Analog Devices (ADI)

We aren’t fans of Analog Devices. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why Analog Devices Is Not Exciting

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

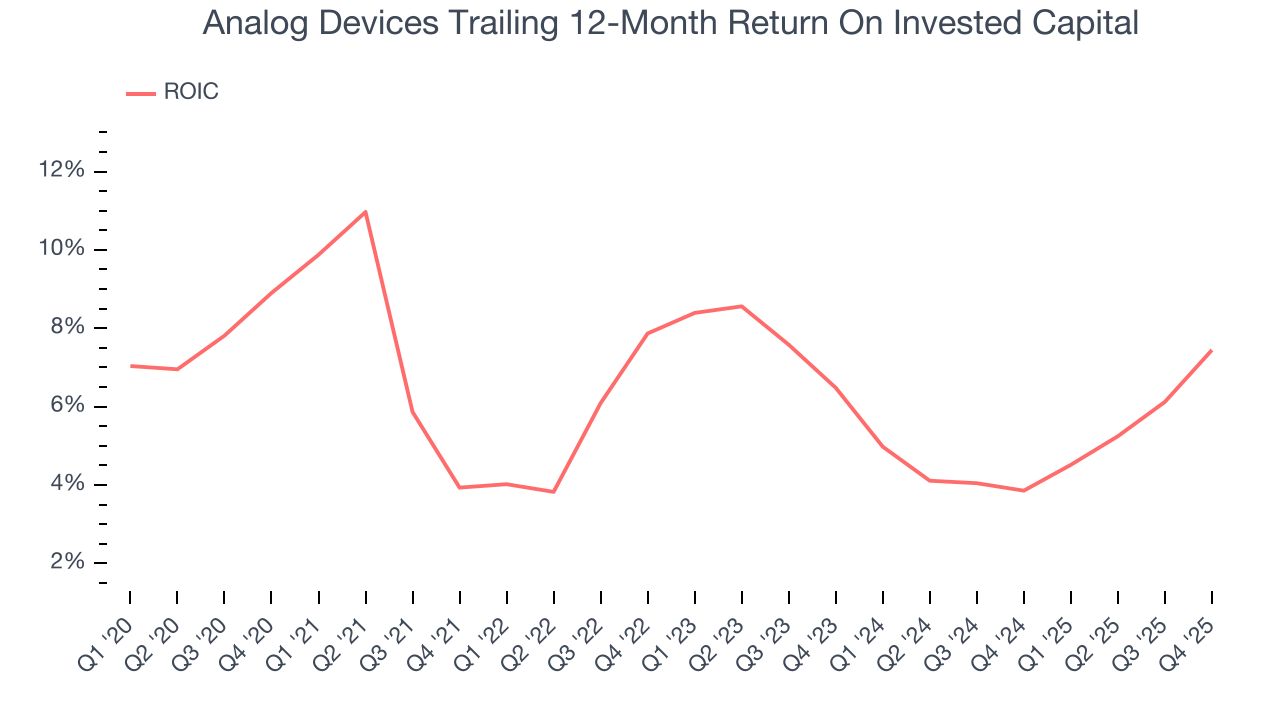

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

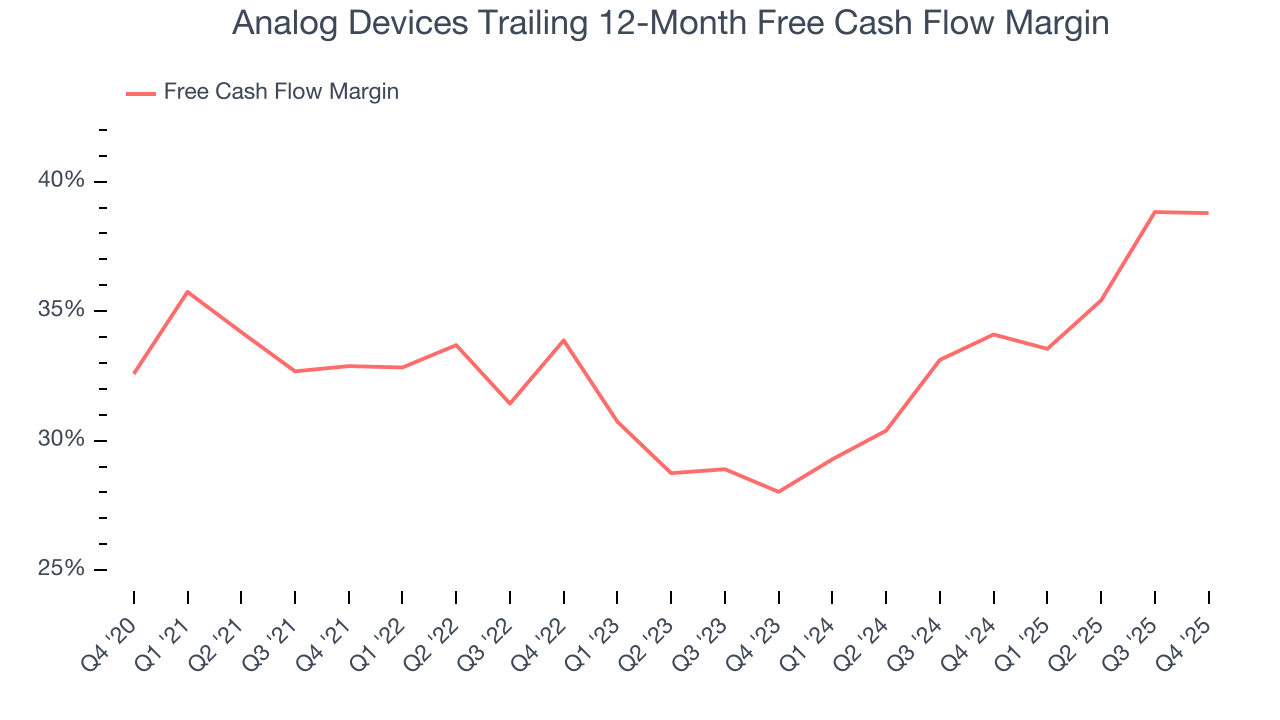

- On the bright side, its strong free cash flow margin of 36.2% gives it the option to reinvest, repurchase shares, or pay dividends, and its recently improved profitability means it has even more resources to invest or distribute

Analog Devices’s quality doesn’t meet our expectations. There are more promising alternatives.

Why There Are Better Opportunities Than Analog Devices

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Analog Devices

Analog Devices is trading at $341.25 per share, or 33.6x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Analog Devices (ADI) Research Report: Q4 CY2025 Update

Manufacturer of analog chips Analog Devices (NASDAQ:ADI) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 30.4% year on year to $3.16 billion. On top of that, next quarter’s revenue guidance ($3.5 billion at the midpoint) was surprisingly good and 8.1% above what analysts were expecting. Its non-GAAP profit of $2.46 per share was 6.6% above analysts’ consensus estimates.

