Pfizer (PFE)

Pfizer is a sound business. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Pfizer Is Interesting

With roots dating back to 1849 when two German immigrants opened a fine chemicals business in Brooklyn, Pfizer (NYSE:PFE) is a global biopharmaceutical company that discovers, develops, manufactures, and sells medicines and vaccines for a wide range of diseases and conditions.

- Enormous revenue base of $62.58 billion gives it economies of scale and advantages over new entrants due to the industry’s regulatory complexity

- Excellent adjusted operating margin highlights the strength of its business model

- One pitfall is its forecasted revenue decline of 2.3% for the upcoming 12 months implies demand will fall off a cliff

Pfizer is close to becoming a high-quality business. If you like the stock, the price looks fair.

Why Is Now The Time To Buy Pfizer?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Pfizer?

Pfizer’s stock price of $26.57 implies a valuation ratio of 9x forward P/E. Price is what you pay, and value is what you get. With this in mind, we think the current price is quite attractive.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Pfizer (PFE) Research Report: Q4 CY2025 Update

Global pharmaceutical company Pfizer (NYSE:PFE) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.2% year on year to $17.56 billion. The company expects the full year’s revenue to be around $61 billion, close to analysts’ estimates. Its non-GAAP profit of $0.66 per share was 16.2% above analysts’ consensus estimates.

Pfizer (PFE) Q4 CY2025 Highlights:

- Revenue: $17.56 billion vs analyst estimates of $16.65 billion (1.2% year-on-year decline, 5.5% beat)

- Adjusted EPS: $0.66 vs analyst estimates of $0.57 (16.2% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.90 at the midpoint, missing analyst estimates by 2.4%

- Operating Margin: -9.3%, down from 15.9% in the same quarter last year

- Organic Revenue fell 3% year on year (miss)

- Market Capitalization: $151.6 billion

Company Overview

With roots dating back to 1849 when two German immigrants opened a fine chemicals business in Brooklyn, Pfizer (NYSE:PFE) is a global biopharmaceutical company that discovers, develops, manufactures, and sells medicines and vaccines for a wide range of diseases and conditions.

Pfizer's product portfolio spans multiple therapeutic areas including oncology, cardiovascular, immunology, rare diseases, and infectious diseases. The company's medicines treat conditions ranging from cancer and heart disease to autoimmune disorders and COVID-19. Its vaccine lineup includes products that help prevent diseases across all age groups, with particular focus on infectious diseases with significant unmet medical needs.

The company operates through a global commercial structure that includes specialized divisions focused on oncology, U.S. commercial operations, and international markets. This structure allows Pfizer to tailor its approach to different healthcare systems and patient populations worldwide.

Healthcare providers prescribe Pfizer's medications to patients with specific medical conditions. For example, a cardiologist might prescribe Eliquis to reduce stroke risk in patients with atrial fibrillation, or an oncologist might use Ibrance to treat certain types of breast cancer. Hospitals purchase Pfizer's injectable medications for inpatient care, while pharmacies dispense its oral medications to patients for home use.

Pfizer generates revenue primarily through the sale of its prescription medications and vaccines to wholesalers, healthcare providers, government agencies, and pharmacies. The company also engages in strategic collaborations with other pharmaceutical and biotechnology companies to develop and commercialize certain products. For instance, Pfizer partnered with BioNTech to develop the Comirnaty COVID-19 vaccine and with Bristol Myers Squibb to commercialize the anticoagulant Eliquis.

The company invests heavily in research and development to discover new treatments and expand the uses of existing medications. Pfizer's 2023 acquisition of Seagen significantly expanded its oncology portfolio, particularly in the area of antibody-drug conjugates (ADCs), which are targeted cancer therapies that deliver cytotoxic agents directly to cancer cells.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Pfizer's main competitors include other large pharmaceutical companies such as Johnson & Johnson (NYSE:JNJ), Merck (NYSE:MRK), Novartis (NYSE:NVS), Roche (OTCMKTS:RHHBY), AstraZeneca (NASDAQ:AZN), and Bristol Myers Squibb (NYSE:BMY). The company also faces competition from generic drug manufacturers once patents on its products expire.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $62.58 billion in revenue over the past 12 months, Pfizer is one of the most scaled enterprises in healthcare. This is particularly important because branded pharmaceuticals companies are volume-driven businesses due to their low margins.

