Boston Beer (SAM)

Boston Beer doesn’t excite us. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Boston Beer Will Underperform

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

- Sales were flat over the last three years, indicating it’s failed to expand its business

- Projected sales for the next 12 months are flat and suggest demand will be subdued

- A consolation is that its earnings per share grew by 35.8% annually over the last three years and beat its peers

Boston Beer’s quality is not up to our standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Boston Beer

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Boston Beer

Boston Beer’s stock price of $247.57 implies a valuation ratio of 23.5x forward P/E. Not only is Boston Beer’s multiple richer than most consumer staples peers, but it’s also expensive for its revenue characteristics.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Boston Beer (SAM) Research Report: Q3 CY2025 Update

Beer company Boston Beer (NYSE:SAM) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 11.2% year on year to $537.5 million. Its non-GAAP profit of $4.25 per share was 27.4% above analysts’ consensus estimates.

Boston Beer (SAM) Q3 CY2025 Highlights:

- Revenue: $537.5 million vs analyst estimates of $542.6 million (11.2% year-on-year decline, 0.9% miss)

- Adjusted EPS: $4.25 vs analyst estimates of $3.34 (27.4% beat)

- Adjusted EBITDA: $84.6 million vs analyst estimates of $77.45 million (15.7% margin, 9.2% beat)

- Operating Margin: 11.5%, up from 7.6% in the same quarter last year

- Free Cash Flow Margin: 16.6%, similar to the same quarter last year

- Market Capitalization: $2.07 billion

Company Overview

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

The company was founded in 1984 by Jim Koch in Boston, Massachusetts. Koch had a vision to reintroduce traditional brewing techniques and artisanal flavors to American consumers, catalyzing a craft beer revolution.

In this context, it’s quite fitting that Boston Beer’s first brand was named after Samuel Adams, an American Founding Father and revolutionary patriot. Samuel Adams Boston Lager is the flagship brand in Boston Beer’s portfolio, which also includes other household names like Truly Hard Seltzer and Angry Orchard hard cider.

Boston Beer’s diversity of beverage types helps it adapt to changing market dynamics and consumer demands. It also positions itself well to capitalize on trends in the beverage industry.

The company’s influence extends across the United States and select international markets. To get its products into the hands of consumers, it leverages a network of distributors and retailers. This includes partnerships with bars, restaurants, supermarkets, and liquor stores.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors include Anheuser-Busch Inbev (NYSE:BUD), Constellation Brands (NYSE:STZ), and Molson Coors (NYSE:TAP) along with international companies such as Asahi, Carlsberg, and Heineken.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.98 billion in revenue over the past 12 months, Boston Beer is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

