Figs (FIGS)

We wouldn’t buy Figs. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Figs Will Underperform

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

- 3.2% annual revenue growth over the last two years was slower than its consumer discretionary peers

- Earnings per share have contracted by 8.8% annually over the last four years, a headwind for returns as stock prices often echo long-term EPS performance

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Figs doesn’t measure up to our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Figs

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Figs

At $10.85 per share, Figs trades at 110.8x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Figs (FIGS) Research Report: Q3 CY2025 Update

Healthcare apparel company Figs (NYSE:FIGS) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 8.2% year on year to $151.7 million. Its non-GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Figs (FIGS) Q3 CY2025 Highlights:

- Revenue: $151.7 million vs analyst estimates of $142.5 million (8.2% year-on-year growth, 6.4% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $18.85 million vs analyst estimates of $12.38 million (12.4% margin, 52.3% beat)

- Operating Margin: 6.4%, up from -6.2% in the same quarter last year

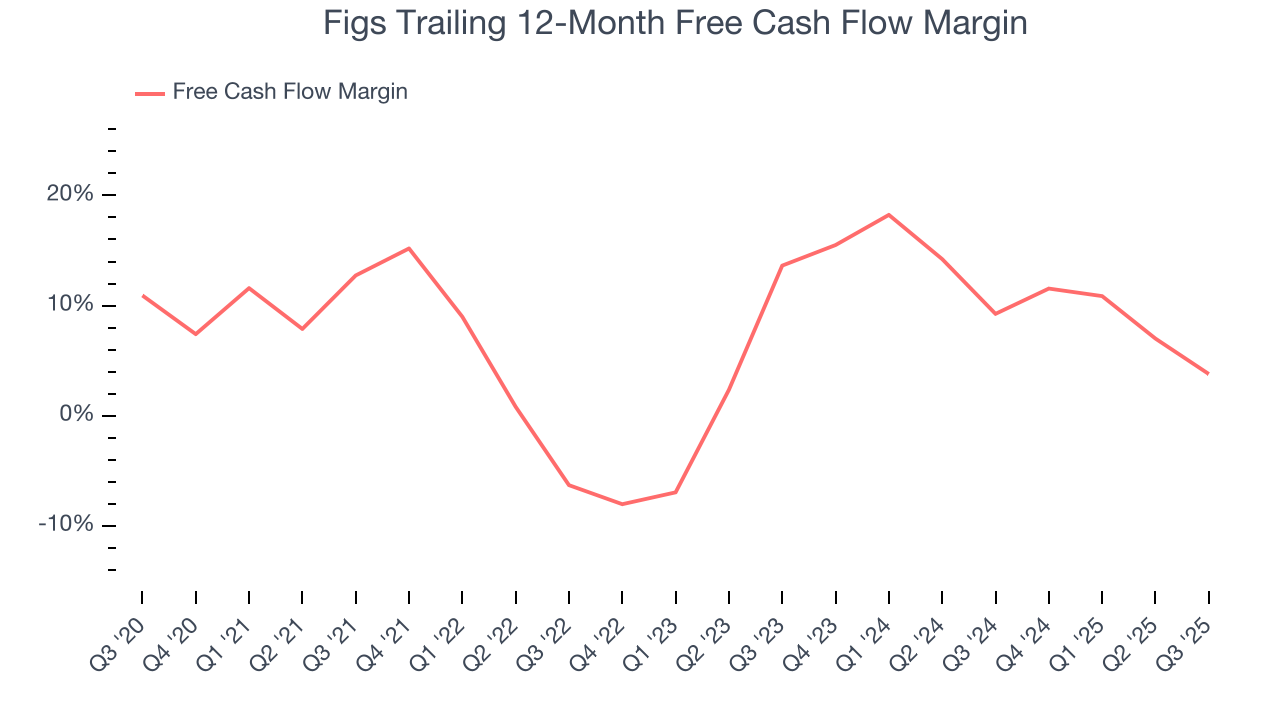

- Free Cash Flow Margin: 0.4%, down from 13.1% in the same quarter last year

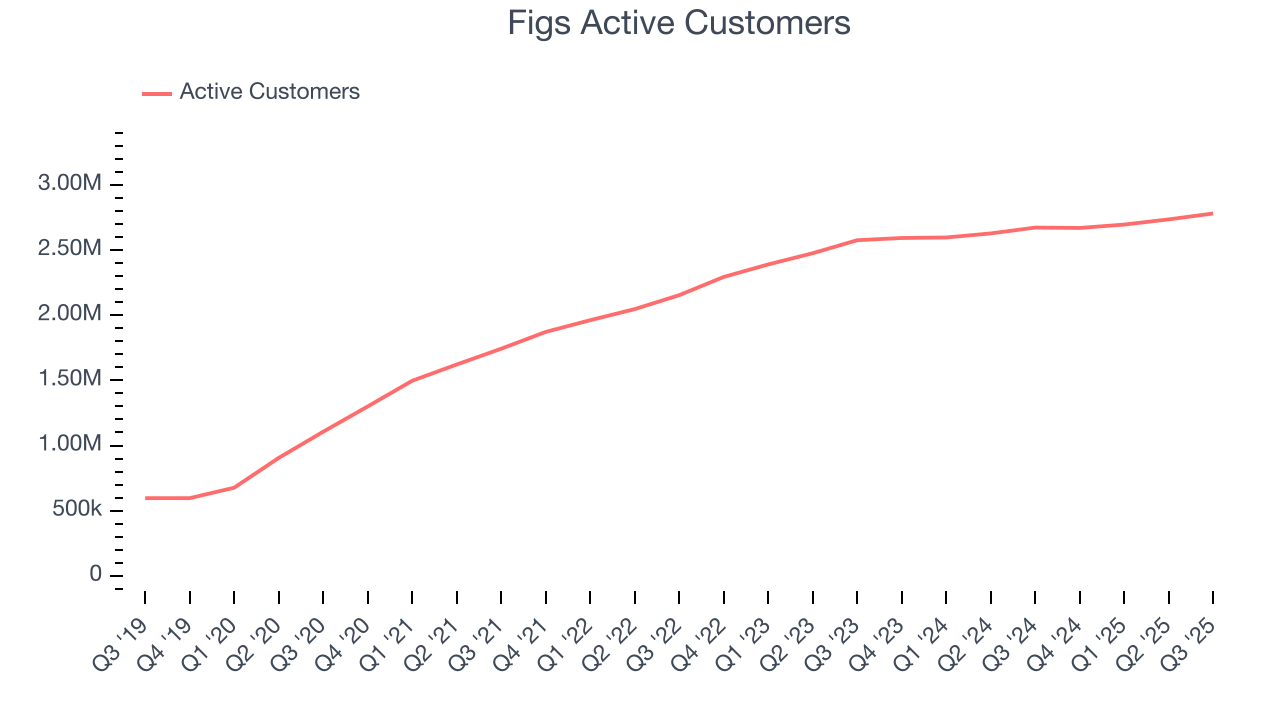

- Active Customers: 2.78 million, up 108,000 year on year

- Market Capitalization: $1.24 billion

Company Overview

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Before Figs, most medical scrubs were unisex, uncomfortable, and lacked style. Figs changed this by introducing scrubs that not only met the practical demands of healthcare professionals but also provided a modern, tailored fit and aesthetic appeal. This focus on design, comfort, and functionality quickly resonated with medical professionals.

The company's product line includes scrubs, lab coats, and other medical apparel accessories designed for men and women, and could expand its offerings into adjacent areas over time. Figs’s products stand out due to their proprietary fabric technology, which is antimicrobial, wrinkle-resistant, moisture-wicking, and highly durable.

Figs operates on a direct-to-consumer model, primarily selling its products online, allowing the company to maintain control over its brand experience, customer service, and pricing strategy. The direct-to-consumer model also enables Figs to build a community with its customer base bolstered by engagement through social media and other digital platforms.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Figs's primary competitors include Dickies Medical (owned by VF Corp NYSE:VFC) and private companies Cherokee Uniforms, Barco Uniforms, Scrubs & Beyond, and Medline Industries.

