Veralto (VLTO)

We’re cautious of Veralto. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Veralto Is Not Exciting

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

- 4.4% annual revenue growth over the last four years was slower than its industrials peers

- Anticipated sales growth of 5.6% for the next year implies demand will be shaky

- A silver lining is that its superior product capabilities and pricing power are reflected in its best-in-class gross margin of 58.5%

Veralto doesn’t meet our quality standards. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Veralto

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Veralto

At $101.29 per share, Veralto trades at 24.8x forward P/E. While valuation is appropriate for the quality you get, we’re still not buyers.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Veralto (VLTO) Research Report: Q3 CY2025 Update

Water analytics and treatment company Veralto (NYSE:VLTO) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.8% year on year to $1.40 billion. On the other hand, next quarter’s revenue guidance of $1.38 billion was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $0.99 per share was 4.6% above analysts’ consensus estimates.

Veralto (VLTO) Q3 CY2025 Highlights:

- Revenue: $1.40 billion vs analyst estimates of $1.4 billion (6.8% year-on-year growth, in line)

- Adjusted EPS: $0.99 vs analyst estimates of $0.95 (4.6% beat)

- Revenue Guidance for Q4 CY2025 is $1.38 billion at the midpoint, below analyst estimates of $1.40 billion

- Management raised its full-year Adjusted EPS guidance to $3.84 at the midpoint, a 2% increase

- Operating Margin: 23.2%, in line with the same quarter last year

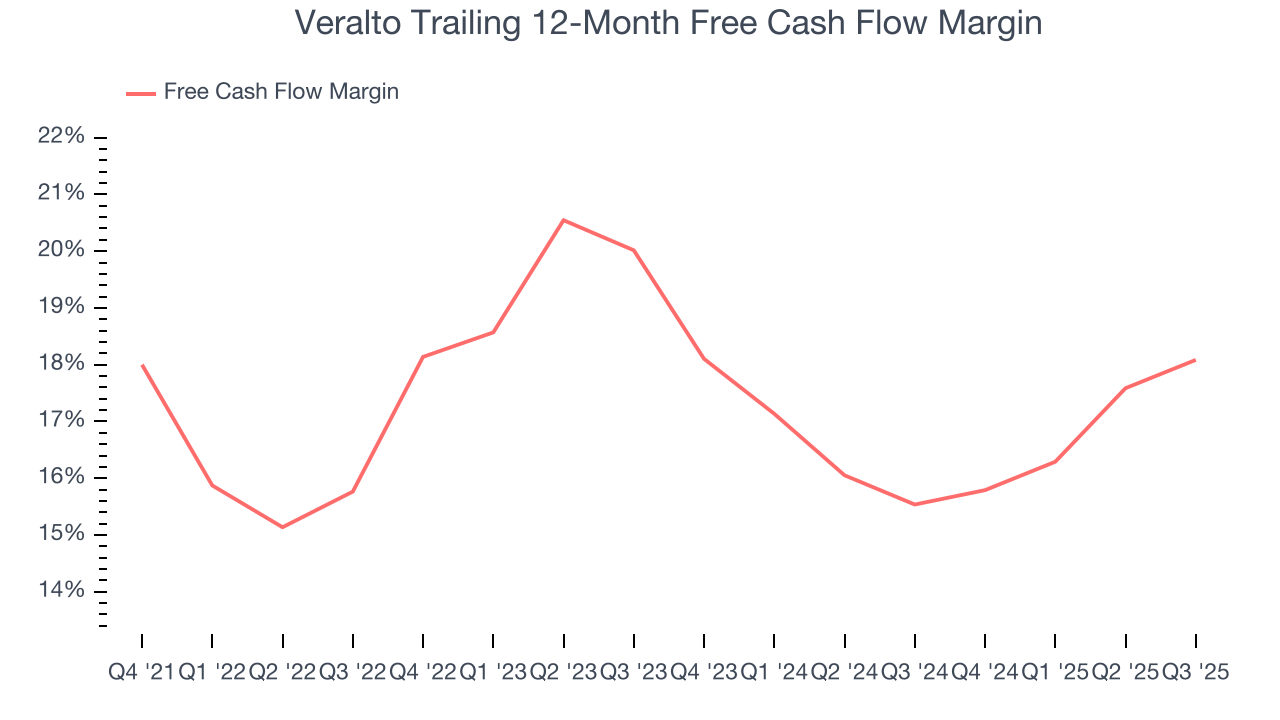

- Free Cash Flow Margin: 18.4%, up from 16.4% in the same quarter last year

- Market Capitalization: $25.84 billion

Company Overview

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

The business operates in two segments, the first of which is Water Quality. This product line helps improve the quality and reliability of water, and the company operates through multiple brands such as Hach and Trojan Technologies. Hach is best known for providing analytics that help test water quality from small community utilities to large public sector governments whereas Trojan Technologies offers UV and membrane filtration systems for water disinfection and contaminant removal.

