AT&T (T)

AT&T is in for a bumpy ride. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think AT&T Will Underperform

Founded by Alexander Graham Bell, AT&T (NYSE:T) is a multinational telecomm conglomerate providing a range of communications and internet services.

- Annual revenue declines of 5.6% over the last five years indicate problems with its market positioning

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

AT&T doesn’t pass our quality test. Better stocks can be found in the market.

Why There Are Better Opportunities Than AT&T

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AT&T

At $23.55 per share, AT&T trades at 10.9x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. AT&T (T) Research Report: Q3 CY2025 Update

Telecommunications conglomerate AT&T (NYSE:T) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.6% year on year to $30.71 billion. Its GAAP profit of $1.29 per share was significantly above analysts’ consensus estimates.

AT&T (T) Q3 CY2025 Highlights:

- Revenue: $30.71 billion vs analyst estimates of $30.85 billion (1.6% year-on-year growth, in line)

- EPS (GAAP): $1.29 vs analyst estimates of $0.53 (significant beat)

- Operating Margin: 19.9%, up from 7% in the same quarter last year

- Free Cash Flow Margin: 17.1%, similar to the same quarter last year

- Wireless subs adds: 405,000 vs expectations of 334,100 adds

- Market Capitalization: $186.3 billion

Company Overview

Founded by Alexander Graham Bell, AT&T (NYSE:T) is a multinational telecomm conglomerate providing a range of communications and internet services.

Over the years, the company has evolved from a traditional telephone service provider into a modern communications leader, expanding its offerings to include wireless and services to keep consumers connected. In recent times, AT&T divested its media assets, such as WarnerMedia in 2022, to refocus on its core telecommunications business and invest in 5G and fiber network expansion. This is why you'll see a big drop in revenue in 2020 (the financials were restated for 2020 and 2021 as if the divestiture had happened so that investors could compare apples-to-apples financials).

AT&T's offerings range from wireless voice and data services to high-speed internet and entertainment products. For example, its flagship wireless service provides nationwide 5G coverage, allowing customers to enjoy fast data speeds and reliable connectivity on their smartphones. Another product, AT&T Fiber, offers ultra-fast internet service to homes and businesses, enabling high-definition streaming, online gaming, and efficient remote work capabilities.

AT&T generates revenue through three primary sources: wireless services, broadband internet, and business services. Under wireless services, its primary cash machine, the company earns income by providing mobile phone plans to consumers and businesses, charging based on data usage, plan features, or device financing. The broadband model involves offering high-speed internet access through fiber and DSL services to residential and commercial customers. AT&T's business products work by generating revenue when enterprises engage with its communications and networking services. For example, consider a corporation that uses AT&T's cloud networking to connect its various offices, AT&T earns fees for providing these essential services that enable the company's operations.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the telecommunications industry include Verizon (NYSE:VZ), T-Mobile (NASDAQ:TMUS), and Comcast (NASDAQ:CMCSA).

