Waste Connections (WCN)

Waste Connections doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why Waste Connections Is Not Exciting

Operating a network of municipal solid waste landfills in the U.S. and Canada, Waste Connections (NYSE:WCN) is North America's third-largest waste management company providing collection, disposal, and recycling services.

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its shrinking returns suggest its past profit sources are losing steam

- Estimated sales growth of 5.3% for the next 12 months implies demand will slow from its two-year trend

- On the plus side, its powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

Waste Connections doesn’t meet our quality criteria. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Waste Connections

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Waste Connections

At $164.25 per share, Waste Connections trades at 30.5x forward P/E. Not only does Waste Connections trade at a premium to companies in the industrials space, but this multiple is also high for its fundamentals.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Waste Connections (WCN) Research Report: Q3 CY2025 Update

Waste management company Waste Connections (NYSE:WCN) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.1% year on year to $2.46 billion. Its non-GAAP profit of $1.44 per share was 4.3% above analysts’ consensus estimates.

Waste Connections (WCN) Q3 CY2025 Highlights:

- Revenue: $2.46 billion vs analyst estimates of $2.45 billion (5.1% year-on-year growth, in line)

- Adjusted EPS: $1.44 vs analyst estimates of $1.38 (4.3% beat)

- All full-year guidance was maintained from what was given in July

- Operating Margin: 17.9%, down from 20.3% in the same quarter last year

- Free Cash Flow Margin: 15.5%, up from 12.2% in the same quarter last year

- Market Capitalization: $44.74 billion

Company Overview

Operating a network of municipal solid waste landfills in the U.S. and Canada, Waste Connections (NYSE:WCN) is North America's third-largest waste management company providing collection, disposal, and recycling services.

Waste Connections handles the entire waste management lifecycle, from collection to disposal or recycling. The company serves a diverse customer base including residential households, commercial businesses, industrial facilities, municipalities, and oil and gas producers. Its operations are typically secured through long-term arrangements such as governmental certificates, exclusive franchise agreements, and municipal contracts that provide stable, recurring revenue streams.

The company's landfill network forms the backbone of its integrated waste management system. With an estimated average remaining capacity of 31 years across its owned and operated landfills, Waste Connections has substantial long-term disposal assets. Many of these sites have potential for expanded capacity beyond current permits, providing growth opportunities as market conditions evolve.

A residential customer might have their household waste collected weekly by Waste Connections trucks, which then transport the material to one of the company's transfer stations where it's consolidated before being moved to a landfill for final disposal. Meanwhile, recyclable materials are separated and processed at dedicated facilities before being sold to third-party manufacturers who convert them into new products.

Beyond traditional waste services, Waste Connections has diversified into environmental solutions like landfill gas recovery. At 59 of its landfills, the company captures methane generated by decomposing waste and converts it into renewable energy. Some projects produce electricity sold to utilities, while others upgrade the gas to pipeline quality for sale to natural gas companies.

The company also provides specialized services for the oil and natural gas industry through its exploration and production (E&P) waste management operations. These services include the treatment, recovery and disposal of drilling fluids, completion fluids, produced water, and contaminated soils from drilling sites. At certain facilities, Waste Connections even processes recovered crude oil for customers, providing terminal access to transport the oil to market.

Waste Connections pursues growth through both organic expansion and strategic acquisitions, allowing it to extend its geographic footprint and service offerings across North America.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Waste Connections competes primarily with other large publicly-traded waste management companies including Waste Management, Inc. (NYSE: WM), Republic Services, Inc. (NYSE: RSG), and GFL Environmental, Inc. (NYSE: GFL). In its E&P waste business, competitors include Clean Harbors, Inc. (NYSE: CLH) and various regional private companies.

