Zeta Global (ZETA)

Zeta Global is a compelling stock. Its financials show it’s a customer acquisition machine that can expand both quickly and organically.― StockStory Analyst Team

1. News

2. Summary

Why We Like Zeta Global

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE:ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

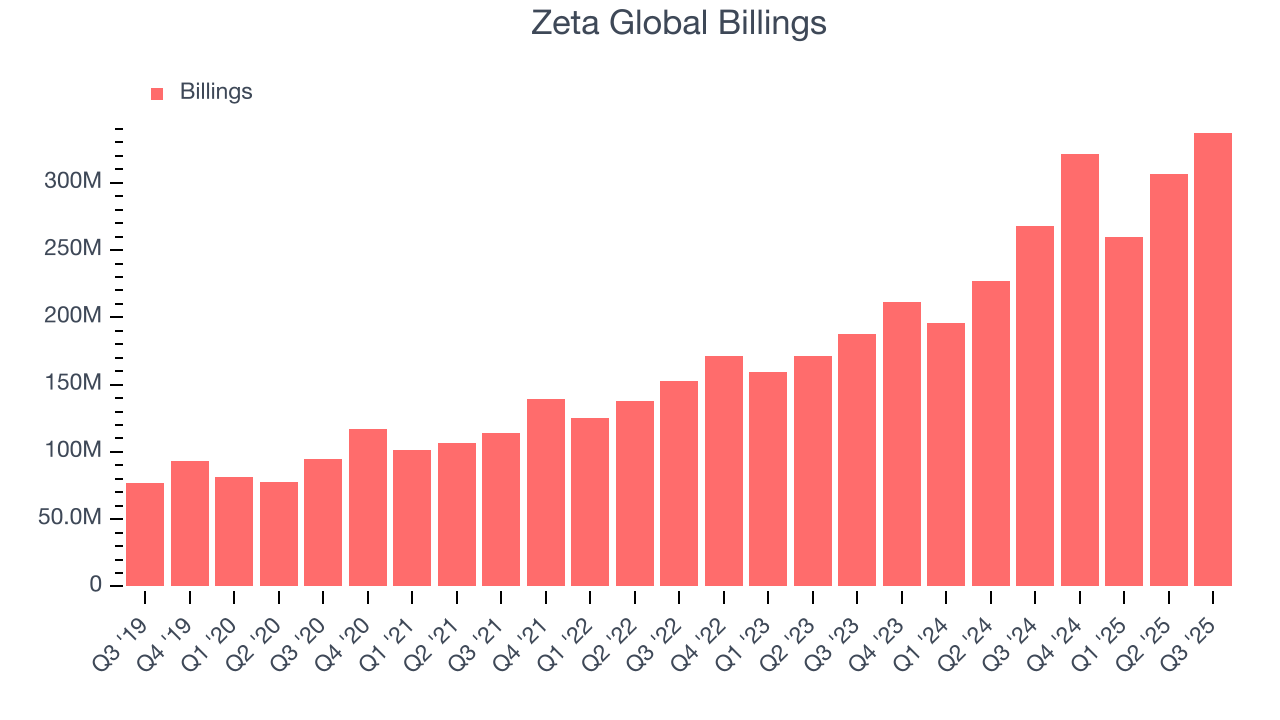

- Average billings growth of 36.4% over the last year enhances its liquidity and shows there is steady demand for its products

- Notable projected revenue growth of 30.4% for the next 12 months hints at market share gains

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

Zeta Global is a market leader. The price seems reasonable relative to its quality, so this could be an opportune time to invest in some shares.

Why Is Now The Time To Buy Zeta Global?

Why Is Now The Time To Buy Zeta Global?

At $21.72 per share, Zeta Global trades at 3x forward price-to-sales. This valuation is attractive, and we think the stock is likely trading below its intrinsic value when considering its fundamentals.

We jump for joy when high-quality companies trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. Zeta Global (ZETA) Research Report: Q3 CY2025 Update

Marketing technology company Zeta Global (NYSE:ZETA) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 25.7% year on year to $337.2 million. The company expects next quarter’s revenue to be around $364.5 million, close to analysts’ estimates.

