Watsco (WSO)

Watsco faces an uphill battle. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Watsco Will Underperform

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

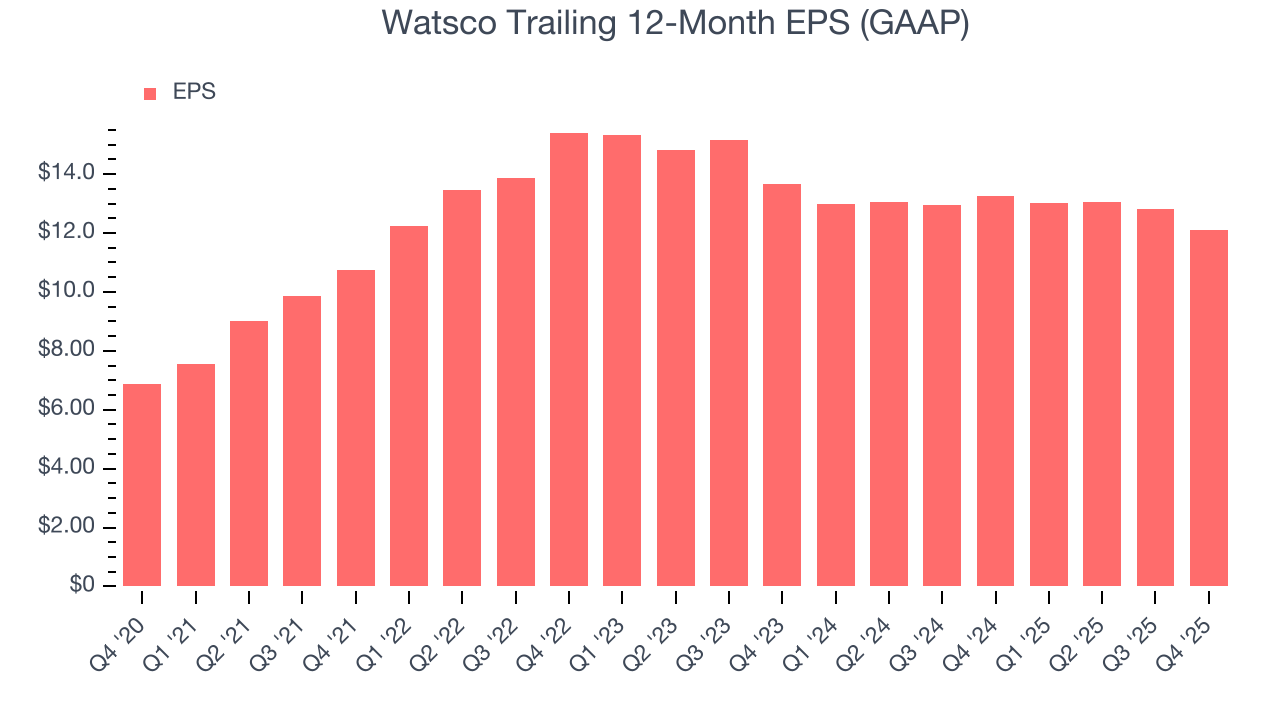

- Incremental sales over the last two years were much less profitable as its earnings per share fell by 4.2% annually while its revenue grew

- Sales are projected to remain flat over the next 12 months as demand decelerates from its two-year trend

- 1% annual revenue growth over the last two years was slower than its industrials peers

Watsco’s quality doesn’t meet our bar. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Watsco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Watsco

Watsco is trading at $417.92 per share, or 33x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the quality you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Watsco (WSO) Research Report: Q4 CY2025 Update

Equipment distributor Watsco (NYSE:WSO) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 10% year on year to $1.58 billion. Its GAAP profit of $1.68 per share was 11% below analysts’ consensus estimates.