Veralto’s second business segment is a marketing and branding business. It operates brands like Videojet, which provides printing technologies to mark and code packaged goods and consumables. Customers bring their products to market by letting Verlato mark their packaging for branding and regulatory reasons.

Veralto’s water quality segment generates most of its overall revenue by selling its water treatment products to the industrial, residential, and public sectors through long-term contracts. Recurring revenue makes up the majority of the company’s net sales due to the consumable and ongoing nature of its products.

4. Air and Water Services

Many air and water services are statutorily mandated or non-discretionary. This means recurring revenues are often earned through contracts, making for more predictable top-line trends. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. On the other hand, air and water services companies are at the whim of economic cycles. Interest rates, for example, can greatly impact manufacturing or industrial processes that drive incremental demand for these companies’ offerings.

No sizeable company offers all of the products and services Veralto offers, but some competing in intersecting areas include Rentokil Initial (NYSE:RTO), GFL Environmental (NYSE:GFL), and Rollins (NYSE:ROL).

5. Revenue Growth

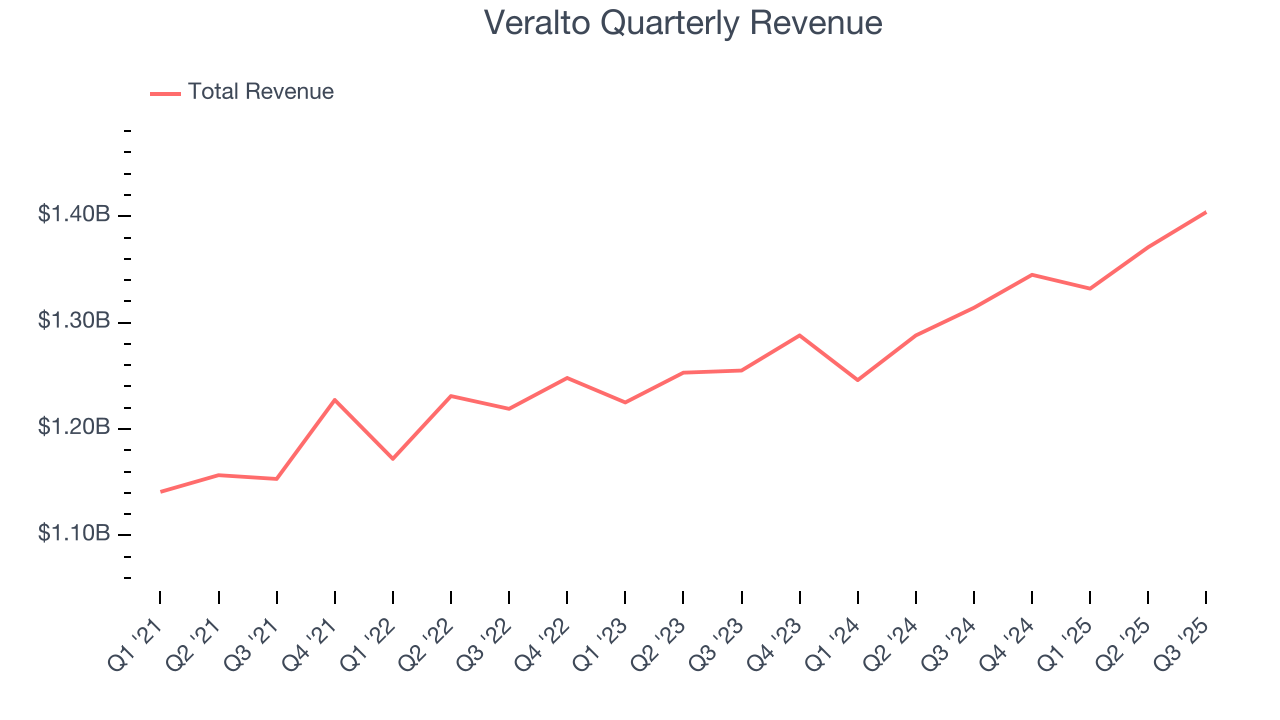

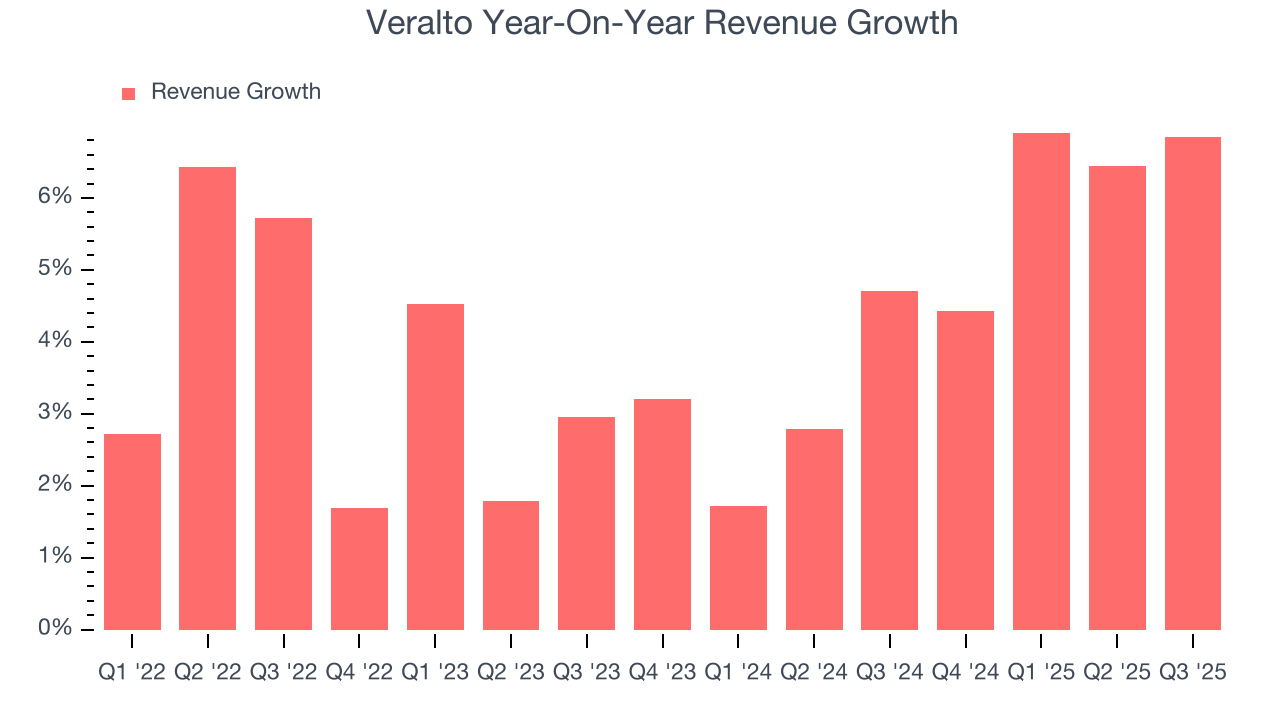

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last four years, Veralto grew its sales at a sluggish 4.4% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Veralto’s annualized revenue growth of 4.6% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

This quarter, Veralto grew its revenue by 6.8% year on year, and its $1.40 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 2.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

