Denny's (DENN)

Denny's keeps us up at night. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Denny's Will Underperform

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

- Menu offerings aren't resonating with the market as its revenue declined by 4.1% annually over the last six years

- Smaller revenue base of $457.2 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- High net-debt-to-EBITDA ratio of 5× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Denny’s quality doesn’t meet our hurdle. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Denny's

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Denny's

At $6.24 per share, Denny's trades at 15.6x forward P/E. This multiple is cheaper than most restaurant peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Denny's (DENN) Research Report: Q3 CY2025 Update

Diner restaurant chain Denny’s (NASDAQ:DENN) fell short of the markets revenue expectations in Q3 CY2025 as sales only rose 1.3% year on year to $113.2 million. Its GAAP profit of $0.01 per share was 90% below analysts’ consensus estimates.

Denny's (DENN) Q3 CY2025 Highlights:

- Denny's will be purchased by private equity investment company TriArtisan Capital Advisors, investment firm Treville Capital and Yadav Enterprises (one of Denny's largest franchisees) in a deal worth $620 million, including debt. Denny's shareholders will receive $6.25 per share in cash for each share of common stock they own, a 52% premium to Denny's closing stock price Monday.

- Revenue: $113.2 million vs analyst estimates of $117 million (1.3% year-on-year growth, 3.2% miss)

- EPS (GAAP): $0.01 vs analyst expectations of $0.10 (90% miss)

- Adjusted EBITDA: $19.32 million vs analyst estimates of $20.17 million (17.1% margin, 4.2% miss)

- Operating Margin: 9.2%, down from 10.5% in the same quarter last year

- Locations: 1,459 at quarter end, down from 1,586 in the same quarter last year

- Same-Store Sales fell 2.9% year on year (0.1% in the same quarter last year)

- Market Capitalization: $211.7 million

Company Overview

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Established in 1953 by Harold Butler and Richard Jezak, it initially opened its doors as a donut stand named "Danny's Donuts." Over the decades, it underwent numerous transformations and name changes, but what remained consistent was its commitment to serving hearty meals 24 hours a day.

Today, Denny's is known for dishes like the Grand Slam breakfast, which is a customizable combination of breakfast items such as eggs, pancakes, bacon, sausage, etc. There are also non-breakfast items such as burgers, steaks, and salads. A fulsome kids menu makes sure that Denny’s remains a family-friendly restaurant.

The inside of a Denny’s location channels traditional diners of eras past. There are booths, tables, and counter seating. The ambiance is usually lively, with waiters and waitresses buzzing around with hearty plates and refilling coffee cups while diners of all ages and group sizes chat.

4. Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Competitors offering breakfast or diner fare include IHOP owner Dine Brands (NYSE:DIN), The Cheesecake Factory (NASDAQ:CAKE), and private company Waffle House.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $457.2 million in revenue over the past 12 months, Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