5. Revenue Growth

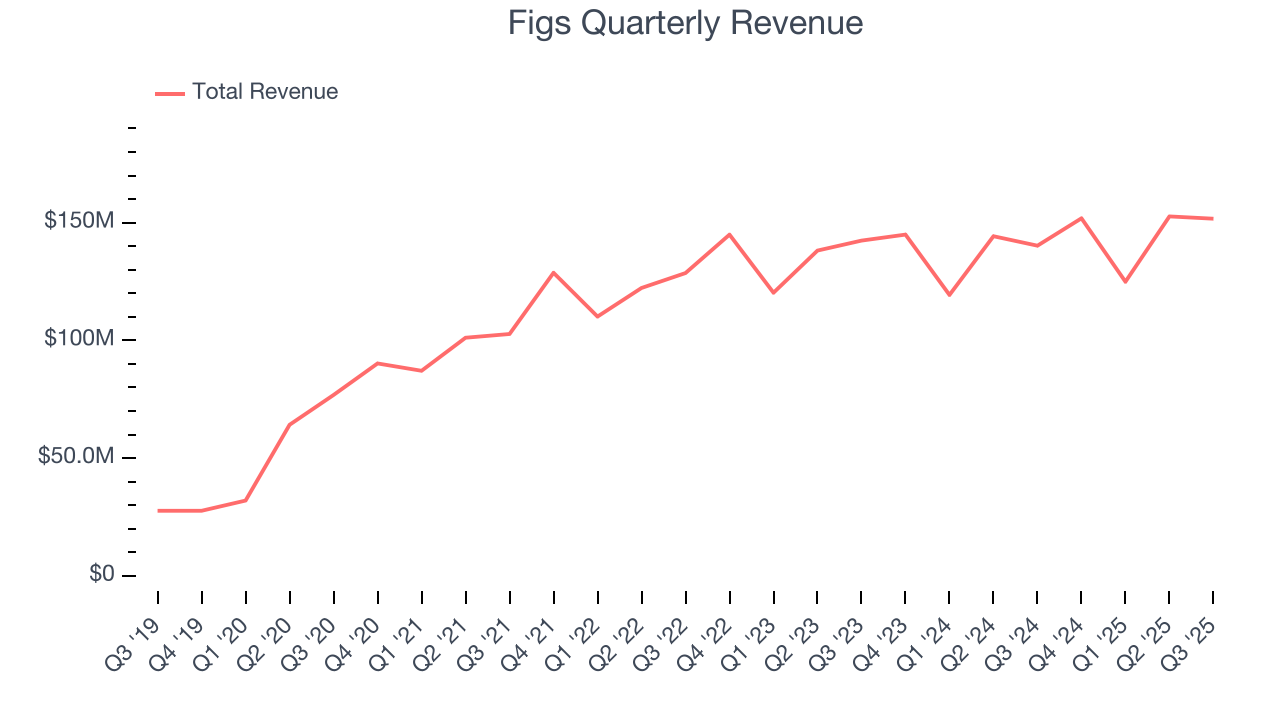

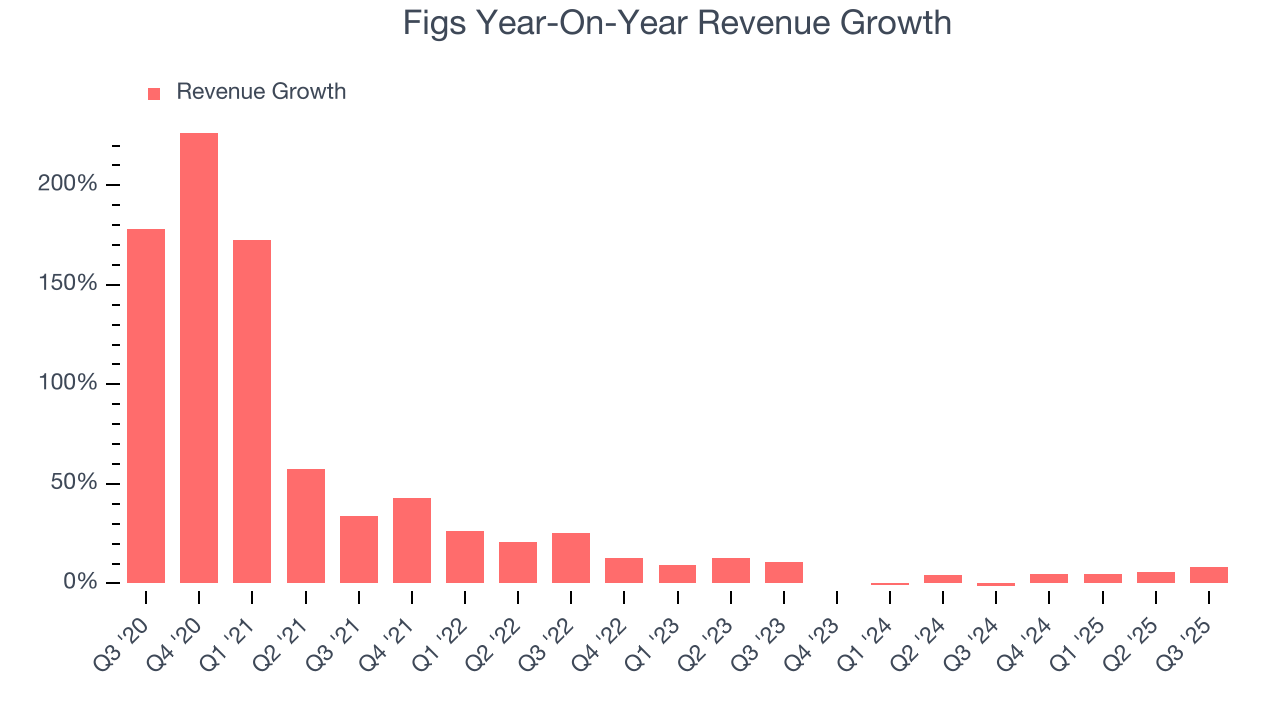

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Figs grew its sales at an impressive 23.7% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Figs’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.2% over the last two years was well below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of active customers, which reached 2.78 million in the latest quarter. Over the last two years, Figs’s active customers averaged 5.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Figs reported year-on-year revenue growth of 8.2%, and its $151.7 million of revenue exceeded Wall Street’s estimates by 6.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Operating Margin

