STERIS (STE)

STERIS doesn’t impress us. Its weak returns on capital indicate management was inefficient with its resources and missed opportunities.― StockStory Analyst Team

1. News

2. Summary

Why STERIS Is Not Exciting

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

- Low returns on capital reflect management’s struggle to allocate funds effectively

- A positive is that its earnings per share grew by 10.8% annually over the last five years and topped the peer group average

STERIS doesn’t pass our quality test. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than STERIS

High Quality

Investable

Underperform

Why There Are Better Opportunities Than STERIS

At $259.48 per share, STERIS trades at 24.5x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. STERIS (STE) Research Report: Q3 CY2025 Update

Medical equipment and services company Steris (NYSE:STE). announced better-than-expected revenue in Q3 CY2025, with sales up 9.9% year on year to $1.46 billion. Its non-GAAP profit of $2.47 per share was 5.1% above analysts’ consensus estimates.

STERIS (STE) Q3 CY2025 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.43 billion (9.9% year-on-year growth, 2% beat)

- Adjusted EPS: $2.47 vs analyst estimates of $2.35 (5.1% beat)

- Management raised its full-year Adjusted EPS guidance to $10.23 at the midpoint, a 2% increase

- Operating Margin: 18.2%, up from 16.5% in the same quarter last year

- Free Cash Flow was -$325.9 million, down from $148.8 million in the same quarter last year

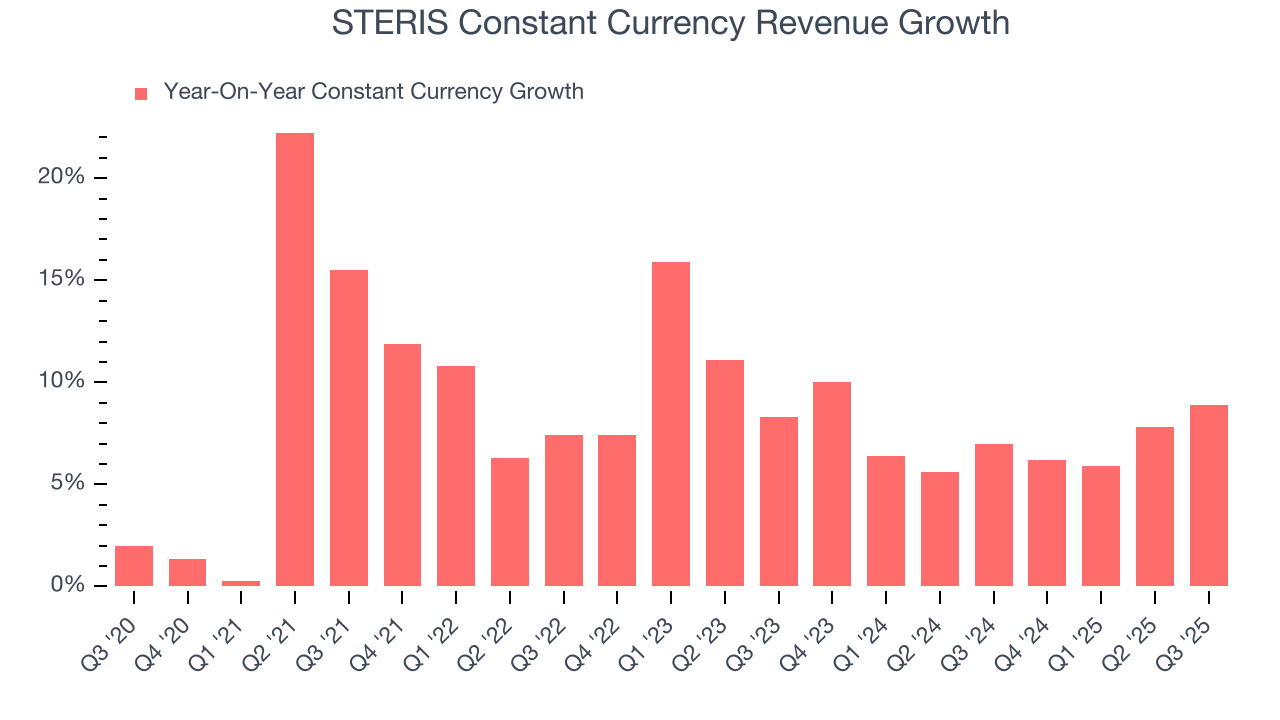

- Constant Currency Revenue rose 8.9% year on year (7% in the same quarter last year)

