Guess (GES)

Guess keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Guess Will Underperform

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

- Annual revenue growth of 8.7% over the last five years was below our standards for the consumer discretionary sector

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

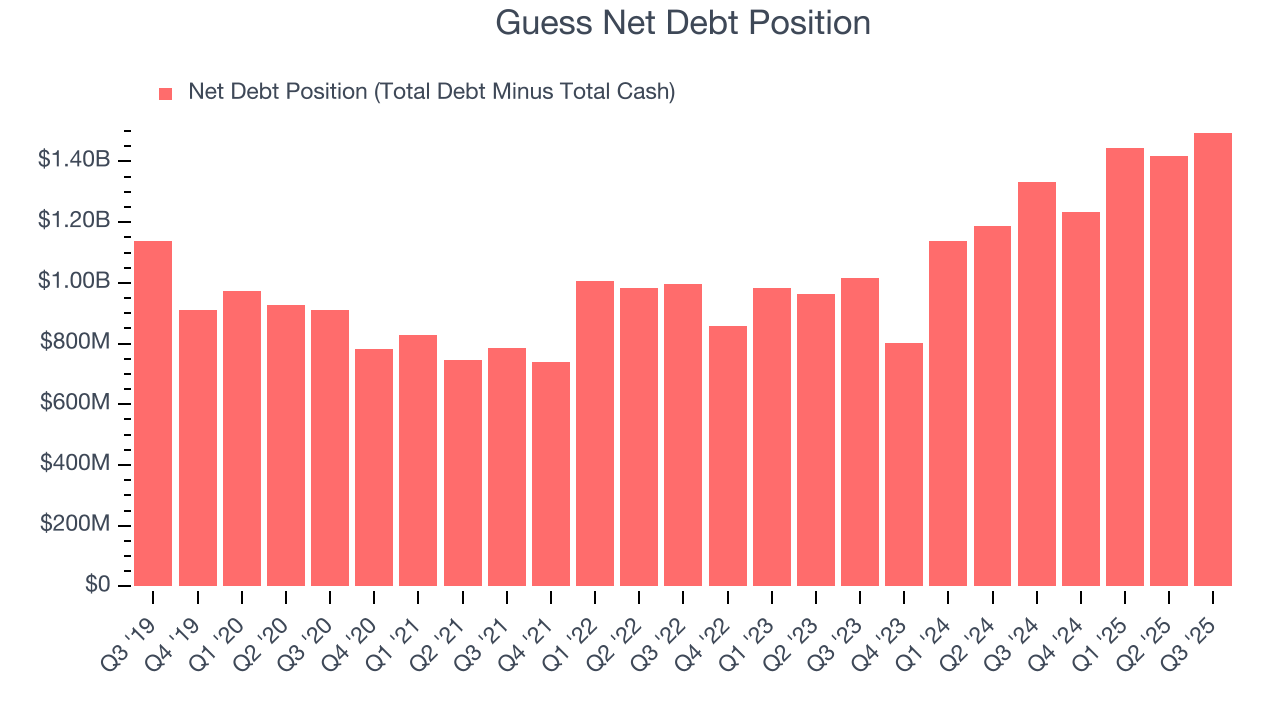

- 7× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Guess doesn’t fulfill our quality requirements. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Guess

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Guess

At $16.81 per share, Guess trades at 10.7x forward P/E. Guess’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Guess (GES) Research Report: Q3 CY2025 Update

Contemporary clothing brand Guess (NYSE:GES) announced better-than-expected revenue in Q3 CY2025, with sales up 7.2% year on year to $791.4 million. Its non-GAAP profit of $0.35 per share was 37.7% above analysts’ consensus estimates.

Guess (GES) Q3 CY2025 Highlights:

- Revenue: $791.4 million vs analyst estimates of $772.3 million (7.2% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.25 (37.7% beat)

- Operating Margin: 2.9%, down from 5.7% in the same quarter last year

- Free Cash Flow was -$58.71 million compared to -$105.4 million in the same quarter last year

- Market Capitalization: $880.7 million

Company Overview

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess was started by the Marciano brothers who sought to redefine denim with stonewashed, slim-fitting jeans that featured their distinctive triangular logo on the back pocket. Their designs quickly gained popularity as the Guess image became more prominent in the fashion world, and today, Guess is known for its youthful and fashionable clothing, accessories, and fragrance lines.