Zeta Global (ZETA) Q3 CY2025 Highlights:

- Revenue: $337.2 million vs analyst estimates of $328.2 million (25.7% year-on-year growth, 2.7% beat)

- Adjusted EBITDA: $78.06 million vs analyst estimates of $70.44 million (23.2% margin, 10.8% beat)

- Revenue Guidance for Q4 CY2025 is $364.5 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $273.7 million at the midpoint, above analyst estimates of $264 million

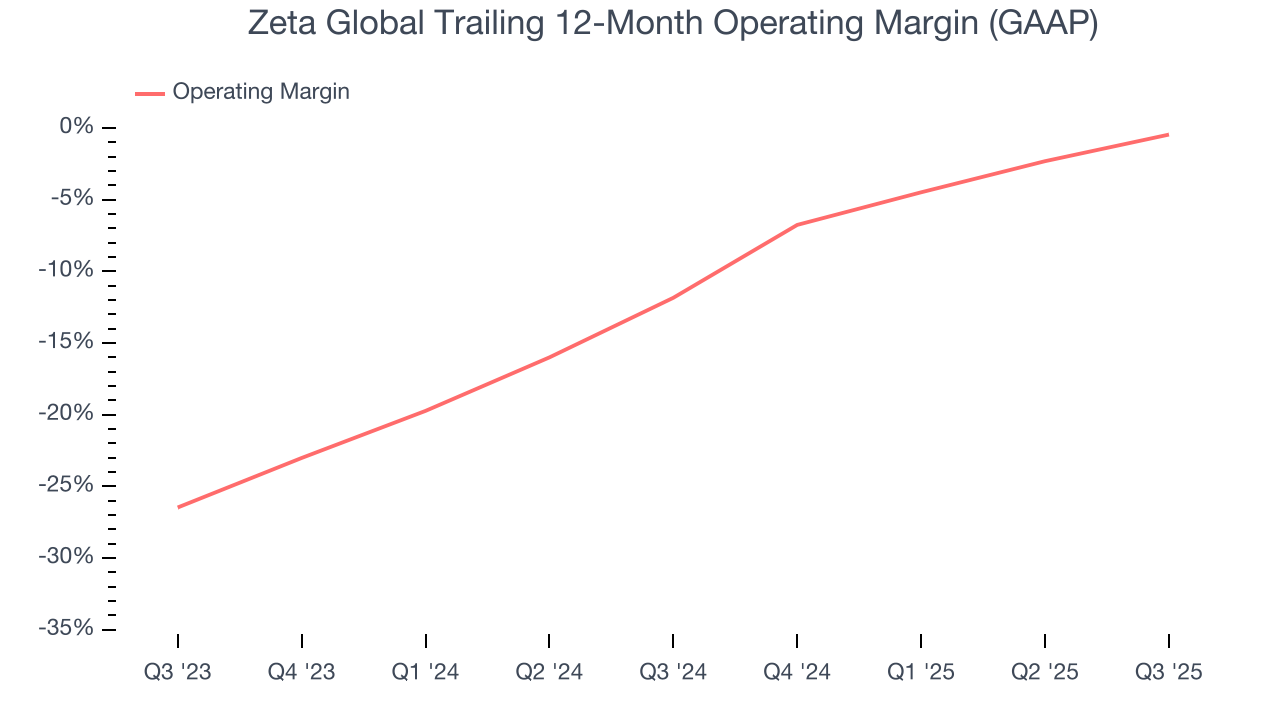

- Operating Margin: 2.6%, up from -4.6% in the same quarter last year

- Free Cash Flow Margin: 14%, up from 10.9% in the previous quarter

- Market Capitalization: $4.19 billion

Company Overview

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE:ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

The company's core product, the Zeta Marketing Platform (ZMP), combines three integrated components: a Customer Data Platform (CDP) that creates unified consumer profiles, an Email Service Provider (ESP) for messaging campaigns, and a Demand-Side Platform (DSP) for paid media activation. This integrated approach allows enterprises to leverage Zeta's extensive data assets - which include over 240 million opted-in individuals in the U.S. and 535 million globally, with approximately 2,500 attributes per person.

Zeta's proprietary artificial intelligence analyzes this data to identify consumer intent and create highly targeted marketing programs. For example, a retail company might use Zeta's platform to identify consumers showing purchase intent for specific products, deliver personalized email offers, and then retarget those same consumers with complementary products across social media and connected TV channels.

The company generates revenue through subscription-based access to its platform and usage-based fees tied to marketing campaign volume. Zeta serves customers across various industries, with particular strength in consumer retail, telecommunications, financial services, and insurance. The company emphasizes data privacy compliance as a core component of its operations, implementing technical measures to manage user consent parameters in accordance with evolving global regulations.

4. Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Zeta Global competes with large marketing technology providers like Adobe (NASDAQ:ADBE) with its Experience Cloud, Salesforce (NYSE:CRM) with its Marketing Cloud, and Oracle (NYSE:ORCL) with its Marketing Cloud, as well as specialized marketing platforms like The Trade Desk (NASDAQ:TTD) and Integral Ad Science (NASDAQ:IAS).

5. Revenue Growth

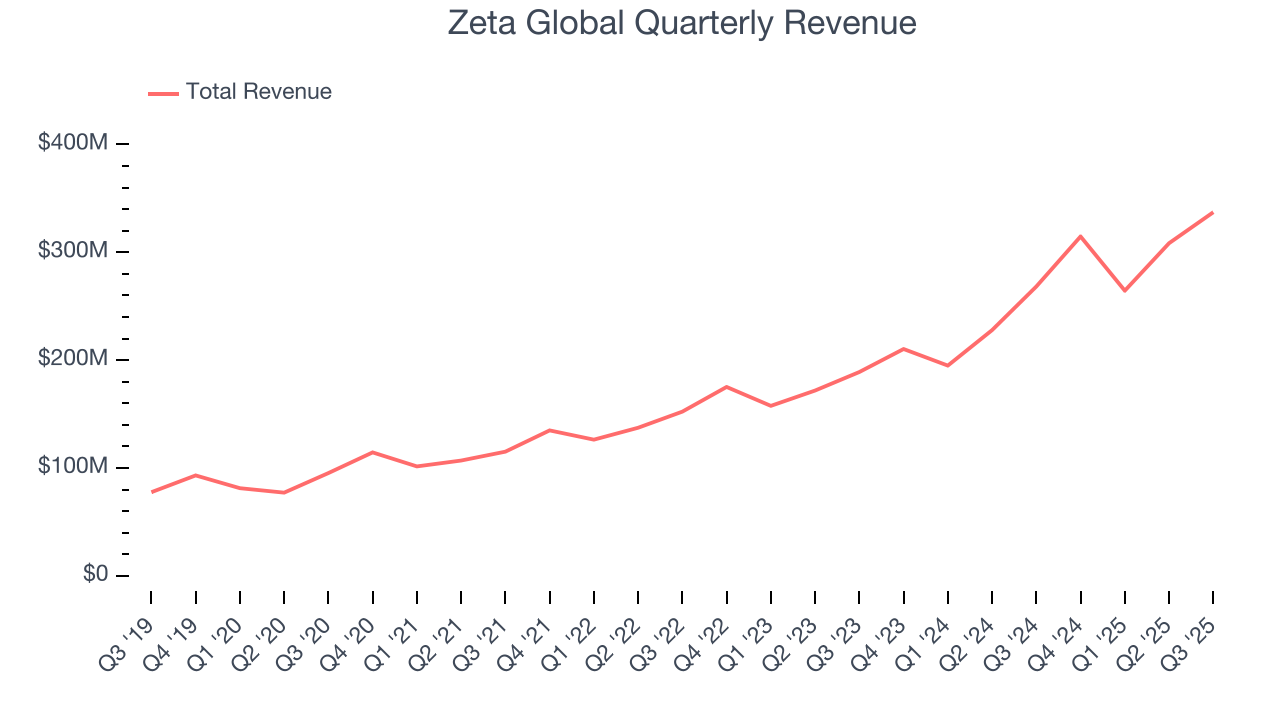

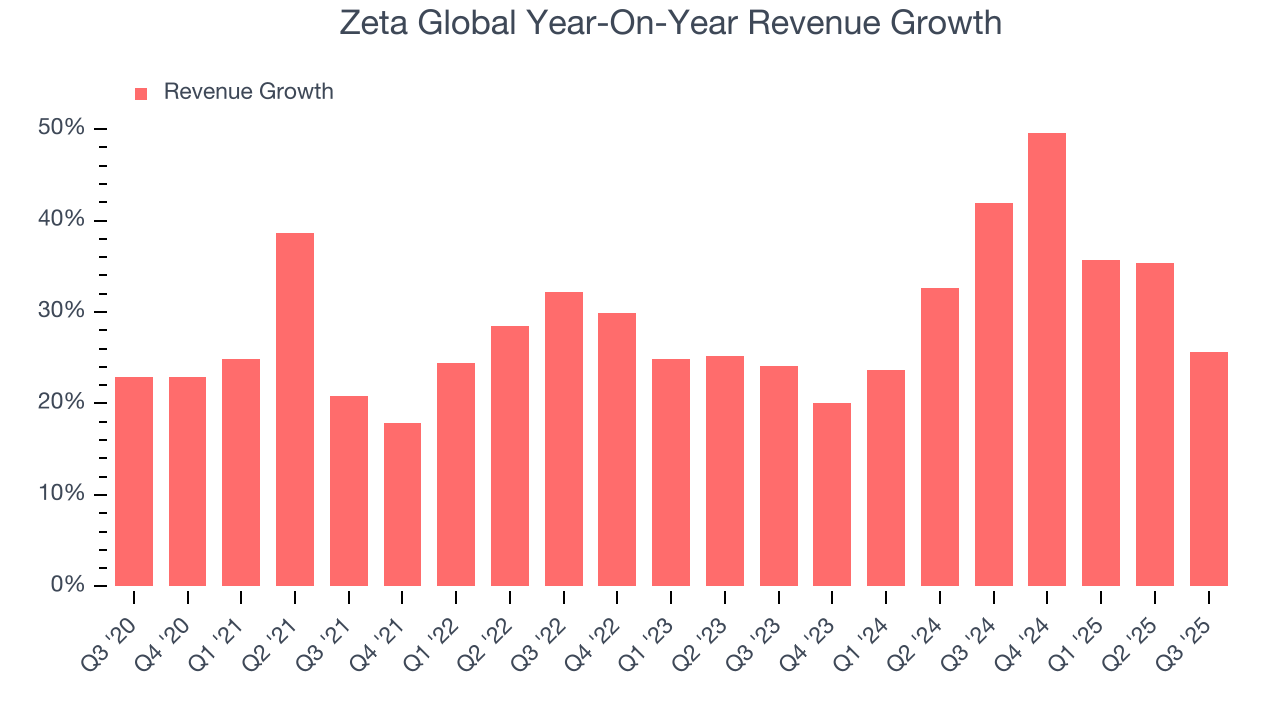

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Zeta Global’s sales grew at an impressive 28.7% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Zeta Global’s annualized revenue growth of 32.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Zeta Global reported robust year-on-year revenue growth of 25.7%, and its $337.2 million of revenue topped Wall Street estimates by 2.7%. Company management is currently guiding for a 15.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and suggests the market is baking in some success for its newer products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zeta Global’s billings punched in at $337.3 million in Q3, and over the last four quarters, its growth was fantastic as it averaged 36.4% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Zeta Global is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Zeta Global more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