5. Revenue Growth

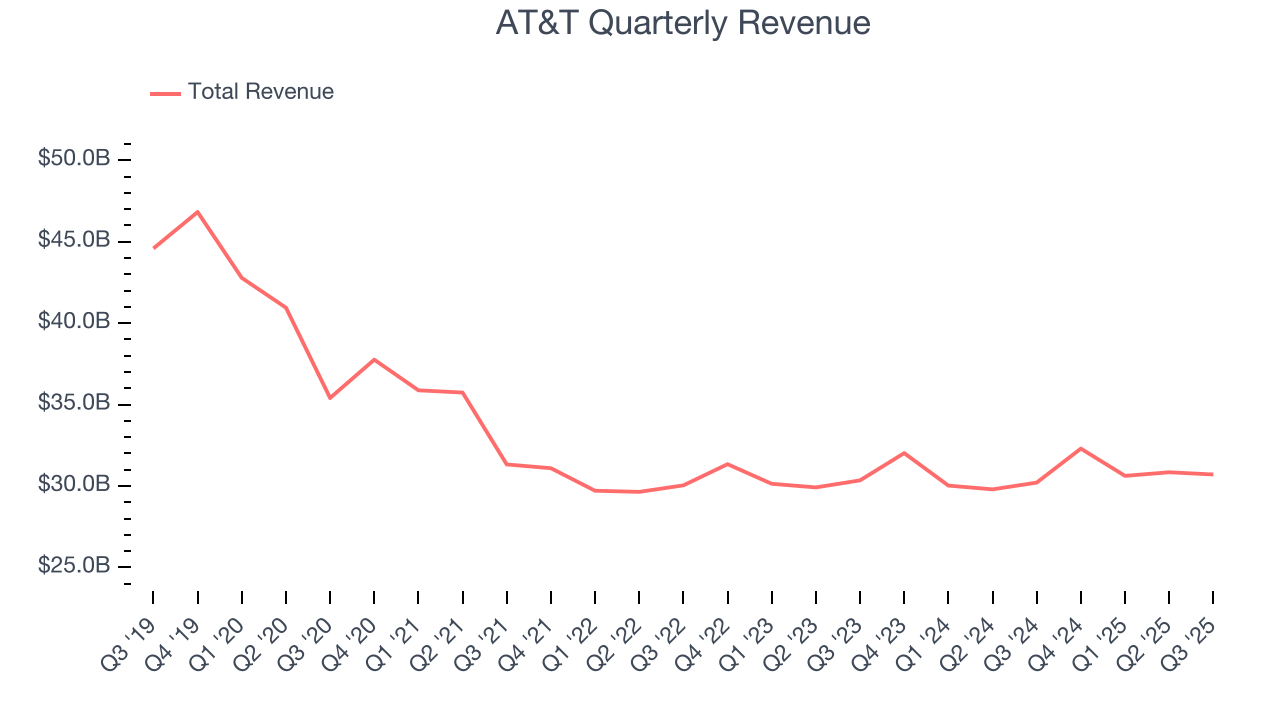

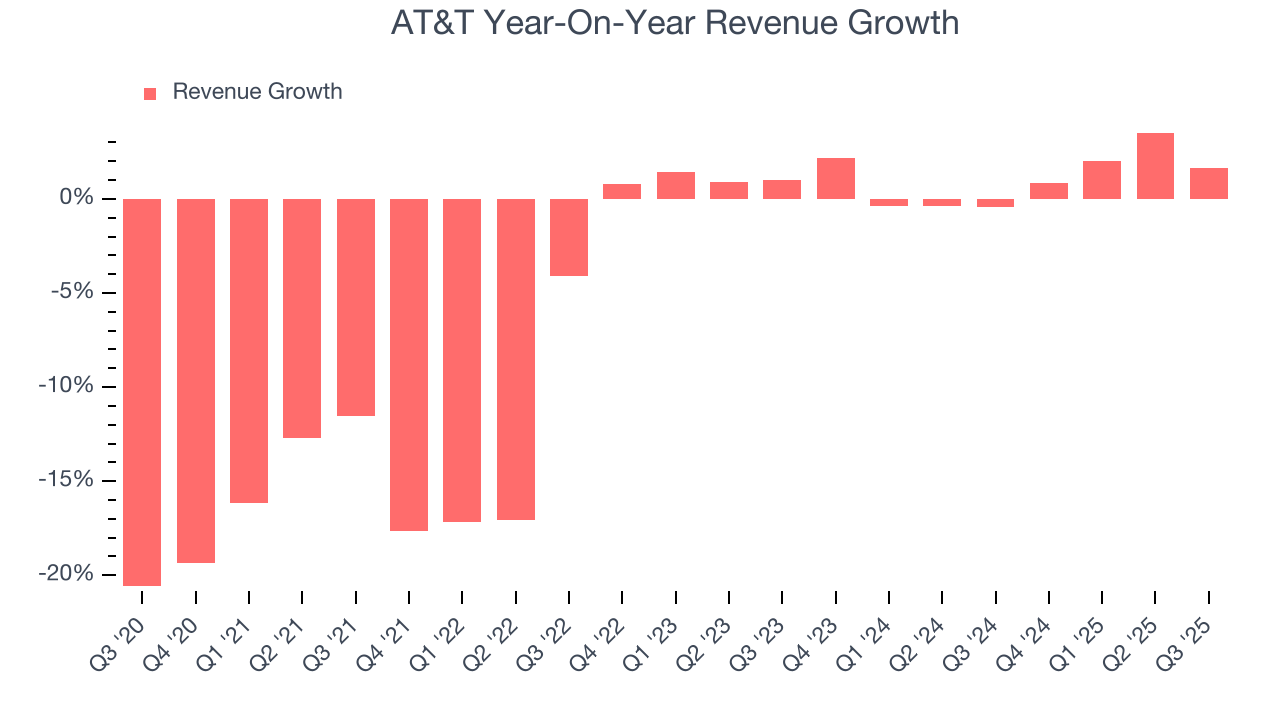

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. AT&T struggled to consistently generate demand over the last five years as its sales dropped at a 5.6% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. AT&T’s annualized revenue growth of 1.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

