Snap (SNAP)

Snap catches our eye. Although its sales growth has been weak, its profitability gives it the flexibility to ride out cycles.― StockStory Analyst Team

1. News

2. Summary

Why Snap Is Interesting

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

- Excellent EBITDA margin highlights the strength of its business model

- Cost-efficient marketing campaigns allow it to target and onboard new users without spending heaps of money

- One pitfall is its annual revenue growth of 7.9% over the last three years was below our standards for the consumer internet sector

Snap almost passes our quality test. If you’re a believer, the valuation seems fair.

Why Is Now The Time To Buy Snap?

Why Is Now The Time To Buy Snap?

Snap is trading at $7.62 per share, or 15.7x forward EV/EBITDA. Scanning the consumer internet peers, we conclude that Snap’s valuation is warranted for the business quality.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Snap (SNAP) Research Report: Q3 CY2025 Update

Social network Snapchat (NYSE: SNAP) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 9.8% year on year to $1.51 billion. Its GAAP loss of $0.06 per share was 50.6% above analysts’ consensus estimates.

Snap (SNAP) Q3 CY2025 Highlights:

- SNAP announced that Perplexity AI will pay the social media company $400 million over 1 year to integrate the artificial intelligence startup’s search features into Snapchat

- Revenue: $1.51 billion vs analyst estimates of $1.49 billion (9.8% year-on-year growth, 1% beat)

- EPS (GAAP): -$0.06 vs analyst estimates of -$0.12 (50.6% beat)

- Adjusted EBITDA: $182 million vs analyst estimates of $124.2 million (12.1% margin, 46.5% beat)

- Operating Margin: -8.5%, up from -12.6% in the same quarter last year

- Free Cash Flow Margin: 6.2%, up from 1.8% in the previous quarter

- Daily Active Users: 477 million, up 34 million year on year

- Market Capitalization: $12.62 billion

Company Overview

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snapchat differentiates itself from other social networks through product innovation around Augmented Reality (AR), demographics, and the ephemeral nature of its messaging and Stories. Snapchat is a mobile first, camera centric image messaging app whose disappearing messages are meant to emphasize personal expression and living in the moment. The Snapchat platform has 5 distinct features: the main Camera tab, where users send snaps to friends, Communication (messaging/video calls), Snap Map (personalized map that shows friends and local businesses), Stories (content from users, news, and professionally generated content), and Spotlight (sort of a TikTok-like never ending spool of content Snapchat tailors to a user’s likes).

More so than other social networks, Snapchat is geared to digital natives, specifically 13-34 year olds. This is what makes the platform appealing to advertisers - its unique ability to address a hard to reach demographic at scale. The majority of under 35s in the US, Australia, and Western Europe use Snapchat. Originally built only for iOS, Snapchat introduced a version for Android in 2019, which is why rest of world adoption is still in its early stages. The reason advertisers have flocked to Snapchat is the very high ROI for advertisers: the cost of advertising on Snap remains low.

4. Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Snapchat (NYSE: SNAP) competes with fellow social media advertising platforms like Google (NASDAQ: GOOGL), Meta Platforms (NASDAQ:FB), Twitter (NYSE: TWTR), and Pinterest (NASDAQ: PINS)

