U-Haul (UHAL)

U-Haul is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think U-Haul Will Underperform

Founded by a husband and wife duo, U-Haul (NYSE:UHAL) is a provider of rental trucks and storage facilities.

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 17.1% annually while its revenue grew

- Cash-burning history and the downward spiral in its margin profile make us wonder if it has a viable business model

- Muted 1.9% annual revenue growth over the last two years shows its demand lagged behind its industrials peers

U-Haul doesn’t meet our quality standards. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than U-Haul

High Quality

Investable

Underperform

Why There Are Better Opportunities Than U-Haul

U-Haul is trading at $57.55 per share, or 1.9x trailing 12-month price-to-sales. The market typically values companies like U-Haul based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. U-Haul (UHAL) Research Report: Q3 CY2025 Update

Moving and storage solutions provider U-Haul (NYSE:UHAL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.7% year on year to $1.72 billion. Its GAAP profit of $0.49 per share was 24.6% below analysts’ consensus estimates.

U-Haul (UHAL) Q3 CY2025 Highlights:

- Revenue: $1.72 billion vs analyst estimates of $1.73 billion (3.7% year-on-year growth, in line)

- EPS (GAAP): $0.49 vs analyst expectations of $0.65 (24.6% miss)

- Operating Margin: 12.7%, down from 18.4% in the same quarter last year

- Market Capitalization: $9.65 billion

Company Overview

Founded by a husband and wife duo, U-Haul (NYSE:UHAL) is a provider of rental trucks and storage facilities.

U-Haul was founded in 1945 under the name AMERCO offering do-it-yourself moving equipment. It expanded by making acquisitions of primarily smaller businesses, many of which were in the moving and storage industry. This enabled the company to grow its fleet and offer storage facilities. Specifically, the $2.3 billion acquisition of StorageUSA in 2006 was notable for expanding its storage capacity.

U-Haul's services today include truck and trailer rentals of different sizes for both local and one-way moves. Its selection of trailers, such as cargo and utility trailers, are suitable for moving household items or equipment. Rentals can range anywhere from a couple of hours to several days. To facilitate the moving process, the company also provides essential moving supplies like boxes, packing materials, and protective covers which are available for purchase at its retail locations. U-Haul provides affordable options from cross-country move to local relocation.

Beyond equipment rentals, U-Haul offers self-storage units in various sizes. Many facilities are equipped with climate-controlled units to safeguard sensitive belongings. For its storage units, the company engages in contracts with both individual customers and businesses that offer rental agreements that are typically month-to-month. The company also offers customers the option to have containers delivered to a customer's location, filled at their leisure, and then transported to a storage facility or a new destination for storage.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors in the moving solutions industry include Penske Truck Leasing (NYSE:PAG) Ryder System (NYSE:R), and Avis Budget Group (NASDAQ:CAR).