Watsco (WSO) Q4 CY2025 Highlights:

- Revenue: $1.58 billion vs analyst estimates of $1.61 billion (10% year-on-year decline, 1.9% miss)

- EPS (GAAP): $1.68 vs analyst expectations of $1.89 (11% miss)

- Adjusted EBITDA: $121.3 million vs analyst estimates of $128.8 million (7.7% margin, 5.9% miss)

- Operating Margin: 6.4%, down from 7.8% in the same quarter last year

- Free Cash Flow Margin: 24.6%, up from 21.1% in the same quarter last year

- Market Capitalization: $15.86 billion

Company Overview

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Specifically, Watsco got its start in 1947 as Wagner Tool & Supply as a manufacturer of parts, components, and tools used in the HVAC/R (heating, ventilation, air conditioning, refrigeration) industry. In 1998, the company sold its manufacturing operations due to management's recognition of growing demand for and better unit economics from distributing the very parts and components it manufactured. This move would ultimately reduce the cyclicality of demand and lessen the capital intensity of the business.

Today, Watsco is known for selling air conditioning units, heating systems, refrigeration equipment, and related parts and supplies. The company addresses the challenges faced by HVAC/R contractors and service providers by offering a vast and reliable inventory of products from many manufacturers. Watsco further ensures the success of its contractor customers by delivering these often hard-to-transport units and systems in a timely manner and aiding with installation and maintenance.

The primary revenue sources for Watsco come from the sale of HVAC/R equipment and parts. A smaller portion of revenue comes from services such as installation and maintenance, as mentioned, and this can help smooth out the cyclical demand of A/C units and heating systems that often depend on the commercial and residential construction markets. The company's business model focuses on distribution through a network of branches and an e-commerce platform, providing convenient access to its products for customers.

4. Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Competitors in the HVAC industry include Carrier Global (NYSE:CARR), Lennox International (NYSE:LII), and Ferguson (NYSE:FERG).

