Teladoc (TDOC)

We’re skeptical of Teladoc. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Teladoc Is Not Exciting

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

- Focus on expanding its platform came at the expense of monetization as its average revenue per user fell by 7.9% annually

- Muted 2.9% annual revenue growth over the last three years shows its demand lagged behind its consumer internet peers

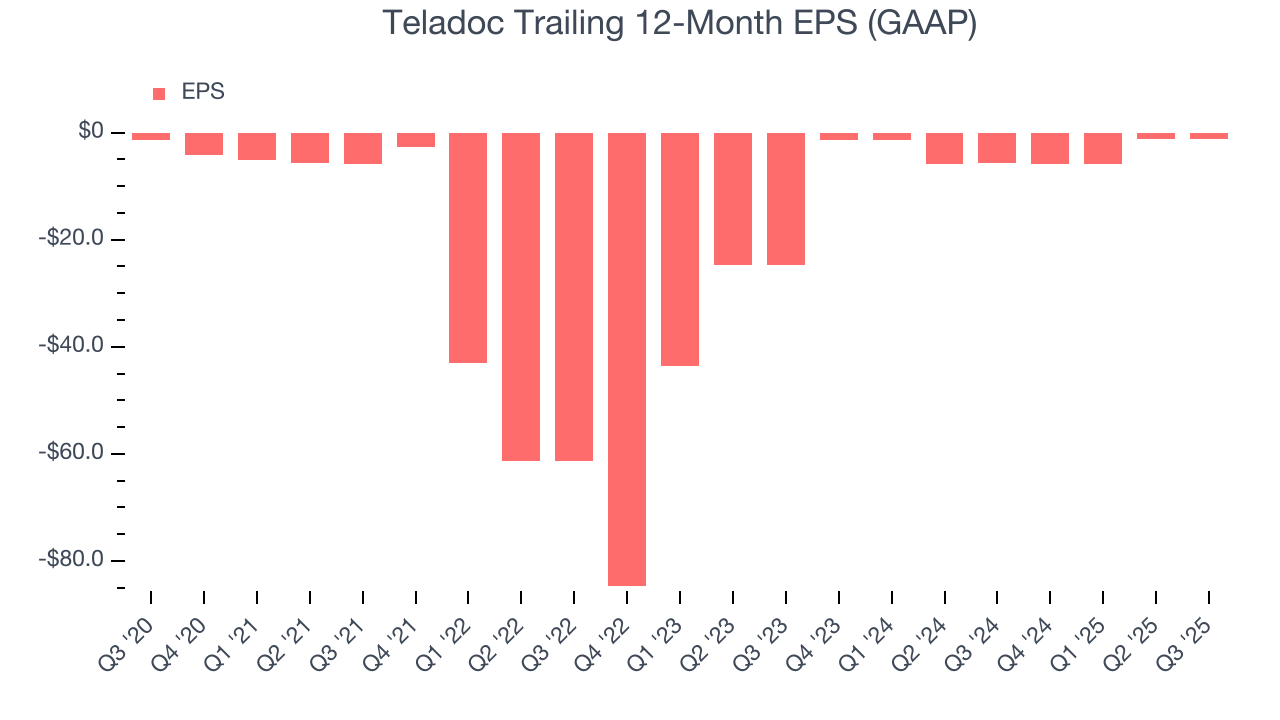

- A silver lining is that its earnings growth has beaten its peers over the last three years as its EPS has compounded at 72.5% annually

Teladoc is in the doghouse. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Teladoc

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Teladoc

Teladoc is trading at $4.66 per share, or 3.6x forward EV/EBITDA. This is a cheap valuation multiple, but for good reason. You get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Teladoc (TDOC) Research Report: Q3 CY2025 Update

Digital medical services platform Teladoc Health (NYSE:TDOC) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 2.2% year on year to $626.4 million. The company expects next quarter’s revenue to be around $637 million, close to analysts’ estimates. Its GAAP loss of $0.28 per share was 9.2% below analysts’ consensus estimates.

