AdaptHealth (AHCO)

We’re wary of AdaptHealth. Its weak returns on capital suggest it doesn’t generate sufficient profits, a sign of value destruction.― StockStory Analyst Team

1. News

2. Summary

Why We Think AdaptHealth Will Underperform

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ:AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Underwhelming 0.5% return on capital reflects management’s difficulties in finding profitable growth opportunities

- On the bright side, its impressive 24.8% annual revenue growth over the last five years indicates it’s winning market share this cycle

AdaptHealth doesn’t check our boxes. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than AdaptHealth

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AdaptHealth

AdaptHealth’s stock price of $9.46 implies a valuation ratio of 9.6x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. AdaptHealth (AHCO) Research Report: Q4 CY2025 Update

Healthcare services provider AdaptHealth Corp. (NASDAQ:AHCO) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.2% year on year to $846.3 million. The company’s full-year revenue guidance of $3.48 billion at the midpoint came in 1% above analysts’ estimates. Its GAAP loss of $0.76 per share was significantly below analysts’ consensus estimates.

AdaptHealth (AHCO) Q4 CY2025 Highlights:

- Revenue: $846.3 million vs analyst estimates of $828.6 million (1.2% year-on-year decline, 2.1% beat)

- EPS (GAAP): -$0.76 vs analyst estimates of $0.35 (significant miss)

- Adjusted EBITDA: $163.1 million vs analyst estimates of $190.1 million (19.3% margin, 14.2% miss)

- EBITDA guidance for the upcoming financial year 2026 is $705 million at the midpoint, in line with analyst expectations

- Operating Margin: -8.7%, down from 11.4% in the same quarter last year

- Free Cash Flow Margin: 9.4%, similar to the same quarter last year

- Market Capitalization: $1.36 billion

Company Overview

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ:AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

AdaptHealth serves as a critical link between healthcare facilities and patients who need ongoing medical equipment and supplies in their homes. The company operates in two main revenue streams: fixed monthly rentals for durable medical equipment like CPAP machines, hospital beds, and oxygen concentrators; and one-time or recurring sales of consumable supplies such as CPAP masks, diabetes management supplies, and wound care products.

When a patient is discharged from a hospital or receives a physician referral, AdaptHealth coordinates the delivery of prescribed medical equipment directly to their home. For example, a patient diagnosed with sleep apnea might receive a CPAP machine, mask, and ongoing supplies from AdaptHealth, along with setup assistance and education on proper use.

The company receives referrals from diverse sources including hospitals, sleep laboratories, specialist physicians, skilled nursing facilities, and primary care providers. AdaptHealth's sales representatives maintain relationships with these referral sources, while their clinical teams provide support for patients using complex equipment.

AdaptHealth generates revenue by billing insurance companies (primarily Medicare and Medicaid) and patients directly for the equipment and supplies provided. The company handles approximately 38,000 equipment and supply deliveries daily, serving about 4.1 million patients annually.

Beyond simple product delivery, AdaptHealth provides services like equipment setup, patient education, and ongoing support. The company also manages resupply programs that automatically send replacement parts and consumables to patients on a regular schedule, helping ensure treatment compliance and continuity of care.

AdaptHealth has expanded its geographic footprint and product offerings through numerous acquisitions, allowing it to achieve economies of scale in a fragmented industry while providing comprehensive solutions for patients with multiple medical equipment needs.

4. Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

AdaptHealth competes with large national providers like Owens & Minor, Lincare Holdings, Rotech Healthcare, and Cardinal Health; regional providers such as DASCO Home Medical Equipment and Quipt Home Medical; and retail giants entering the healthcare space including CVS and Amazon.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.24 billion in revenue over the past 12 months, AdaptHealth has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, AdaptHealth’s 24.8% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. AdaptHealth’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, AdaptHealth’s revenue fell by 1.2% year on year to $846.3 million but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