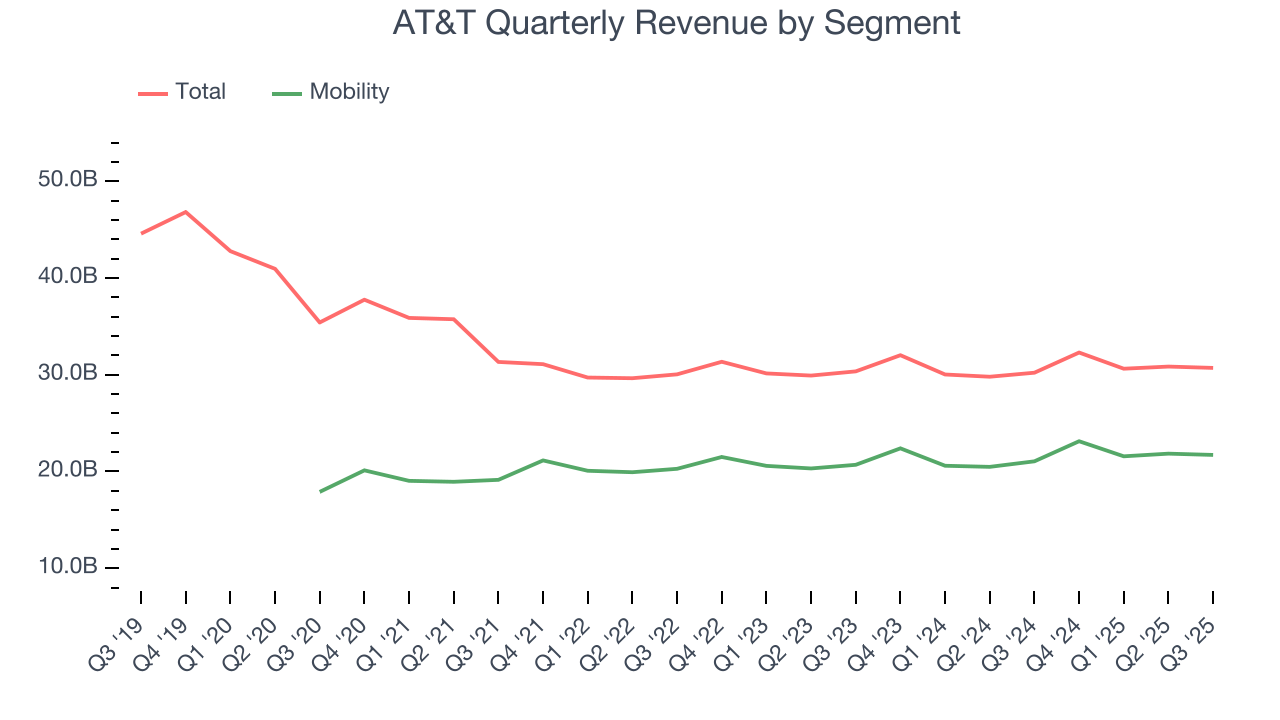

AT&T also breaks out the revenue for its most important segment, Mobility. Over the last two years, AT&T’s Mobility revenue (wireless plans) averaged 3.1% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, AT&T grew its revenue by 1.6% year on year, and its $30.71 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

