Zevia (ZVIA)

We’re not sold on Zevia. Its flat sales suggest demand is weak and its cash burn makes us question the business’s long-term viability.― StockStory Analyst Team

1. News

2. Summary

Why Zevia Is Not Exciting

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Smaller revenue base of $162.8 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- On the bright side, its earnings growth has beaten its peers over the last three years as its EPS has compounded at 26% annually

Zevia’s quality doesn’t meet our bar. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Zevia

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zevia

At $2.05 per share, Zevia trades at 246.1x forward EV-to-EBITDA. This valuation is extremely expensive, especially for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Zevia (ZVIA) Research Report: Q3 CY2025 Update

Beverage company Zevia (NYSE:ZVIA) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 12.3% year on year to $40.84 million. The company expects next quarter’s revenue to be around $40 million, close to analysts’ estimates. Its GAAP loss of $0.04 per share was $0.03 above analysts’ consensus estimates.

Zevia (ZVIA) Q3 CY2025 Highlights:

- Revenue: $40.84 million vs analyst estimates of $39.39 million (12.3% year-on-year growth, 3.7% beat)

- EPS (GAAP): -$0.04 vs analyst estimates of -$0.07 ($0.03 beat)

- Adjusted EBITDA: -$1.72 million vs analyst estimates of -$3.57 million (-4.2% margin, 51.7% beat)

- Revenue Guidance for Q4 CY2025 is $40 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $5.25 million at the midpoint, above analyst estimates of -$8.8 million

- Operating Margin: -7%, up from -8.2% in the same quarter last year

- Free Cash Flow was -$65,000, down from $3.75 million in the same quarter last year

- Sales Volumes rose 12.6% year on year, in line with the same quarter last year

- Market Capitalization: $155.5 million

Company Overview

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

The company was founded in 2007 and launched with three flavors of zero-calorie, naturally-sweetened sodas. Zevia believed that consumers deserved a soda that was both healthy and great-tasting. Since its founding, more flavors have been launched and range from familiar favorites such as cola to innovative flavors such as grapefruit citrus. In addition to expanding the soda portfolio, Zevia has launched products in the energy drink, alcoholic mixer, tea, and kids’ beverage categories.

The Zevia core customer enjoys the taste of soda but has also soured on traditional sodas due to their sugar content and negative health impacts. This individual is also likely wary of artificial sweeteners that have flooded the market. Lastly, Zevia’s loyalists are likely educated and have the willingness and means to pay a premium for products that tout health benefits.

Zevia products don’t enjoy the widespread distribution of traditional sodas, but the company has made major strides since its founding. Zevia beverages can be found in major supermarkets and convenience stores. Over time, the company is hoping to follow in the footsteps of storied soda brands where brand recognition leads to higher demand, which then increasingly incentivizes retailers to carry the brand to satisfy consumers.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors mainly include traditional soda companies such as Coca-Cola (NYSE:KO), PepsiCo (NASDAQ:PEP), Keurig Dr. Pepper (NASDAQ:KDP).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $162.8 million in revenue over the past 12 months, Zevia is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

