Tutor Perini (TPC)

We aren’t fans of Tutor Perini. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why Tutor Perini Is Not Exciting

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- Gross margin of 6.7% is below its competitors, leaving less money to invest in areas like marketing and R&D

- A silver lining is that its notable projected revenue growth of 16.2% for the next 12 months hints at market share gains

Tutor Perini doesn’t meet our quality standards. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Tutor Perini

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tutor Perini

At $78.77 per share, Tutor Perini trades at 18.1x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Tutor Perini (TPC) Research Report: Q3 CY2025 Update

General contracting company Tutor Perini (NYSE:TPC) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 30.7% year on year to $1.42 billion. Its non-GAAP profit of $1.15 per share was 28.6% above analysts’ consensus estimates.

Tutor Perini (TPC) Q3 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.38 billion (30.7% year-on-year growth, 2.3% beat)

- Adjusted EPS: $1.15 vs analyst estimates of $0.89 (28.6% beat)

- Management raised its full-year Adjusted EPS guidance to $4.10 at the midpoint, a 7.9% increase

- Operating Margin: 2.8%, up from -9.8% in the same quarter last year

- Free Cash Flow Margin: 3.5%, up from 1.4% in the same quarter last year

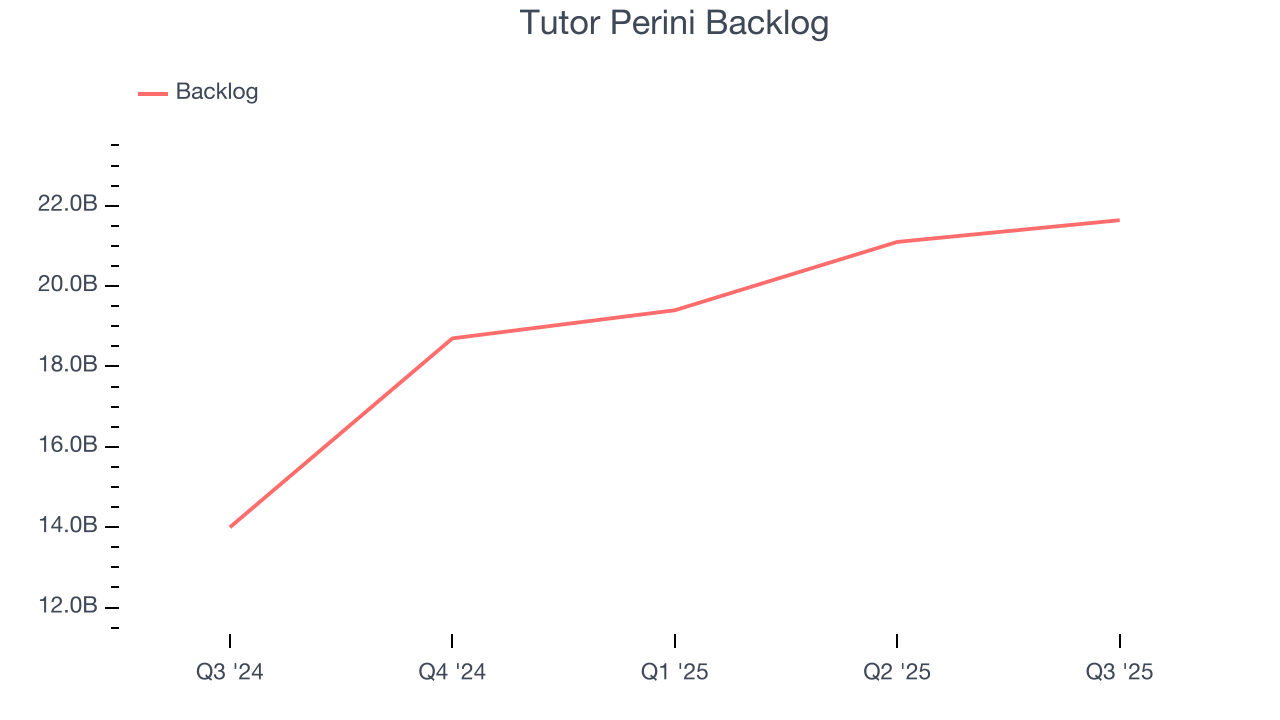

- Backlog: $21.64 billion at quarter end, up 54.6% year on year

- Market Capitalization: $3.47 billion

Company Overview

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Tutor Perini was founded in 1894 by Bonfiglio Perini under the name Perini Corporation, initially focusing on stonework and excavation. The company has since evolved into a general construction firm, handling large-scale civil, building, and specialty construction projects across various sectors, including healthcare, education, transportation, and defense.