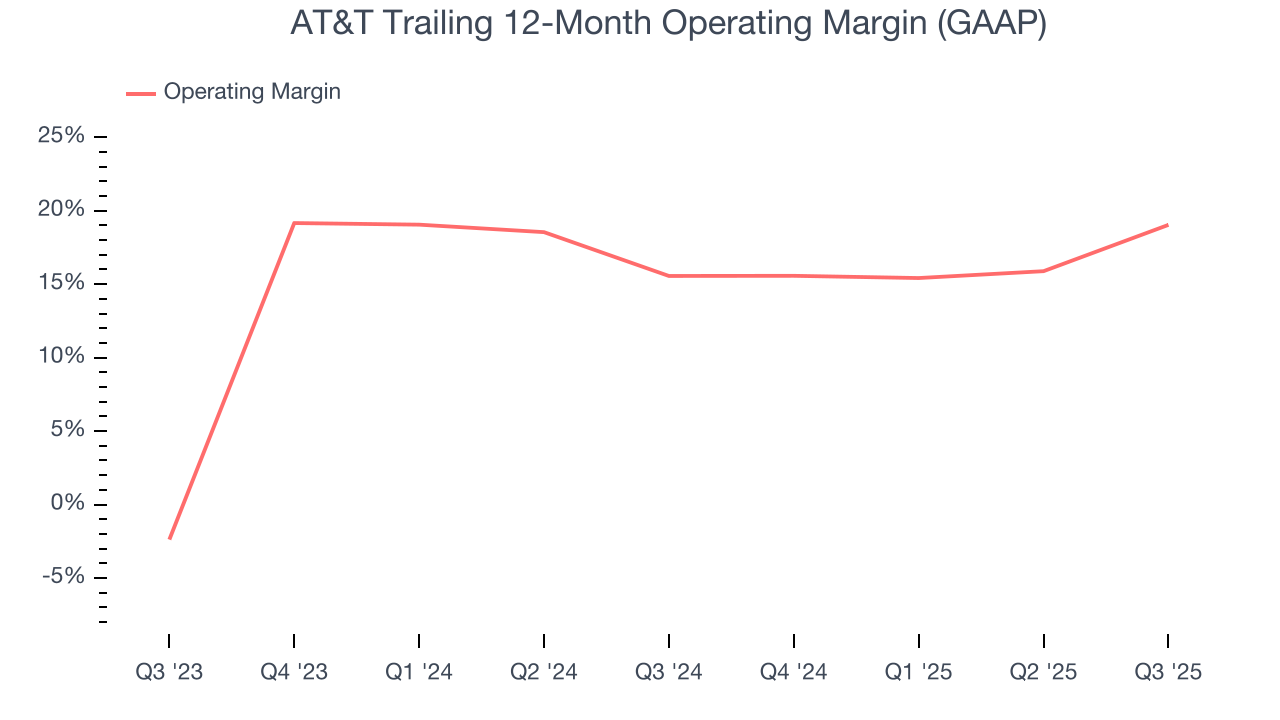

AT&T’s operating margin has risen over the last 12 months and averaged 17.3% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, AT&T generated an operating margin profit margin of 19.9%, up 12.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

