Select Medical (SEM)

We wouldn’t buy Select Medical. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Select Medical Will Underperform

With a nationwide network spanning 46 states and over 2,700 healthcare facilities, Select Medical (NYSE:SEM) operates critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers across the United States.

- Earnings per share fell by 11.7% annually over the last five years while its revenue was flat, showing each sale was less profitable

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 2.5% annually over the last two years

- Adjusted operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

Select Medical’s quality is insufficient. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Select Medical

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Select Medical

Select Medical’s stock price of $15.10 implies a valuation ratio of 12.7x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Select Medical (SEM) Research Report: Q3 CY2025 Update

Healthcare services company Select Medical (NYSE:SEM) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 22.6% year on year to $1.36 billion. The company expects the full year’s revenue to be around $5.4 billion, close to analysts’ estimates. Its GAAP profit of $0.23 per share was 38% above analysts’ consensus estimates.

Select Medical (SEM) Q3 CY2025 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.33 billion (22.6% year-on-year decline, 2.7% beat)

- EPS (GAAP): $0.23 vs analyst estimates of $0.17 (38% beat)

- Adjusted EBITDA: $111.7 million vs analyst estimates of $112.7 million (8.2% margin, 0.9% miss)

- The company reconfirmed its revenue guidance for the full year of $5.4 billion at the midpoint

- EPS (GAAP) guidance for the full year is $1.19 at the midpoint, beating analyst estimates by 2%

- EBITDA guidance for the full year is $520 million at the midpoint, in line with analyst expectations

- Operating Margin: 5.4%, down from 8% in the same quarter last year

- Free Cash Flow Margin: 9%, up from 7.4% in the same quarter last year

- Sales Volumes rose 2.1% year on year (-0.7% in the same quarter last year)

- Market Capitalization: $1.77 billion

Company Overview

With a nationwide network spanning 46 states and over 2,700 healthcare facilities, Select Medical (NYSE:SEM) operates critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers across the United States.

Select Medical's business is organized into four distinct segments, each addressing different healthcare needs. The Critical Illness Recovery Hospital segment operates facilities certified as long-term care hospitals (LTCHs), serving patients with complex medical conditions requiring extended recovery periods, typically following intensive care. These patients often have serious conditions affecting multiple organ systems, with an average stay of about a month.

The Rehabilitation Hospital segment provides comprehensive physical medicine and rehabilitation programs for patients recovering from conditions like brain and spinal cord injuries, strokes, and orthopedic issues. These inpatient facilities are certified as IRFs (Inpatient Rehabilitation Facilities) by Medicare.

Through its Outpatient Rehabilitation segment, Select Medical delivers physical, occupational, and speech therapy services at clinics typically located in medical complexes or retail settings. These facilities treat patients with musculoskeletal impairments from accidents, sports injuries, or post-surgical conditions, helping them regain functional abilities.

The Concentra segment focuses on occupational health, operating centers and onsite clinics at employer workplaces. Services include treating work-related injuries, conducting pre-employment physicals, substance abuse testing, and providing preventative care. This segment is particularly important for industries with higher workplace injury risks, such as transportation, manufacturing, and construction.

Select Medical generates revenue primarily through reimbursements from Medicare, commercial insurance, workers' compensation programs, and other healthcare payors. The company has announced plans to separate its Concentra business into a standalone public company by the end of 2024, which would create two distinct publicly traded healthcare entities.

4. Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Select Medical's competitors include Encompass Health Corporation (NYSE: EHC), which operates in the inpatient rehabilitation and home health segments, ScionHealth, which runs long-term acute care hospitals, and U.S. Physical Therapy (NYSE: USPH) in the outpatient rehabilitation space.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.37 billion in revenue over the past 12 months, Select Medical has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