Today, Tutor Perini offers a range of construction services, including complex civil engineering projects like highway and bridge construction, railway and transit systems, and airport infrastructures. It also handles large building contracts for high-rises, hospitals, universities, and casinos.

The company’s revenue comes primarily from contracts won through bidding and negotiated procurements, fostering long-term relationships with public and private sector clients. Revenue is primarily project-based, with some recurring aspects through maintenance and management contracts within the civil and specialty sectors. The company’s ability to secure large-scale projects regularly contributes to a large project pipeline, which supports sustained financial performance.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Competitors in the construction services industry include Fluor Corporation (NYSE:FLR), AECOM (NYSE:ACM), and Jacobs Engineering (NYSE:J)

5. Revenue Growth

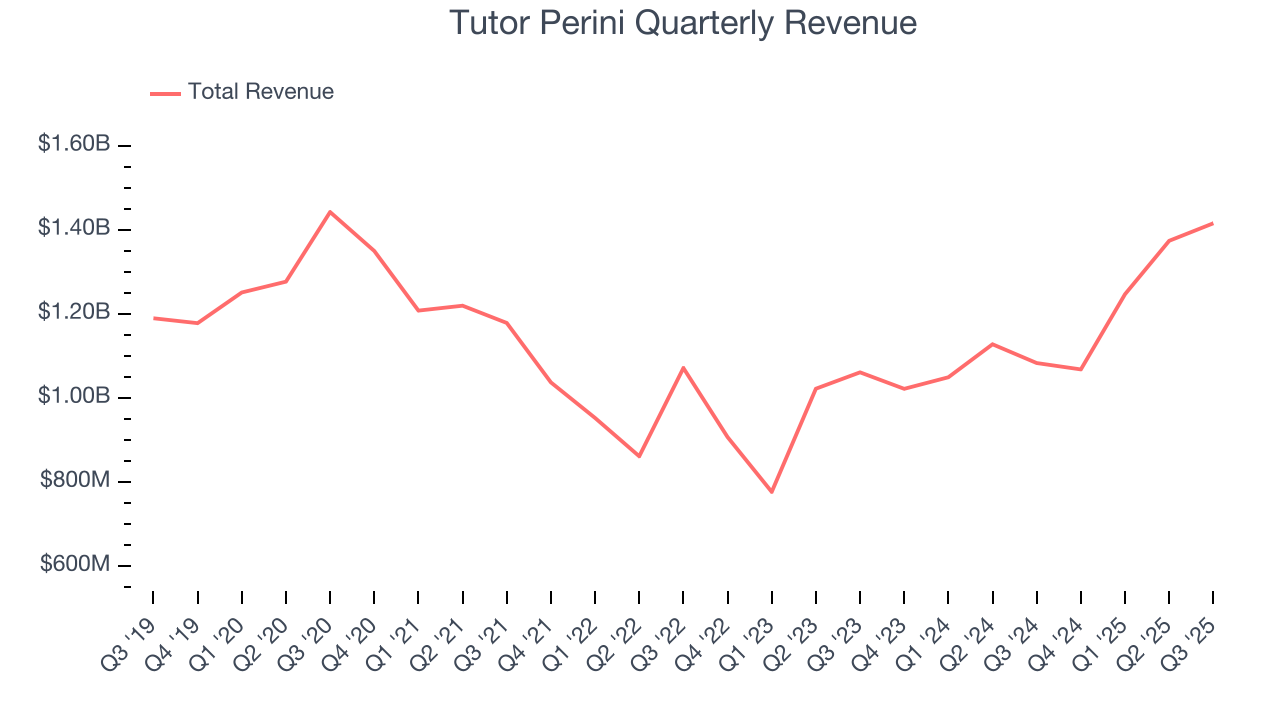

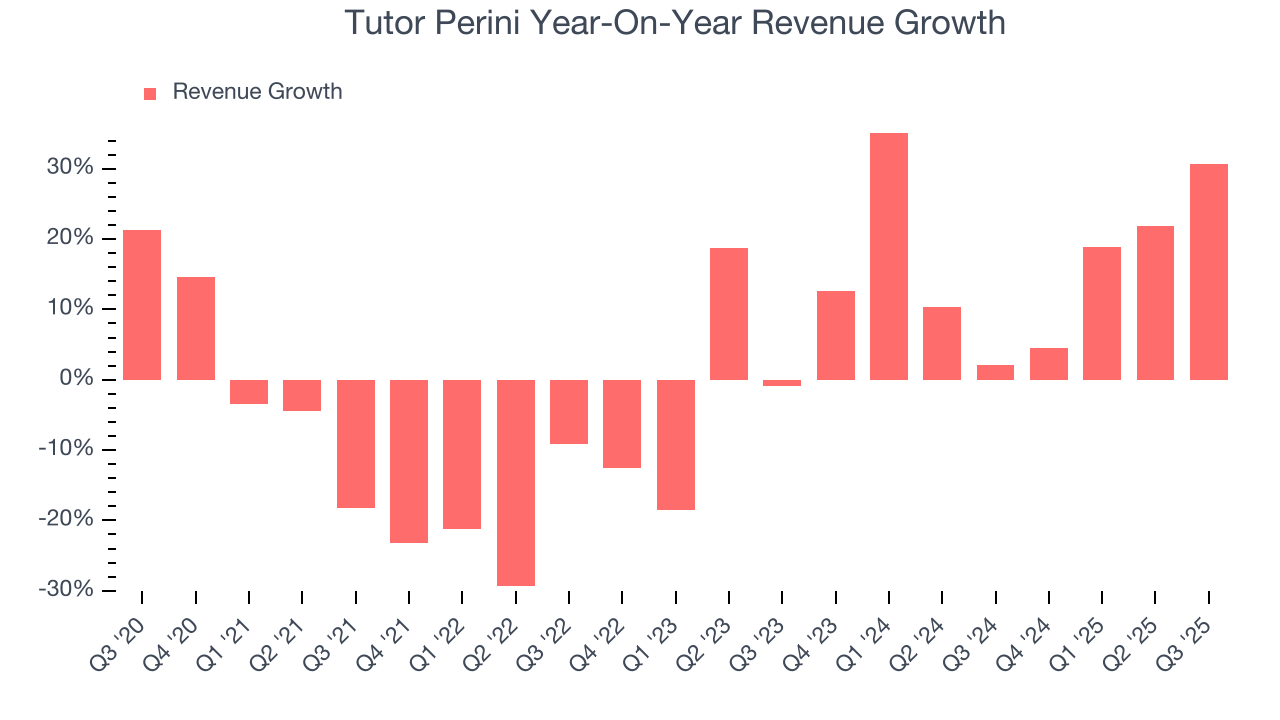

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Tutor Perini struggled to consistently increase demand as its $5.10 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Tutor Perini’s annualized revenue growth of 16.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Tutor Perini’s backlog reached $21.64 billion in the latest quarter and averaged 54.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Tutor Perini’s products and services but raises concerns about capacity constraints.

This quarter, Tutor Perini reported wonderful year-on-year revenue growth of 30.7%, and its $1.42 billion of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 15.1% over the next 12 months, similar to its two-year rate. Despite the slowdown, this projection is commendable and suggests the market sees success for its products and services.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

