Delta (DAL)

Delta faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Delta Will Underperform

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE:DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 4.5% over the last two years was below our standards for the consumer discretionary sector

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Delta is in the penalty box. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Delta

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Delta

Delta’s stock price of $69.47 implies a valuation ratio of 9.7x forward P/E. Delta’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Delta (DAL) Research Report: Q4 CY2025 Update

Global airline Delta Air Lines (NYSE:DAL) announced better-than-expected revenue in Q4 CY2025, with sales up 2.9% year on year to $16 billion. Guidance for next quarter’s revenue was better than expected at $14.88 billion at the midpoint, 1.1% above analysts’ estimates. Its GAAP profit of $1.86 per share was 18.7% above analysts’ consensus estimates.

Delta (DAL) Q4 CY2025 Highlights:

- Revenue: $16 billion vs analyst estimates of $15.75 billion (2.9% year-on-year growth, 1.6% beat)

- EPS (GAAP): $1.86 vs analyst estimates of $1.57 (18.7% beat)

- Adjusted EBITDA: $2.09 billion vs analyst estimates of $2.23 billion (13% margin, 6.6% miss)

- Revenue Guidance for Q1 CY2026 is $14.88 billion at the midpoint, above analyst estimates of $14.72 billion

- EPS (GAAP) guidance for the upcoming financial year 2026 is $7 at the midpoint, missing analyst estimates by 4.3%

- Operating Margin: 9.2%, down from 11% in the same quarter last year

- Free Cash Flow Margin: 8.4%, up from 3.9% in the same quarter last year

- Revenue Passenger Miles: 59.86 billion, in line with the same quarter last year

- Market Capitalization: $46.07 billion

Company Overview

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE:DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

The company was founded in 1925 as a crop-dusting operation known as Huff Daland Dusters in Macon, Georgia. It began passenger flights in 1929, and over time, Delta grew through M&A, including its 1987 purchase of Western Airlines and its 2008 merger with Northwest Airlines, which positioned Delta as one of the largest global air carriers.

Today, Delta's primary product offering is air travel, which generates the bulk of its revenue. The company offers a variety of fare classes, from basic economy to first-class. Ancillary services, such as checked baggage, in-flight food, and priority boarding, are also revenue streams, although these depend on air travel ticket sales. Beyond passenger services, the company also provides cargo services, transporting goods across its global network.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Competitors in the air carrier space include American Airlines (NASDAQ:AAL), JetBlue Airways (NASDAQ:JBLU), and Southwest Airlines (NYSE:LUV).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Delta grew its sales at a 30% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Delta’s recent performance shows its demand has slowed as its annualized revenue growth of 4.5% over the last two years was below its five-year trend.

Delta also discloses its number of revenue passenger miles, which reached 59.86 billion in the latest quarter. Over the last two years, Delta’s revenue passenger miles averaged 3.8% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Delta reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 1.6%. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

