STERIS (STE)

STERIS doesn’t impress us. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why STERIS Is Not Exciting

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- The good news is that its earnings growth has topped the peer group average over the last five years as its EPS has compounded at 10.8% annually

STERIS’s quality doesn’t meet our bar. Our attention is focused on better businesses.

Why There Are Better Opportunities Than STERIS

High Quality

Investable

Underperform

Why There Are Better Opportunities Than STERIS

STERIS’s stock price of $261.68 implies a valuation ratio of 24.9x forward P/E. This multiple is higher than most healthcare companies, and we think it’s quite expensive for the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. STERIS (STE) Research Report: Q4 CY2025 Update

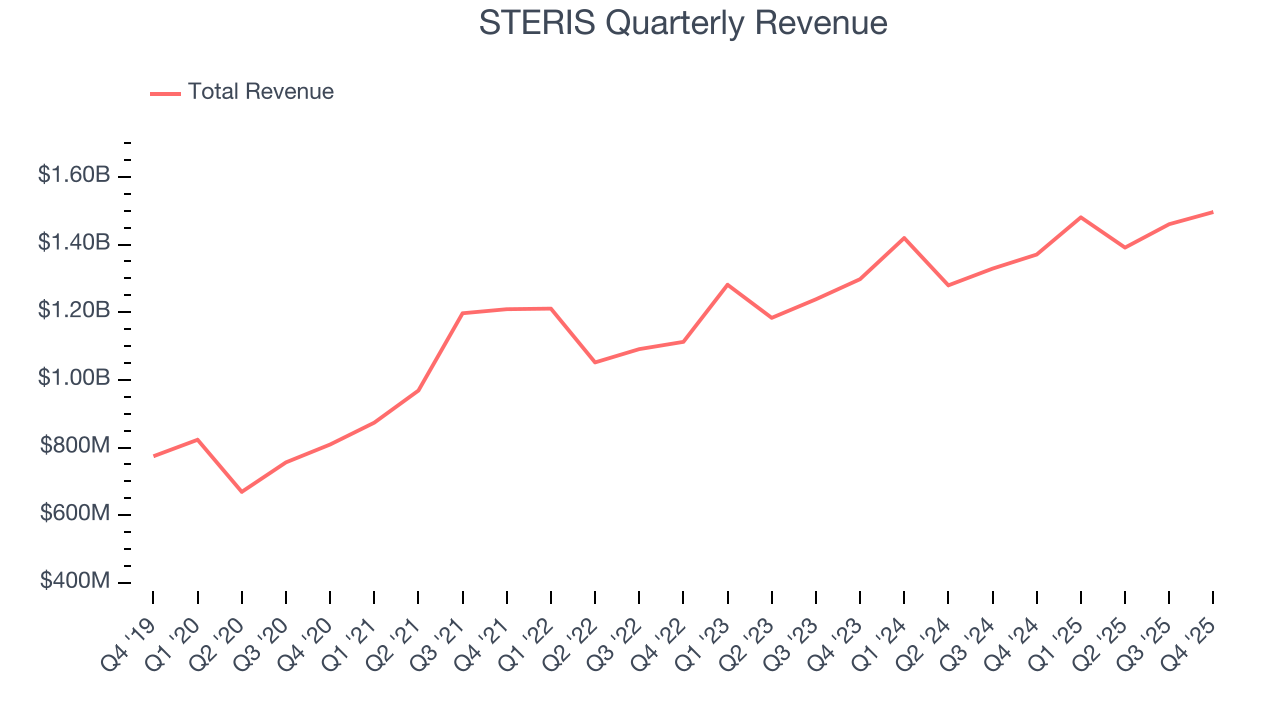

Medical equipment and services company Steris (NYSE:STE). reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 9.2% year on year to $1.50 billion. Its non-GAAP profit of $2.53 per share was in line with analysts’ consensus estimates.