Teladoc (TDOC) Q3 CY2025 Highlights:

- Revenue: $626.4 million vs analyst estimates of $625.8 million (2.2% year-on-year decline, in line)

- EPS (GAAP): -$0.28 vs analyst expectations of -$0.26 (9.2% miss)

- Adjusted EBITDA: $66.07 million vs analyst estimates of $64.95 million (10.5% margin, 1.7% beat)

- Revenue Guidance for Q4 CY2025 is $637 million at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for the full year is -$1.18 at the midpoint, missing analyst estimates by 14.3%

- EBITDA guidance for the full year is $278.5 million at the midpoint, above analyst estimates of $274.2 million

- Operating Margin: -8.3%, down from -6.9% in the same quarter last year

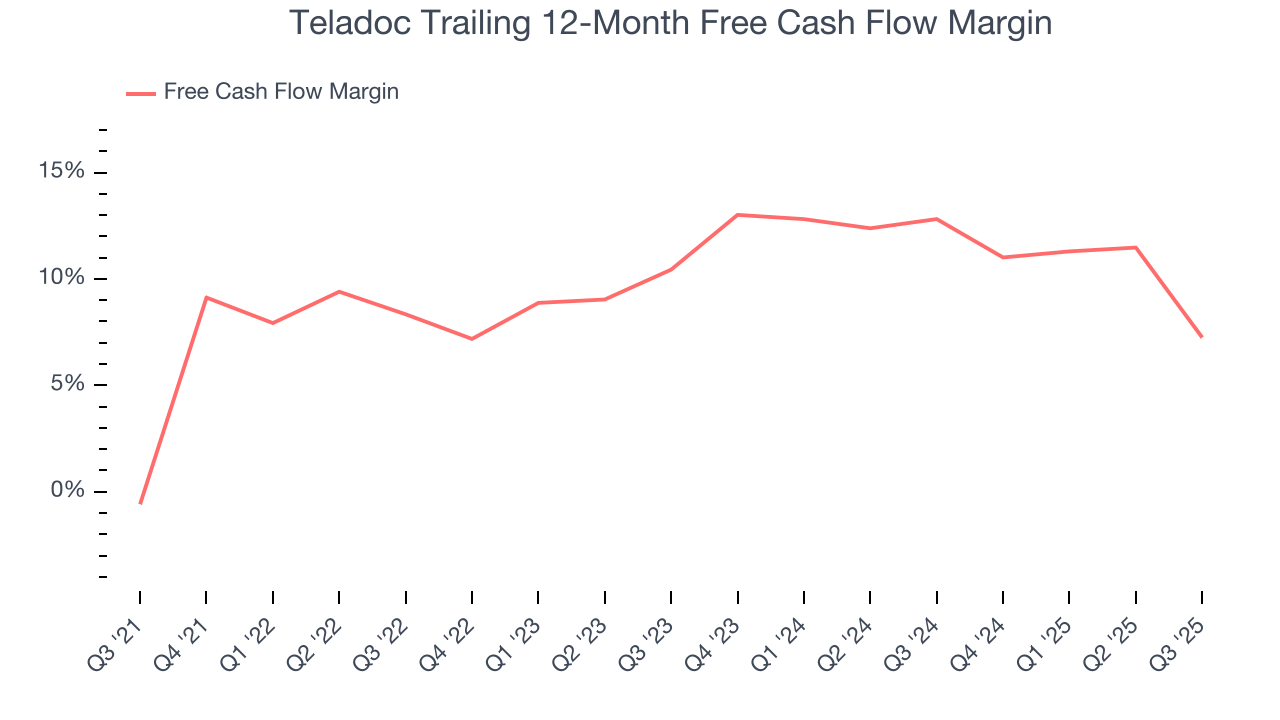

- Free Cash Flow Margin: 0%, down from 14.3% in the previous quarter

- Market Capitalization: $1.48 billion

Company Overview

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

The company's key product is their virtual care platform, which allows patients to connect with licensed healthcare providers through a secure online portal or mobile app. Patients can get virtual consultations for a range of medical issues such as mental health, dermatology, and respiratory health.

The customer problem that Teladoc's product solves is access to proper healthcare. Many people, especially those in rural areas, have limited access to doctors or specialists. These individuals may be elderly or in poor health, making it difficult to travel long distances for medical care. Teladoc's platform enables medical consultations from home. Over time, though, a broader population has adopted the platform due to convenience and time saved.

Teladoc generates revenue by charging a fee for each virtual consultation, which varies depending on the type of service provided. A virtual consultation with a primary care physician may cost $75, while a therapy session may cost $150. The healthcare providers who partner with Teladoc are paid by the company for each virtual consultation, and fees also vary by service and specialty. Teladoc also generates revenue by partnering with insurance companies and employers to provide telemedicine services to their members or employees.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering online legal or document services include Doximity (NYSE:DOCS) and private companies Sesame Health and MDLive.