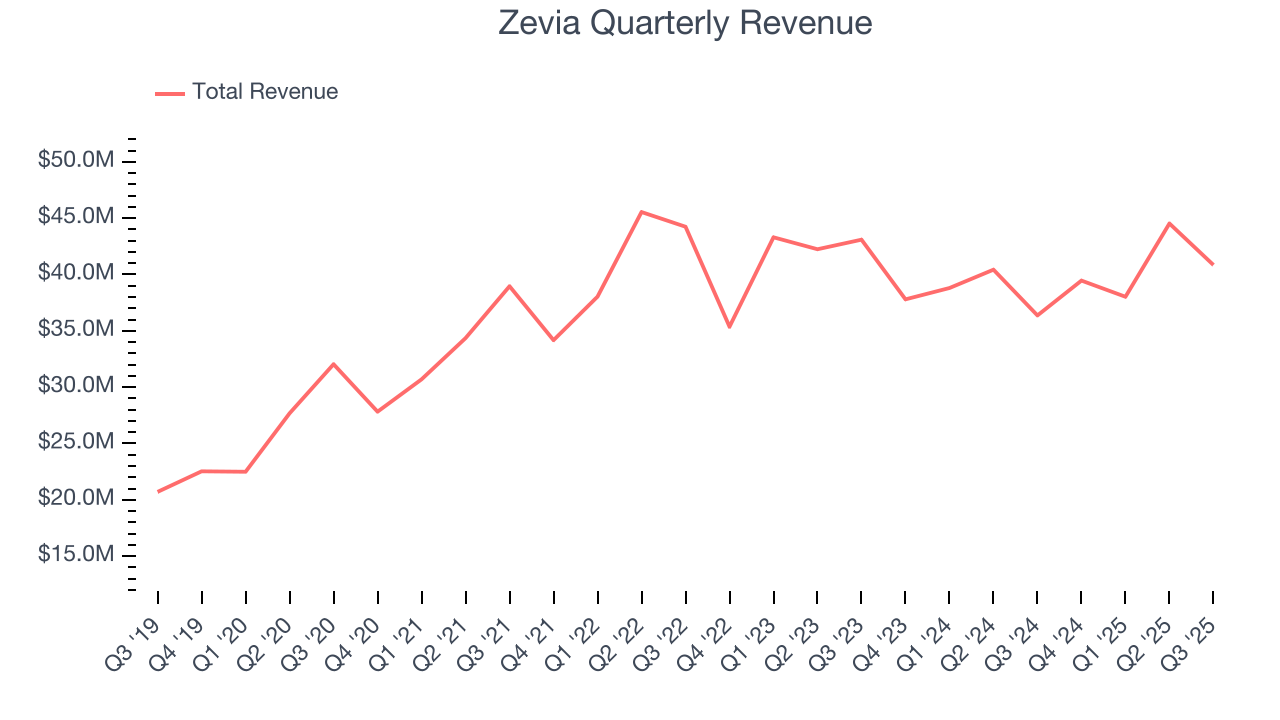

As you can see below, Zevia struggled to increase demand as its $162.8 million of sales for the trailing 12 months was close to its revenue three years ago. To its credit, however, consumers bought more of its products - we’ll explore what this means in the "Volume Growth" section.

This quarter, Zevia reported year-on-year revenue growth of 12.3%, and its $40.84 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for a 1.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. While this projection indicates its newer products will catalyze better top-line performance, it is still below the sector average.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