STERIS (STE) Q4 CY2025 Highlights:

- Revenue: $1.50 billion vs analyst estimates of $1.48 billion (9.2% year-on-year growth, 1% beat)

- Adjusted EPS: $2.53 vs analyst estimates of $2.53 (in line)

- Management reiterated its full-year Adjusted EPS guidance of $10.23 at the midpoint

- Operating Margin: 18.3%, in line with the same quarter last year

- Free Cash Flow Margin: 0%, down from 17.8% in the same quarter last year

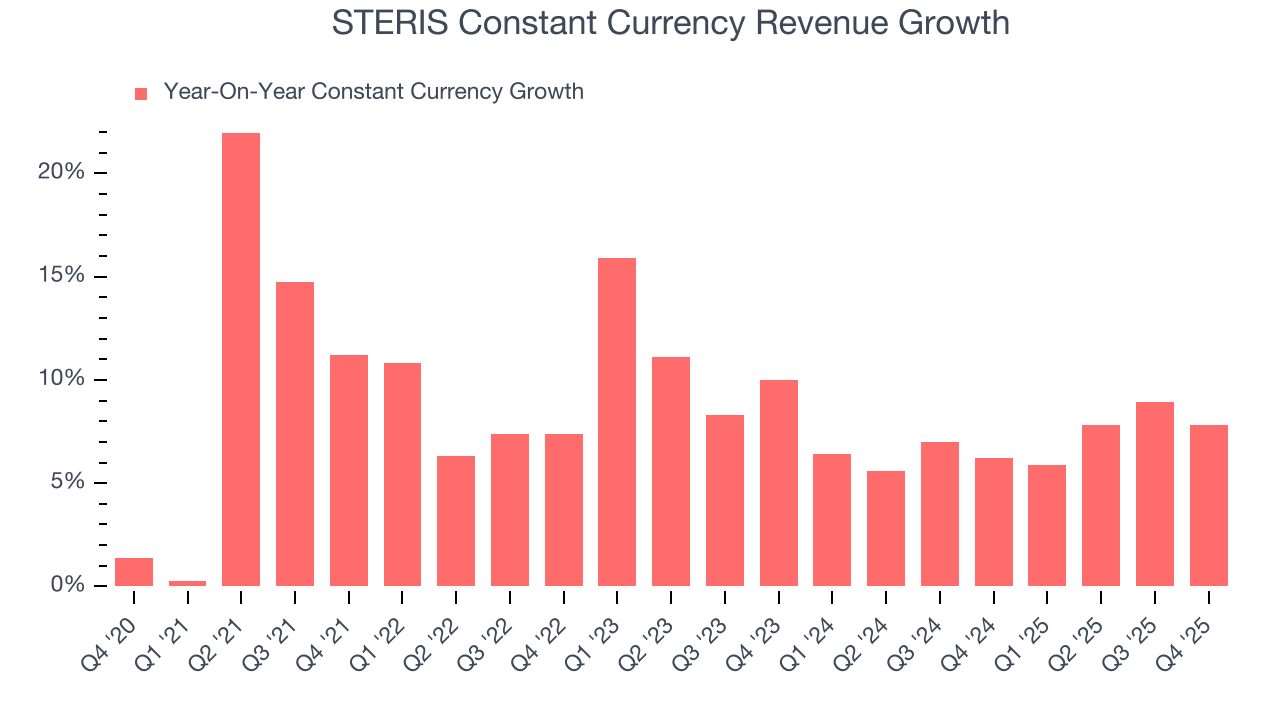

- Constant Currency Revenue rose 7.8% year on year (6.2% in the same quarter last year)

- Market Capitalization: $25.68 billion

Company Overview

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

STERIS operates through three main segments: Healthcare, Applied Sterilization Technologies (AST), and Life Sciences. Each segment addresses different aspects of infection control and sterility assurance across the healthcare ecosystem.

The Healthcare segment serves hospitals and surgical centers with a comprehensive range of products and services. These include specialized detergents and disinfectants, sterilization equipment for surgical instruments, surgical tables, operating room lights, and endoscopy accessories. A hospital might use STERIS's automated washing systems to clean surgical instruments, then sterilize them in a STERIS steam sterilizer before surgery. The company also provides maintenance services for this equipment and offers instrument repair services to extend the life of valuable medical tools.

In the Applied Sterilization Technologies segment, STERIS operates a global network of contract sterilization facilities. Medical device manufacturers ship their products to these facilities where STERIS sterilizes them using various technologies including gamma radiation, electron beam, and vaporized hydrogen peroxide. For example, a manufacturer of single-use syringes would send their packaged products to a STERIS facility for sterilization before they reach hospitals or pharmacies. This segment also provides laboratory testing services to validate sterilization processes.