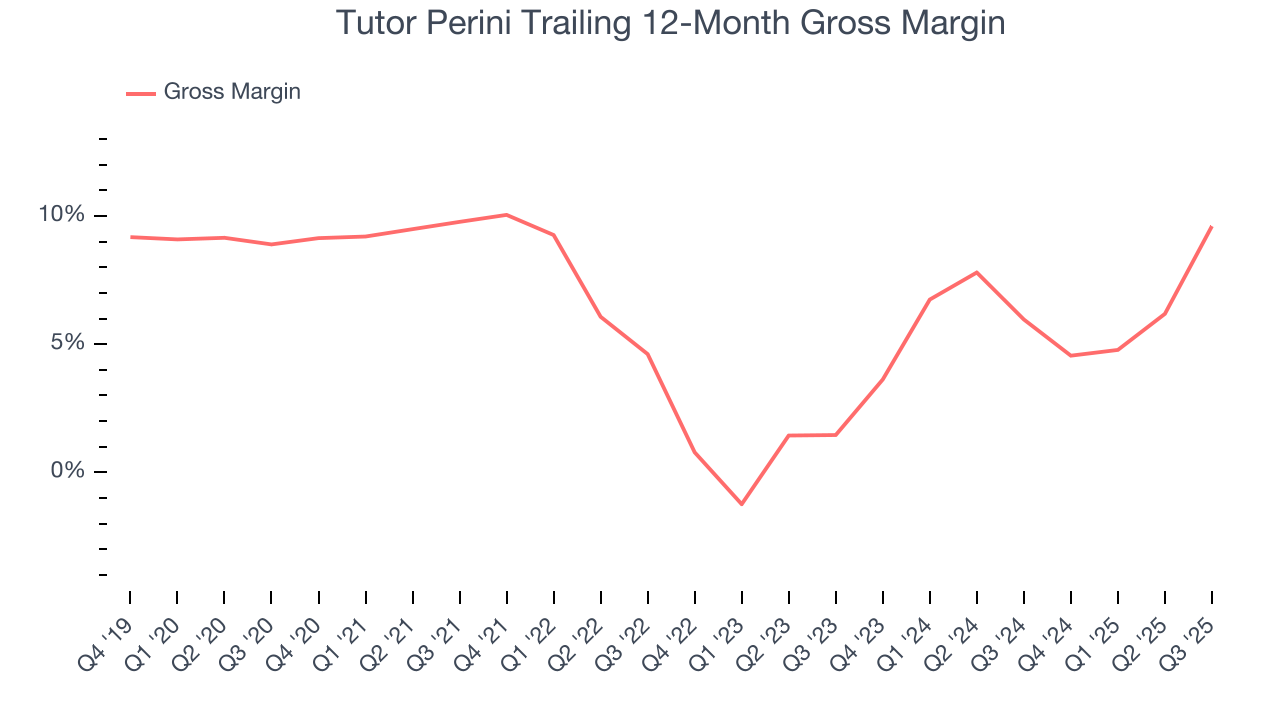

Tutor Perini has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 6.7% gross margin over the last five years. Said differently, Tutor Perini had to pay a chunky $93.34 to its suppliers for every $100 in revenue.

Tutor Perini’s gross profit margin came in at 12% this quarter, marking a 14.4 percentage point increase from -2.4% in the same quarter last year. Tutor Perini’s full-year margin has also been trending up over the past 12 months, increasing by 3.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