5. Revenue Growth

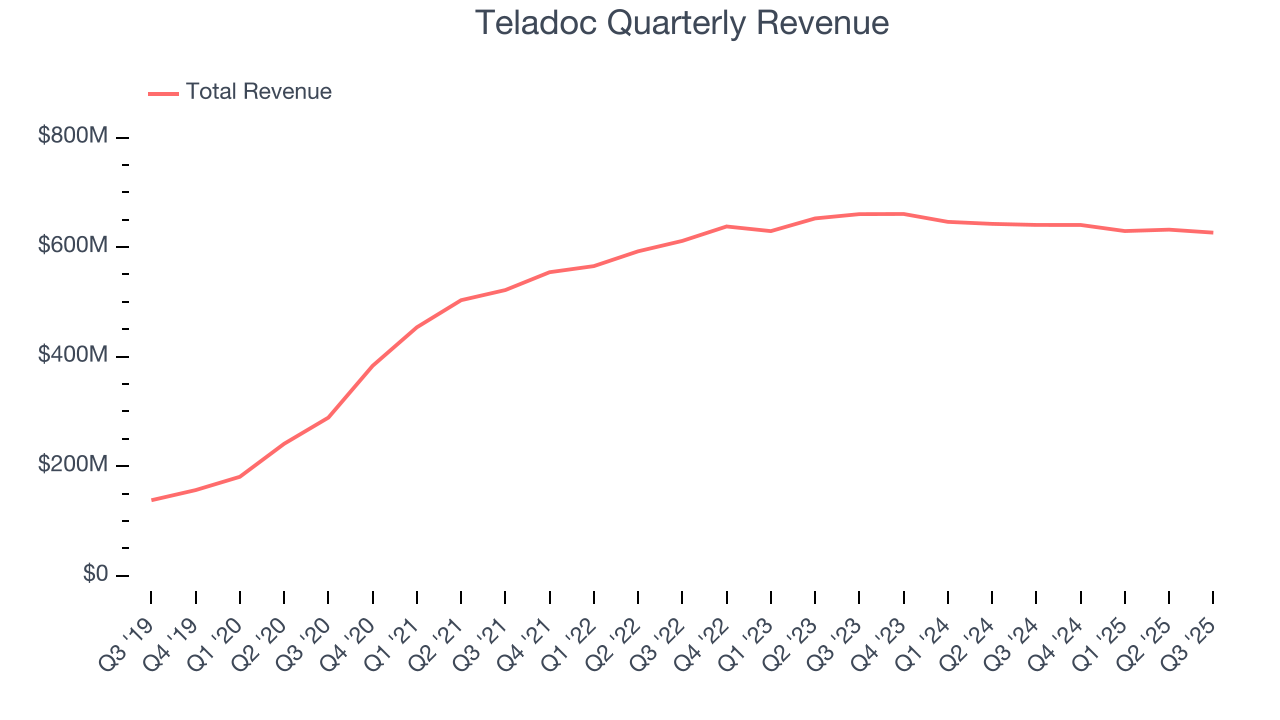

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Teladoc’s 2.9% annualized revenue growth over the last three years was sluggish. This fell short of our benchmarks and is a rough starting point for our analysis.

This quarter, Teladoc reported a rather uninspiring 2.2% year-on-year revenue decline to $626.4 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

For online marketplaces like Teladoc, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