5. Revenue Growth

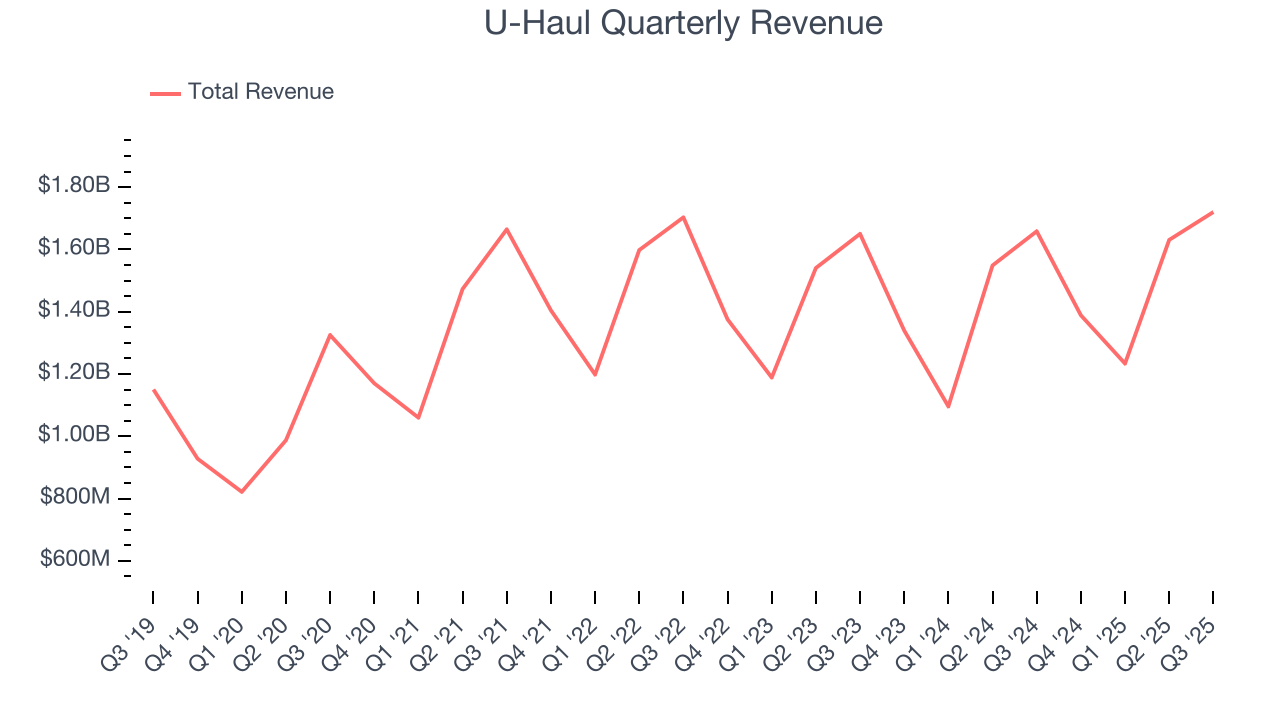

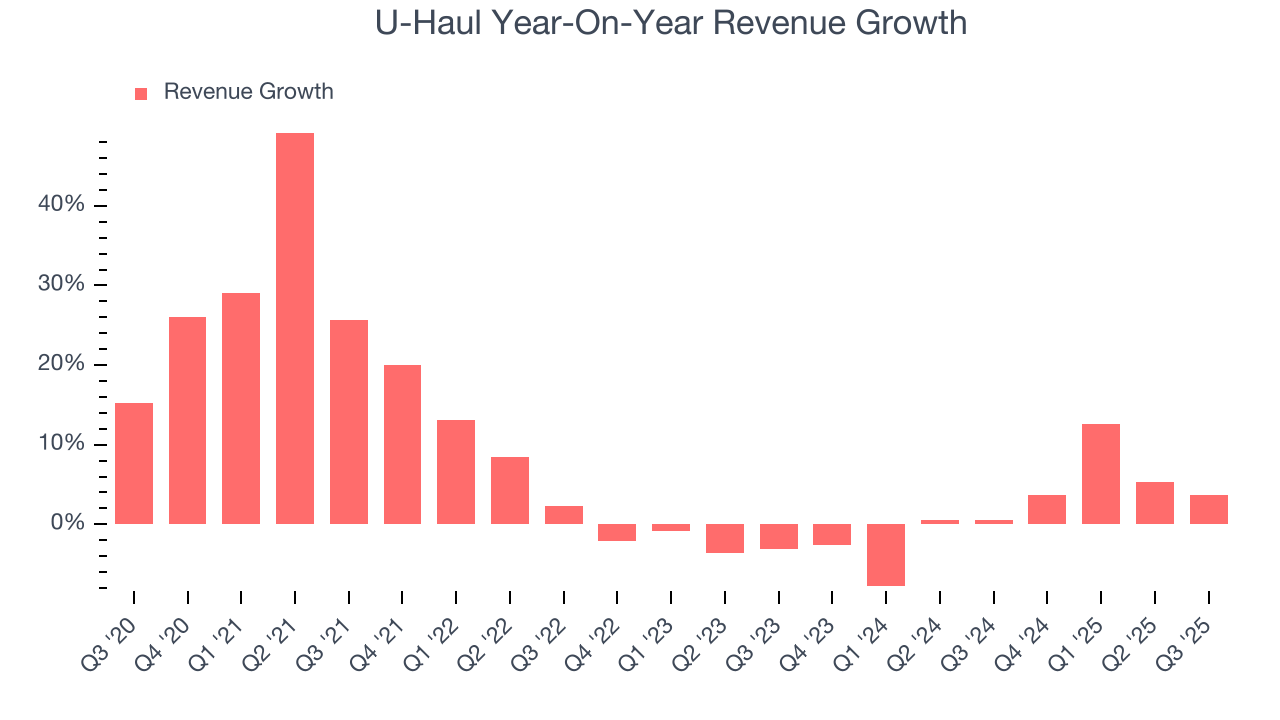

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, U-Haul grew its sales at a decent 8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. U-Haul’s recent performance shows its demand has slowed as its annualized revenue growth of 1.9% over the last two years was below its five-year trend. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While U-Haul grew slower than we’d like, it did do better than its peers.

This quarter, U-Haul grew its revenue by 3.7% year on year, and its $1.72 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

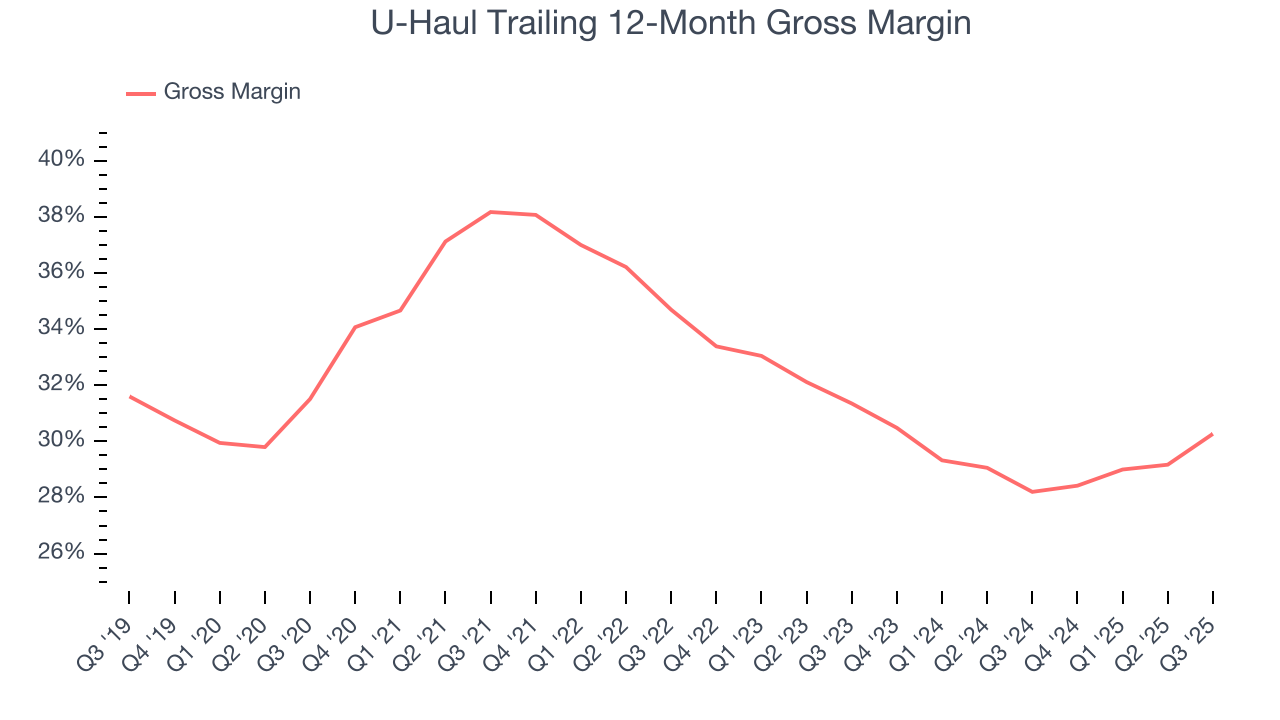

U-Haul’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 32.5% gross margin over the last five years. Said differently, U-Haul paid its suppliers $67.53 for every $100 in revenue.

