VF Corp (VFC)

We wouldn’t buy VF Corp. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think VF Corp Will Underperform

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

- Flat sales over the last five years suggest it must innovate and find new ways to grow

- Sales over the last five years were less profitable as its earnings per share fell by 11.6% annually while its revenue was flat

- High net-debt-to-EBITDA ratio of 6× increases the risk of forced asset sales or dilutive financing if operational performance weakens

VF Corp’s quality doesn’t meet our hurdle. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than VF Corp

High Quality

Investable

Underperform

Why There Are Better Opportunities Than VF Corp

VF Corp’s stock price of $19.87 implies a valuation ratio of 25.3x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. VF Corp (VFC) Research Report: Q3 CY2025 Update

Lifestyle clothing conglomerate VF Corp (NYSE:VFC) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 3.5% year on year to $2.80 billion. The company expects next quarter’s revenue to be around $2.90 billion, close to analysts’ estimates. Its non-GAAP profit of $0.52 per share was 22.5% above analysts’ consensus estimates.

VF Corp (VFC) Q3 CY2025 Highlights:

- Revenue: $2.80 billion vs analyst estimates of $2.78 billion (3.5% year-on-year decline, 0.9% beat)

- Adjusted EPS: $0.52 vs analyst estimates of $0.42 (22.5% beat)

- Revenue Guidance for Q4 CY2025 is $2.90 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 11.2%, up from 9.4% in the same quarter last year

- Market Capitalization: $6.49 billion

Company Overview

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

Its brands cater to different lifestyles and consumer segments, and some notable names under the VF Corp umbrella include The North Face, a top brand for outdoor apparel, gear, and footwear; Vans, a leading brand known for its skate-culture-inspired shoes and apparel; Supreme, a well-known streetwear brand; Timberland, which specializes in durable outdoor wear and is famous for its waterproof leather boots; Dickies, a brand that delivers performance-oriented workwear and apparel for workers in various industries including construction and service; JanSport, a popular backpack and collegiate gear brand among students and young adults; and Smartwool, a company known for high-quality Merino wool socks, apparel, and accessories.

VF Corp's target consumer base is as diverse as its brand portfolio, ranging from outdoor enthusiasts and athletes to fashion-conscious individuals and professionals needing workwear. Its products can be found at various retailers, department stores, and e-commerce websites.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

VF Corp's primary competitors include Nike, Inc. (NYSE:NKE), Adidas (OTCMKTS:ADDYY), Columbia Sportswear (NASDAQ:COLM), Lululemon (NASDAQ:LULU), and Levi (NYSE:LEVI).