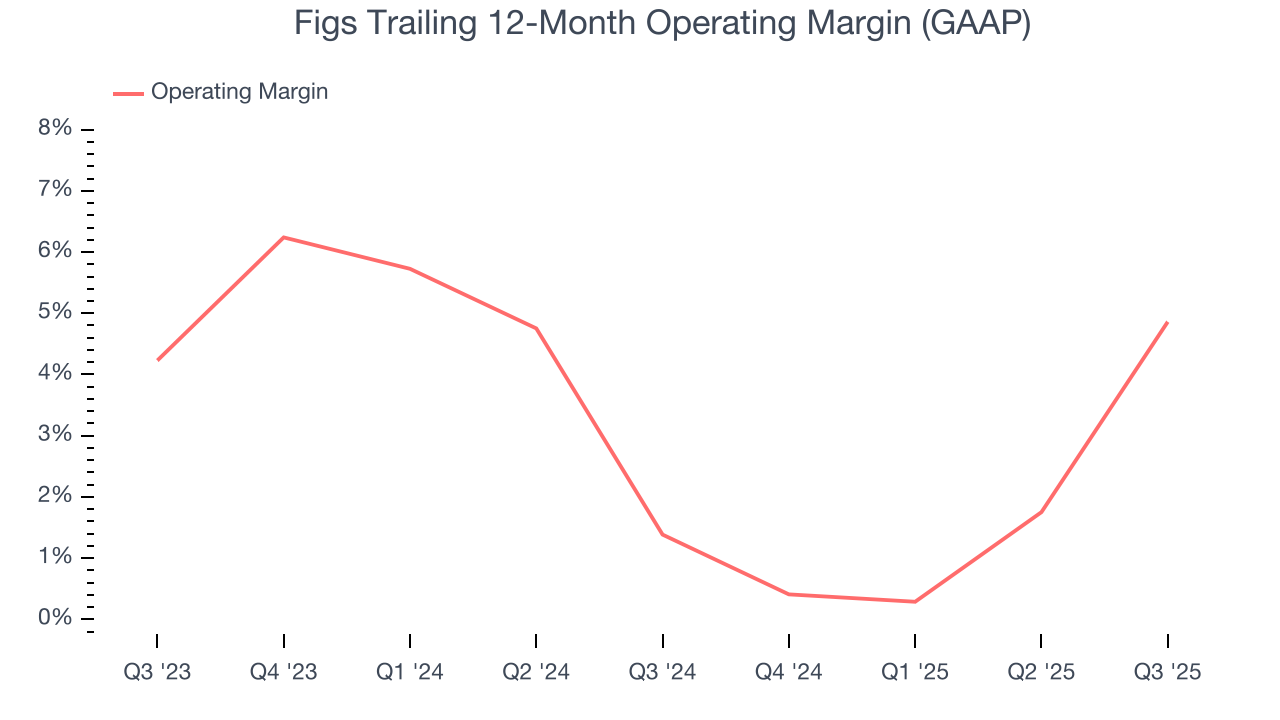

Figs’s operating margin has been trending up over the last 12 months and averaged 3.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

This quarter, Figs generated an operating margin profit margin of 6.4%, up 12.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