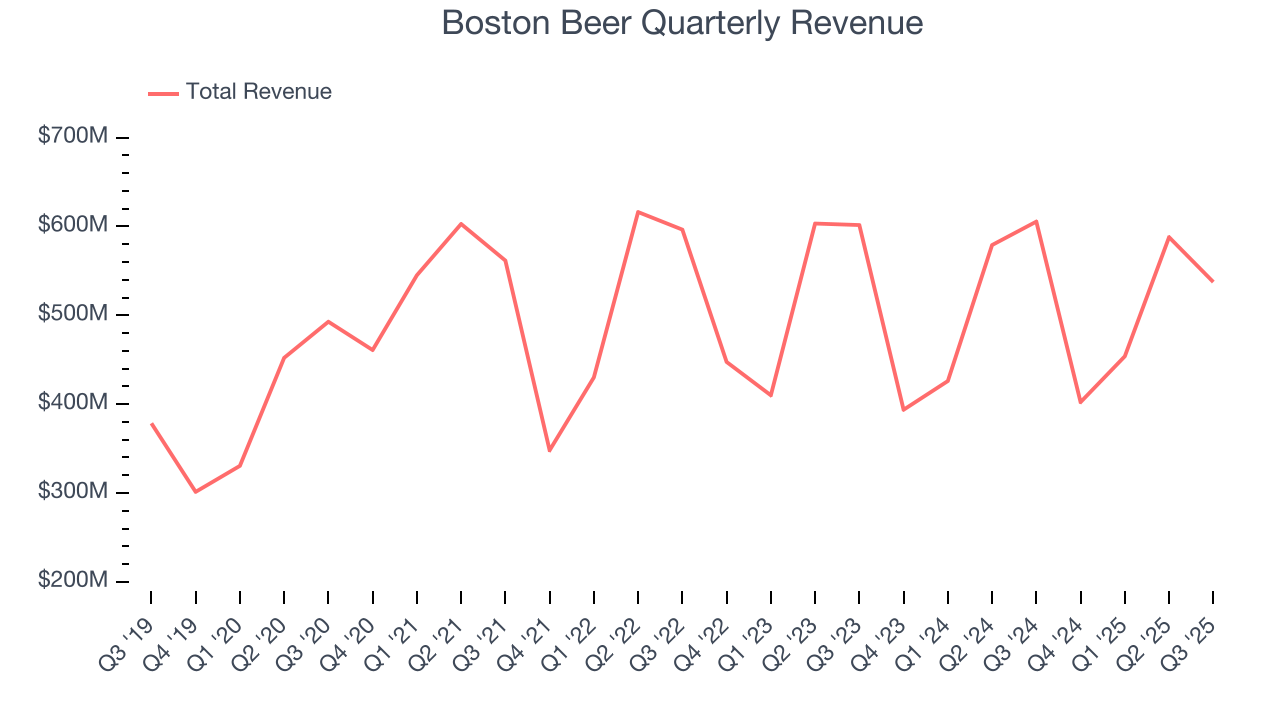

As you can see below, Boston Beer struggled to increase demand as its $1.98 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a poor baseline for our analysis.

This quarter, Boston Beer missed Wall Street’s estimates and reported a rather uninspiring 11.2% year-on-year revenue decline, generating $537.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and indicates its newer products will not accelerate its top-line performance yet.