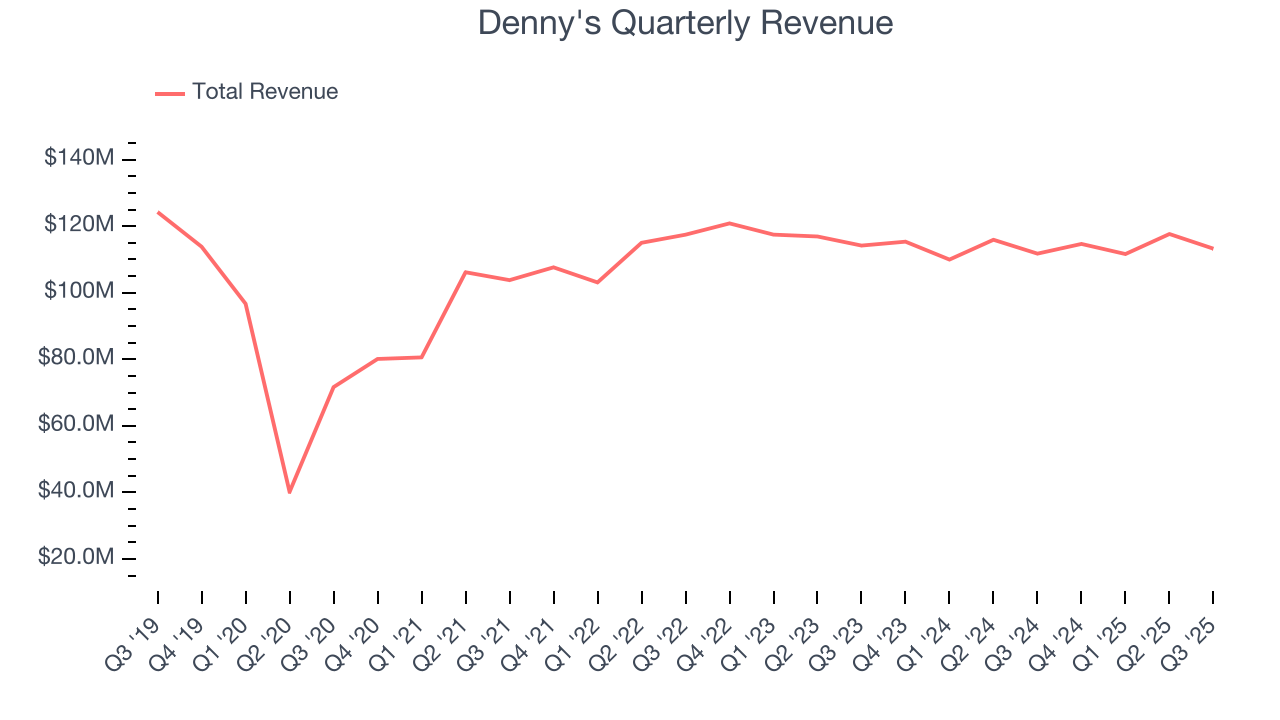

As you can see below, Denny’s demand was weak over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 4.1% annually as it closed restaurants.

This quarter, Denny’s revenue grew by 1.3% year on year to $113.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, an acceleration versus the last six years. This projection is above average for the sector and implies its newer menu offerings will fuel better top-line performance.

