WideOpenWest (WOW)

WideOpenWest is up against the odds. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think WideOpenWest Will Underperform

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

- Sales tumbled by 12.3% annually over the last five years, showing consumer trends are working against its favor

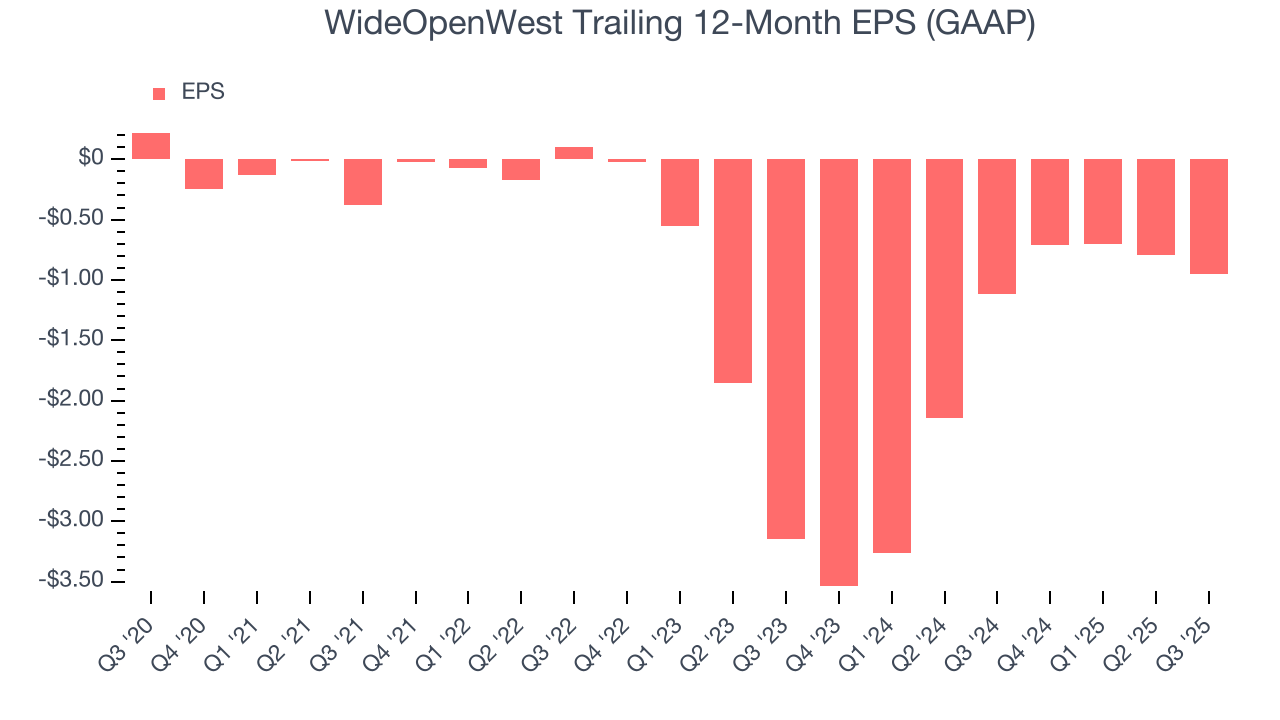

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 44.5% annually, worse than its revenue

