Penumbra (PEN)

We aren’t fans of Penumbra. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why Penumbra Is Not Exciting

Founded in 2004 to address challenging medical conditions with significant unmet needs, Penumbra (NYSE:PEN) develops and manufactures innovative medical devices for treating vascular diseases and providing immersive healthcare rehabilitation solutions.

- Modest revenue base of $1.33 billion gives it less fixed cost leverage and fewer distribution channels than larger companies

- Underwhelming 2.1% return on capital reflects management’s difficulties in finding profitable growth opportunities

- The good news is that its additional sales over the last five years increased its profitability as the 180% annual growth in its earnings per share outpaced its revenue

Penumbra lacks the business quality we seek. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Penumbra

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Penumbra

Penumbra is trading at $359.51 per share, or 76.3x forward P/E. This valuation is extremely expensive, especially for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Penumbra (PEN) Research Report: Q3 CY2025 Update

Medical device company Penumbra (NYSE:PEN) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 17.8% year on year to $354.7 million. Its non-GAAP profit of $0.97 per share was 5.3% above analysts’ consensus estimates.

Penumbra (PEN) Q3 CY2025 Highlights:

- Revenue: $354.7 million vs analyst estimates of $340.4 million (17.8% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.92 (5.3% beat)

- Adjusted EBITDA: $66.72 million vs analyst estimates of $59.43 million (18.8% margin, 12.3% beat)

- Operating Margin: 13.8%, up from 11.7% in the same quarter last year

- Constant Currency Revenue rose 16.9% year on year (10.9% in the same quarter last year)

- Market Capitalization: $9.17 billion

Company Overview

Founded in 2004 to address challenging medical conditions with significant unmet needs, Penumbra (NYSE:PEN) develops and manufactures innovative medical devices for treating vascular diseases and providing immersive healthcare rehabilitation solutions.

Penumbra's product portfolio spans three main categories: thrombectomy, embolization and access, and immersive healthcare. The company's thrombectomy devices remove blood clots from vessels throughout the body, addressing conditions like pulmonary embolism, deep vein thrombosis, and ischemic stroke. These systems use vacuum-based aspiration technology to extract clots, with products like the Indigo System for peripheral and coronary vessels and the Penumbra System for neurovascular applications.

In the embolization and access category, Penumbra offers devices that treat aneurysms and occlude vessels. The Ruby Coil System and POD (Penumbra Occlusion Device) are designed for peripheral applications, while the Penumbra Coil 400 and SMART COIL families target neurovascular lesions. The company also produces specialized catheters like the Neuron family and BENCHMARK systems that provide access to difficult-to-reach vascular areas.

Penumbra's newest market is immersive healthcare, where its REAL Immersive System uses proprietary 3D virtual reality technology for rehabilitation and mental well-being applications. This platform includes the REAL i-Series for cognitive applications and the REAL y-Series for physical rehabilitation, with sensors that allow clinicians to track patient movements in real time.

The company sells its products primarily through a direct sales force to specialist physicians, including interventional radiologists, neurosurgeons, and vascular surgeons. These healthcare professionals use Penumbra's devices in hospital and clinical settings to perform minimally invasive procedures. In the United States and most of Europe, Canada, and Australia, Penumbra sells directly to healthcare providers, while using distributors in other international markets.

Penumbra invests significantly in research and development to expand its product offerings and enhance existing technologies. The company's innovations are protected by a substantial intellectual property portfolio including patents covering its key technologies and product designs.

4. Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

Penumbra competes with several large medical device manufacturers including Boston Scientific (NYSE:BSX), Medtronic (NYSE:MDT), and Stryker (NYSE:SYK), as well as specialized companies like Inari Medical (NASDAQ:NARI) in the thrombectomy space and Terumo Corporation (OTC:TRUMY) in vascular devices.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.33 billion in revenue over the past 12 months, Penumbra is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