- Market Capitalization: $23.82 billion

Company Overview

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

STERIS operates through three main segments: Healthcare, Applied Sterilization Technologies (AST), and Life Sciences. Each segment addresses different aspects of infection control and sterility assurance across the healthcare ecosystem.

The Healthcare segment serves hospitals and surgical centers with a comprehensive range of products and services. These include specialized detergents and disinfectants, sterilization equipment for surgical instruments, surgical tables, operating room lights, and endoscopy accessories. A hospital might use STERIS's automated washing systems to clean surgical instruments, then sterilize them in a STERIS steam sterilizer before surgery. The company also provides maintenance services for this equipment and offers instrument repair services to extend the life of valuable medical tools.

In the Applied Sterilization Technologies segment, STERIS operates a global network of contract sterilization facilities. Medical device manufacturers ship their products to these facilities where STERIS sterilizes them using various technologies including gamma radiation, electron beam, and vaporized hydrogen peroxide. For example, a manufacturer of single-use syringes would send their packaged products to a STERIS facility for sterilization before they reach hospitals or pharmacies. This segment also provides laboratory testing services to validate sterilization processes.

The Life Sciences segment focuses on pharmaceutical and biotechnology companies that require sterile manufacturing environments. STERIS provides specialized cleanroom disinfectants, sterilization equipment, and pure water systems essential for aseptic drug production. A vaccine manufacturer, for instance, would use STERIS products to maintain the sterility of their production facility.

STERIS generates revenue through a mix of consumable products (like detergents and sterility assurance products), capital equipment sales, service contracts, and sterilization services. The company maintains operations throughout North America, Europe, and Asia, serving customers globally.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

STERIS competes with several companies across its different segments, including 3M (NYSE:MMM), Getinge (STO:GETI-B), Ecolab (NYSE:ECL), and Sterigenics International in sterilization services. In the operating room equipment space, competitors include Stryker (NYSE:SYK) and Skytron.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.70 billion in revenue over the past 12 months, STERIS has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

