Verizon (VZ)

Verizon keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Verizon Will Underperform

Formed in 1984 as Bell Atlantic after the breakup of Bell System into seven companies, Verizon (NYSE:VZ) is a telecom giant providing a range of communications and internet services.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 1.4% over the last five years was below our standards for the consumer discretionary sector

- Earnings per share were flat over the last five years while its revenue grew, showing its incremental sales were less profitable

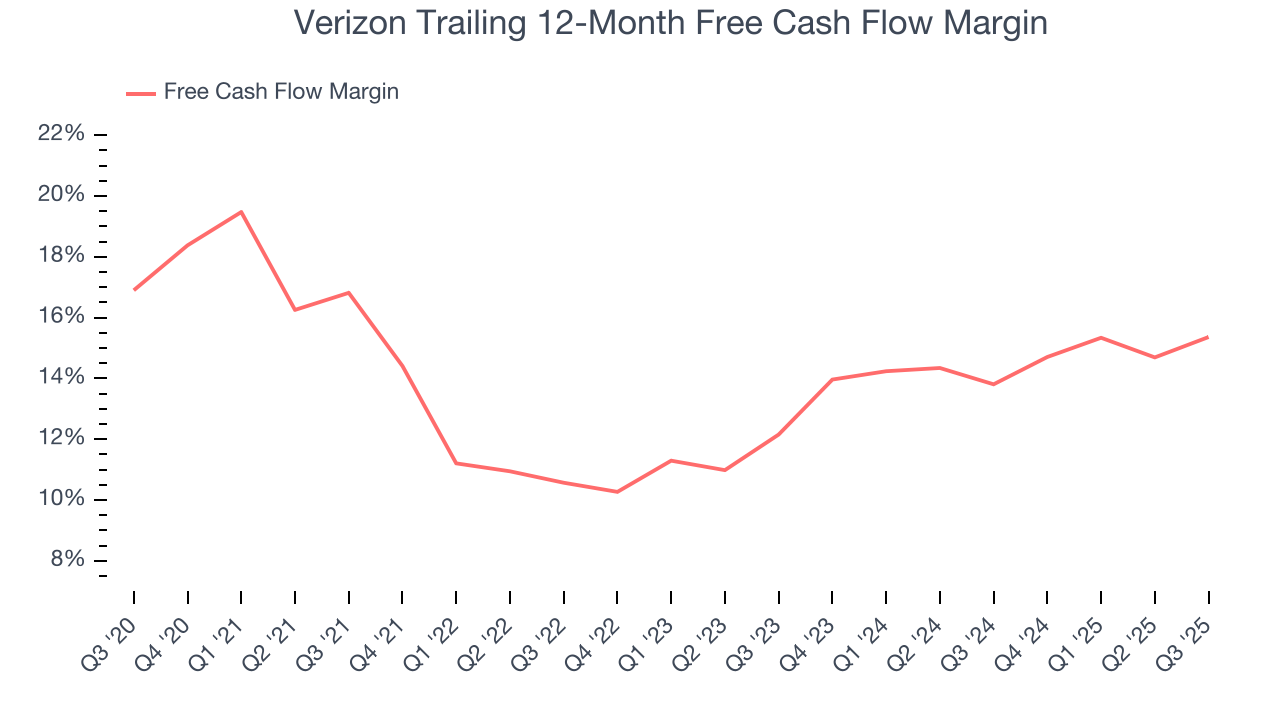

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Verizon doesn’t meet our quality criteria. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Verizon

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Verizon

At $39.51 per share, Verizon trades at 8.4x forward P/E. Verizon’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Verizon (VZ) Research Report: Q3 CY2025 Update

Telecommunications giant Verizon (NYSE:VZ) missed Wall Street’s revenue expectations in Q3 CY2025 as sales only rose 1.5% year on year to $33.82 billion. Its non-GAAP profit of $1.21 per share was 1.5% above analysts’ consensus estimates.

Verizon (VZ) Q3 CY2025 Highlights:

- Revenue: $33.82 billion vs analyst estimates of $34.23 billion (1.5% year-on-year growth, 1.2% miss)

- Adjusted EPS: $1.21 vs analyst estimates of $1.19 (1.5% beat)

- Adjusted EBITDA: $12.78 billion vs analyst estimates of $12.73 billion (37.8% margin, in line)

- Operating Margin: 24%, up from 17.8% in the same quarter last year

- Free Cash Flow Margin: 20.6%, up from 17.9% in the same quarter last year

- Market Capitalization: $165.8 billion

Company Overview

Formed in 1984 as Bell Atlantic after the breakup of Bell System into seven companies, Verizon (NYSE:VZ) is a telecom giant providing a range of communications and internet services.

