Semrush (SEMR)

Semrush doesn’t impress us. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why Semrush Is Not Exciting

Born from the need to make sense of the complex digital marketing landscape, Semrush (NYSE:SEMR) is a software-as-a-service platform that helps companies improve their online visibility, analyze digital marketing efforts, and optimize content across search engines and social media.

- Operating margin dropped by 4.3 percentage points over the last year as the company focused on expansion rather than profitability

- Struggled to drive increased usage of its software, demonstrated by its subpar 106% net revenue retention rate

- On the bright side, its superior software functionality and low servicing costs result in a premier gross margin of 80.9%

Semrush fails to meet our quality criteria. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Semrush

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Semrush

Semrush’s stock price of $11.94 implies a valuation ratio of 3.6x forward price-to-sales. Semrush’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Semrush (SEMR) Research Report: Q3 CY2025 Update

Online visibility management platform Semrush (NYSE:SEMR) met Wall Streets revenue expectations in Q3 CY2025, with sales up 15.1% year on year to $112.1 million. The company expects next quarter’s revenue to be around $118.5 million, close to analysts’ estimates. Its GAAP loss of $0.01 per share was $0.03 below analysts’ consensus estimates.

Semrush (SEMR) Q3 CY2025 Highlights:

- Revenue: $112.1 million vs analyst estimates of $111.6 million (15.1% year-on-year growth, in line)

- EPS (GAAP): -$0.01 vs analyst estimates of $0.02 ($0.03 miss)

- Revenue Guidance for Q4 CY2025 is $118.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -4%, down from 1.8% in the same quarter last year

- Free Cash Flow was $17.04 million, up from -$3.57 million in the previous quarter

- Net Revenue Retention Rate: 105%, in line with the previous quarter

- Market Capitalization: $1.05 billion

Company Overview

Born from the need to make sense of the complex digital marketing landscape, Semrush (NYSE:SEMR) is a software-as-a-service platform that helps companies improve their online visibility, analyze digital marketing efforts, and optimize content across search engines and social media.

The Semrush platform leverages machine learning and proprietary technology to aggregate and analyze trillions of data points from more than 808 million domains. This massive dataset allows customers to identify trends, spot opportunities, and make data-driven decisions about their digital marketing strategies. The company's tools span multiple digital marketing disciplines, including search engine optimization (SEO), pay-per-click advertising (PPC), content marketing, social media management, and competitive analysis.

Semrush operates on a tiered subscription model with four main paid plans—Pro, Guru, Business, and Enterprise—each offering progressively more features and higher usage limits. The platform also offers free accounts with limited functionality, serving as an entry point for potential paying customers. Revenue comes primarily from these recurring subscriptions, with additional income from one-time purchases and add-ons such as local listing management tools and competitive intelligence features.

A marketing team might use Semrush to identify which keywords their competitors rank for, analyze their website's technical SEO issues, track position changes in search results, research content ideas, and measure the effectiveness of their campaigns—all within a single integrated platform. Semrush serves customers across diverse industries and company sizes, from small businesses and marketing agencies to large enterprises, with its technology enabling workflow integration with other marketing tools through APIs and partnerships.

4. Listing Management Software

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

Semrush competes with other digital marketing platforms such as Moz (private), Ahrefs (private), HubSpot (NYSE:HUBS), and Conductor (private), as well as specialized tools like BrightEdge (private) for enterprise SEO and Sprout Social (NASDAQ:SPT) for social media management.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Semrush’s sales grew at an impressive 30.3% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Semrush’s annualized revenue growth of 20.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Semrush’s year-on-year revenue growth was 15.1%, and its $112.1 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 15.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and indicates the market is forecasting some success for its newer products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Semrush’s billings punched in at $114.2 million in Q3, and over the last four quarters, its growth was impressive as it averaged 19.7% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Customer Acquisition Efficiency

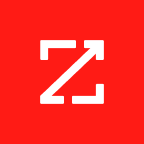

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Semrush does a decent job acquiring new customers, and its CAC payback period checked in at 44.9 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Customer Retention