Analog Devices (ADI) Q4 CY2025 Highlights:

- Revenue: $3.16 billion vs analyst estimates of $3.11 billion (30.4% year-on-year growth, 1.5% beat)

- Adjusted EPS: $2.46 vs analyst estimates of $2.31 (6.6% beat)

- Revenue Guidance for Q1 CY2026 is $3.5 billion at the midpoint, above analyst estimates of $3.24 billion

- Adjusted EPS guidance for Q1 CY2026 is $2.88 at the midpoint, above analyst estimates of $2.46

- Operating Margin: 31.5%, up from 20.3% in the same quarter last year

- Free Cash Flow Margin: 39.8%, similar to the same quarter last year

- Inventory Days Outstanding: 144, up from 133 in the previous quarter

- Market Capitalization: $164.9 billion

Company Overview

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

ADI is one of the largest analog chip makers, and is a major supplier of converters, amplifiers, sensors, and digital signal processing chips used by over hundred thousand customers.

ADI has been an active consolidator in the space, acquiring Hittite Microwave in 2014 which added radio frequency or RF chips to its portfolio, Linear Technology in 2017 which bolstered ADI’s power management chips. In 2021 it closed its $21 billion acquisition of Maxim Integrated, which increased ADI’s exposure to faster growing automotive and data center end markets.