6. Restaurant Performance

Number of Restaurants

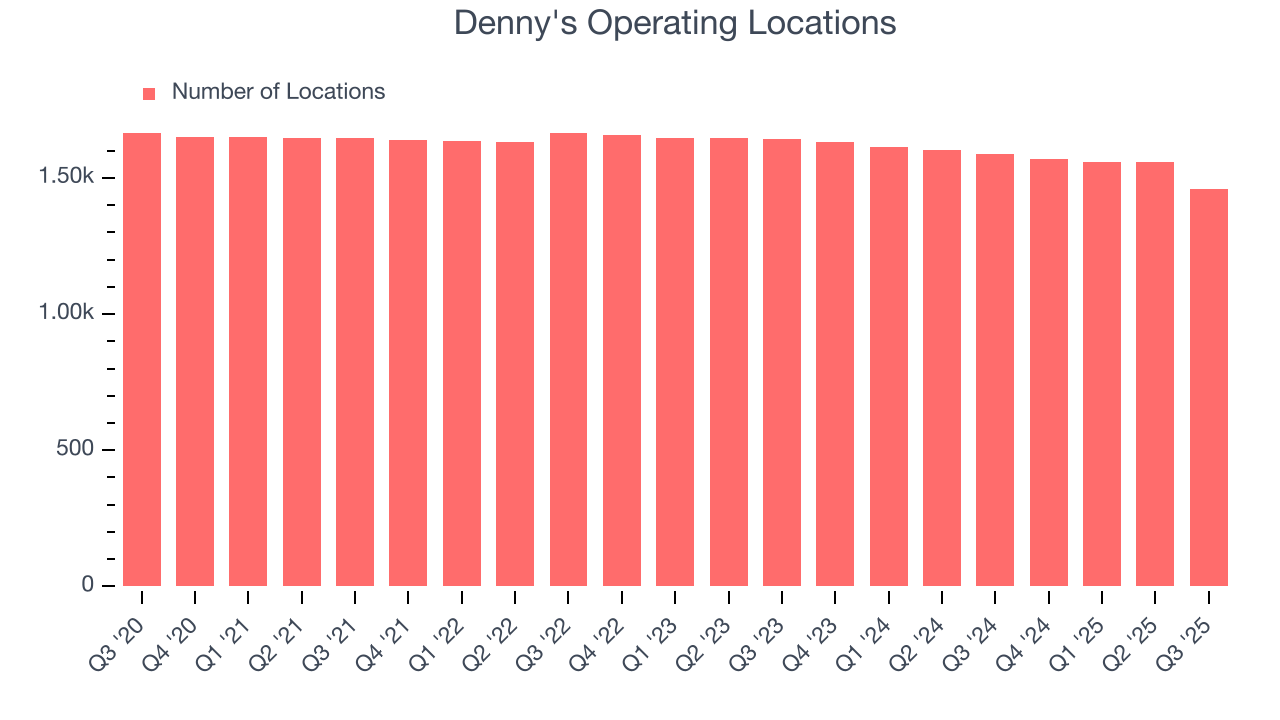

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Denny's operated 1,459 locations in the latest quarter. Over the last two years, the company has generally closed its restaurants, averaging 3.5% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

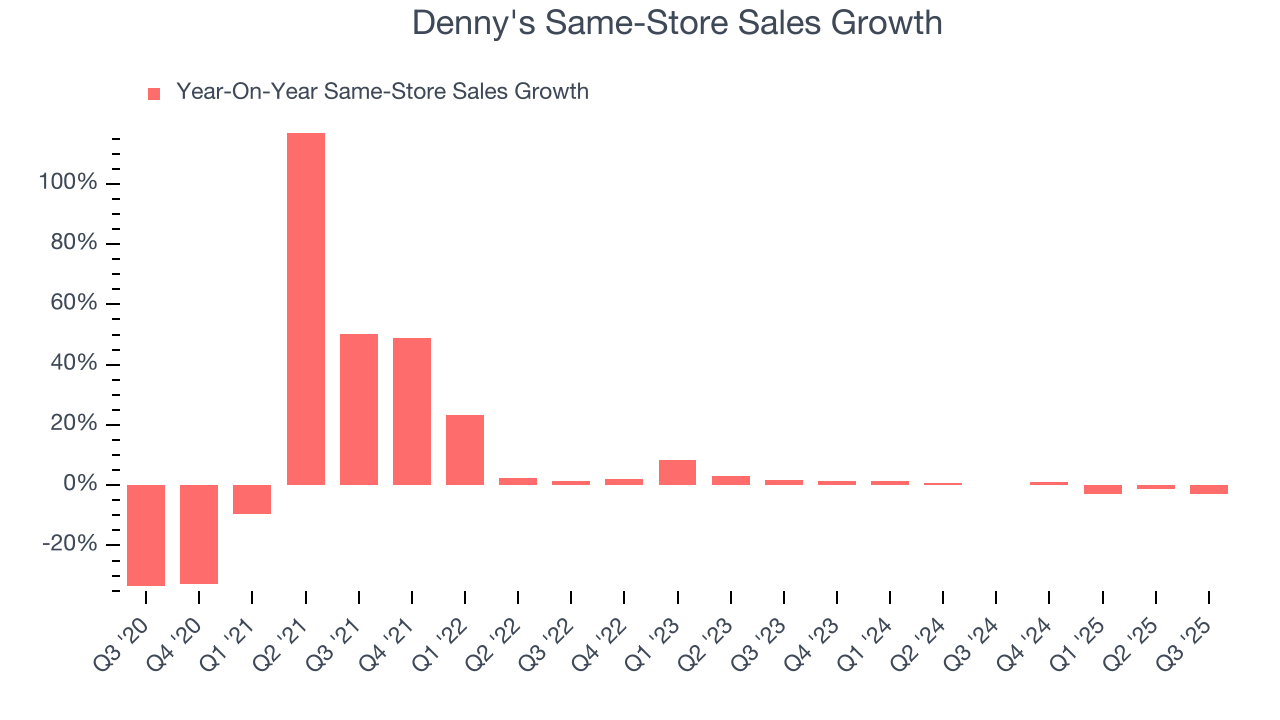

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Denny’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Denny's is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Denny’s same-store sales fell by 2.9% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