5. Revenue Growth

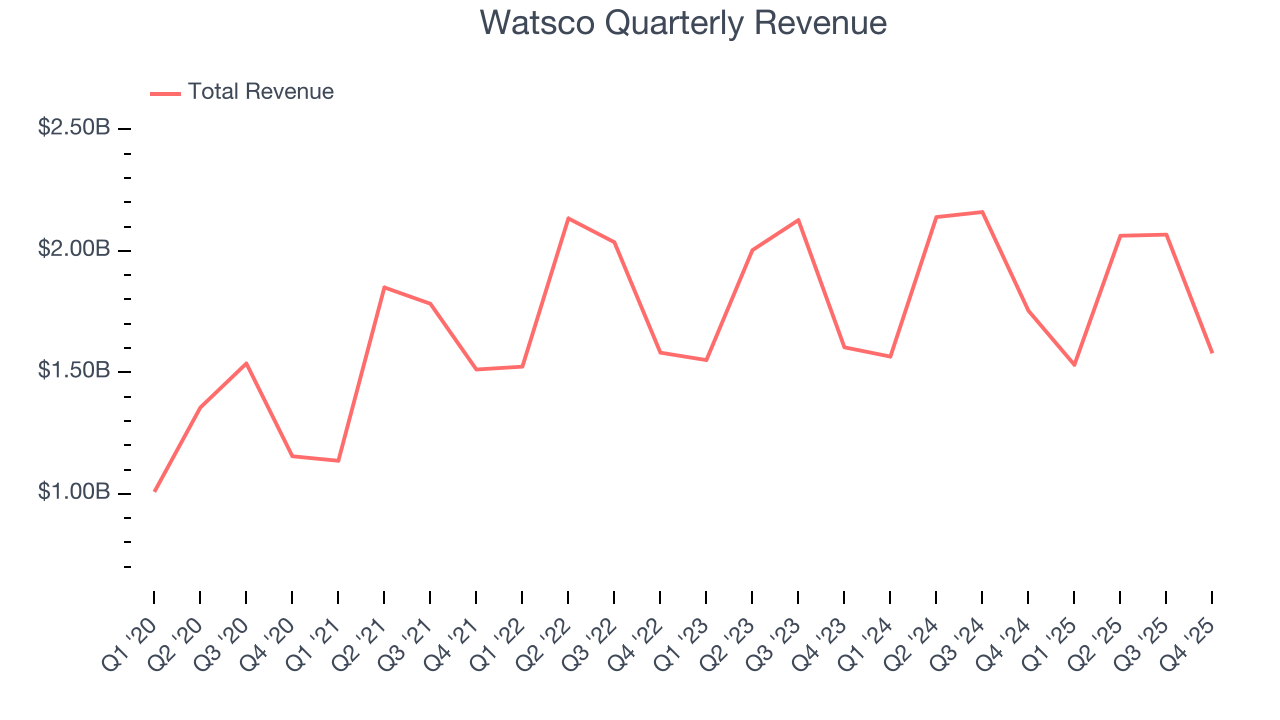

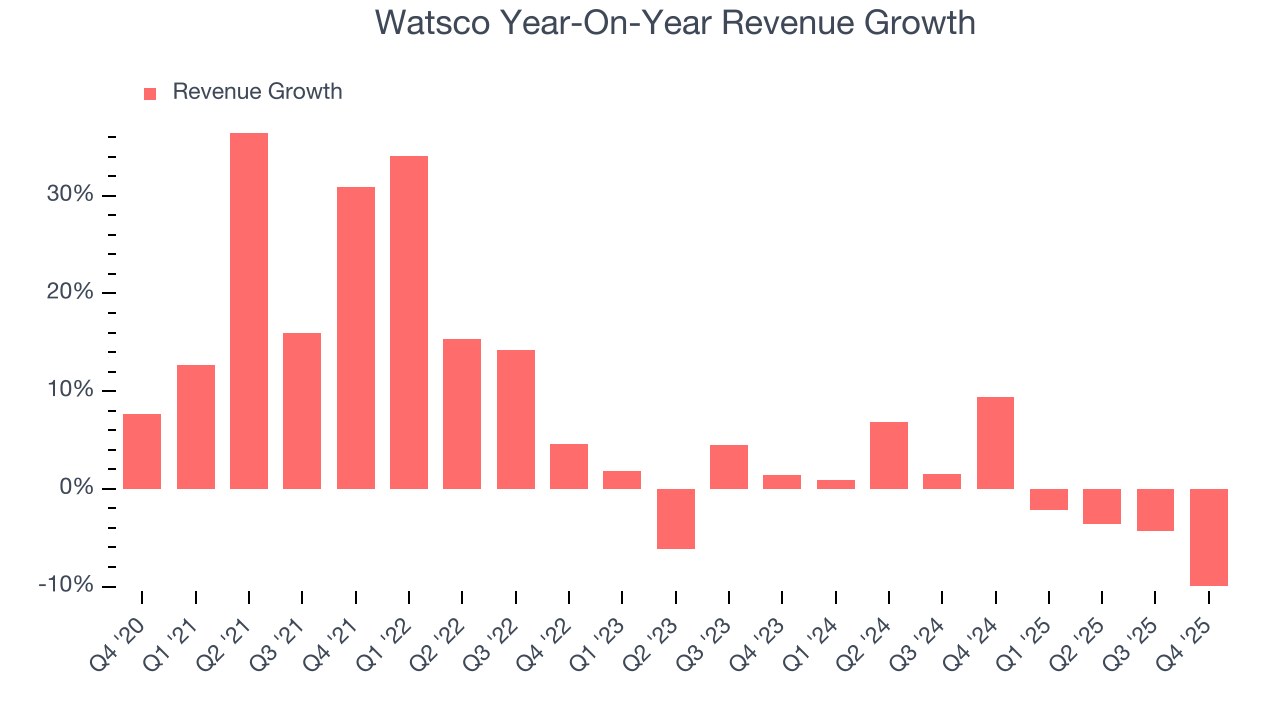

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Watsco grew its sales at a mediocre 7.4% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Watsco’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Watsco missed Wall Street’s estimates and reported a rather uninspiring 10% year-on-year revenue decline, generating $1.58 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