6. Revenue Growth

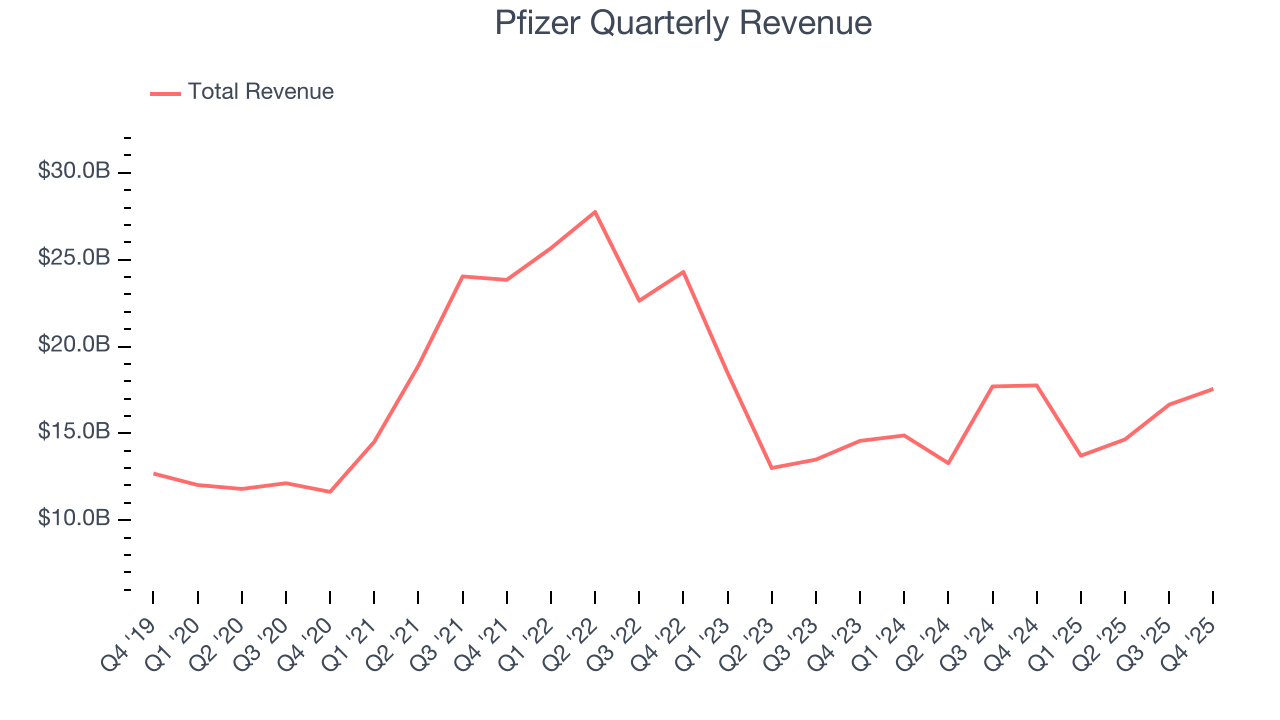

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Pfizer grew its sales at a mediocre 5.6% compounded annual growth rate. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Pfizer’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Pfizer’s organic revenue averaged 3.9% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Pfizer’s revenue fell by 1.2% year on year to $17.56 billion but beat Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to decline by 4.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

