CrowdStrike (CRWD)

CrowdStrike is a great business. Its efficient sales engine has led to first-class growth, showing it can win market share organically.― StockStory Analyst Team

1. News

2. Summary

Why We Like CrowdStrike

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ:CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

- Annual revenue growth of 43.1% over the last five years was superb and indicates its market share is rising

- Forecasted revenue growth of 22.1% for the next 12 months indicates its momentum over the last two years is sustainable

- Software platform has product-market fit given the rapid recovery of its customer acquisition costs

CrowdStrike is a market leader. The valuation seems reasonable when considering its quality, so this could be an opportune time to invest in some shares.

Why Is Now The Time To Buy CrowdStrike?

Why Is Now The Time To Buy CrowdStrike?

CrowdStrike’s stock price of $421 implies a valuation ratio of 18.8x forward price-to-sales. Sure, the valuation multiple seems high and could make for some share price rockiness. But given its fundamentals, we think the multiple is justified.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. Over a multi-year investment horizon, entry price doesn’t matter nearly as much as business quality.

3. CrowdStrike (CRWD) Research Report: Q3 CY2025 Update

Cybersecurity platform provider CrowdStrike (NASDAQ:CRWD) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 22.2% year on year to $1.23 billion. The company expects next quarter’s revenue to be around $1.30 billion, close to analysts’ estimates. Its non-GAAP profit of $0.96 per share was 2% above analysts’ consensus estimates.

CrowdStrike (CRWD) Q3 CY2025 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.22 billion (22.2% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.94 (2% beat)

- Adjusted Operating Income: $264.6 million vs analyst estimates of $260.7 million (21.4% margin, 1.5% beat)

- Revenue Guidance for Q4 CY2025 is $1.30 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $3.71 at the midpoint, a 1.4% increase

- Operating Margin: -5.6%, in line with the same quarter last year

- Free Cash Flow Margin: 24%, similar to the previous quarter

- Annual Recurring Revenue: $4.92 billion vs analyst estimates of $4.89 billion (22.5% year-on-year growth, 0.5% beat)

- Market Capitalization: $126.5 billion

Company Overview

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ:CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

CrowdStrike's Falcon platform uses a single lightweight agent installed on customer devices that collects and analyzes data to detect and prevent cyber threats in real-time. The platform leverages cloud-scale artificial intelligence and massive datasets to identify sophisticated attacks, including fileless malware that traditional security tools often miss. When the agent detects suspicious activity, it can automatically block the threat and alert security teams.

At the core of CrowdStrike's technology is its proprietary "Threat Graph" - a dynamic database that processes trillions of security events weekly to identify patterns of malicious behavior. For example, when a financial services company's employee clicks a phishing email, Threat Graph can instantly recognize the attack pattern and prevent the malware from executing based on behavioral indicators rather than relying on known signatures.

The company offers 27 integrated modules spanning endpoint security, cloud security, identity protection, and threat intelligence. Customers typically begin with core protection modules and add additional services over time. CrowdStrike also provides professional services including incident response for organizations experiencing active breaches.

CrowdStrike generates revenue through subscription-based pricing for its software modules. Enterprise customers ranging from Fortune 500 companies to government agencies make up its client base, with customers in sectors like finance, healthcare, and critical infrastructure that face sophisticated cyber threats. In recent years, CrowdStrike has expanded from its enterprise focus to also serve small and medium-sized businesses.

4. Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

CrowdStrike competes with traditional endpoint security providers like Microsoft (NASDAQ:MSFT) with its Defender product, Palo Alto Networks (NASDAQ:PANW), SentinelOne (NYSE:S), and VMware's Carbon Black (now part of Broadcom, NASDAQ:AVGO). In the cloud security space, it faces competition from Wiz, Zscaler (NASDAQ:ZS), and Cisco (NASDAQ:CSCO).