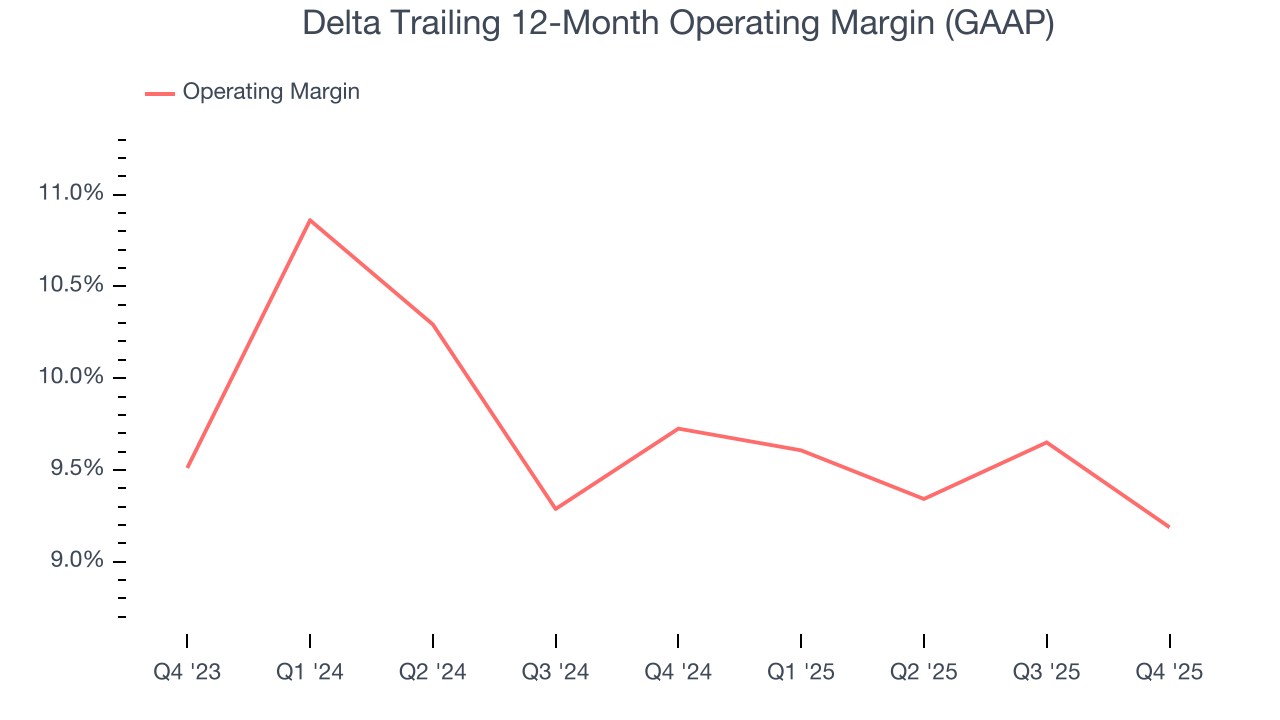

Delta’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9.5% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Delta generated an operating margin profit margin of 9.2%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

In the coming year, Wall Street expects Delta to become more profitable. Analysts are expecting the company’s trailing 12-month operating margin of 9.2% to rise to 10.5%.

7. Earnings Per Share

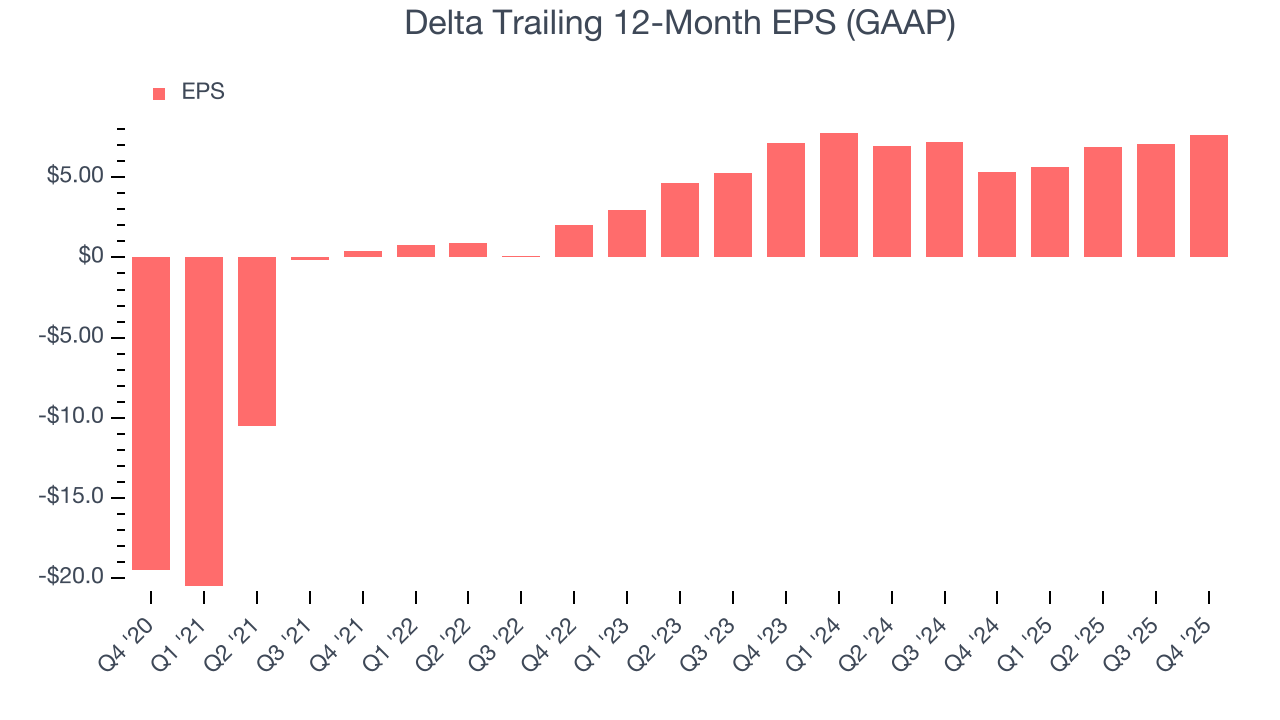

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Delta’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Delta reported EPS of $1.86, up from $1.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Delta’s full-year EPS of $7.67 to shrink by 6.9%. This is unusual as its revenue and operating margin are anticipated to increase, signaling the fall likely stems from "below-the-line" items such as taxes.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Delta has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.4%, lousy for a consumer discretionary business.