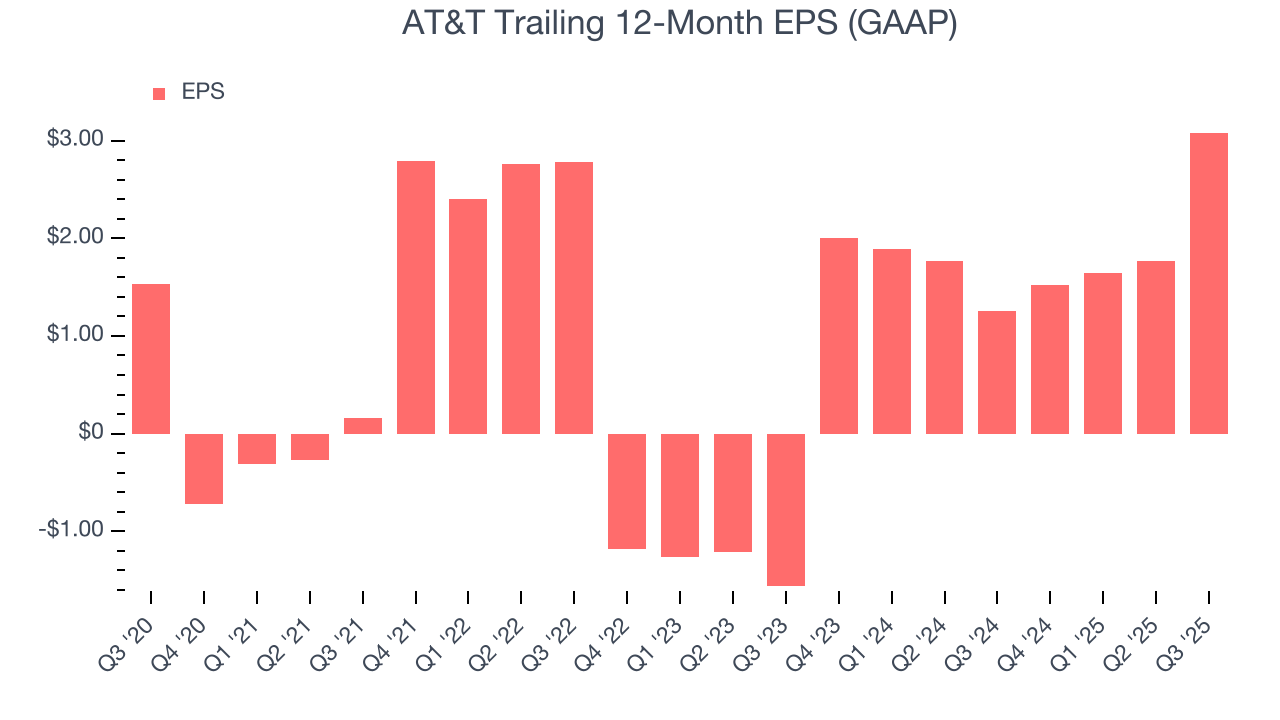

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AT&T’s EPS grew at a solid 14.9% compounded annual growth rate over the last five years, higher than its 5.6% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

In Q3, AT&T reported EPS of $1.29, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AT&T’s full-year EPS of $3.08 to shrink by 31%.