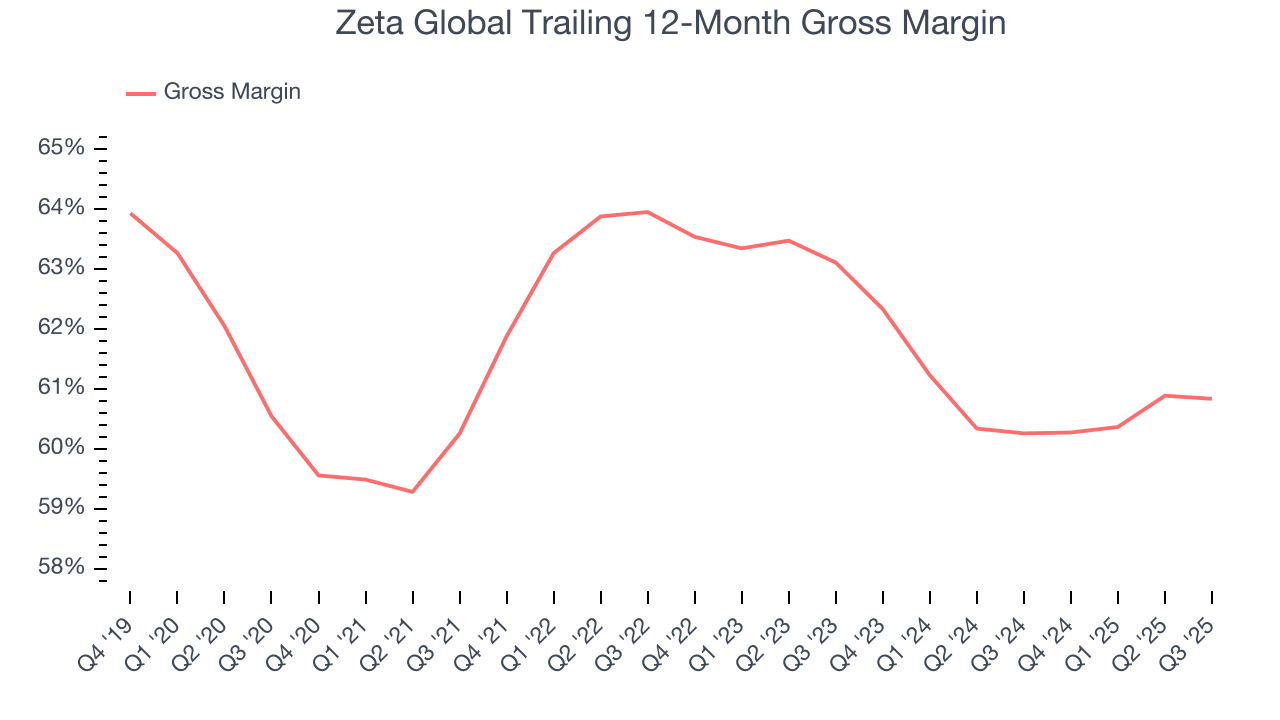

For software companies like Zeta Global, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Zeta Global’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.8% gross margin over the last year. That means Zeta Global paid its providers a lot of money ($39.16 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Zeta Global has seen gross margins decline by 2.3 percentage points over the last 2 year, which is among the worst in the software space.

This quarter, Zeta Global’s gross profit margin was 60.5%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Zeta Global was roughly breakeven when averaging the last year of quarterly operating profits, mediocre for a software business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Zeta Global’s operating margin rose by 11.4 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, Zeta Global generated an operating margin profit margin of 2.6%, up 7.2 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

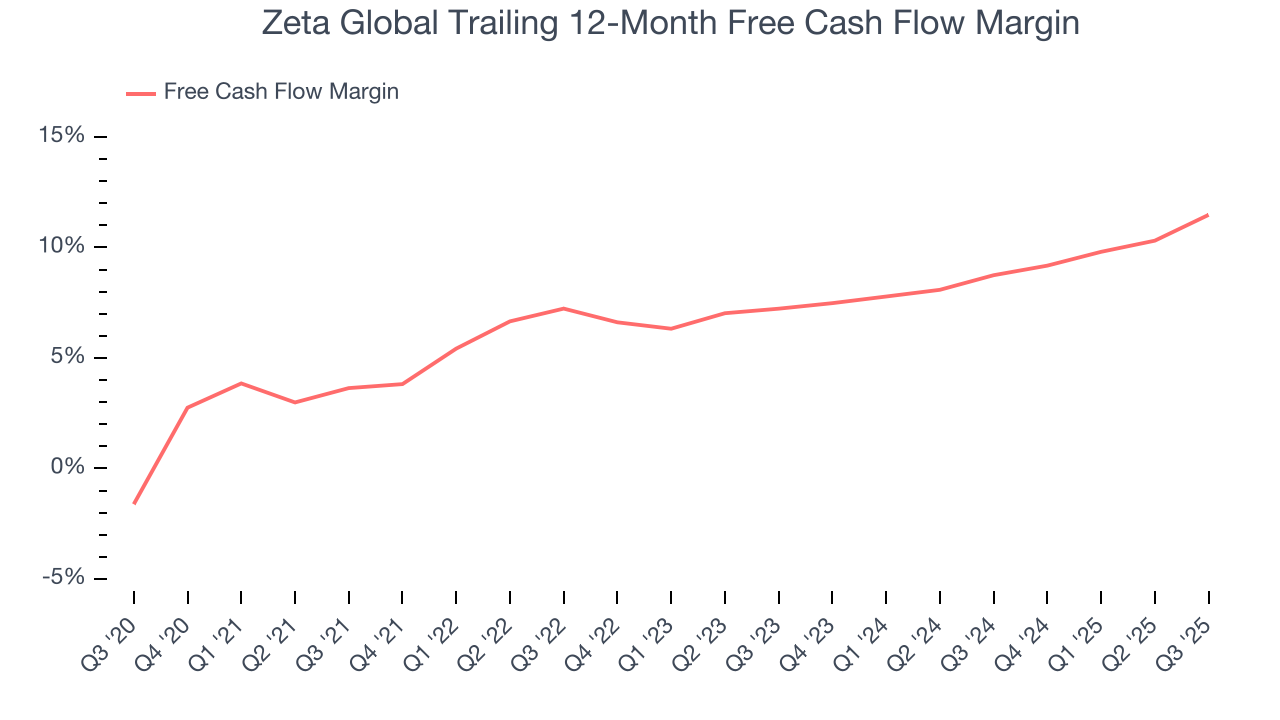

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Zeta Global has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.5%, subpar for a software business.

