Steelcase (SCS)

We wouldn’t recommend Steelcase. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Steelcase Will Underperform

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE:SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

- Flat earnings per share over the last five years underperformed the sector average

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

Steelcase doesn’t measure up to our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Steelcase

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Steelcase

Steelcase is trading at $16.36 per share, or 13.7x forward P/E. Steelcase’s multiple may seem like a great deal among business services peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Steelcase (SCS) Research Report: Q3 CY2025 Update

Office furniture manufacturer Steelcase (NYSE:SCS) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 4.8% year on year to $897.1 million. Its non-GAAP profit of $0.45 per share was 23.3% above analysts’ consensus estimates.

Steelcase (SCS) Q3 CY2025 Highlights:

- Revenue: $897.1 million vs analyst estimates of $873.6 million (4.8% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.45 vs analyst estimates of $0.37 (23.3% beat)

- Adjusted EBITDA: $99.6 million vs analyst estimates of $80.23 million (11.1% margin, 24.1% beat)

- Operating Margin: 5.9%, in line with the same quarter last year

- Free Cash Flow Margin: 4.5%, down from 11.2% in the same quarter last year

- Market Capitalization: $1.94 billion

Company Overview

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE:SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

Steelcase's product portfolio spans individual and collaborative workspaces, featuring furniture systems, ergonomic seating, storage solutions, height-adjustable desks, tables, and architectural elements like walls and pods. The company's offerings are designed based on human-centered research to help organizations create environments that enhance productivity, support employee well-being, and reflect organizational culture.

The company serves its customers primarily through a network of approximately 770 independent and company-owned dealers worldwide. Its client base includes corporations, government entities, educational institutions, and healthcare organizations of various sizes, with particular strength among larger multinational companies. Steelcase generates revenue by selling its furniture and architectural products, while also offering complementary services such as workplace strategy consulting and furniture management.

Beyond its flagship Steelcase brand, the company operates several specialized brands that target specific market segments. These include AMQ (affordable collaborative furniture), Coalesse (premium design-focused products), Designtex (surface materials and fabrics), HALCON (precision wood furniture), Orangebox (flexible workspace solutions), Smith System (education furniture), and Viccarbe (contemporary collaborative furniture).

Steelcase maintains manufacturing and distribution operations across North America, Europe, and Asia, with facilities in countries including the United States, Mexico, Czech Republic, France, Germany, Spain, the United Kingdom, China, India, and Malaysia. This global footprint allows the company to serve international clients while adapting to regional preferences and requirements.

4. Office & Commercial Furniture

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

Steelcase's primary competitors include MillerKnoll, Inc. (formed by the merger of Herman Miller and Knoll), Haworth, Inc., and HNI Corporation (NYSE:HNI), along with numerous regional and specialized furniture manufacturers in its various global markets.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.26 billion in revenue over the past 12 months, Steelcase is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