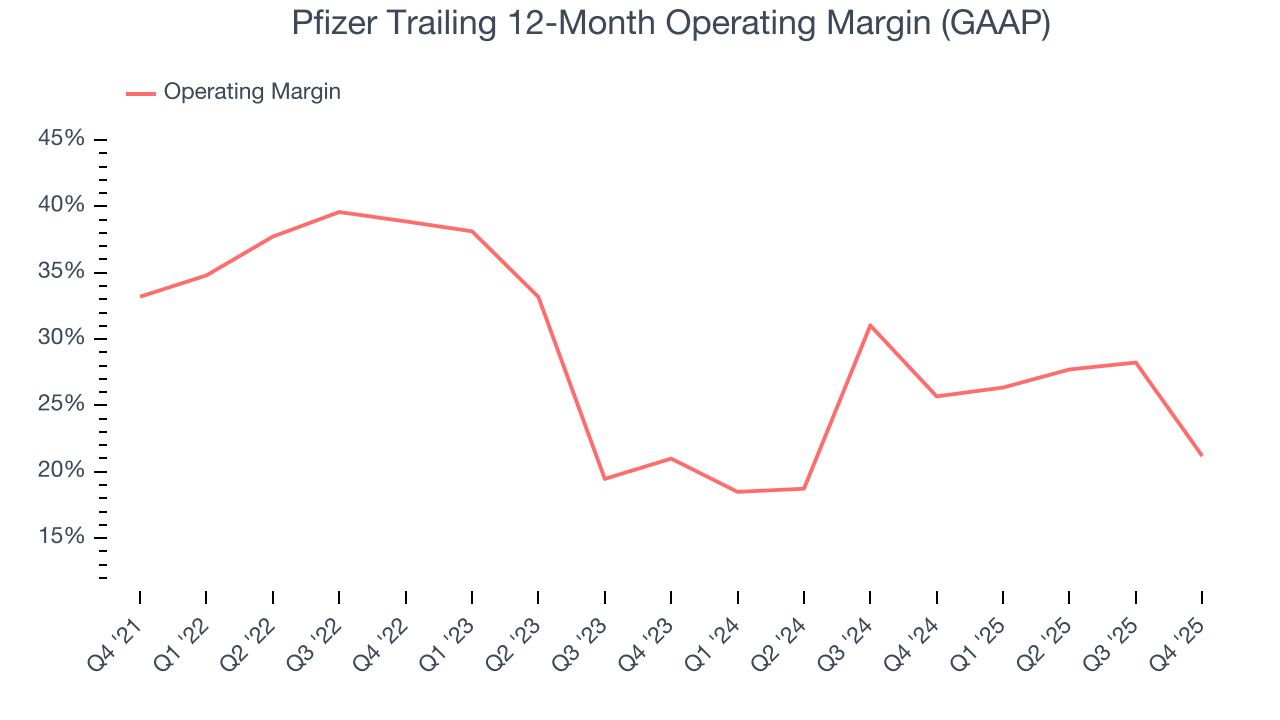

Pfizer has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 29.4%.

Looking at the trend in its profitability, Pfizer’s operating margin decreased by 12 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Pfizer generated an operating margin profit margin of negative 9.3%, down 25.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