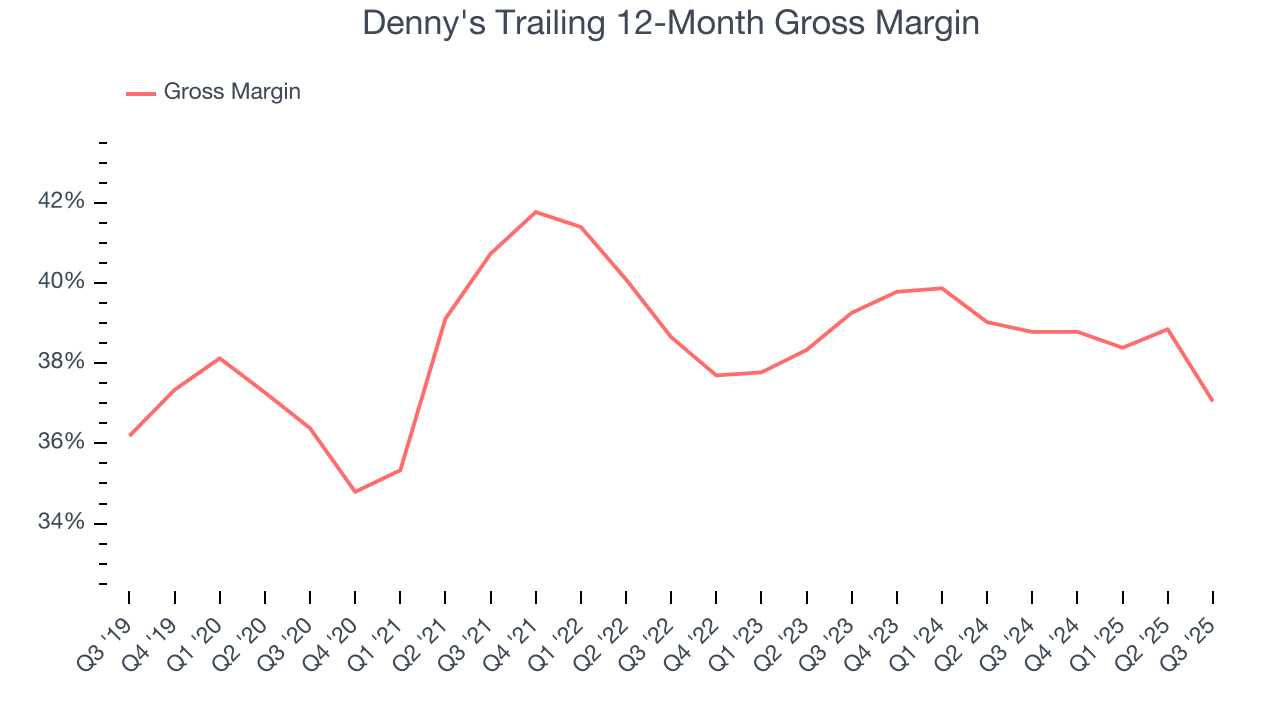

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Denny's has great unit economics for a restaurant company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 37.9% gross margin over the last two years. Said differently, roughly $37.91 was left to spend on selling, marketing, and general administrative overhead for every $100 in revenue.

Denny’s gross profit margin came in at 32% this quarter, marking a 7.3 percentage point decrease from 39.3% in the same quarter last year. Denny’s full-year margin has also been trending down over the past 12 months, decreasing by 1.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as ingredients and transportation expenses).