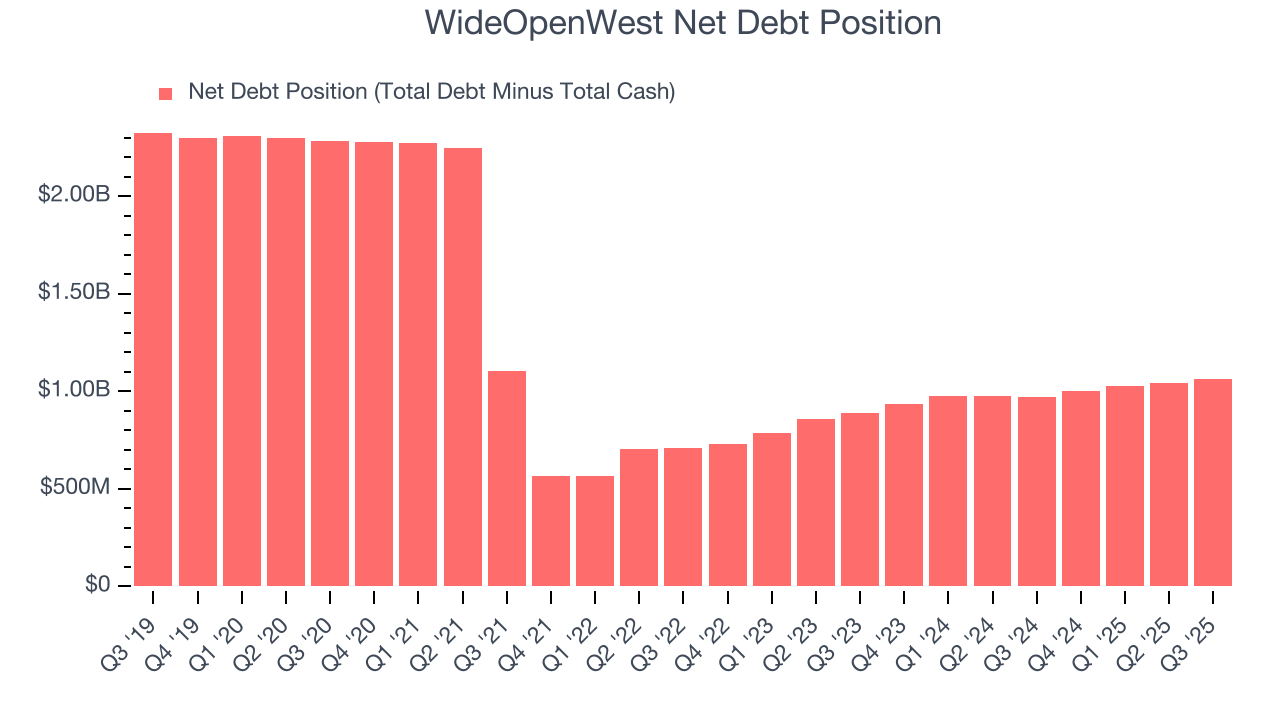

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

WideOpenWest’s quality is not up to our standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than WideOpenWest

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WideOpenWest

WideOpenWest is trading at $5.19 per share, or 1.7x forward EV-to-EBITDA. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. WideOpenWest (WOW) Research Report: Q3 CY2025 Update

Broadband and telecommunications services provider WideOpenWest (NYSE:WOW) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 8.9% year on year to $144 million. Its GAAP loss of $0.43 per share was significantly below analysts’ consensus estimates.

WideOpenWest (WOW) Q3 CY2025 Highlights:

- Revenue: $144 million vs analyst estimates of $142.4 million (8.9% year-on-year decline, 1.1% beat)

- EPS (GAAP): -$0.43 vs analyst estimates of -$0.16 (significant miss)

- Adjusted EBITDA: $68.8 million vs analyst estimates of $70.54 million (47.8% margin, 2.5% miss)

