Veralto (VLTO)

We’re wary of Veralto. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Veralto Is Not Exciting

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

- Muted 4.4% annual revenue growth over the last four years shows its demand lagged behind its industrials peers

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 5.6%

- A positive is that its offerings are difficult to replicate at scale and lead to a best-in-class gross margin of 58.5%

Veralto’s quality isn’t great. You should search for better opportunities.

Why There Are Better Opportunities Than Veralto

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Veralto

At $101.47 per share, Veralto trades at 24.2x forward P/E. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Veralto (VLTO) Research Report: Q4 CY2025 Update

Water analytics and treatment company Veralto (NYSE:VLTO) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.8% year on year to $1.40 billion. Its non-GAAP profit of $1.04 per share was 6% above analysts’ consensus estimates.

Veralto (VLTO) Q4 CY2025 Highlights:

- Revenue: $1.40 billion vs analyst estimates of $1.40 billion (3.8% year-on-year growth, 0.5% miss)

- Adjusted EPS: $1.04 vs analyst estimates of $0.98 (6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.15 at the midpoint, missing analyst estimates by 0.7%

- Operating Margin: 22.6%, in line with the same quarter last year

- Free Cash Flow Margin: 20.8%, up from 19.6% in the same quarter last year

- Market Capitalization: $25.2 billion

Company Overview

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

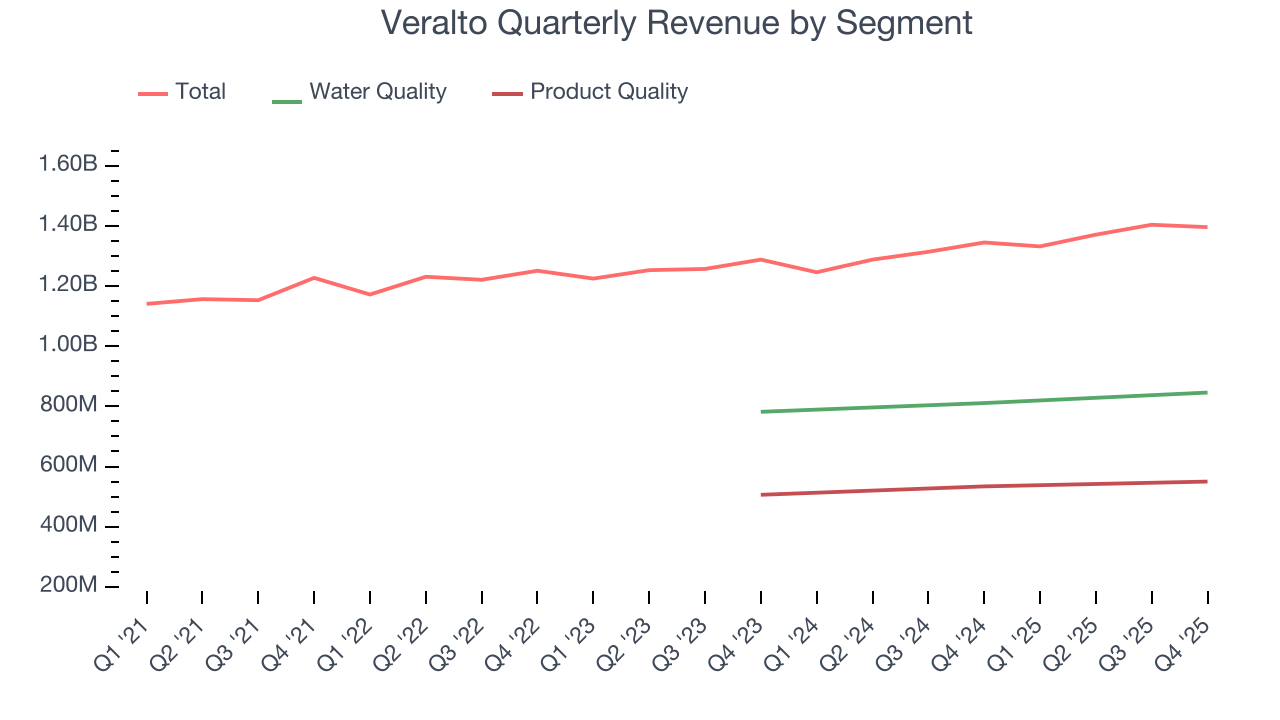

The business operates in two segments, the first of which is Water Quality. This product line helps improve the quality and reliability of water, and the company operates through multiple brands such as Hach and Trojan Technologies. Hach is best known for providing analytics that help test water quality from small community utilities to large public sector governments whereas Trojan Technologies offers UV and membrane filtration systems for water disinfection and contaminant removal.

