TEGNA (TGNA)

We wouldn’t buy TEGNA. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think TEGNA Will Underperform

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

- 1.3% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 7.9% annually

- Projected sales for the next 12 months are flat and suggest demand will be subdued

TEGNA fails to meet our quality criteria. Better stocks can be found in the market.

Why There Are Better Opportunities Than TEGNA

High Quality

Investable

Underperform

Why There Are Better Opportunities Than TEGNA

TEGNA is trading at $20.91 per share, or 9x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. TEGNA (TGNA) Research Report: Q3 CY2025 Update

Broadcasting and digital media company TEGNA (NYSE:TGNA) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.3% year on year to $650.8 million. Its non-GAAP profit of $0.33 per share was 3.5% above analysts’ consensus estimates.

TEGNA (TGNA) Q3 CY2025 Highlights:

- Revenue: $650.8 million vs analyst estimates of $658.8 million (19.3% year-on-year decline, 1.2% miss)

- Adjusted EPS: $0.33 vs analyst estimates of $0.32 (3.5% beat)

- Adjusted EBITDA: $130.7 million vs analyst estimates of $127.9 million (20.1% margin, 2.1% beat)

- Operating Margin: 14.2%, down from 28.5% in the same quarter last year

- Free Cash Flow Margin: 7.4%, down from 24.1% in the same quarter last year

- Market Capitalization: $3.21 billion

Company Overview

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

TEGNA's separation from Gannett allowed the company to intensify its focus on developing television and digital services tailored to local markets, addressing the growing demand for community-oriented media content.

The company offers local news broadcasting, digital media services, and marketing solutions. Its diverse content across various platforms caters to niche communities often overlooked by national media networks.

Revenue for TEGNA is primarily generated from advertising, digital marketing services, and content licensing. Its network of local TV stations and digital platforms provides targeted advertising and marketing opportunities for all kinds of advertisers.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the local television broadcasting and digital media sector include Nexstar Media (NASDAQ:NXST), Sinclair (NASDAQ:SBGI), and Gray Television (NYSE:GTN).