5. Revenue Growth

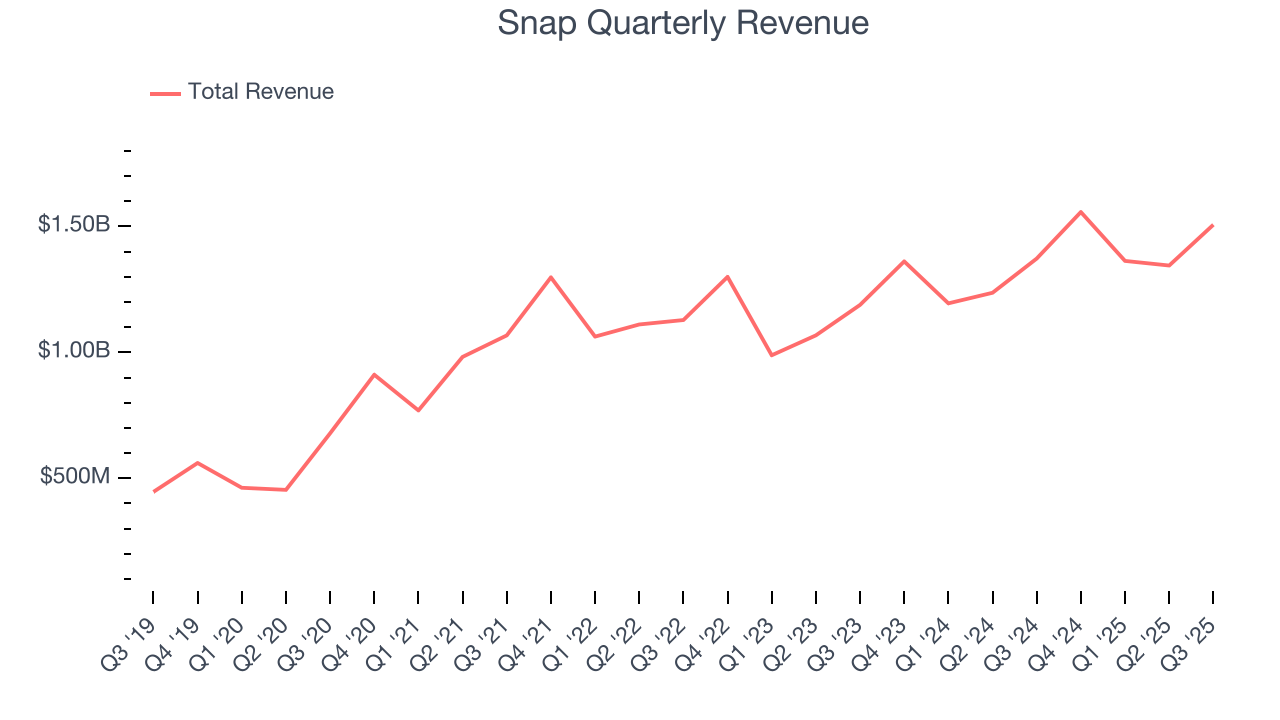

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Snap’s 7.9% annualized revenue growth over the last three years was tepid. This was below our standard for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Snap reported year-on-year revenue growth of 9.8%, and its $1.51 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Daily Active Users