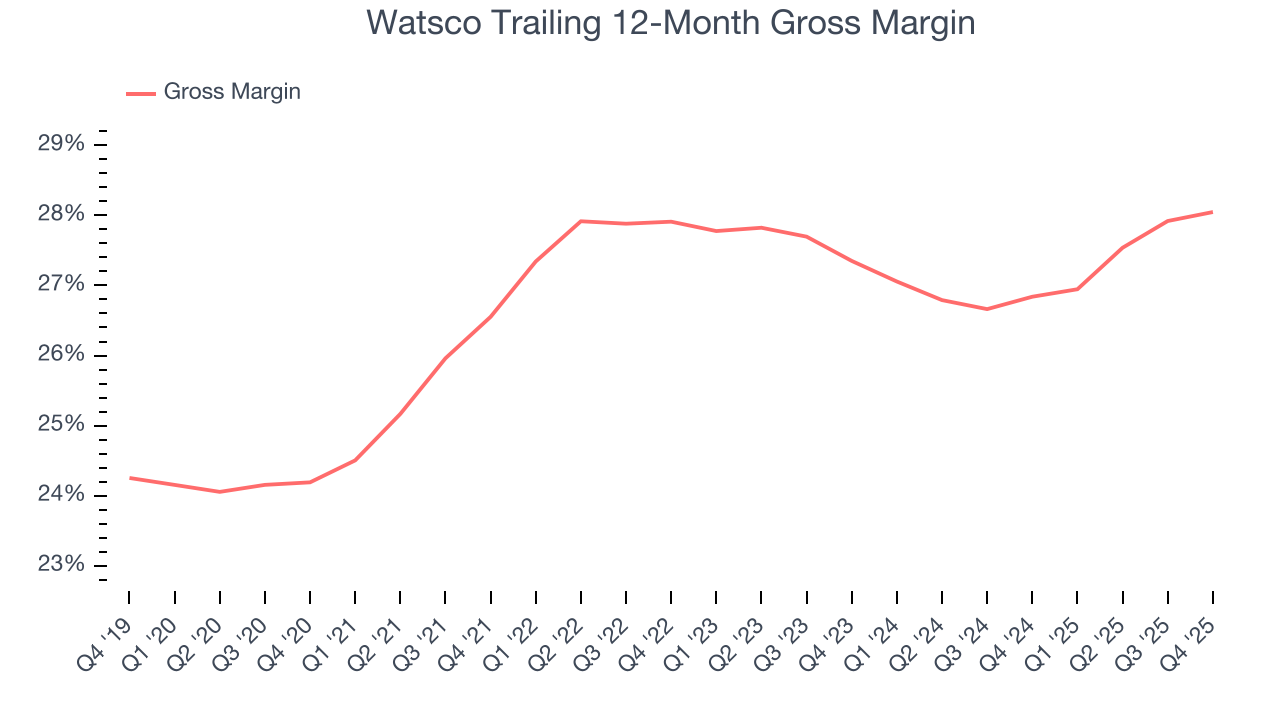

Watsco’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 27.4% gross margin over the last five years. Said differently, Watsco had to pay a chunky $72.64 to its suppliers for every $100 in revenue.

Watsco produced a 27.1% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, Watsco’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

