Online travel agency Expedia (NASDAQ: EXPE) missed analyst expectations in Q4 FY2021 quarter, with revenue up 147% year on year to $2.27 billion. Expedia made a GAAP profit of $395 million, improving on its loss of $391 million, in the same quarter last year.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

Expedia (EXPE) Q4 FY2021 Highlights:

- Revenue: $2.27 billion vs analyst estimates of $2.29 billion (0.81% miss)

- EPS (non-GAAP): $1.06 vs analyst estimates of $0.65 (63% beat)

- Free cash flow of $142 million, up from negative free cash flow of $1.4 billion in previous quarter

- Gross Margin (GAAP): 82.6%, up from 68.8% same quarter last year

- Stayed Room Nights: 62.9 million, up 26.8 million year on year

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Phocuswright estimated that the annual global travel market will reach $1.4 trillion of bookings in 2022 and online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead. Covid lockdowns in 2020 halted global travel for months on end, and may have fundamentally reduced the market for business travel, a long term threat for the profitability of online travel platforms.

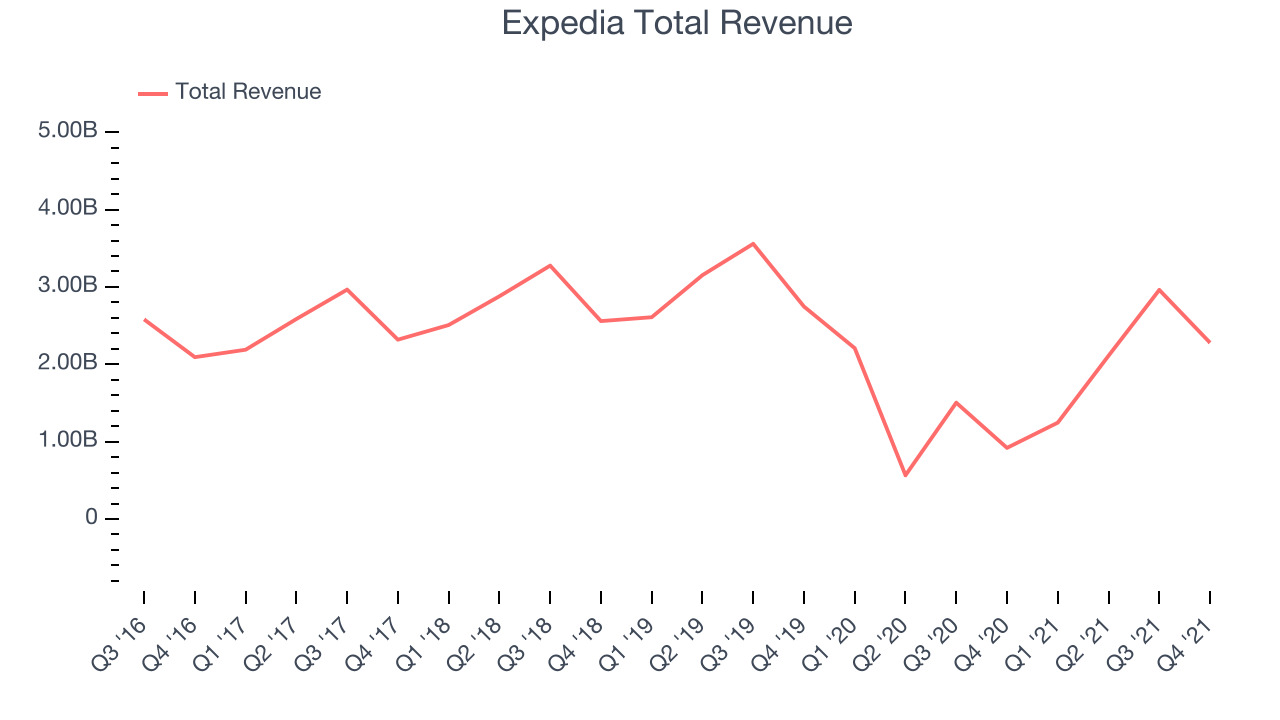

Sales Growth

Expedia's revenue growth over the last three years has been strong, averaging 23.4% annually. Expedia's revenue took a hit when the pandemic first hit, but it has since rebounded strongly, as you can see below.

This quarter, Expedia reported a mind-blowing 147% year on year revenue growth, roughly in line with what analysts expected.

There are others doing even better than Expedia. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Usage Growth

As an online travel company, Expedia generates revenue growth by a combination of increasing the number of stays (or experiences) booked, as well as the level of commission charged on those bookings.

Over the last two years the number of Expedia's nights booked, a key usage metric for the company, grew 70.4% annually to 62.9 million users. This is among the fastest growth of any consumer internet company, indicating that users are excited to come back after the pandemic.

In Q4 the company added 26.8 million nights booked, translating to a 74.2% growth year on year.

Key Takeaways from Expedia's Q4 Results

Sporting a market capitalization of $29.8 billion, more than $4.31 billion in cash and with positive free cash flow over the last twelve months, we're confident that Expedia has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue and EPS growth Expedia delivered this quarter. And we were also glad to see the user growth. On the other hand, it was unfortunate to see that Expedia missed analysts' revenue expectations. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. The company is up 4.25% on the results and currently trades at $206.03 per share.

Should you invest in Expedia right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.