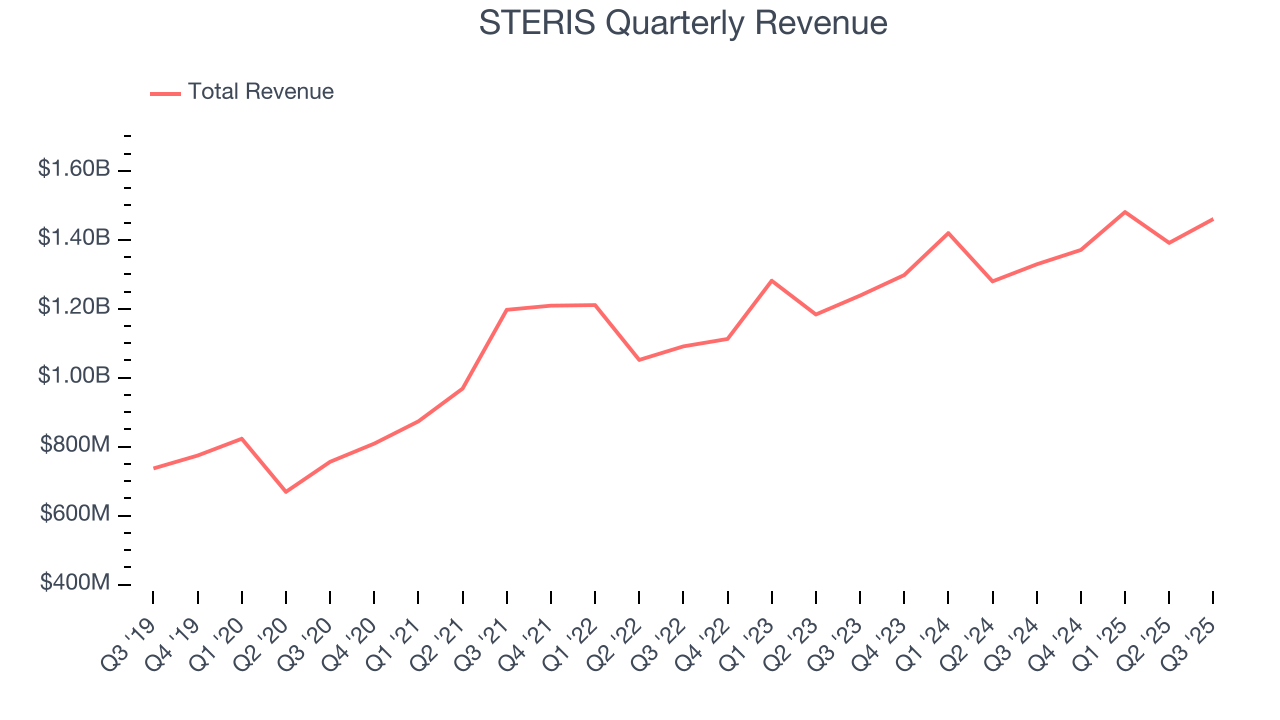

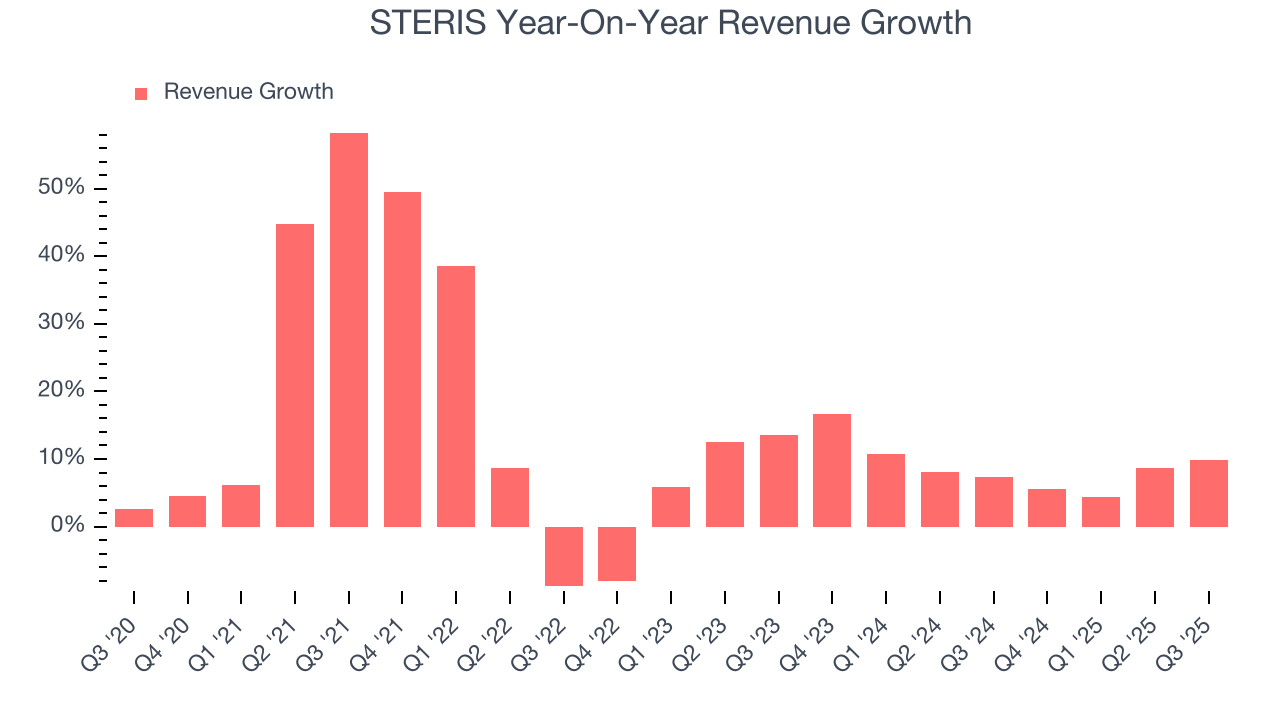

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, STERIS’s sales grew at a solid 13.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. STERIS’s annualized revenue growth of 8.8% over the last two years is below its five-year trend, but we still think the results were respectable.