5. Revenue Growth

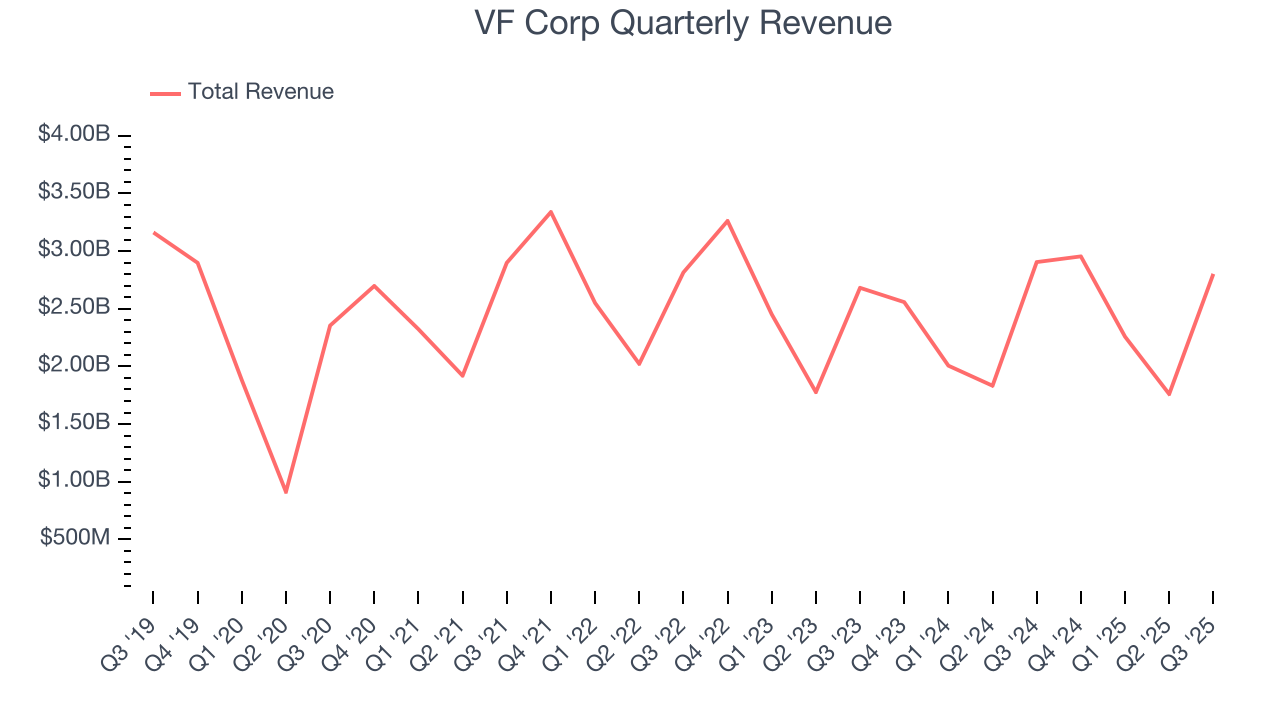

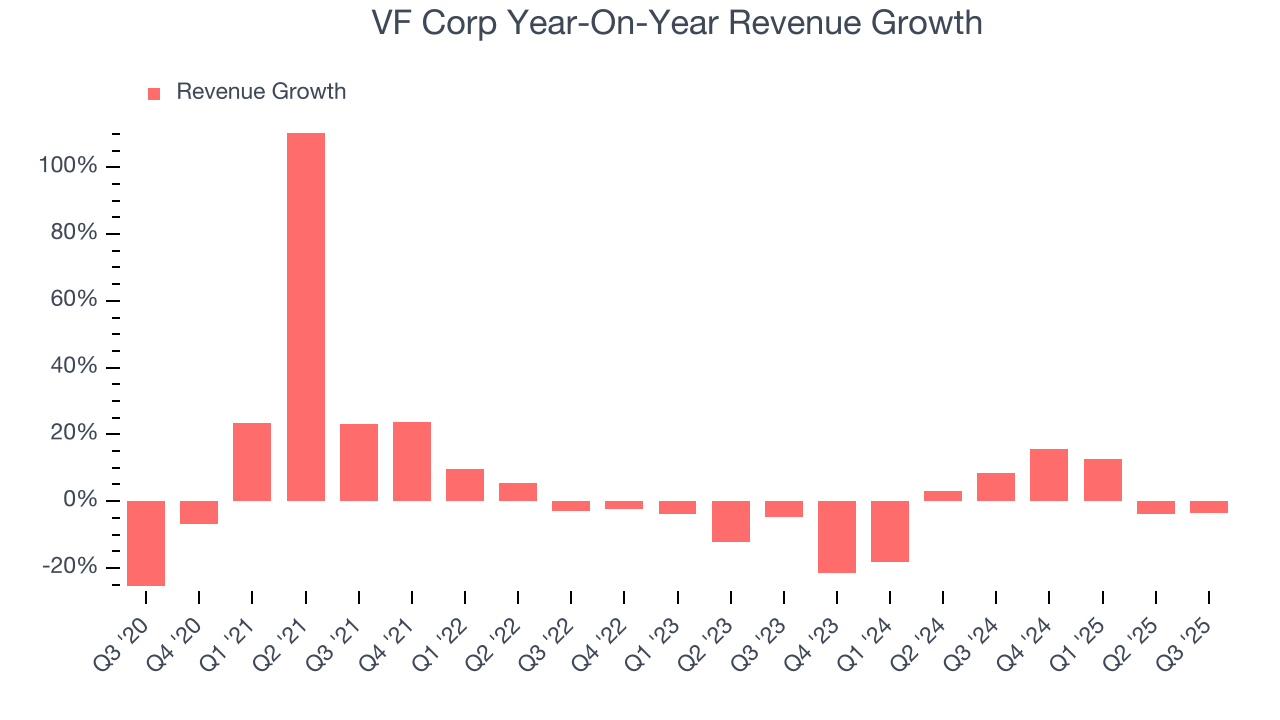

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, VF Corp grew its sales at a sluggish 4% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. VF Corp’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

This quarter, VF Corp’s revenue fell by 3.5% year on year to $2.80 billion but beat Wall Street’s estimates by 0.9%. Company management is currently guiding for a 2% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

