Sensata Technologies (ST)

Sensata Technologies keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sensata Technologies Will Underperform

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

- Gross margin of 30.2% is below its competitors, leaving less money to invest in areas like marketing and R&D

- Projected sales growth of 2.1% for the next 12 months suggests sluggish demand

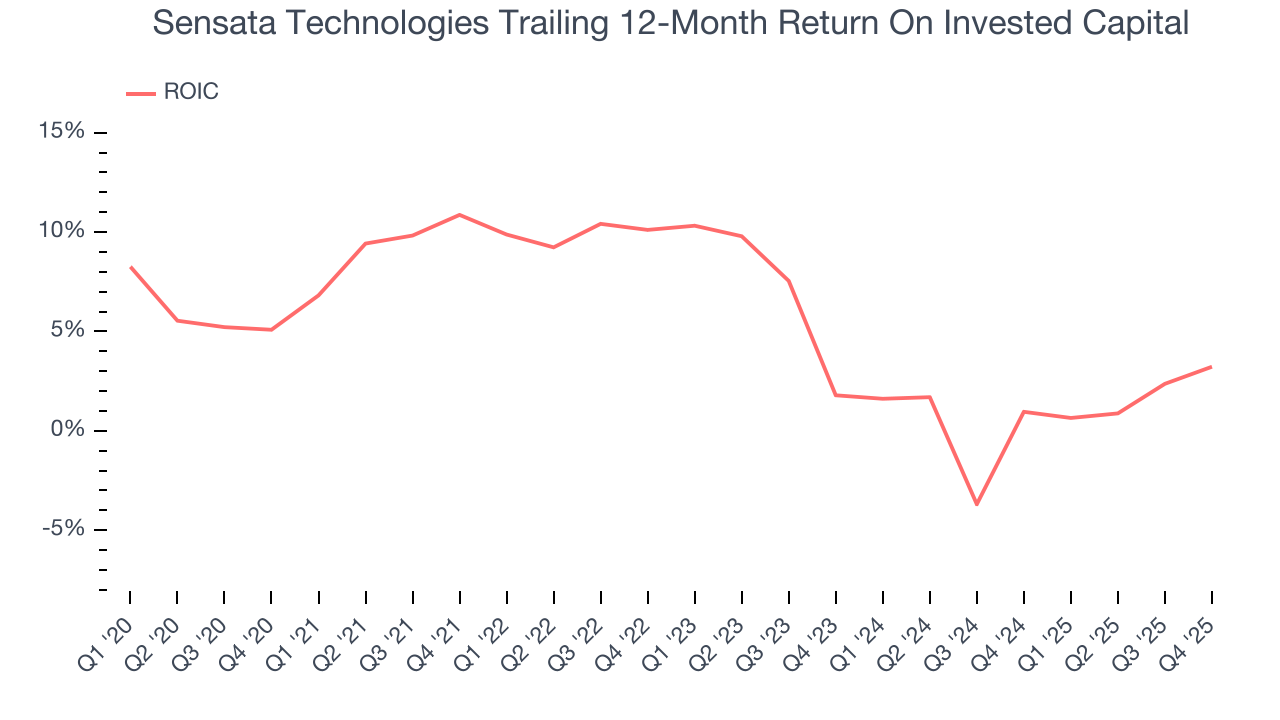

- ROIC of 5.3% reflects management’s challenges in identifying attractive investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

Sensata Technologies’s quality is inadequate. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Sensata Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sensata Technologies

Sensata Technologies’s stock price of $36.64 implies a valuation ratio of 10.4x forward P/E. Sensata Technologies’s valuation may seem like a bargain, especially when stacked up against other semiconductor companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Sensata Technologies (ST) Research Report: Q4 CY2025 Update

Sensor manufacturer Sensata Technology (NYSE:ST) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 1.1% year on year to $917.9 million. The company expects next quarter’s revenue to be around $927 million, close to analysts’ estimates. Its non-GAAP profit of $0.88 per share was 2.1% above analysts’ consensus estimates.

