E-signature company DocuSign (DOCU) reported Q4 FY2023 results beating Wall St's expectations, with revenue up 13.6% year on year to $659.6 million. The company expects that next quarter's revenue would be around $641 million, which is the midpoint of the guidance range. That was roughly in line with analyst expectations. DocuSign made a GAAP profit of $4.86 million, improving on its loss of $30.4 million, in the same quarter last year.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it's free.

DocuSign (DOCU) Q4 FY2023 Highlights:

- Revenue: $659.6 million vs analyst estimates of $639.5 million (3.14% beat)

- EPS (non-GAAP): $0.65 vs analyst estimates of $0.52 (24% beat)

- Revenue guidance for Q1 2024 is $641 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for upcoming financial year 2024 is $2.7 billion at the midpoint, in line with analyst expectations and predicting 7.36% growth (vs 19.7% in FY2023)

- Free cash flow of $113 million, up from $36.1 million in previous quarter

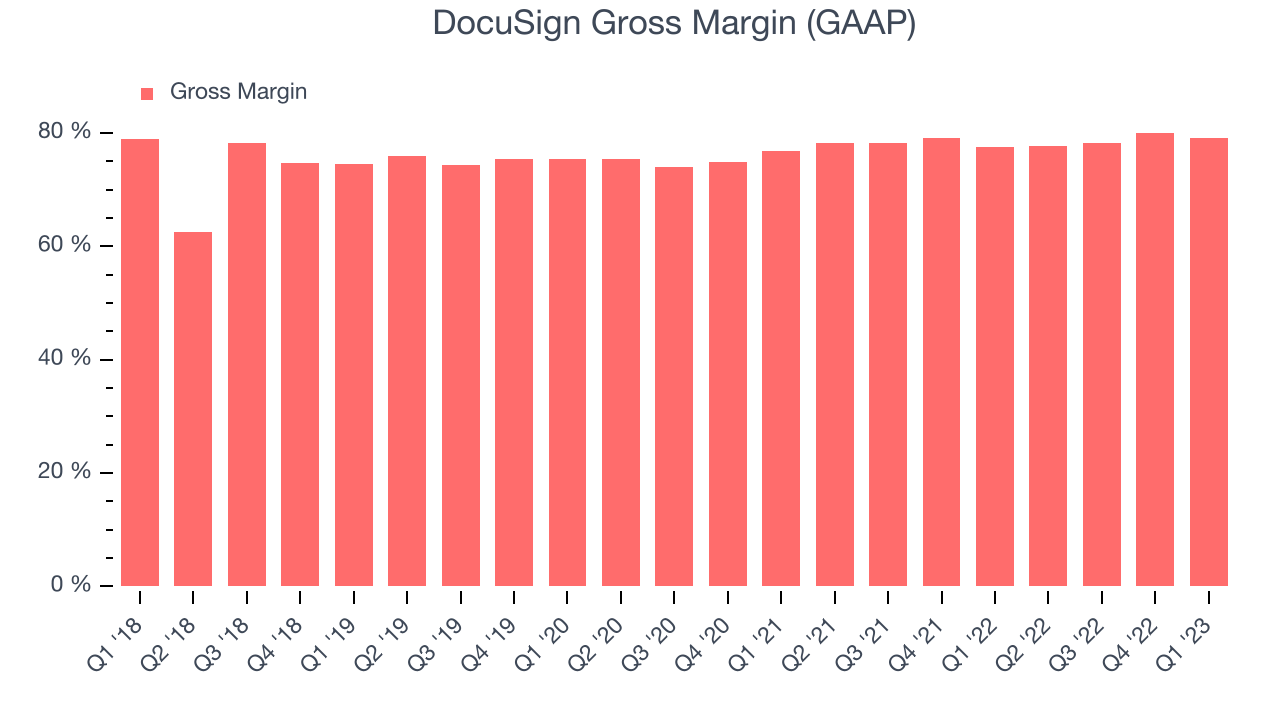

- Gross Margin (GAAP): 79.2%, up from 77.5% same quarter last year

"We finished the year strong, delivering across our key financial metrics and making tangible progress on our strategic priorities. We are reshaping DocuSign to invest in our innovation roadmap and self-service capabilities," said Allan Thygesen, CEO of DocuSign.