The Life Sciences segment focuses on pharmaceutical and biotechnology companies that require sterile manufacturing environments. STERIS provides specialized cleanroom disinfectants, sterilization equipment, and pure water systems essential for aseptic drug production. A vaccine manufacturer, for instance, would use STERIS products to maintain the sterility of their production facility.

STERIS generates revenue through a mix of consumable products (like detergents and sterility assurance products), capital equipment sales, service contracts, and sterilization services. The company maintains operations throughout North America, Europe, and Asia, serving customers globally.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

STERIS competes with several companies across its different segments, including 3M (NYSE:MMM), Getinge (STO:GETI-B), Ecolab (NYSE:ECL), and Sterigenics International in sterilization services. In the operating room equipment space, competitors include Stryker (NYSE:SYK) and Skytron.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.83 billion in revenue over the past 12 months, STERIS has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

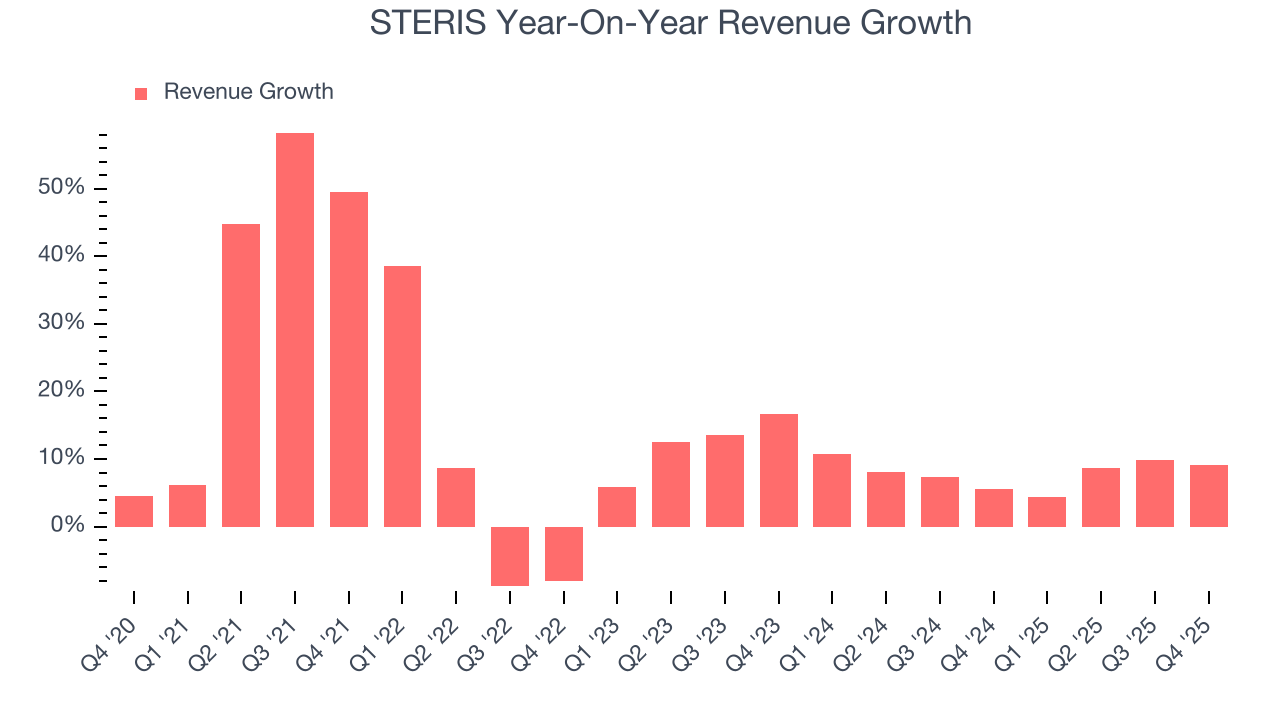

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, STERIS grew its sales at a solid 13.8% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. STERIS’s annualized revenue growth of 8% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that STERIS has properly hedged its foreign currency exposure.