Veralto’s second business segment is a marketing and branding business. It operates brands like Videojet, which provides printing technologies to mark and code packaged goods and consumables. Customers bring their products to market by letting Verlato mark their packaging for branding and regulatory reasons.

Veralto’s water quality segment generates most of its overall revenue by selling its water treatment products to the industrial, residential, and public sectors through long-term contracts. Recurring revenue makes up the majority of the company’s net sales due to the consumable and ongoing nature of its products.

4. Air and Water Services

Many air and water services are statutorily mandated or non-discretionary. This means recurring revenues are often earned through contracts, making for more predictable top-line trends. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. On the other hand, air and water services companies are at the whim of economic cycles. Interest rates, for example, can greatly impact manufacturing or industrial processes that drive incremental demand for these companies’ offerings.

No sizeable company offers all of the products and services Veralto offers, but some competing in intersecting areas include Rentokil Initial (NYSE:RTO), GFL Environmental (NYSE:GFL), and Rollins (NYSE:ROL).

5. Revenue Growth

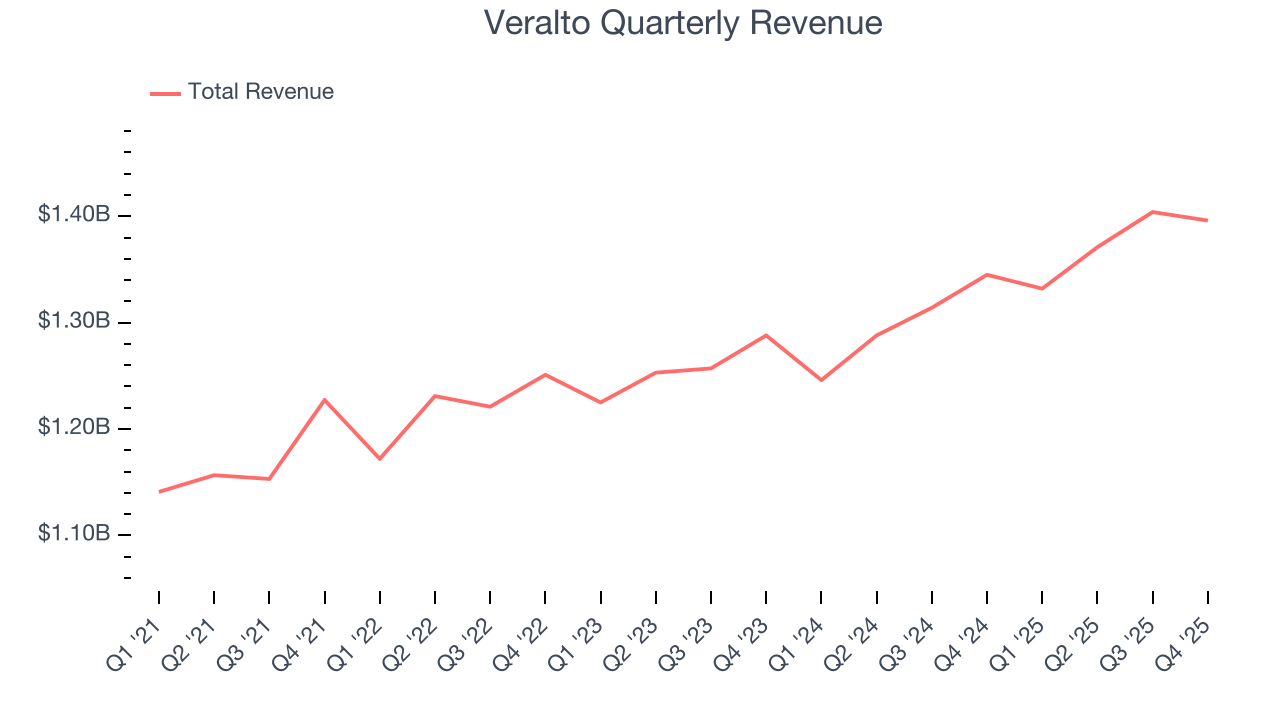

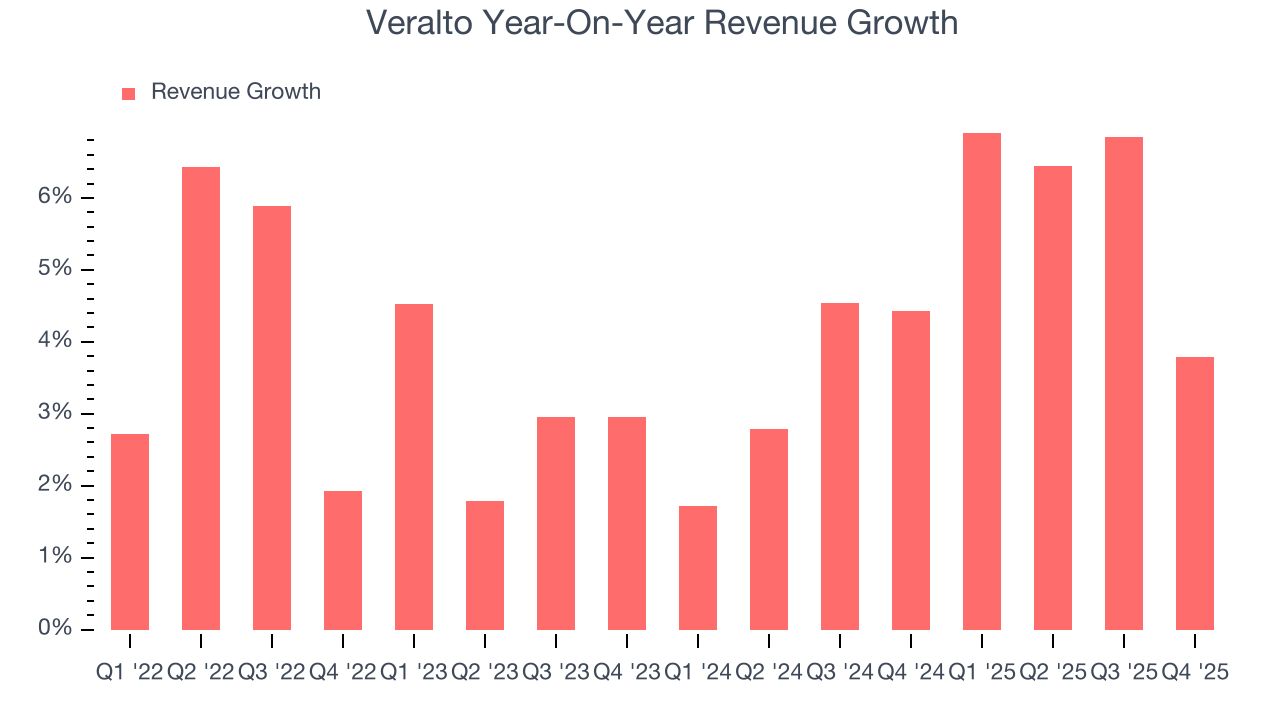

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Veralto grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Veralto’s annualized revenue growth of 4.7% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

Veralto also breaks out the revenue for its most important segments, Water Quality and Product Quality, which are 60.6% and 39.4% of revenue. Over the last two years, Veralto’s Water Quality revenue (measurement and analysis equipment) averaged 4% year-on-year growth while its Product Quality revenue (marking and coding for packages) averaged 4.3% growth.

This quarter, Veralto’s revenue grew by 3.8% year on year to $1.40 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