Analog Devices’ peers and competitors include Texas Instruments (NASDAQ: TXN), Skyworks (NASDAQ:SWKS), Infineon (XTRA:IFX), NXP Semiconductors NV (NASDAQ:NXPI), ON Semi (NASDAQ:ON), Marvell Technology (NASDAQ:MRVL), and Microchip (NASDAQ:MCHP).

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

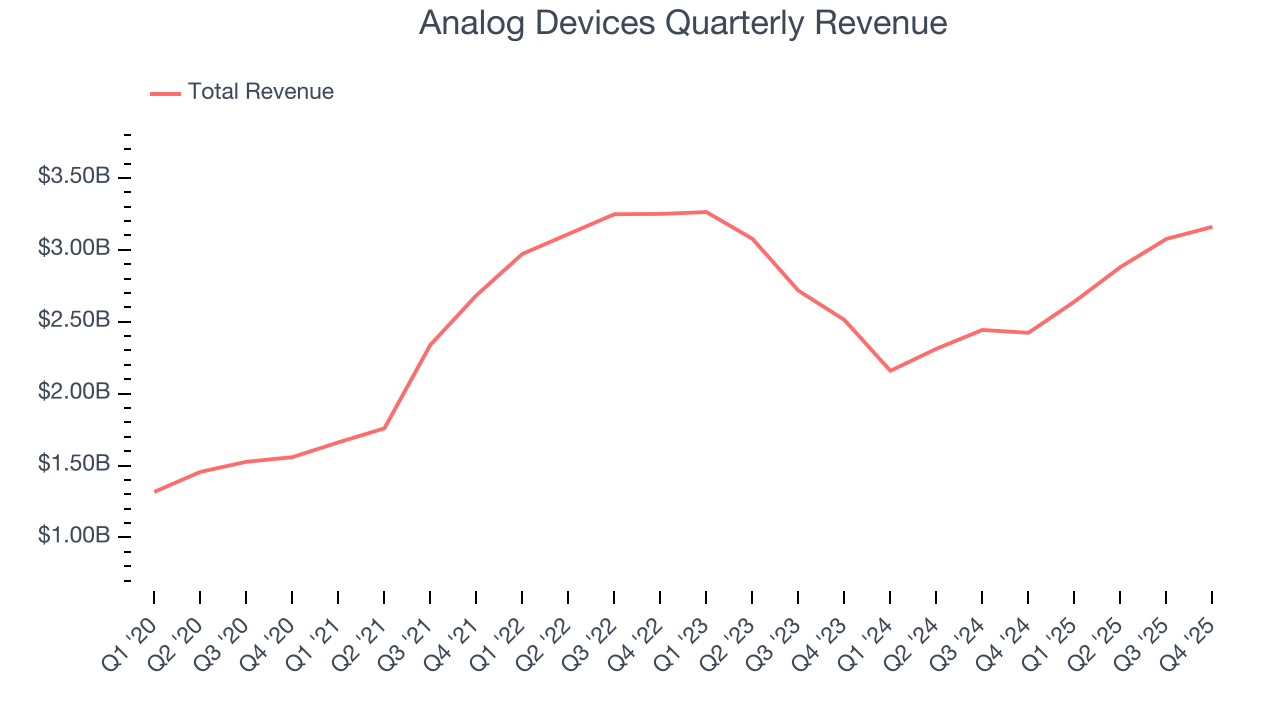

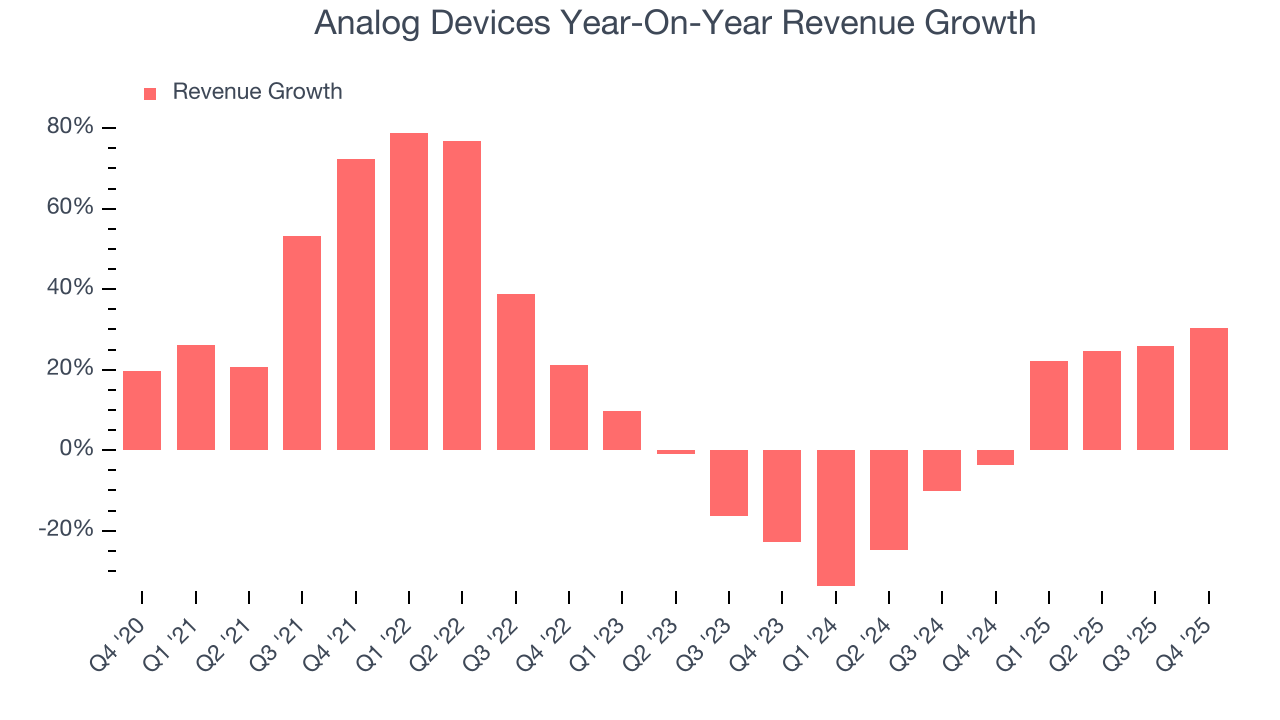

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Analog Devices’s sales grew at an impressive 14.9% compounded annual growth rate over the last five years. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Analog Devices’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, Analog Devices reported wonderful year-on-year revenue growth of 30.4%, and its $3.16 billion of revenue exceeded Wall Street’s estimates by 1.5%. Beyond the beat, this marks 4 straight quarters of growth, implying that Analog Devices is in the middle of its cycle - a typical upcycle generally lasts 8-10 quarters. Company management is currently guiding for a 32.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