Sensata Technologies (ST) Q4 CY2025 Highlights:

- Revenue: $917.9 million vs analyst estimates of $912.8 million (1.1% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.88 vs analyst estimates of $0.86 (2.1% beat)

- Adjusted EBITDA: $211.5 million vs analyst estimates of $211.8 million (23% margin, in line)

- Revenue Guidance for Q1 CY2026 is $927 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q1 CY2026 is $0.83 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.9%, up from 8.1% in the same quarter last year

- Free Cash Flow Margin: 16.5%, up from 15.3% in the same quarter last year

- Inventory Days Outstanding: 86, in line with the previous quarter

- Market Capitalization: $5.34 billion

Company Overview

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Sensata's products serve as the critical interface between physical phenomena and electronic systems across automotive, industrial, and aerospace sectors. The company's sensors measure variables like pressure, temperature, position, and speed, while its electrical protection components safeguard systems from power surges and electrical failures. These technologies are essential in applications ranging from vehicle braking systems to industrial equipment and aircraft controls.

The company operates through two main segments: Performance Sensing, which primarily serves automotive and heavy vehicle markets, and Sensing Solutions, which focuses on industrial and aerospace applications. In vehicles, Sensata's components enable functions like tire pressure monitoring, powertrain management, and high-voltage protection in electric vehicles. For industrial customers, the company provides controls for appliances, HVAC systems, and renewable energy infrastructure.

Sensata's business model relies on close engineering collaboration with customers, resulting in highly customized solutions that become deeply integrated into their products. This creates strong, long-lasting relationships—the company has worked with its top ten customers for an average of 32 years. As vehicles and industrial systems become increasingly electrified, connected, and automated, Sensata's sensing and protection technologies play an expanding role in ensuring safety, efficiency, and performance across these evolving platforms.

Sensatas peers and competitors include Analog Devices (NASDAQ:ADI), Texas Instruments (NASDAQ:TXN), Skyworks (NASDAQ:SWKS), NXP Semiconductors NV (NASDAQ:NXPI) and Monolithic Power Systems (NASDAQ:MPWR).

