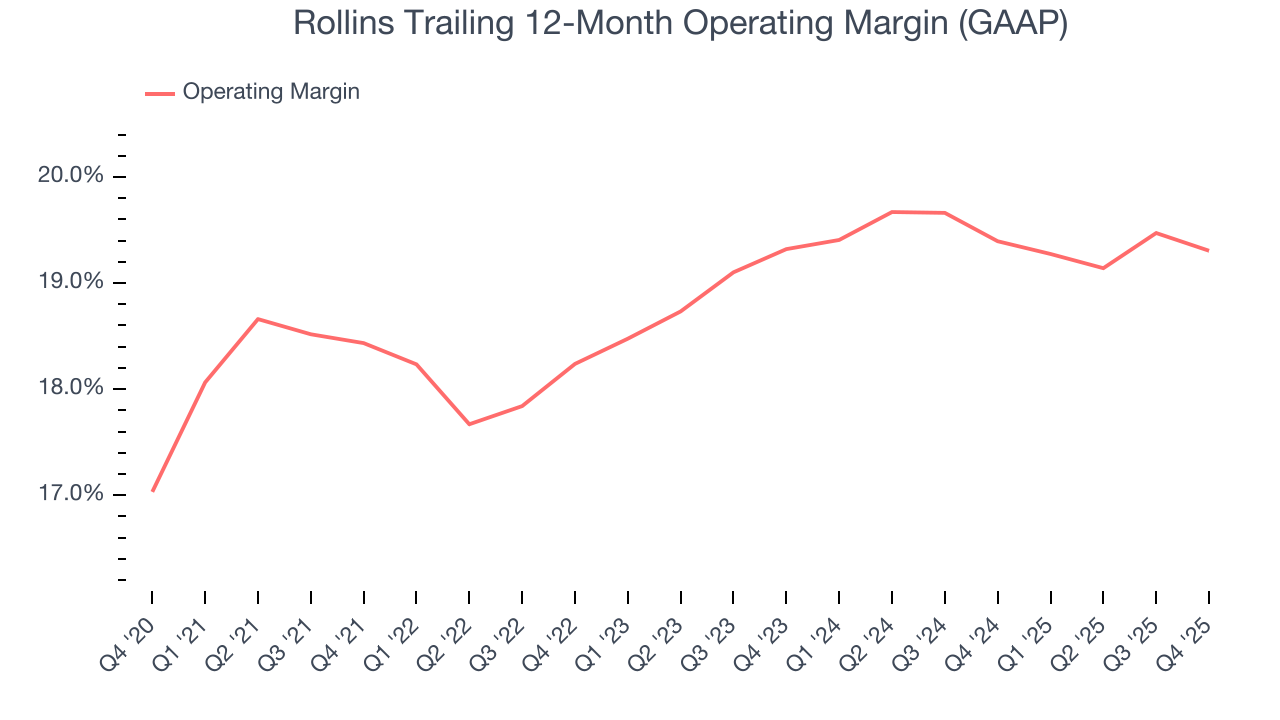

7. Operating Margin

Rollins’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 19% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Analyzing the trend in its profitability, Rollins’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Rollins generated an operating margin profit margin of 17.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