STERIS also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 7.2% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that foreign exchange rates have boosted STERIS’s performance.

This quarter, STERIS reported year-on-year revenue growth of 9.9%, and its $1.46 billion of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above the sector average and indicates the market sees some success for its newer products and services.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

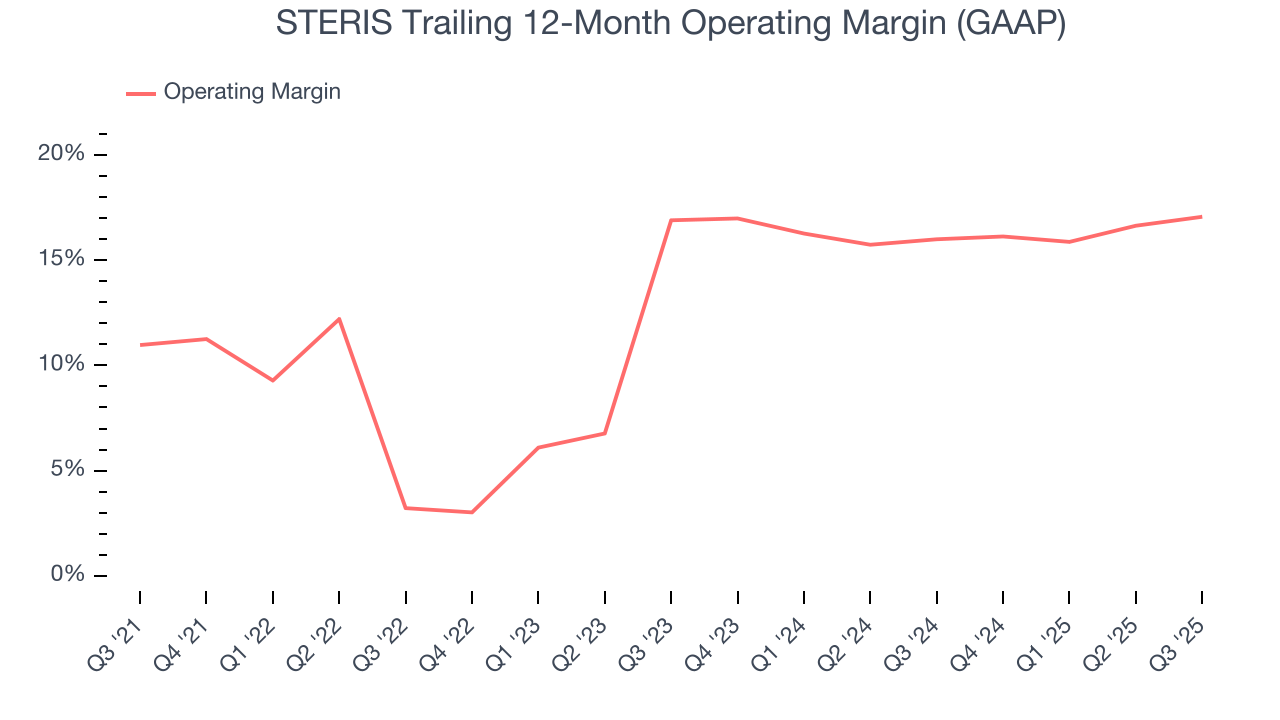

STERIS has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.2%, higher than the broader healthcare sector.