5. Revenue Growth

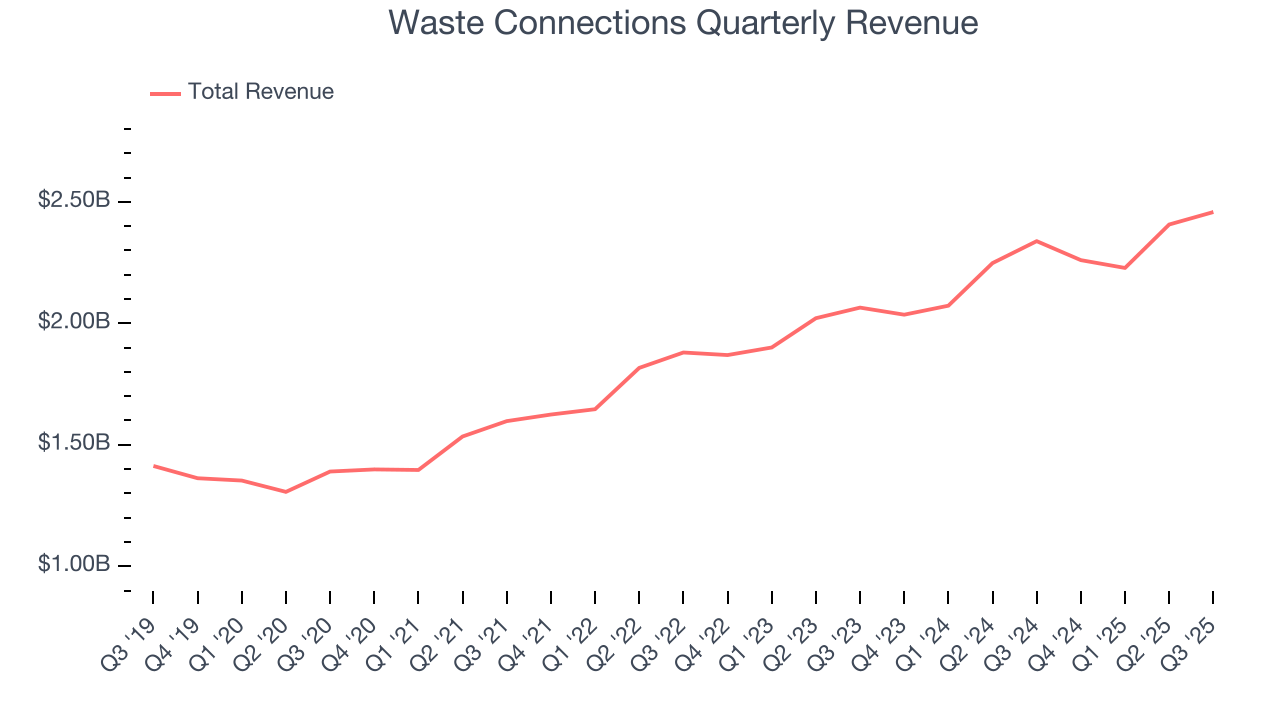

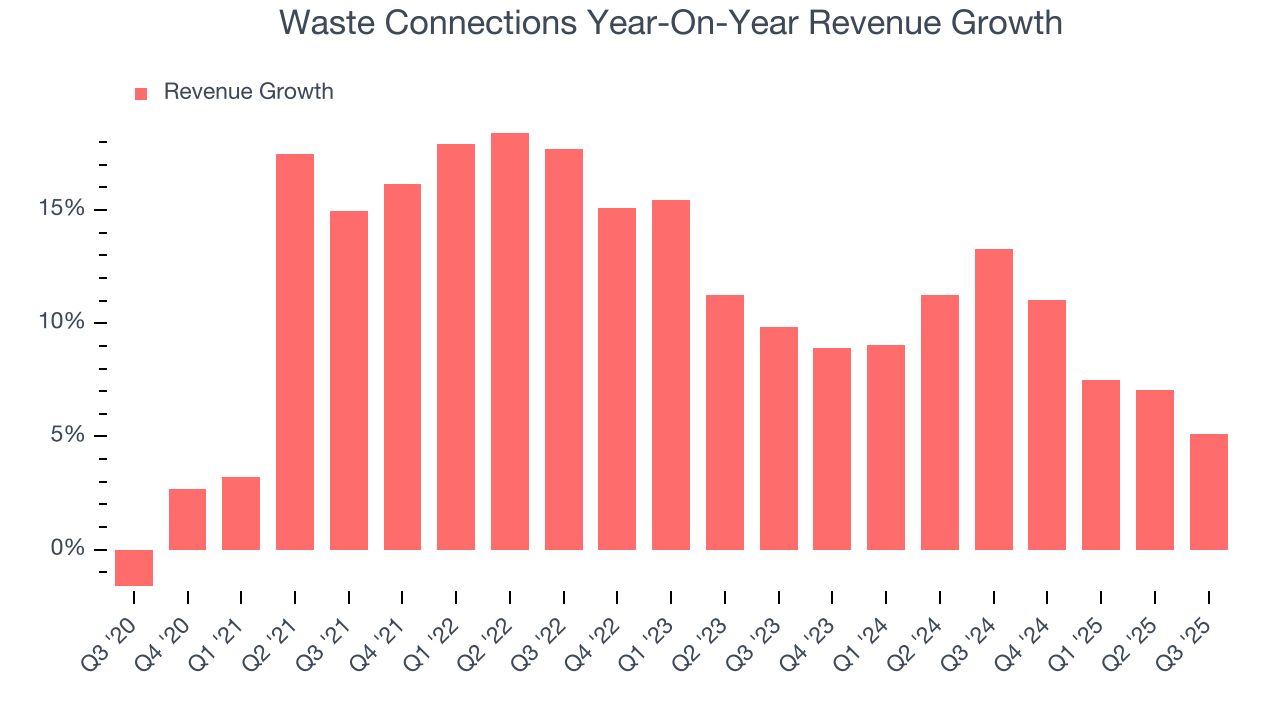

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Waste Connections’s sales grew at an impressive 11.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Waste Connections’s annualized revenue growth of 9.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Waste Connections grew its revenue by 5.1% year on