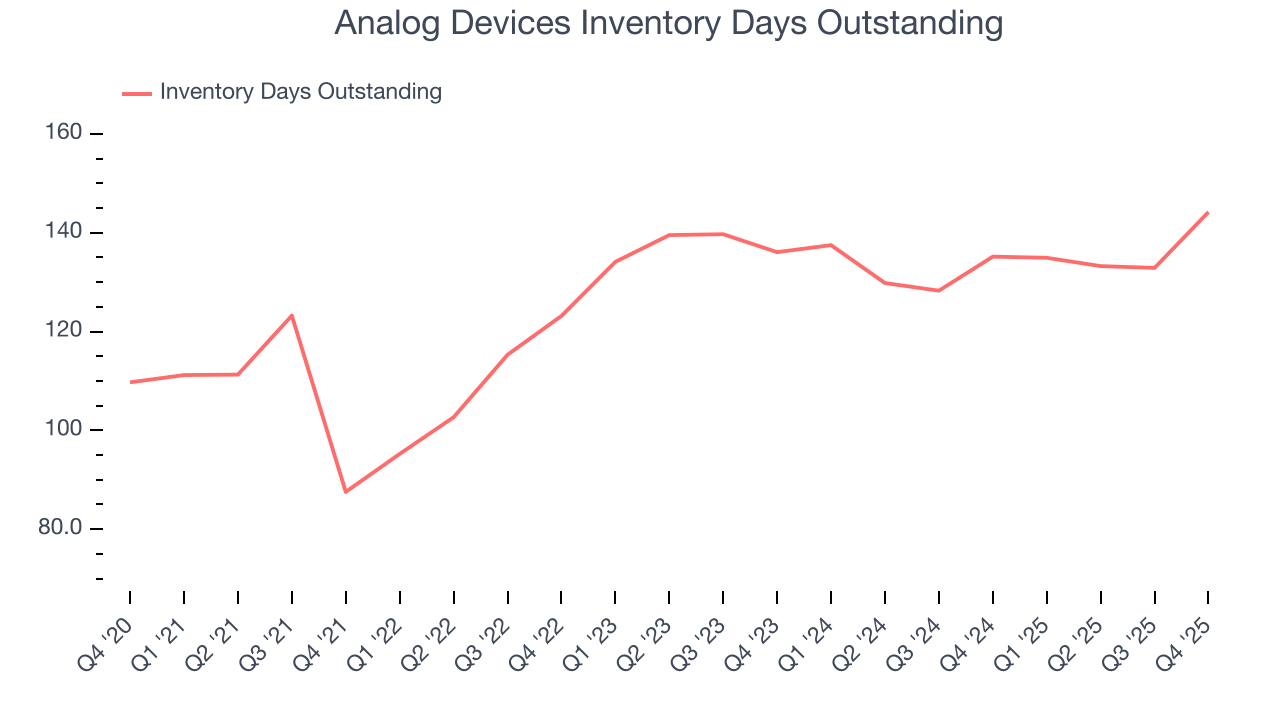

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Analog Devices’s DIO came in at 144, which is 19 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