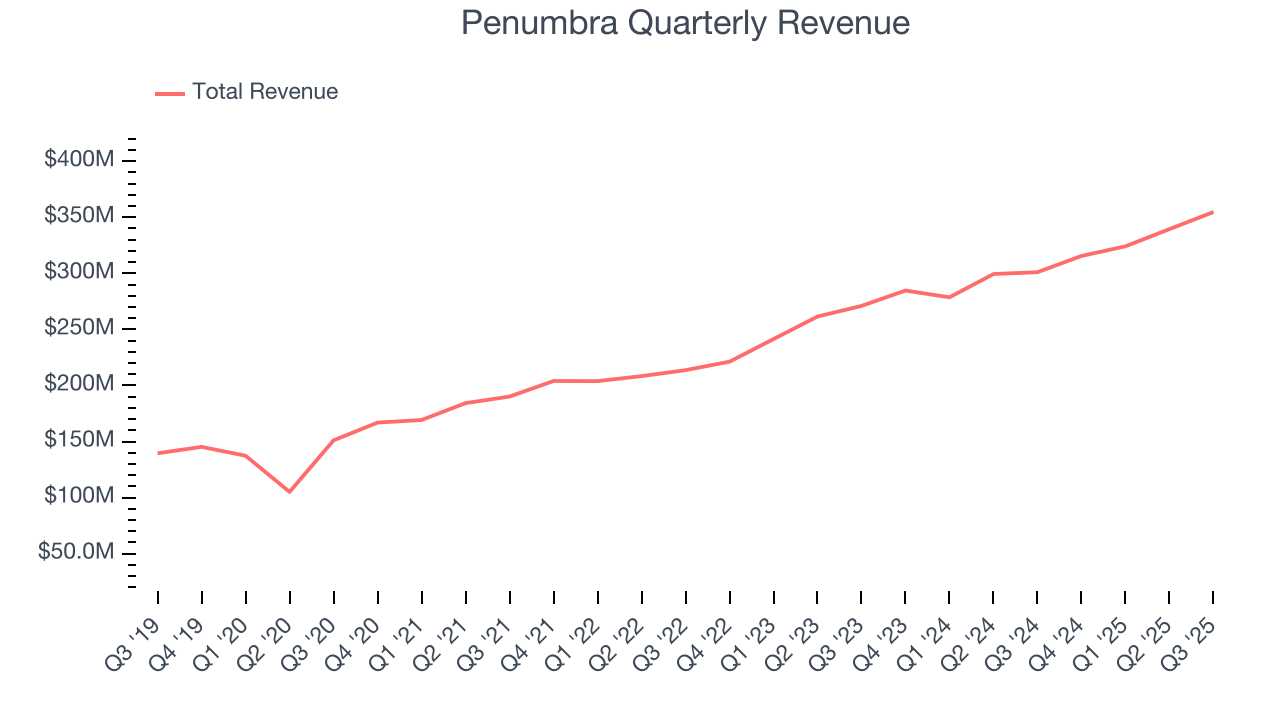

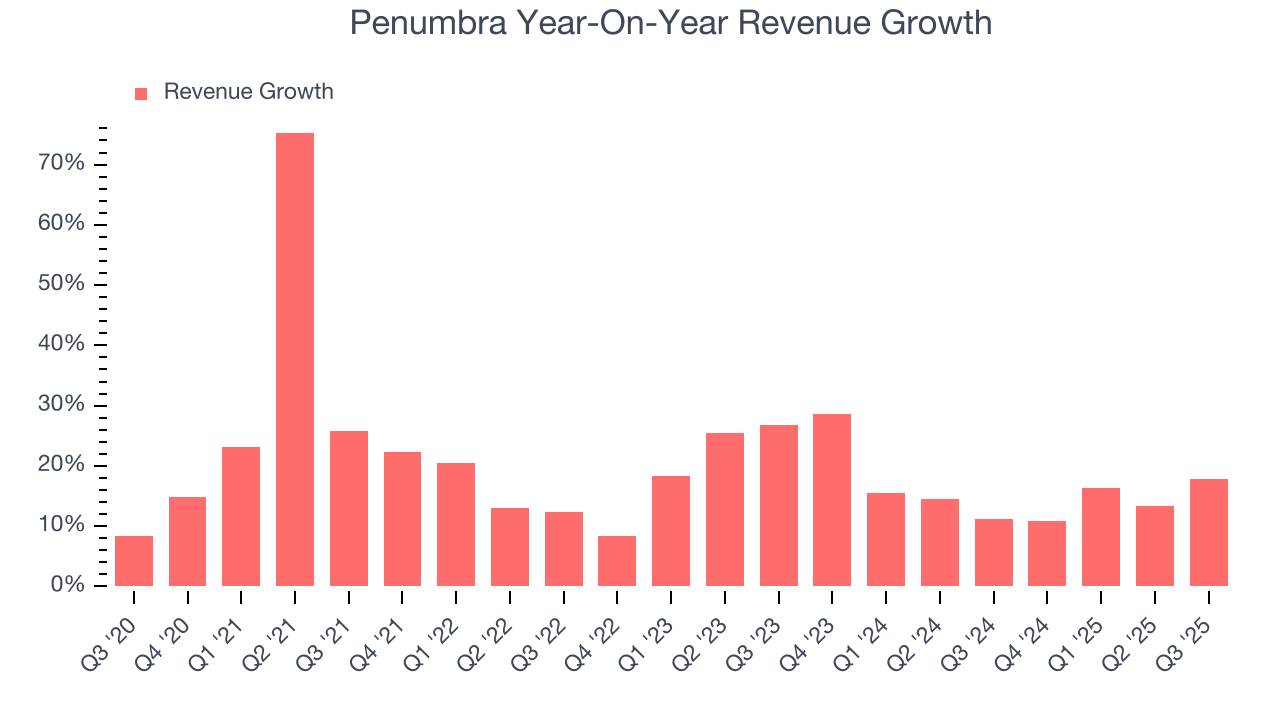

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Penumbra’s 19.9% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Penumbra’s annualized revenue growth of 15.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