Looking at the trend in its profitability, STERIS’s operating margin rose by 6.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, STERIS generated an operating margin profit margin of 18.2%, up 1.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

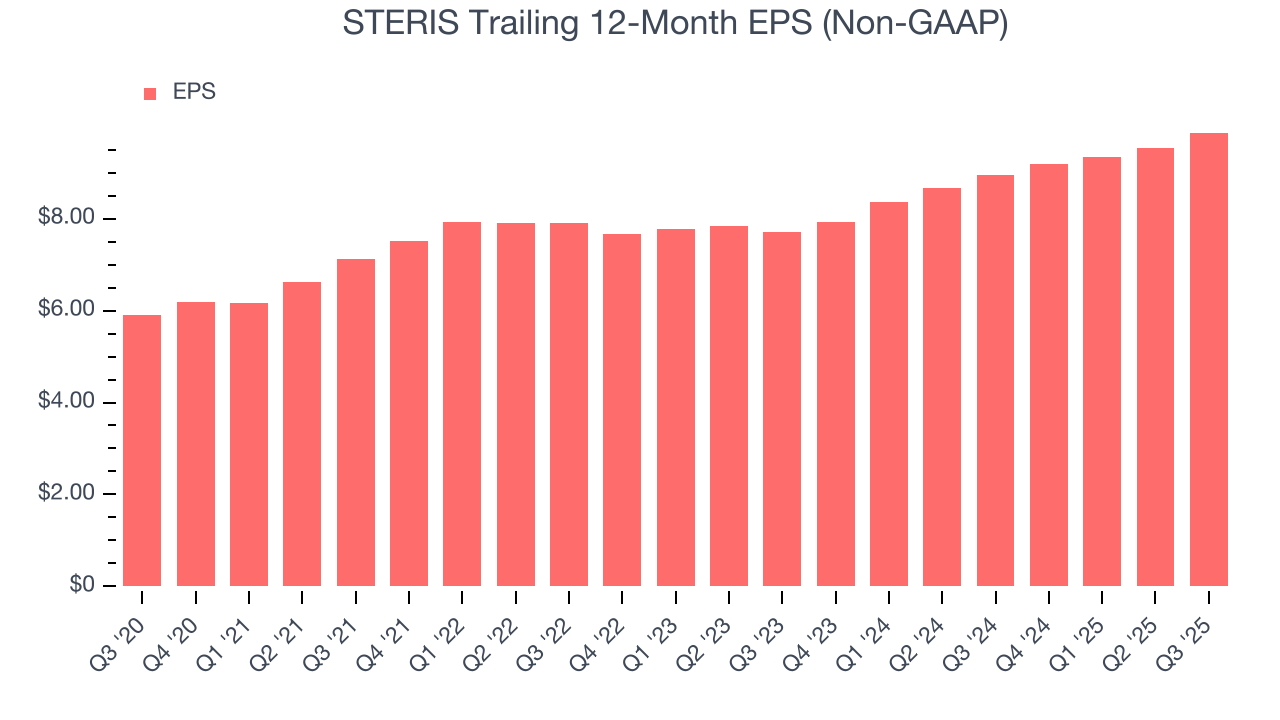

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

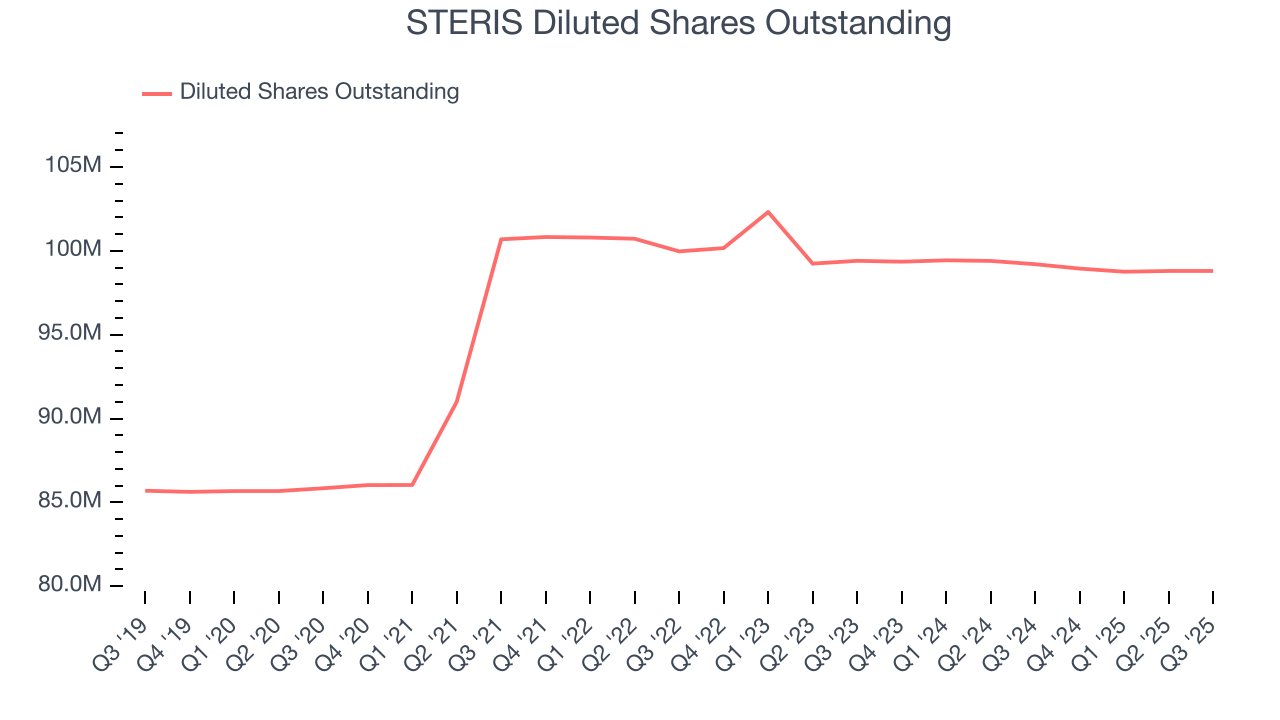

STERIS’s EPS grew at a remarkable 10.8% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 13.5% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into the nuances of STERIS’s earnings can give us a better understanding of its performance. A five-year view shows STERIS has diluted its shareholders, growing its share count by 15.1%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, STERIS reported adjusted EPS of $2.47, up from $2.14 in the same quarter last year. This print beat analysts’ estimates by 5.1%. Over the next 12 months, Wall Street expects STERIS’s full-year EPS of $9.87 to grow 6.9%.