U-Haul’s gross profit margin came in at 35.8% this quarter, marking a 3.7 percentage point increase from 32.1% in the same quarter last year. U-Haul’s full-year margin has also been trending up over the past 12 months, increasing by 2.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

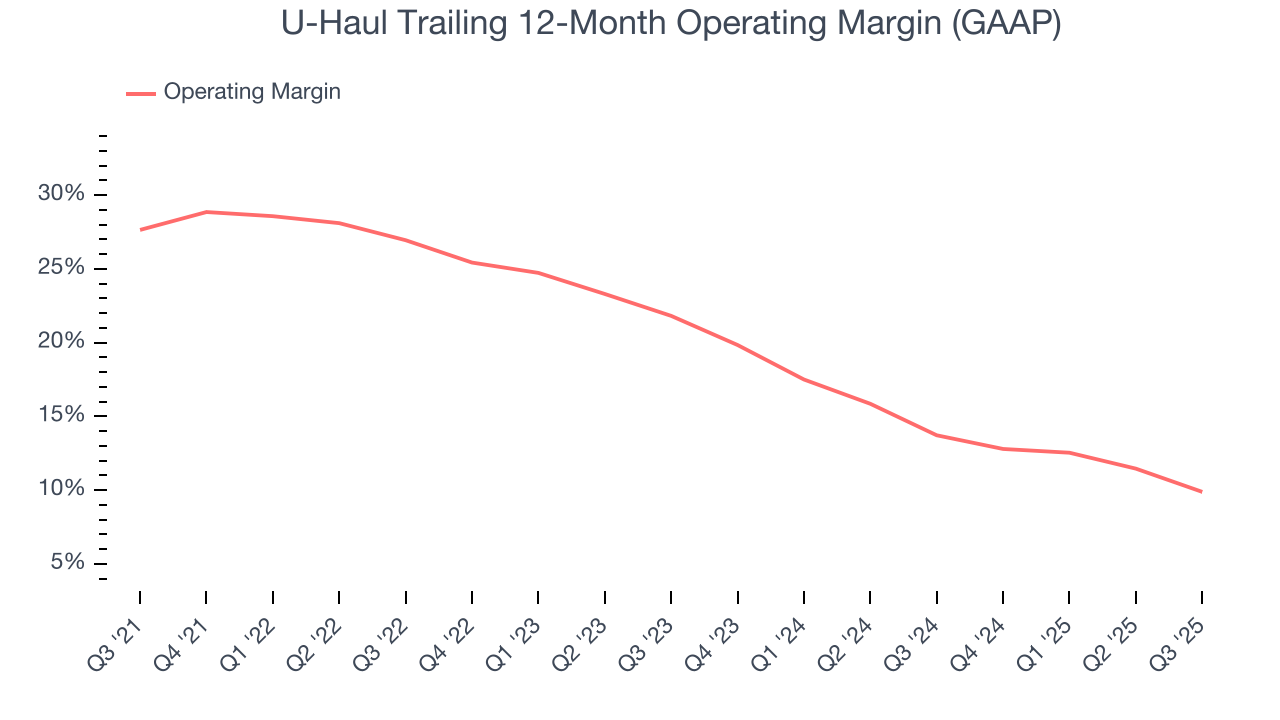

U-Haul has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.9%.

Looking at the trend in its profitability, U-Haul’s operating margin decreased by 17.8 percentage points over the last five years. Many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope U-Haul can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

This quarter, U-Haul generated an operating margin profit margin of 12.7%, down 5.7 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