Guess's innovative marketing campaigns and iconic black-and-white advertisements contributed to the brand's success by appealing to a brand-conscious, fashion-conscious, and trend-savvy consumer base. Guess also formed strategic partnerships with celebrities like A$AP Rocky, Gigi Hadid, and Hailey Baldwin to grow its mainstream presence.

Guess generates its revenues from direct-to-consumer sales, which come from its brick-and-mortar locations and e-commerce platform, and wholesale distribution, licensing, and royalty agreements. The company’s revenue-driving strategies are to elevate its brand relevance through marketing and product quality.

4. Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Guess’s main competitors are Zara (owned by Inditex, OTCMKTS:IDEXF), H&M (OTCMKTS:HNNMY), ASOS (OTCMKTS:ASOMY), and private company Forever 21.

5. Revenue Growth

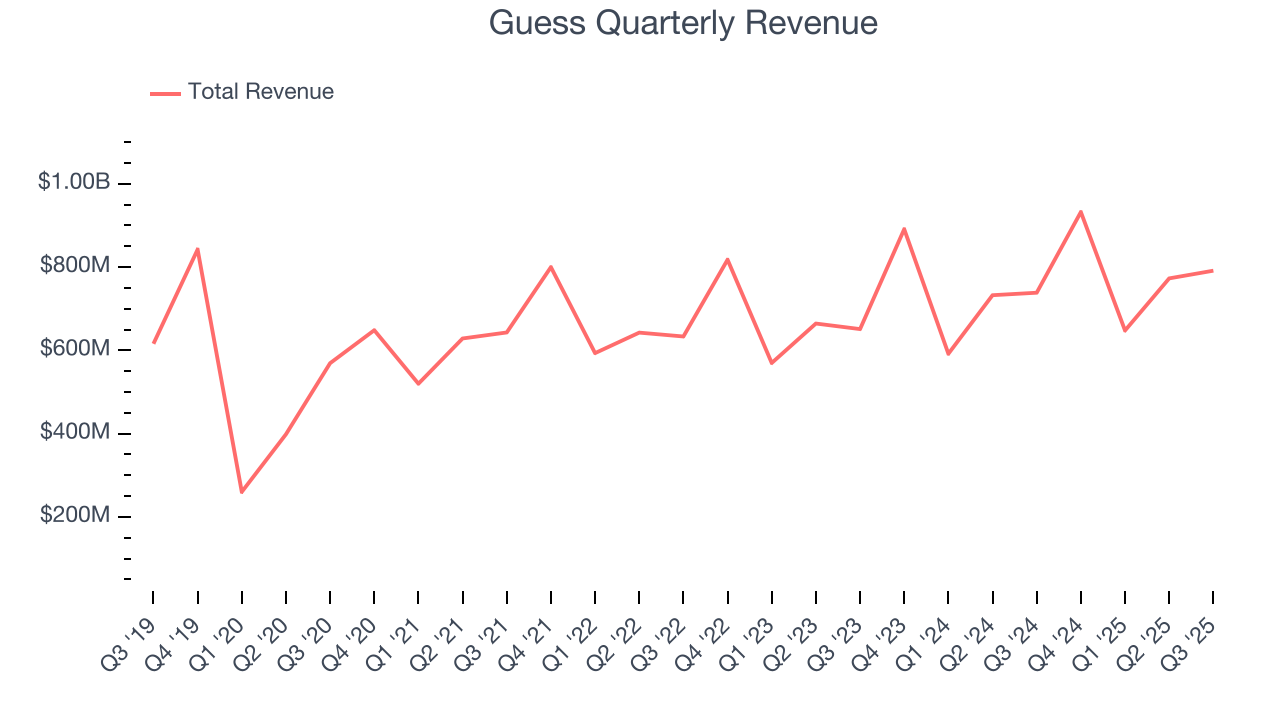

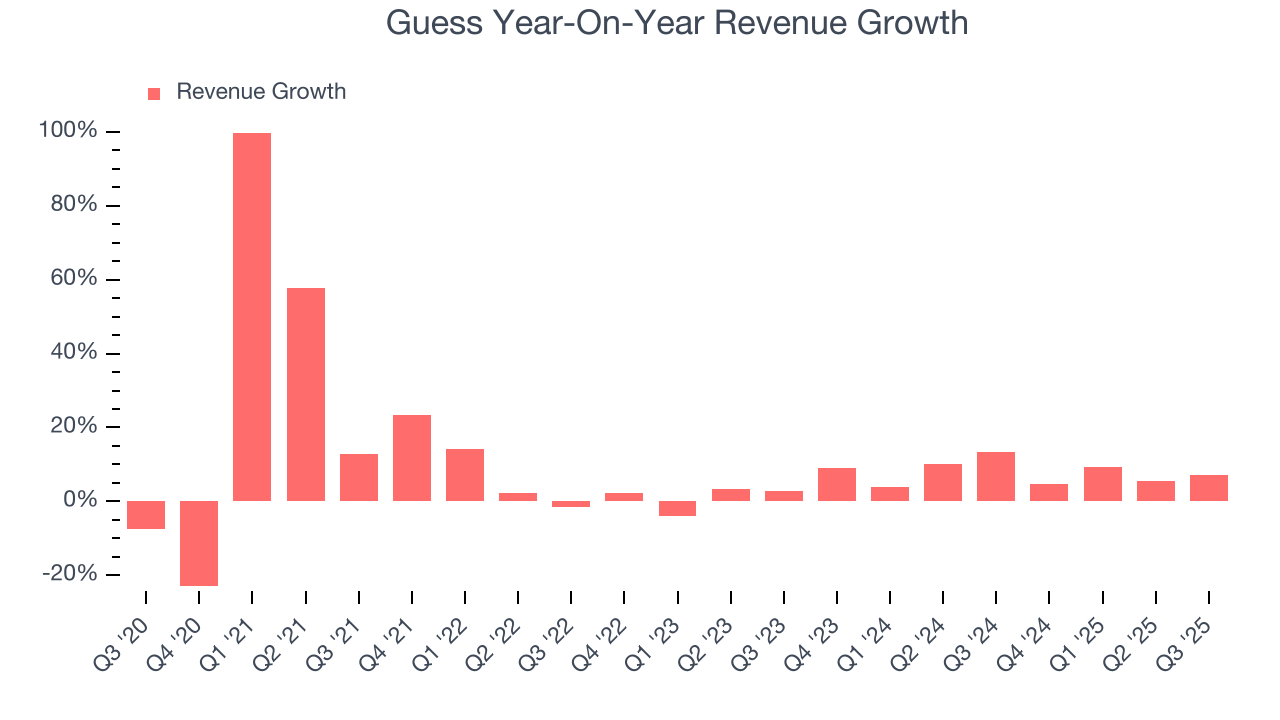

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Guess’s sales grew at a weak 8.7% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Guess’s annualized revenue growth of 7.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Guess reported year-on-year revenue growth of 7.2%, and its $791.4 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