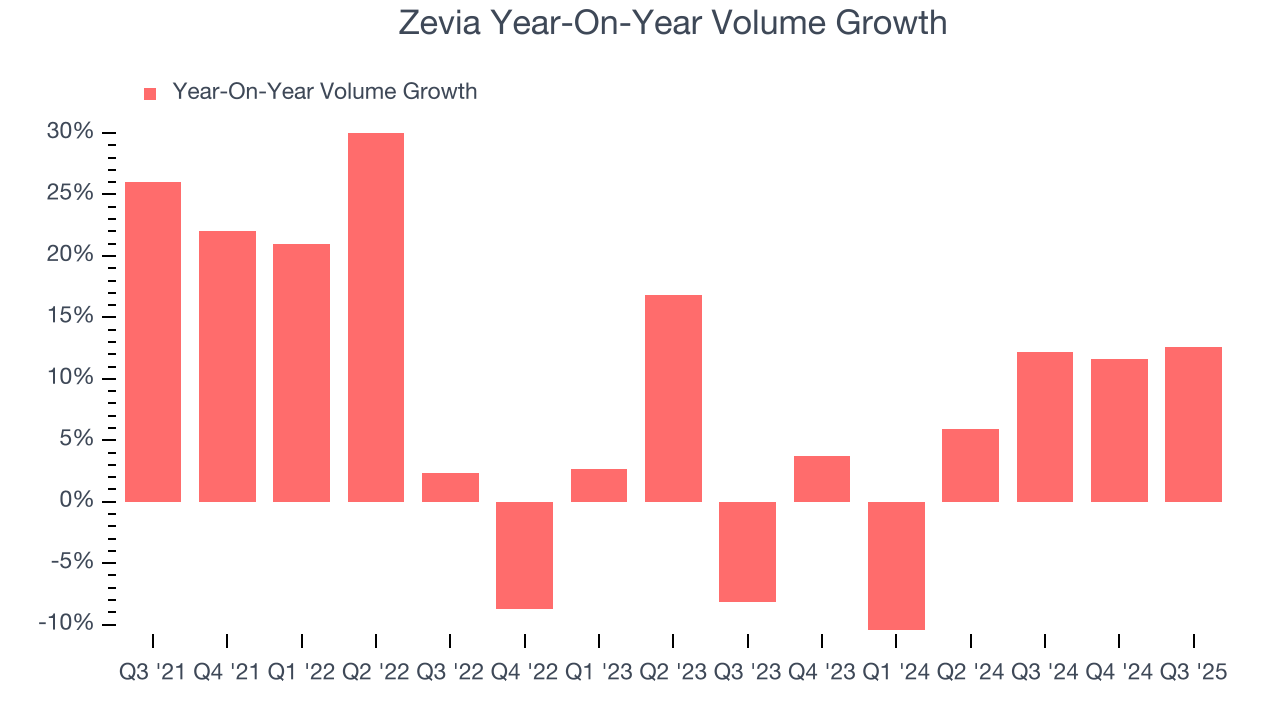

Zevia’s average quarterly volume growth was a robust 5.9% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

In Zevia’s Q3 2025, sales volumes jumped 12.6% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

7. Gross Margin & Pricing Power

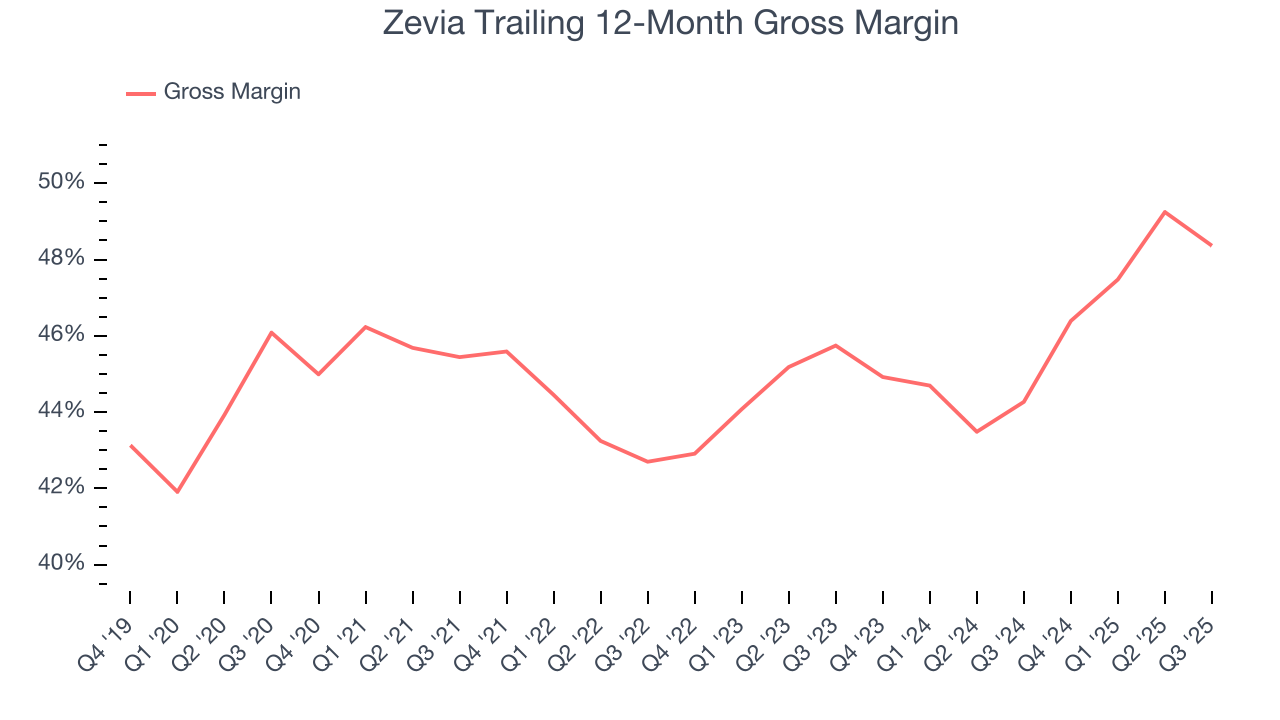

Zevia has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 46.4% gross margin over the last two years. That means Zevia only paid its suppliers $53.62 for every $100 in revenue.