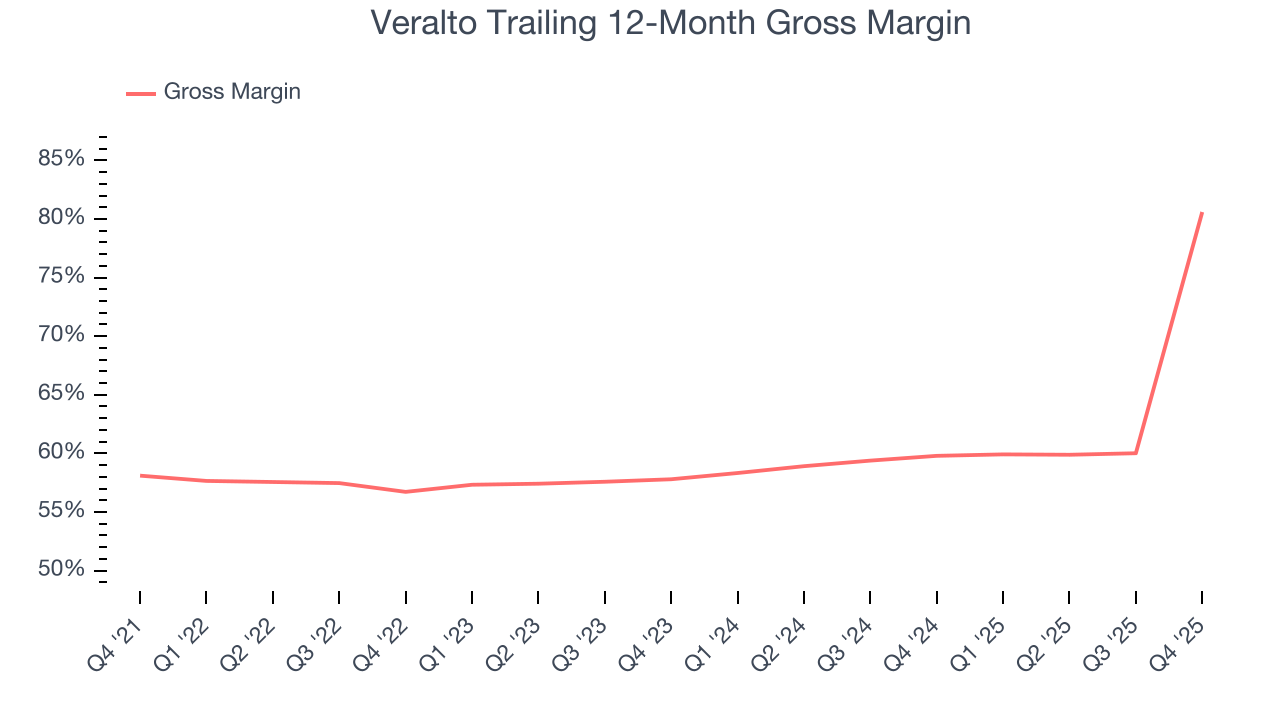

Veralto has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 63% gross margin over the last five years. That means Veralto only paid its suppliers $36.98 for every $100 in revenue.

Veralto produced a 141% gross profit margin in Q4, marking a 81.1 percentage point increase from 59.6% in the same quarter last year. Veralto’s full-year margin has also been trending up over the past 12 months, increasing by 20.8 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