5. Revenue Growth

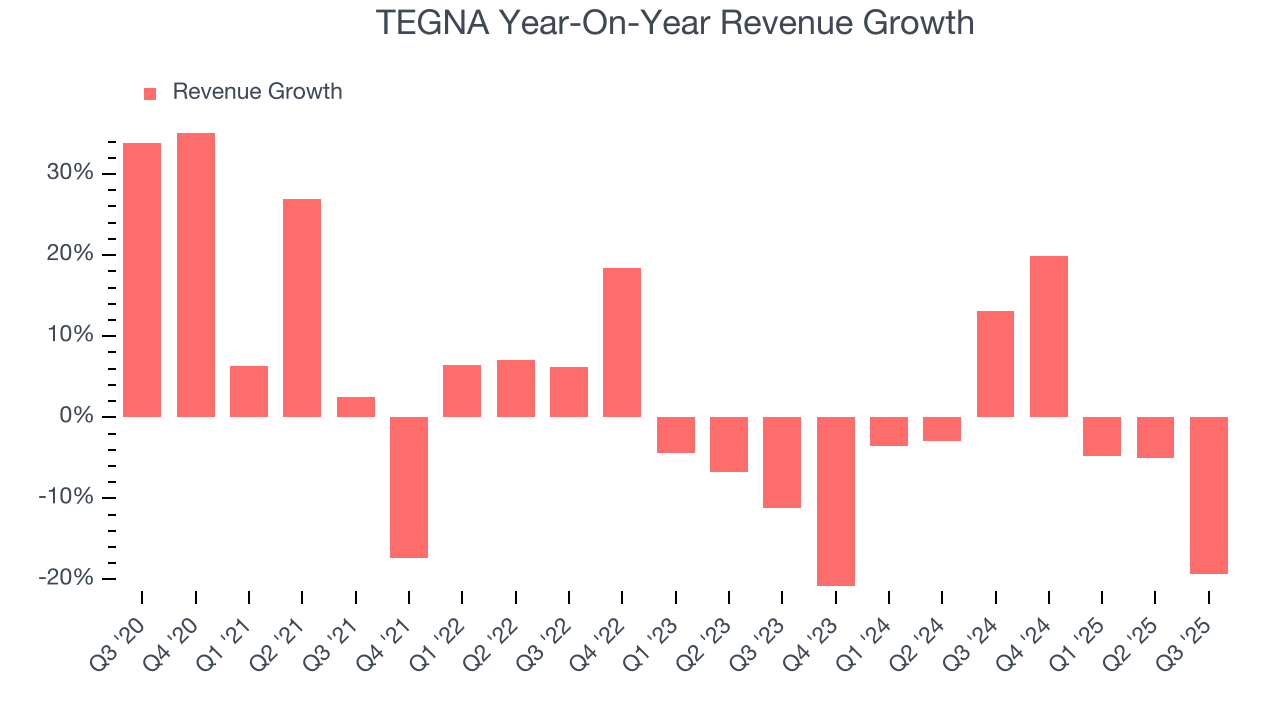

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, TEGNA’s 1.3% annualized revenue growth over the last five years was weak. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. TEGNA’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.7% annually.

