IonQ (IONQ)

IonQ catches our eye. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why IonQ Is Interesting

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE:IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

- Annual revenue growth of 181% over the past four years was outstanding, reflecting market share gains this cycle

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

- On the other hand, its subscale operations are evident in its revenue base of $130 million, meaning it has fewer distribution channels than its larger rivals (but more room for growth)

IonQ is solid, but not perfect. If you’re a believer, the price seems fair.

Why Is Now The Time To Buy IonQ?

High Quality

Investable

Underperform

Why Is Now The Time To Buy IonQ?

At $35.90 per share, IonQ trades at 58.3x forward price-to-sales. Looking at the business services landscape right now, IonQ trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Now could be a good time to invest if you believe in the long-term prospects of the business.

3. IonQ (IONQ) Research Report: Q4 CY2025 Update

Quantum computing company IonQ (NYSE:IONQ) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 429% year on year to $61.89 million. The company’s full-year revenue guidance of $235 million at the midpoint came in 22% above analysts’ estimates. Its non-GAAP loss of $0.20 per share was 13% above analysts’ consensus estimates.

IonQ (IONQ) Q4 CY2025 Highlights:

- Revenue: $61.89 million vs analyst estimates of $40.39 million (429% year-on-year growth, 53.2% beat)

- Adjusted EPS: -$0.20 vs analyst estimates of -$0.23 (13% beat)

- Adjusted EBITDA: -$67.39 million (-109% margin, 105% year-on-year decline)

- EBITDA guidance for the upcoming financial year 2026 is -$320 million at the midpoint, below analyst estimates of -$316.8 million

- Operating Margin: -369%, up from -662% in the same quarter last year

- Free Cash Flow was -$80.34 million compared to -$43.02 million in the same quarter last year

- Market Capitalization: $11.2 billion

Company Overview

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE:IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

IonQ's quantum computers harness the principles of quantum mechanics to perform calculations that would be impractical or impossible for conventional computers. Unlike traditional computers that use bits (0s and 1s), quantum computers use quantum bits or "qubits" that can exist in multiple states simultaneously, potentially enabling exponential increases in computing power for certain applications.

The company's technology specifically uses trapped ions as qubits, where individual atoms are suspended in electromagnetic fields and manipulated with lasers. This approach differs from other quantum computing methods that use superconducting circuits or silicon-based qubits. IonQ claims its ion-trap approach offers advantages in qubit quality and coherence time—how long qubits maintain their quantum state before errors creep in.

IonQ makes its quantum computers accessible through a cloud-based quantum-computing-as-a-service (QCaaS) model. Researchers, businesses, and government agencies can run quantum algorithms on IonQ's hardware through major cloud platforms including Amazon Web Services' Amazon Braket, Microsoft's Azure Quantum, and Google Cloud Marketplace. A pharmaceutical company might use IonQ's quantum computers to simulate molecular interactions for drug discovery, while a financial institution could explore quantum algorithms for portfolio optimization.

Beyond cloud access, IonQ offers direct system access for select customers who need dedicated computing time or specialized support. The company also provides professional services to help clients identify and develop quantum computing applications relevant to their businesses. For organizations requiring on-premises solutions, IonQ is developing systems that can be installed at customer locations.

IonQ maintains research partnerships with academic institutions, particularly the University of Maryland and Duke University, from which it licenses key intellectual property. These relationships give IonQ access to ongoing research in quantum physics and engineering, helping the company advance its technology.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

IonQ competes with tech giants developing their own quantum computing technologies, including Google (NASDAQ:GOOGL), IBM (NYSE:IBM), Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN). Other quantum computing competitors include Rigetti Computing (NASDAQ:RGTI), D-Wave Quantum (NYSE:QBTS), and privately-held companies like Quantinuum and PsiQuantum.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $130 million in revenue over the past 12 months, IonQ is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, IonQ grew its sales at an incredible 181% compounded annual growth rate over the last four years. This is an encouraging starting point for our analysis because it shows IonQ’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. IonQ’s annualized revenue growth of 143% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, IonQ reported magnificent year-on-year revenue growth of 429%, and its $61.89 million of revenue beat Wall Street’s estimates by 53.2%.

Looking ahead, sell-side analysts expect revenue to grow 44.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market sees success for its products and services.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

IonQ’s high expenses have contributed to an average operating margin of negative 551% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, IonQ’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, IonQ generated a negative 369% operating margin.