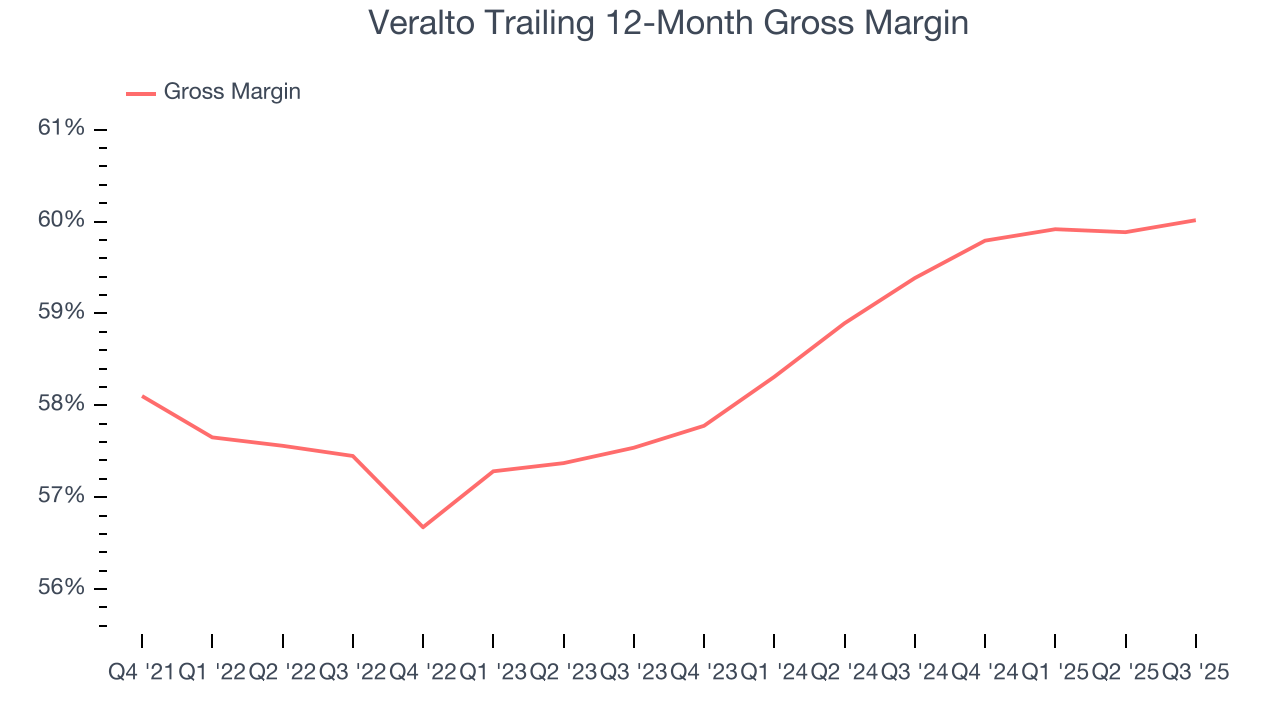

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Veralto has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 58.5% gross margin over the last five years. Said differently, roughly $58.46 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Veralto’s gross profit margin was 60.1%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

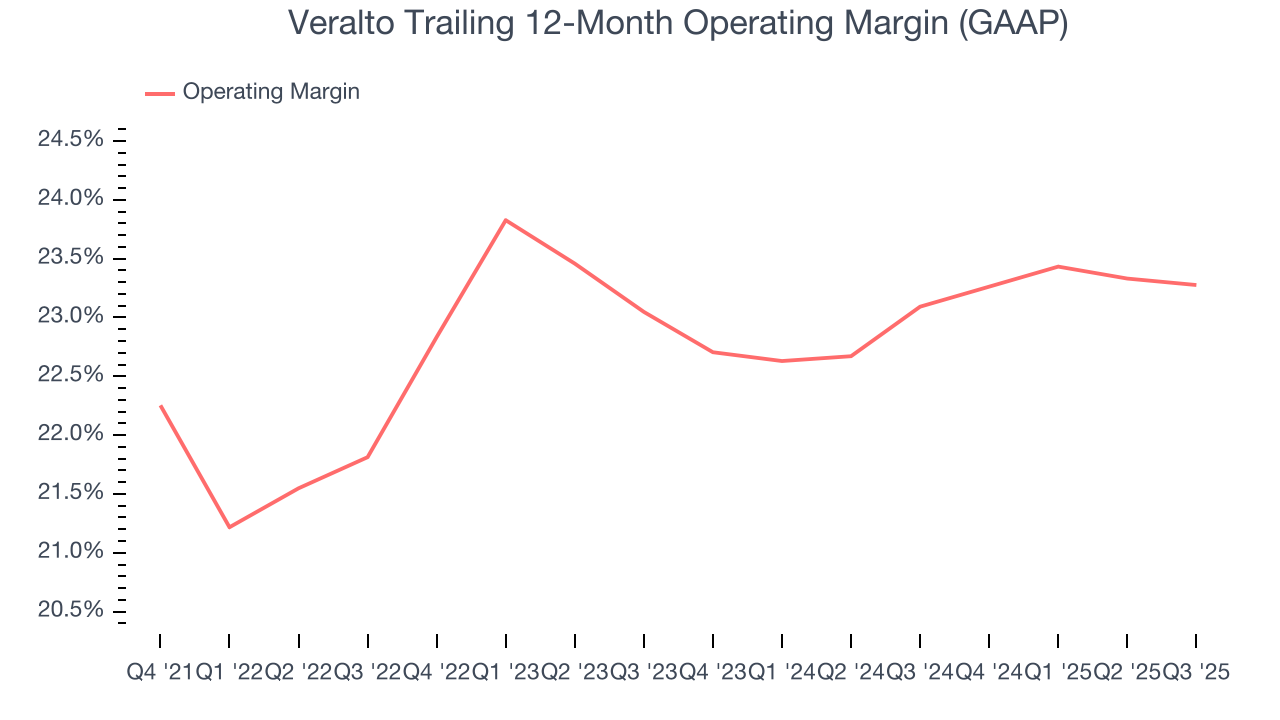

7. Operating Margin

Veralto’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 22.9% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Veralto’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with Veralto’s performance considering most Air and Water Services companies saw their margins plummet.