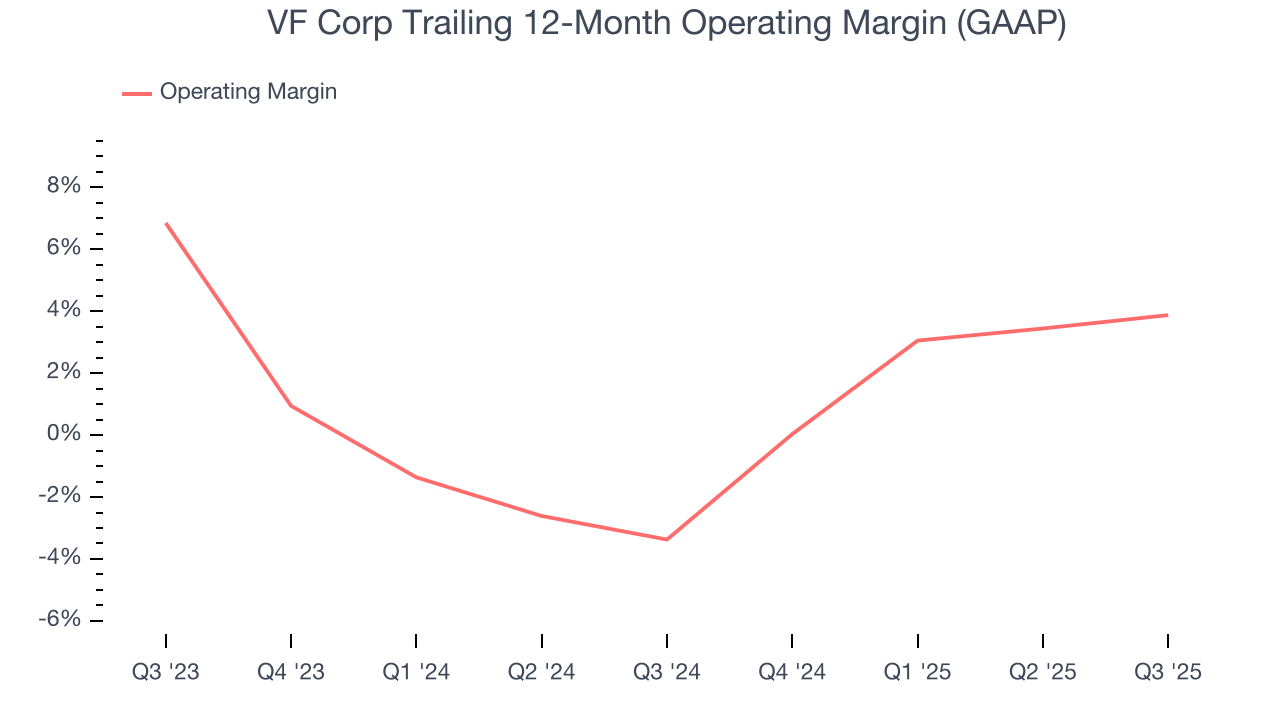

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

VF Corp’s operating margin has risen over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

This quarter, VF Corp generated an operating margin profit margin of 11.2%, up 1.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