year, and its $2.46 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

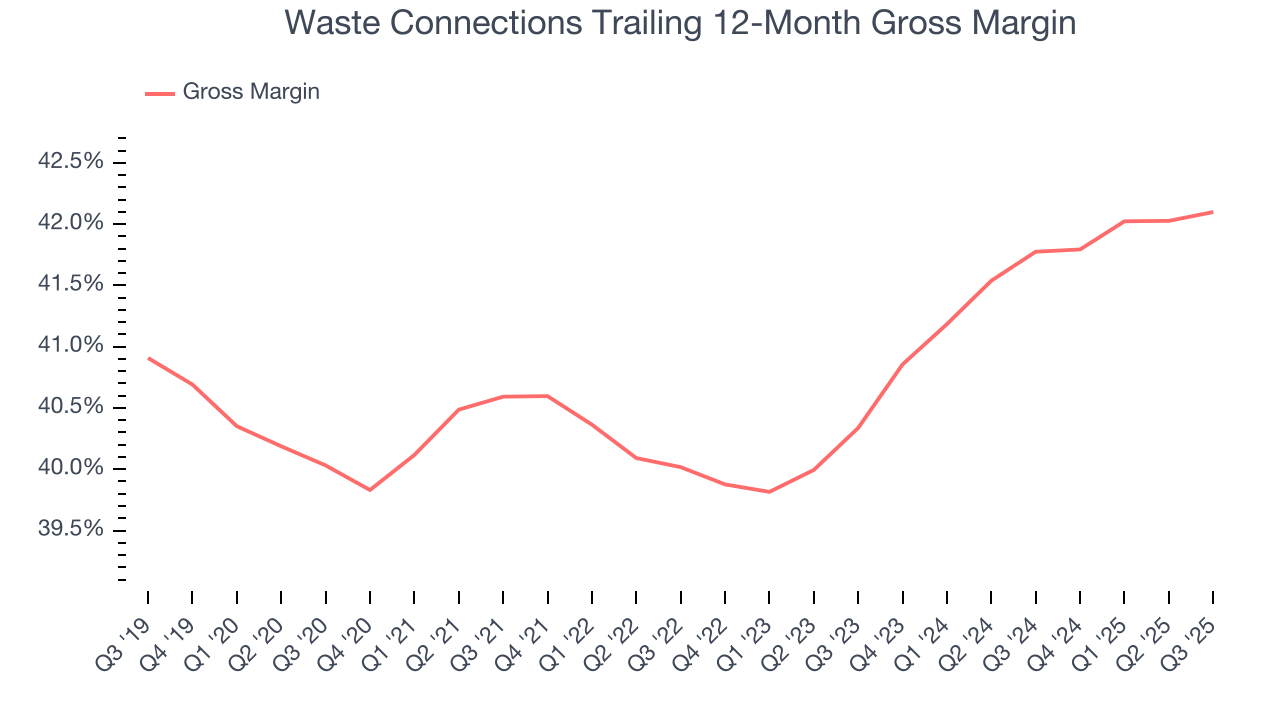

Waste Connections’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 41.1% gross margin over the last five years. Said differently, roughly $41.07 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Waste Connections’s gross profit margin was 42.8%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