6. Gross Margin & Pricing Power

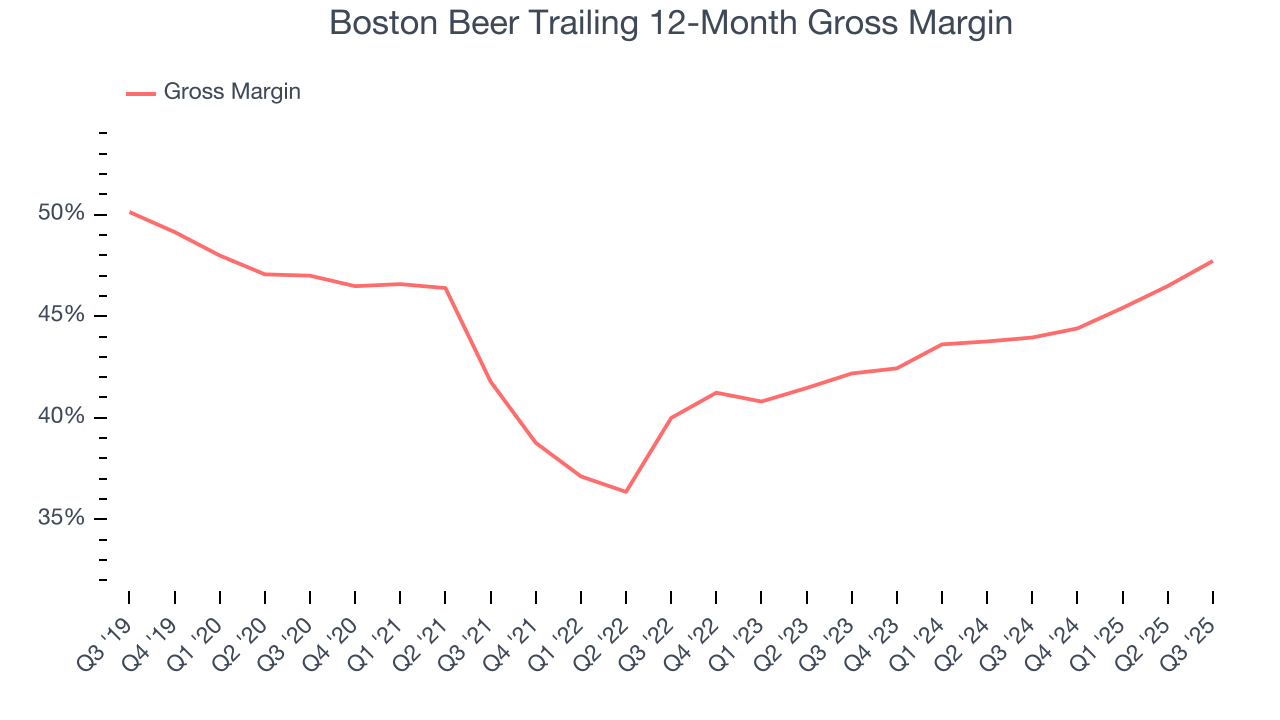

Boston Beer has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 45.8% gross margin over the last two years. That means for every $100 in revenue, only $54.18 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, Boston Beer’s gross profit margin was 50.8%, marking a 4.5 percentage point increase from 46.3% in the same quarter last year. Boston Beer’s full-year margin has also been trending up over the past 12 months, increasing by 3.8 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

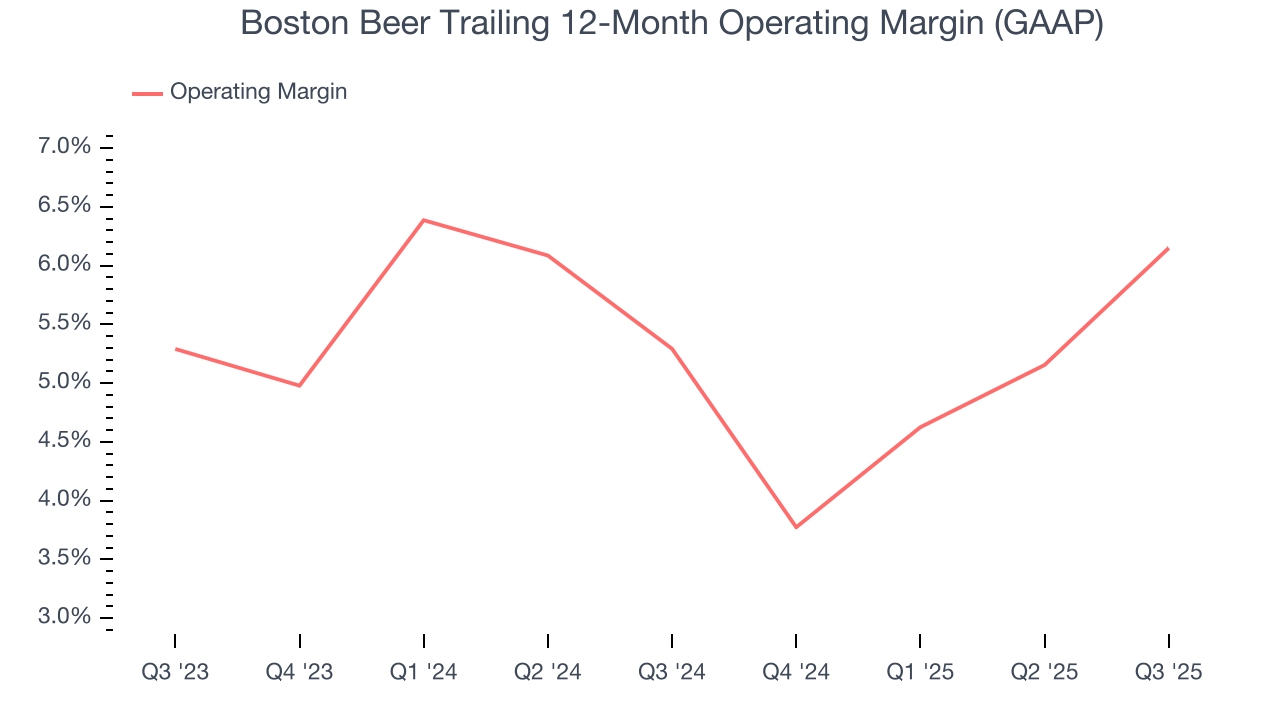

Boston Beer’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5.7% over the last two years. This profitability was mediocre for a consumer staples business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Boston Beer’s operating margin might fluctuated slightly but has generally stayed the same over the last year, which doesn’t help its cause.