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

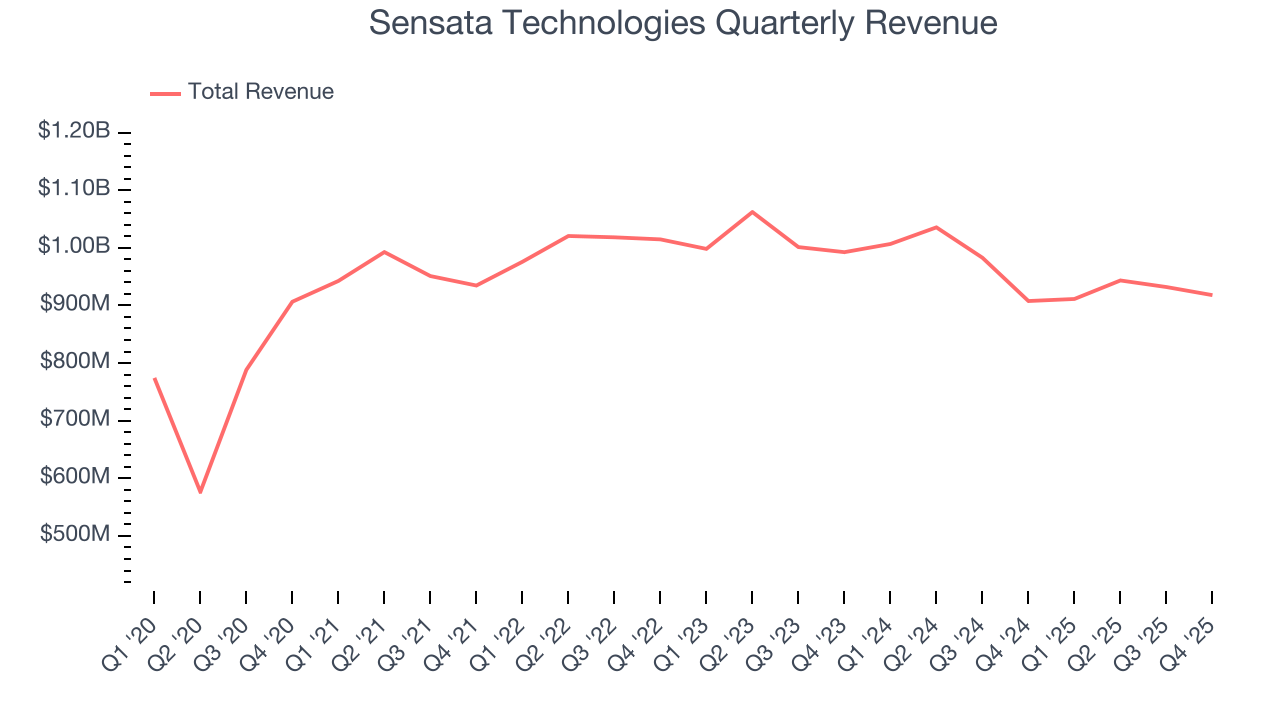

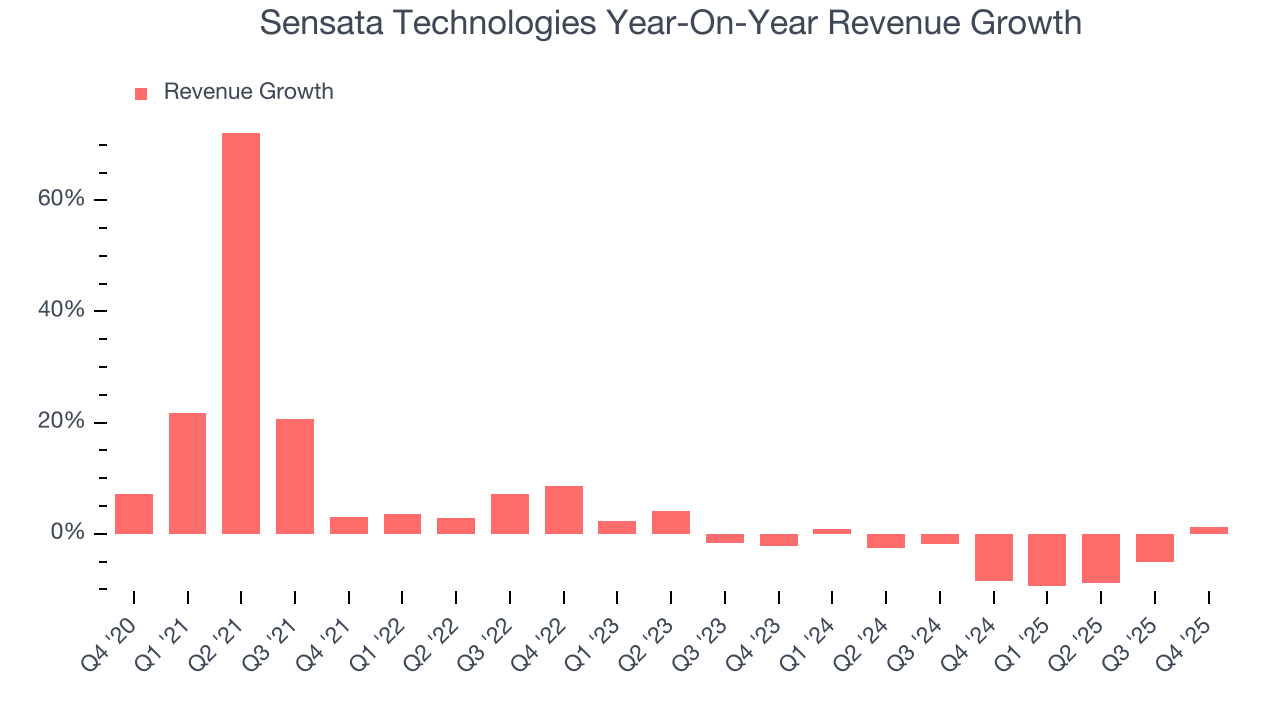

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Sensata Technologies’s sales grew at a mediocre 4% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Sensata Technologies’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

This quarter, Sensata Technologies reported modest year-on-year revenue growth of 1.1% but beat Wall Street’s estimates by 0.6%. Adding to the positive news, Sensata Technologies’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 1.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Product Demand & Outstanding Inventory