5. Revenue Growth

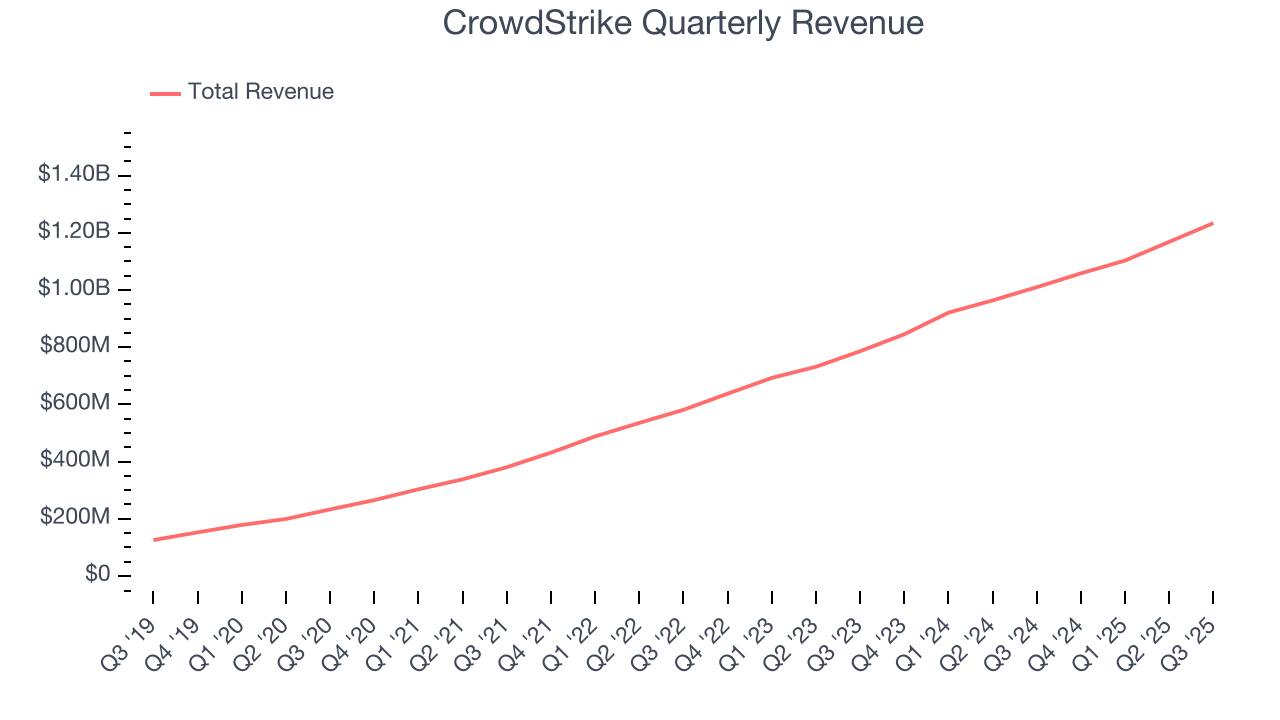

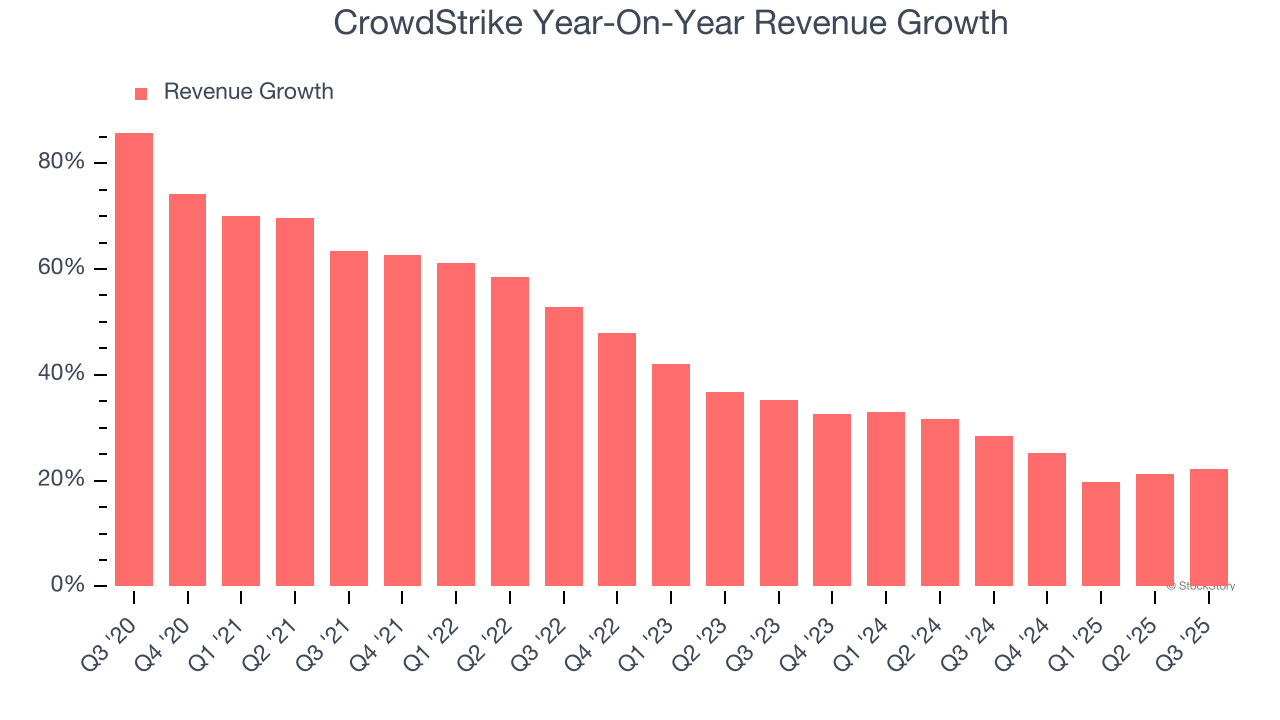

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, CrowdStrike’s 43.1% annualized revenue growth over the last five years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. CrowdStrike’s annualized revenue growth of 26.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, CrowdStrike reported robust year-on-year revenue growth of 22.2%, and its $1.23 billion of revenue topped Wall Street estimates by 1.6%. Company management is currently guiding for a 22.