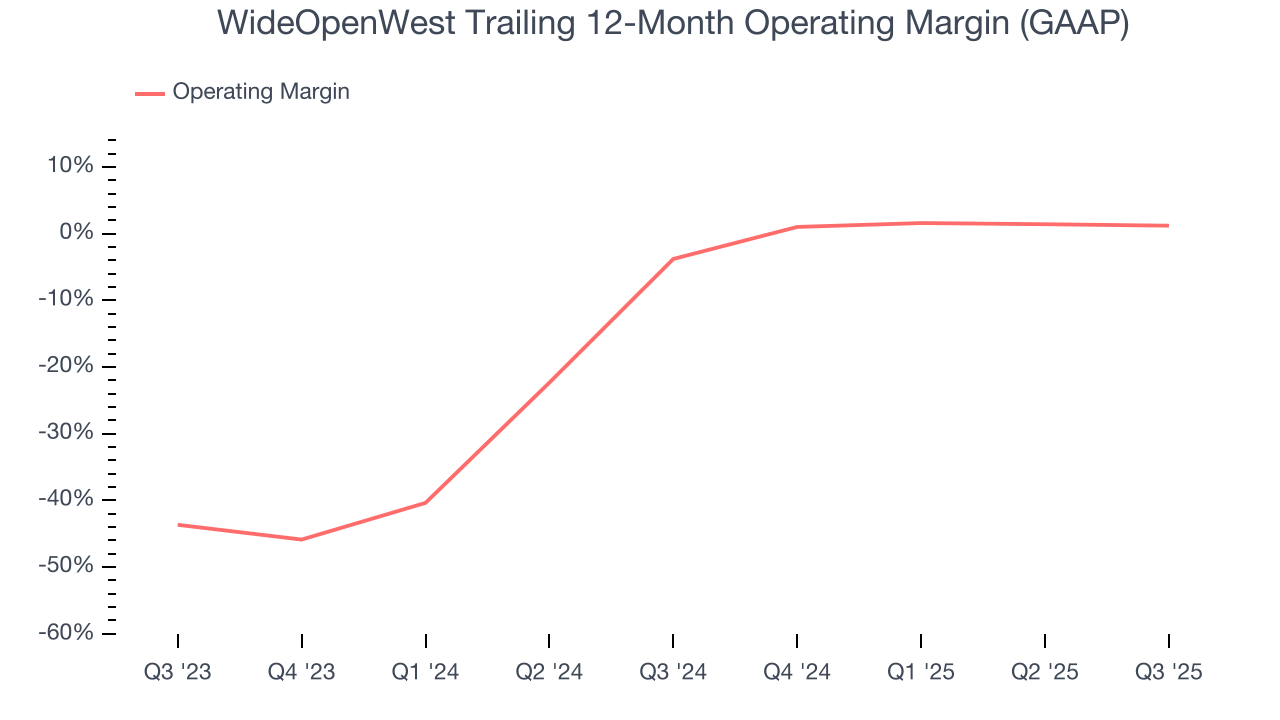

- Operating Margin: 0.6%, in line with the same quarter last year

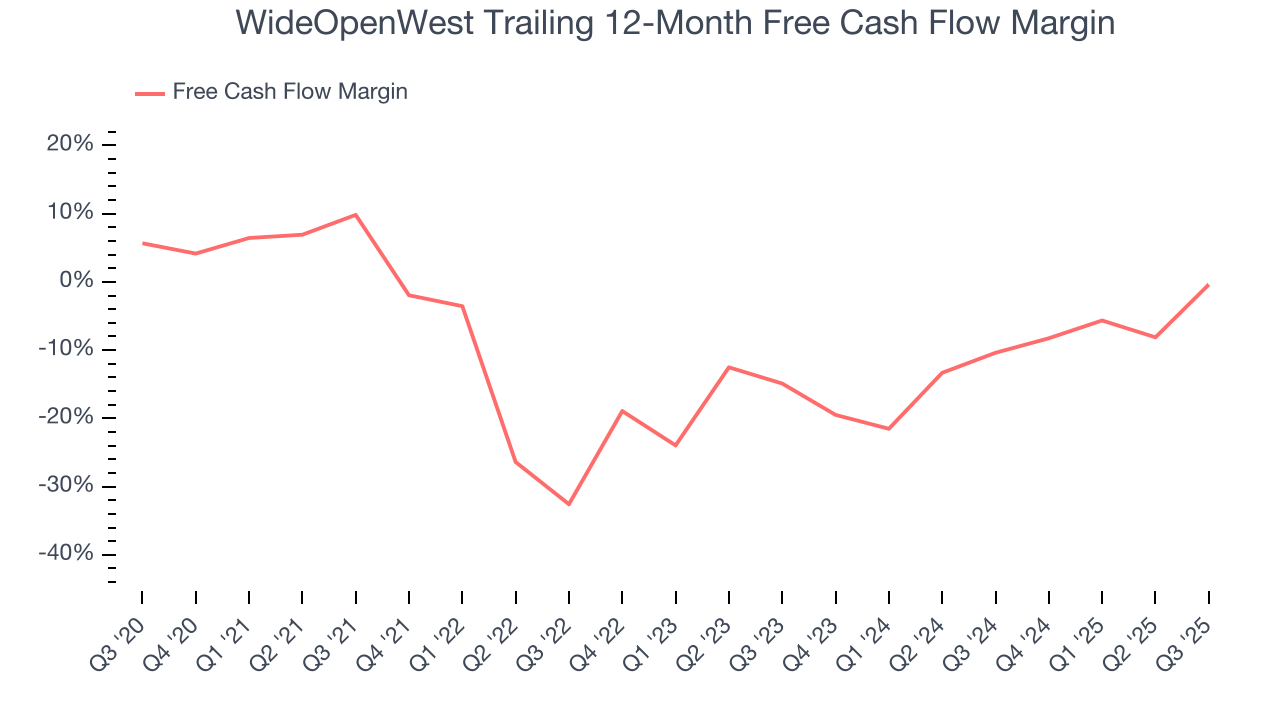

- Free Cash Flow Margin: 36.5%, up from 3.6% in the same quarter last year

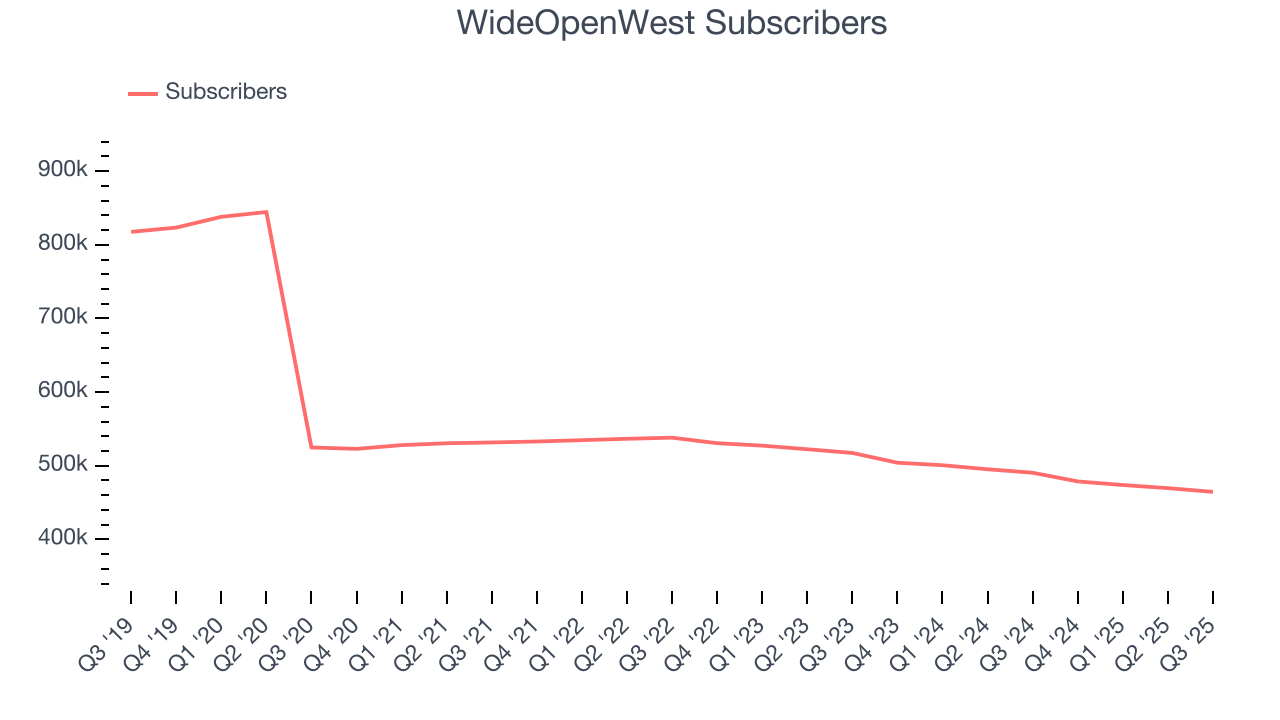

- Subscribers: 464,500, down 26,000 year on year

- Market Capitalization: $440.5 million

Company Overview

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

The company has grown through organic expansion, especially in its home market of the Midwest, but acquisitions of regional competitors have also contributed to its growth. Specifically, WideOpenWest acquired Knology in 2012 and NuLink in 2014, which established and expanded its footprint in the Southeastern US.