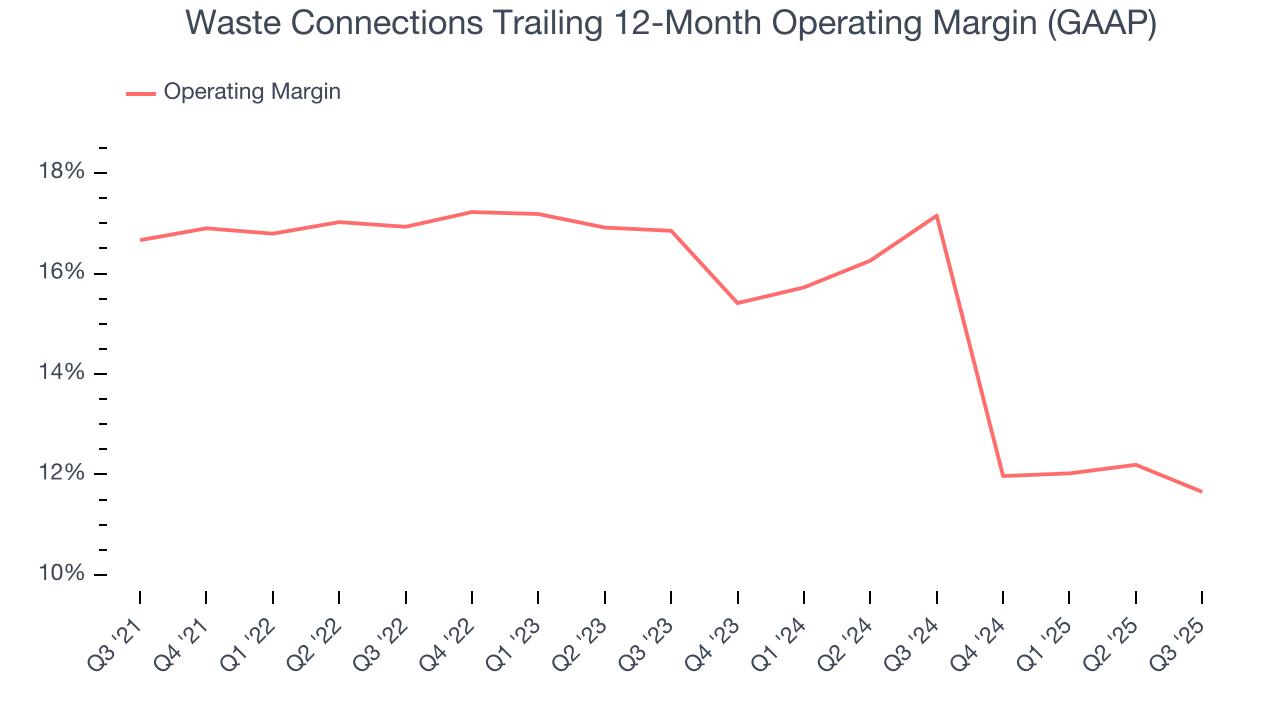

Waste Connections has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 15.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Waste Connections’s operating margin decreased by 5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Waste Connections generated an operating margin profit margin of 17.9%, down 2.4 percentage points year on year. Since Waste Connections’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