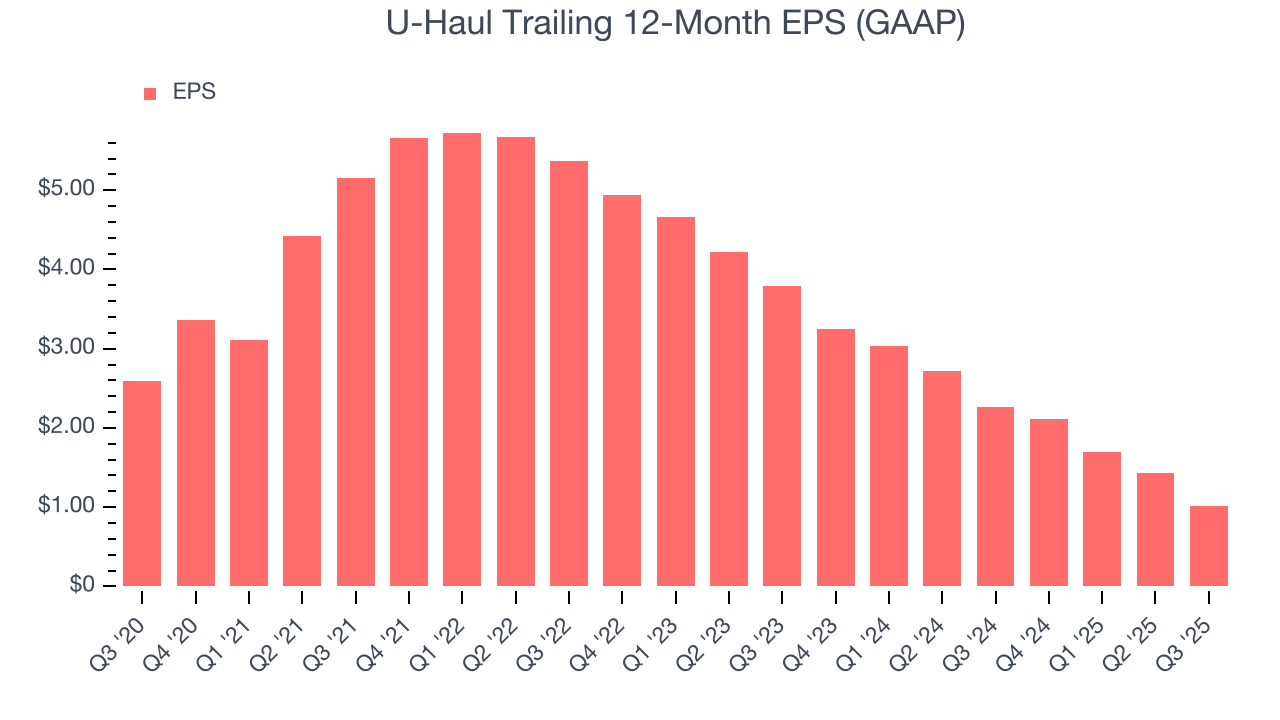

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for U-Haul, its EPS declined by 17.1% annually over the last five years while its revenue grew by 8%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of U-Haul’s earnings can give us a better understanding of its performance. As we mentioned earlier, U-Haul’s operating margin declined by 17.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For U-Haul, its two-year annual EPS declines of 48.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, U-Haul reported EPS of $0.49, down from $0.91 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