User Growth

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

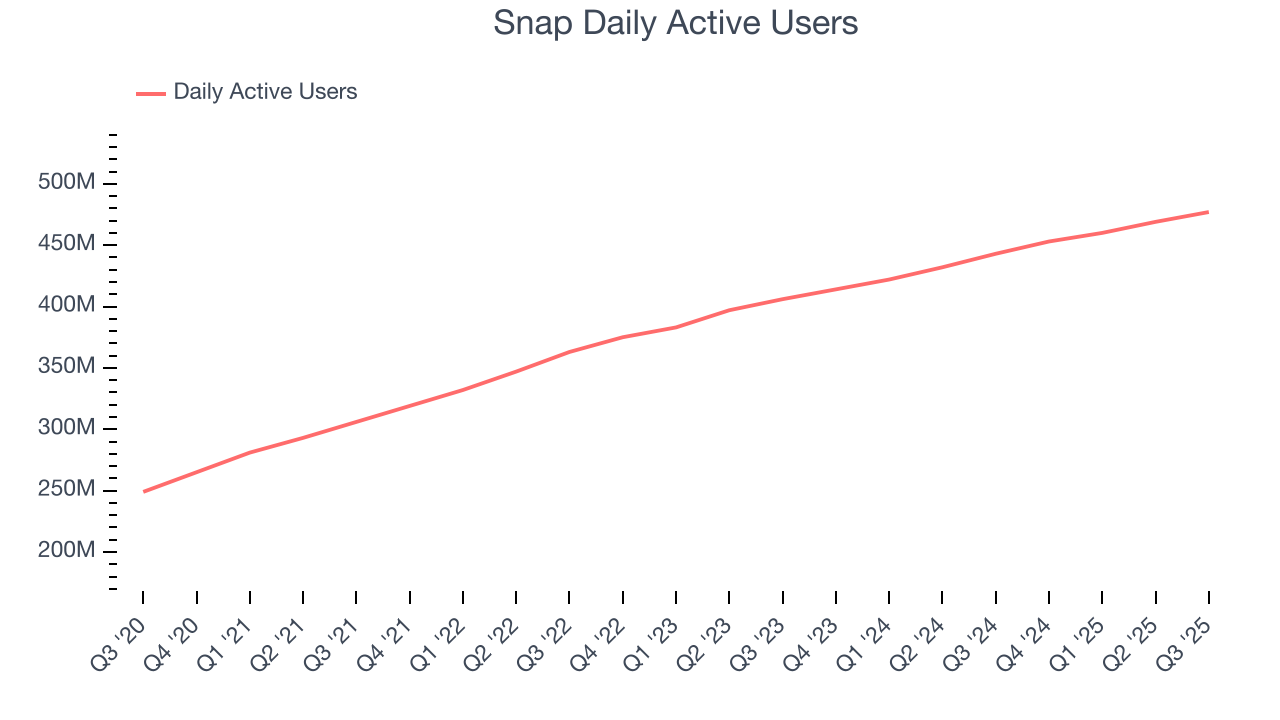

Over the last two years, Snap’s daily active users, a key performance metric for the company, increased by 9.1% annually to 477 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q3, Snap added 34 million daily active users, leading to 7.7% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

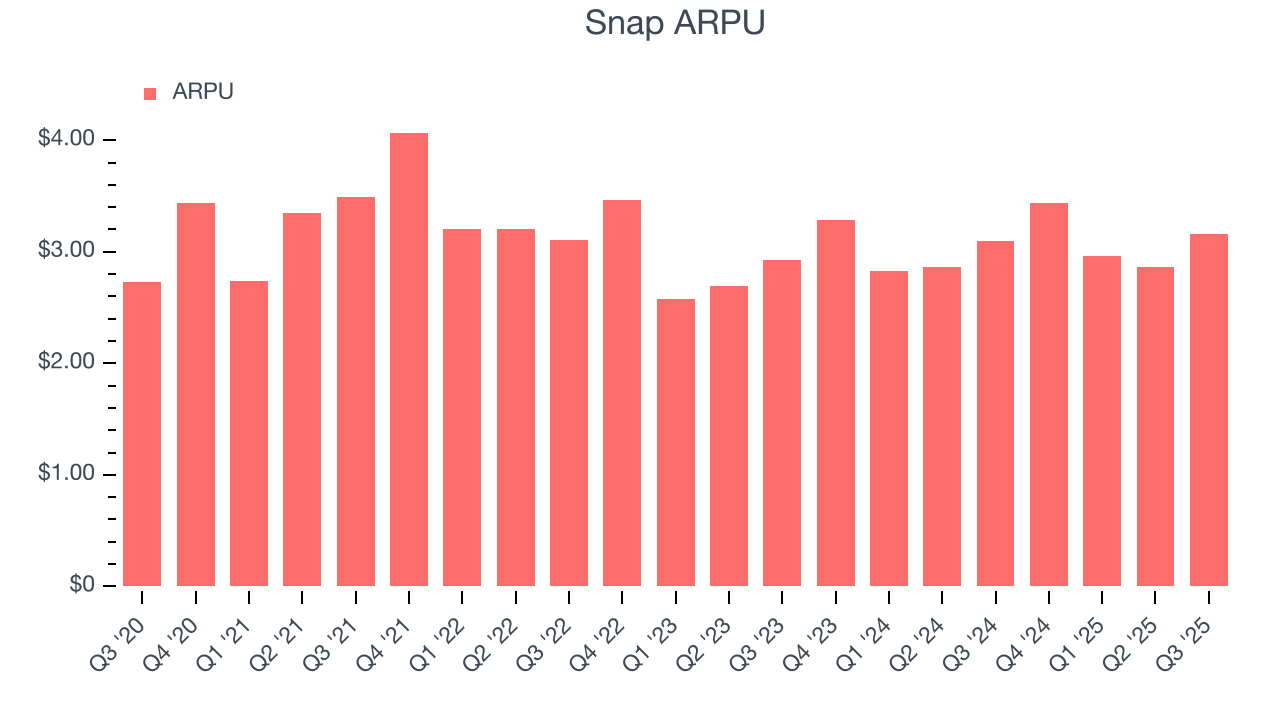

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap’s audience and its ad-targeting capabilities.