7. Gross Margin & Pricing Power

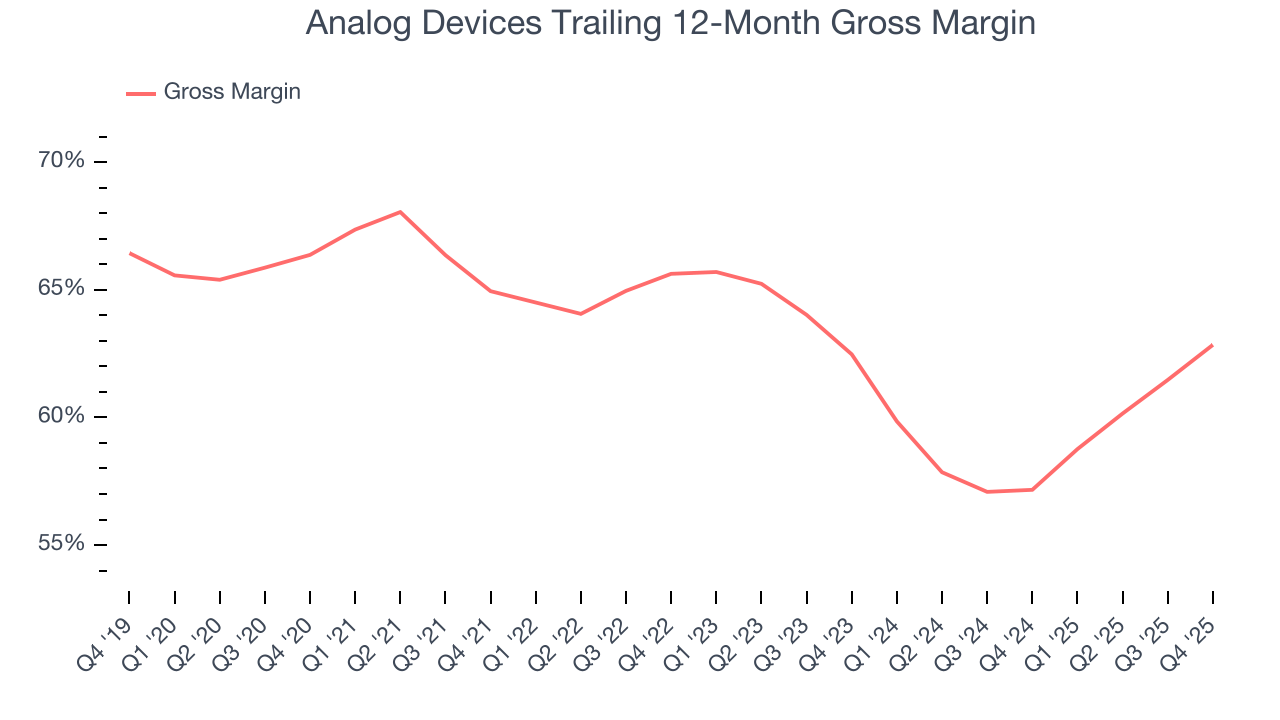

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Analog Devices’s gross margin is one of the best in the semiconductor sector, and its strong pricing power is a direct result of its differentiated products and technological expertise. As you can see below, it averaged an elite 60.3% gross margin over the last two years. Said differently, roughly $60.33 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Analog Devices produced a 64.7% gross profit margin in Q4 , marking a 5.7 percentage point increase from 59% in the same quarter last year. Analog Devices’s full-year margin has also been trending up over the past 12 months, increasing by 5.7 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