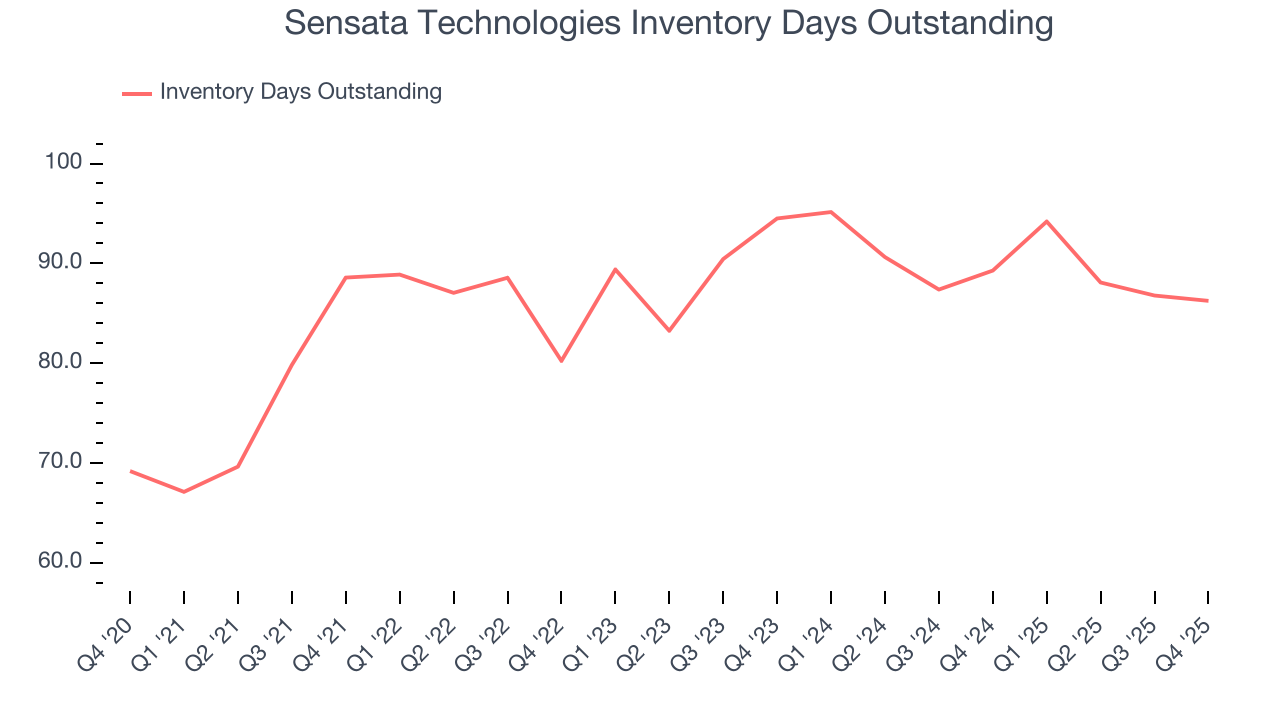

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Sensata Technologies’s DIO came in at 86, which is in line with its five-year average. At the moment, these numbers suggest that there isn’t any unusual buildup of inventory.

7. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

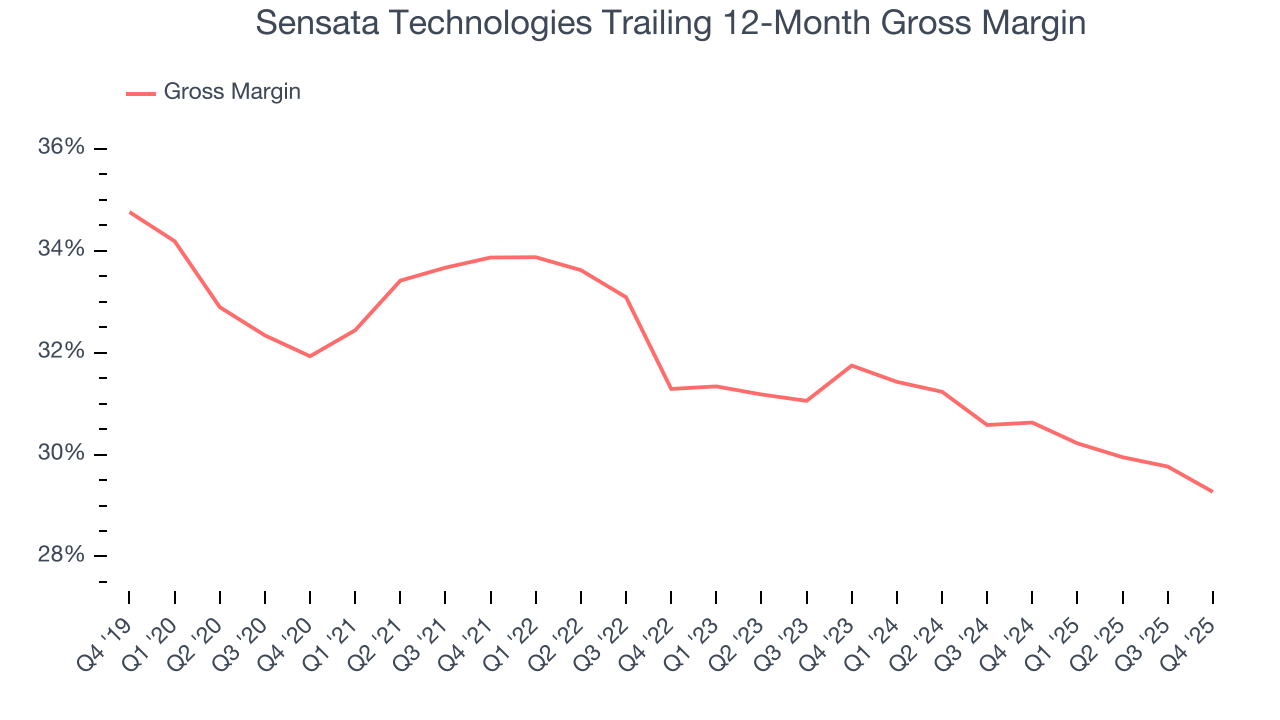

Sensata Technologies’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 30% gross margin over the last two years. That means Sensata Technologies paid its suppliers a lot of money ($70.03 for every $100 in revenue) to run its business.

In Q4, Sensata Technologies produced a 29% gross profit margin, down 2 percentage points year on year. Sensata Technologies’s full-year margin has also been trending down over the past 12 months, decreasing by 1.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

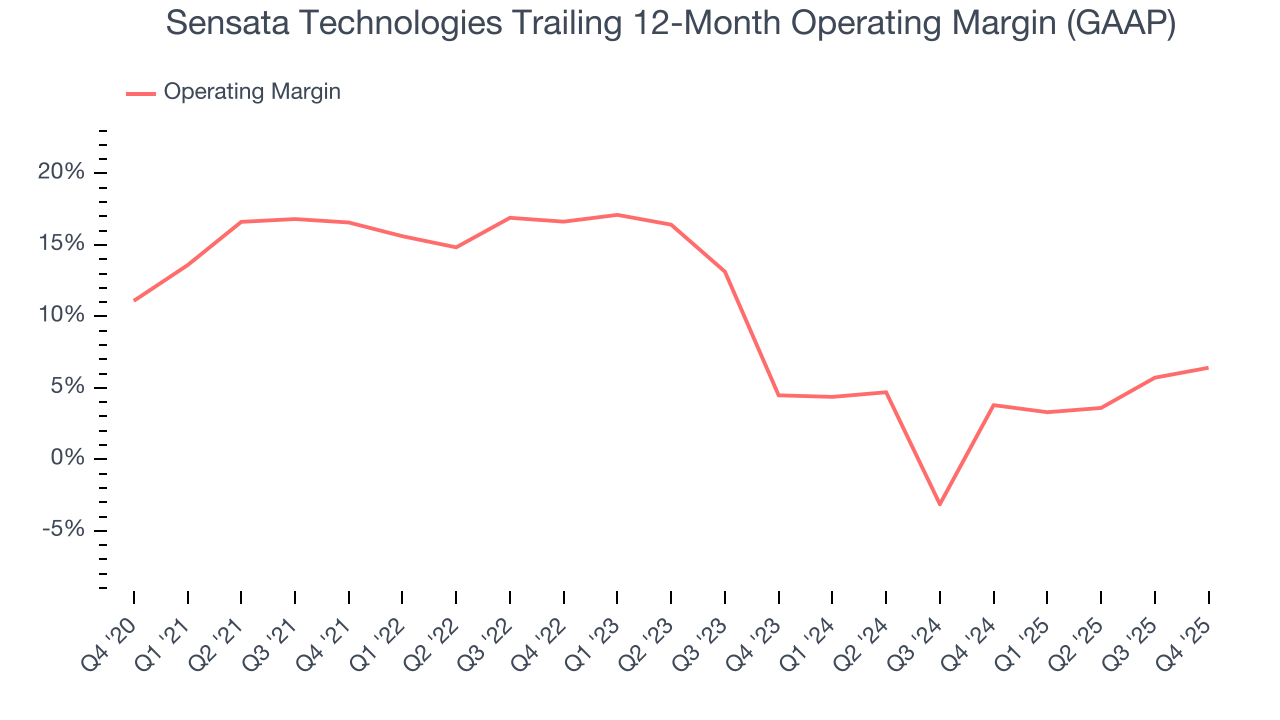

Sensata Technologies was profitable over the last two years but held back by its large cost base. Its average operating margin of 5.1% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Sensata Technologies’s operating margin decreased by 10.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Sensata Technologies’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Sensata Technologies generated an operating margin profit margin of 10.9%, up 2.8 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

