Wiley (WLY)

We wouldn’t recommend Wiley. Strike one is its drop in sales and strike two is its falling cash conversion. No need to wait for strike three.― StockStory Analyst Team

1. News

2. Summary

Why We Think Wiley Will Underperform

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE:WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2.2% annually over the last five years

- Sales are projected to be flat over the next 12 months and imply weak demand

- Earnings growth over the last two years fell short of the peer group average as its EPS only increased by 7.3% annually

Wiley doesn’t live up to our standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Wiley

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wiley

Wiley is trading at $29.08 per share, or 1x trailing 12-month price-to-sales. The market typically values companies like Wiley based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Wiley (WLY) Research Report: Q3 CY2025 Update

Academic publishing company John Wiley & Sons (NYSE:WLY) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 1.1% year on year to $421.8 million. Its non-GAAP profit of $1.10 per share was 13.4% above analysts’ consensus estimates.

Wiley (WLY) Q3 CY2025 Highlights:

- Revenue: $421.8 million vs analyst estimates of $416.4 million (1.1% year-on-year decline, 1.3% beat)

- Adjusted EPS: $1.10 vs analyst estimates of $0.97 (13.4% beat)

- Adjusted EBITDA: $115.1 million vs analyst estimates of $105 million (27.3% margin, 9.6% beat)

- Management reiterated its full-year Adjusted EPS guidance of $4.13 at the midpoint

- Operating Margin: 17.3%, up from 15.4% in the same quarter last year

- Free Cash Flow was -$8.03 million compared to -$19.81 million in the same quarter last year

- Market Capitalization: $2.01 billion

Company Overview

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE:WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

Wiley operates through three main segments: Research, Learning, and businesses that are held for sale or have been sold. The Research segment, which generates the majority of revenue, publishes over 1,900 academic journals spanning disciplines from physical sciences to humanities. These journals are distributed to academic institutions, corporations, and researchers through subscription models, transformational agreements, and open access publishing.

The company's Learning segment serves academic and professional markets with textbooks, reference materials, and digital courseware. Its academic products support higher education with materials for students and faculty, while professional offerings include business, technology, and specialized publications like the popular "For Dummies" series. The segment also provides assessment tools for organizations to evaluate and develop their workforce.

A researcher using Wiley's services might publish findings in a peer-reviewed Wiley journal, access other scholarly articles through the Wiley Online Library platform, or use Wiley's editorial services to prepare manuscripts. Similarly, a business professional might use Wiley's assessment tools to evaluate team dynamics or access professional development resources.

Wiley generates revenue through multiple channels: journal subscriptions where institutions pay for access, open access publishing where authors pay article publication charges, textbook and book sales, digital platform licensing, and assessment services. The company has evolved from traditional print publishing to digital content delivery, with platforms like Literatum and WileyPLUS serving as digital hubs for its content.

Wiley maintains strategic partnerships with over 900 societies and professional organizations, publishing journals on their behalf and providing them with publishing expertise while gaining access to specialized content and communities. The company operates globally with publishing centers in the United States, United Kingdom, Germany, Australia, India, and China.

4. Traditional Media & Publishing

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

Wiley competes with other academic and professional publishers including Elsevier (owned by RELX Group, NYSE:RELX), Springer Nature (privately held), Taylor & Francis (owned by Informa, LSE:INF), McGraw Hill (privately held), and Pearson (NYSE:PSO).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.67 billion in revenue over the past 12 months, Wiley is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Wiley struggled to generate demand over the last five years. Its sales dropped by 2.2% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Wiley’s recent performance shows its demand remained suppressed as its revenue has declined by 7.8% annually over the last two years.

This quarter, Wiley’s revenue fell by 1.1% year on year to $421.8 million but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