Snap’s ARPU growth has been mediocre over the last two years, averaging 3.5%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Snap tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Snap’s ARPU clocked in at $3.16. It grew by 2% year on year, slower than its user growth.

7. Gross Margin & Pricing Power

For social network businesses like Snap, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

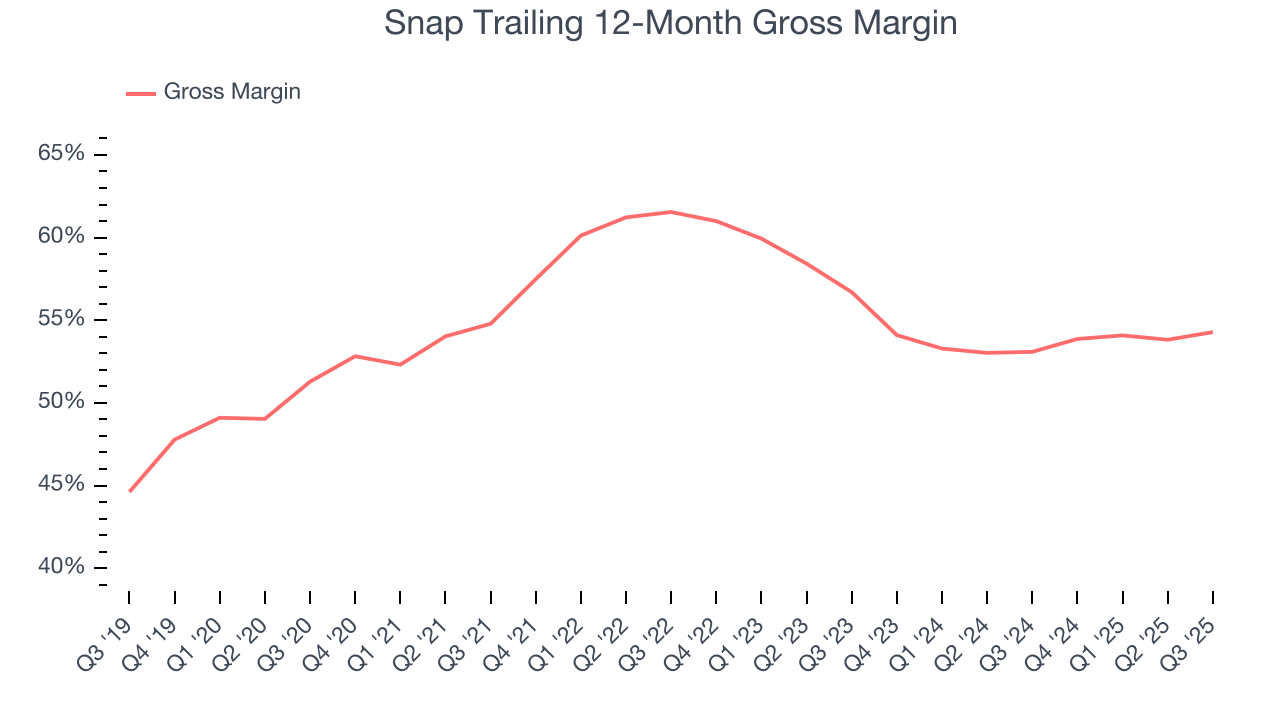

Snap’s gross margin is slightly below the average consumer internet company, giving it less room to invest in areas such as product and marketing to grow its presence. As you can see below, it averaged a 53.7% gross margin over the last two years. That means Snap paid its providers a lot of money ($46.28 for every $100 in revenue) to run its business.