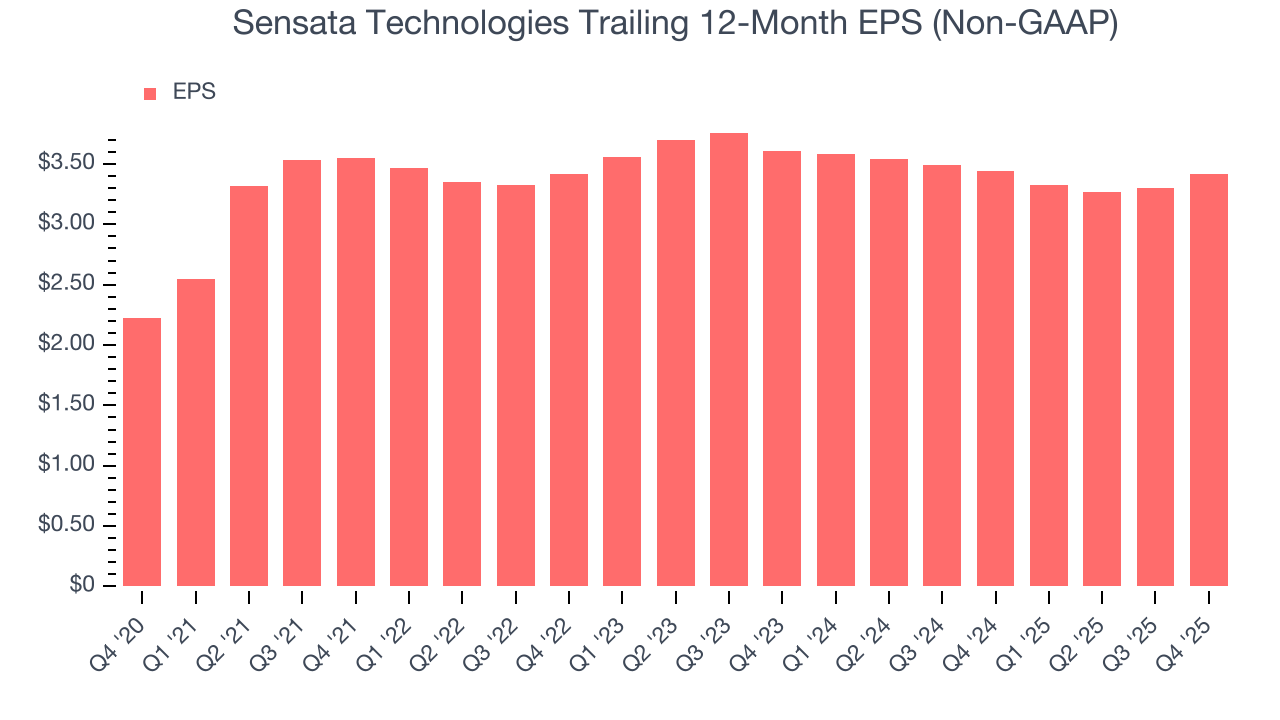

Sensata Technologies’s EPS grew at an unimpressive 9% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