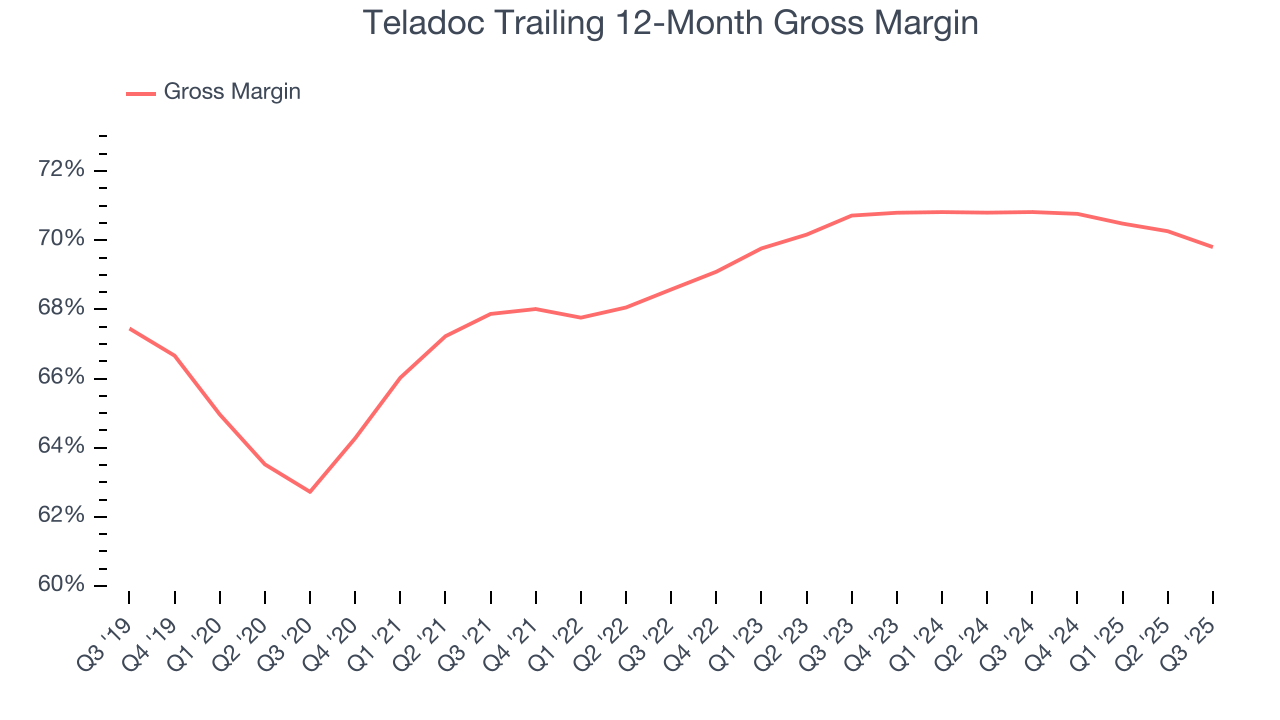

Teladoc has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 70.3% gross margin over the last two years. That means Teladoc only paid its providers $29.69 for every $100 in revenue.

This quarter, Teladoc’s gross profit margin was 70.1%, marking a 1.8 percentage point decrease from 71.9% in the same quarter last year. Teladoc’s full-year margin has also been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

7. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Teladoc grow from a combination of product virality, paid advertisement, and incentives.