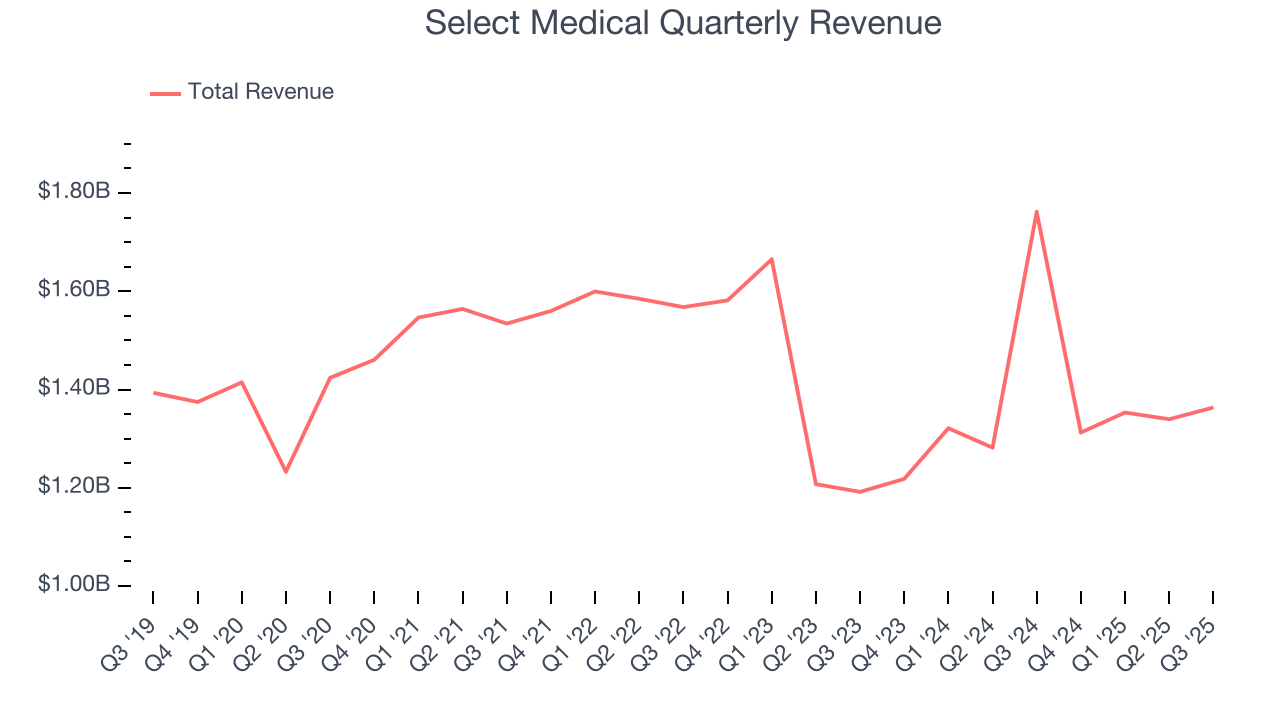

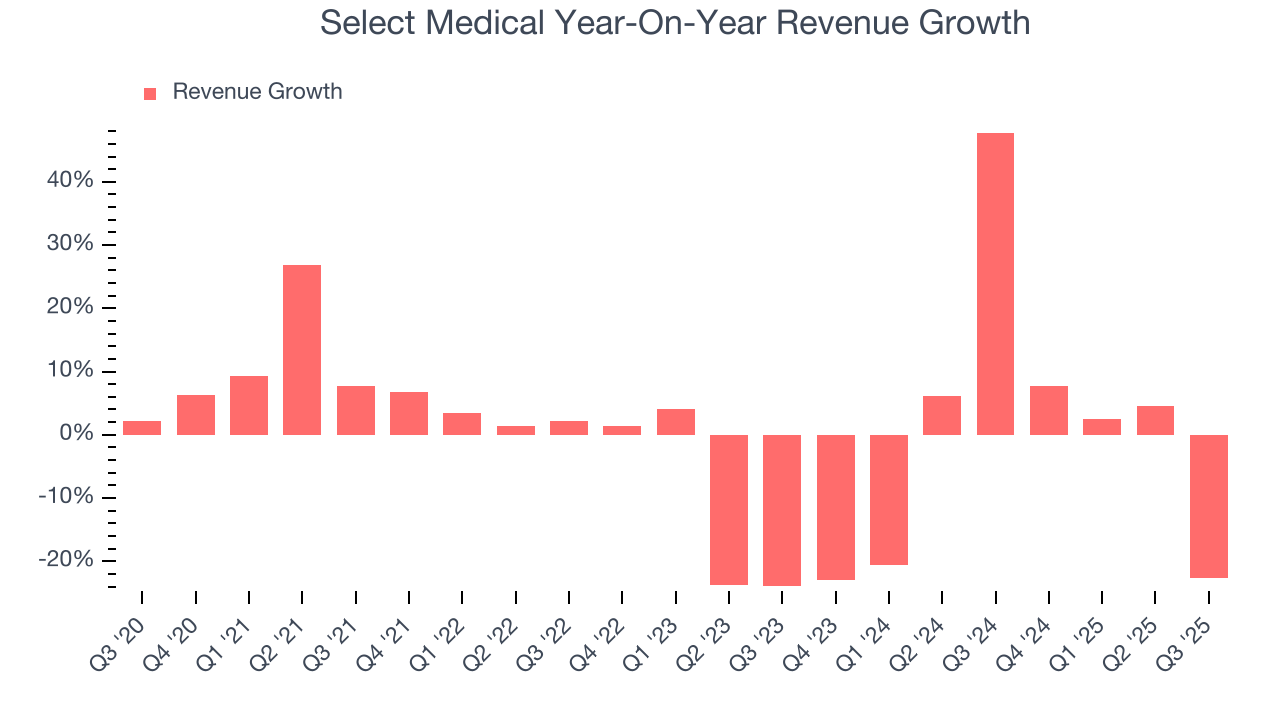

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Select Medical struggled to consistently increase demand as its $5.37 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Select Medical’s recent performance shows its demand remained suppressed as its revenue has declined by 2.5% annually over the last two years.