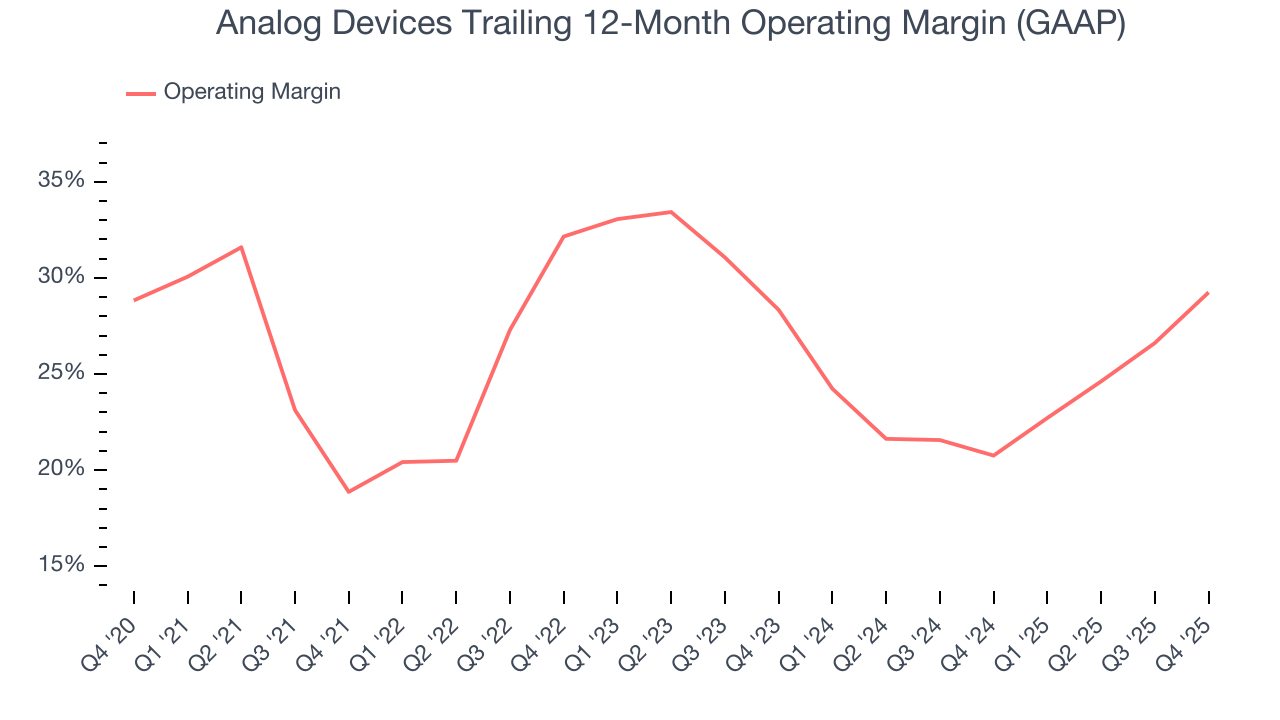

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analog Devices has been an efficient company over the last two years. It was one of the more profitable businesses in the semiconductor sector, boasting an average operating margin of 25.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Analog Devices’s operating margin rose by 10.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Analog Devices generated an operating margin profit margin of 31.5%, up 11.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Earnings Per Share