In 2000, Bell Atlantic acquired GTE, a telecomm company with a footprint where Bell wasn’t. The combined company changed its name to Verizon, a combination of of veritas (Latin for "truth") and horizon. One more recent major acquisition was TracFone in 2021 TracFone is a leading provider of prepaid wireless services in the US, and it added roughly 20 million subscribers to Verizon's base, which is why you'll see a big jump in the customer chart below.

Verizon’s offerings range from wireless voice and data services to high-speed internet products. For example, its flagship wireless service provides nationwide 5G voice, data, and mobile broadband services sold to both consumers and businesses. Verizon also offers Fios, its fiber-optic internet, TV, and phone service, primarily catering to residential users. The company also provides network and communications solutions for businesses, including Internet of Things (IoT) connectivity, cybersecurity, and cloud services.

Verizon generates the majority of its revenue through subscription-based services, particularly from its wireless business. Customers pay monthly fees for access to mobile networks, data plans, and bundled services. This recurring revenue model provides consistent cash flow for the company. In addition, Verizon makes money from the sale of devices such as smartphones and tablets, often bundled with service plans, though the margin on these products is lower compared to its service revenue. Business services, such as cloud and security solutions, also contribute to Verizon’s revenue, particularly in enterprise segments.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the telecommunications industry include AT&T (NYSE:T), T-Mobile (NASDAQ:TMUS), and Comcast (NASDAQ:CMCSA).