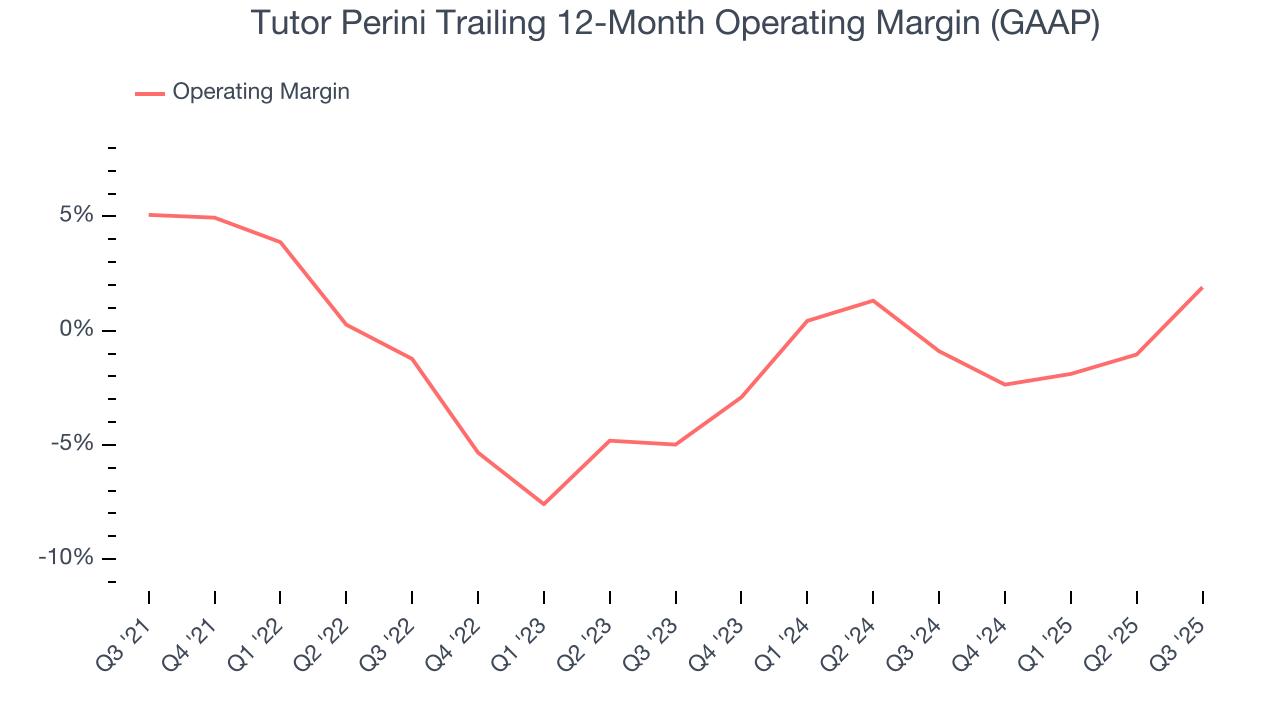

Tutor Perini was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Tutor Perini’s operating margin decreased by 3.2 percentage points over the last five years. Tutor Perini’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Tutor Perini generated an operating margin profit margin of 2.8%, up 12.7 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

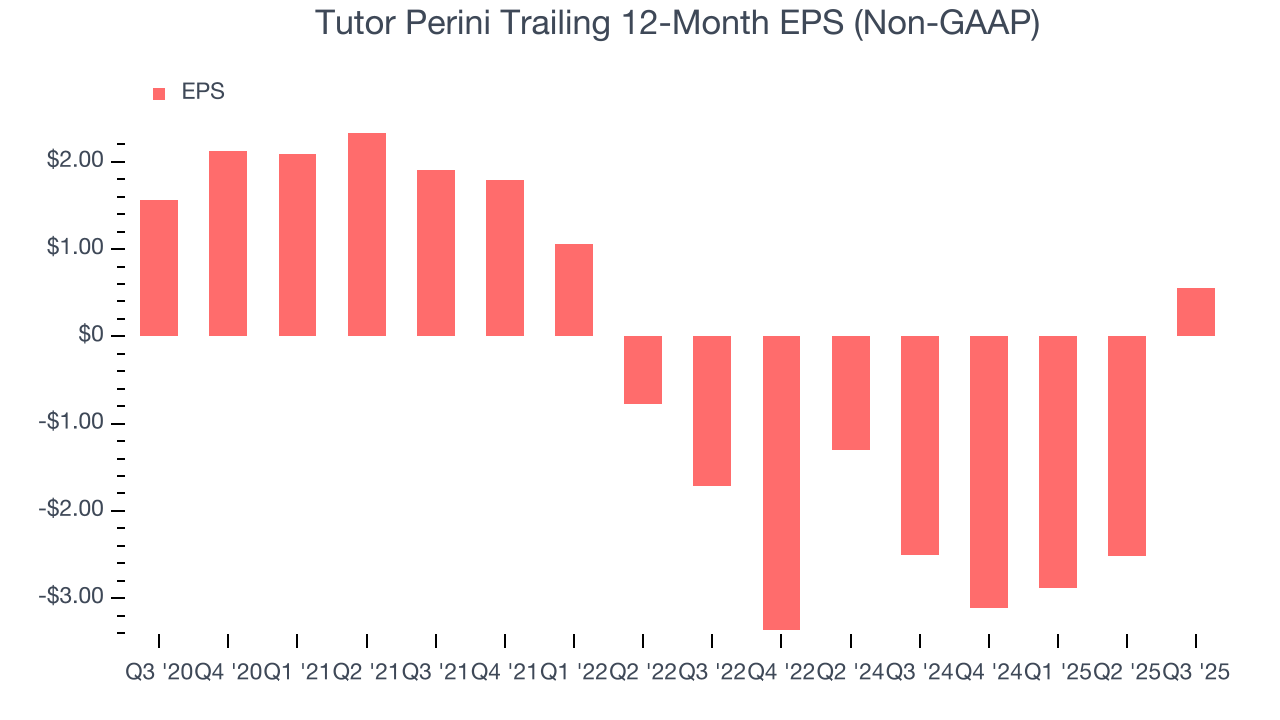

Sadly for Tutor Perini, its EPS declined by 18.8% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