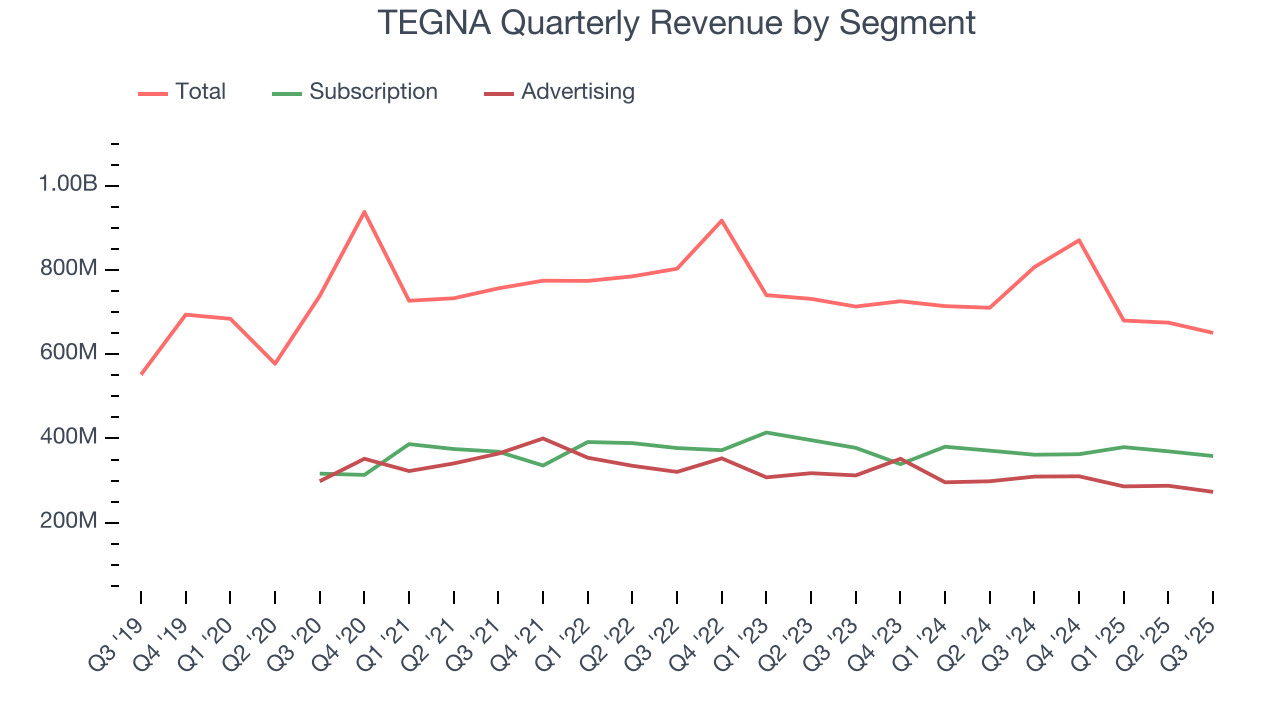

TEGNA also breaks out the revenue for its most important segments, Subscription and Advertising, which are 55.1% and 42% of revenue. Over the last two years, TEGNA’s Subscription revenue (access to content) averaged 2.8% year-on-year declines while its Advertising revenue (marketing services) averaged 5.2% declines.

This quarter, TEGNA missed Wall Street’s estimates and reported a rather uninspiring 19.3% year-on-year revenue decline, generating $650.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Operating Margin

TEGNA’s operating margin has shrunk over the last 12 months, but it still averaged 21.5% over the last two years, top-notch for a consumer discretionary business. This shows it’s an efficient company that manages its expenses effectively.

In Q3, TEGNA generated an operating margin profit margin of 14.2%, down 14.3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Earnings Per Share

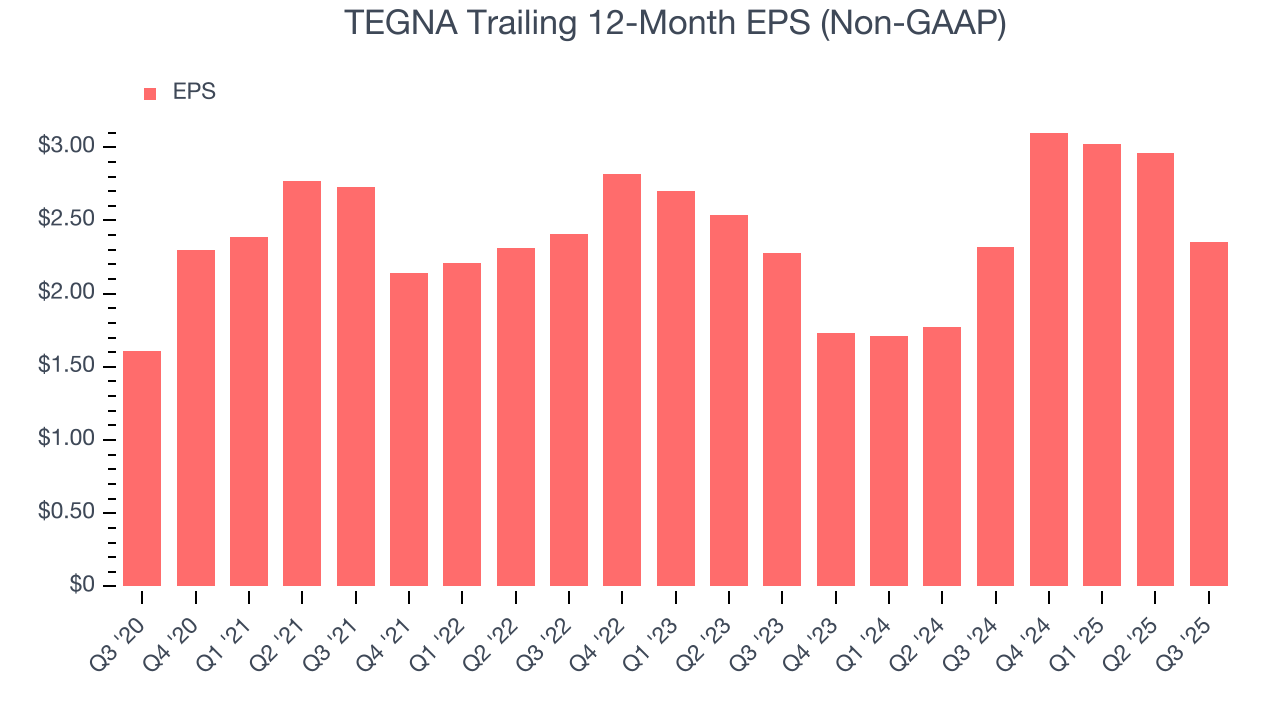

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

TEGNA’s EPS grew at an unimpressive 7.9% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q3, TEGNA reported adjusted EPS of $0.33, down from $0.94 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.5%. Over the next 12 months, Wall Street expects TEGNA’s full-year EPS of $2.35 to shrink by 3.5%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