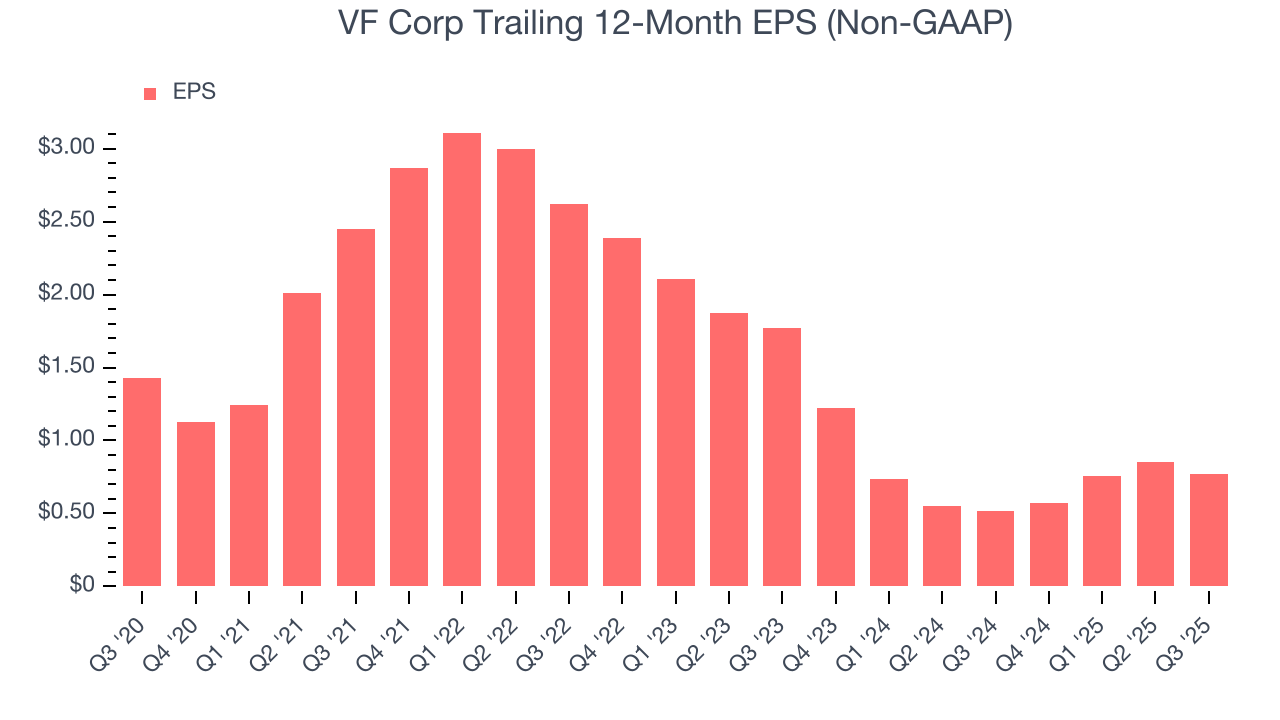

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for VF Corp, its EPS declined by 11.6% annually over the last five years while its revenue grew by 4%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, VF Corp reported adjusted EPS of $0.52, down from $0.60 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects VF Corp’s full-year EPS of $0.77 to grow 16.1%.