This quarter, STERIS reported year-on-year revenue growth of 9.2%, and its $1.50 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above the sector average and indicates the market is baking in some success for its newer products and services.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

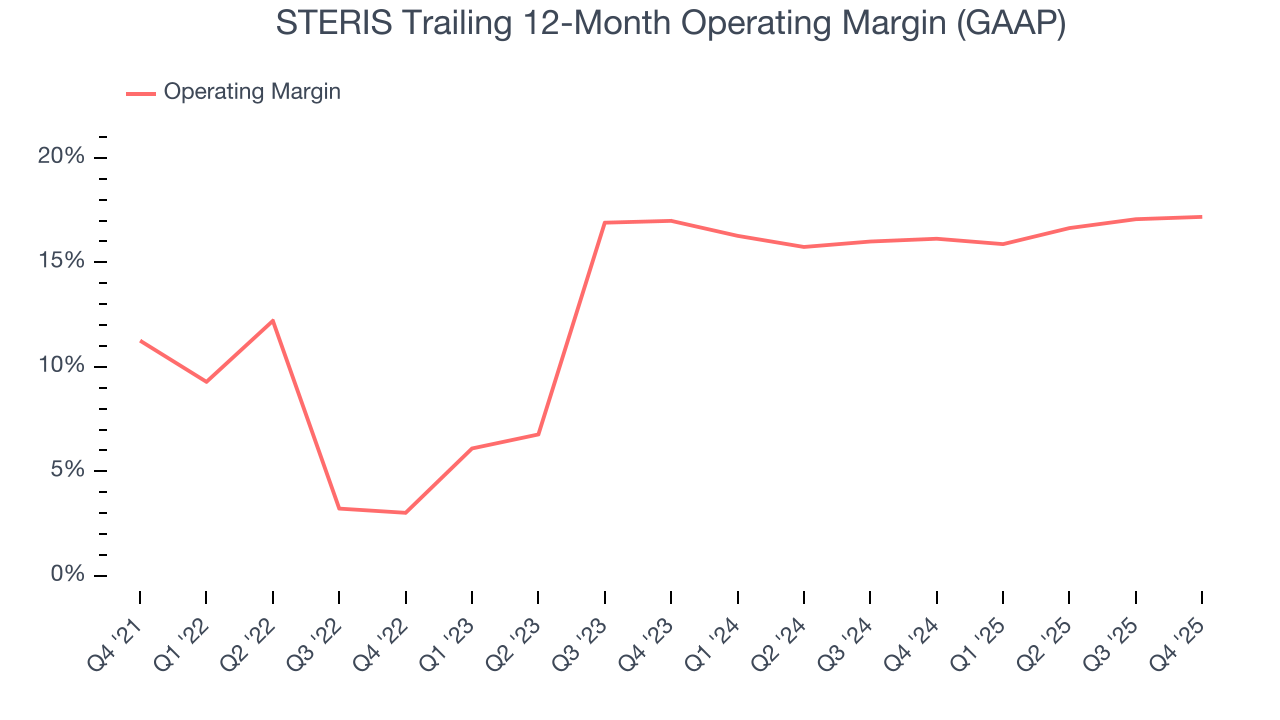

STERIS has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.4%, higher than the broader healthcare sector.

Looking at the trend in its profitability, STERIS’s operating margin rose by 5.9 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, STERIS generated an operating margin profit margin of 18.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