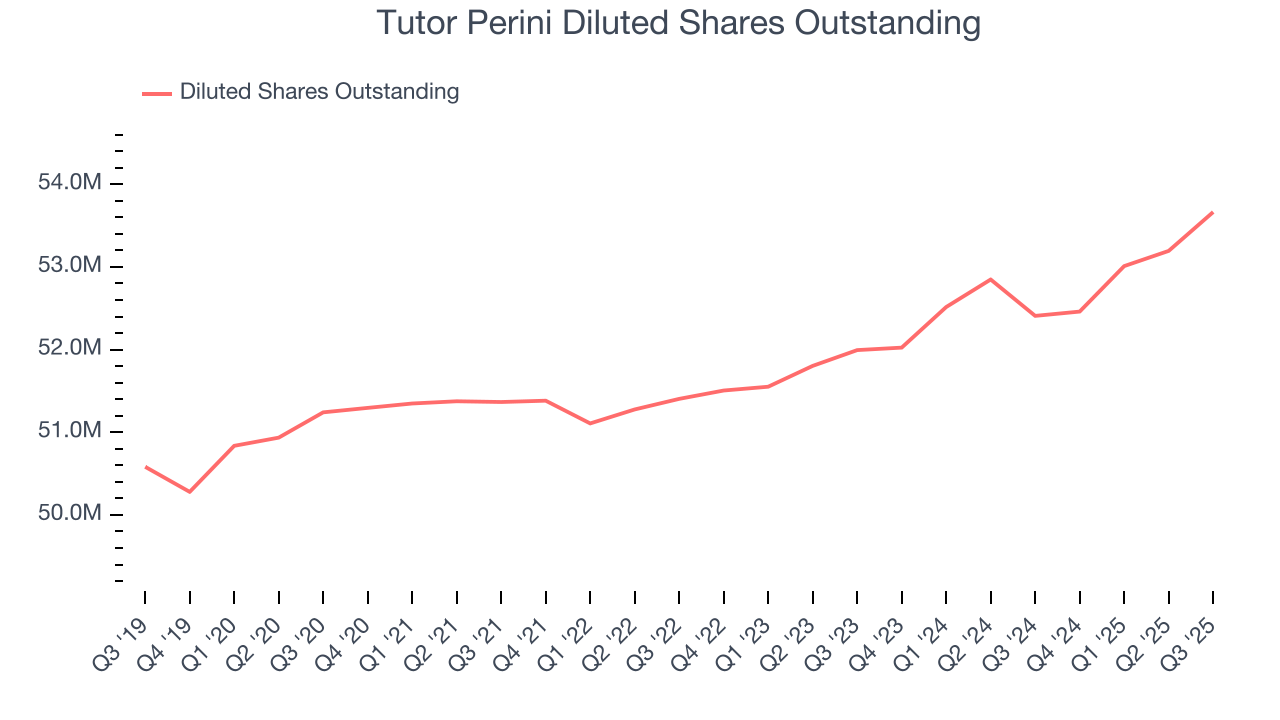

We can take a deeper look into Tutor Perini’s earnings to better understand the drivers of its performance. As we mentioned earlier, Tutor Perini’s operating margin expanded this quarter but declined by 3.2 percentage points over the last five years. Its share count also grew by 4.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Tutor Perini, its two-year annual EPS growth of 55.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Tutor Perini reported adjusted EPS of $1.15, up from negative $1.92 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Tutor Perini’s full-year EPS of $0.55 to grow 669%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