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products and services.

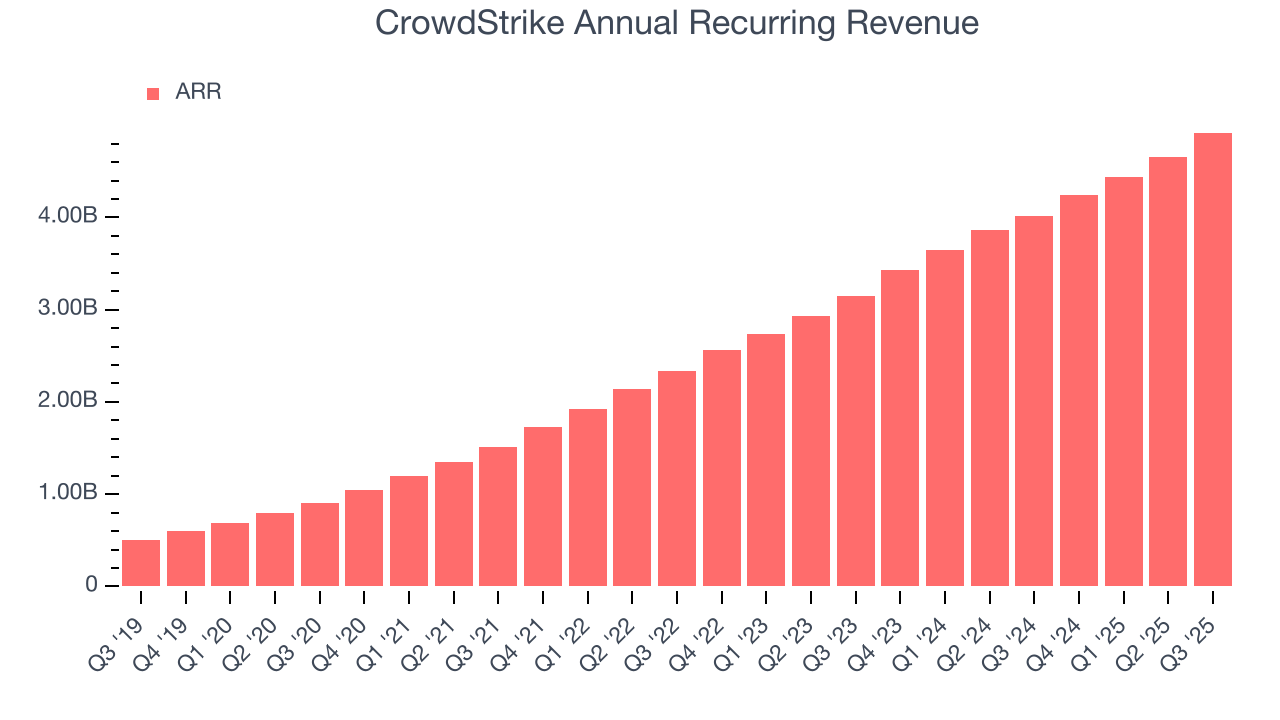

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

CrowdStrike’s ARR punched in at $4.92 billion in Q3, and over the last four quarters, its growth was impressive as it averaged 22% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes CrowdStrike a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