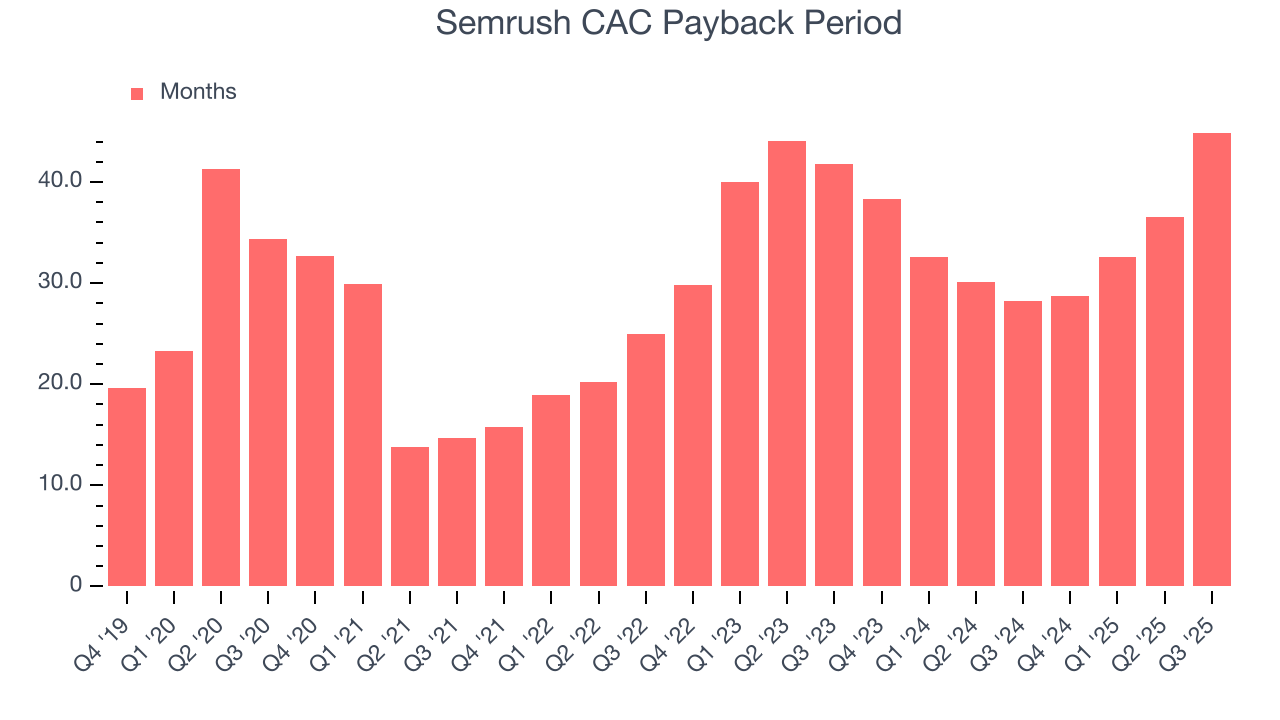

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Semrush’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 106% in Q3. This means Semrush would’ve grown its revenue by 5.5% even if it didn’t win any new customers over the last 12 months.

Semrush has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

9. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Semrush’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 80.9% gross margin over the last year. That means Semrush only paid its providers $19.13 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Semrush has seen gross margins decline by 1.9 percentage points over the last 2 year, which is poor compared to software peers.

Semrush produced a 80.2% gross profit margin in Q3, down 2.3 percentage points year on year. Semrush’s full-year margin has also been trending down over the past 12 months, decreasing by 2.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