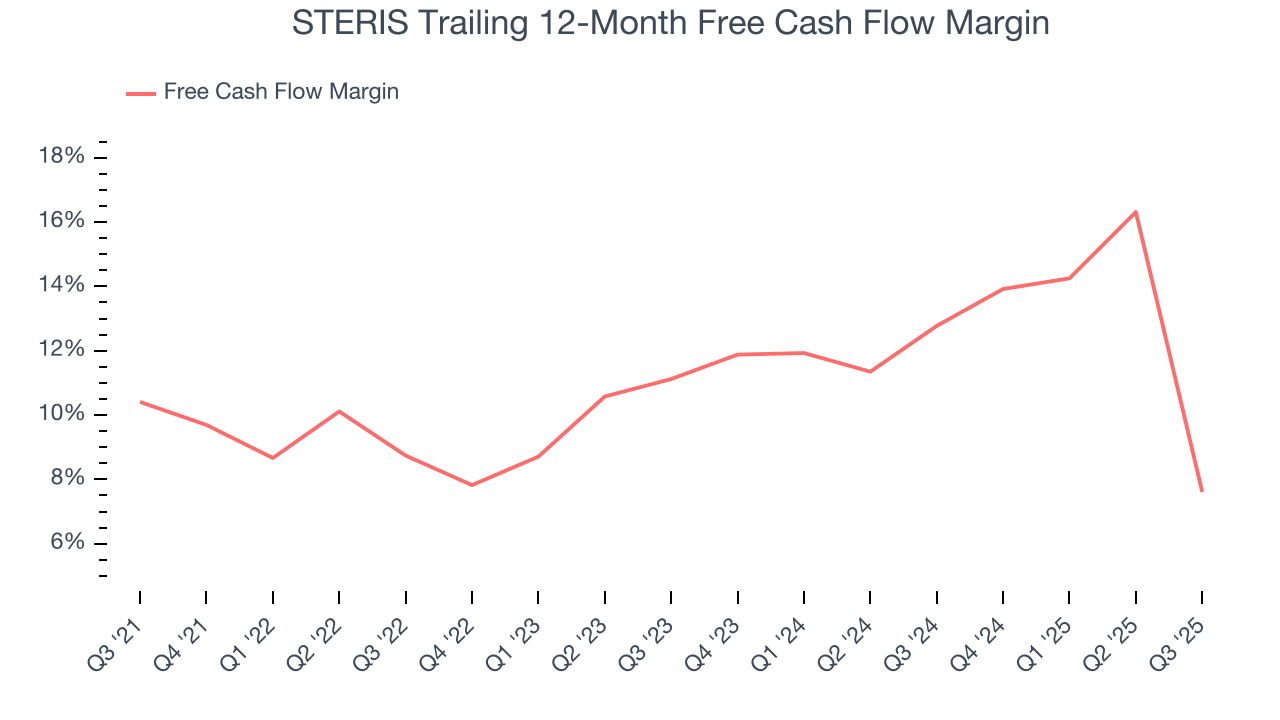

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

STERIS has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.1% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that STERIS’s margin dropped by 2.8 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

STERIS burned through $325.9 million of cash in Q3, equivalent to a negative 22.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

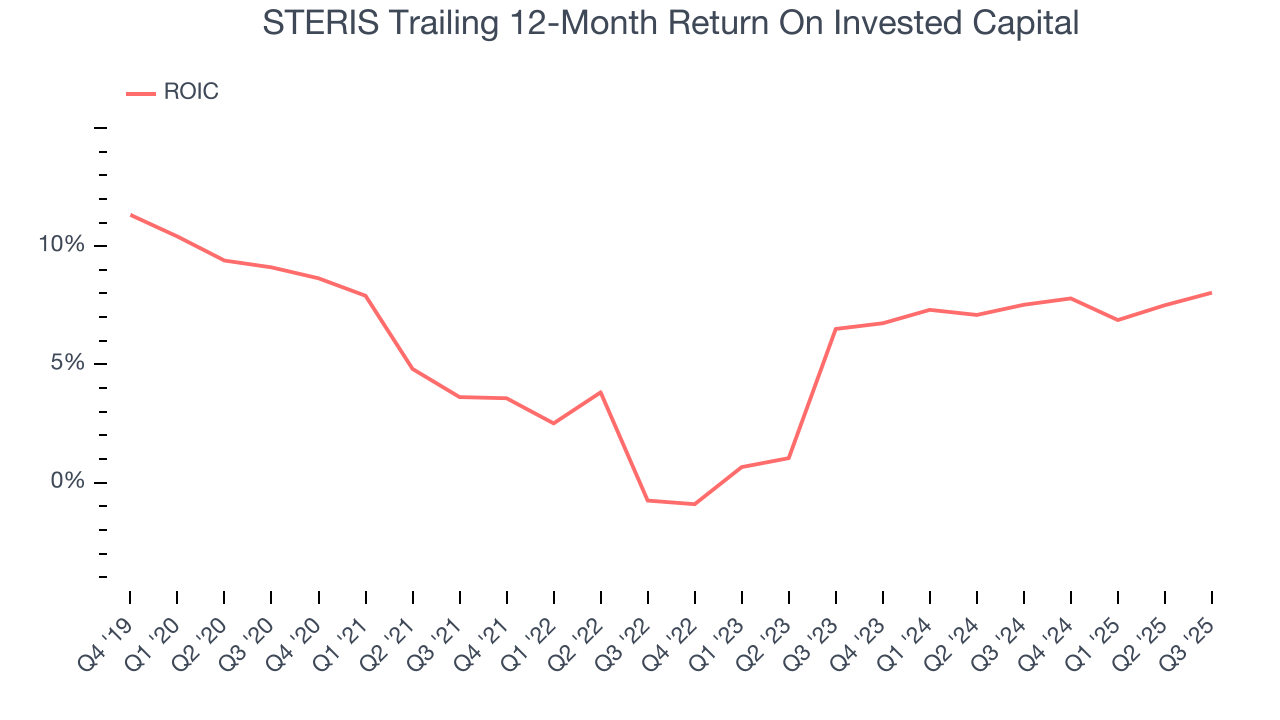

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

STERIS historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, STERIS’s ROIC has increased. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