5. Revenue Growth

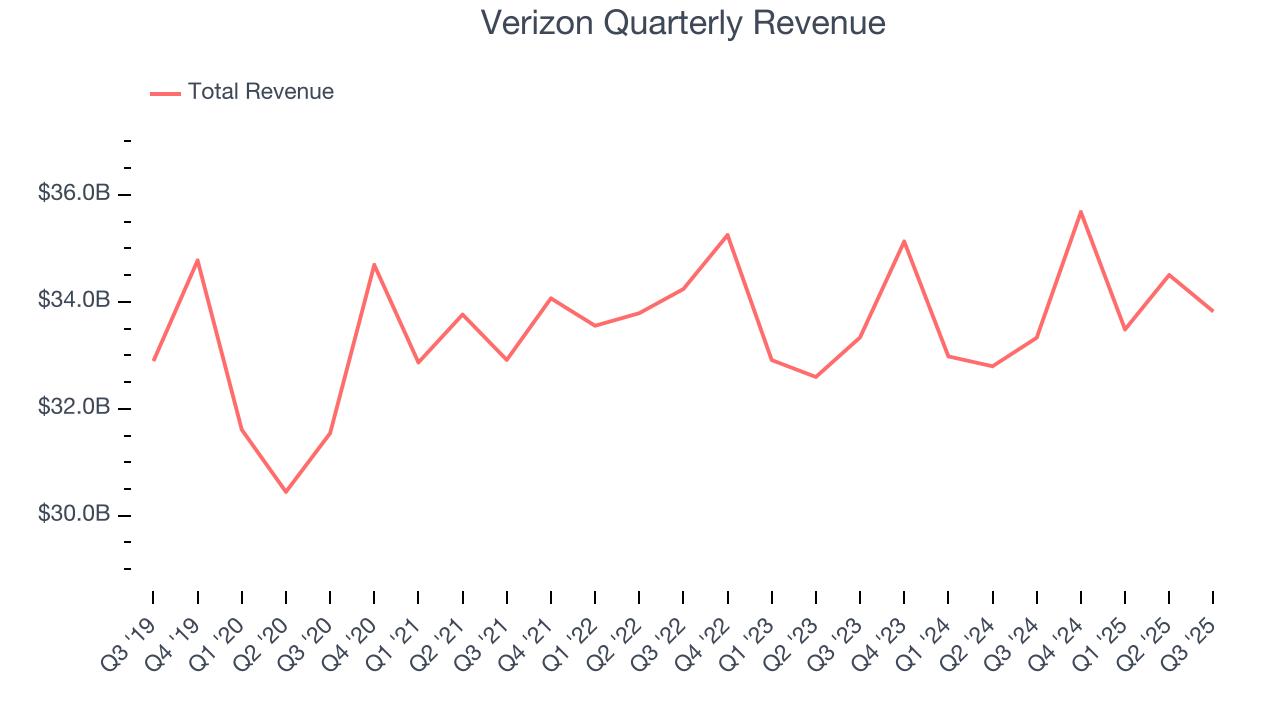

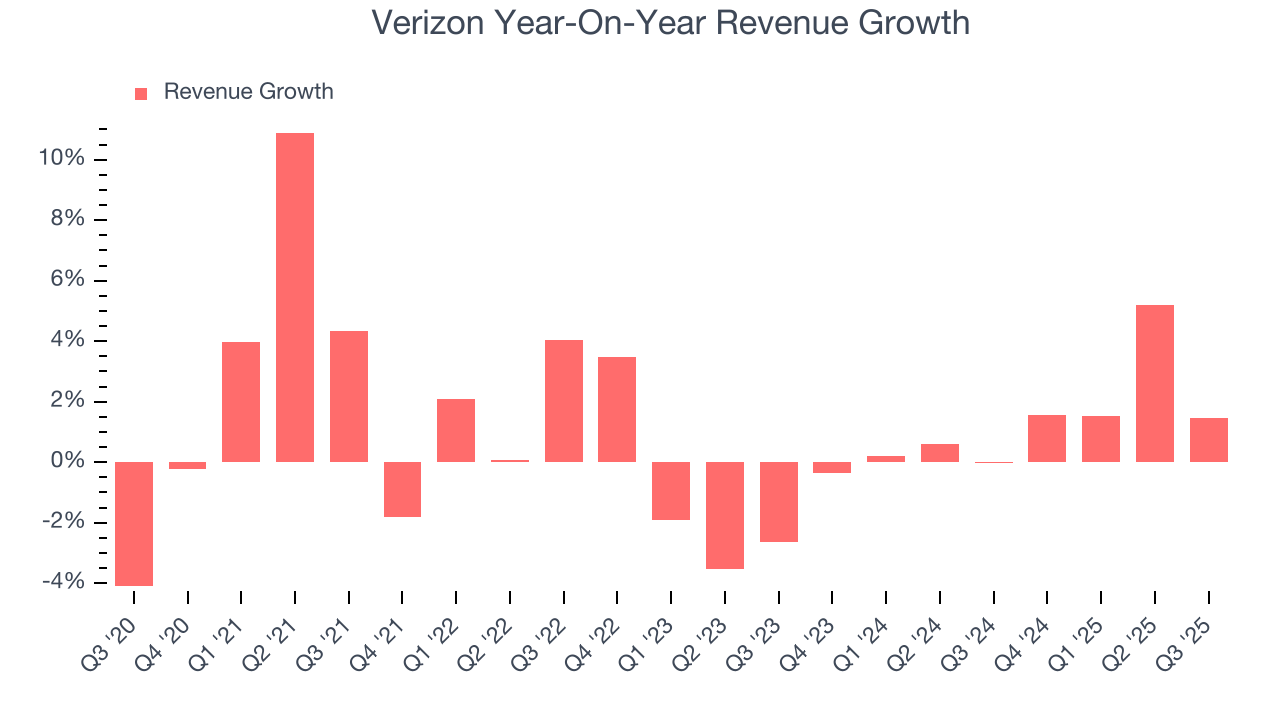

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Verizon grew its sales at a weak 1.4% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Verizon’s annualized revenue growth of 1.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Verizon’s revenue grew by 1.5% year on year to $33.82 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