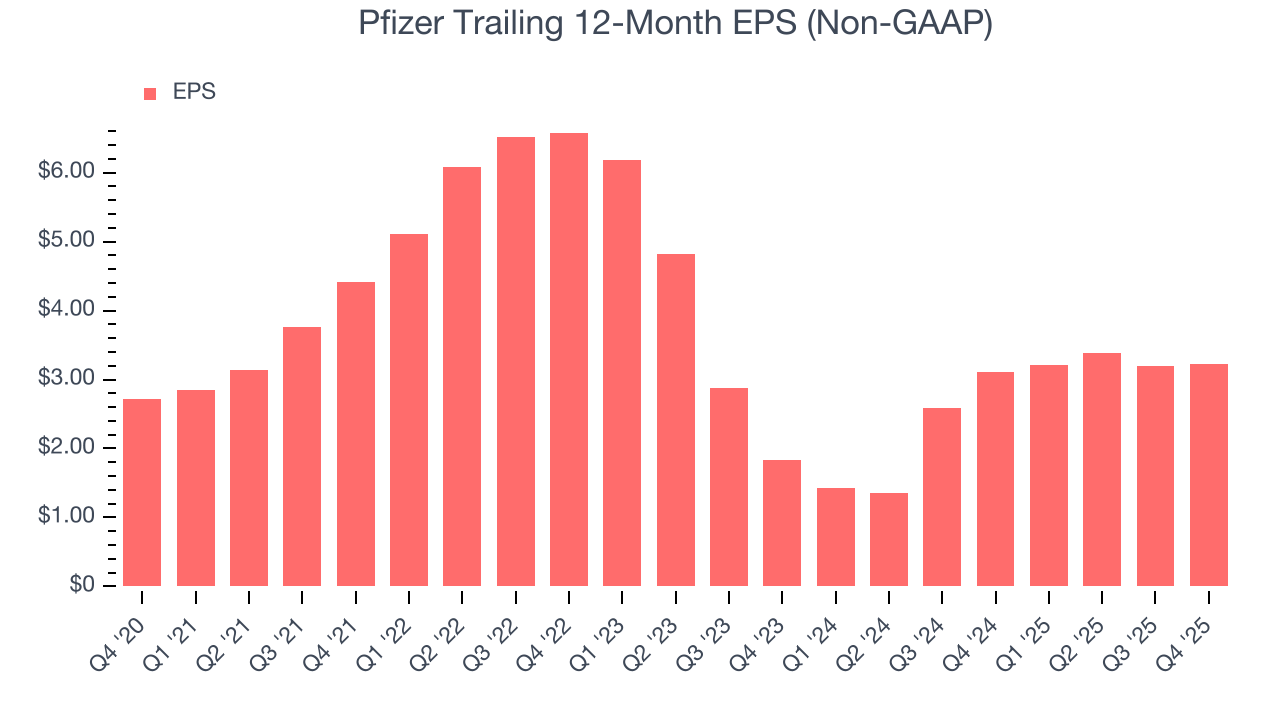

Pfizer’s EPS grew at an unimpressive 3.5% compounded annual growth rate over the last five years, lower than its 5.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Pfizer’s earnings to better understand the drivers of its performance. As we mentioned earlier, Pfizer’s operating margin declined by 12 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Pfizer reported adjusted EPS of $0.66, up from $0.63 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pfizer’s full-year EPS of $3.23 to shrink by 6.8%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

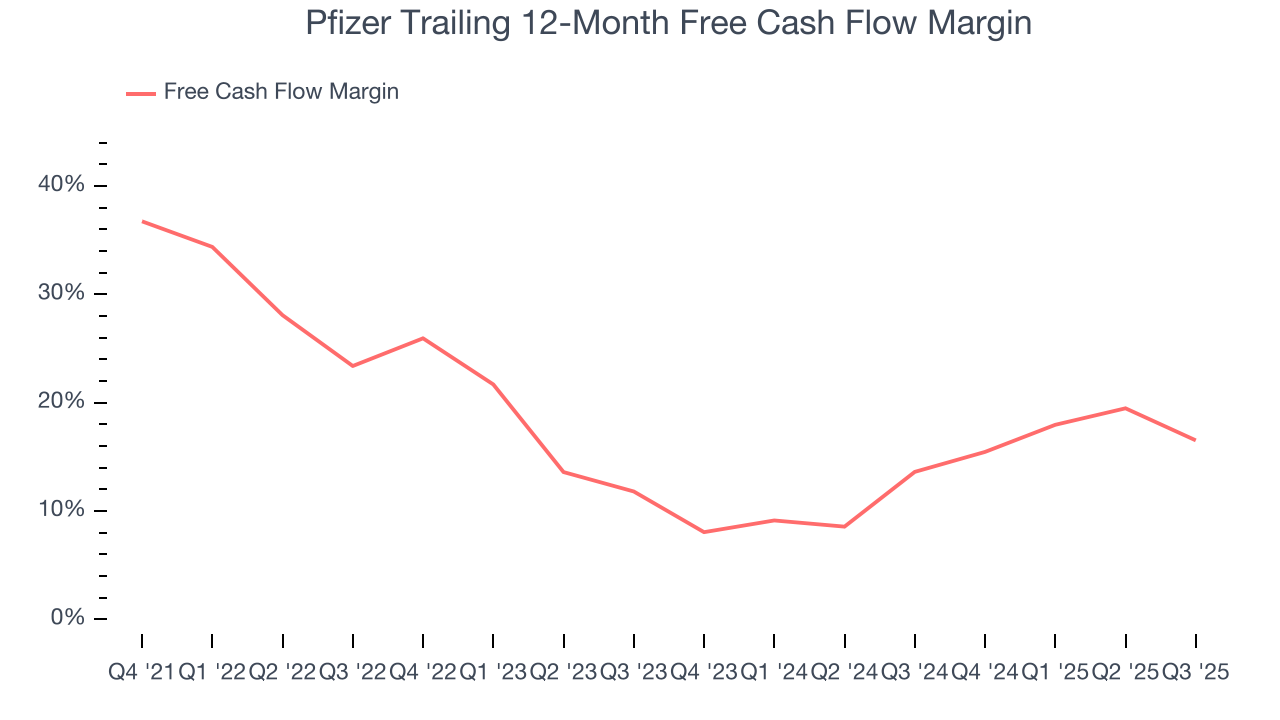

Pfizer has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.5% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Pfizer’s margin dropped by 33.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Pfizer hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 20.1%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Pfizer’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