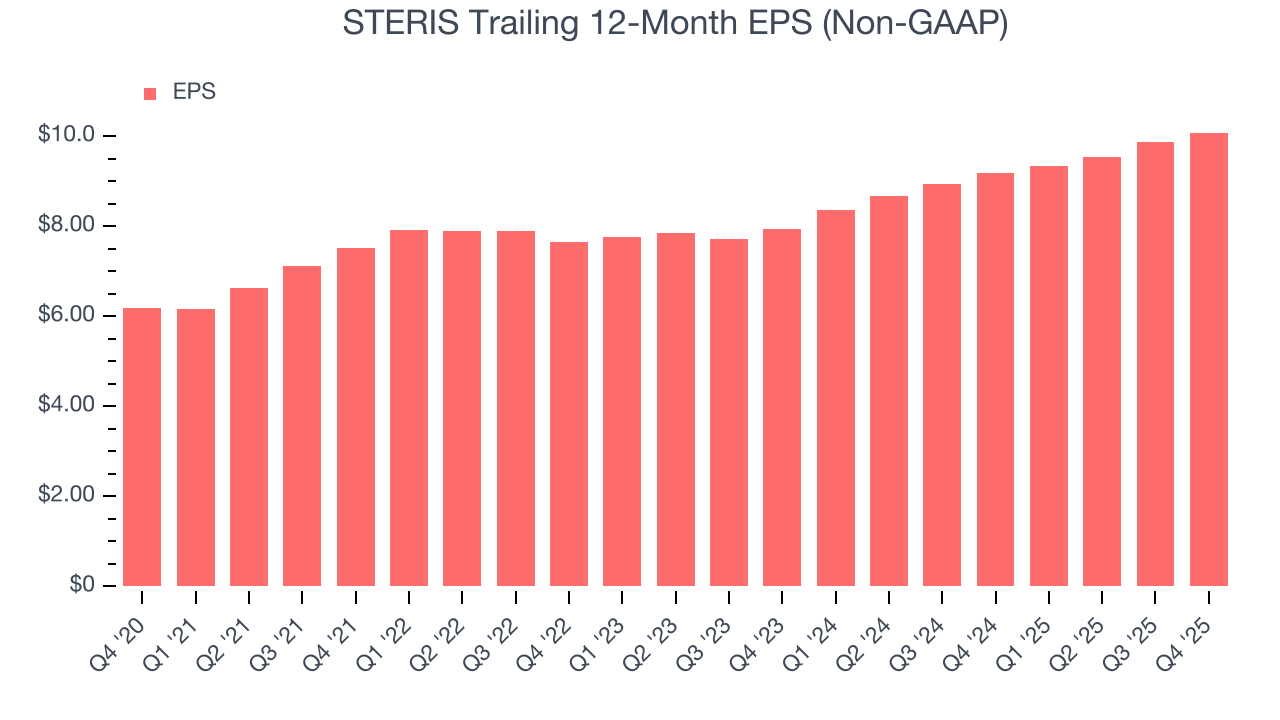

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

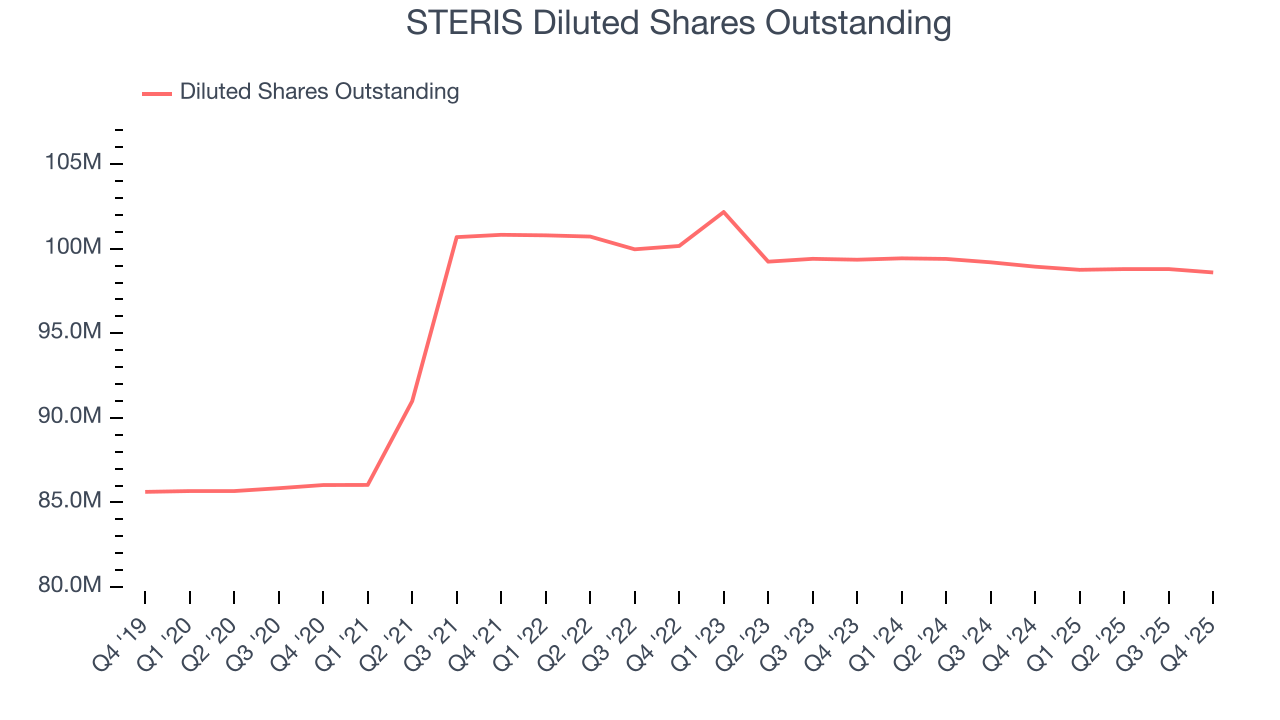

STERIS’s EPS grew at a remarkable 10.3% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 13.8% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

We can take a deeper look into STERIS’s earnings quality to better understand the drivers of its performance. A five-year view shows STERIS has diluted its shareholders, growing its share count by 14.6%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, STERIS