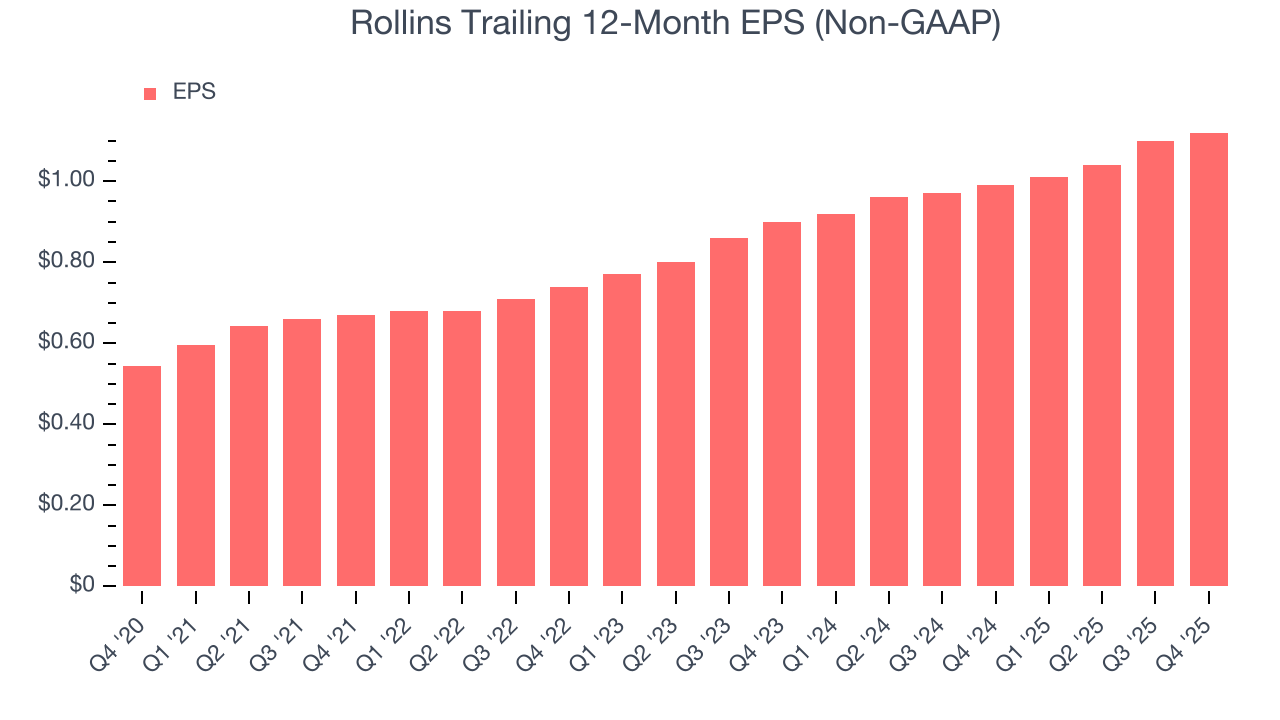

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

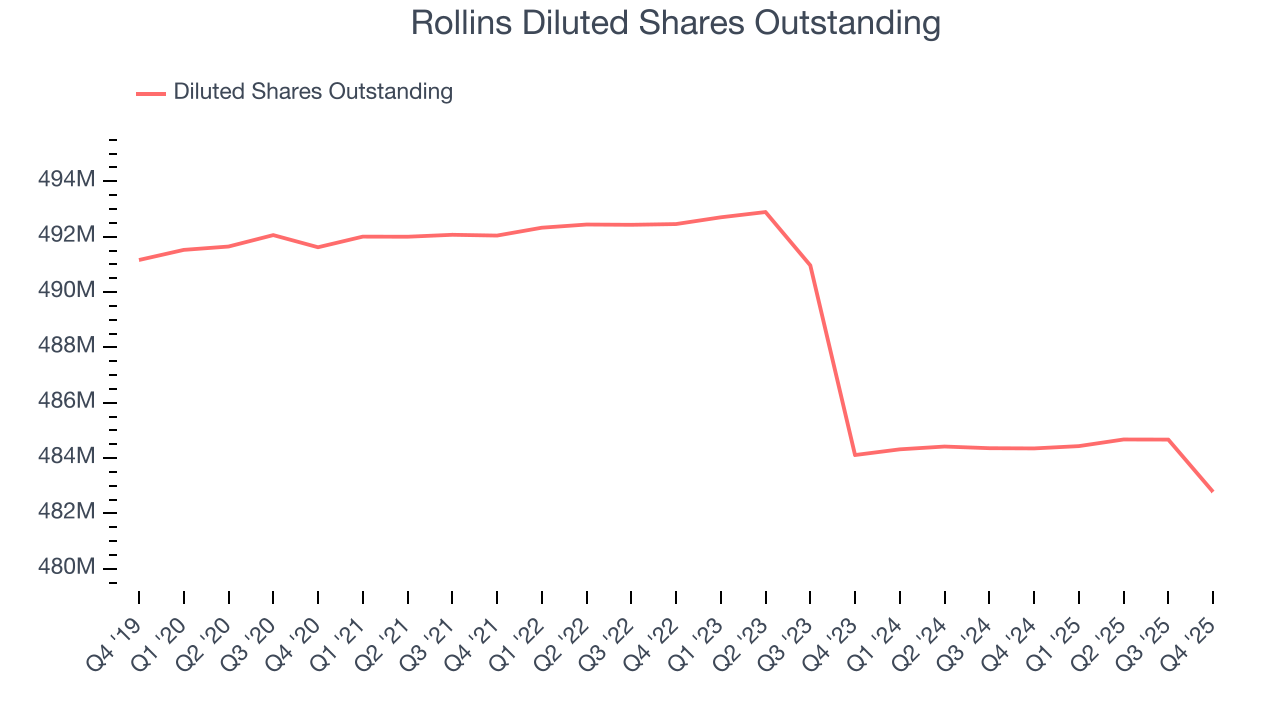

Rollins’s EPS grew at a spectacular 15.6% compounded annual growth rate over the last five years, higher than its 11.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Rollins’s earnings can give us a better understanding of its performance. A five-year view shows that Rollins has repurchased its stock, shrinking its share count by 1.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rollins, its two-year annual EPS growth of 11.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Rollins reported adjusted EPS of $0.25, up from $0.23 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Rollins’s full-year EPS of $1.12 to grow 14.1%.