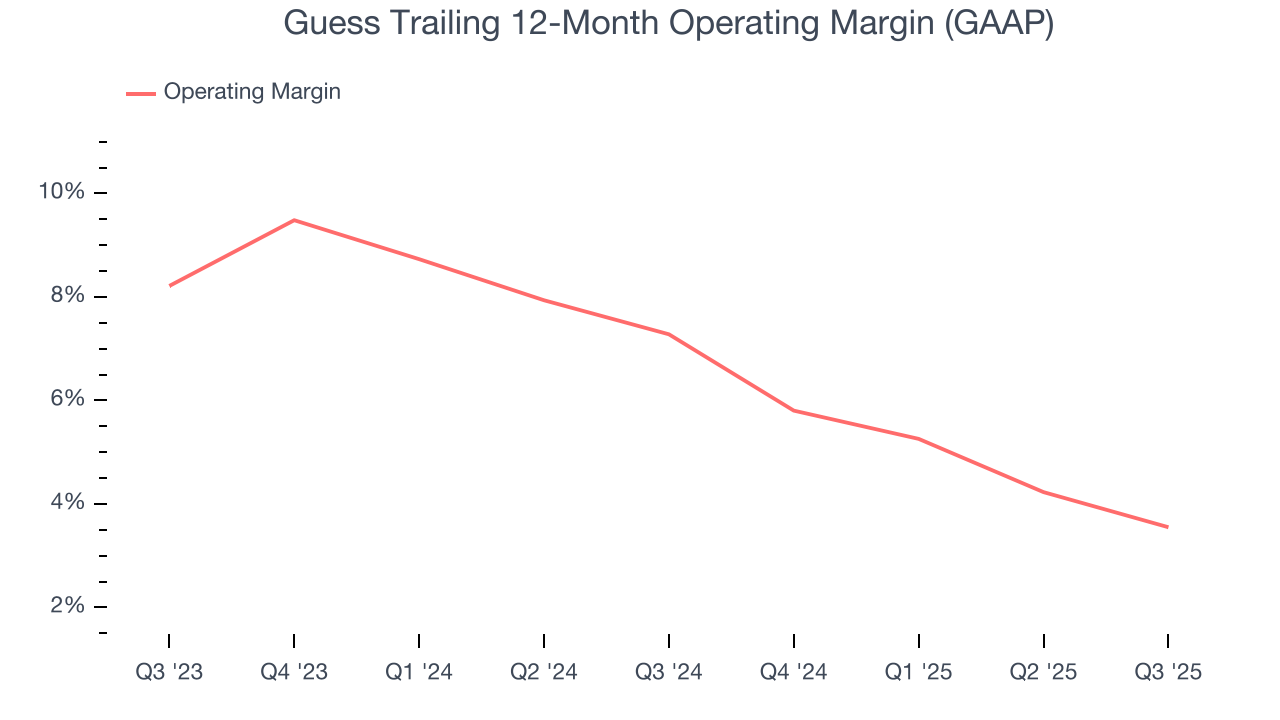

Guess’s operating margin has shrunk over the last 12 months and averaged 5.4% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q3, Guess generated an operating margin profit margin of 2.9%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