reported adjusted EPS of $2.53, up from $2.32 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects STERIS’s full-year EPS of $10.08 to grow 8.3%.

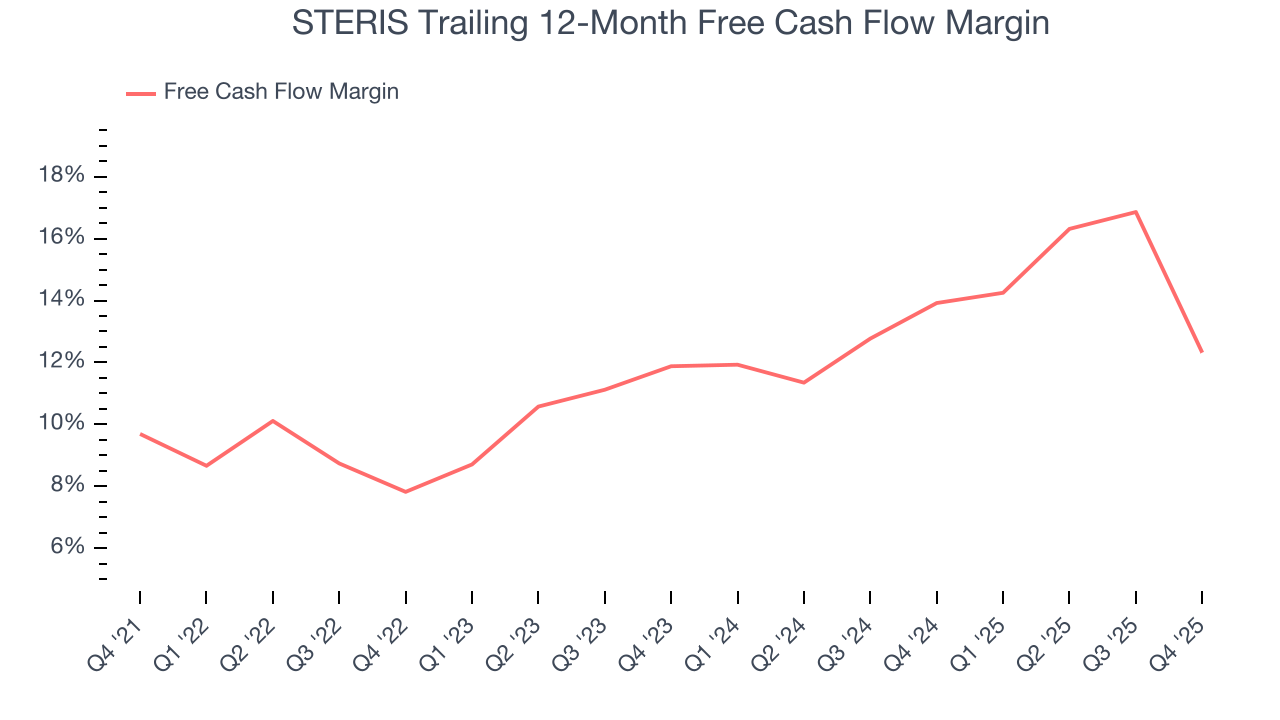

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

STERIS has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.3% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that STERIS’s margin expanded by 2.6 percentage points during that time. This is encouraging because it gives the company more optionality.