WideOpenWest principally serves residential customers who want some combination of high-speed broadband connectivity to access the internet, cable television for entertainment, and traditional telephony for voice calls. While broadband has been growing secularly, cable television and landline telephony have been challenged. In a milestone move that was a nod to traditional television’s decline, WideOpenWest announced on May 15, 2023 that it would discontinue its in-house TV services and migrate its television customers to YouTube TV, owned by Alphabet (NASDAQ:GOOGL).

The company's revenue is primarily derived from subscription packages. Prices vary based on a customer’s geographic location, the number of services the customer is buying in a bundle, and the broadband speeds or television channels desired. To grow its revenue over time, WideOpenWest has attempted to increase market share in existing markets, broaden its footprint to new geographies (which requires capital investment), and offer more services such as connected home subscription packages.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the telecommunications sector include AT&T (NYSE:T), Verizon (NYSE:VZ), and Charter Communications (NASDAQ:CHTR).

5. Revenue Growth

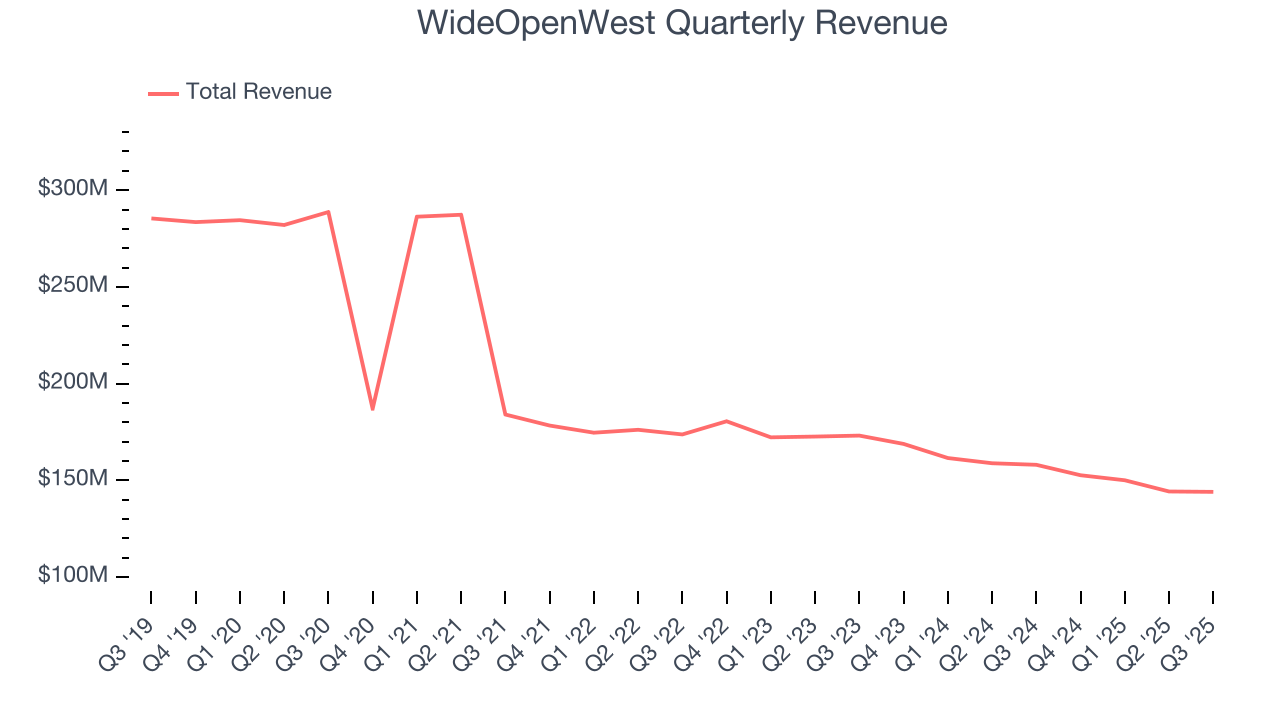

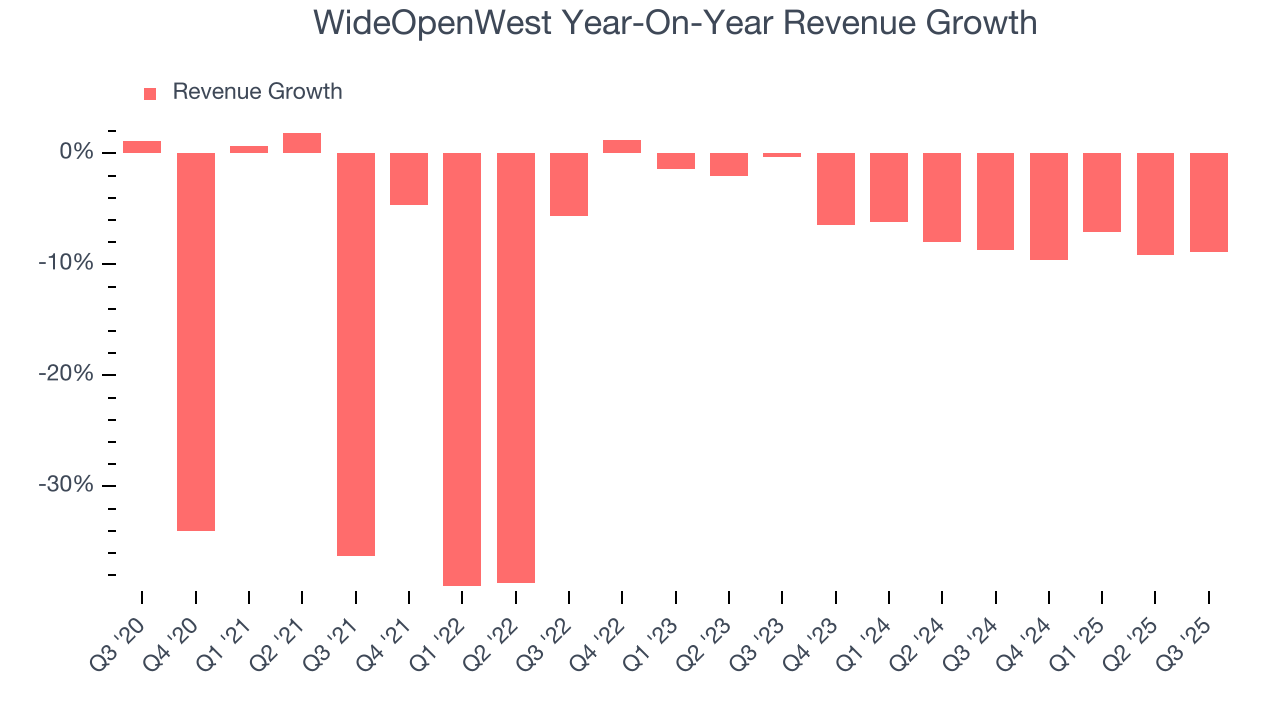

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. WideOpenWest struggled to consistently generate demand over the last five years as its sales dropped at a 12.3% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. WideOpenWest’s annualized revenue declines of 8% over the last two years suggest its demand continued shrinking.

We can dig further into the company’s revenue dynamics by analyzing its number of subscribers, which reached 464,500 in the latest quarter. Over the last two years, WideOpenWest’s subscribers averaged 5.2% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, WideOpenWest’s revenue fell by 8.9% year on year to $144 million but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to decline by 8.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

WideOpenWest’s operating margin has risen over the last 12 months, but it still averaged negative 1.4% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, WideOpenWest’s breakeven margin was in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for WideOpenWest, its EPS declined by 44.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, WideOpenWest reported EPS of negative $0.43, down from negative $0.27 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects WideOpenWest to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.95 will advance to negative $0.89.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While WideOpenWest posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, WideOpenWest’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.6%, meaning it lit $5.61 of cash on fire for every $100 in revenue.