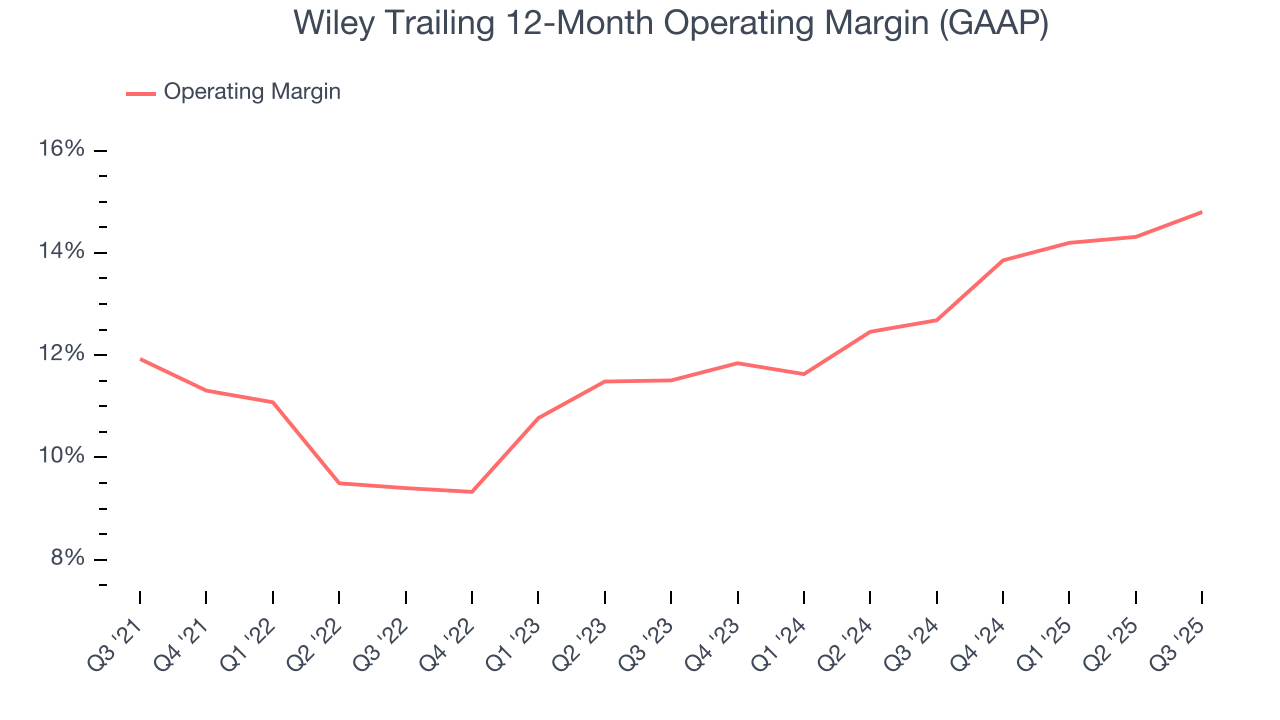

6. Operating Margin

Wiley has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.9%, higher than the broader business services sector.

Looking at the trend in its profitability, Wiley’s operating margin rose by 2.9 percentage points over the last five years, showing its efficiency has improved.

This quarter, Wiley generated an operating margin profit margin of 17.3%, up 1.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