This quarter, Zevia’s gross profit margin was 45.6%, marking a 3.5 percentage point decrease from 49.1% in the same quarter last year. Zooming out, however, Zevia’s full-year margin has been trending up over the past 12 months, increasing by 4.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

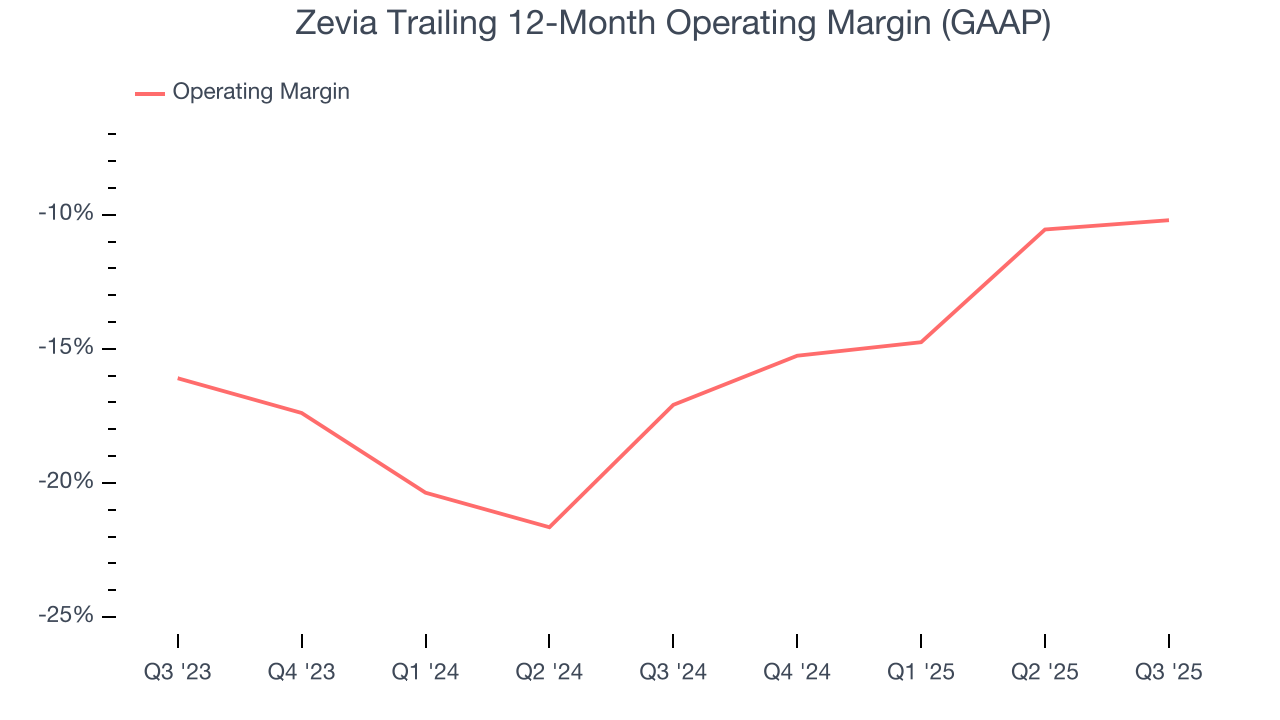

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, Zevia was one of them over the last two years as its high expenses contributed to an average operating margin of negative 13.5%.

On the plus side, Zevia’s operating margin rose by 6.9 percentage points over the last year. Still, it will take much more for the company to reach long-term profitability.

Zevia’s operating margin was negative 7% this quarter. The company's consistent lack of profits raise a flag.