This quarter, Boston Beer generated an operating margin profit margin of 11.5%, up 4 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

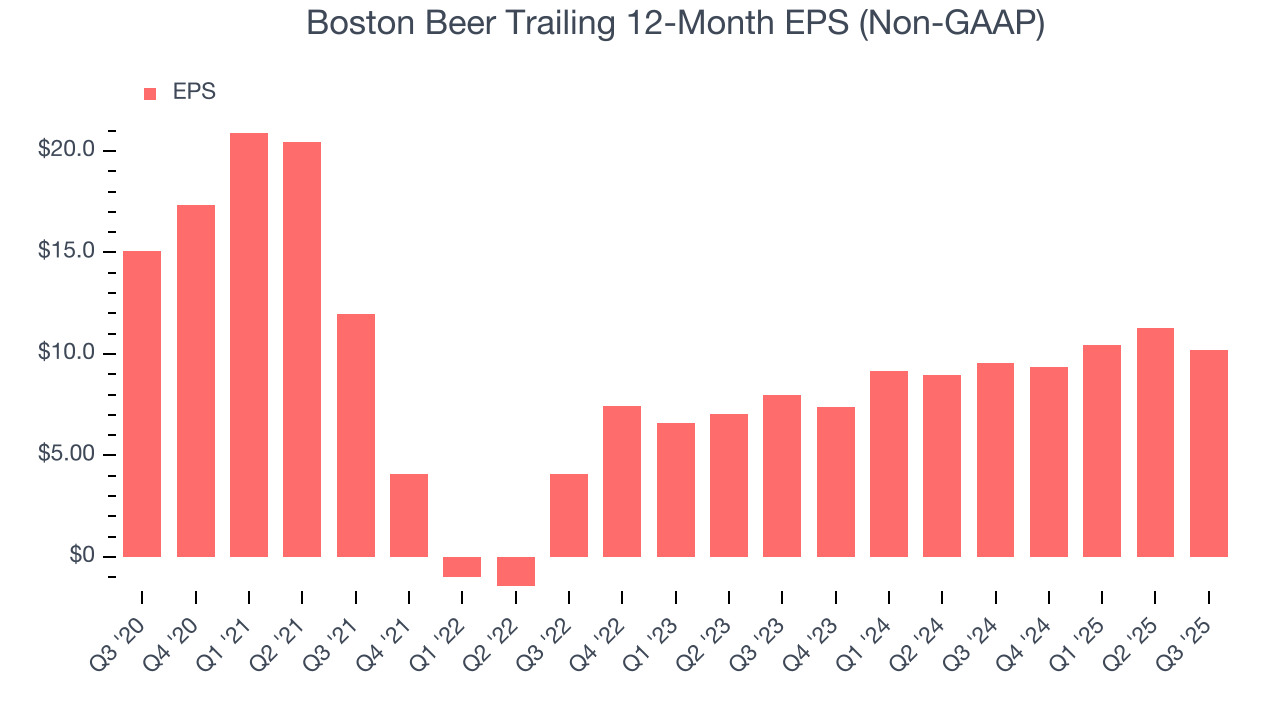

In Q3, Boston Beer reported adjusted EPS of $4.25, down from $5.36 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Boston Beer’s full-year EPS of $10.18 to grow 2.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