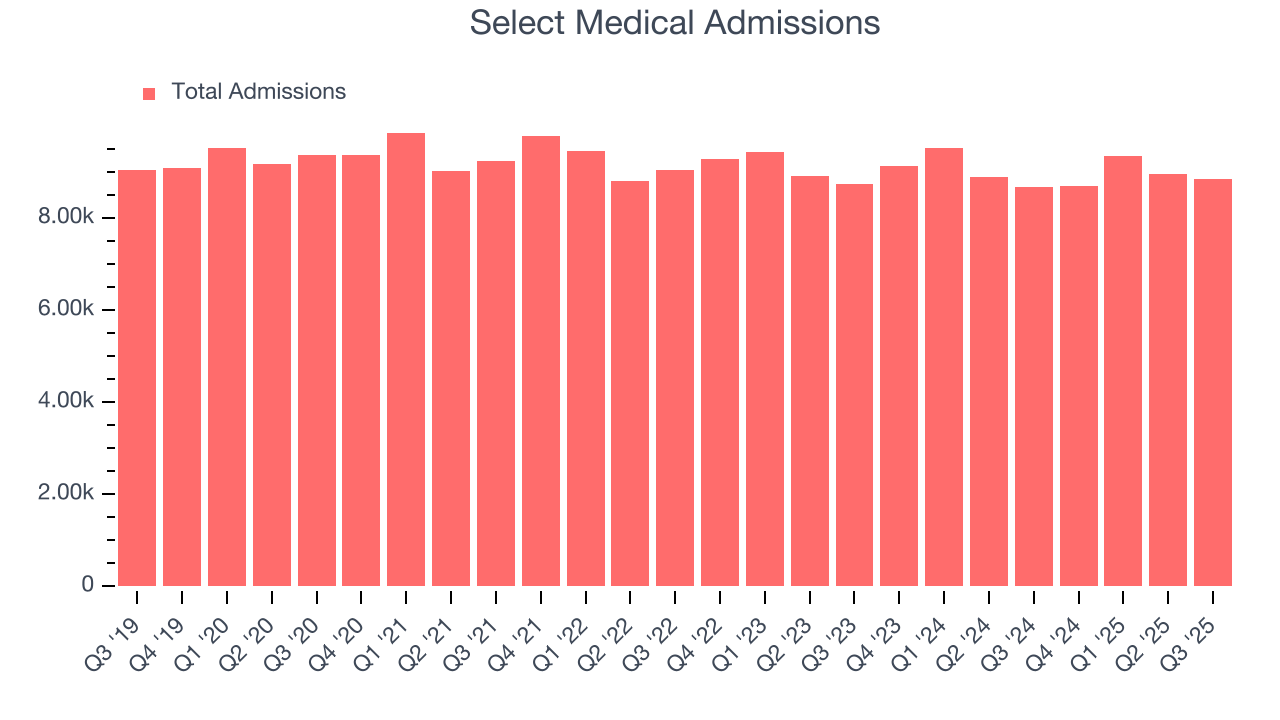

We can better understand the company’s revenue dynamics by analyzing its number of admissions, which reached 8,859 in the latest quarter. Over the last two years, Select Medical’s admissions were flat. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Select Medical’s revenue fell by 22.6% year on year to $1.36 billion but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