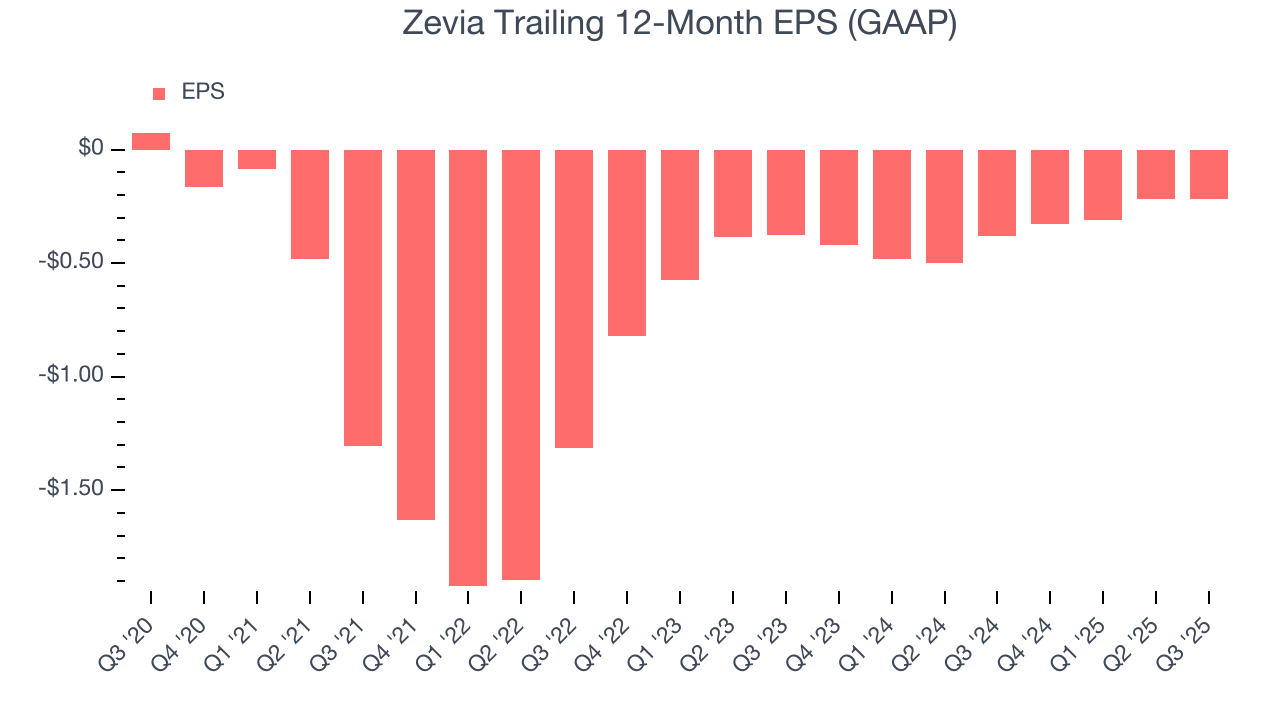

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Zevia reported EPS of negative $0.04, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Zevia to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.22 will advance to negative $0.12.

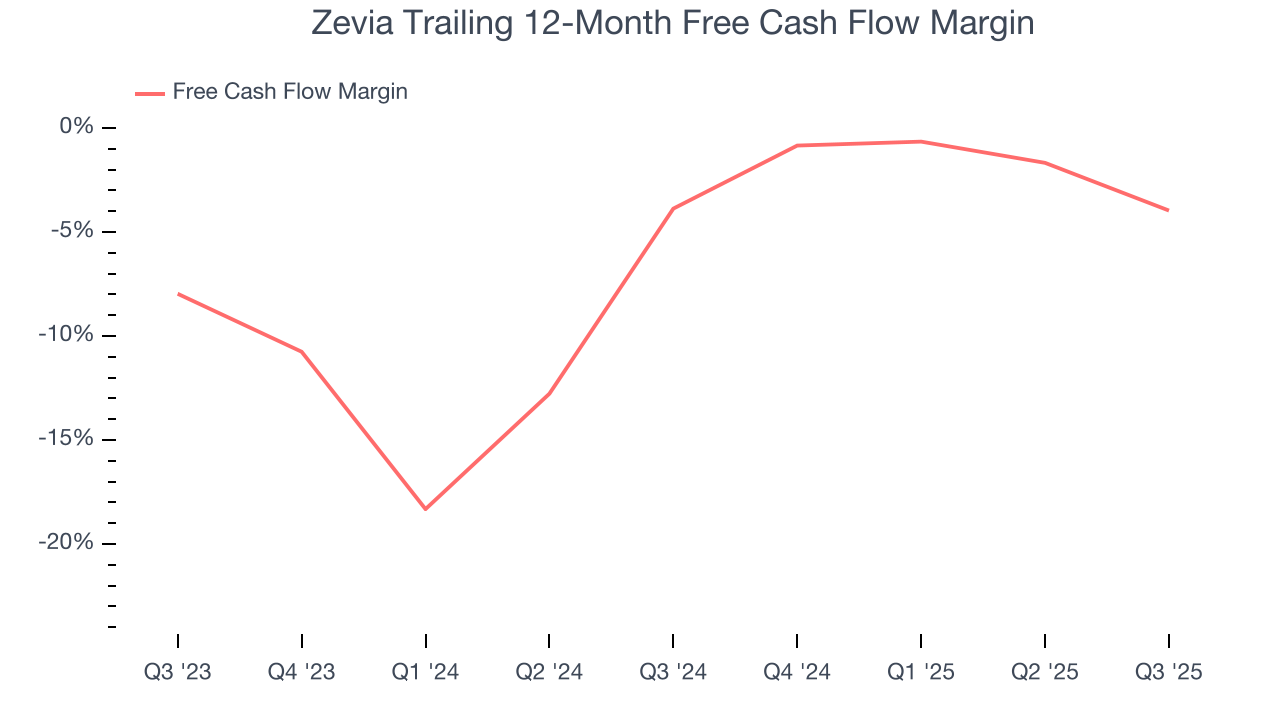

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Zevia’s free cash flow broke even this quarter, the broader story hasn’t been so clean. Zevia’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 3.9%. This means it lit $3.92 of cash on fire for every $100 in revenue.