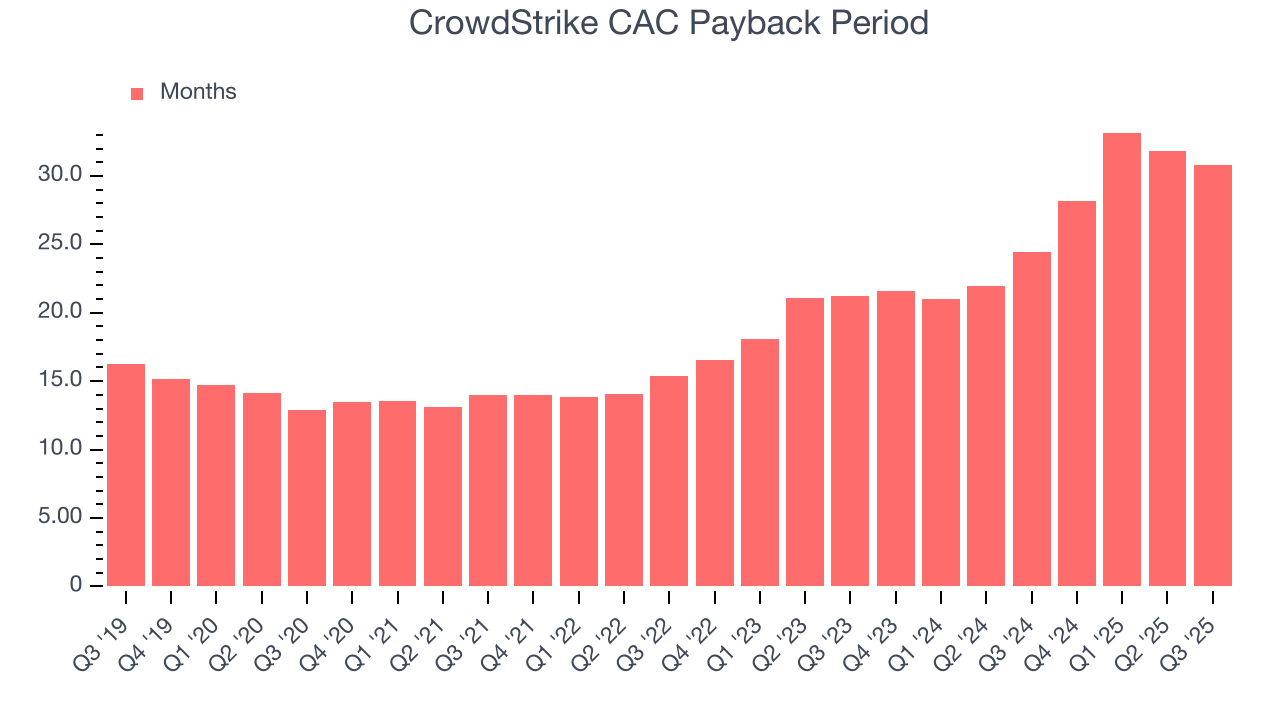

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

CrowdStrike is quite efficient at acquiring new customers, and its CAC payback period checked in at 30.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