TEGNA has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.8% over the last two years, quite impressive for a consumer discretionary business.

TEGNA’s free cash flow clocked in at $48.38 million in Q3, equivalent to a 7.4% margin. The company’s cash profitability regressed as it was 16.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict TEGNA’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 14.9% for the last 12 months will increase to 21.3%, giving it more flexibility for investments, share buybacks, and dividends.

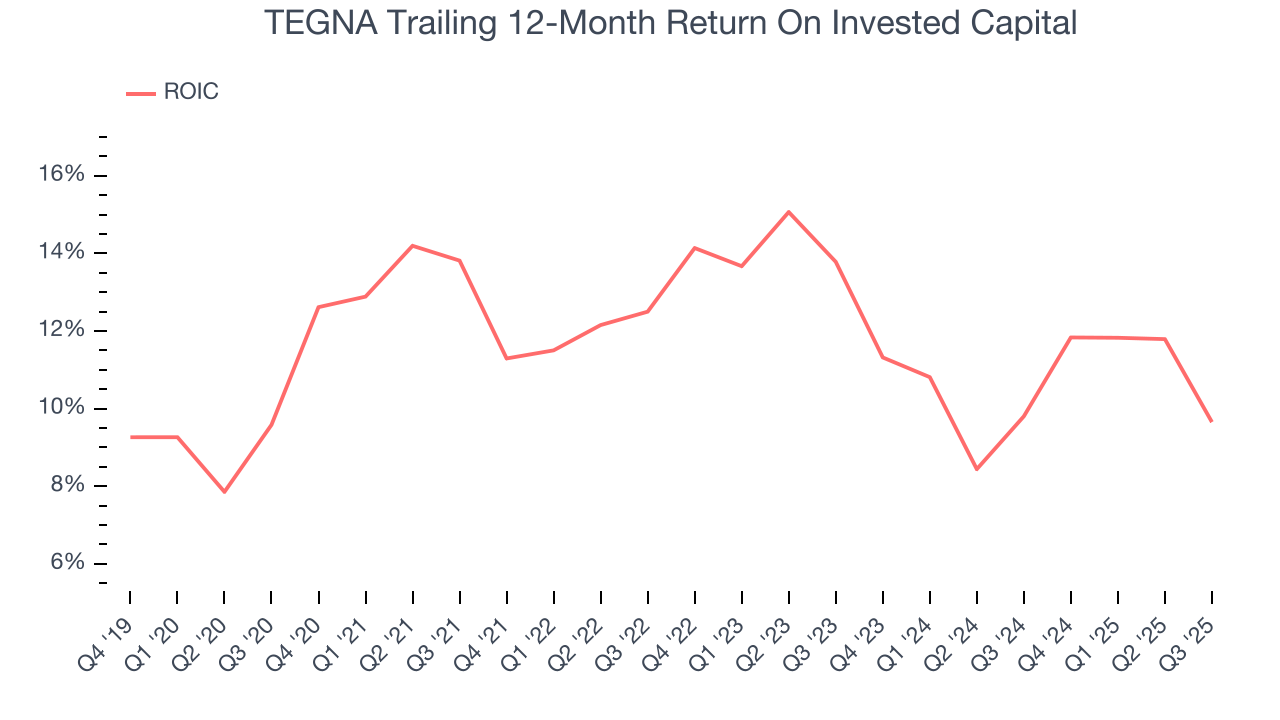

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

TEGNA historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, TEGNA’s ROIC averaged 3.4 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