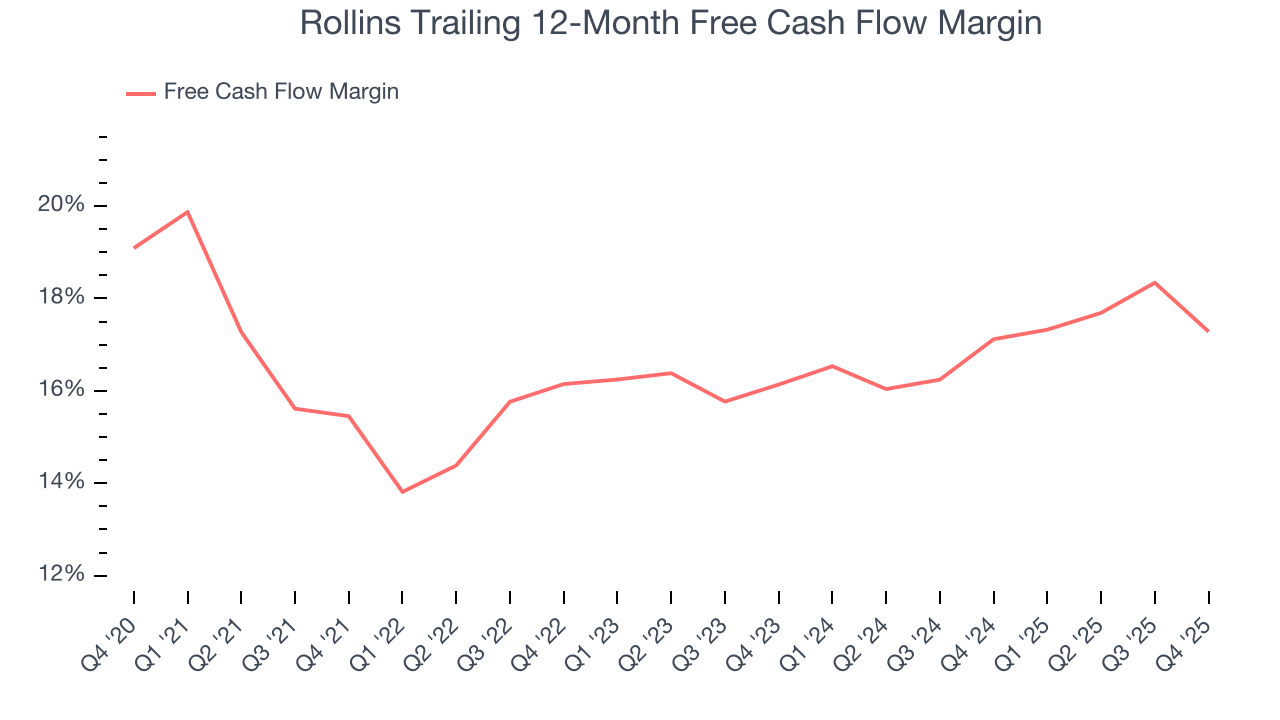

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Rollins has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.5% over the last five years.

Taking a step back, we can see that Rollins’s margin expanded by 1.8 percentage points during that time. This is encouraging because it gives the company more optionality.

Rollins’s free cash flow clocked in at $159 million in Q4, equivalent to a 17.4% margin. The company’s cash profitability regressed as it was 4.7 percentage points