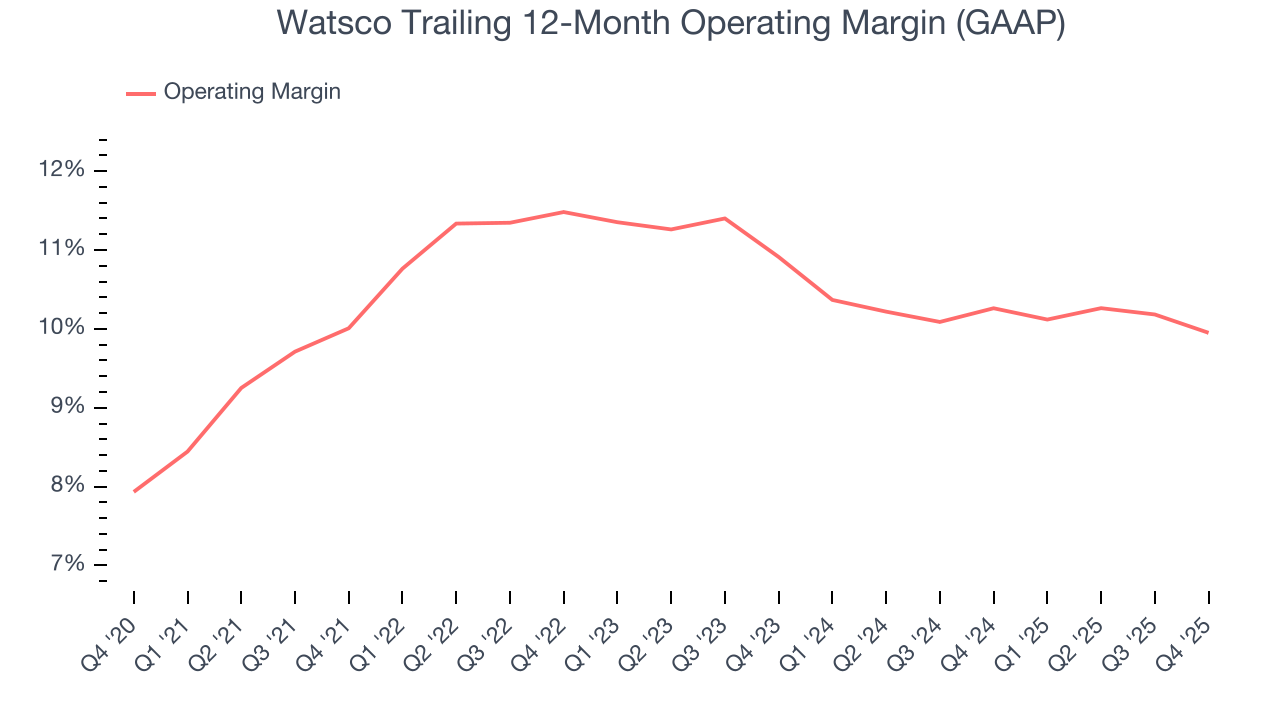

Watsco’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 10.5% over the last five years. This profitability was solid for an industrials business and shows it’s an efficient company that manages its expenses well. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Watsco’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Watsco generated an operating margin profit margin of 6.4%, down 1.3 percentage points year on year. Since Watsco’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