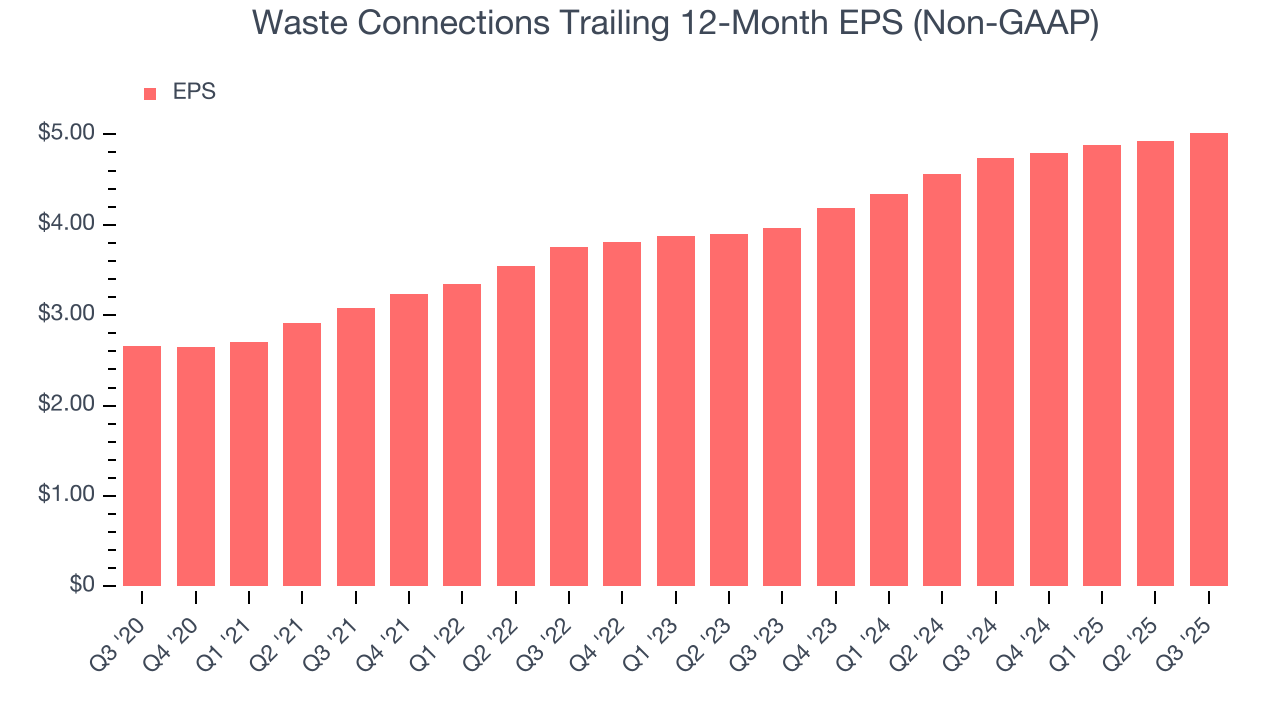

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Waste Connections’s remarkable 13.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Waste Connections, its two-year annual EPS growth of 12.4% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Waste Connections reported adjusted EPS of $1.44, up from $1.35 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Waste Connections’s full-year EPS of $5.02 to grow 10.8%.