lower than in the same quarter last year, but we wouldn’t read too much into it because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to quarter-to-quarter swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

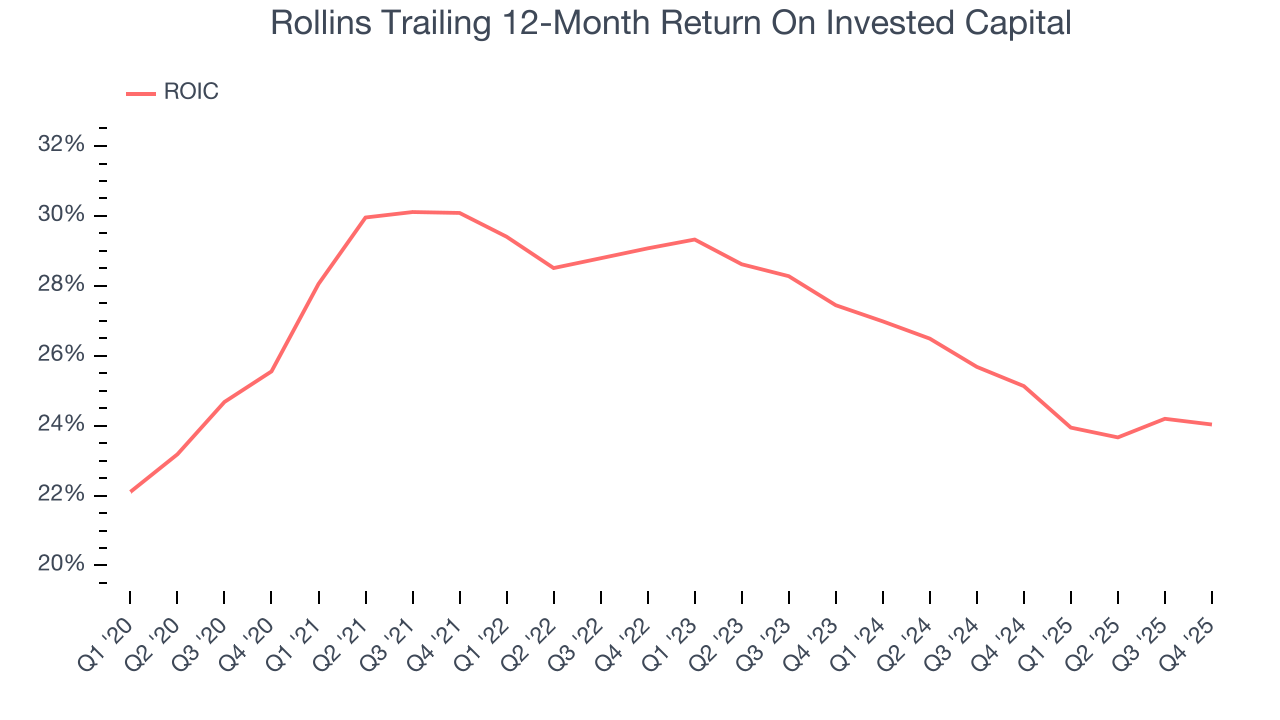

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Rollins’s five-year average ROIC was 27.2%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Rollins’s ROIC averaged 5 percentage point decreases each year over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