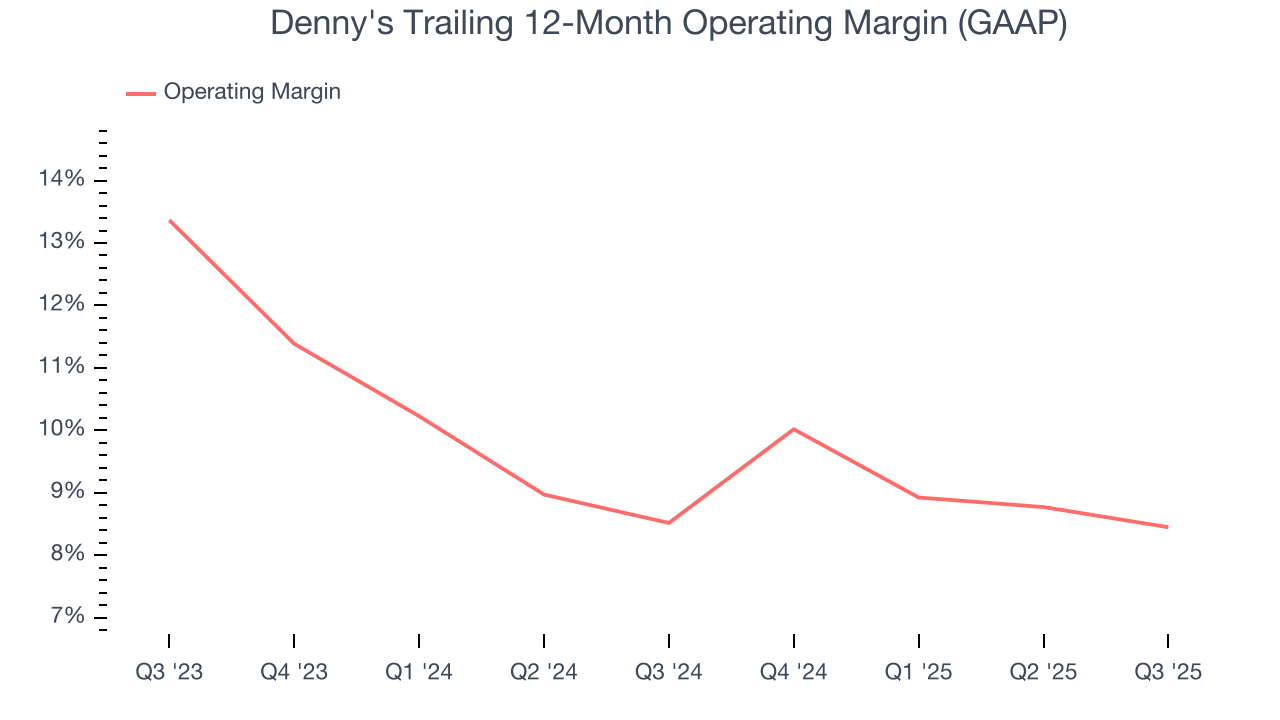

8. Operating Margin

Denny’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.5% over the last two years. This profitability was higher than the broader restaurant sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Denny’s operating margin might fluctuated slightly but has generally stayed the same over the last year. Shareholders will want to see Denny's grow its margin in the future.

This quarter, Denny's generated an operating margin profit margin of 9.2%, down 1.3 percentage points year on year. Since Denny’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, and administrative overhead expenses.