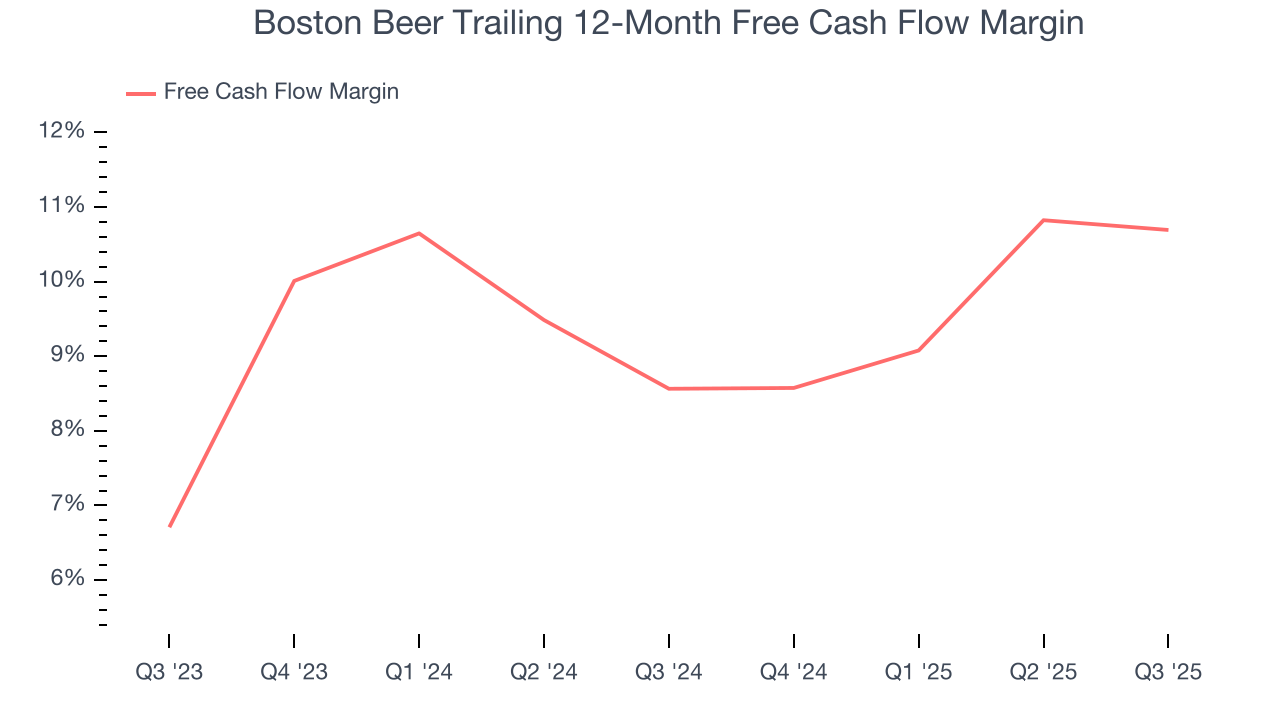

Boston Beer has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.6% over the last two years, quite impressive for a consumer staples business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Boston Beer’s margin expanded by 2.1 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Boston Beer’s free cash flow clocked in at $89.24 million in Q3, equivalent to a 16.6% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

10. Return on Invested Capital (ROIC)

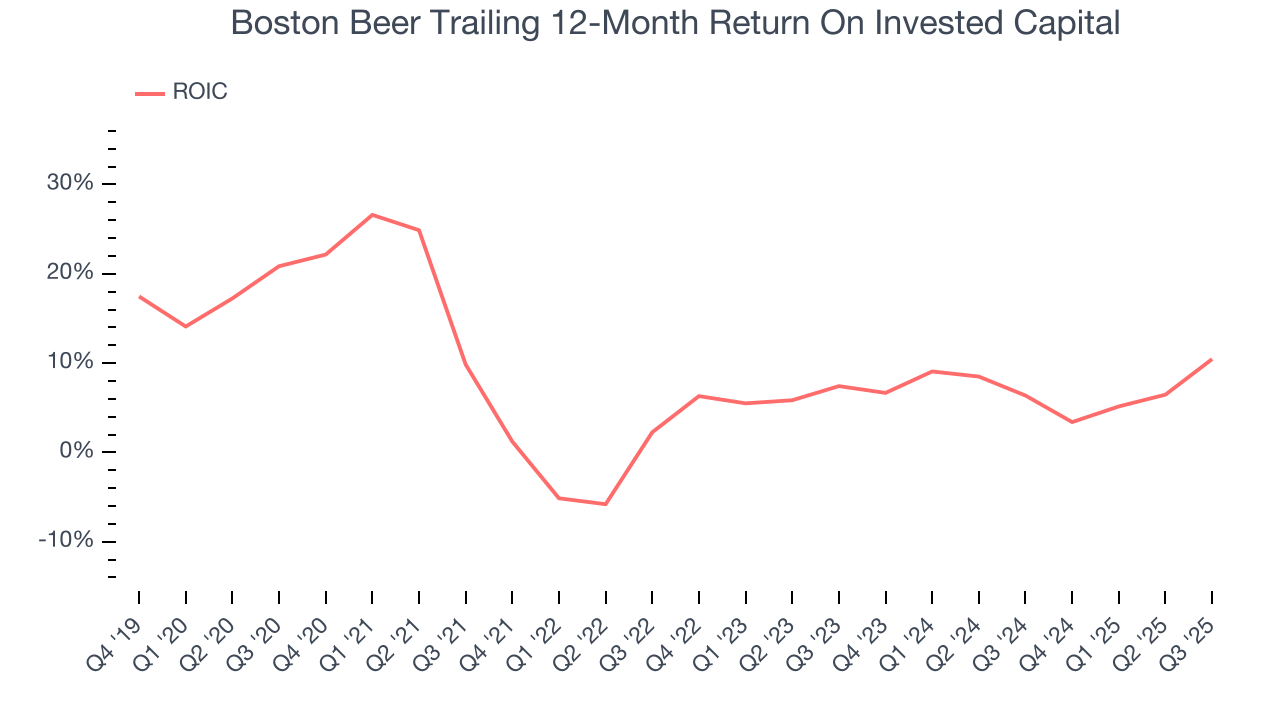

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Boston Beer historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.3%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