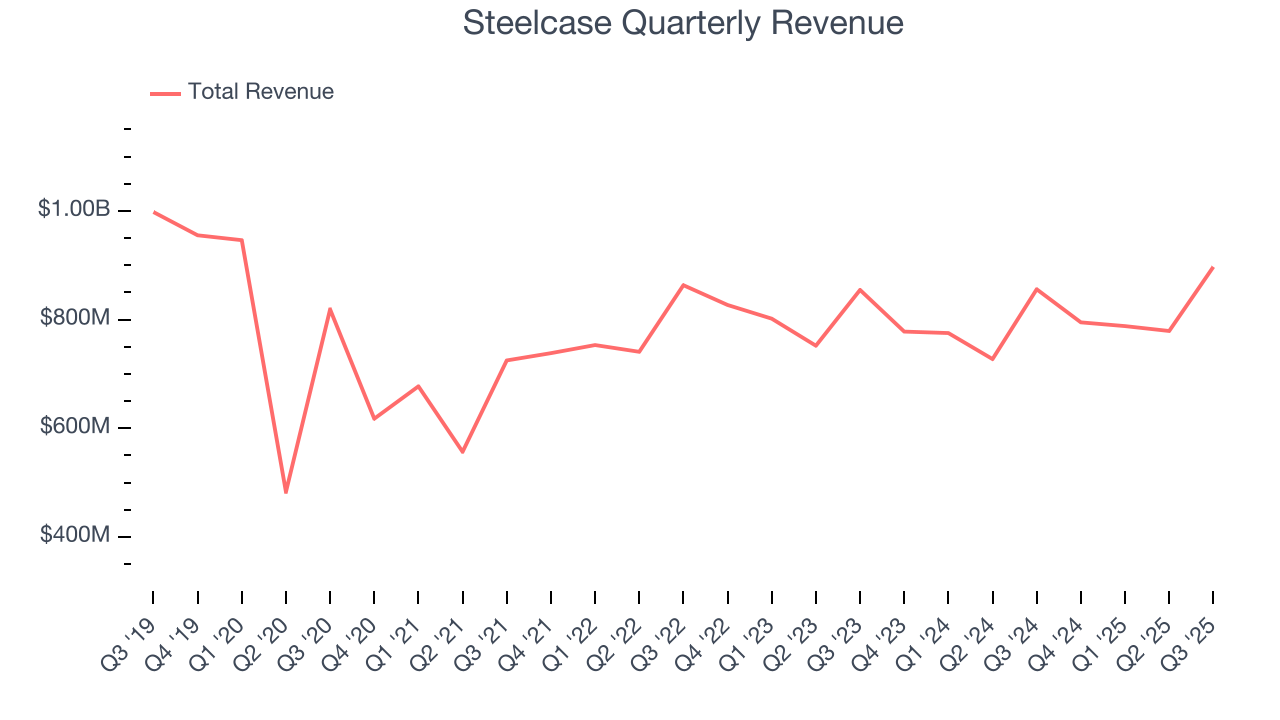

As you can see below, Steelcase struggled to increase demand as its $3.26 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Just like its five-year trend, Steelcase’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Steelcase reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

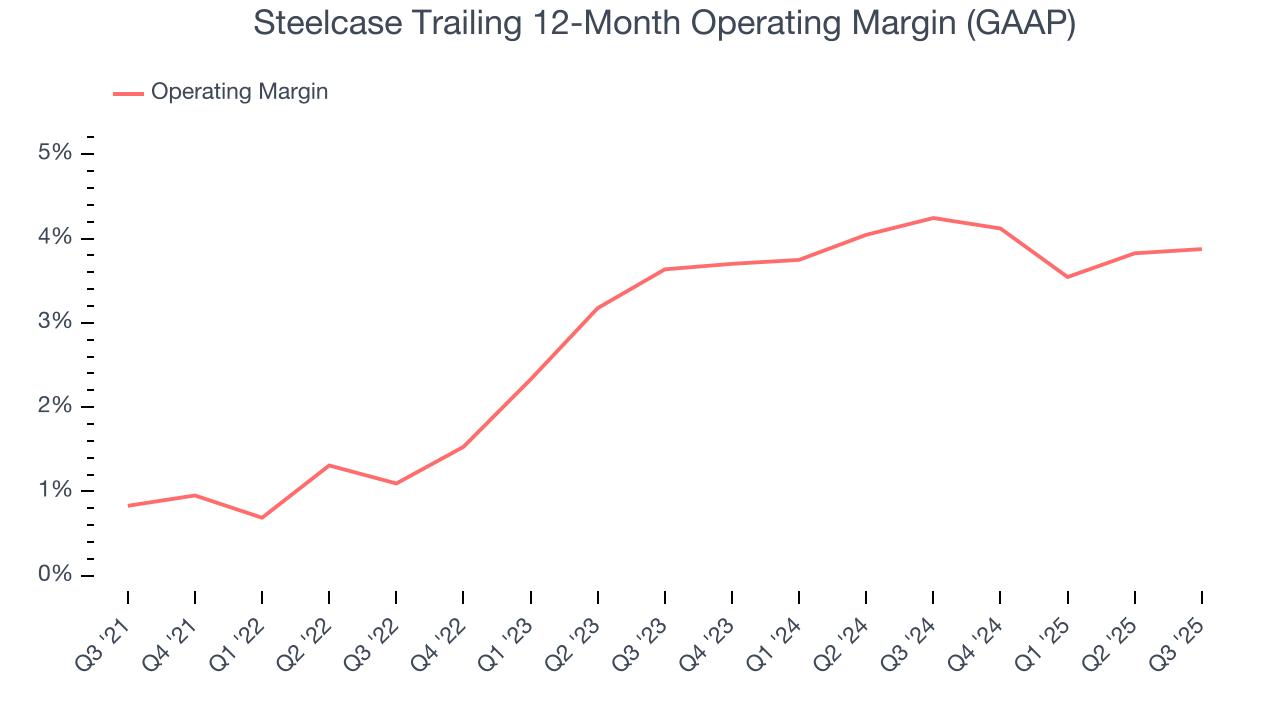

Steelcase was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.8% was weak for a business services business.