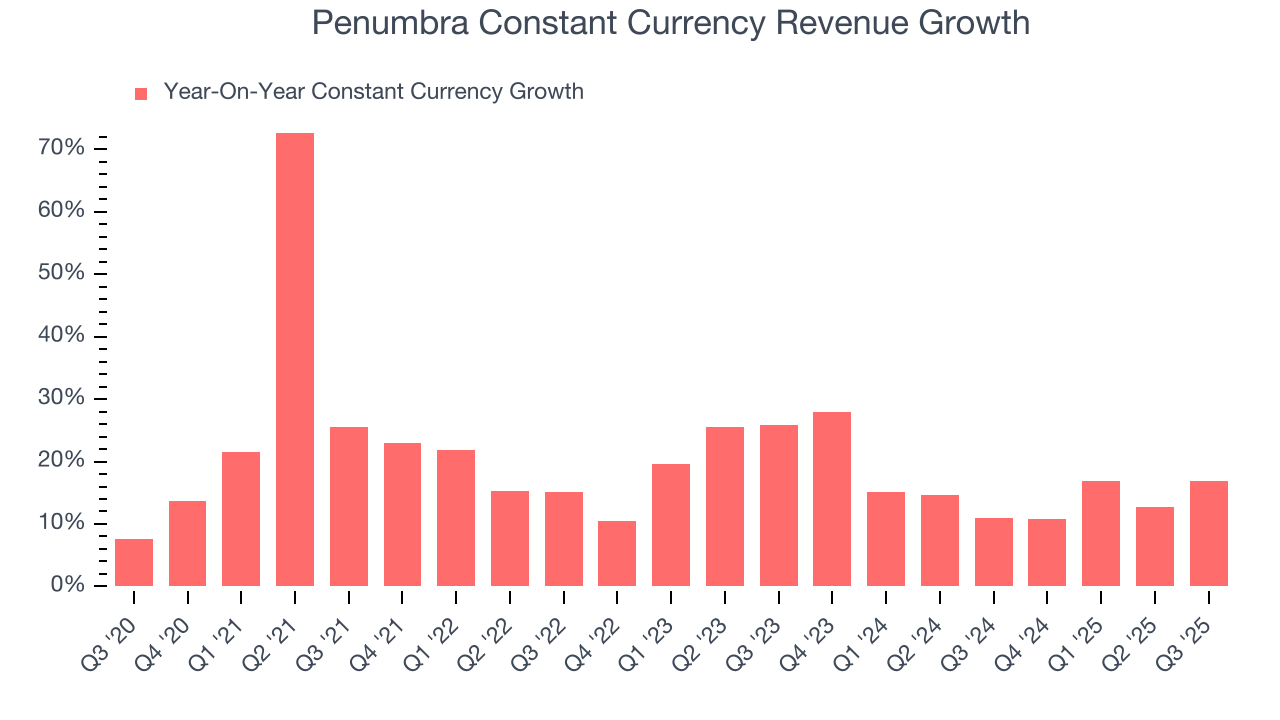

Penumbra also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 15.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Penumbra has properly hedged its foreign currency exposure.

