Jazz Pharmaceuticals (JAZZ)

We aren’t fans of Jazz Pharmaceuticals. Its weak returns on capital suggest it doesn’t generate sufficient profits, a sign of value destruction.― StockStory Analyst Team

1. News

2. Summary

Why We Think Jazz Pharmaceuticals Will Underperform

Originally founded in 2003 and now headquartered in Ireland following a 2012 tax inversion merger, Jazz Pharmaceuticals (NASDAQGS:JAZZ) develops and markets medicines for sleep disorders, epilepsy, and cancer, with a focus on treatments for patients with limited therapeutic options.

- Earnings per share have contracted by 8% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

- ROIC of 1.5% reflects management’s challenges in identifying attractive investment opportunities

- The good news is that its excellent adjusted operating margin highlights the strength of its business model

Jazz Pharmaceuticals doesn’t pass our quality test. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Jazz Pharmaceuticals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Jazz Pharmaceuticals

Jazz Pharmaceuticals’s stock price of $181.22 implies a valuation ratio of 7.7x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Jazz Pharmaceuticals (JAZZ) Research Report: Q4 CY2025 Update

Biopharma company Jazz Pharmaceuticals (NASDAQ:JAZZ) announced better-than-expected revenue in Q4 CY2025, with sales up 10.1% year on year to $1.20 billion. On the other hand, the company’s full-year revenue guidance of $4.38 billion at the midpoint came in 2.8% below analysts’ estimates. Its non-GAAP profit of $6.64 per share was 2.1% above analysts’ consensus estimates.

Jazz Pharmaceuticals (JAZZ) Q4 CY2025 Highlights:

- Revenue: $1.20 billion vs analyst estimates of $1.17 billion (10.1% year-on-year growth, 2.4% beat)

- Adjusted EPS: $6.64 vs analyst estimates of $6.51 (2.1% beat)

- Operating Margin: 21.2%, up from 17.5% in the same quarter last year

- Market Capitalization: $10.53 billion

Company Overview

Originally founded in 2003 and now headquartered in Ireland following a 2012 tax inversion merger, Jazz Pharmaceuticals (NASDAQGS:JAZZ) develops and markets medicines for sleep disorders, epilepsy, and cancer, with a focus on treatments for patients with limited therapeutic options.

Jazz's portfolio is anchored by two main therapeutic areas: neuroscience and oncology. In neuroscience, the company's flagship products include Xywav and Xyrem, both oxybate medications used to treat narcolepsy. Xywav, which contains 92% less sodium than Xyrem, has become a standard of care for narcolepsy and idiopathic hypersomnia. The company also markets Epidiolex, the first FDA-approved prescription cannabidiol medication for treating rare forms of epilepsy.

In oncology, Jazz offers Rylaze for acute lymphoblastic leukemia patients who develop hypersensitivity to E. coli-derived asparaginase, and Zepzelca for metastatic small cell lung cancer. These specialized treatments address significant unmet needs in cancer care.

Jazz employs a risk evaluation and mitigation strategy (REMS) for its oxybate products, requiring distribution through a central pharmacy rather than retail outlets. This controlled distribution system helps manage the risks associated with these medications, which are classified as controlled substances.

The company maintains an active research and development program, with multiple clinical-stage candidates in its pipeline. Current development efforts include zanidatamab for HER2-expressing cancers, suvecaltamide for essential tremor, and JZP441 for sleep disorders. Jazz both develops compounds internally and acquires promising candidates through licensing agreements and acquisitions.

Jazz manufactures some products at its own facilities in Athlone, Ireland and Kent Science Park in the UK, while partnering with contract manufacturers for others. The company commercializes its products directly in the US, Europe, Australia, and Canada, and works with distributors in other markets worldwide.

4. Specialty Pharmaceuticals

The specialty pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs for niche diseases. Successful products can generate significant revenue streams over their patent life, and the larger a roster of niche drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Jazz Pharmaceuticals' competitors include UCB Pharma in sleep disorders, GW Pharmaceuticals (now part of Curalevy) in epilepsy treatments, and pharmaceutical companies like PharmaMar, Takeda, and Bristol Myers Squibb in oncology therapeutics.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.27 billion in revenue over the past 12 months, Jazz Pharmaceuticals has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Jazz Pharmaceuticals grew its sales at a decent 11.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Jazz Pharmaceuticals’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Jazz Pharmaceuticals reported year-on-year revenue growth of 10.1%, and its $1.20 billion of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Jazz Pharmaceuticals was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.1% was weak for a healthcare business.