WideOpenWest’s free cash flow clocked in at $52.5 million in Q3, equivalent to a 36.5% margin. This result was good as its margin was 32.9 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

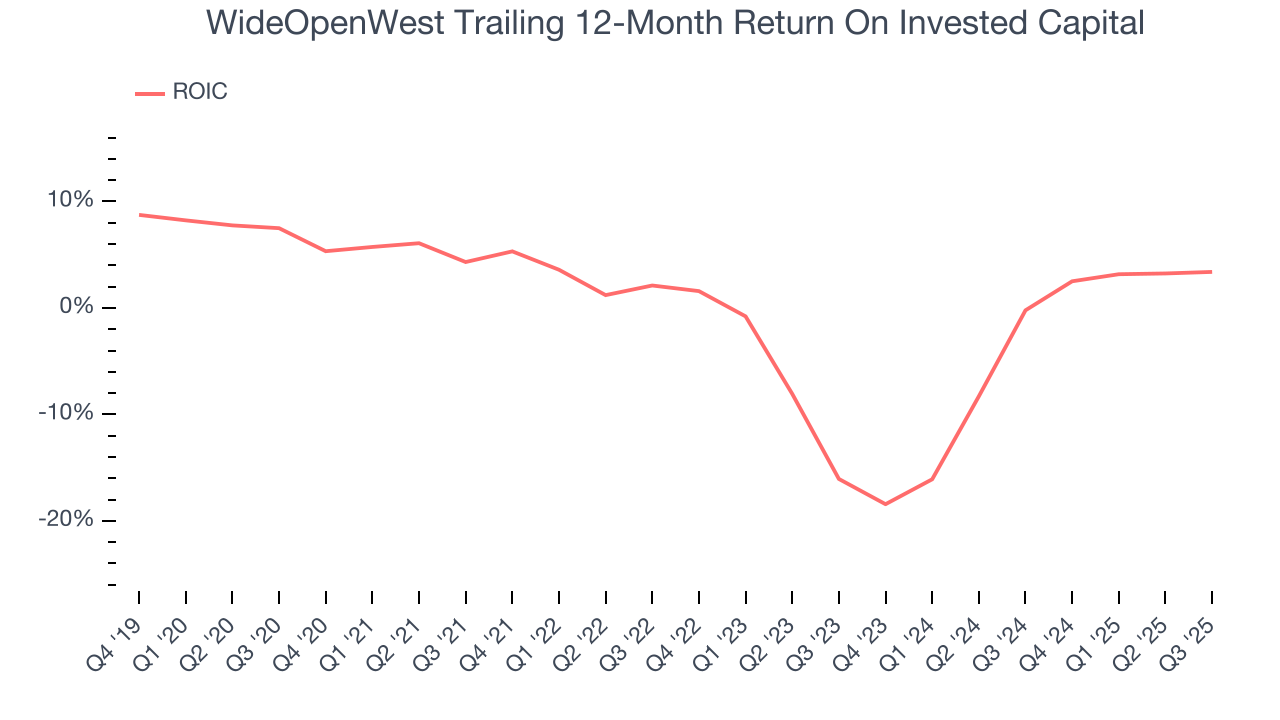

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

WideOpenWest’s five-year average ROIC was negative 1.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, WideOpenWest’s ROIC averaged 1.6 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

WideOpenWest reported $22.9 million of cash and $1.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $229 million of EBITDA over the last 12 months, we view WideOpenWest’s 4.6× net-debt-to-EBITDA ratio as safe. We also see its $45.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from WideOpenWest’s Q3 Results

It was good to see WideOpenWest narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its number of subscribers fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $5.14 immediately following the results.

12. Is Now The Time To Buy WideOpenWest?

Updated: December 3, 2025 at 9:56 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping consumers, but in the case of WideOpenWest, we’re out. For starters, its revenue has declined over the last five years. On top of that, WideOpenWest’s number of subscribers has disappointed, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

WideOpenWest’s EV-to-EBITDA ratio based on the next 12 months is 1.7x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $4.77 on the company (compared to the current share price of $5.19).