This quarter, Snap’s gross profit margin was 55.3%, up 1.8 percentage points year on year. Snap’s full-year margin has also been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. User Acquisition Efficiency

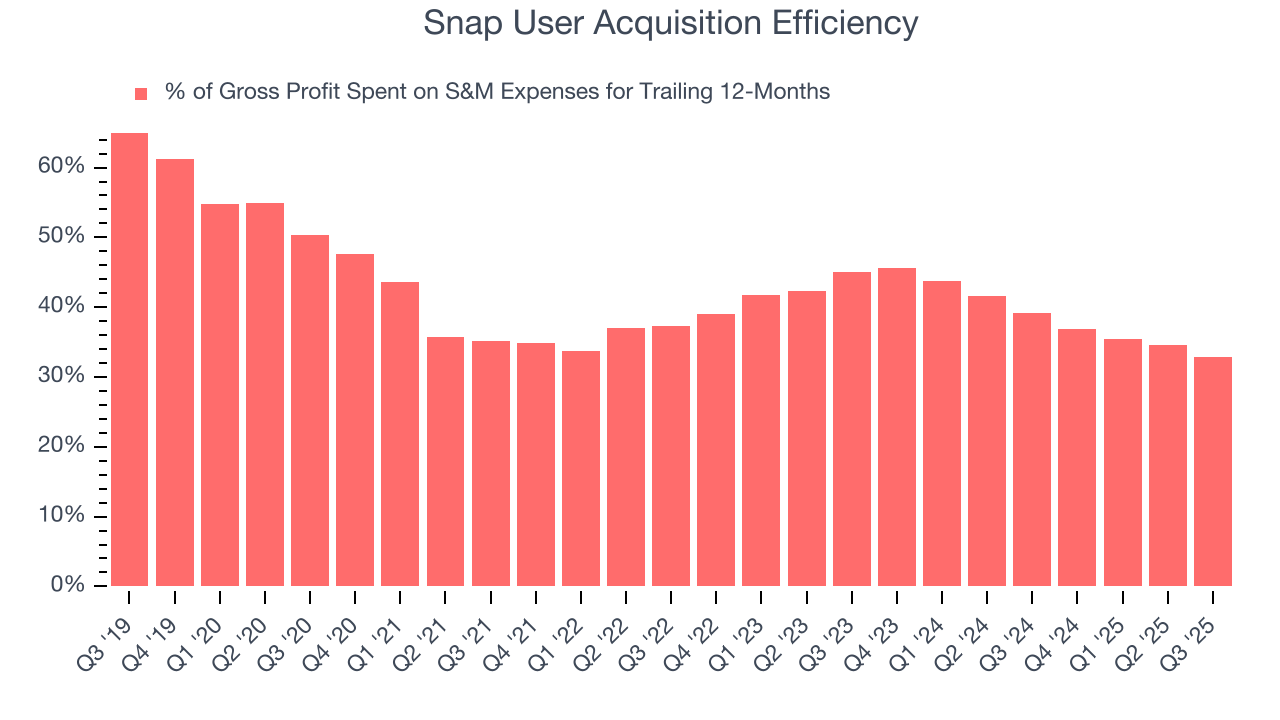

Consumer internet businesses like Snap grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Snap is quite efficient at acquiring new users, spending only 32.9% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that Snap has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