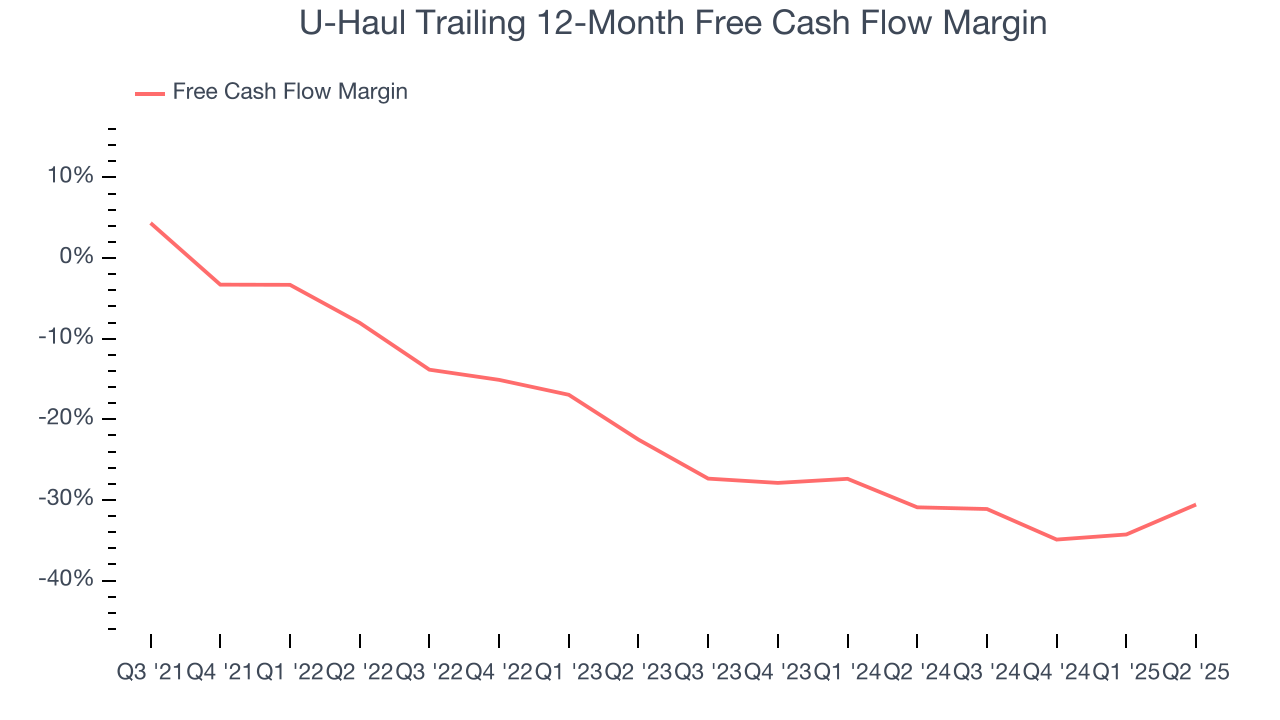

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

U-Haul’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 19.6%, meaning it lit $19.64 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, we can see that U-Haul’s margin dropped by 33.4 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

10. Return on Invested Capital (ROIC)

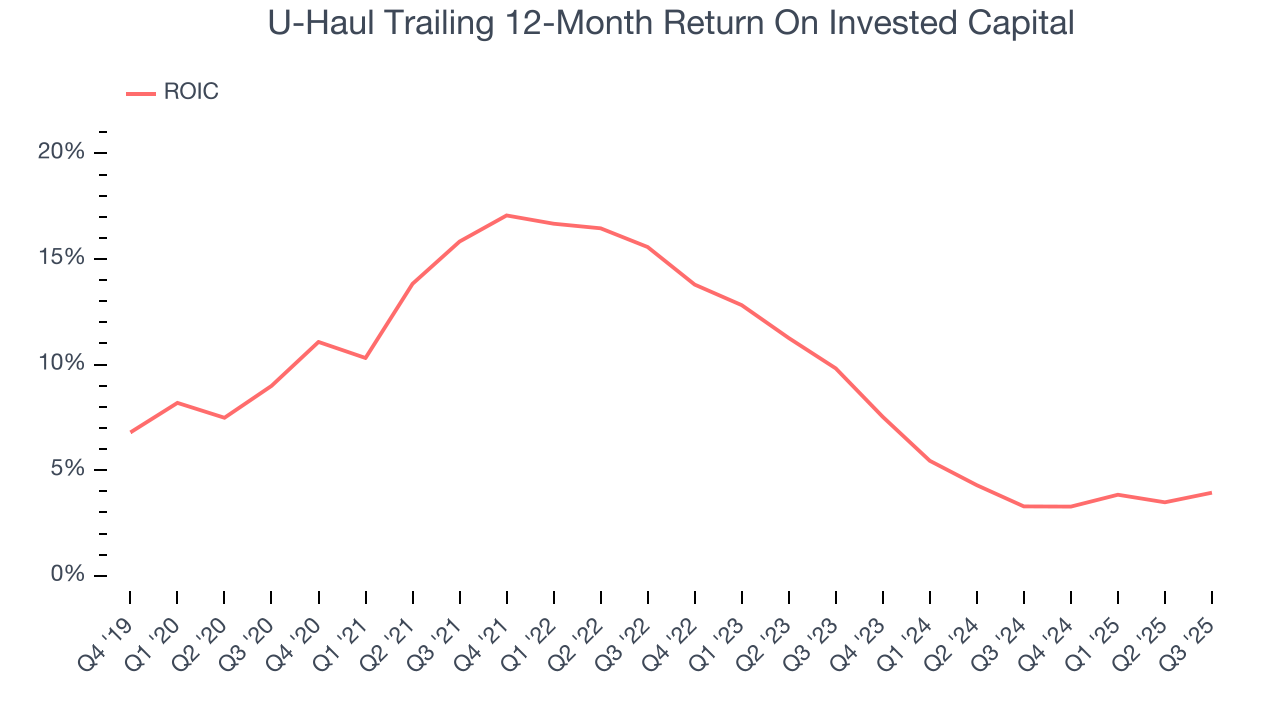

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

U-Haul historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, U-Haul’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