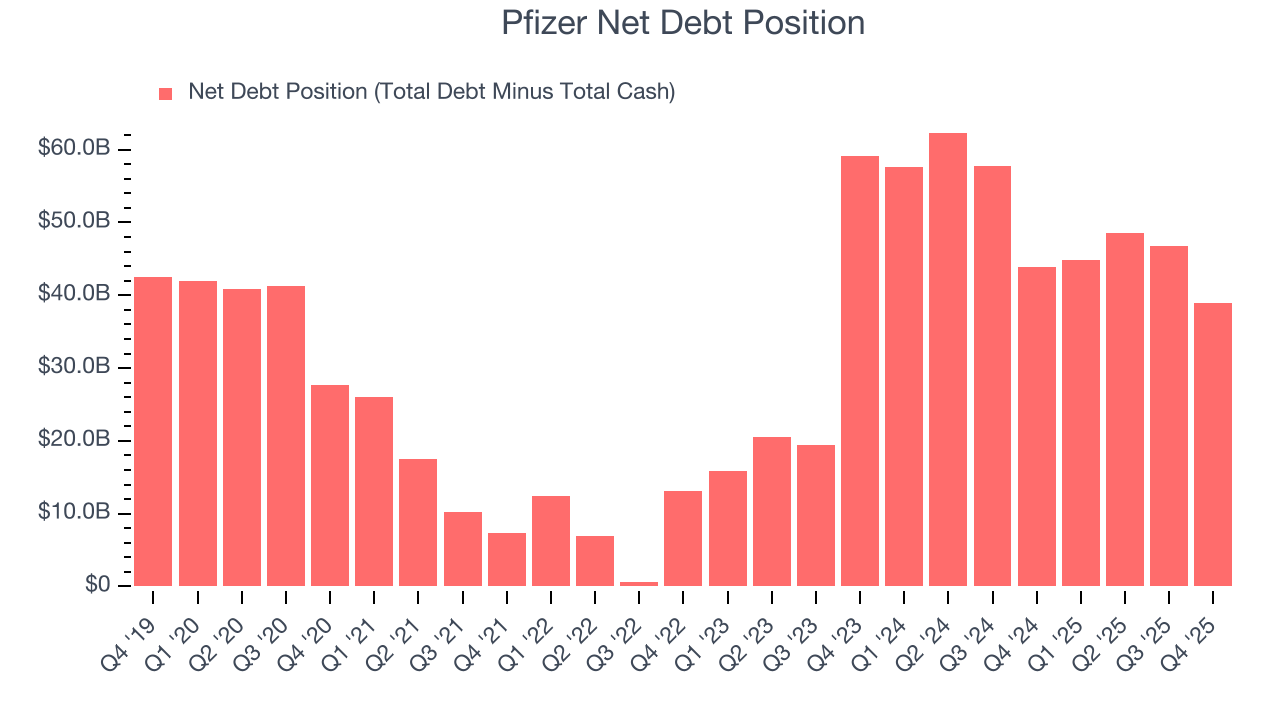

Pfizer reported $21.81 billion of cash and $60.78 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $23.67 billion of EBITDA over the last 12 months, we view Pfizer’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $2.03 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Pfizer’s Q4 Results

We were impressed by how significantly Pfizer blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its organic revenue missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.2% to $26.34 immediately following the results.

13. Is Now The Time To Buy Pfizer?

Updated: March 5, 2026 at 11:44 PM EST

Before deciding whether to buy Pfizer or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Pfizer possesses a number of positive attributes. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its scale makes it a trusted partner with negotiating leverage. And while its diminishing returns show management's recent bets still have yet to bear fruit, its impressive operating margins show it has a highly efficient business model.

Pfizer’s P/E ratio based on the next 12 months is 9x. Looking at the healthcare landscape right now, Pfizer trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $28.43 on the company (compared to the current share price of $26.57), implying they see 7% upside in buying Pfizer in the short term.