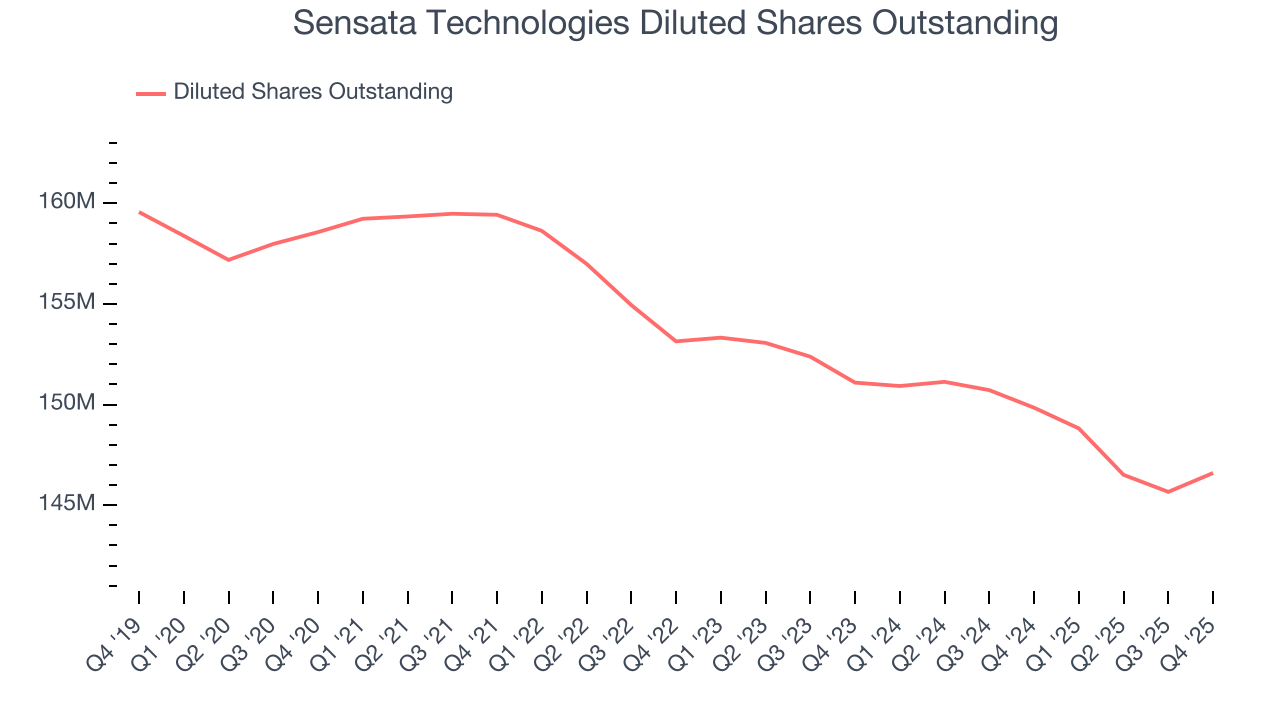

We can take a deeper look into Sensata Technologies’s earnings to better understand the drivers of its performance. A five-year view shows that Sensata Technologies has repurchased its stock, shrinking its share count by 7.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Sensata Technologies reported adjusted EPS of $0.88, up from $0.76 in the same quarter last year. This print beat analysts’ estimates by 2.1%. Over the next 12 months, Wall Street expects Sensata Technologies’s full-year EPS of $3.42 to grow 6.7%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

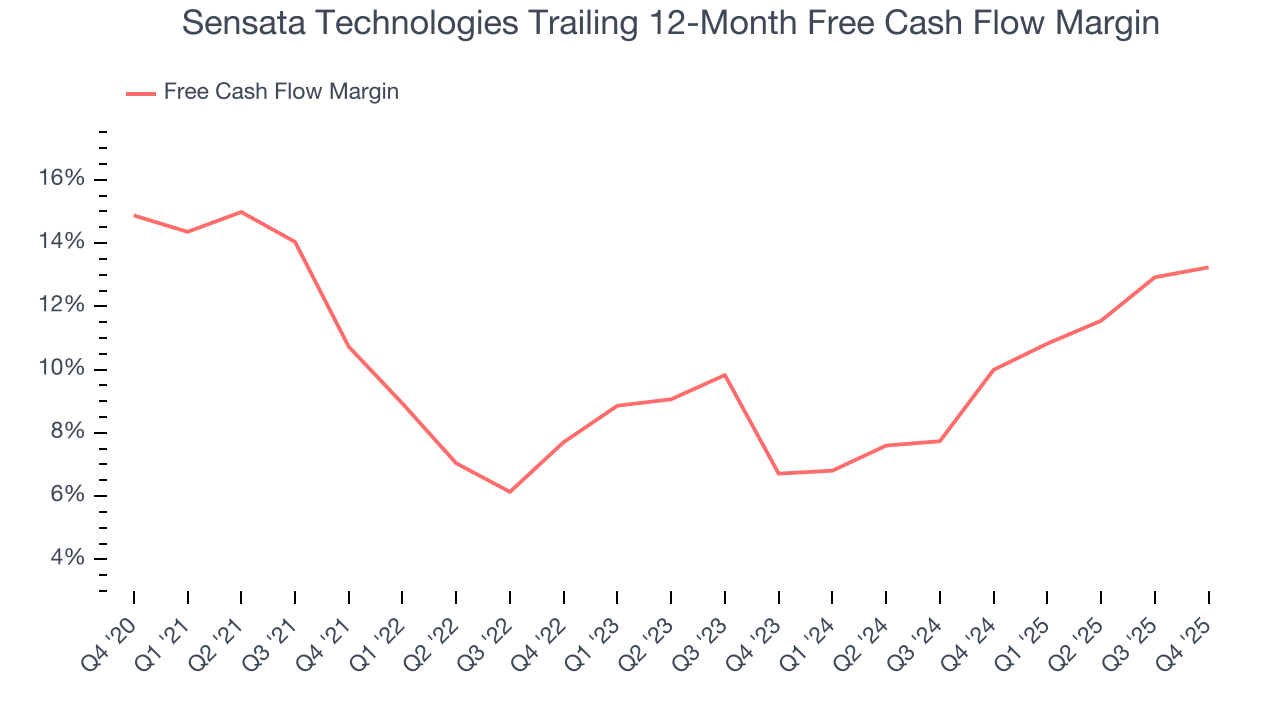

Sensata Technologies has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.6%, subpar for a semiconductor business.