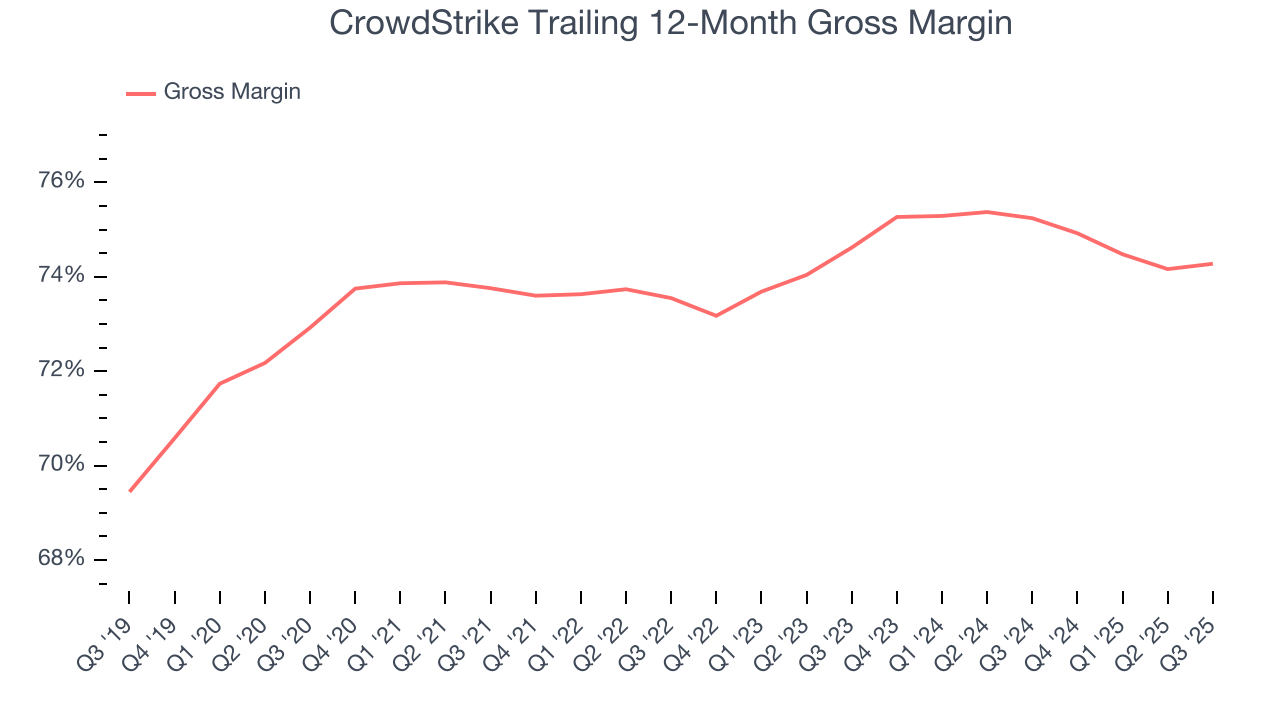

CrowdStrike’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74.3% gross margin over the last year. That means for every $100 in revenue, roughly $74.28 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. CrowdStrike has seen gross margins decline by 0.3 percentage points over the last 2 year, which is slightly worse than average for software.

In Q3, CrowdStrike produced a 75.1% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