9. EBITDA

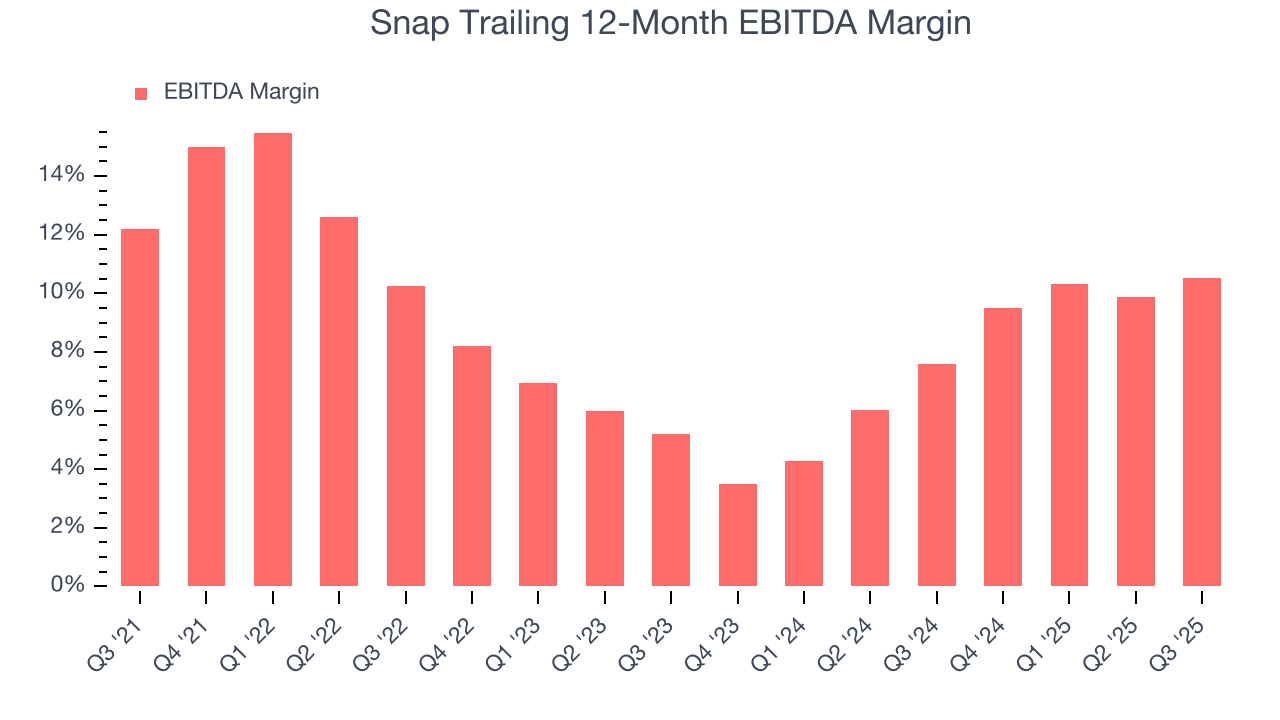

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Snap’s EBITDA margin has risen over the last 12 months and averaged 9.1% over the last two years. On top of that, its profitability was top-notch for a consumer internet business, showing it’s an well-run company with an efficient cost structure. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Snap’s EBITDA margin might fluctuated slightly but has generally stayed the same over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Snap generated an EBITDA margin profit margin of 12.1%, up 2.5 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