7. Operating Margin

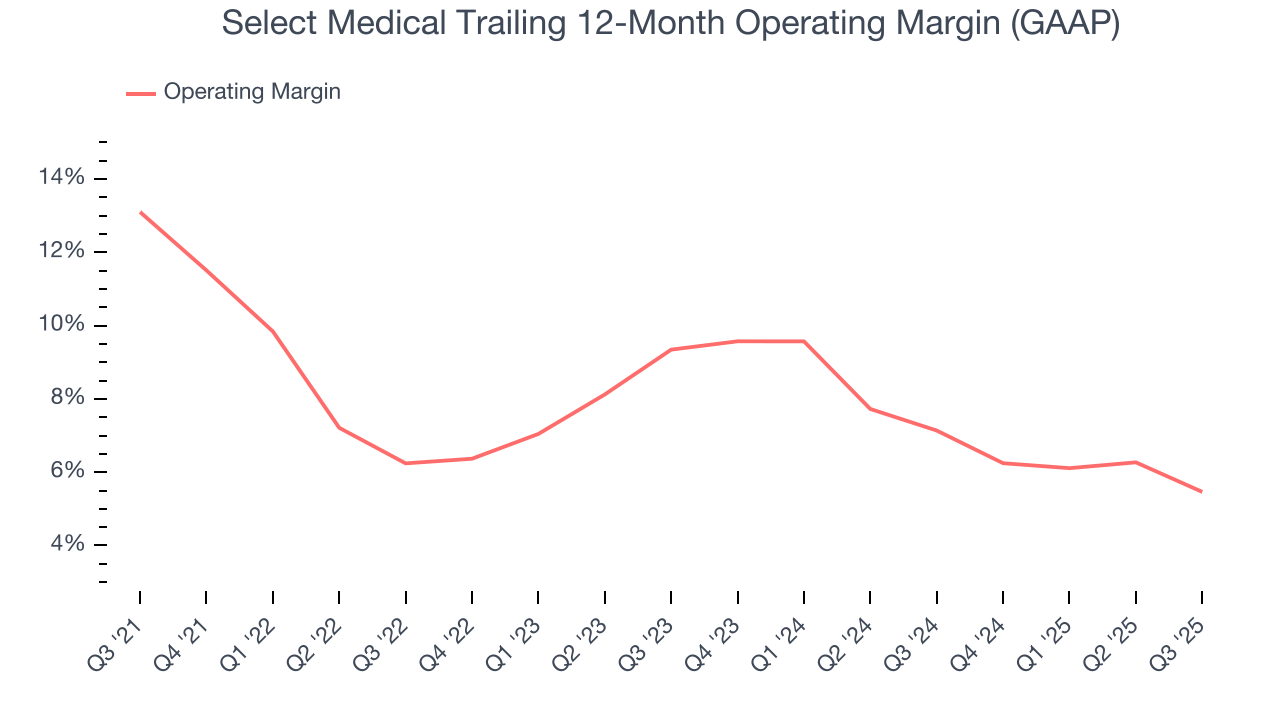

Select Medical was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.3% was weak for a healthcare business.

Looking at the trend in its profitability, Select Medical’s operating margin decreased by 7.6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Select Medical generated an operating margin profit margin of 5.4%, down 2.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