This quarter, Penumbra reported year-on-year revenue growth of 17.8%, and its $354.7 million of revenue exceeded Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 12.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and implies the market is forecasting success for its products and services.

7. Operating Margin

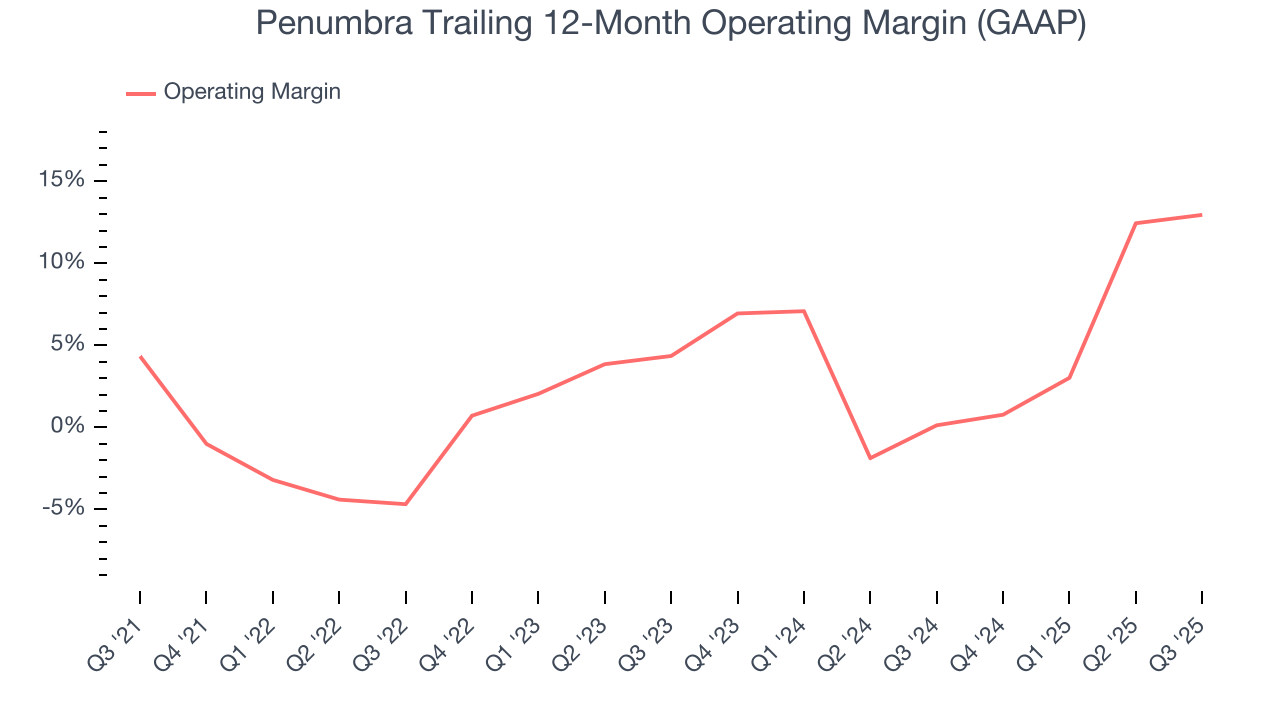

Penumbra was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for a healthcare business.