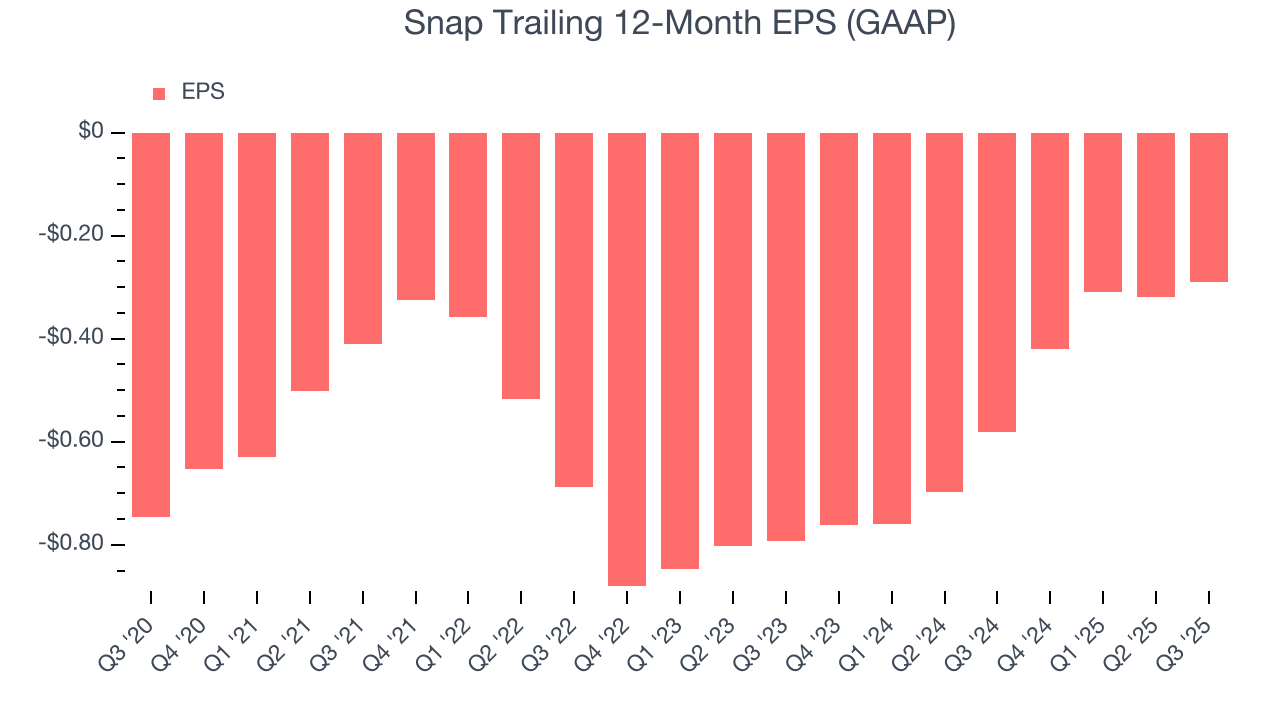

10. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Snap reported EPS of negative $0.06, up from negative $0.09 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Snap to perform poorly. Analysts forecast its full-year EPS of negative $0.29 will tumble to negative $0.35.

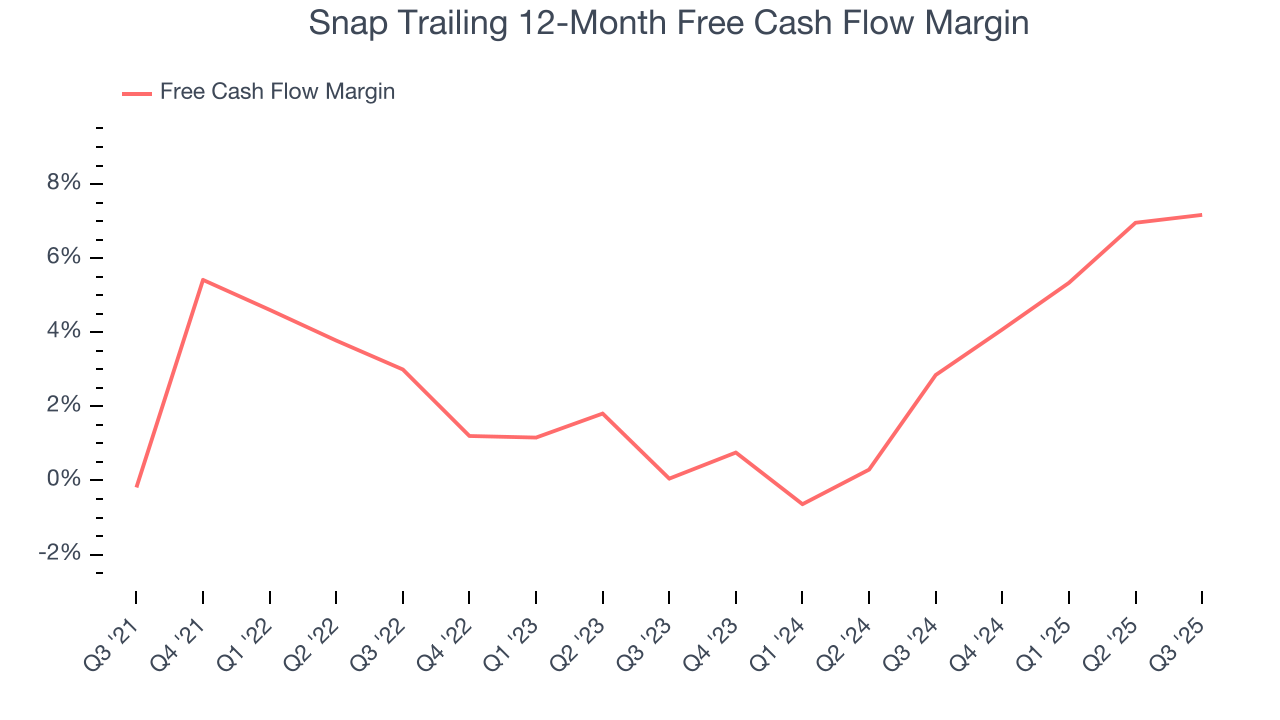

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Snap has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.1% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Snap’s margin expanded by 4.2 percentage points over the last few years. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Snap’s free cash flow clocked in at $93.44 million in Q3, equivalent to a 6.2% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