Zevia broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 10.5 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

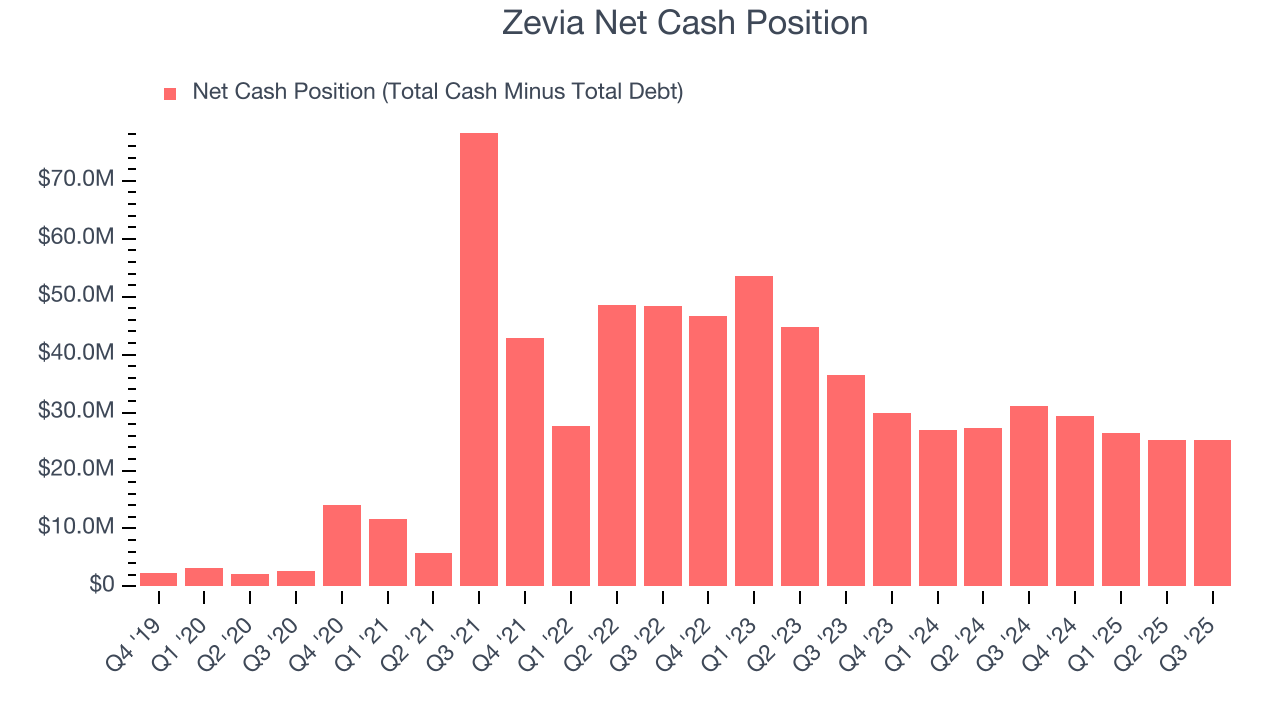

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Zevia is a well-capitalized company with $26.03 million of cash and $830,000 of debt on its balance sheet. This $25.2 million net cash position is 16.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Zevia’s Q3 Results

We were impressed by Zevia’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The stock traded up 11% to $2.62 immediately after reporting.

13. Is Now The Time To Buy Zevia?

Updated: January 21, 2026 at 9:58 PM EST

Before deciding whether to buy Zevia or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Zevia has a few positive attributes, but it doesn’t top our wishlist. Although its revenue growth was weak over the last three years, its growth over the next 12 months is expected to be higher. And while Zevia’s brand caters to a niche market, its projected EPS for the next year implies the company’s fundamentals will improve.

Zevia’s EV-to-EBITDA ratio based on the next 12 months is 229.4x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $4.77 on the company (compared to the current share price of $1.93).