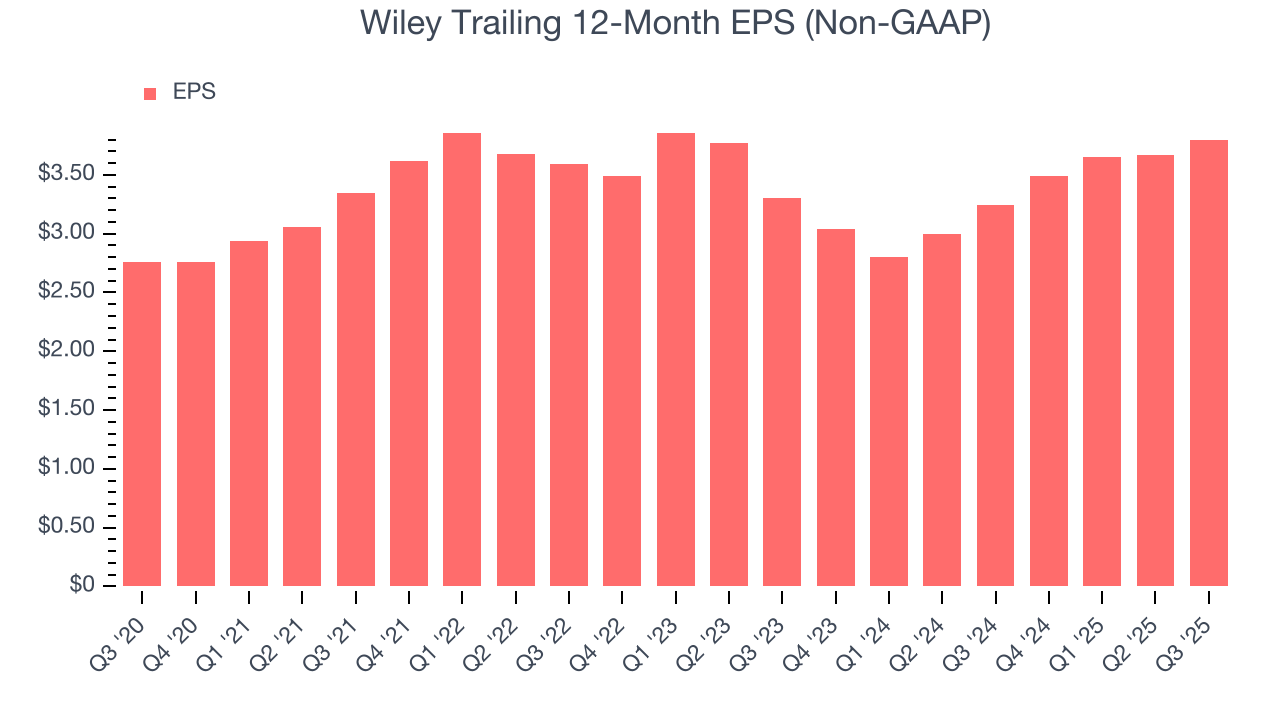

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Wiley’s EPS grew at an unimpressive 6.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Diving into the nuances of Wiley’s earnings can give us a better understanding of its performance. As we mentioned earlier, Wiley’s operating margin expanded by 2.9 percentage points over the last five years. On top of that, its share count shrank by 4.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Wiley, its two-year annual EPS growth of 7.3% is similar to its five-year trend, implying stable earnings.

In Q3, Wiley reported adjusted EPS of $1.10, up from $0.97 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

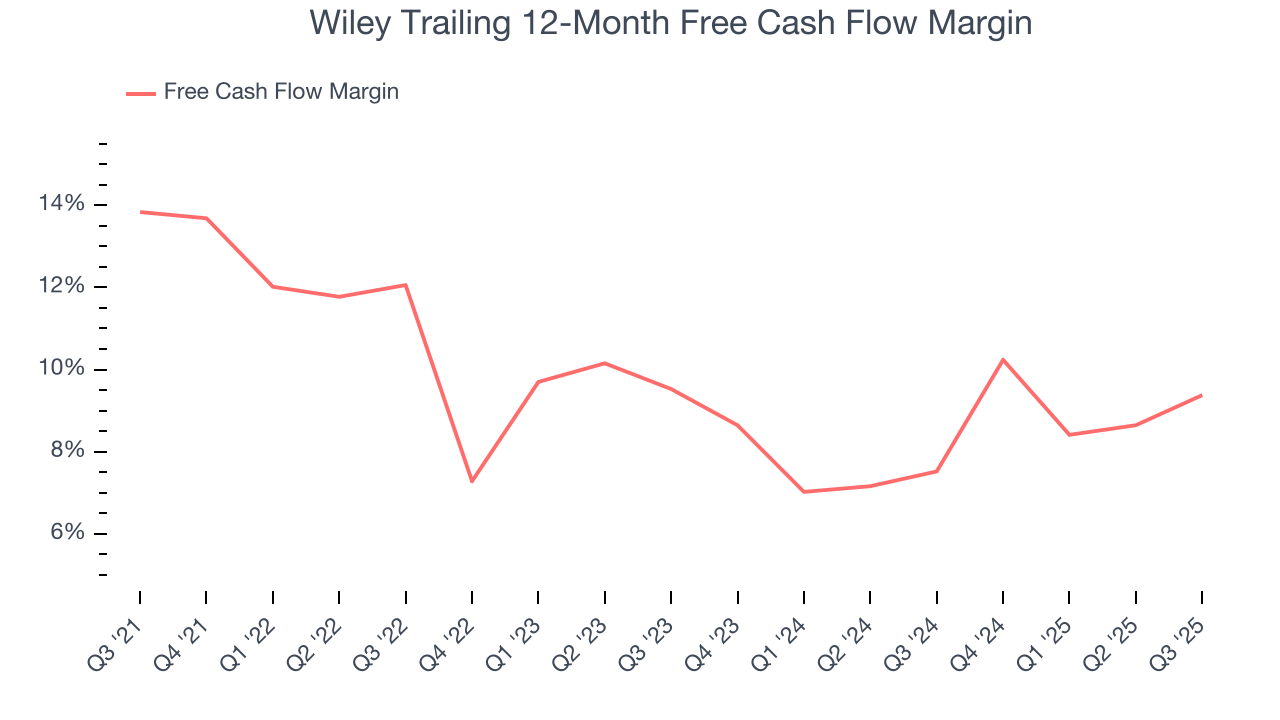

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Wiley has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.6% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Wiley’s margin dropped by 4.5 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Wiley burned through $8.03 million of cash in Q3, equivalent to a negative 1.9% margin. The company’s cash burn was similar to its $19.81 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wiley’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.7%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Wiley’s ROIC increased by 1.9 percentage points annually over the last few years. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

Wiley reported $67.4 million of cash and $964.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $405 million of EBITDA over the last 12 months, we view Wiley’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $24.67 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Wiley’s Q3 Results

It was good to see Wiley beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $37.89 immediately following the results.

12. Is Now The Time To Buy Wiley?

Updated: February 23, 2026 at 10:01 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Wiley doesn’t pass our quality test. First off, its revenue has declined over the last five years. While its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its cash profitability fell over the last five years. On top of that, its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Wiley’s price-to-sales ratio based on the trailing 12 months is 1x. The market typically values companies like Wiley based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $60 on the company (compared to the current share price of $29.08).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.