8. Cash Is King

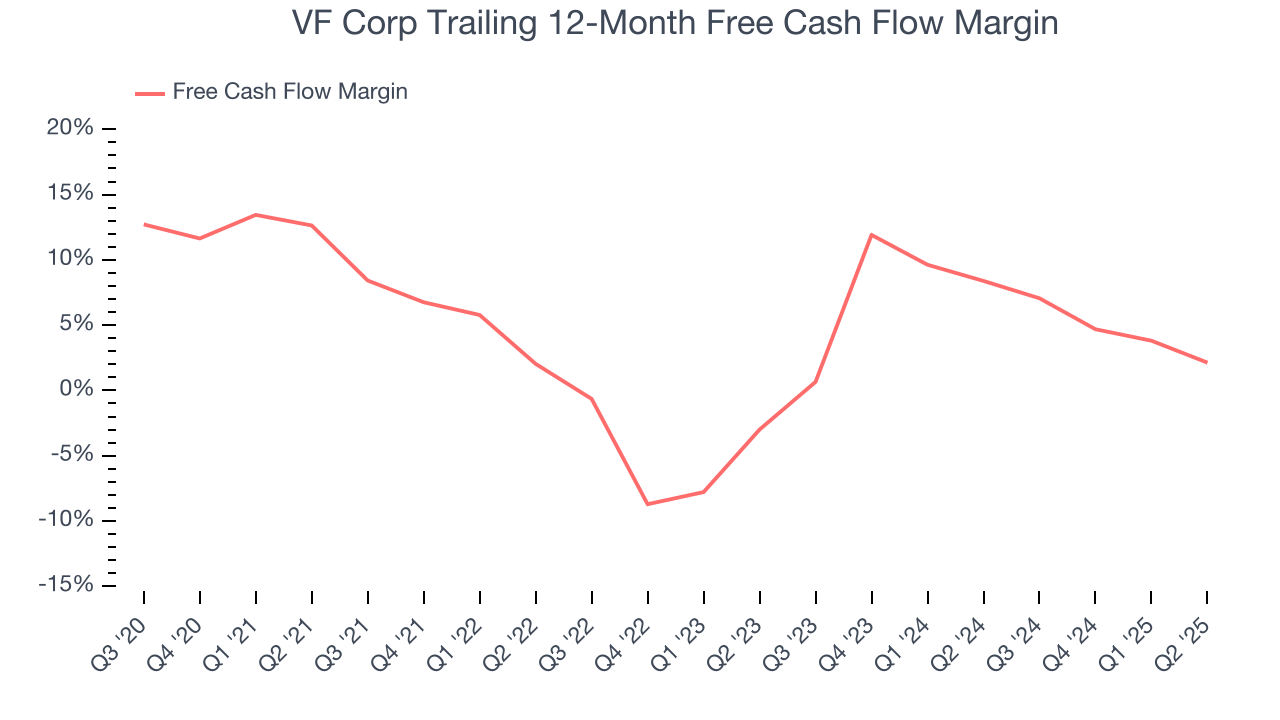

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

VF Corp has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.3%, subpar for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

VF Corp historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, VF Corp’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

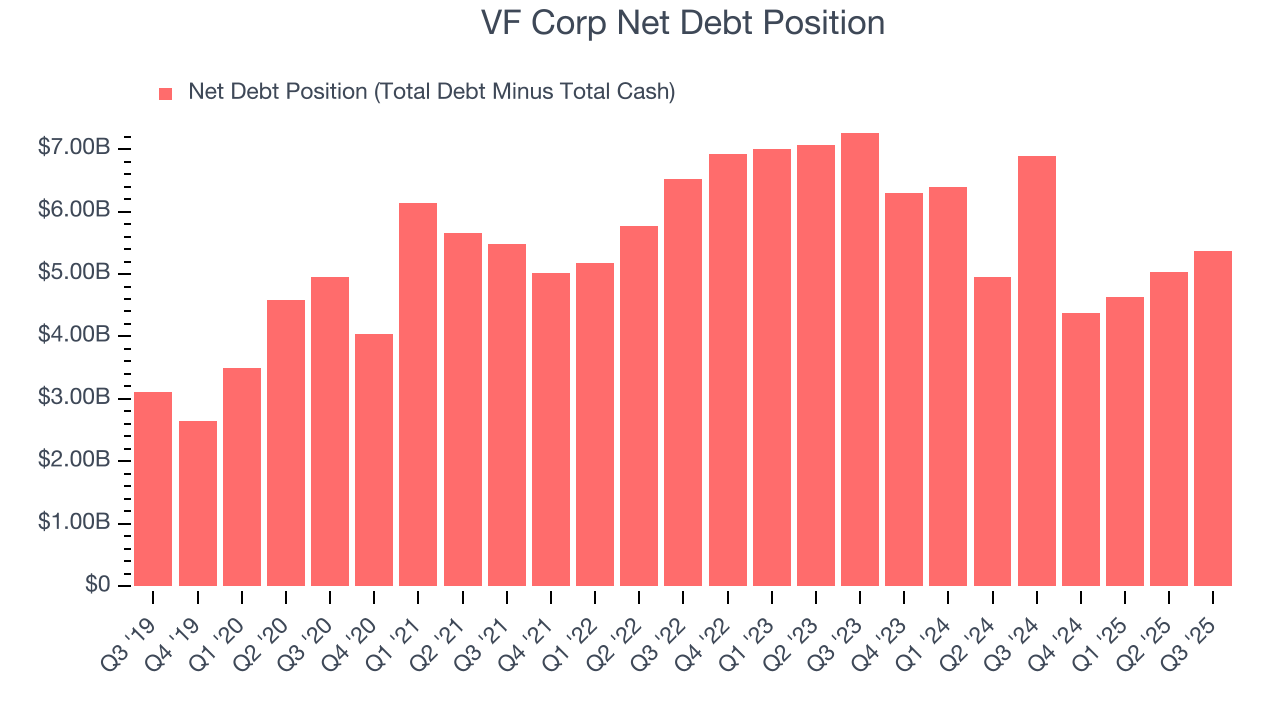

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

VF Corp’s $5.79 billion of debt exceeds the $419.1 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $883.6 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. VF Corp could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope VF Corp can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from VF Corp’s Q3 Results

It was good to see VF Corp beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 5% to $17.43 immediately after reporting.

12. Is Now The Time To Buy VF Corp?

Updated: January 23, 2026 at 9:57 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own VF Corp, you should also grasp the company’s longer-term business quality and valuation.

VF Corp falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. On top of that, VF Corp’s constant currency sales performance has disappointed, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

VF Corp’s P/E ratio based on the next 12 months is 25.3x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $18.05 on the company (compared to the current share price of $19.87), implying they don’t see much short-term potential in VF Corp.