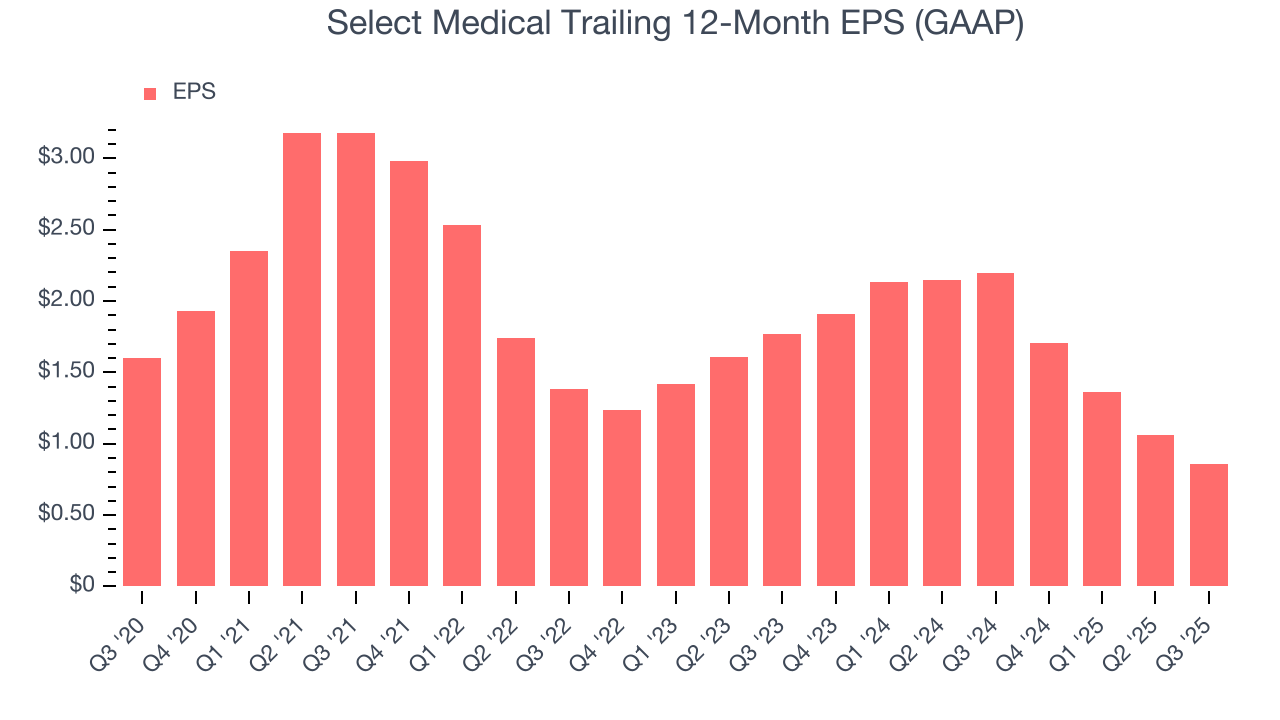

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Select Medical, its EPS declined by 11.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of Select Medical’s earnings can give us a better understanding of its performance. As we mentioned earlier, Select Medical’s operating margin declined by 7.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Select Medical reported EPS of $0.23, down from $0.43 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Select Medical’s full-year EPS of $0.86 to grow 41.1%.