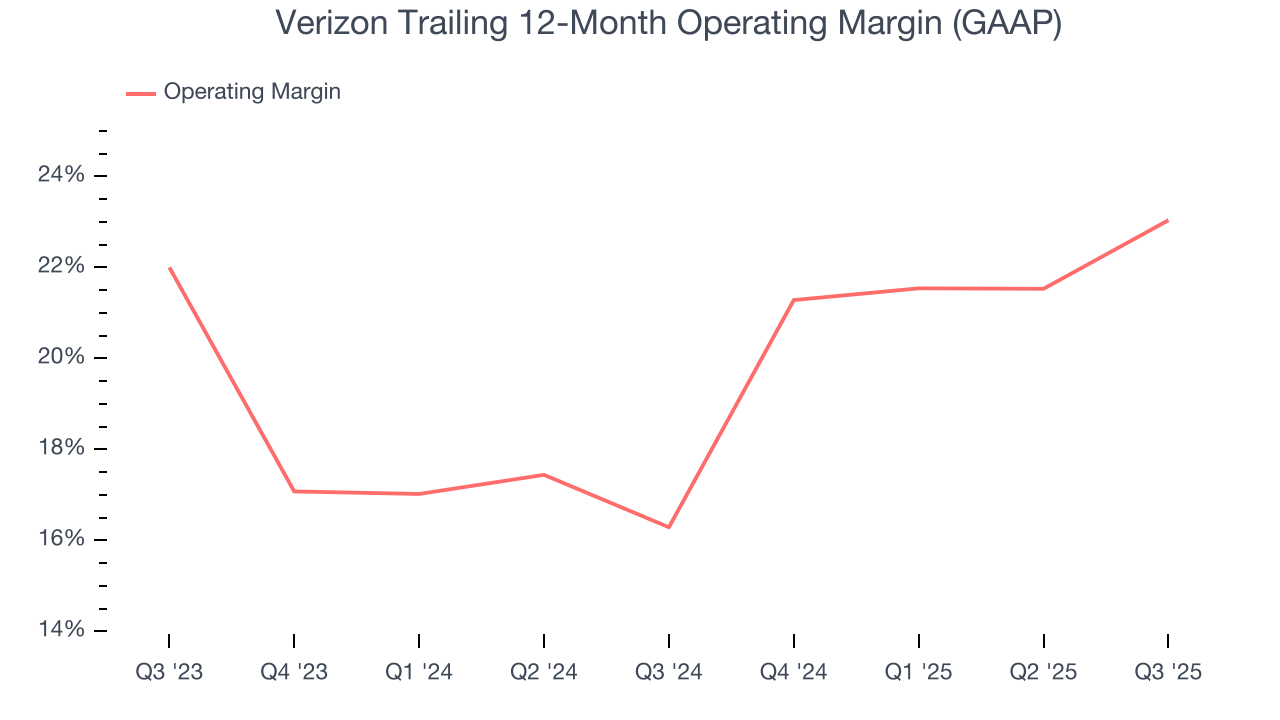

6. Operating Margin

Verizon’s operating margin has risen over the last 12 months and averaged 19.7% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Verizon generated an operating margin profit margin of 24%, up 6.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