This quarter, Veralto generated an operating margin profit margin of 23.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Veralto has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 17.5% over the last five years.

Veralto’s free cash flow clocked in at $258 million in Q3, equivalent to a 18.4% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

9. Balance Sheet Assessment

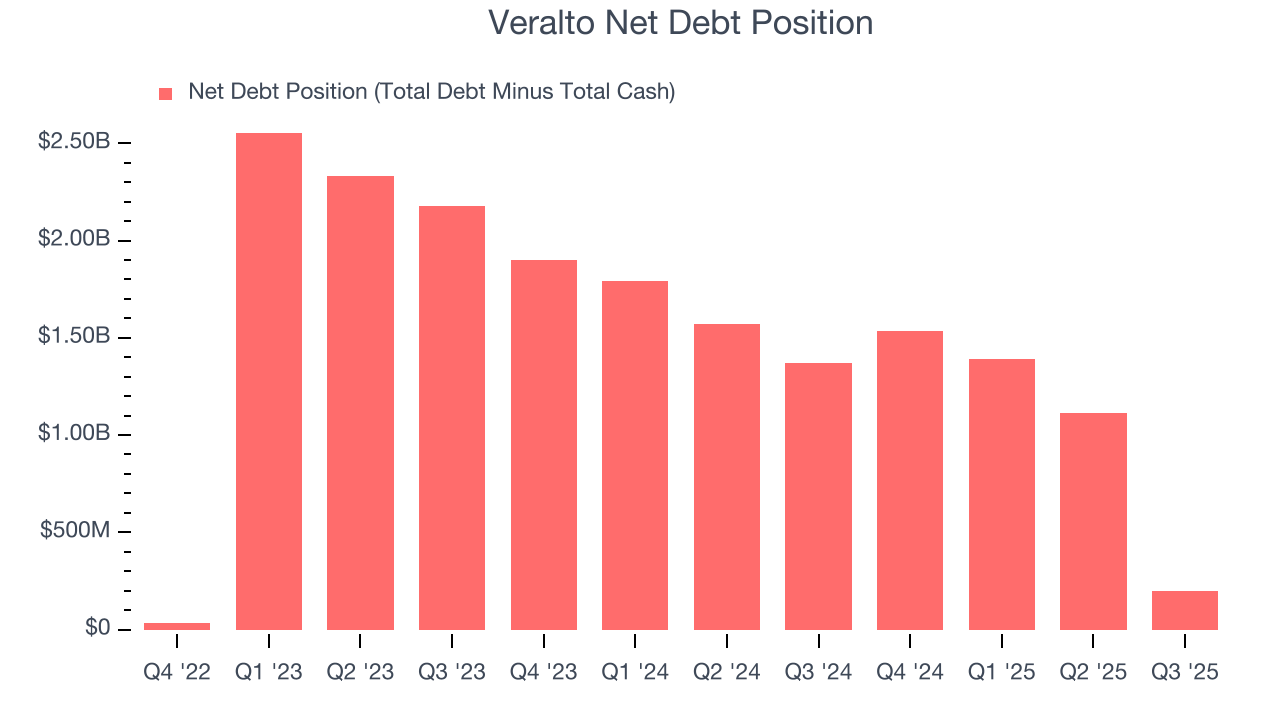

Veralto reported $1.78 billion of cash and $1.97 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.36 billion of EBITDA over the last 12 months, we view Veralto’s 0.1× net-debt-to-EBITDA ratio as safe. We also see its $104 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Veralto’s Q3 Results

It was good to see Veralto provide full-year EPS guidance that slightly beat analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print was mixed. The stock remained flat at $103 immediately following the results.

11. Is Now The Time To Buy Veralto?

Updated: January 21, 2026 at 10:17 PM EST

When considering an investment in Veralto, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Veralto isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue growth was uninspiring over the last four years.

Veralto’s P/E ratio based on the next 12 months is 24.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $114.94 on the company (compared to the current share price of $101.71).