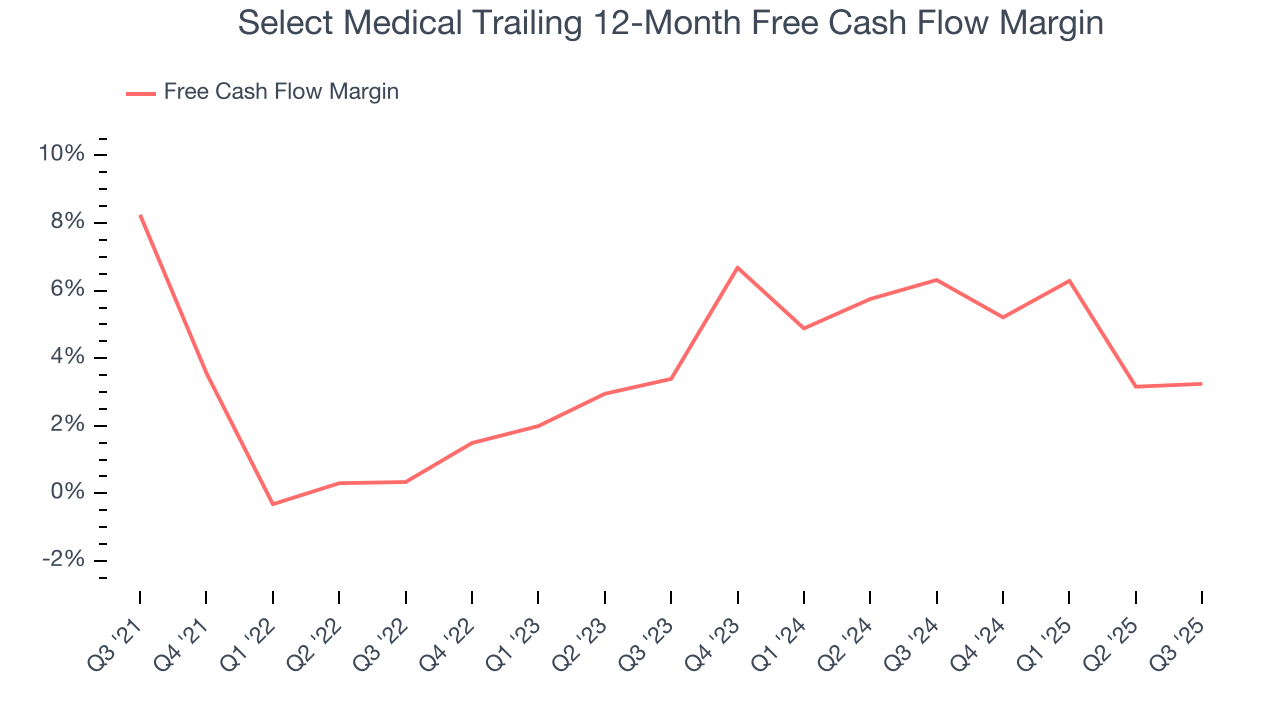

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Select Medical has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a healthcare business.

Taking a step back, we can see that Select Medical’s margin dropped by 5 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Select Medical’s free cash flow clocked in at $122.2 million in Q3, equivalent to a 9% margin. This result was good as its margin was 1.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

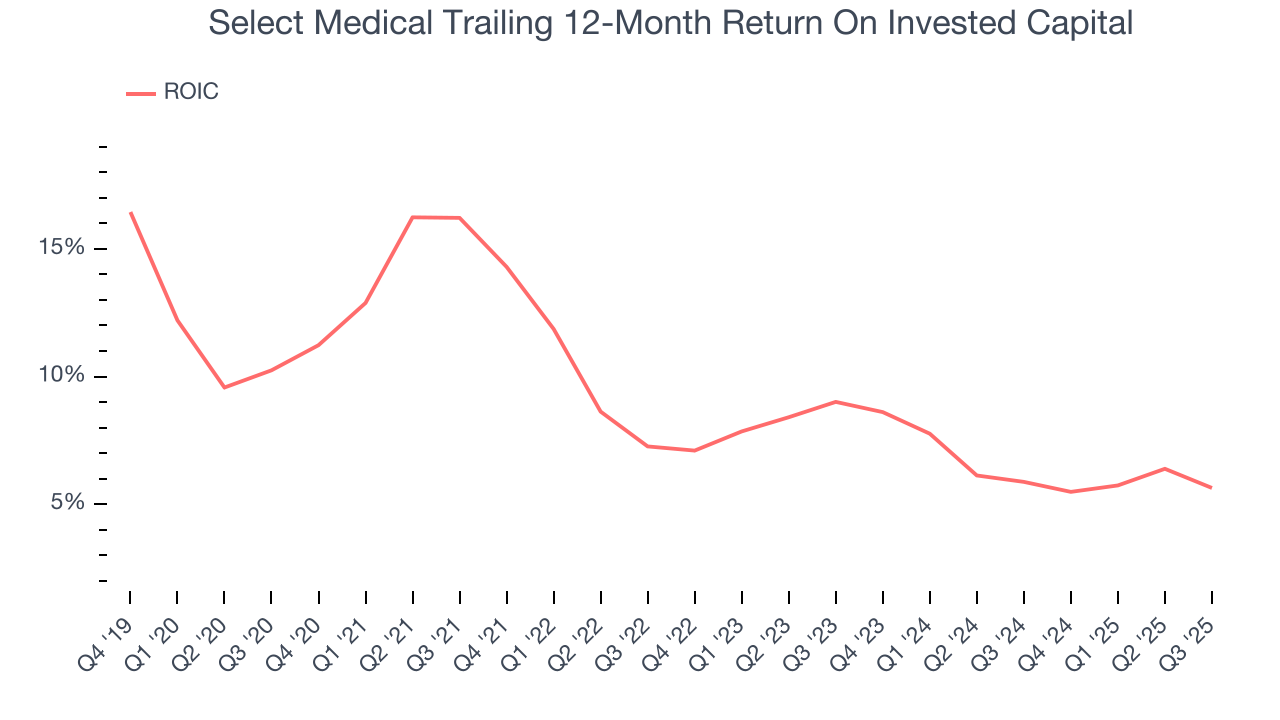

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Select Medical’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.8%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Select Medical’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