Looking at the trend in its profitability, Jazz Pharmaceuticals’s operating margin decreased by 15.6 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 25.2 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Jazz Pharmaceuticals generated an operating margin profit margin of 21.2%, up 3.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Jazz Pharmaceuticals, its EPS declined by 8% annually over the last five years while its revenue grew by 11.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Jazz Pharmaceuticals’s earnings can give us a better understanding of its performance. As we mentioned earlier, Jazz Pharmaceuticals’s operating margin expanded this quarter but declined by 15.6 percentage points over the last five years. Its share count also grew by 10.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Jazz Pharmaceuticals reported adjusted EPS of $6.64, up from $6.60 in the same quarter last year. This print beat analysts’ estimates by 2.1%. Over the next 12 months, Wall Street expects Jazz Pharmaceuticals’s full-year EPS of $8.20 to grow 157%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Jazz Pharmaceuticals has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 30.3% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Jazz Pharmaceuticals’s margin expanded by 4.5 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Jazz Pharmaceuticals historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.7%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Jazz Pharmaceuticals’s ROIC averaged 2.6 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Assessment

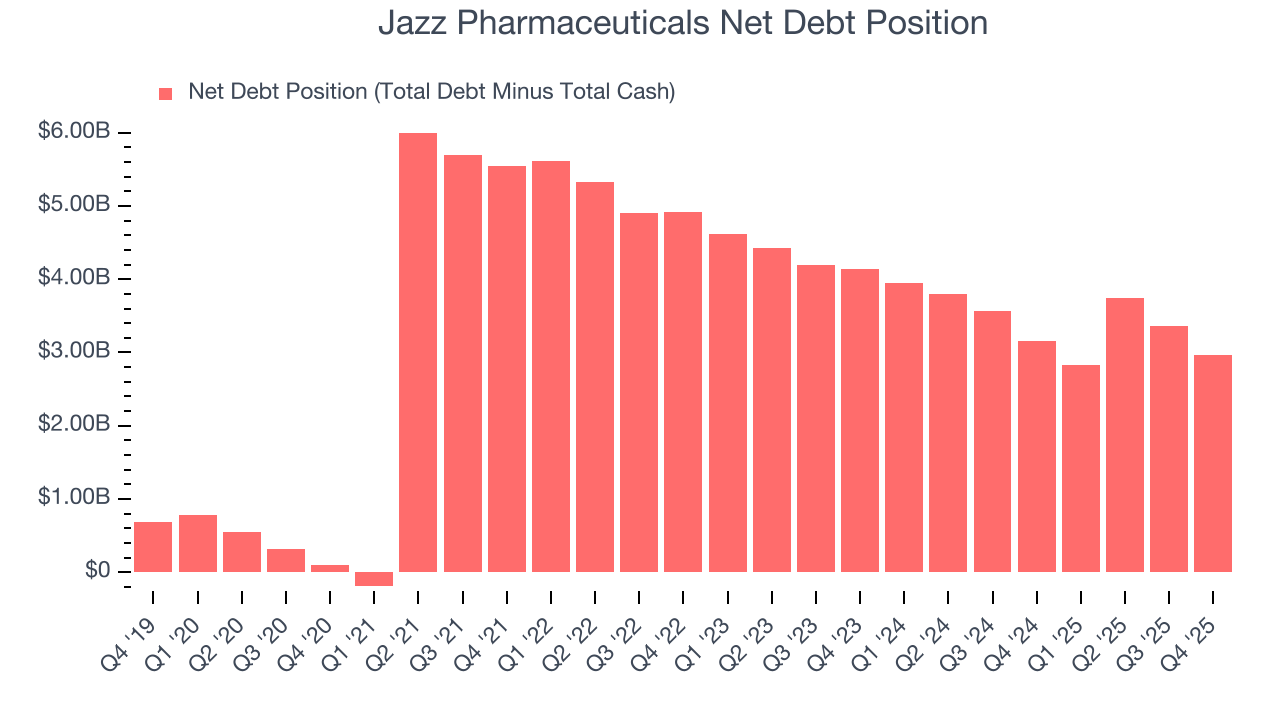

Jazz Pharmaceuticals reported $2.44 billion of cash and $5.41 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $735.4 million of EBITDA over the last 12 months, we view Jazz Pharmaceuticals’s 4.0× net-debt-to-EBITDA ratio as safe. We also see its $195.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Jazz Pharmaceuticals’s Q4 Results

It was encouraging to see Jazz Pharmaceuticals beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed. Overall, this quarter could have been better. The stock remained flat at $173.81 immediately following the results.

13. Is Now The Time To Buy Jazz Pharmaceuticals?

Updated: March 6, 2026 at 11:50 PM EST

Before deciding whether to buy Jazz Pharmaceuticals or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Jazz Pharmaceuticals isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining adjusted operating margin shows the business has become less efficient.

Jazz Pharmaceuticals’s P/E ratio based on the next 12 months is 7.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $222.69 on the company (compared to the current share price of $181.22).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.