On the plus side, Penumbra’s operating margin rose by 8.6 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

In Q3, Penumbra generated an operating margin profit margin of 13.8%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

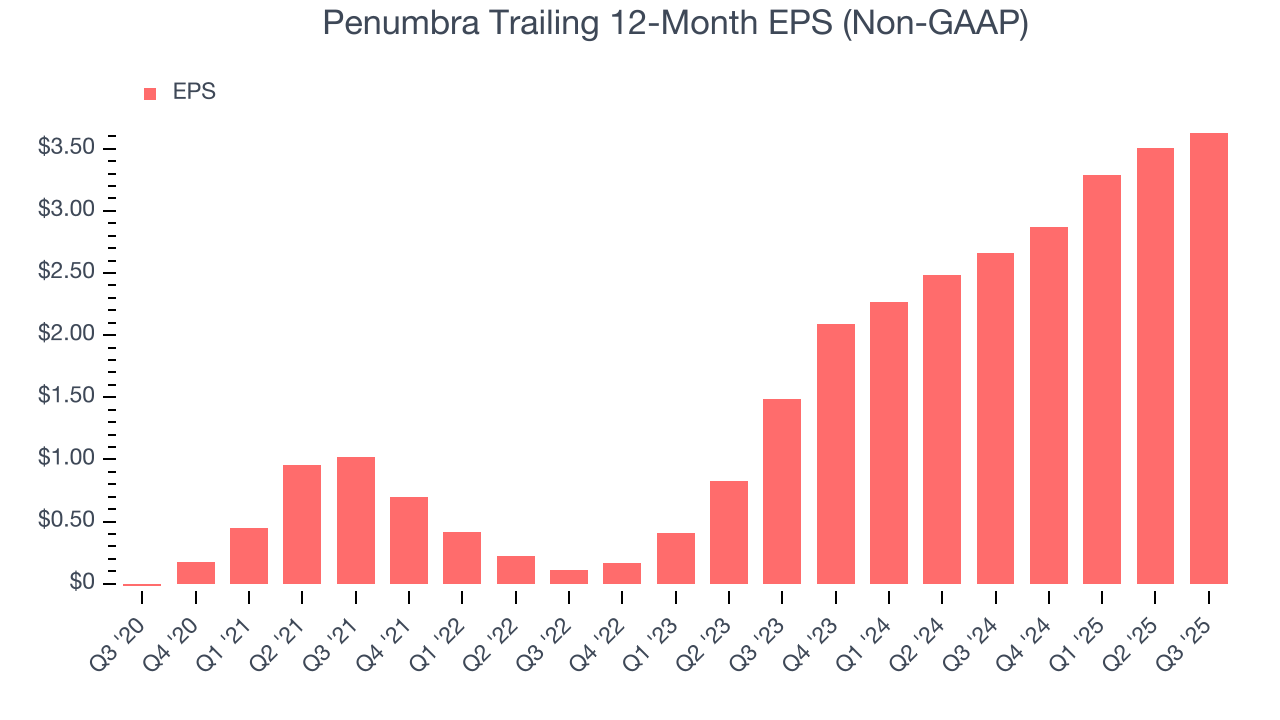

Penumbra’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Penumbra reported adjusted EPS of $0.97, up from $0.85 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects Penumbra’s full-year EPS of $3.63 to grow 27.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