STERIS broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 17.8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

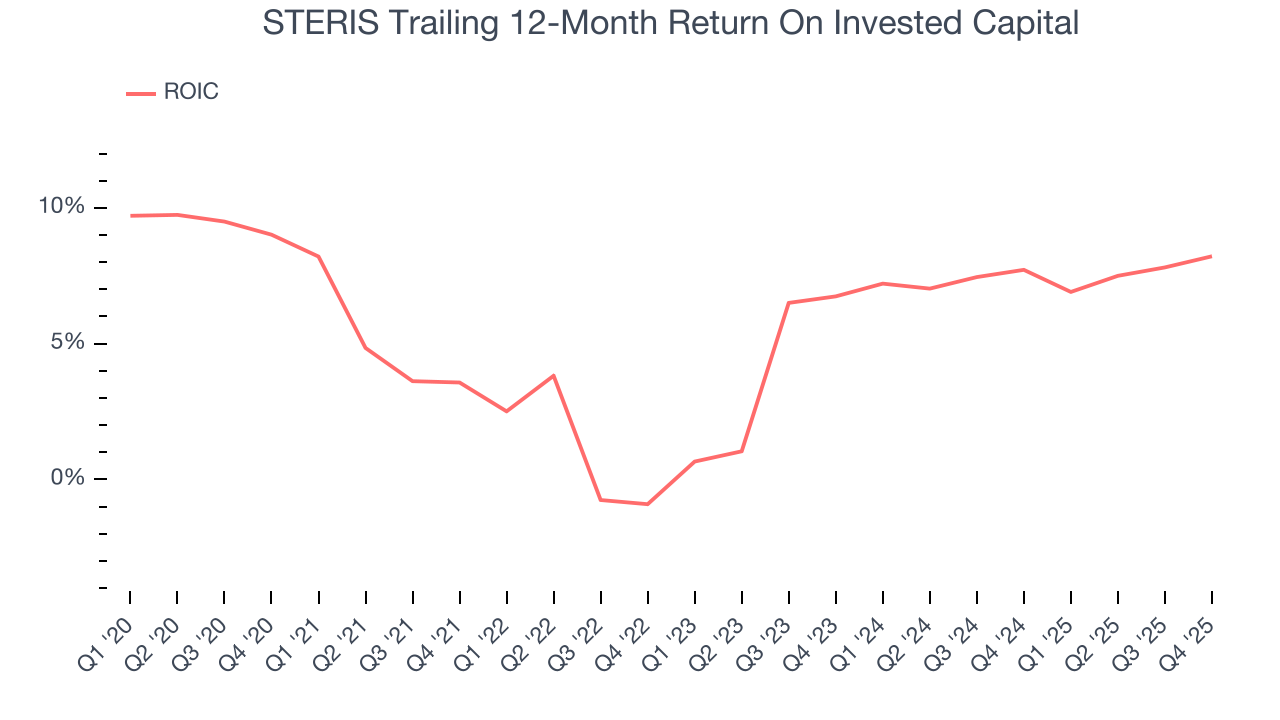

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

STERIS historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.1%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, STERIS’s ROIC has increased. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Key Takeaways from STERIS’s Q4 Results

It was good to see STERIS narrowly top analysts’ constant currency revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 4.4% to $252.67 immediately after reporting.

12. Is Now The Time To Buy STERIS?

Updated: February 4, 2026 at 10:41 PM EST

Before investing in or passing on STERIS, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

When it comes to STERIS’s business quality, there are some positives, but it ultimately falls short. First off, its revenue growth was solid over the last five years. And while STERIS’s mediocre ROIC lags the market and is a headwind for its stock price, its rising returns show management's prior bets are at least better than before.

STERIS’s P/E ratio based on the next 12 months is 24x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $281.63 on the company (compared to the current share price of $257.89).