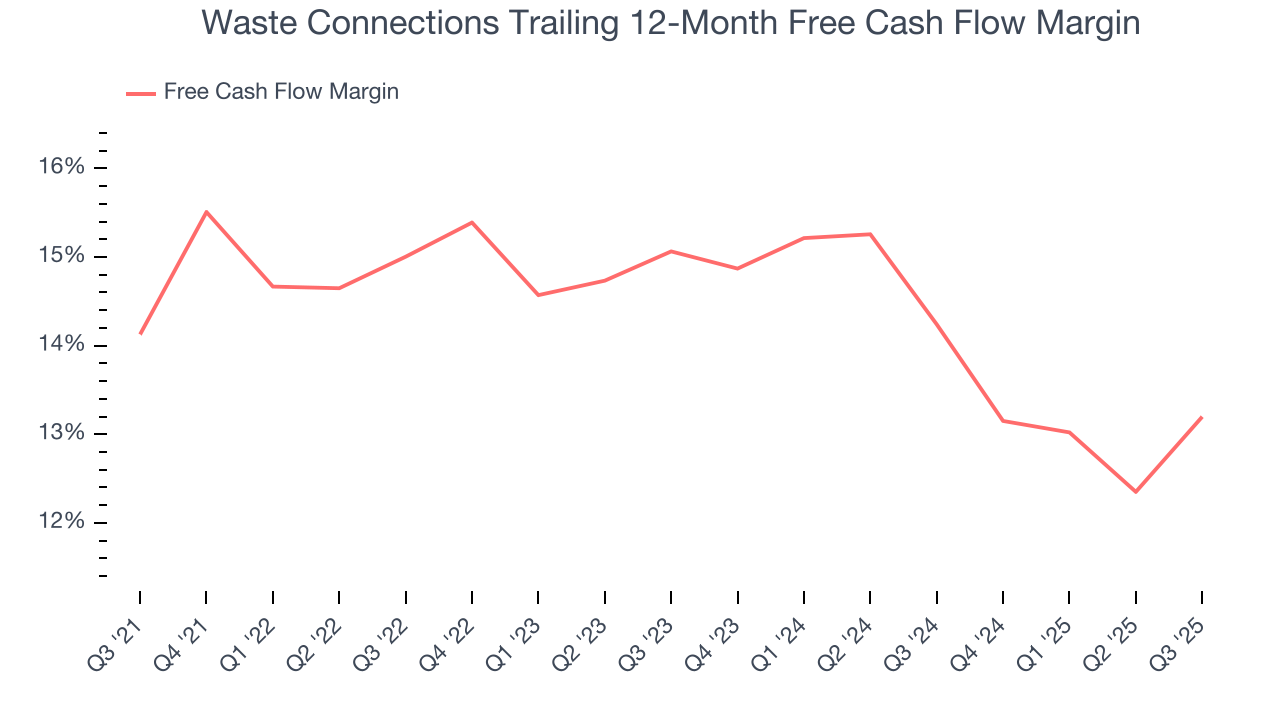

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Waste Connections has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 14.3% over the last five years.

Waste Connections’s free cash flow clocked in at $380.3 million in Q3, equivalent to a 15.5% margin. This result was good as its margin was 3.2 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

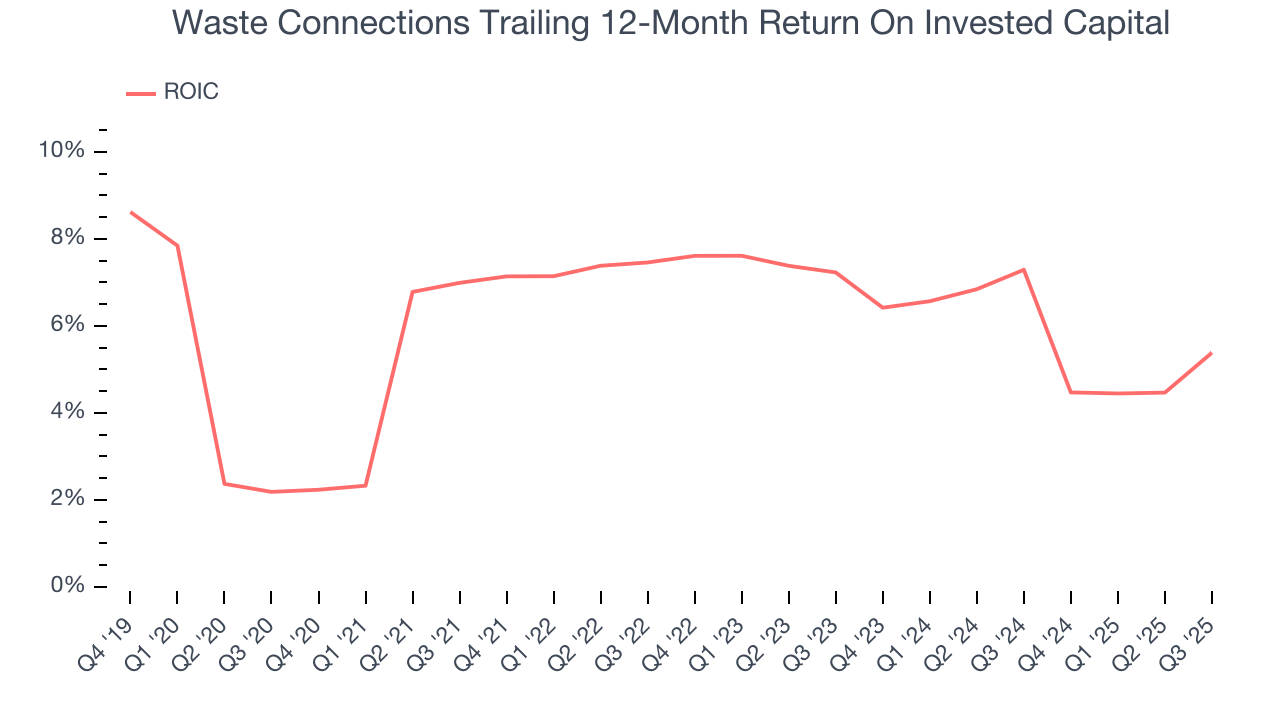

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Waste Connections historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.9%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Waste Connections’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