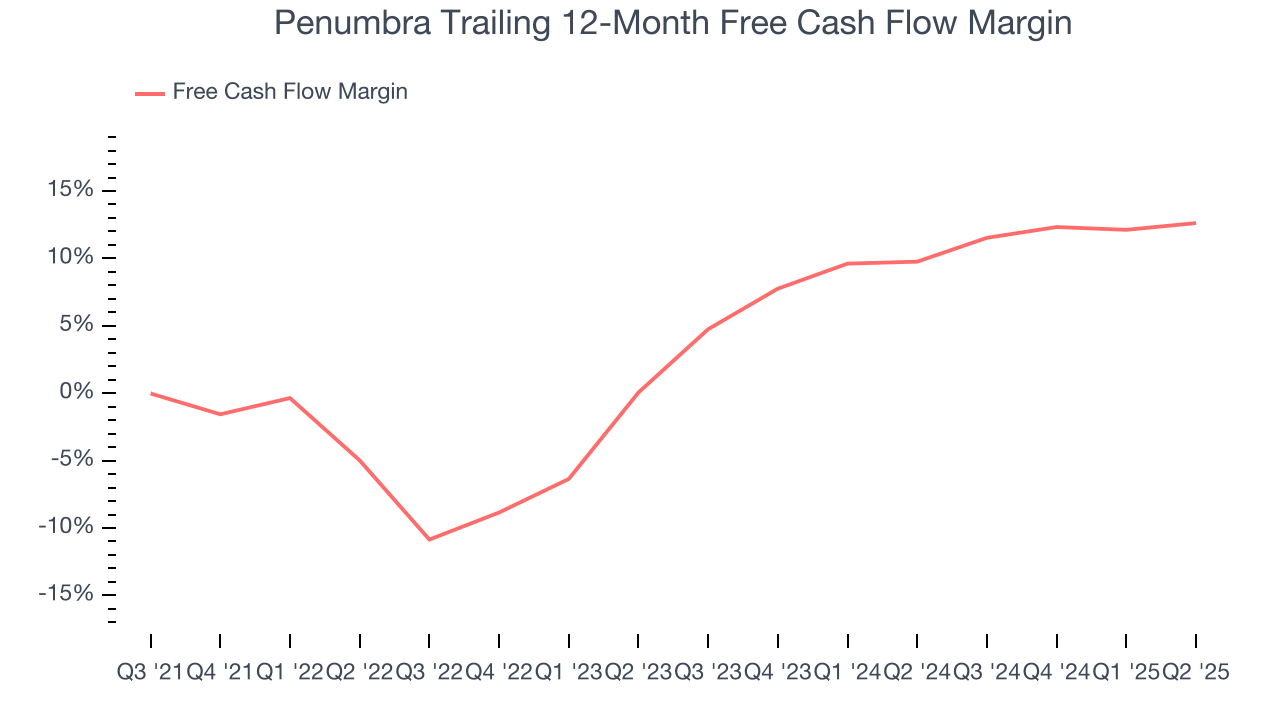

Penumbra has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Penumbra’s margin expanded by 17.2 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

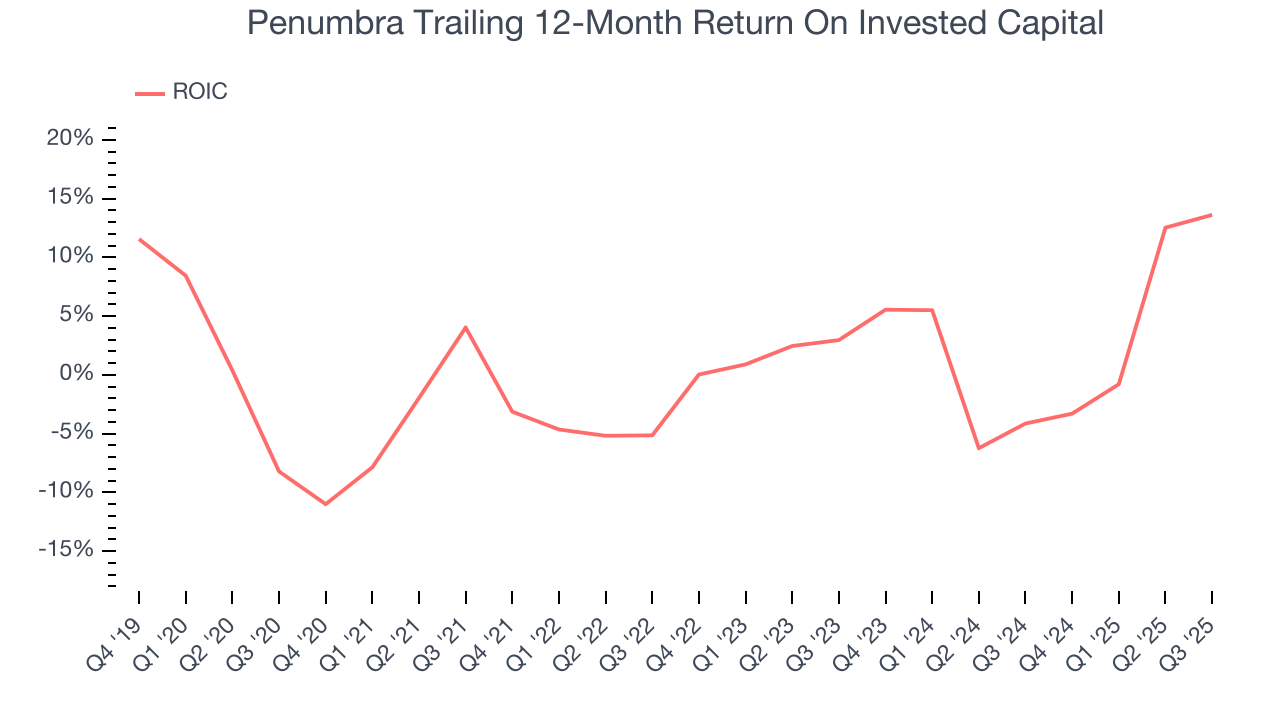

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Penumbra historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.3%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Penumbra’s has increased over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