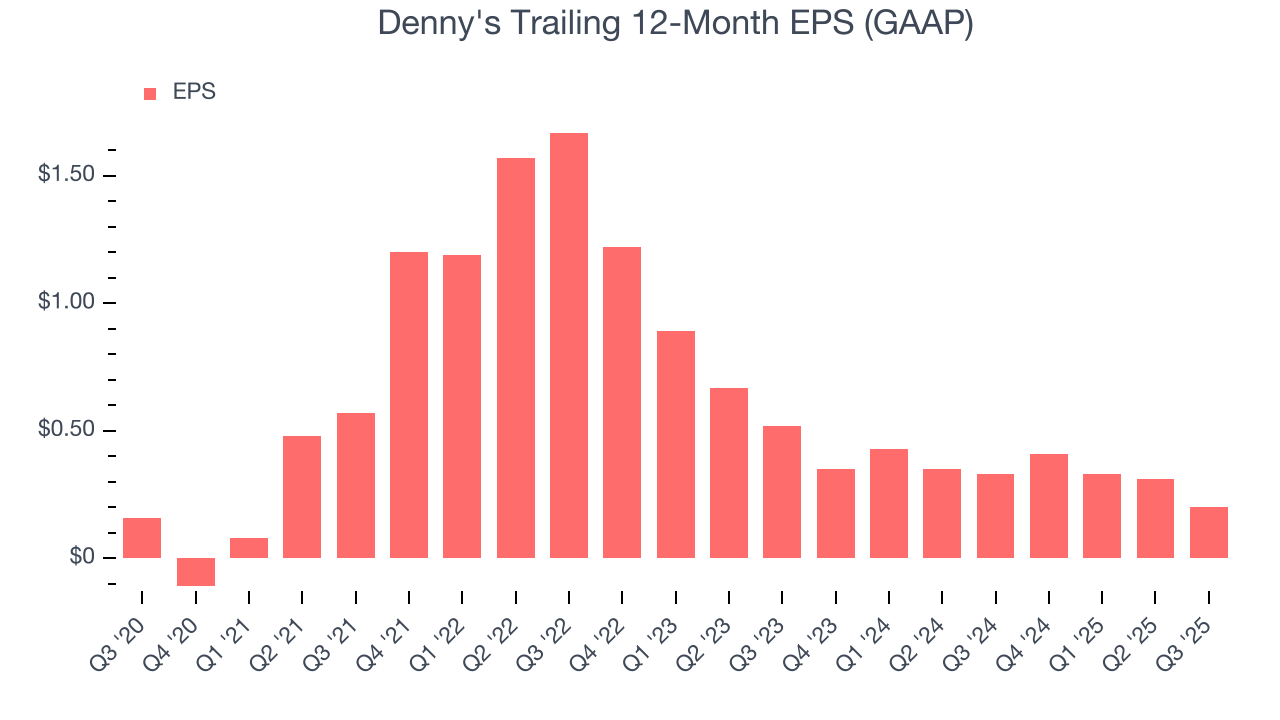

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Denny's, its EPS declined by 30.5% annually over the last six years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, Denny's reported EPS of $0.01, down from $0.12 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Denny’s full-year EPS of $0.20 to grow 125%.

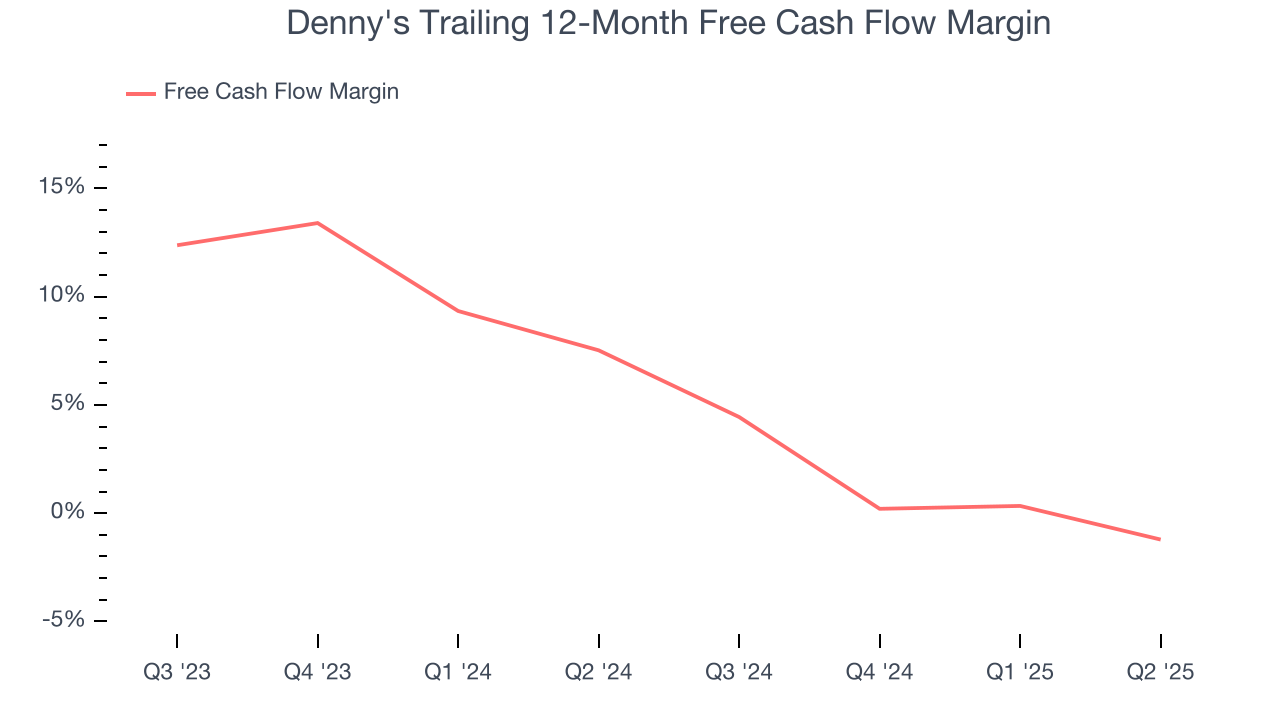

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Denny's has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2%, subpar for a restaurant business.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Denny's hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 26.3%, splendid for a restaurant business.