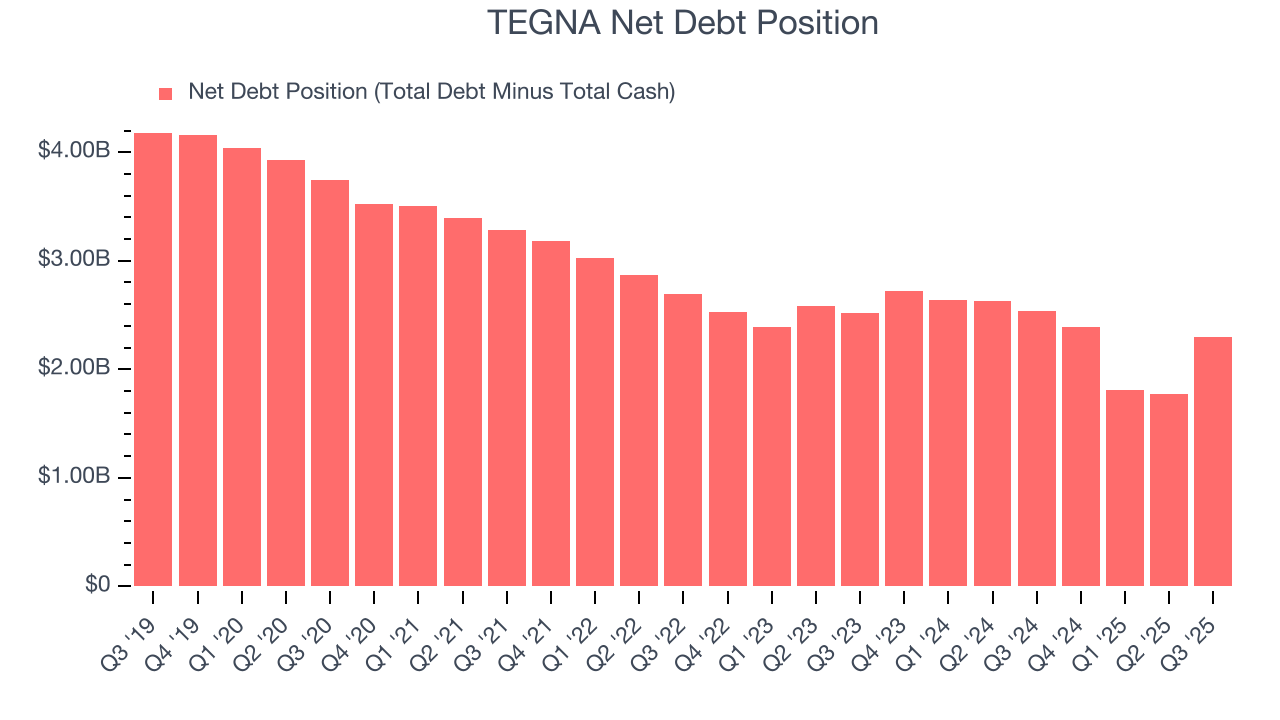

10. Balance Sheet Assessment

TEGNA reported $232.8 million of cash and $2.53 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $729.9 million of EBITDA over the last 12 months, we view TEGNA’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $68.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from TEGNA’s Q3 Results

It was good to see TEGNA beat analysts’ EPS expectations this quarter. On the other hand, its Advertising revenue missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $19.93 immediately after reporting.

12. Is Now The Time To Buy TEGNA?

Updated: February 19, 2026 at 9:57 PM EST

Before deciding whether to buy TEGNA or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies serving everyday consumers, but in the case of TEGNA, we’ll be cheering from the sidelines. On top of that, TEGNA’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, and its projected EPS for the next year is lacking.

TEGNA’s P/E ratio based on the next 12 months is 9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $21.67 on the company (compared to the current share price of $20.77).