7. Operating Margin

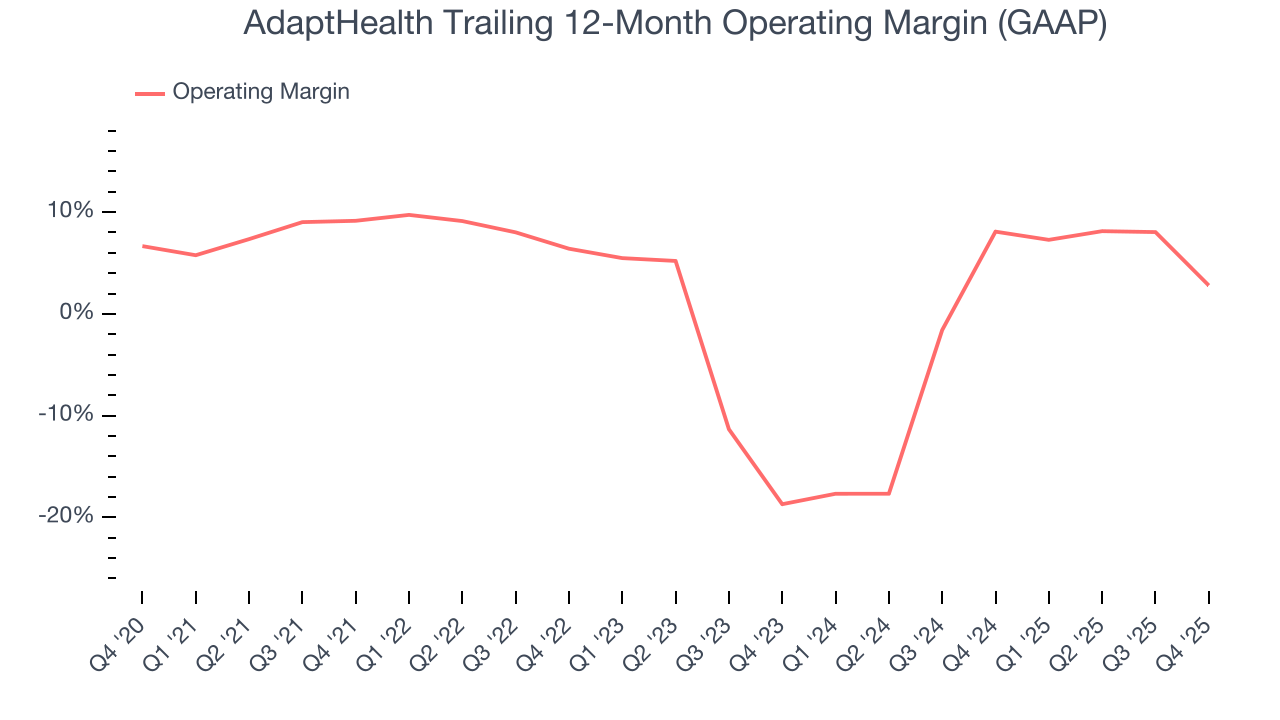

AdaptHealth was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.1% was weak for a healthcare business.

Analyzing the trend in its profitability, AdaptHealth’s operating margin decreased by 6.4 percentage points over the last five years, but it rose by 21.5 percentage points on a two-year basis. Still, shareholders will want to see AdaptHealth become more profitable in the future.

In Q4, AdaptHealth generated an operating margin profit margin of negative 8.7%, down 20.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

8. Earnings Per Share

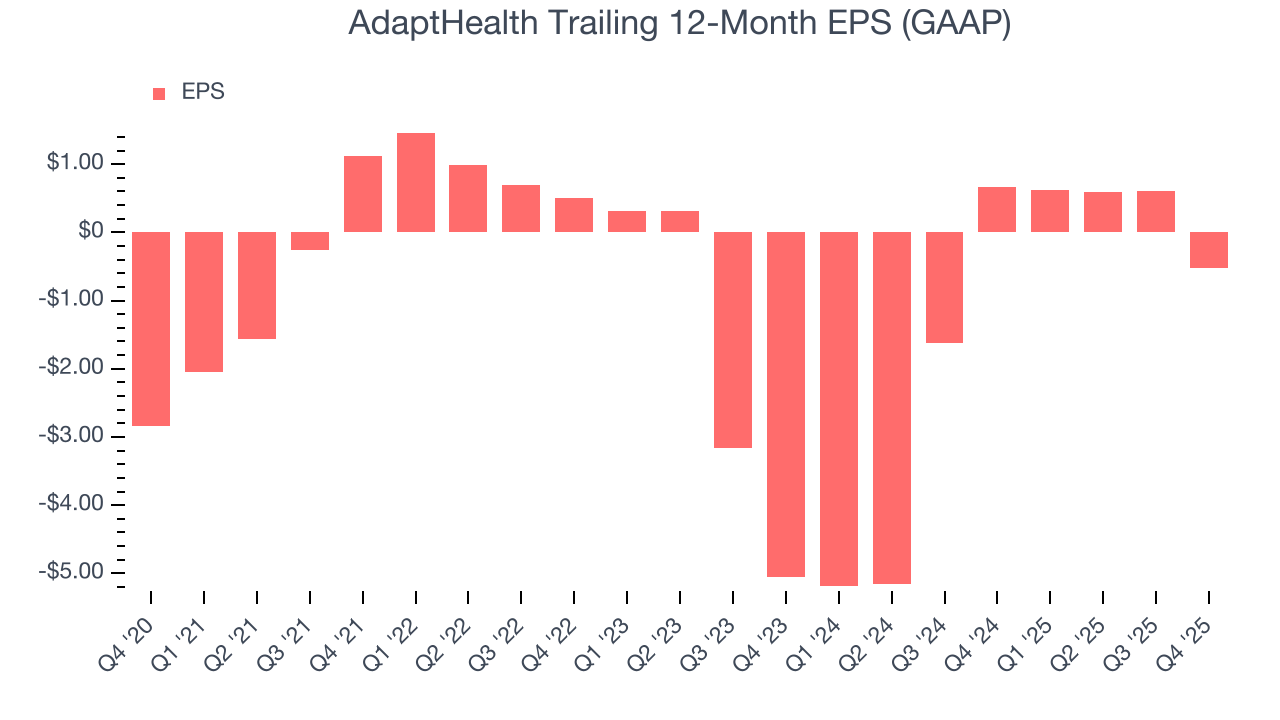

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although AdaptHealth’s full-year earnings are still negative, it reduced its losses and improved its EPS by 28.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, AdaptHealth reported EPS of negative $0.76, down from $0.37 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast AdaptHealth’s full-year EPS of negative $0.53 will flip to positive $0.89.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AdaptHealth has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that AdaptHealth’s margin expanded by 3.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

AdaptHealth’s free cash flow clocked in at $79.29 million in Q4, equivalent to a 9.4% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AdaptHealth historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.5%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, AdaptHealth’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

AdaptHealth reported $106.1 million of cash and $1.90 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $616.7 million of EBITDA over the last 12 months, we view AdaptHealth’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $56.87 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AdaptHealth’s Q4 Results

It was encouraging to see AdaptHealth beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $10.29 immediately after reporting.

13. Is Now The Time To Buy AdaptHealth?

Updated: March 6, 2026 at 11:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AdaptHealth.

AdaptHealth isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s rising cash profitability gives it more optionality, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

AdaptHealth’s P/E ratio based on the next 12 months is 9.6x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $12.88 on the company (compared to the current share price of $9.46).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.