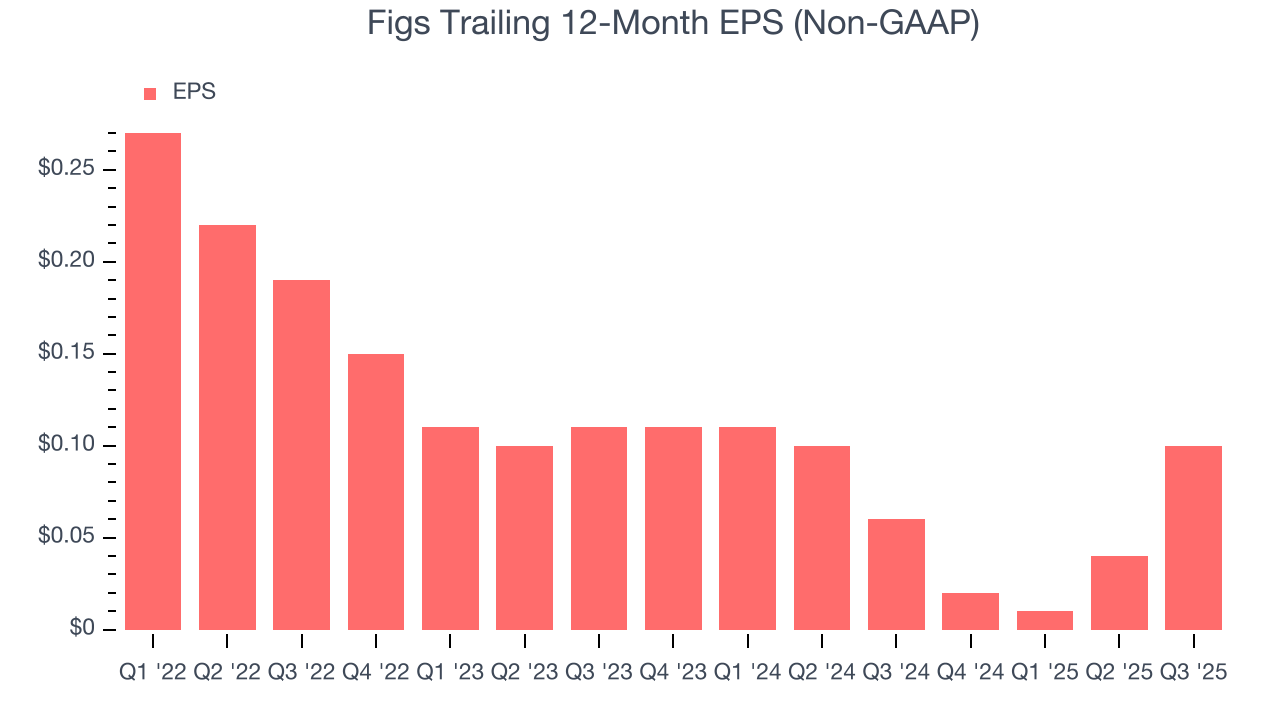

Figs’s full-year EPS dropped 40%, or 8.8% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Figs’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Figs reported adjusted EPS of $0.05, up from negative $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Figs’s full-year EPS of $0.10 to shrink by 30.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Figs has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.4%, subpar for a consumer discretionary business.