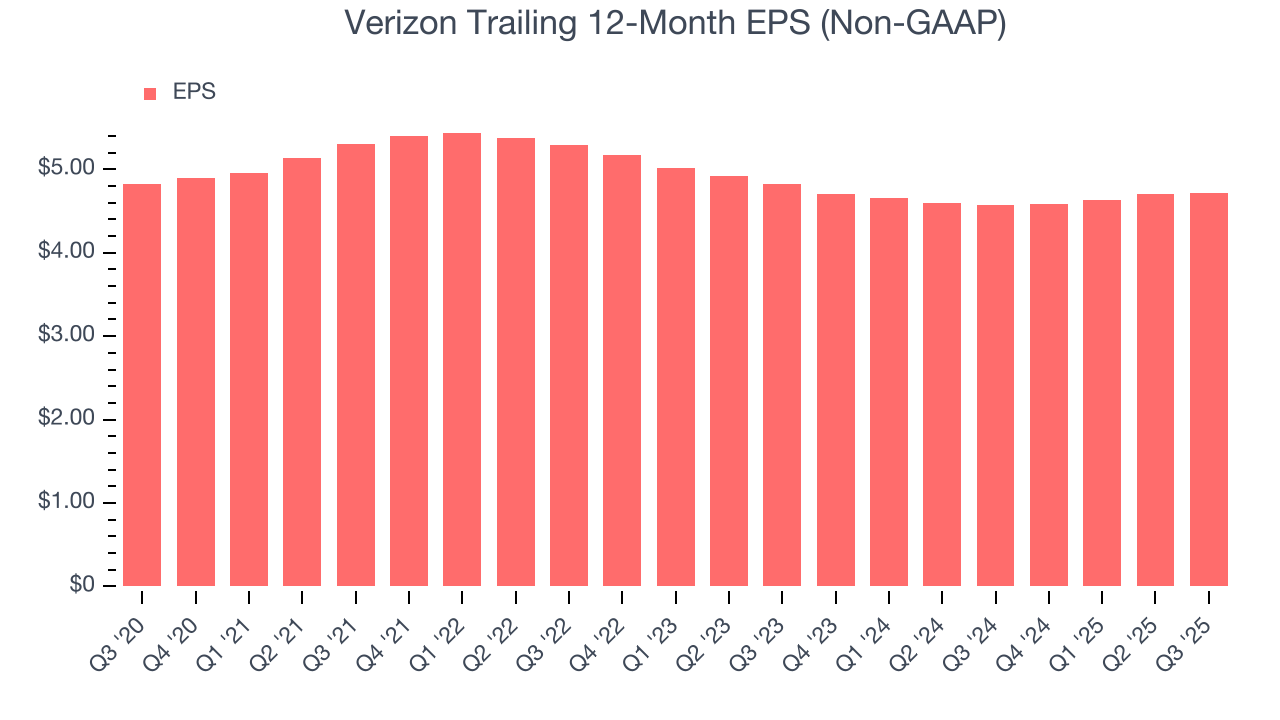

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Verizon’s flat EPS over the last five years was below its 1.4% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q3, Verizon reported adjusted EPS of $1.21, up from $1.19 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Verizon’s full-year EPS of $4.72 to grow 1.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Verizon has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 14.6% over the last two years, better than the broader consumer discretionary sector.

Verizon’s free cash flow clocked in at $6.96 billion in Q3, equivalent to a 20.6% margin. This result was good as its margin was 2.7 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts’ consensus estimates show they’re expecting Verizon’s free cash flow margin of 15.4% for the last 12 months to remain the same.

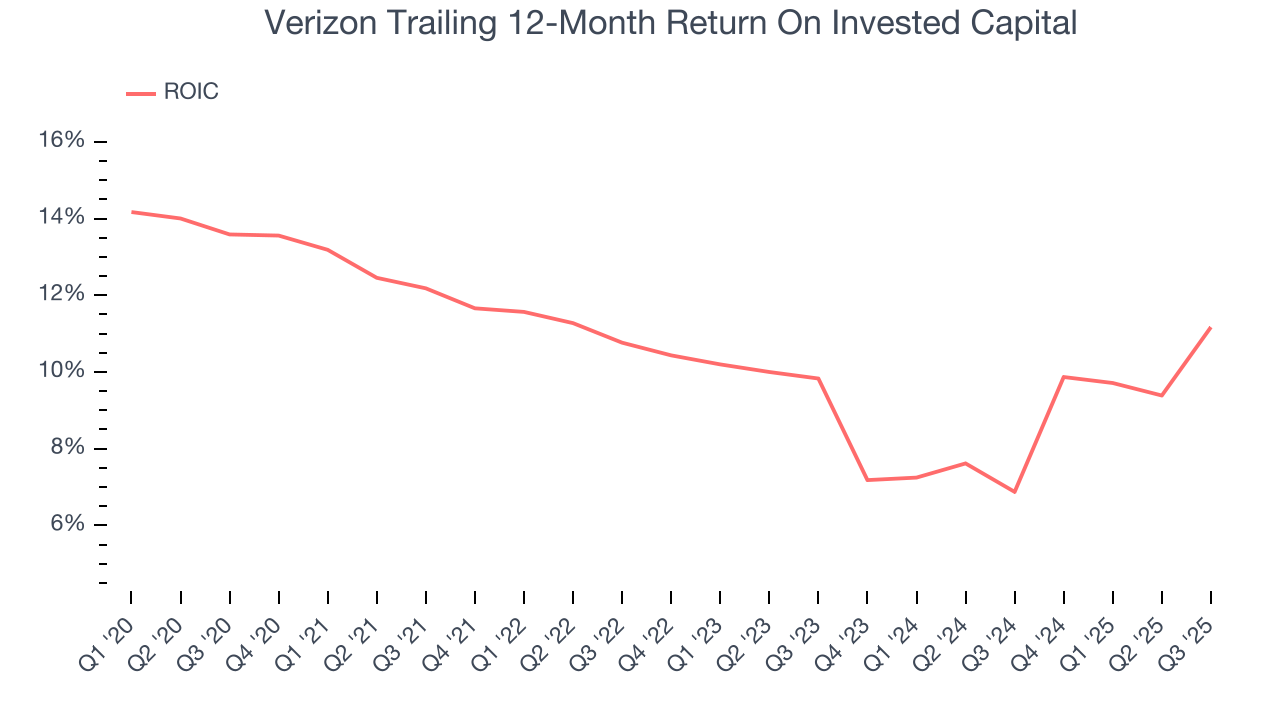

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Verizon historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Verizon’s ROIC decreased by 2.5 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