On the plus side, Steelcase’s operating margin rose by 3 percentage points over the last five years.

This quarter, Steelcase generated an operating margin profit margin of 5.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

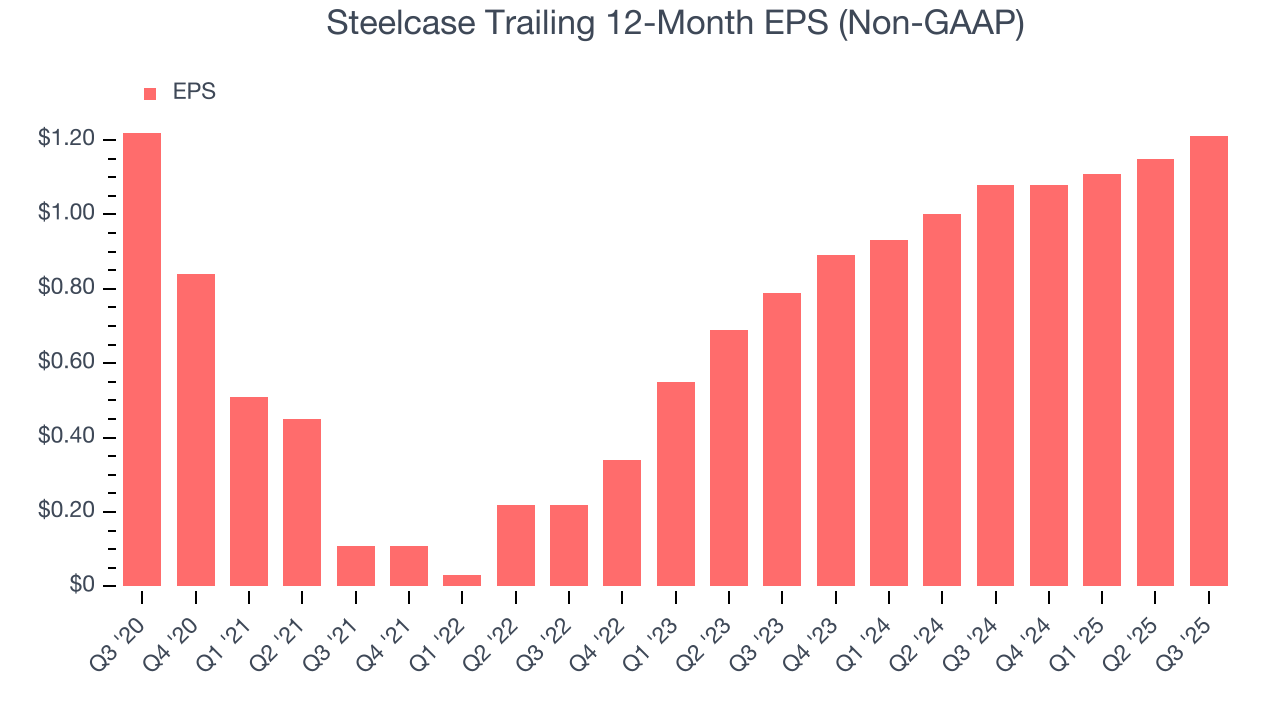

Steelcase’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Steelcase, its two-year annual EPS growth of 23.8% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q3, Steelcase reported adjusted EPS of $0.45, up from $0.39 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Steelcase’s full-year EPS of $1.21 to shrink by 1.2%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