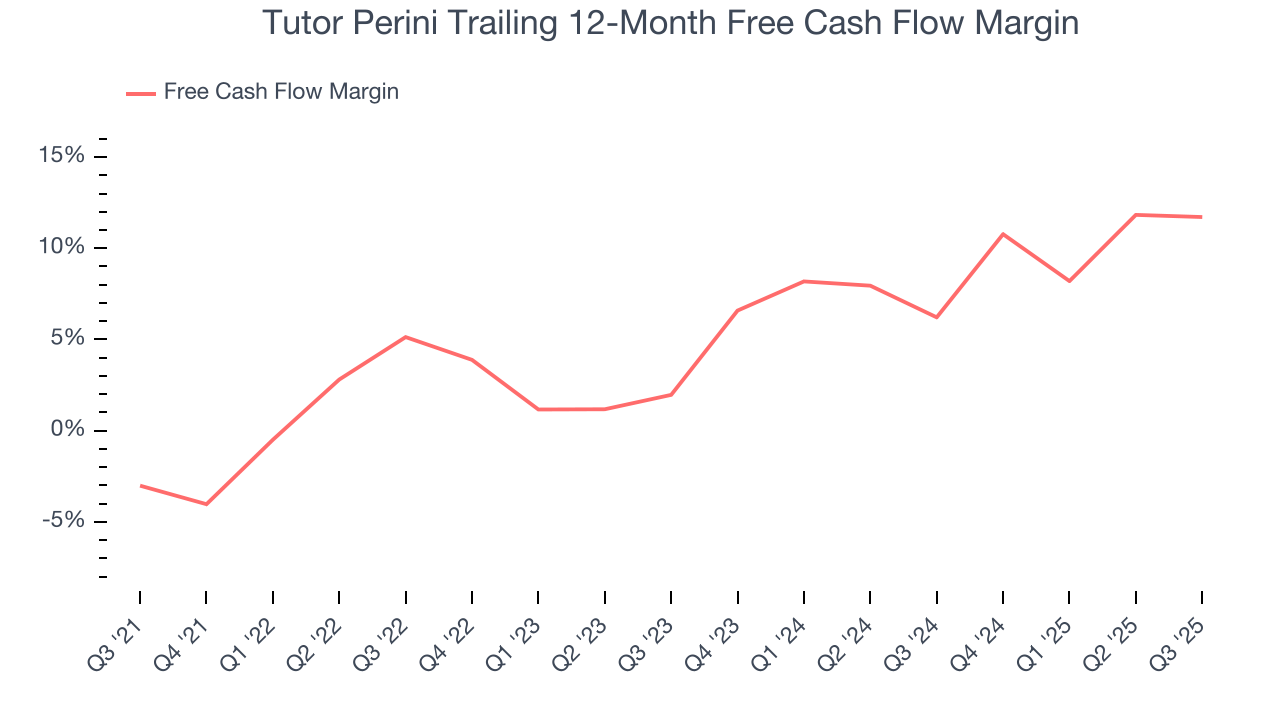

Tutor Perini has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.5%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Tutor Perini’s margin expanded by 14.7 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Tutor Perini’s free cash flow clocked in at $48.95 million in Q3, equivalent to a 3.5% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

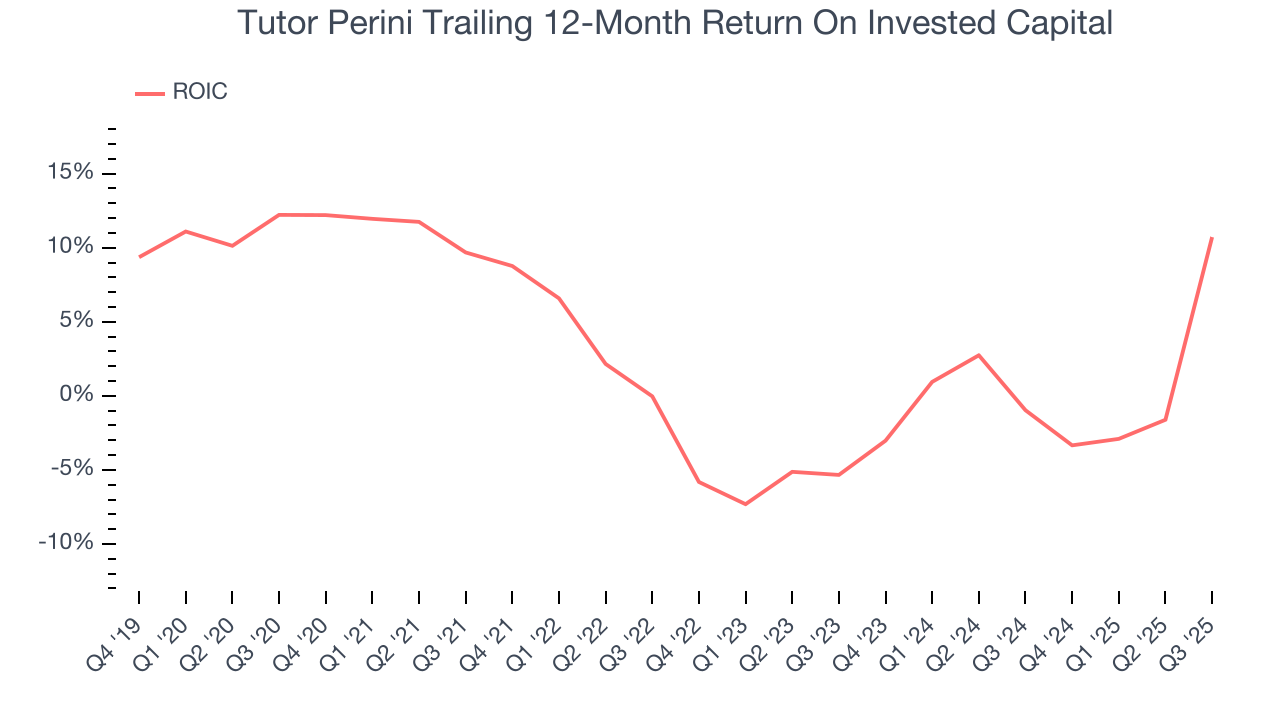

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Tutor Perini historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.8%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Tutor Perini’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