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

Sales Growth

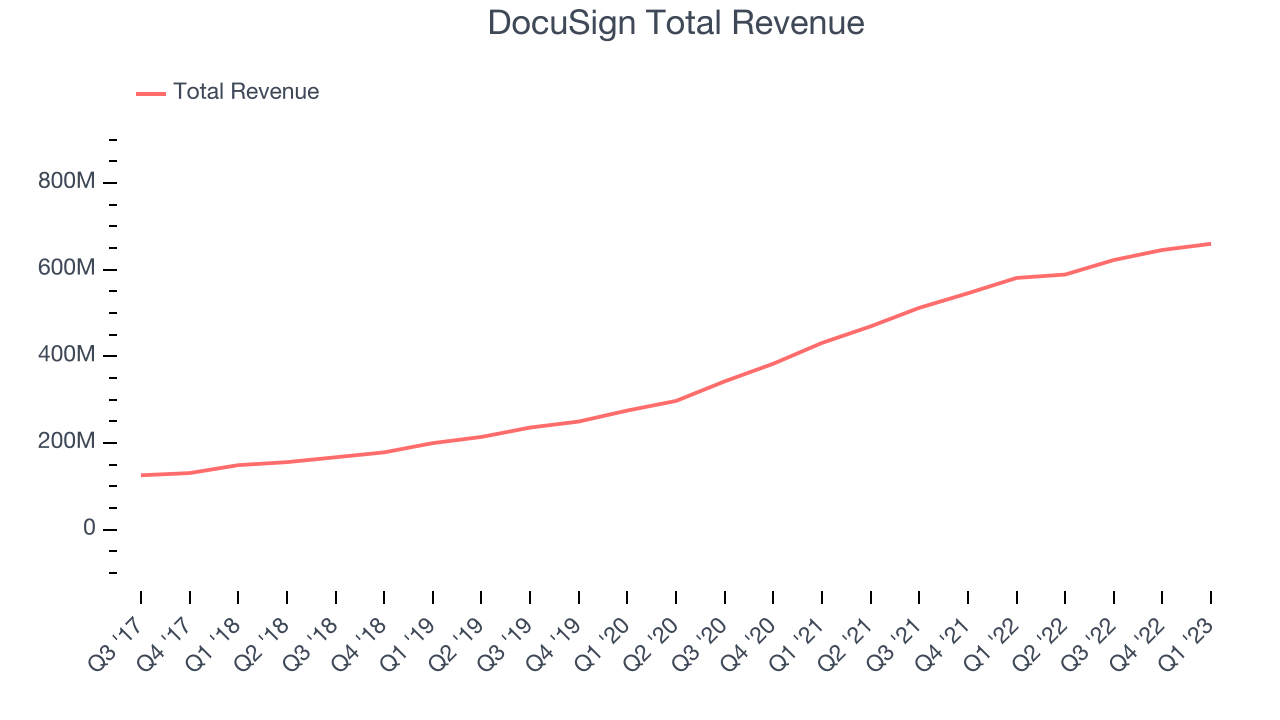

As you can see below, DocuSign's revenue growth has been very strong over the last two years, growing from quarterly revenue of $430.9 million in Q4 FY2021, to $659.6 million.

This quarter, DocuSign's quarterly revenue was once again up 13.6% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $14.1 million in Q4, compared to $23.3 million in Q3 2023. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates DocuSign is expecting revenue to grow 8.89% year on year to $641 million, slowing down from the 25.5% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $2.7 billion at the midpoint, growing 7.36% compared to 19.4% increase in FY2023.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. DocuSign's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 79.2% in Q4.

That means that for every $1 in revenue the company had $0.79 left to spend on developing new products, marketing & sales and the general administrative overhead. Despite the recent drop, this is still a good gross margin that allows companies like DocuSign to fund large investments in product and sales during periods of rapid growth and be profitable when they reach maturity.

Key Takeaways from DocuSign's Q4 Results

With a market capitalization of $13.2 billion, more than $1.03 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

It was good to see DocuSign outperform Wall St’s expectations this quarter. That feature of these results really stood out as a positive. On the other hand, the revenue guidance for next year indicates a significant slowdown. Overall, it seems to us that this was an ok quarter for DocuSign. The company is up 2.66% on the results and currently trades at $66.15 per share.

DocuSign may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.