Taking a step back, an encouraging sign is that Sensata Technologies’s margin expanded by 2.5 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Sensata Technologies’s free cash flow clocked in at $151.8 million in Q4, equivalent to a 16.5% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sensata Technologies historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

12. Balance Sheet Assessment

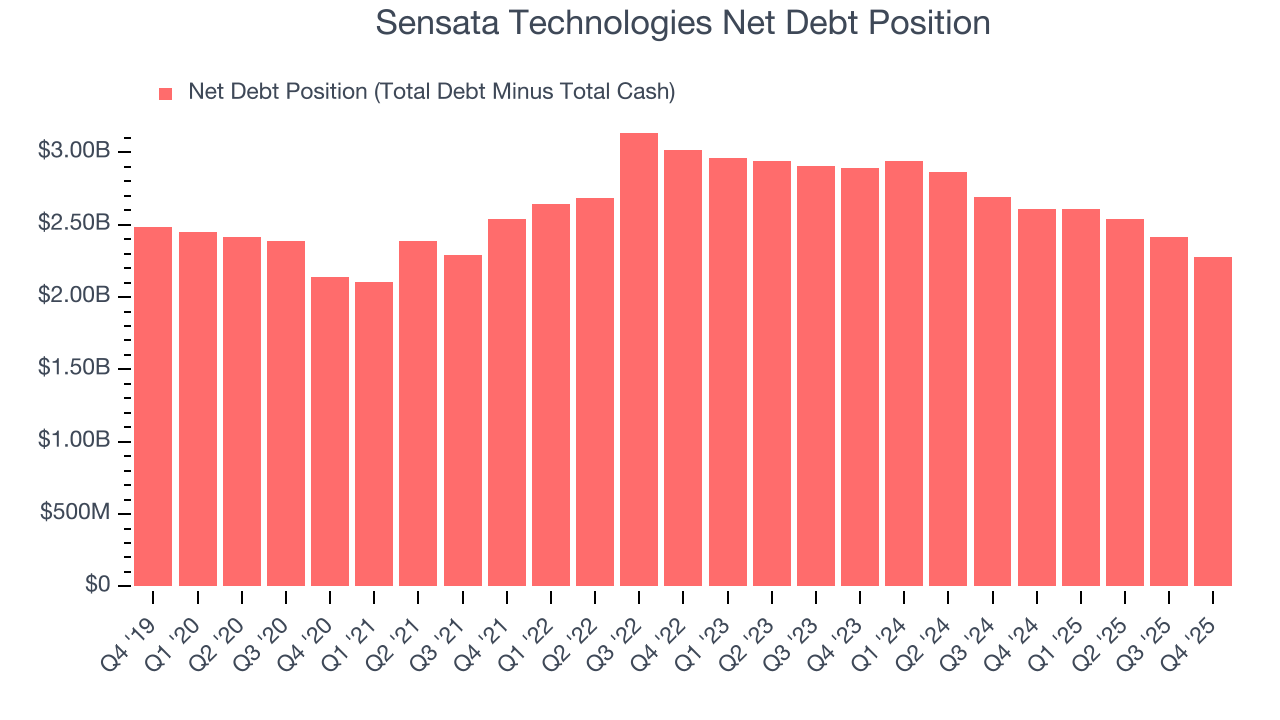

Sensata Technologies reported $573 million of cash and $2.85 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $835.9 million of EBITDA over the last 12 months, we view Sensata Technologies’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $68.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Sensata Technologies’s Q4 Results

It was good to see Sensata Technologies beat analysts’ EPS expectations this quarter. We were also happy its adjusted operating income narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter was in line. Zooming out, we think this was a mixed quarter. The stock traded up 2.4% to $37 immediately after reporting.

14. Is Now The Time To Buy Sensata Technologies?

Updated: February 19, 2026 at 9:24 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Sensata Technologies.

Sensata Technologies falls short of our quality standards. For starters, its revenue growth was mediocre over the last five years, and analysts don’t see anything changing over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its low gross margins indicate some combination of pricing pressures or rising production costs. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Sensata Technologies’s P/E ratio based on the next 12 months is 10x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $39.80 on the company (compared to the current share price of $35.98).