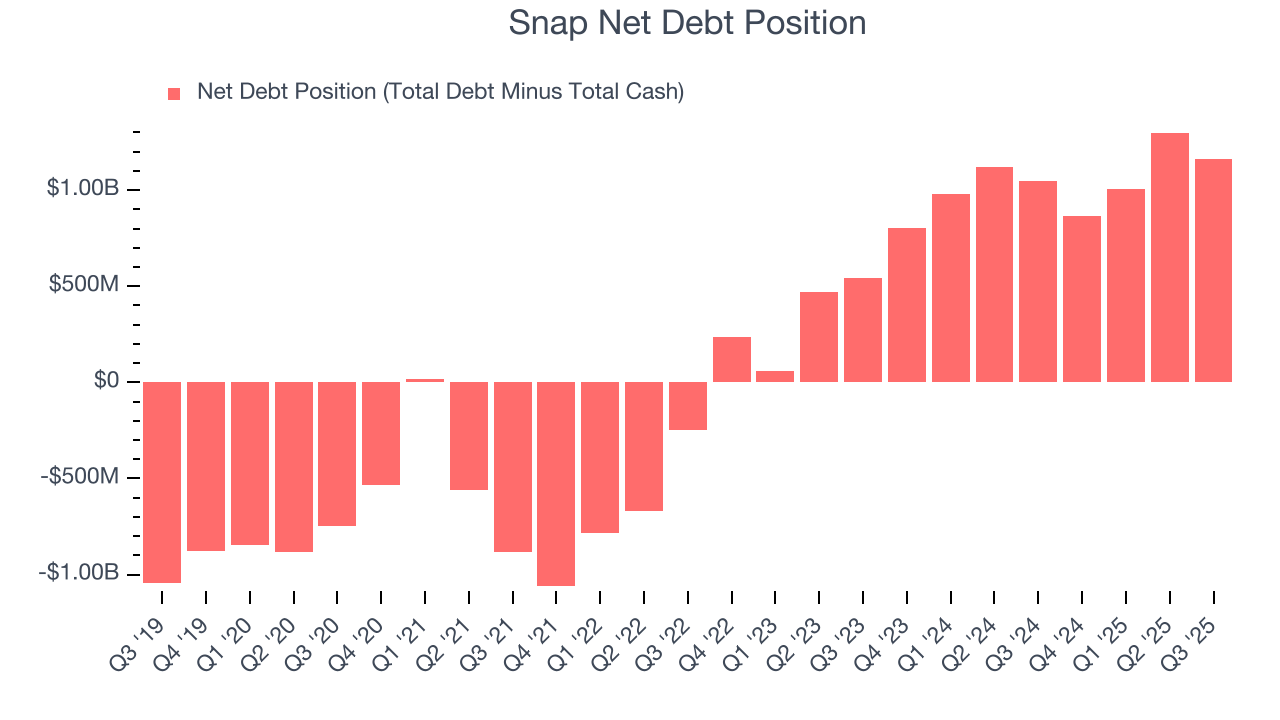

12. Balance Sheet Assessment

Snap reported $2.99 billion of cash and $4.15 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $607.7 million of EBITDA over the last 12 months, we view Snap’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $49.73 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Snap’s Q3 Results

We were impressed by how significantly Snap blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Importantly, Snap announced that Perplexity AI will pay the social media company $400 million over 1 year to integrate the artificial intelligence startup’s search features into Snapchat. The stock traded up 22.8% to $8.98 immediately following the results.

14. Is Now The Time To Buy Snap?

Updated: January 23, 2026 at 9:16 PM EST

Before deciding whether to buy Snap or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are a lot of things to like about Snap. Although its revenue growth was uninspiring over the last three years, its growth over the next 12 months is expected to be higher. And while Snap’s ARPU growth has been mediocre over the last two years, its projected EPS for the next year implies the company’s fundamentals will improve. On top of that, its sturdy EBITDA margins show it has disciplined cost controls.

Snap’s EV/EBITDA ratio based on the next 12 months is 15.7x. When scanning the consumer internet space, Snap trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $9.78 on the company (compared to the current share price of $7.62), implying they see 28.3% upside in buying Snap in the short term.