Figs broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 12.8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Figs’s free cash flow margin of 3.8% for the last 12 months to remain the same.

9. Return on Invested Capital (ROIC)

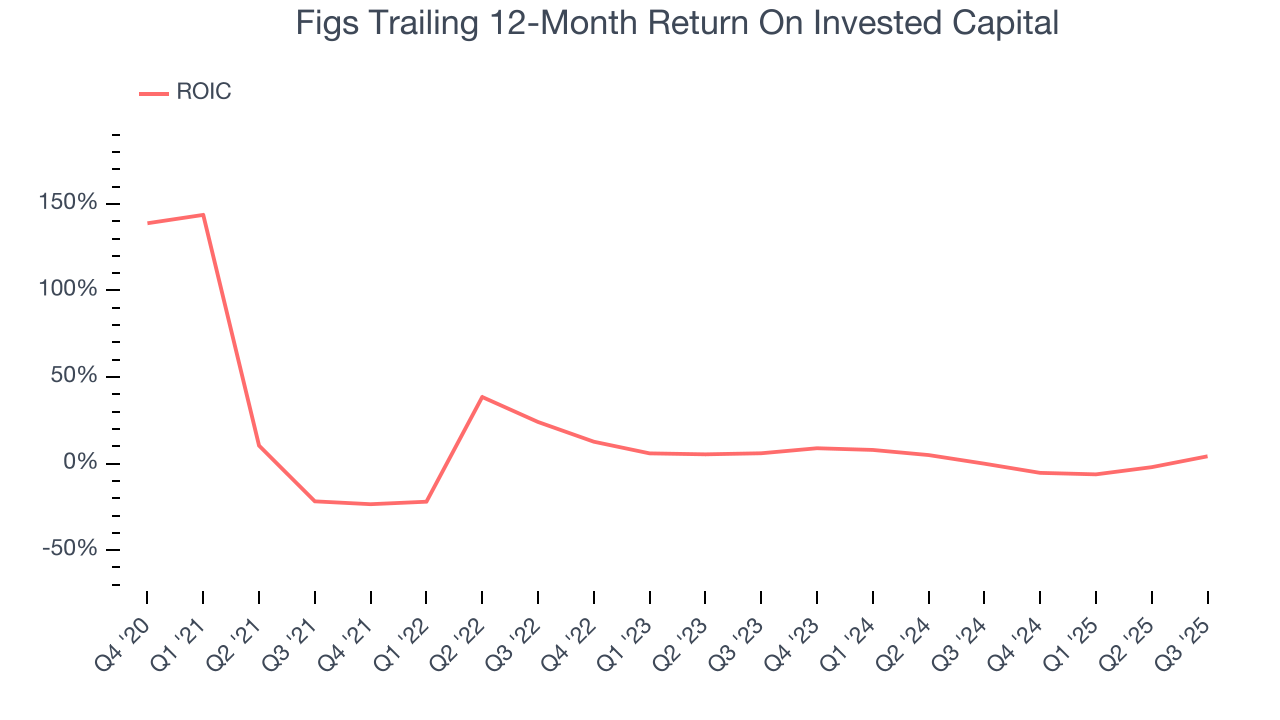

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Figs historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.5%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Figs’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