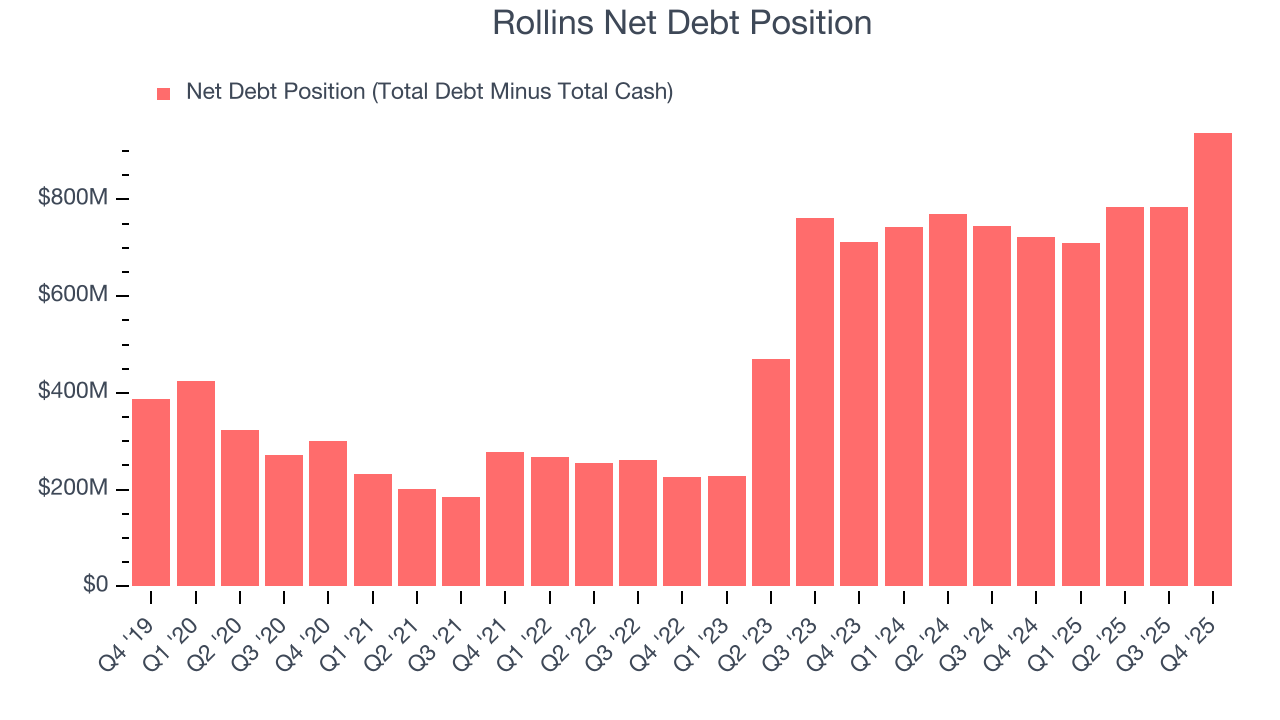

Rollins reported $100 million of cash and $1.04 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $855.1 million of EBITDA over the last 12 months, we view Rollins’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $13.68 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Rollins’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 13.6% to $56.68 immediately following the results.

13. Is Now The Time To Buy Rollins?

Updated: February 11, 2026 at 10:14 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are several reasons why we think Rollins is a great business. For starters, its revenue growth was impressive over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its admirable gross margins indicate the mission-critical nature of its offerings. Additionally, Rollins’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Rollins’s P/E ratio based on the next 12 months is 50.8x. A lot of good news is certainly baked in given its premium multiple, but we’ll happily own Rollins as its fundamentals really stand out. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $65.28 on the company (compared to the current share price of $56.42).