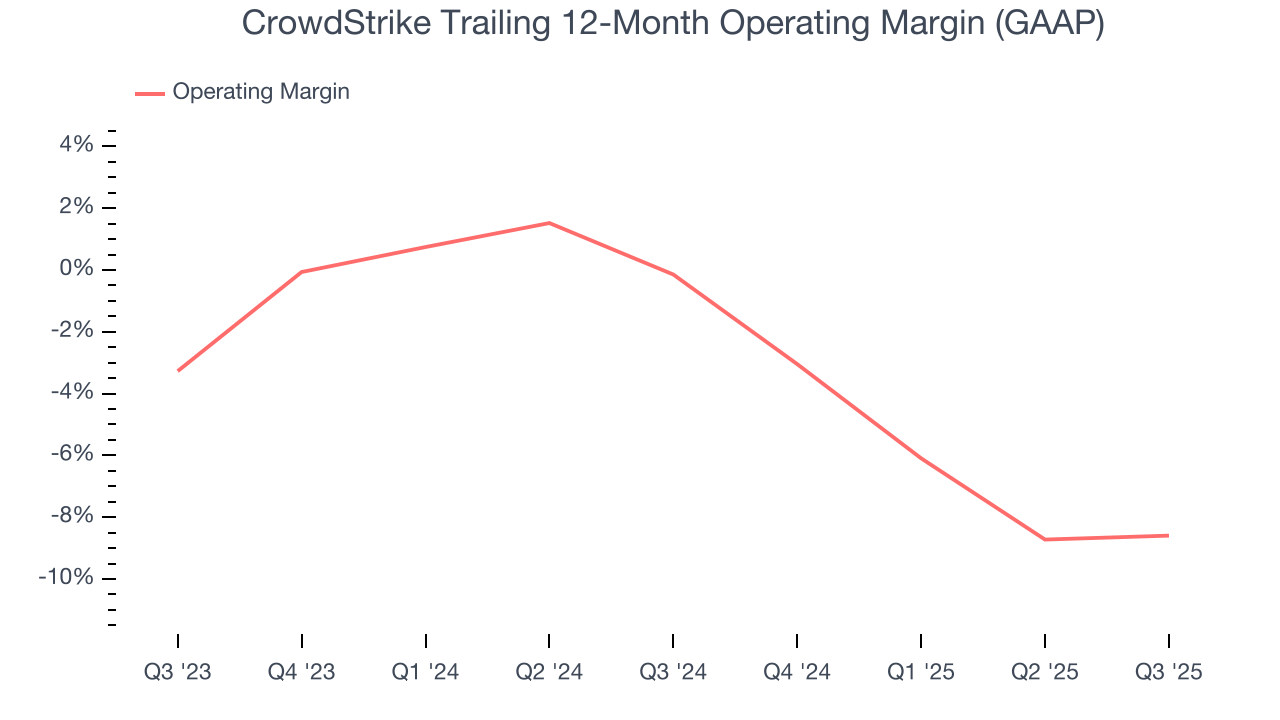

CrowdStrike’s expensive cost structure has contributed to an average operating margin of negative 8.6% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Analyzing the trend in its profitability, CrowdStrike’s operating margin decreased by 8.4 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. CrowdStrike’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, CrowdStrike generated a negative 5.6% operating margin.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

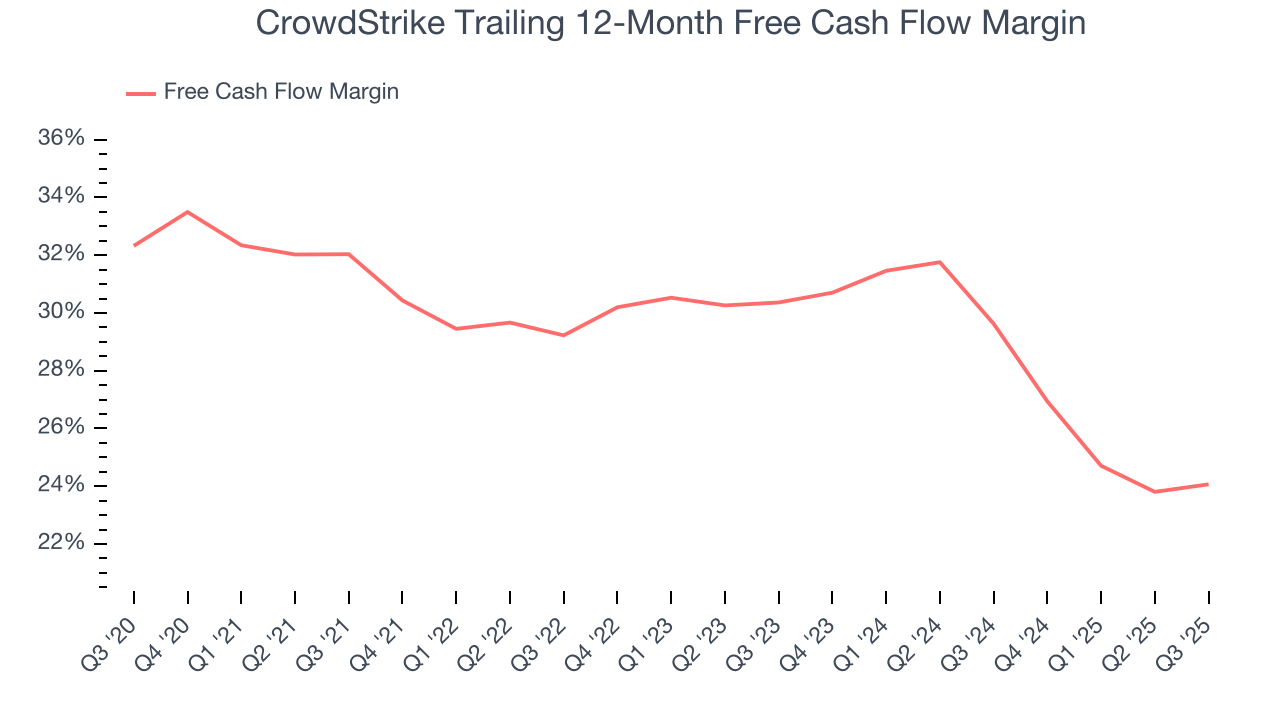

CrowdStrike has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 24.1% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

CrowdStrike’s free cash flow clocked in at $295.9 million in Q3, equivalent to a 24% margin. This result was good as its margin was 1.1 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