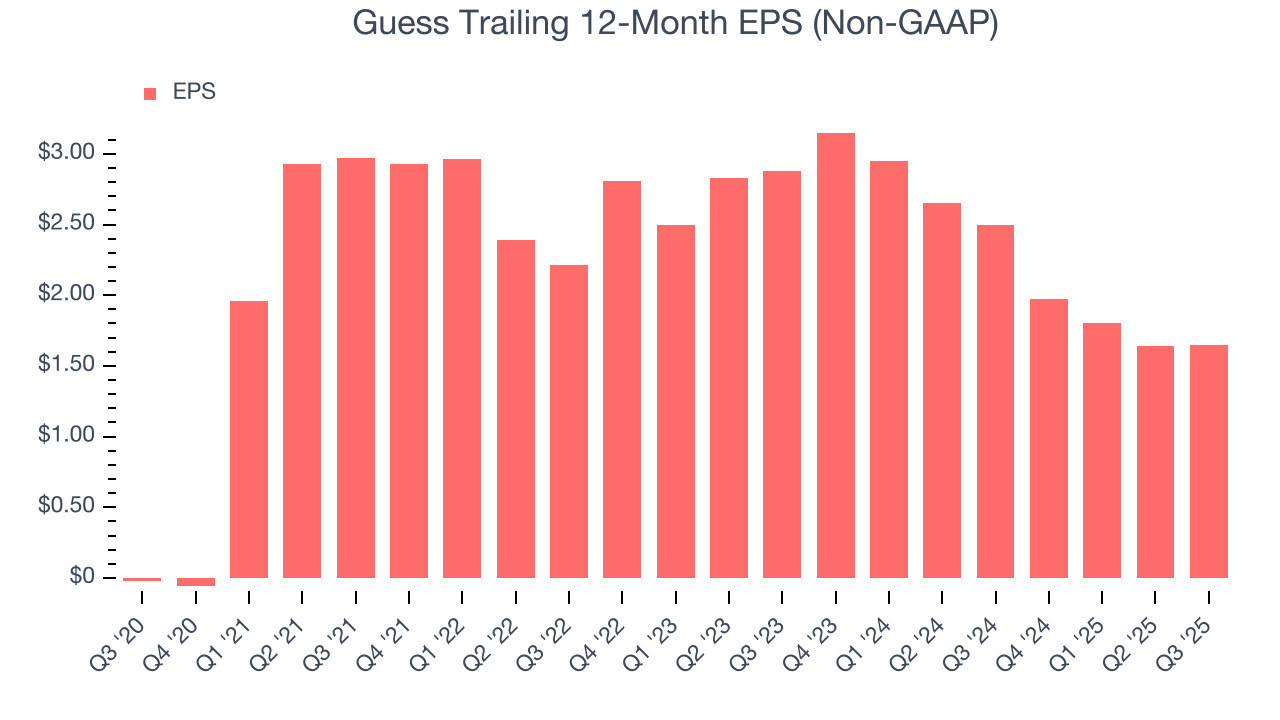

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Guess’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Guess reported adjusted EPS of $0.35, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Guess’s full-year EPS of $1.65 to shrink by 3%.

8. Cash Is King

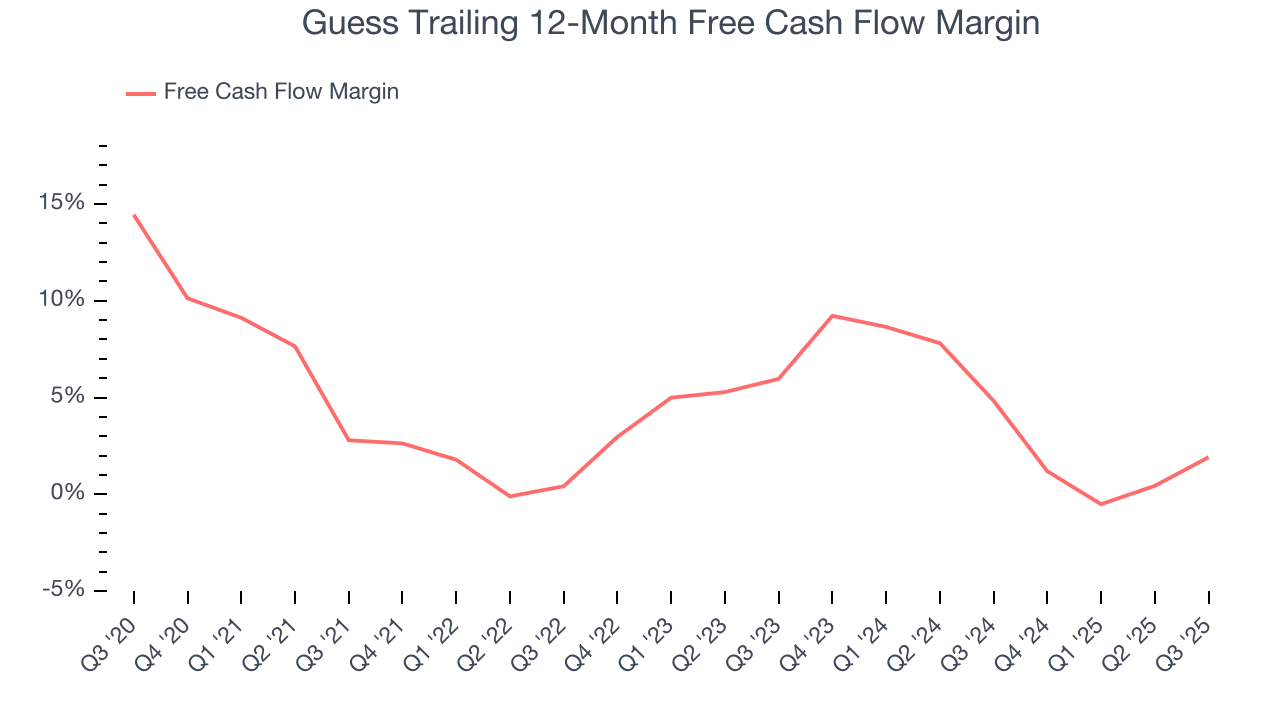

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Guess has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, lousy for a consumer discretionary business.