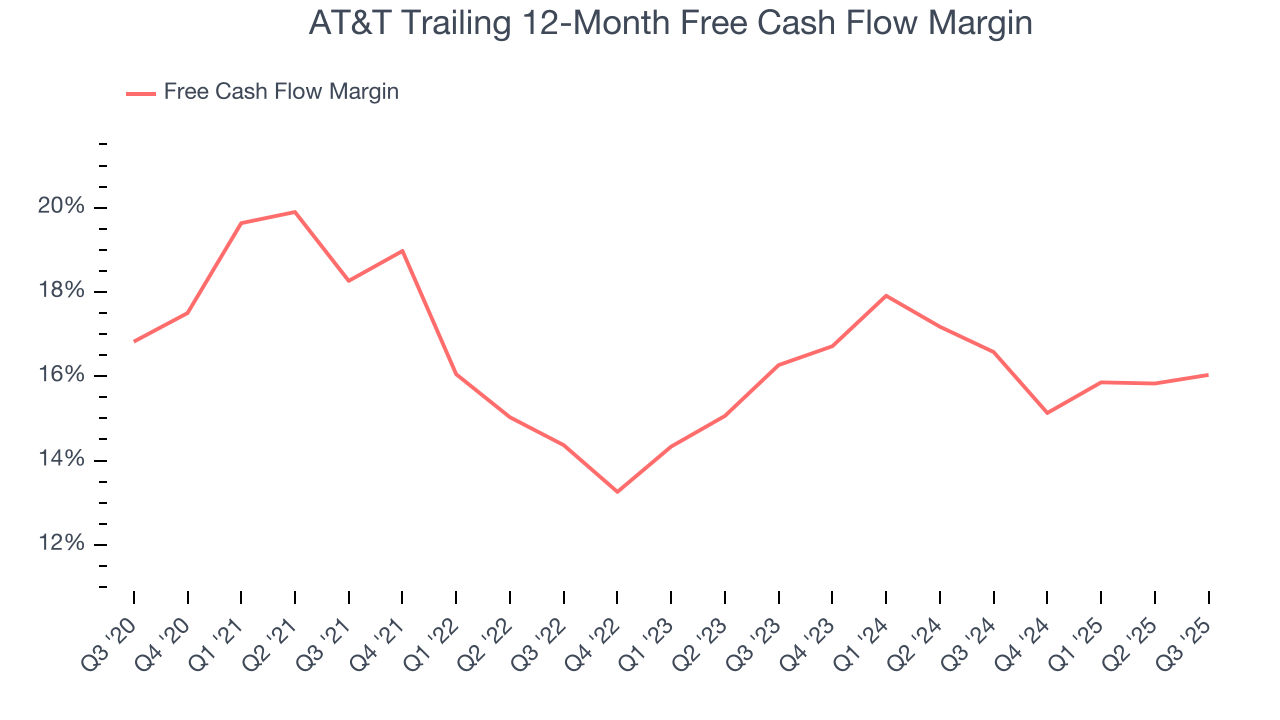

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AT&T has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.3% over the last two years, quite impressive for a consumer discretionary business.

AT&T’s free cash flow clocked in at $5.27 billion in Q3, equivalent to a 17.1% margin. This cash profitability was in line with the comparable period last year and its two-year average.

Over the next year, analysts predict AT&T’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 16% for the last 12 months will decrease to 14.1%.

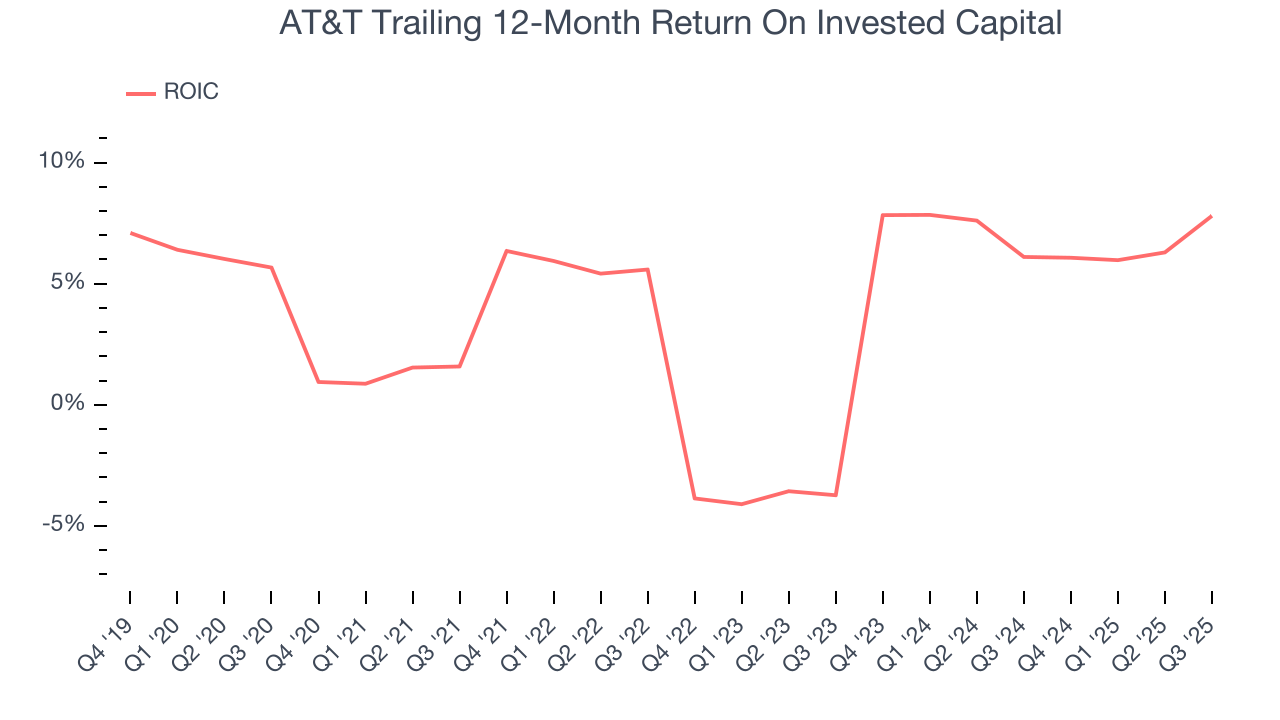

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AT&T historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.5%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, AT&T’s ROIC averaged 3.4 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