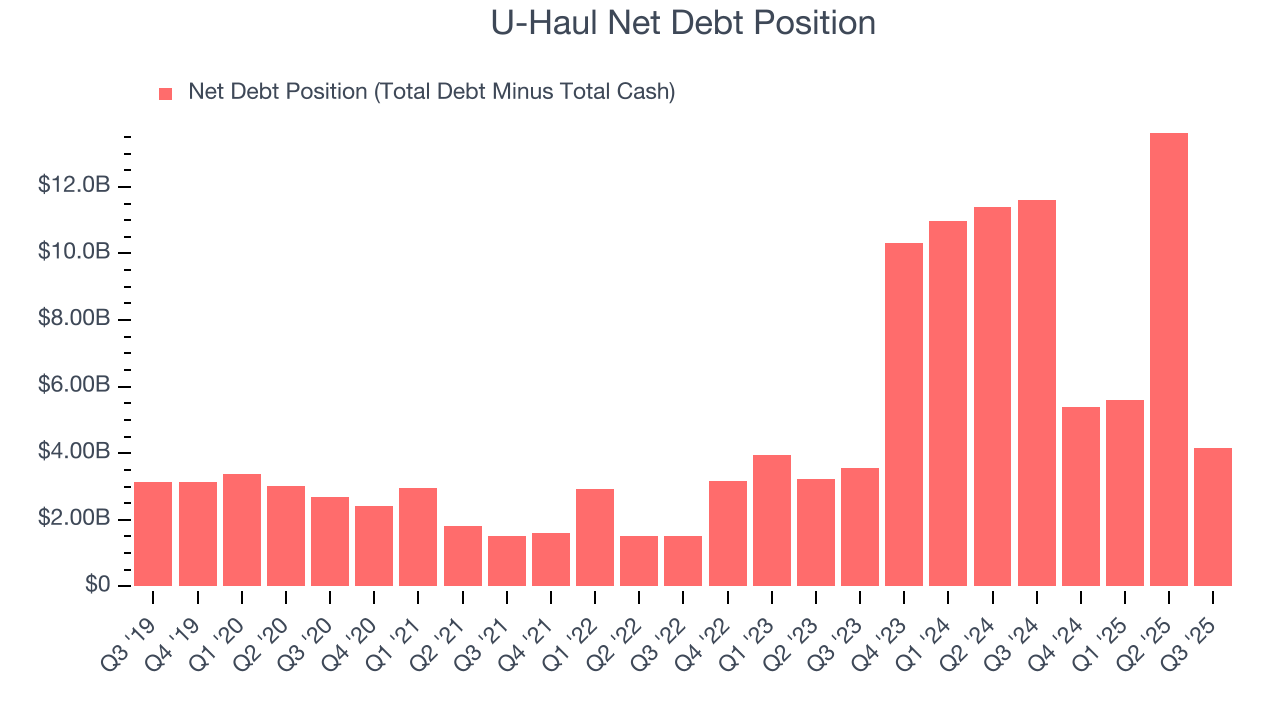

11. Balance Sheet Assessment

U-Haul reported $3.58 billion of cash and $7.74 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.71 billion of EBITDA over the last 12 months, we view U-Haul’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $284.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from U-Haul’s Q3 Results

We struggled to find many positives in these results. Its EPS missed and its revenue was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.8% to $52.47 immediately following the results.

13. Is Now The Time To Buy U-Haul?

Updated: February 3, 2026 at 10:27 PM EST

When considering an investment in U-Haul, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping their customers, but in the case of U-Haul, we’re out. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its projected EPS for the next year is lacking.

U-Haul’s price-to-sales ratio based on the trailing 12 months is 1.9x. The market typically values companies like U-Haul based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $80.45 on the company (compared to the current share price of $57.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.