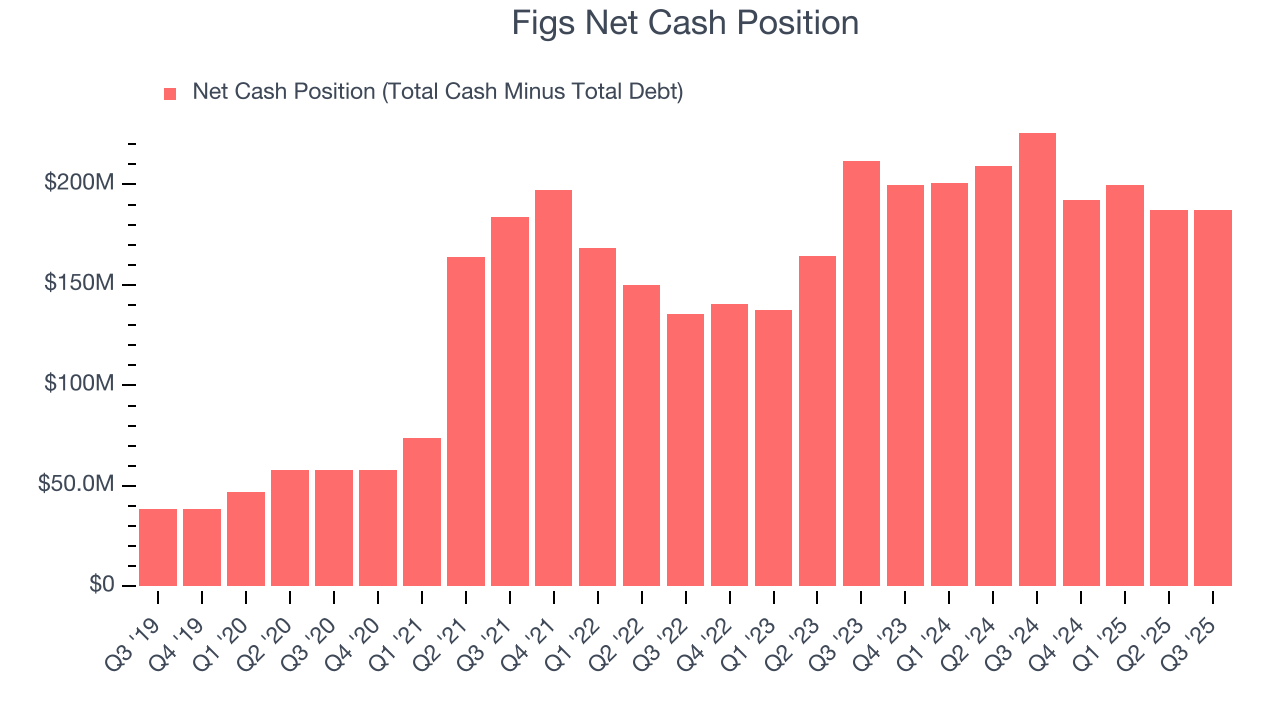

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Figs is a profitable, well-capitalized company with $241.5 million of cash and $54.12 million of debt on its balance sheet. This $187.4 million net cash position is 15.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Figs’s Q3 Results

It was good to see Figs beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 16.2% to $8.75 immediately after reporting.

12. Is Now The Time To Buy Figs?

Updated: February 3, 2026 at 9:56 PM EST

Are you wondering whether to buy Figs or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Figs doesn’t pass our quality test. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Figs’s number of active customers has disappointed, and its declining EPS over the last four years makes it a less attractive asset to the public markets.

Figs’s P/E ratio based on the next 12 months is 110.8x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $9.81 on the company (compared to the current share price of $10.85), implying they don’t see much short-term potential in Figs.