Delta’s free cash flow clocked in at $1.35 billion in Q4, equivalent to a 8.4% margin. This result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts’ consensus estimates show they’re expecting Delta’s free cash flow margin of 6.1% for the last 12 months to remain the same.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Delta historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 16.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Delta’s ROIC decreased by 1.4 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

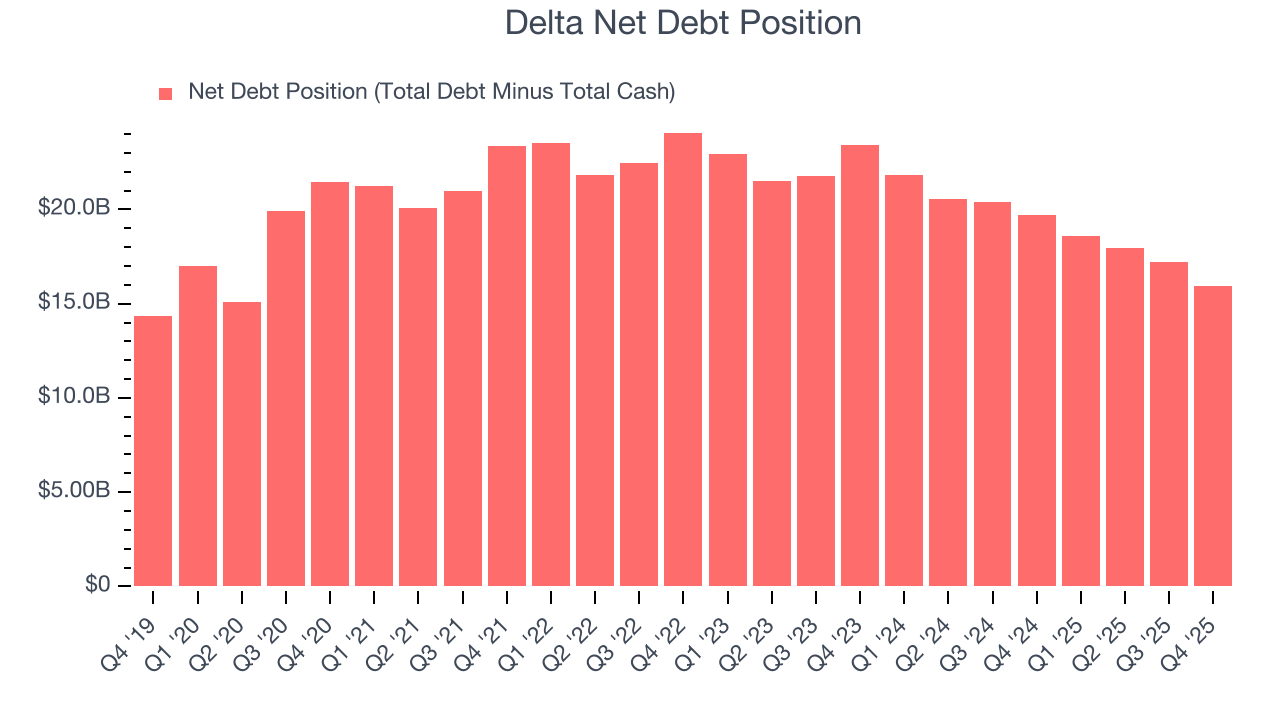

10. Balance Sheet Assessment

Delta reported $4.31 billion of cash and $20.27 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $8.24 billion of EBITDA over the last 12 months, we view Delta’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $679 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Delta’s Q4 Results

It was good to see Delta beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its number of revenue passenger miles missed and its full-year EPS guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 5.1% to $67.21 immediately after reporting.

12. Is Now The Time To Buy Delta?

Updated: February 25, 2026 at 11:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Delta.

We see the value of companies helping consumers, but in the case of Delta, we’re out. On top of that, Delta’s number of revenue passenger miles has disappointed, and its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

Delta’s P/E ratio based on the next 12 months is 9.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $81.89 on the company (compared to the current share price of $69.47).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.