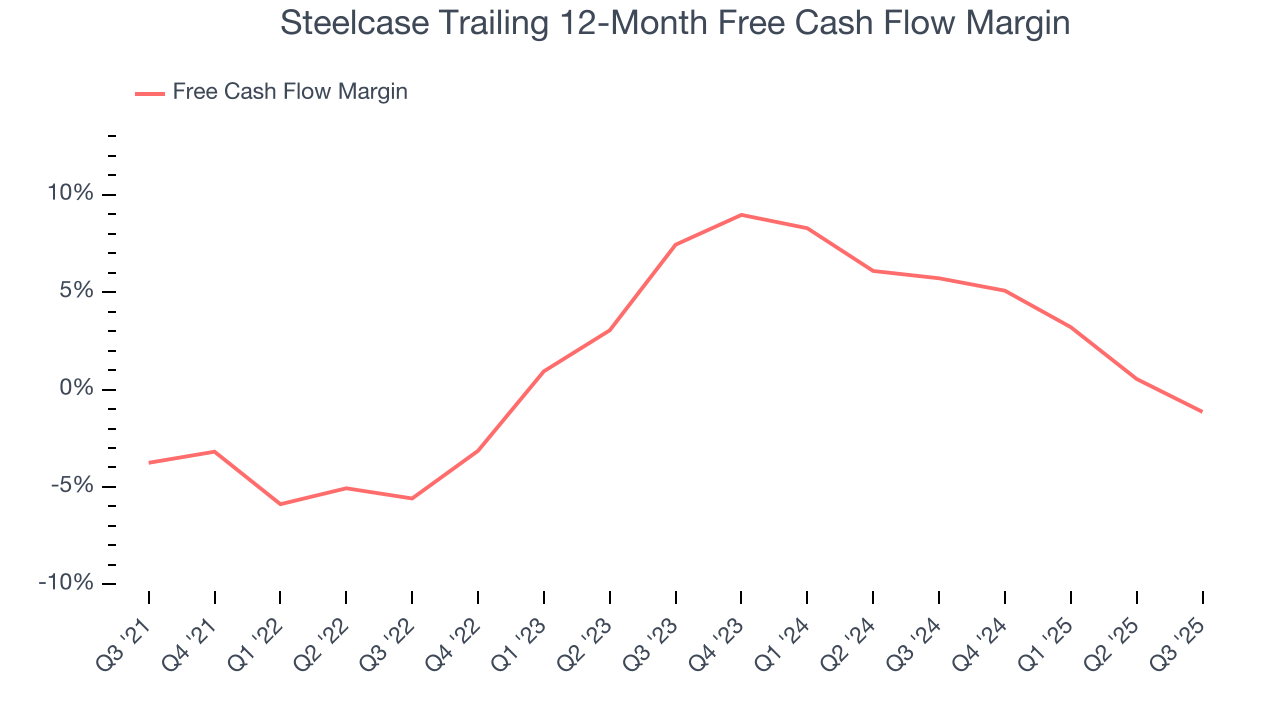

Steelcase broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Steelcase’s margin expanded by 2.6 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Steelcase’s free cash flow clocked in at $40.8 million in Q3, equivalent to a 4.5% margin. The company’s cash profitability regressed as it was 6.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