Zeta Global’s free cash flow clocked in at $47.13 million in Q3, equivalent to a 14% margin. This result was good as its margin was 4.4 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting Zeta Global’s free cash flow margin of 11.5% for the last 12 months to remain the same.

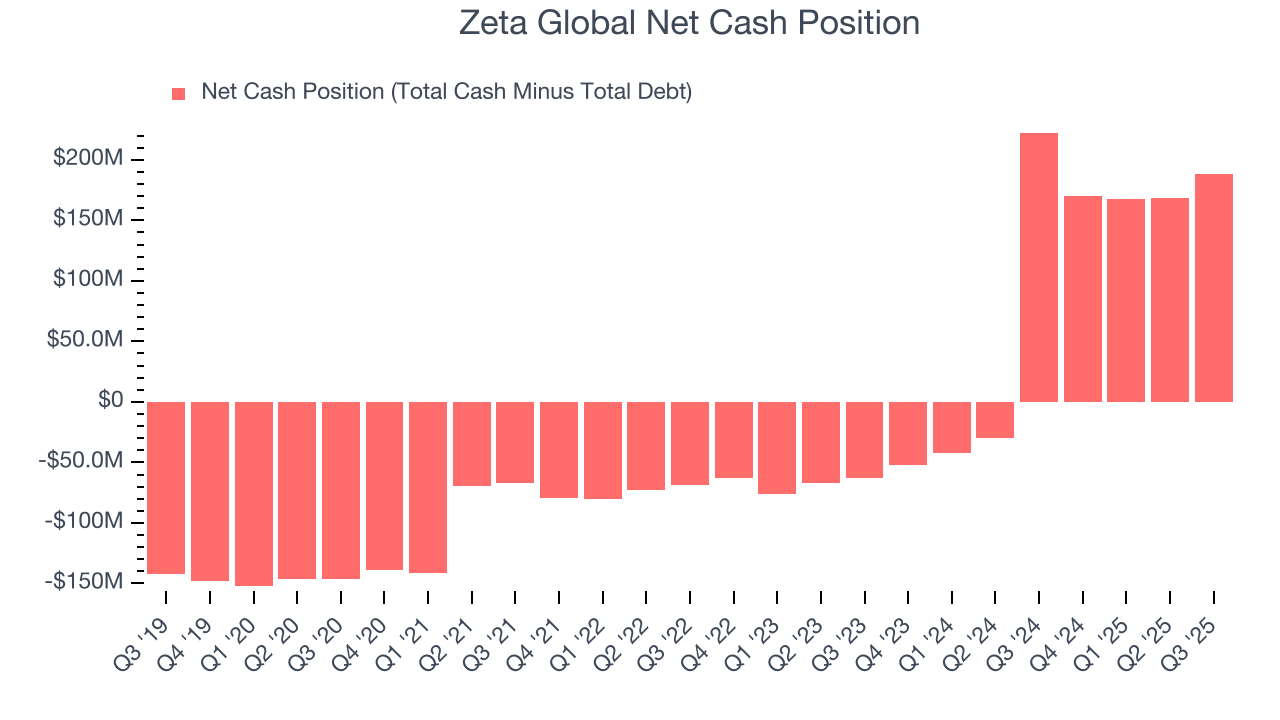

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Zeta Global is a well-capitalized company with $385.2 million of cash and $196.9 million of debt on its balance sheet. This $188.3 million net cash position is 4.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Zeta Global’s Q3 Results

We were impressed by how significantly Zeta Global blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 9% to $18.21 immediately following the results.

13. Is Now The Time To Buy Zeta Global?

Updated: January 24, 2026 at 9:37 PM EST

Are you wondering whether to buy Zeta Global or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are multiple reasons why we think Zeta Global is an amazing business. For starters, its revenue growth was strong over the last five years and is expected to accelerate over the next 12 months. And while its gross margins show its business model is much less lucrative than other companies, its efficient sales strategy allows it to target and onboard new users at scale.

Zeta Global’s price-to-sales ratio based on the next 12 months is 3x. Scanning the software space today, Zeta Global’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $30 on the company (compared to the current share price of $21.72), implying they see 38.2% upside in buying Zeta Global in the short term.