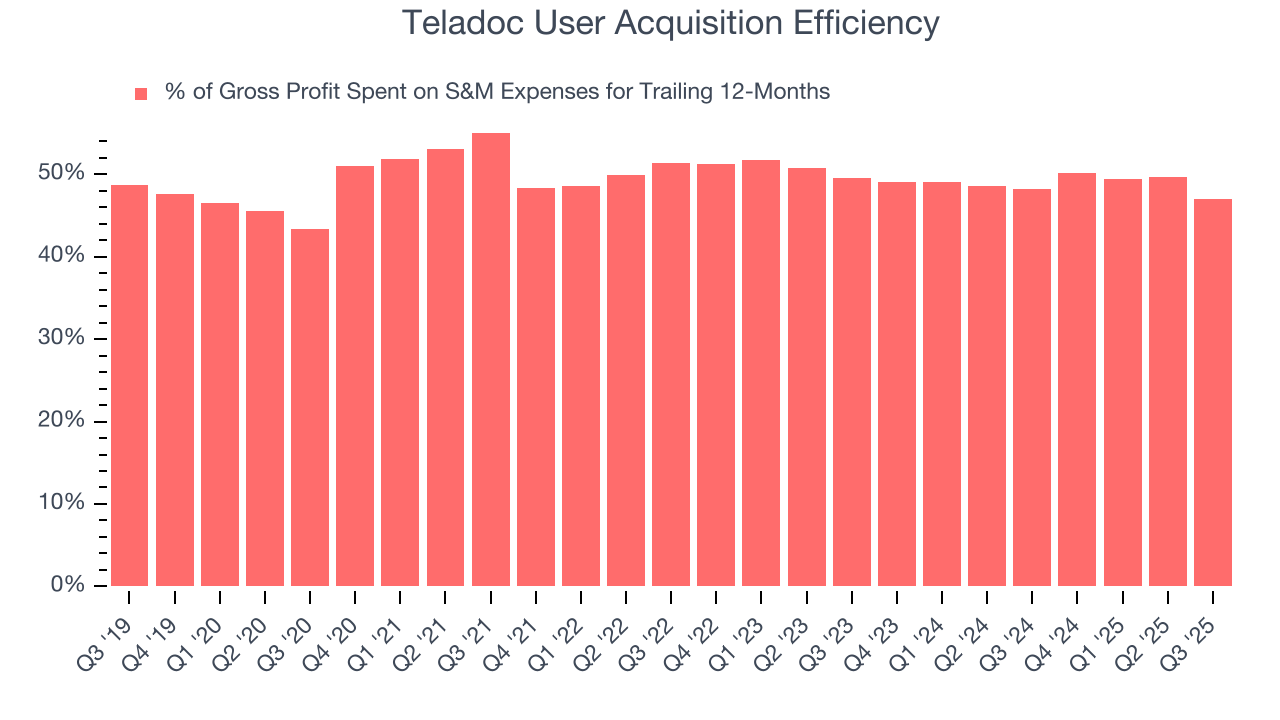

It’s relatively expensive for Teladoc to acquire new users as the company has spent 47% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Teladoc operates in a competitive market and must continue investing to maintain an acceptable growth trajectory.

8. EBITDA

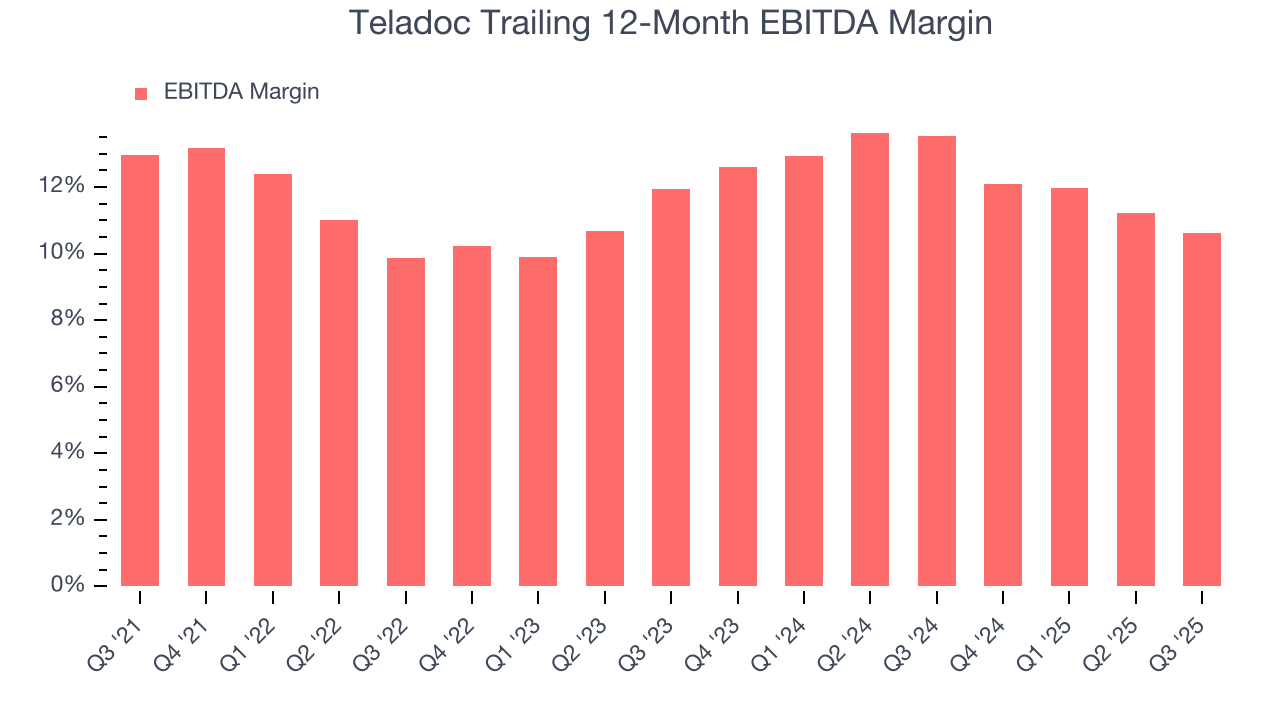

Teladoc’s EBITDA margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 12.1% over the last two years. This profitability was top-notch for a consumer internet business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Teladoc’s EBITDA margin might fluctuated slightly but has generally stayed the same over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Teladoc generated an EBITDA margin profit margin of 10.5%, down 2.5 percentage points year on year. Since Teladoc’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Teladoc reported EPS of negative $0.28, down from negative $0.19 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Teladoc to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.28 will advance to negative $0.75.

10. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Teladoc has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.1% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that Teladoc’s margin dropped by 1.1 percentage points over the last few years. If its declines continue, it could signal increasing investment needs and capital intensity.

Teladoc broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 16.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

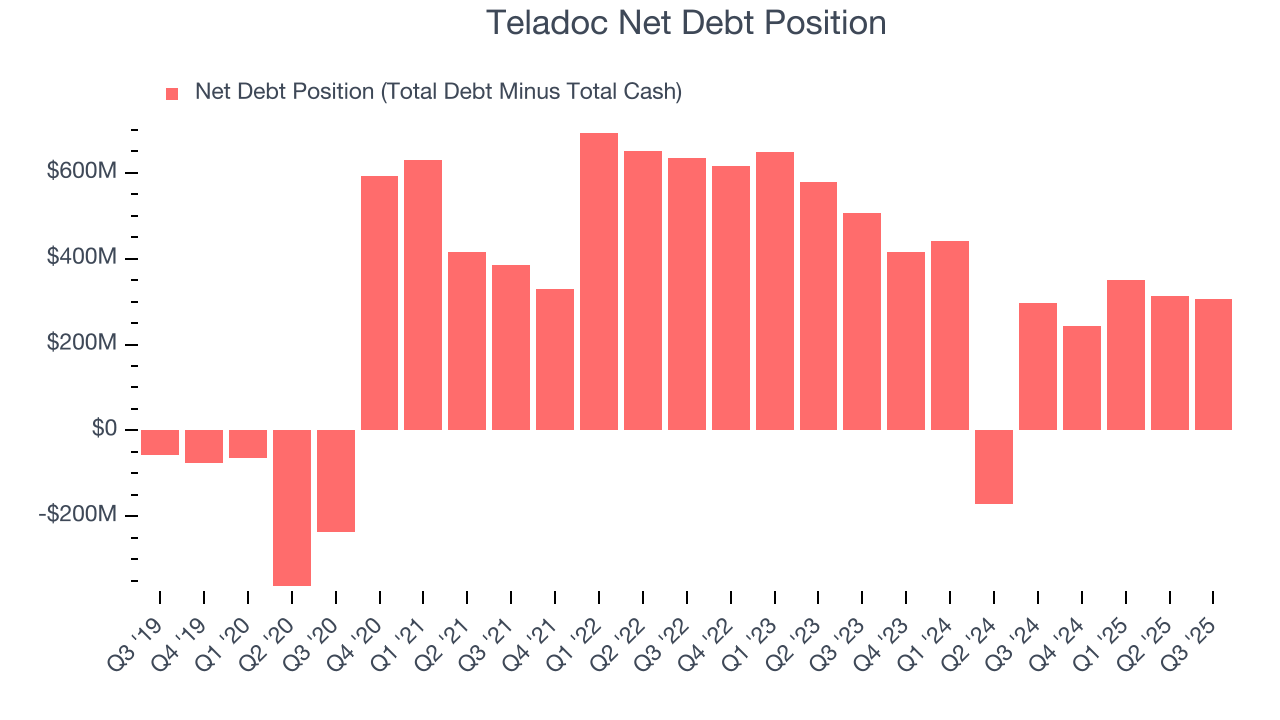

11. Balance Sheet Assessment

Teladoc reported $726.2 million of cash and $1.03 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $268.3 million of EBITDA over the last 12 months, we view Teladoc’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $22.44 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Teladoc’s Q3 Results

It was great to see Teladoc’s full-year EBITDA guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS and full-year EPS guidance missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.5% to $8.10 immediately after reporting.

13. Is Now The Time To Buy Teladoc?

Updated: February 14, 2026 at 9:39 PM EST

Before investing in or passing on Teladoc, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Teladoc’s business quality ultimately falls short of our standards. First off, its revenue growth was weak over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its EPS growth over the last three years has been fantastic, the downside is its ARPU has declined over the last two years. On top of that, its sales and marketing efficiency is subpar.

Teladoc’s EV/EBITDA ratio based on the next 12 months is 3.6x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $8.93 on the company (compared to the current share price of $4.66).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.