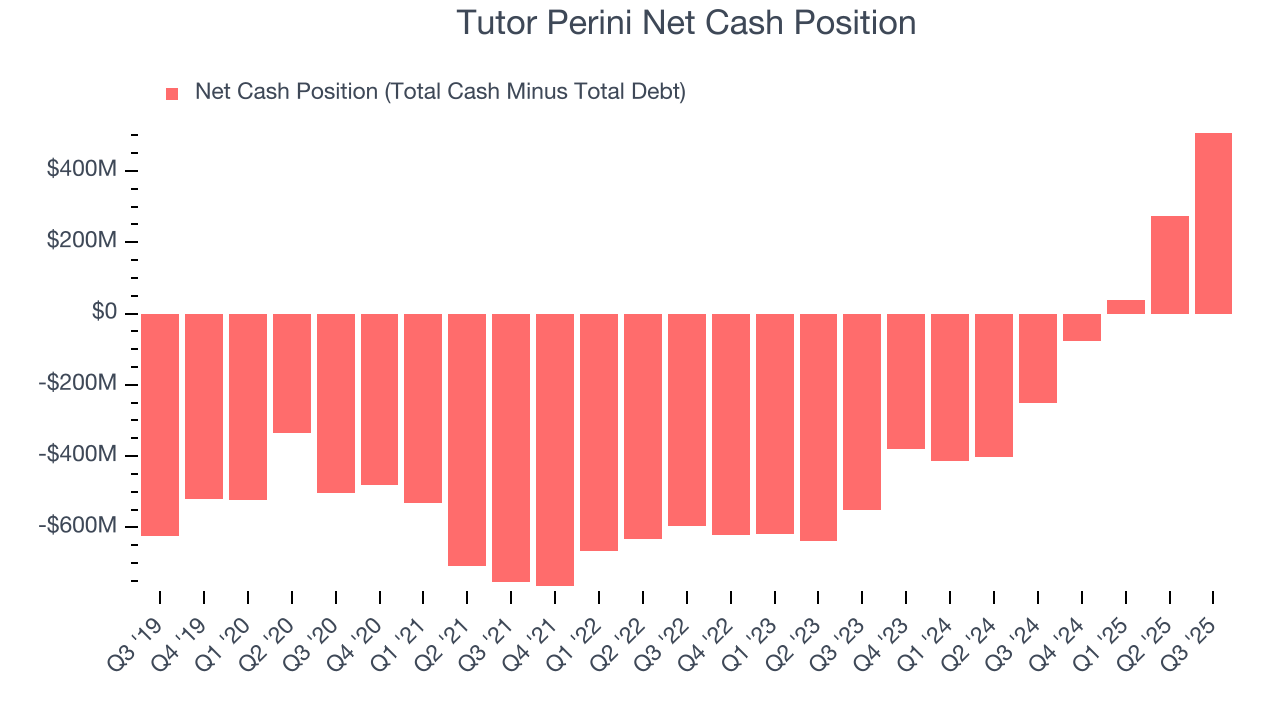

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Tutor Perini is a profitable, well-capitalized company with $931.5 million of cash and $424.1 million of debt on its balance sheet. This $507.4 million net cash position is 14.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Tutor Perini’s Q3 Results

It was good to see Tutor Perini beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.1% to $72 immediately after reporting.

13. Is Now The Time To Buy Tutor Perini?

Updated: January 30, 2026 at 10:44 PM EST

Before making an investment decision, investors should account for Tutor Perini’s business fundamentals and valuation in addition to what happened in the latest quarter.

Tutor Perini’s business quality ultimately falls short of our standards. To begin with, its revenue growth was weak over the last five years. And while its backlog growth has been marvelous, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Tutor Perini’s P/E ratio based on the next 12 months is 18.1x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $91.50 on the company (compared to the current share price of $78.77).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.