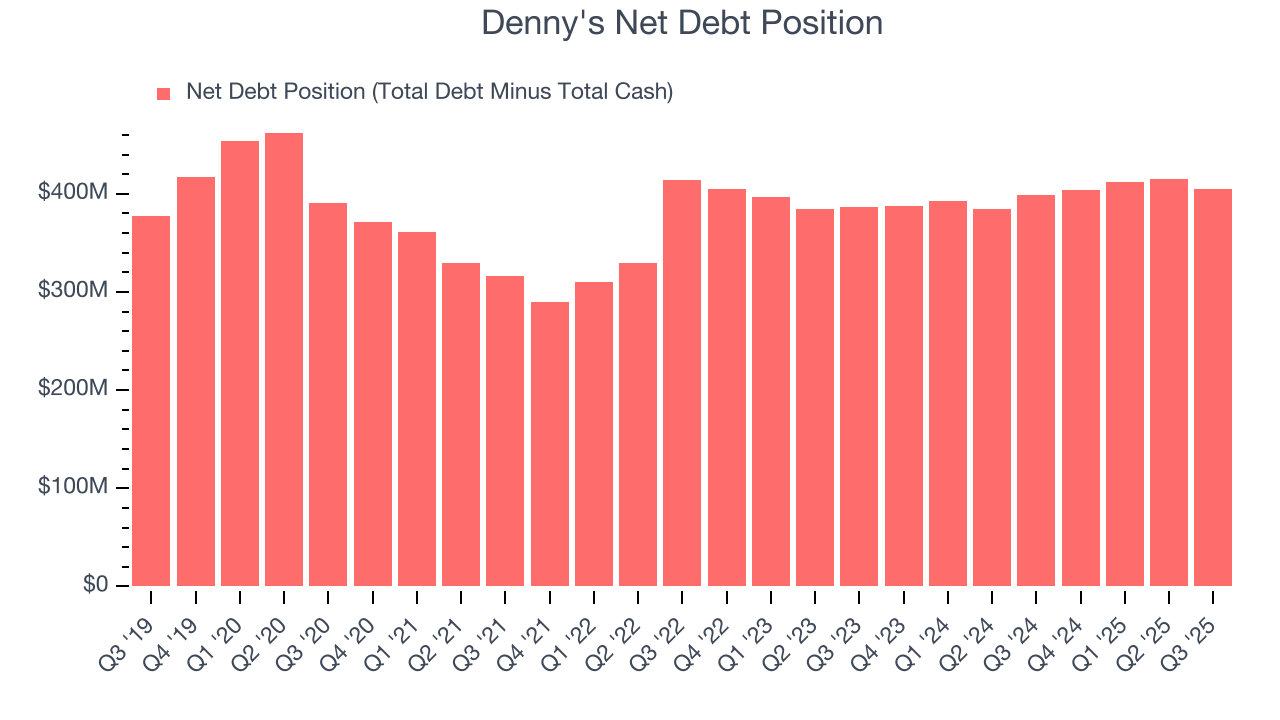

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Denny’s $406.7 million of debt exceeds the $2.22 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $77.07 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Denny's could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Denny's can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from Denny’s Q3 Results

Denny's will be purchased by private equity investment company TriArtisan Capital Advisors, investment firm Treville Capital and Yadav Enterprises (one of Denny's largest franchisees) in a deal worth $620 million, including debt. Denny's shareholders will receive $6.25 per share in cash for each share of common stock they own, a 52% premium to Denny's closing stock price Monday. This overshadows the results in the quarter. The stock traded up 46.5% to $6.03 immediately following the results.

14. Is Now The Time To Buy Denny's?

Updated: November 3, 2025 at 9:45 PM EST

Denny's will be purchased by private equity investment company TriArtisan Capital Advisors, investment firm Treville Capital and Yadav Enterprises (one of Denny's largest franchisees) in a deal worth $620 million, including debt. Denny's shareholders will receive $6.25 per share in cash for each share of common stock they own, a 52% premium to Denny's closing stock price Monday.