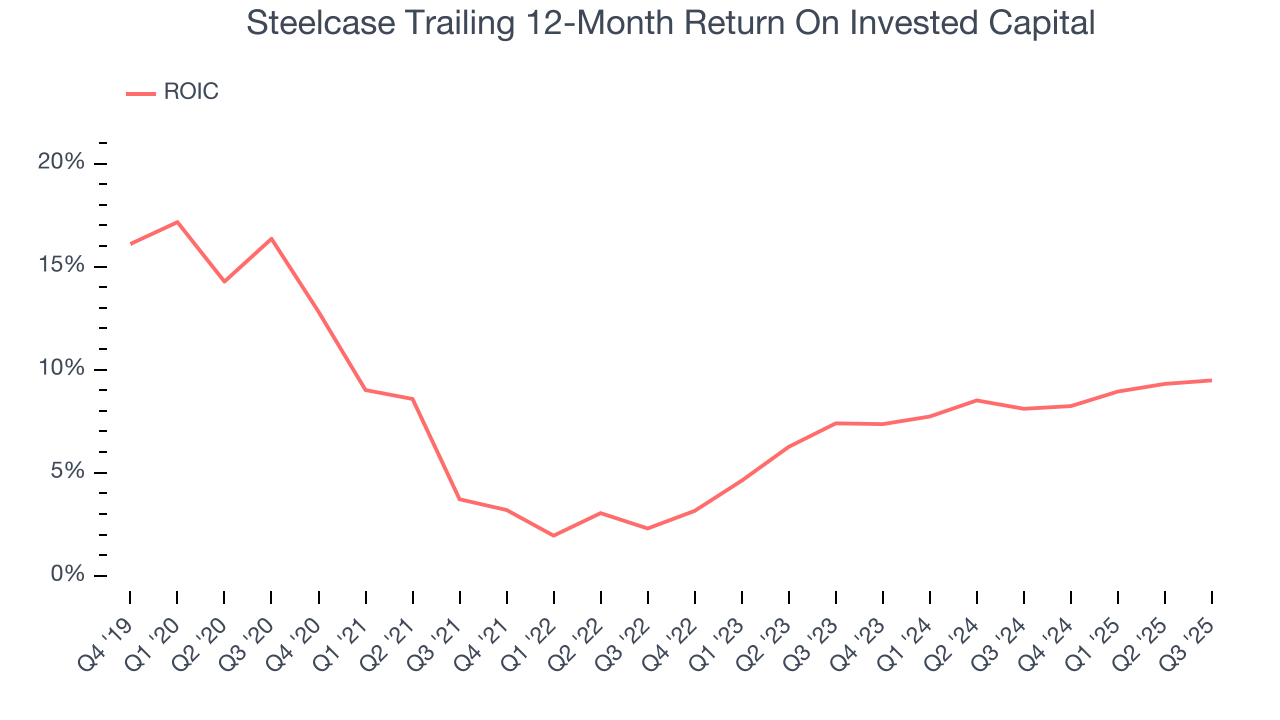

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Steelcase historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Steelcase’s has increased over the last few years. This is a good sign, and we hope the company can continue improving.

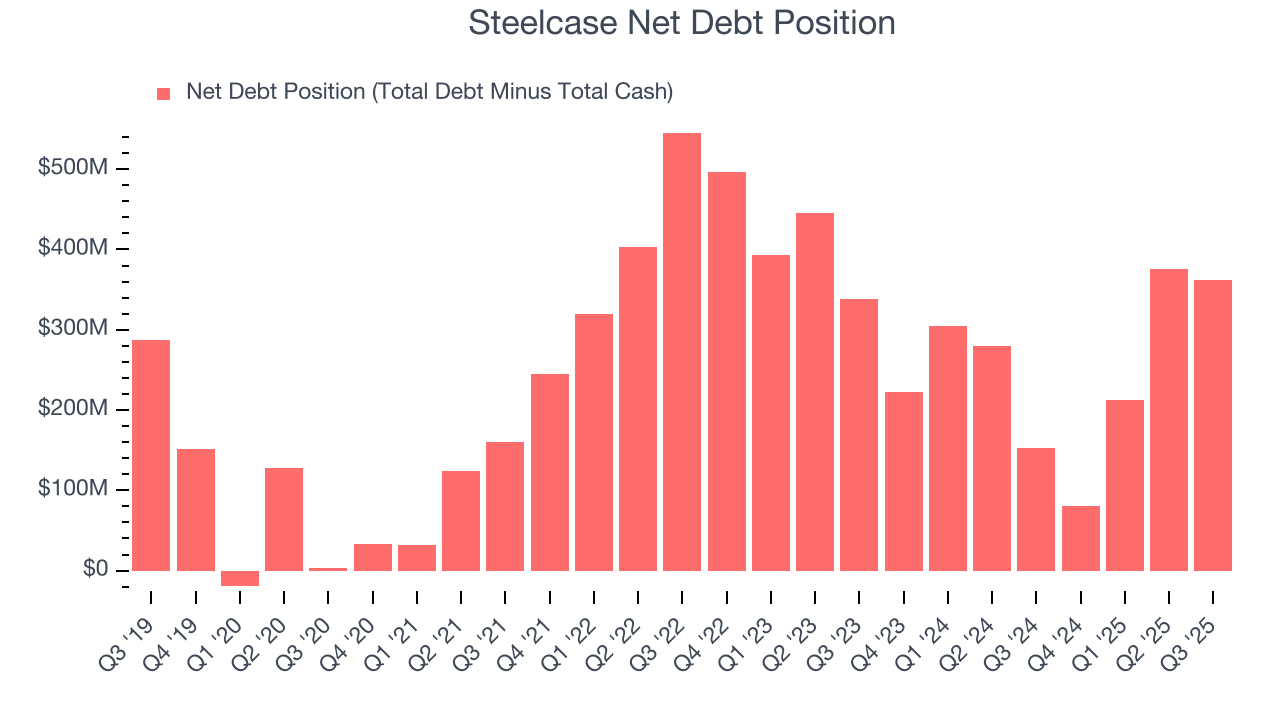

10. Balance Sheet Assessment

Steelcase reported $257.9 million of cash and $620.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $249.6 million of EBITDA over the last 12 months, we view Steelcase’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $1.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Steelcase’s Q3 Results

It was good to see Steelcase beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.4% to $16.92 immediately following the results.

12. Is Now The Time To Buy Steelcase?

Updated: December 4, 2025 at 10:28 PM EST

Before deciding whether to buy Steelcase or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping their customers, but in the case of Steelcase, we’re out. To begin with, its revenue growth was weak over the last five years. And while its rising returns show management's prior bets are at least better than before, the downside is its projected EPS for the next year is lacking. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Steelcase’s P/E ratio based on the next 12 months is 13.7x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $16.83 on the company (compared to the current share price of $16.23).