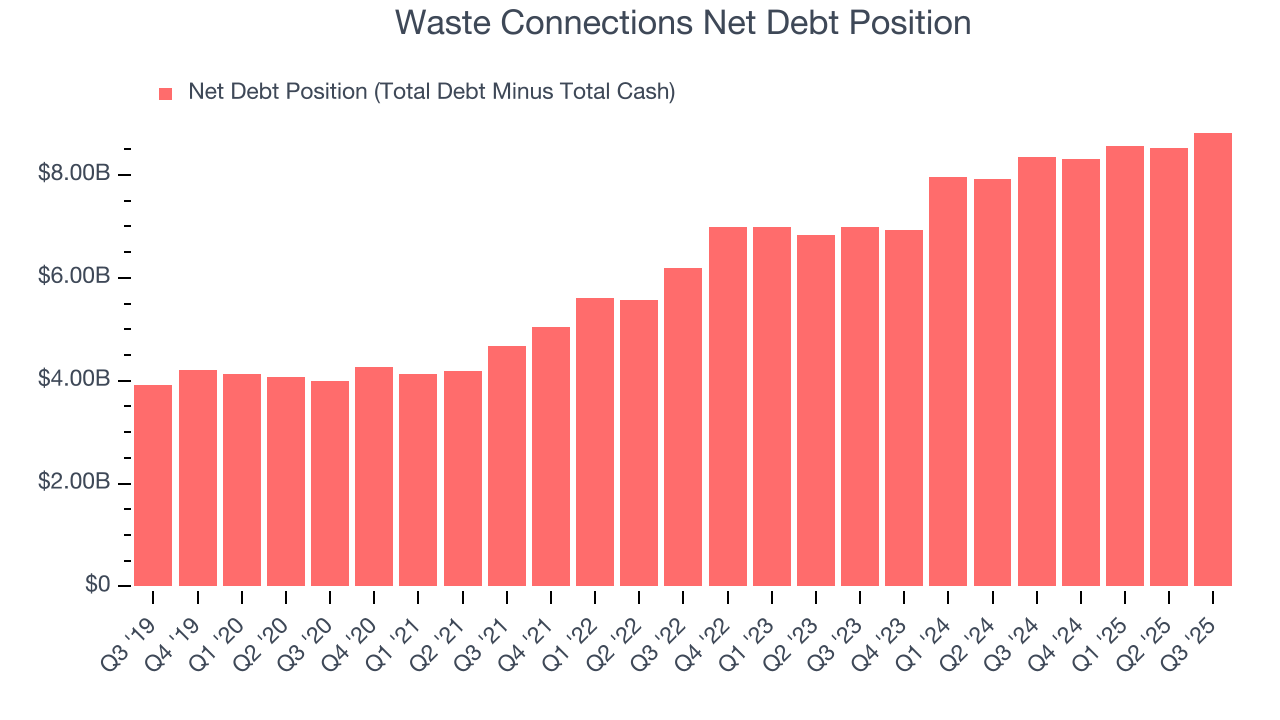

11. Balance Sheet Assessment

Waste Connections reported $117.6 million of cash and $8.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.99 billion of EBITDA over the last 12 months, we view Waste Connections’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $160.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Waste Connections’s Q3 Results

It was good to see Waste Connections beat analysts’ EPS expectations this quarter on in-line revenue. Looking ahead, full-year guidance was maintained from what was given previously. Overall, this quarter didn't have many surprises, good or bad. The stock remained flat at $175 immediately after reporting.

13. Is Now The Time To Buy Waste Connections?

Updated: January 20, 2026 at 11:13 PM EST

Before making an investment decision, investors should account for Waste Connections’s business fundamentals and valuation in addition to what happened in the latest quarter.

Waste Connections isn’t a bad business, but we’re not clamoring to buy it here and now. First off, its revenue growth was impressive over the last five years. And while Waste Connections’s declining operating margin shows the business has become less efficient, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Waste Connections’s P/E ratio based on the next 12 months is 30.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $204.46 on the company (compared to the current share price of $164.25).