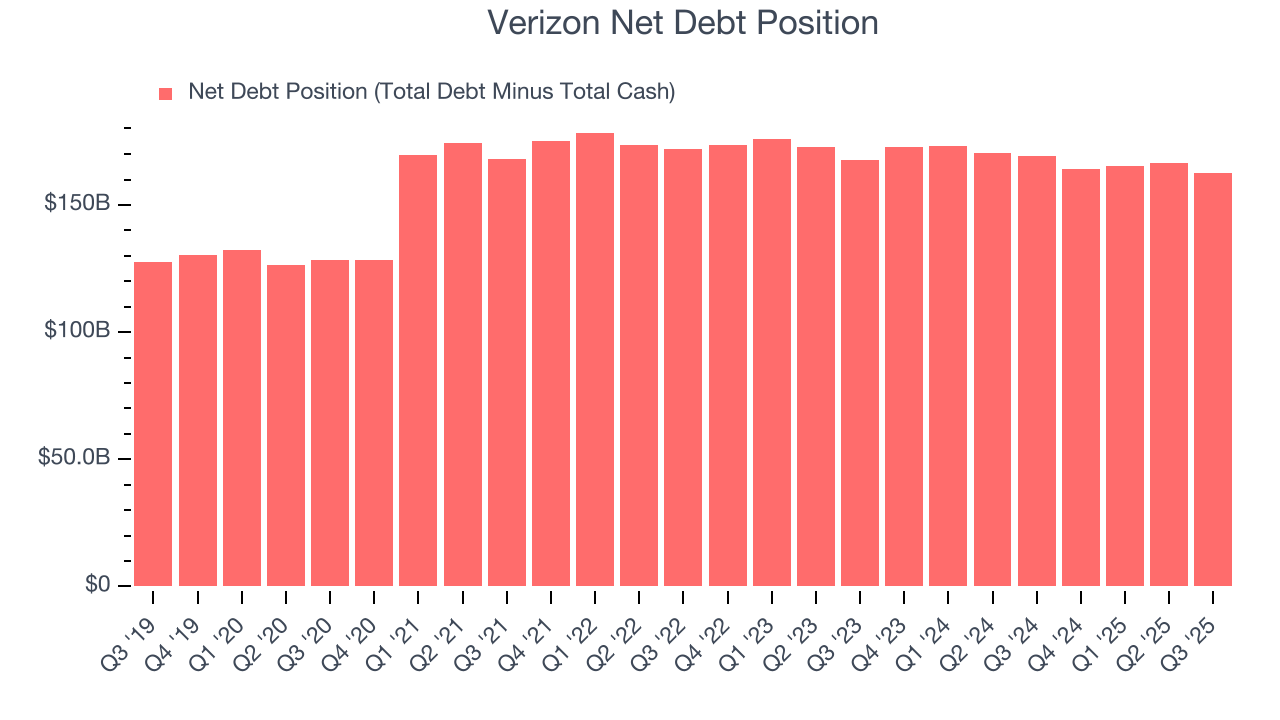

10. Balance Sheet Assessment

Verizon reported $7.71 billion of cash and $170.5 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $50.06 billion of EBITDA over the last 12 months, we view Verizon’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $6.38 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Verizon’s Q3 Results

Revenue missed, but EPS managed to beat as the company lifted operating margin year on year. Overall, this was a mixed quarter. The stock traded up 2.8% to $40.41 immediately following the results.

12. Is Now The Time To Buy Verizon?

Updated: January 23, 2026 at 10:34 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Verizon, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies serving everyday consumers, but in the case of Verizon, we’ll be cheering from the sidelines. First off, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. On top of that, Verizon’s Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion, and its .

Verizon’s P/E ratio based on the next 12 months is 8.4x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $47.11 on the company (compared to the current share price of $39.51).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.