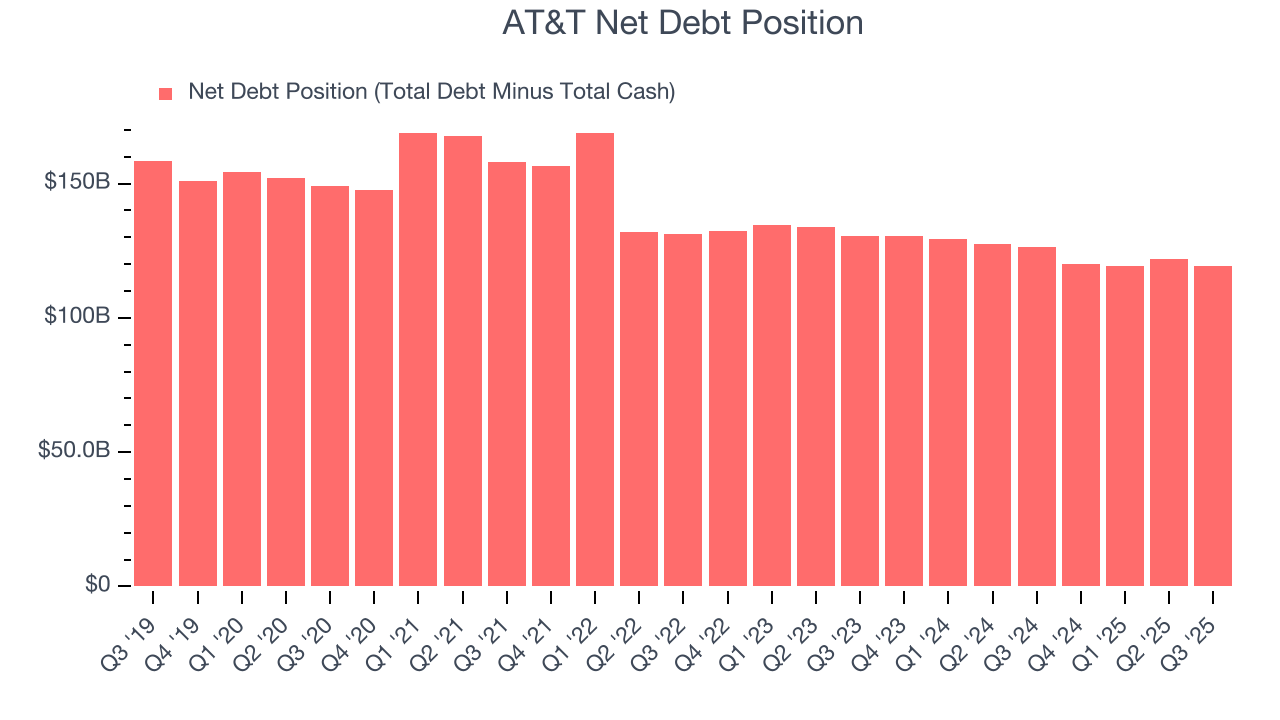

10. Balance Sheet Assessment

AT&T reported $20.27 billion of cash and $139.5 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $45.92 billion of EBITDA over the last 12 months, we view AT&T’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $6.67 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AT&T’s Q3 Results

It was good to see AT&T beat analysts’ wireless sub net adds and EPS expectations this quarter. On the other hand, its revenue was just in line with Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock remained flat at $26.27 immediately after reporting.

12. Is Now The Time To Buy AT&T?

Updated: January 24, 2026 at 11:00 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AT&T.

AT&T falls short of our quality standards. To begin with, its revenue has declined over the last five years. On top of that, AT&T’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

AT&T’s P/E ratio based on the next 12 months is 10.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $29.48 on the company (compared to the current share price of $23.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.