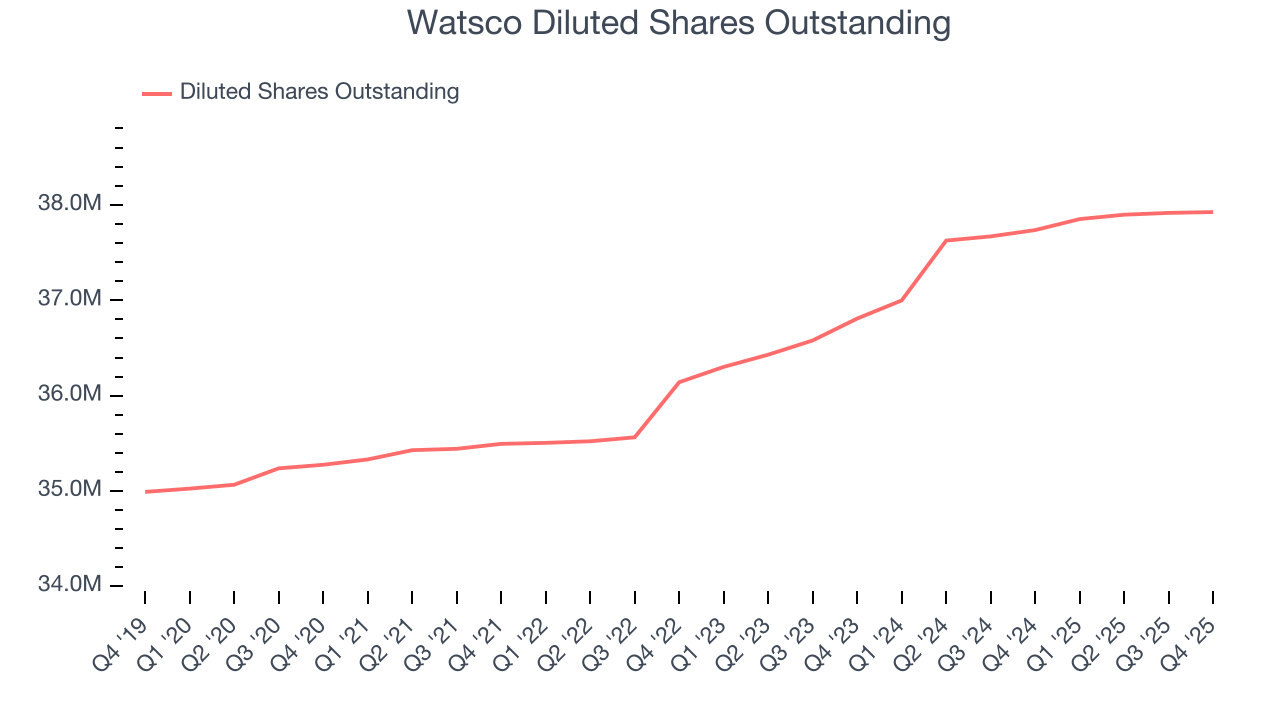

Watsco’s EPS grew at a remarkable 12% compounded annual growth rate over the last five years, higher than its 7.4% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Watsco’s two-year annual EPS declines of 5.8% were bad and lower than its flat revenue.

Diving into the nuances of Watsco’s earnings can give us a better understanding of its performance. A two-year view shows Watsco has diluted its shareholders, growing its share count by 3%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Watsco reported EPS of $1.68, down from $2.37 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Watsco’s full-year EPS of $12.11 to grow 8.1%.