11. Balance Sheet Assessment

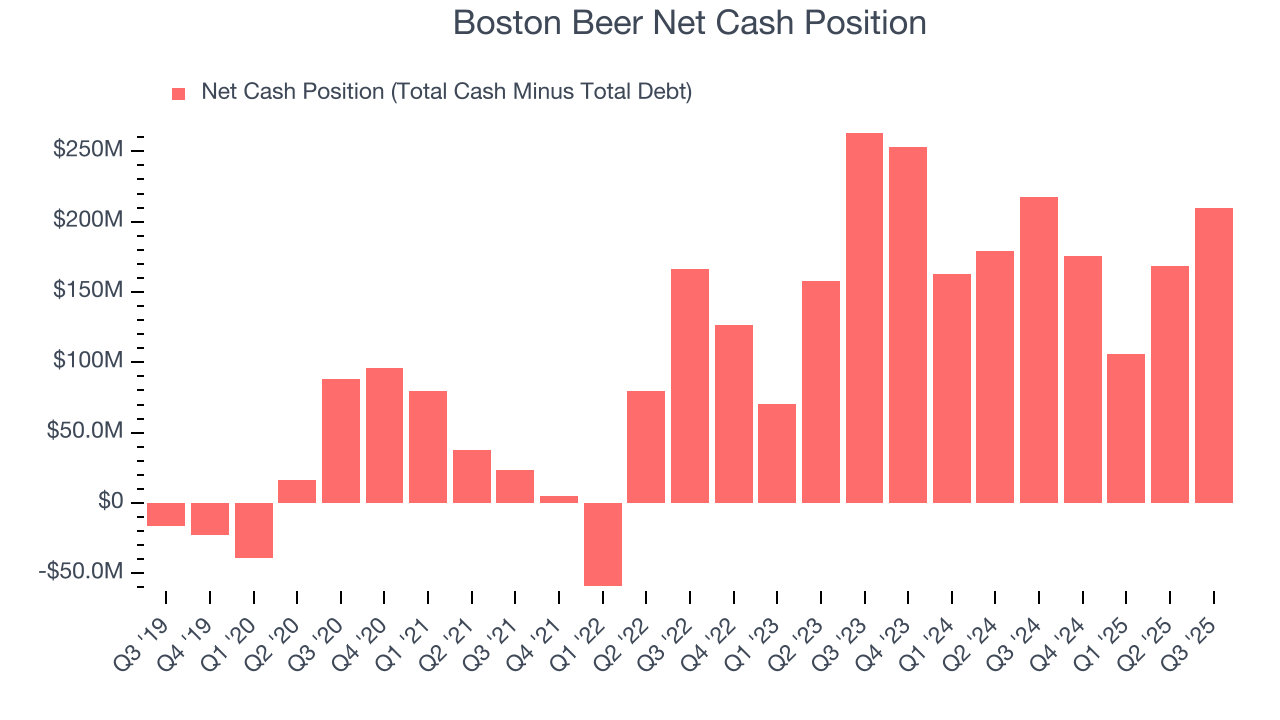

Companies with more cash than debt have lower bankruptcy risk.

Boston Beer is a profitable, well-capitalized company with $250.5 million of cash and $40.9 million of debt on its balance sheet. This $209.6 million net cash position is 10.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Boston Beer’s Q3 Results

We were impressed by how significantly Boston Beer blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $198.28 immediately following the results.

13. Is Now The Time To Buy Boston Beer?

Updated: February 16, 2026 at 9:58 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Boston Beer isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue has declined over the last three years, and analysts don’t see anything changing over the next 12 months. While its EPS growth over the last three years has been fantastic, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

Boston Beer’s P/E ratio based on the next 12 months is 23.5x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $240.15 on the company (compared to the current share price of $247.57), implying they don’t see much short-term potential in Boston Beer.