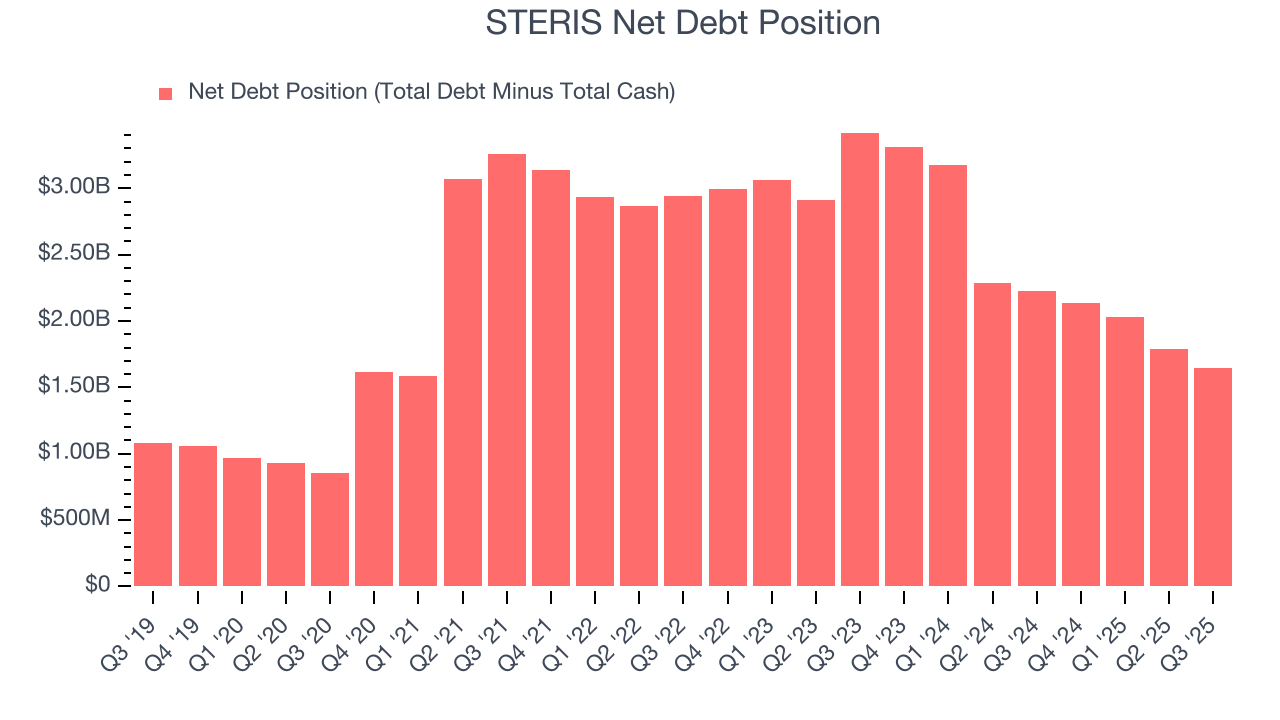

STERIS reported $319.2 million of cash and $1.96 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.60 billion of EBITDA over the last 12 months, we view STERIS’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $57.74 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from STERIS’s Q3 Results

We enjoyed seeing STERIS beat analysts’ constant currency revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.8% to $250 immediately following the results.

13. Is Now The Time To Buy STERIS?

Updated: January 24, 2026 at 10:46 PM EST

When considering an investment in STERIS, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in STERIS’s fundamentals, but its business quality ultimately falls short. To kick things off, its revenue growth was solid over the last five years. And while STERIS’s mediocre ROIC lags the market and is a headwind for its stock price, its rising cash profitability gives it more optionality.

STERIS’s P/E ratio based on the next 12 months is 24.5x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $281.63 on the company (compared to the current share price of $259.48).