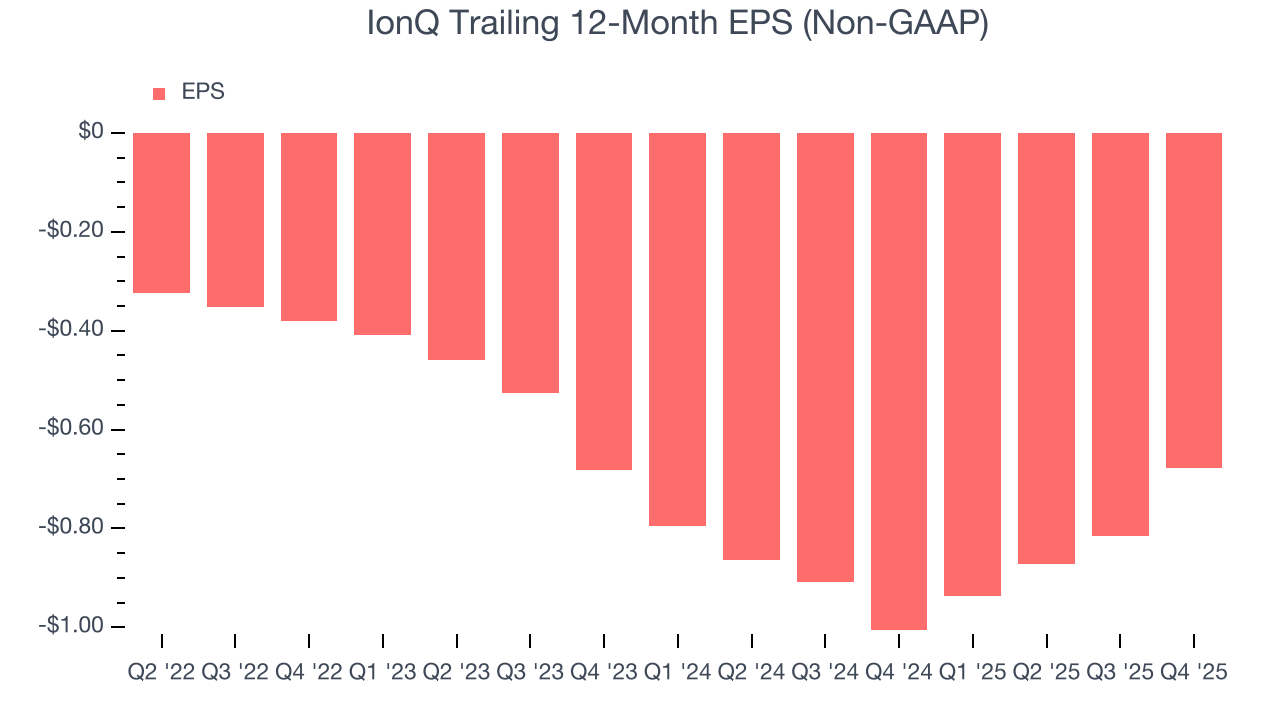

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

IonQ’s earnings losses deepened over the last four years as its EPS dropped 26.8% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For IonQ, EPS didn’t budge over the last two years, but at least that was better than its four-year trend. Given the merits in other parts of its business, we’re hopeful it can generate earnings growth in the coming years.

In Q4, IonQ reported adjusted EPS of negative $0.20, up from negative $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects IonQ to perform poorly. Analysts forecast its full-year EPS of negative $0.68 will tumble to negative $1.04.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

IonQ’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 289%, meaning it lit $288.53 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that IonQ’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

IonQ burned through $80.34 million of cash in Q4, equivalent to a negative 130% margin. The company’s cash burn increased from $43.02 million of lost cash in the same quarter last year.

9. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

IonQ is a well-capitalized company with $2.39 billion of cash and $30.02 million of debt on its balance sheet. This $2.36 billion net cash position is 19.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from IonQ’s Q4 Results

We were impressed by how significantly IonQ blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.6% to $35.58 immediately following the results.

11. Is Now The Time To Buy IonQ?

Updated: March 5, 2026 at 11:22 PM EST

Are you wondering whether to buy IonQ or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

IonQ is a fine business. First off, its revenue growth was exceptional over the last four years. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding adjusted operating margin shows the business has become more efficient.

IonQ’s forward price-to-sales ratio is 58.3x. Looking at the business services landscape right now, IonQ trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $67.04 on the company (compared to the current share price of $35.90), implying they see 86.8% upside in buying IonQ in the short term.