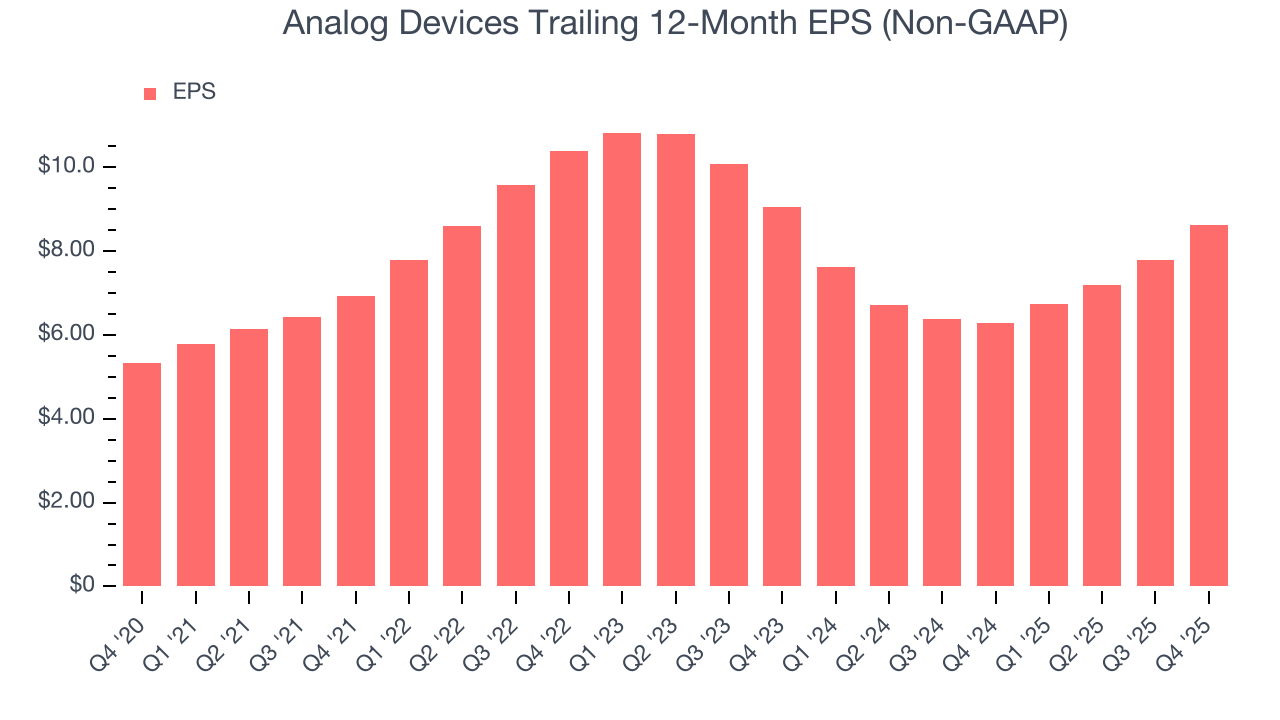

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

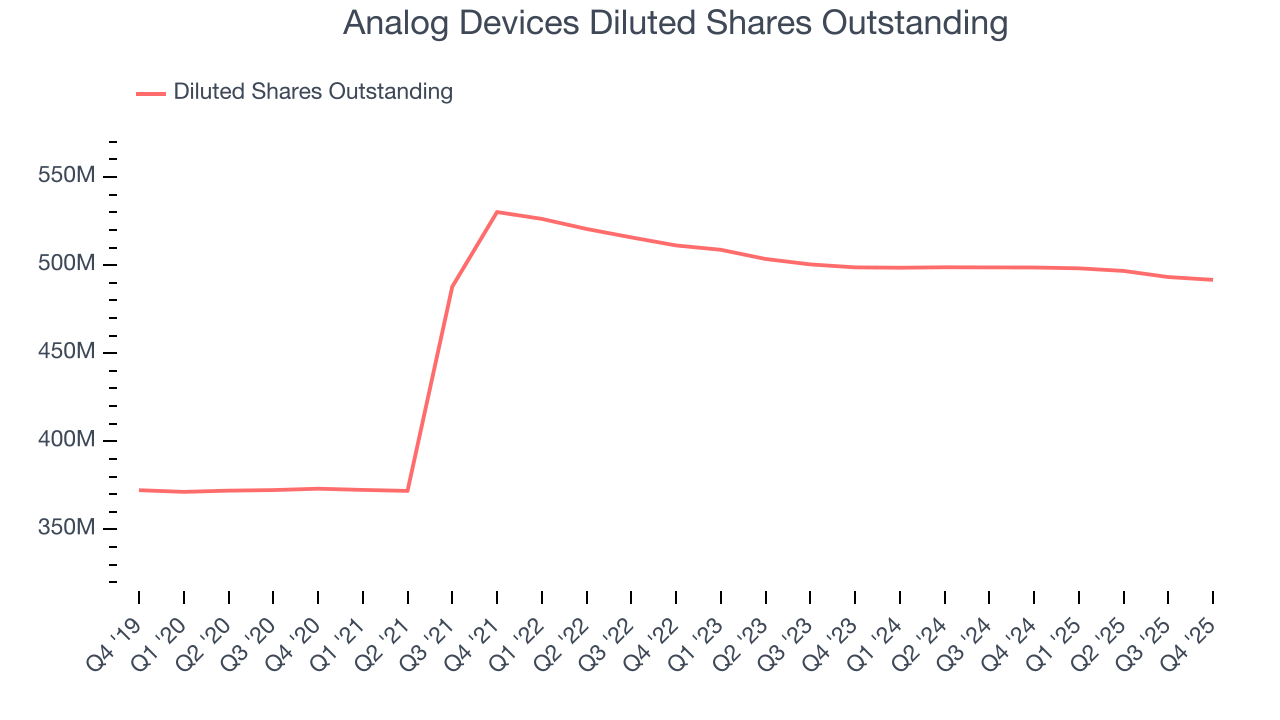

Analog Devices’s EPS grew at an unimpressive 10.1% compounded annual growth rate over the last five years, lower than its 14.9% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Analog Devices’s earnings to better understand the drivers of its performance. A five-year view shows Analog Devices has diluted its shareholders, growing its share count by 31.8%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Analog Devices reported adjusted EPS of $2.46, up from $1.63 in the same quarter last year. This print beat analysts’ estimates by 6.6%. Over the next 12 months, Wall Street expects Analog Devices’s full-year EPS of $8.62 to grow 20.1%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Analog Devices has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 36.7% over the last two years.

Taking a step back, we can see that Analog Devices’s margin expanded by 5.9 percentage points over the last five years. This is encouraging because it gives the company more optionality.

Analog Devices’s free cash flow clocked in at $1.26 billion in Q4, equivalent to a 39.8% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Analog Devices historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

12. Key Takeaways from Analog Devices’s Q4 Results

We were impressed by Analog Devices’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its inventory levels materially increased. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 9.3% to $368.99 immediately after reporting.

13. Is Now The Time To Buy Analog Devices?

Updated: February 18, 2026 at 7:23 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Analog Devices has a few positive attributes, but it doesn’t top our wishlist. First off, its revenue growth was impressive over the last five years, and analysts believe it can continue growing at these levels. And while Analog Devices’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Analog Devices’s P/E ratio based on the next 12 months is 32.6x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $320.19 on the company (compared to the current share price of $368.99).