Guess burned through $58.71 million of cash in Q3, equivalent to a negative 7.4% margin. The company’s cash burn slowed from $105.4 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

9. Return on Invested Capital (ROIC)

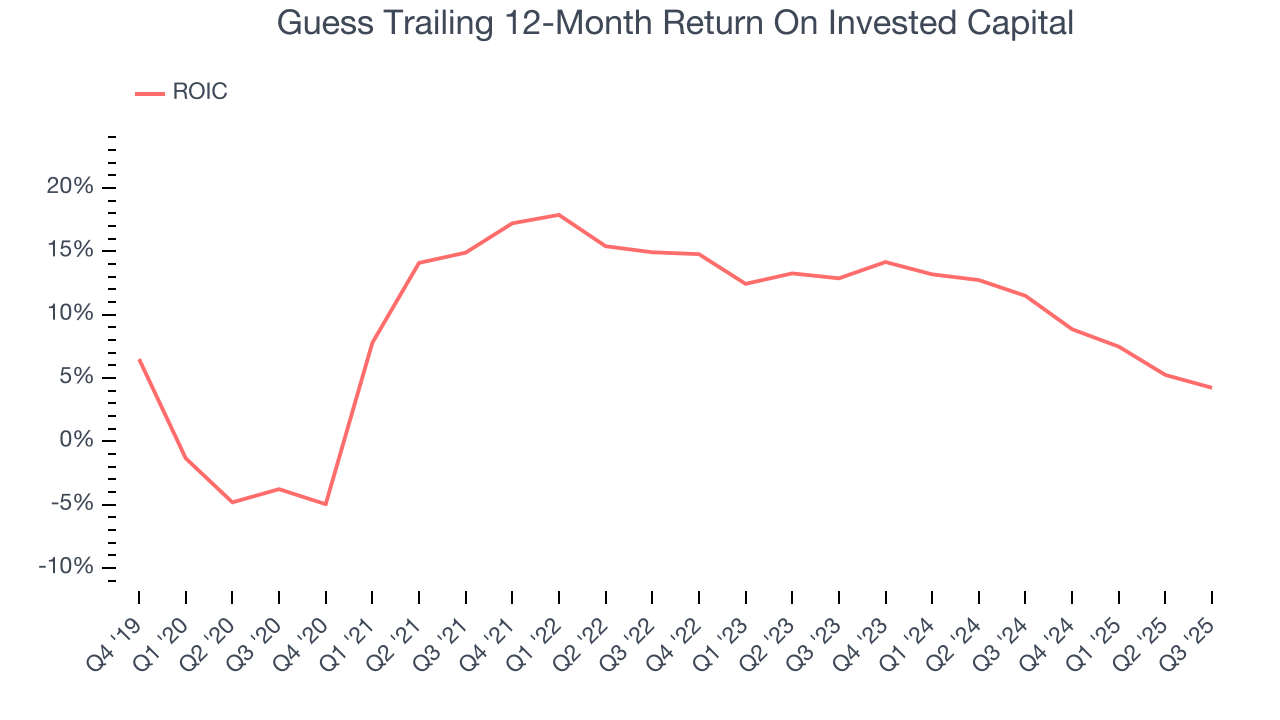

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Guess historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Guess’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Guess’s $1.65 billion of debt exceeds the $154.2 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $204.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Guess could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Guess can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Guess’s Q3 Results

It was good to see Guess beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $17.05 immediately following the results.

12. Is Now The Time To Buy Guess?

Updated: January 23, 2026 at 10:00 PM EST

Before investing in or passing on Guess, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Guess falls short of our quality standards. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Guess’s P/E ratio based on the next 12 months is 10.7x. This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $16.75 on the company (compared to the current share price of $16.81).