10. Operating Margin

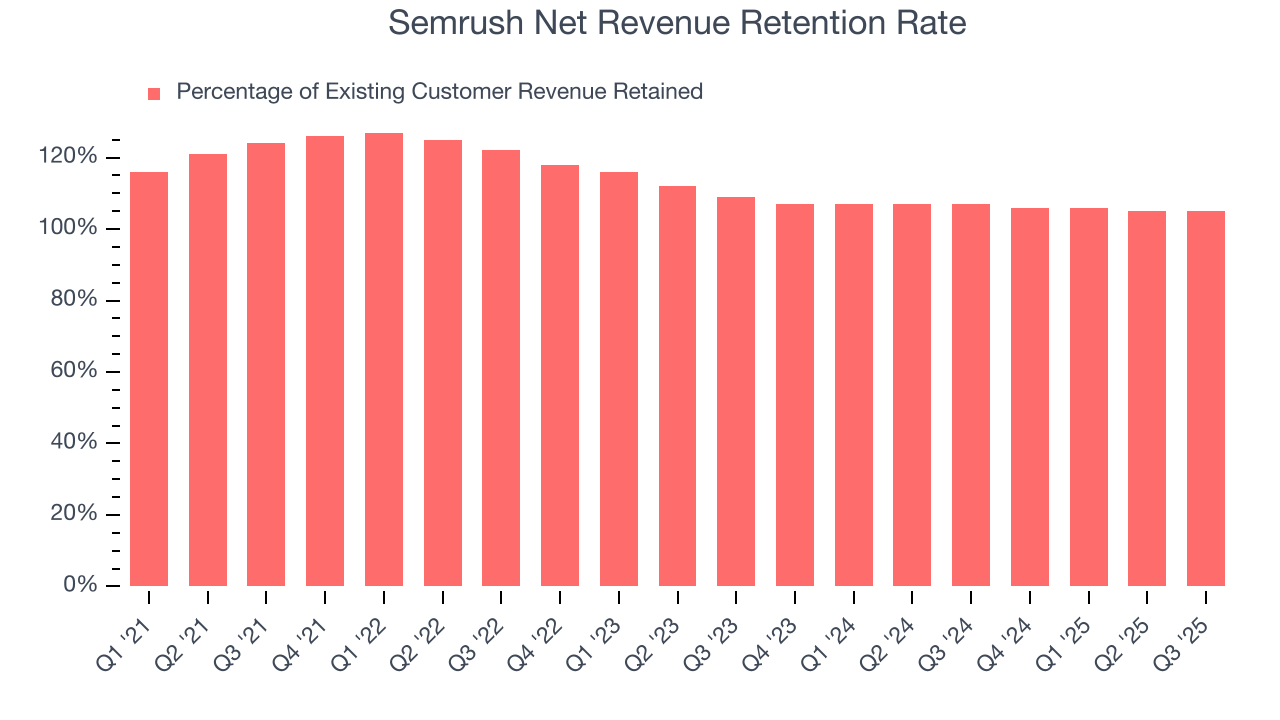

Semrush’s expensive cost structure has contributed to an average operating margin of negative 1.7% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Semrush reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Analyzing the trend in its profitability, Semrush’s operating margin decreased by 4.3 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Semrush’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Semrush’s operating margin was negative 4% this quarter.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Semrush has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.7%, subpar for a software business.

Semrush’s free cash flow clocked in at $17.04 million in Q3, equivalent to a 15.2% margin. This result was good as its margin was 8.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Semrush’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 9.7% for the last 12 months will increase to 13.5%, giving it more flexibility for investments, share buybacks, and dividends.

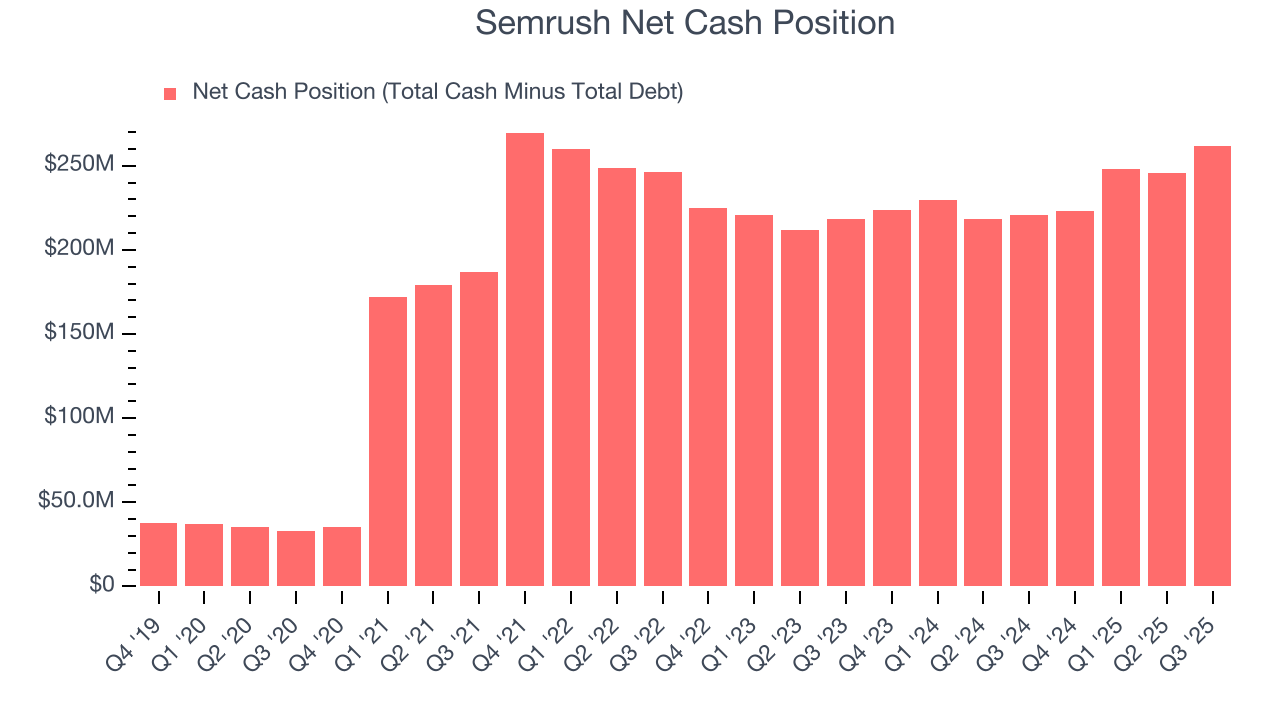

12. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Semrush is a well-capitalized company with $275.7 million of cash and $13.94 million of debt on its balance sheet. This $261.8 million net cash position is 23.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Semrush’s Q3 Results

We struggled to find many positives in these results. Revenue and revenue guidance were in line while EPS missed. The stock remained flat at $7.50 immediately following the results.

14. Is Now The Time To Buy Semrush?

Updated: March 6, 2026 at 9:20 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Semrush.

Semrush isn’t a bad business, but we have other favorites. First off, its revenue growth was strong over the last five years. And while Semrush’s declining operating margin shows it’s becoming less efficient at building and selling its software, its admirable gross margin indicates excellent unit economics.

Semrush’s price-to-sales ratio based on the next 12 months is 3.6x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $12 on the company (compared to the current share price of $11.94).