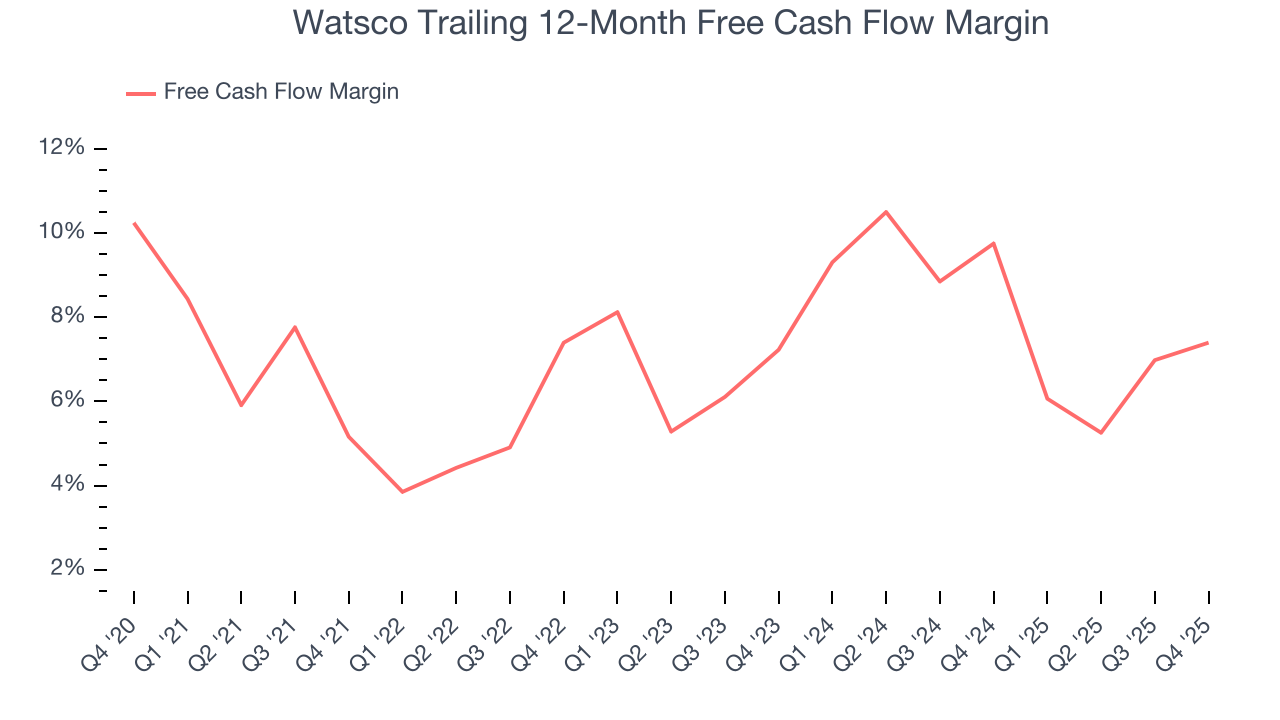

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Watsco has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.5% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Watsco’s margin expanded by 2.2 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Watsco’s free cash flow clocked in at $388.6 million in Q4, equivalent to a 24.6% margin. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

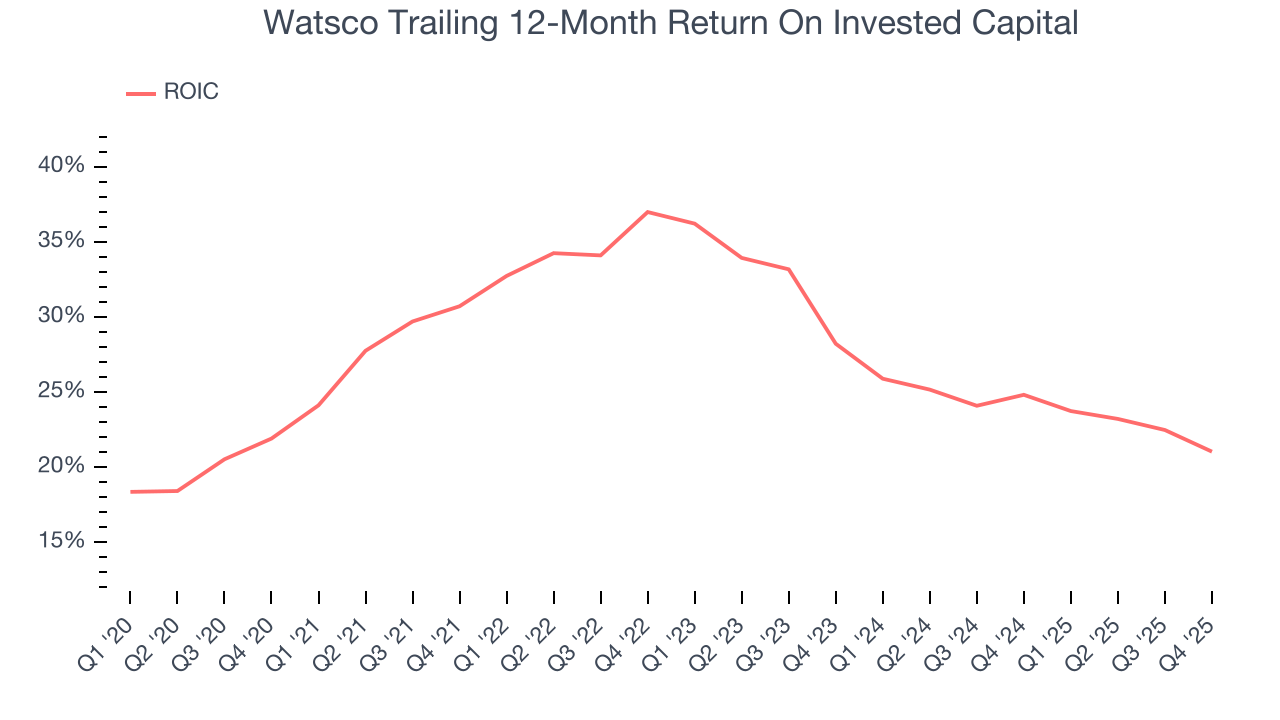

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Watsco hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 28.4%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Watsco’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