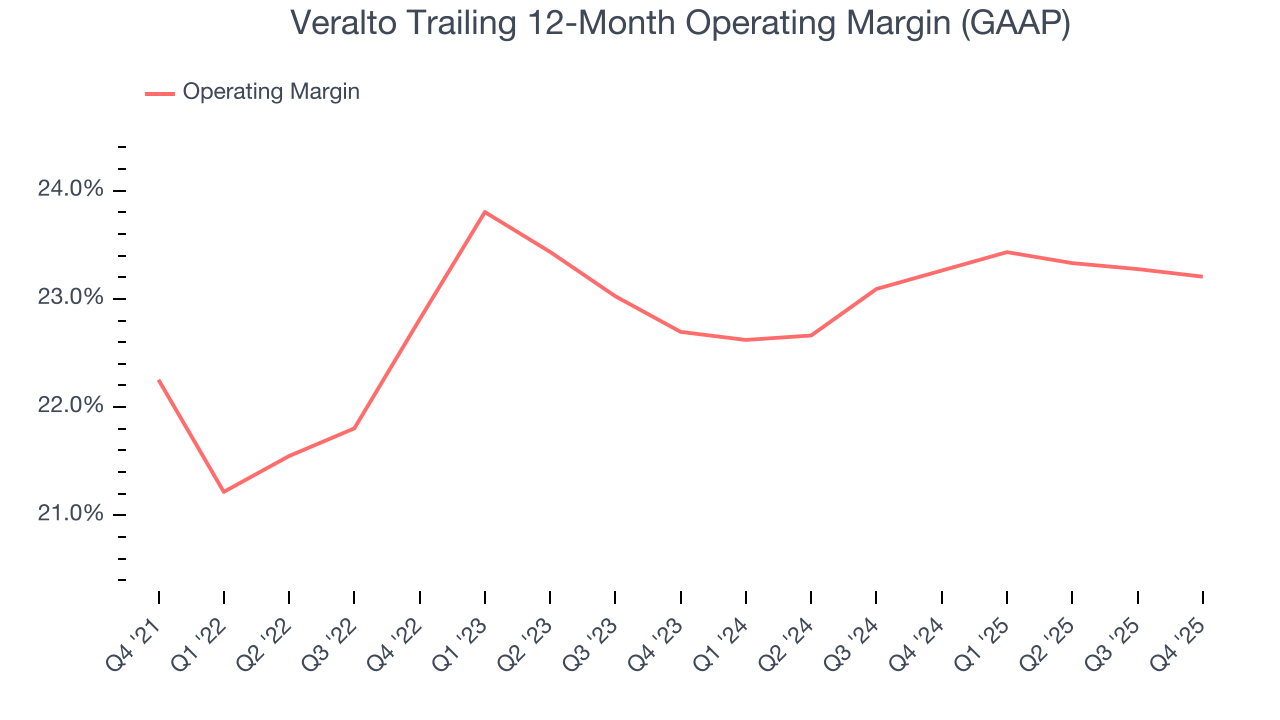

Veralto’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 22.9% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Veralto’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with Veralto’s performance considering most Air and Water Services companies saw their margins plummet.

This quarter, Veralto generated an operating margin profit margin of 22.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

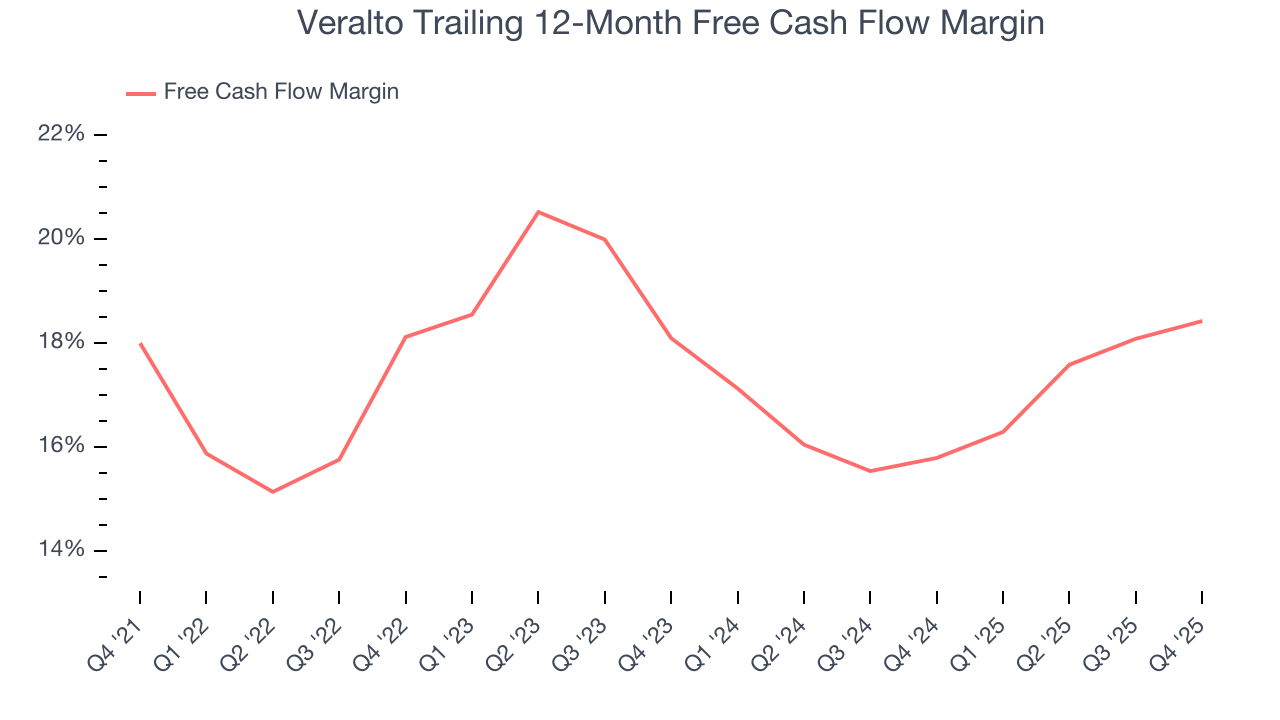

Veralto has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 17.7% over the last five years.

Veralto’s free cash flow clocked in at $291 million in Q4, equivalent to a 20.8% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Key Takeaways from Veralto’s Q4 Results

It was good to see Veralto beat analysts’ EPS expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.5% to $95.91 immediately after reporting.

10. Is Now The Time To Buy Veralto?

Updated: February 3, 2026 at 5:22 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Veralto, you should also grasp the company’s longer-term business quality and valuation.

Veralto isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue growth was uninspiring over the last four years.

Veralto’s P/E ratio based on the next 12 months is 23.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $114.94 on the company (compared to the current share price of $95.91).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.