Over the next year, analysts predict CrowdStrike’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 24.1% for the last 12 months will increase to 30.4%, giving it more flexibility for investments, share buybacks, and dividends.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

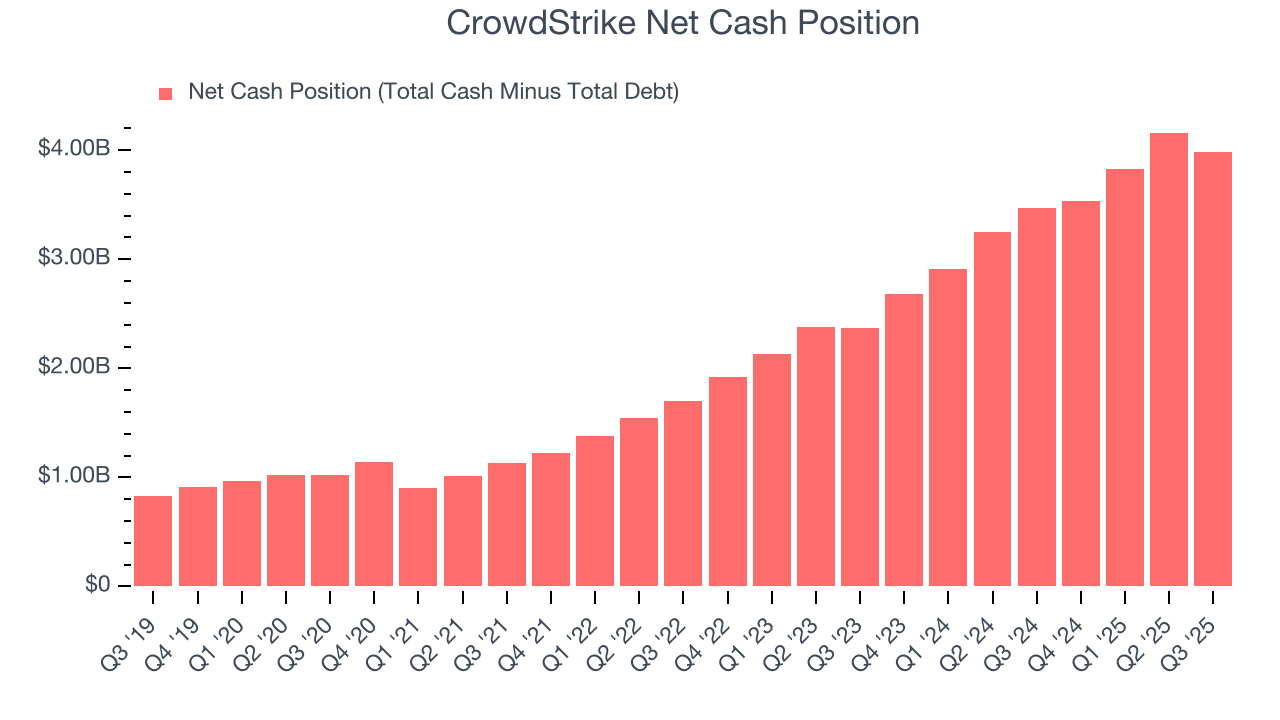

CrowdStrike is a well-capitalized company with $4.80 billion of cash and $818 million of debt on its balance sheet. This $3.98 billion net cash position is 3.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from CrowdStrike’s Q3 Results

It was encouraging to see CrowdStrike’s EPS guidance for next quarter beat analysts’ expectations. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $514.10 immediately after reporting.

13. Is Now The Time To Buy CrowdStrike?

Updated: February 19, 2026 at 9:12 PM EST

When considering an investment in CrowdStrike, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

CrowdStrike is a rock-solid business worth owning. First of all, the company’s revenue growth was exceptional over the last five years. And while its declining operating margin shows it’s becoming less efficient at building and selling its software, its splendid ARR growth shows it’s securing more long-term contracts and becoming a more predictable business. On top of that, CrowdStrike’s efficient sales strategy allows it to target and onboard new users at scale.

CrowdStrike’s price-to-sales ratio based on the next 12 months is 18.8x. You get what you pay for, and in this particular situation, CrowdStrike’s higher valuation multiple is justified because its fundamentals shine bright. We think it deserves a spot in your portfolio.

Wall Street analysts have a consensus one-year price target of $546.89 on the company (compared to the current share price of $421), implying they see 29.9% upside in buying CrowdStrike in the short term.