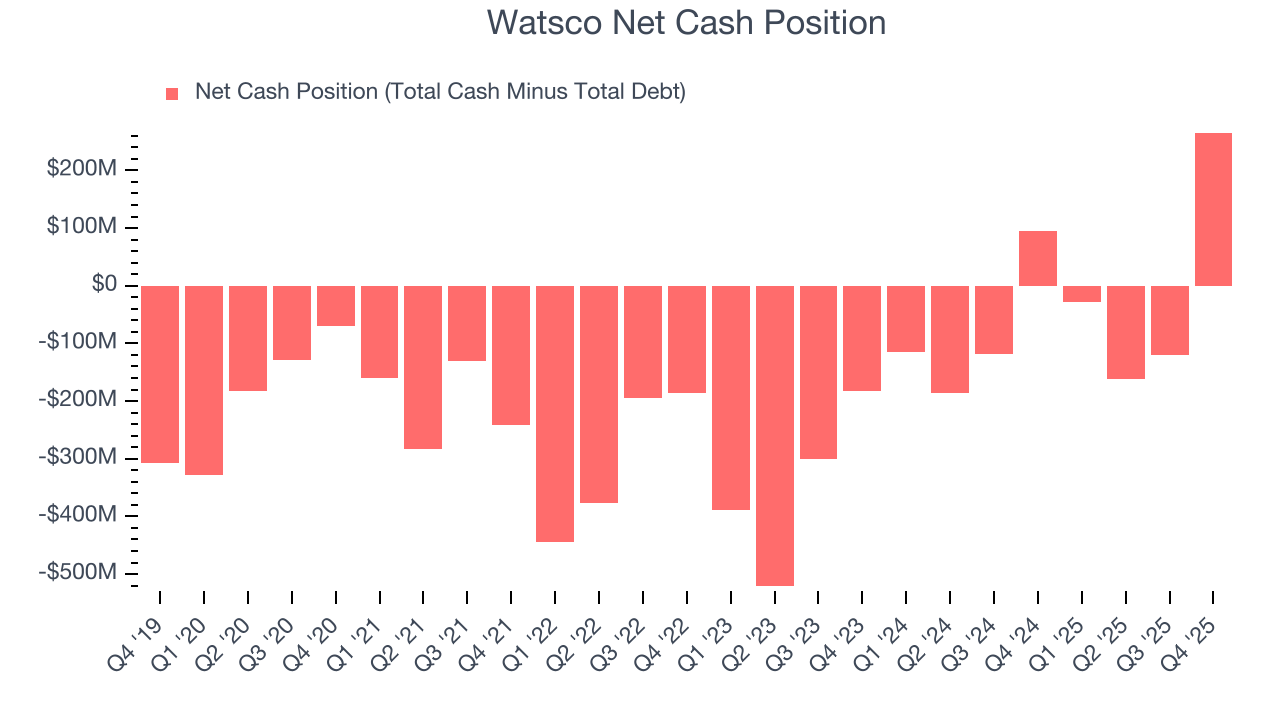

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Watsco is a profitable, well-capitalized company with $733.3 million of cash and $467.8 million of debt on its balance sheet. This $265.5 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Watsco’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.9% to $410.00 immediately following the results.

13. Is Now The Time To Buy Watsco?

Updated: February 17, 2026 at 7:42 AM EST

Before investing in or passing on Watsco, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Watsco falls short of our quality standards. For starters, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its same-store sales growth has disappointed.

Watsco’s forward price-to-sales ratio is 0x. The market typically values companies like Watsco based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $395.58 on the company (compared to the current share price of $410.00), implying they don’t see much short-term potential in Watsco.