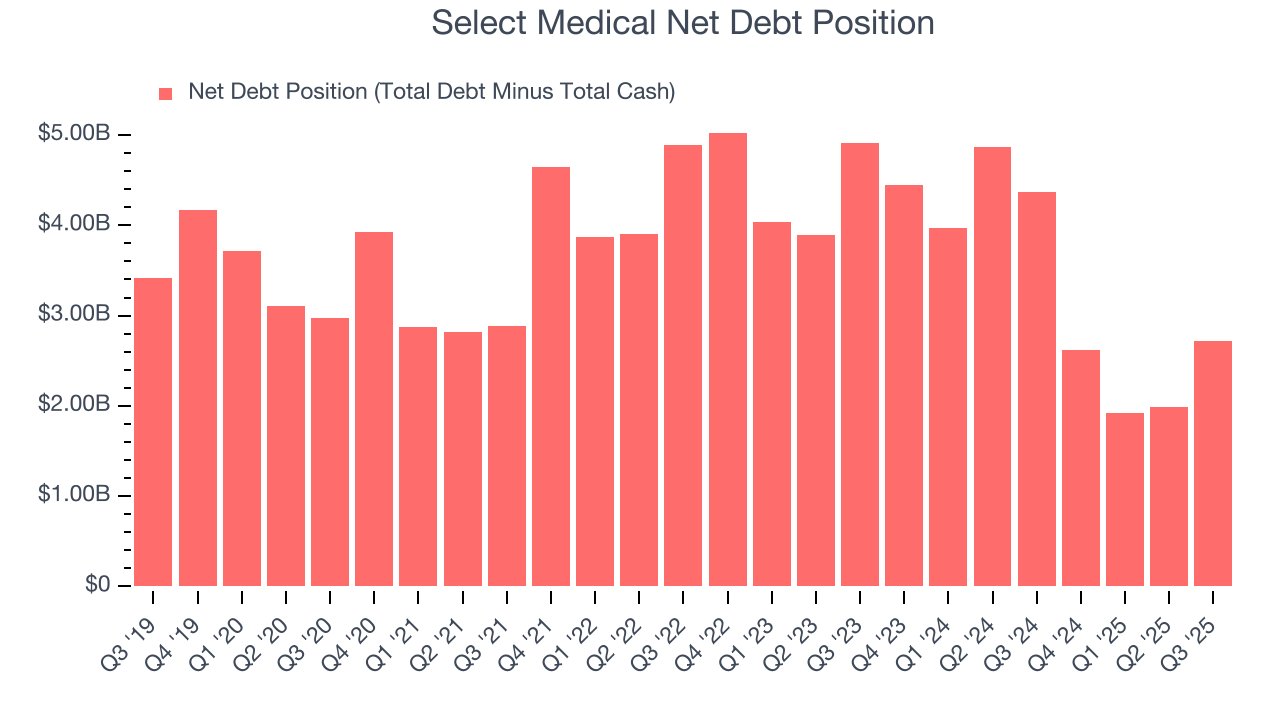

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Select Medical’s $2.77 billion of debt exceeds the $60.05 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $504.5 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Select Medical could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Select Medical can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Select Medical’s Q3 Results

It was good to see Select Medical beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $14.20 immediately following the results.

13. Is Now The Time To Buy Select Medical?

Updated: January 19, 2026 at 11:05 PM EST

Before making an investment decision, investors should account for Select Medical’s business fundamentals and valuation in addition to what happened in the latest quarter.

We see the value of companies making people healthier, but in the case of Select Medical, we’re out. For starters, its revenue growth was uninspiring over the last five years. On top of that, Select Medical’s declining EPS over the last five years makes it a less attractive asset to the public markets, and its diminishing returns show management's prior bets haven't worked out.

Select Medical’s P/E ratio based on the next 12 months is 12.7x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $18.40 on the company (compared to the current share price of $15.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.