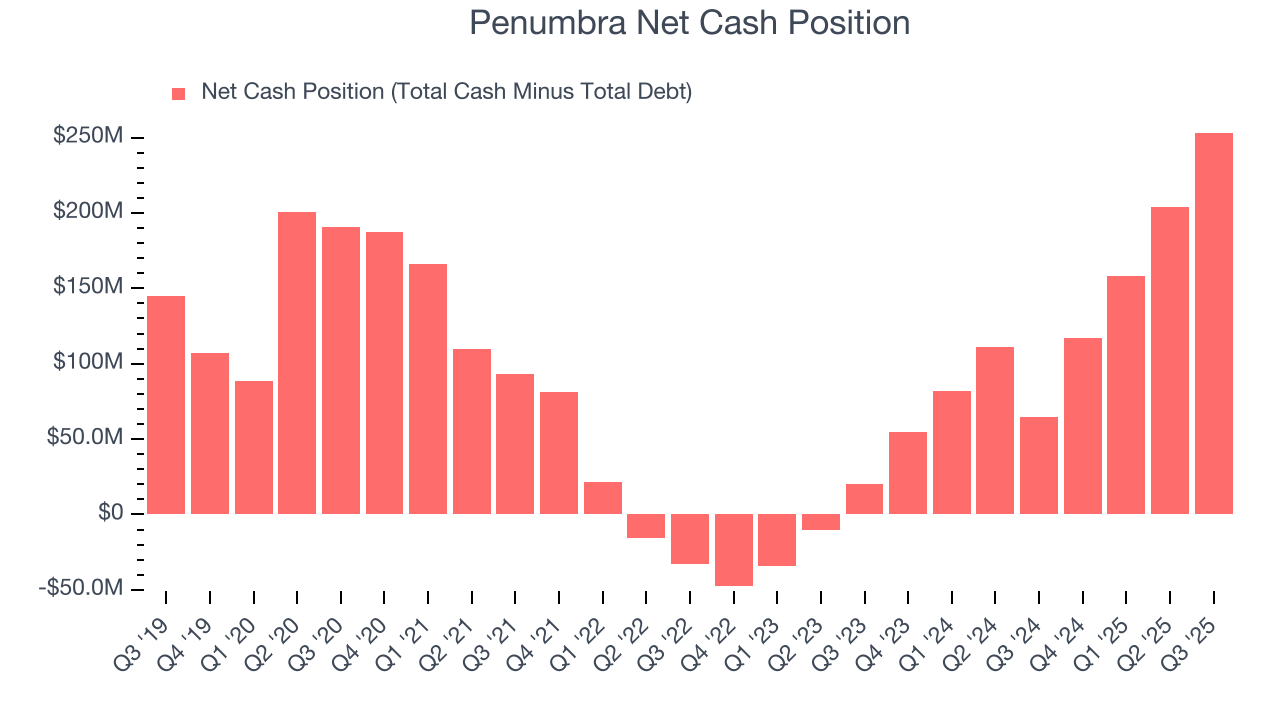

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Penumbra is a profitable, well-capitalized company with $470.3 million of cash and $217 million of debt on its balance sheet. This $253.3 million net cash position is 2.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Penumbra’s Q3 Results

We were impressed by how significantly Penumbra blew past analysts’ constant currency revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 18.7% to $268 immediately after reporting.

13. Is Now The Time To Buy Penumbra?

Updated: January 28, 2026 at 11:12 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Penumbra.

Penumbra isn’t a bad business, but we’re not clamoring to buy it here and now. First off, its revenue growth was impressive over the last five years. And while Penumbra’s subscale operations give it fewer distribution channels than its larger rivals, its rising cash profitability gives it more optionality.

Penumbra’s P/E ratio based on the next 12 months is 76.3x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $348.53 on the company (compared to the current share price of $359.51).