ANI Pharmaceuticals (ANIP)

ANI Pharmaceuticals doesn’t excite us. Its negative returns on capital show it destroyed shareholder value by losing money.― StockStory Analyst Team

1. News

2. Summary

Why ANI Pharmaceuticals Is Not Exciting

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ:ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

- Negative returns on capital show management lost money while trying to expand the business

- Smaller revenue base of $883.4 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- The good news is that its annual revenue growth of 33.5% over the past five years was outstanding, reflecting market share gains this cycle

ANI Pharmaceuticals fails to meet our quality criteria. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than ANI Pharmaceuticals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ANI Pharmaceuticals

ANI Pharmaceuticals’s stock price of $75.19 implies a valuation ratio of 8.2x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. ANI Pharmaceuticals (ANIP) Research Report: Q4 CY2025 Update

Specialty pharmaceutical company ANI Pharmaceuticals (NASDAQ:ANIP) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 29.6% year on year to $247.1 million. The company’s full-year revenue guidance of $1.09 billion at the midpoint came in 4.8% above analysts’ estimates. Its non-GAAP profit of $2.33 per share was 17.9% above analysts’ consensus estimates.

ANI Pharmaceuticals (ANIP) Q4 CY2025 Highlights:

- Revenue: $247.1 million vs analyst estimates of $231 million (29.6% year-on-year growth, 6.9% beat)

- Adjusted EPS: $2.33 vs analyst estimates of $1.98 (17.9% beat)

- Adjusted EBITDA: $65.36 million vs analyst estimates of $62.07 million (26.5% margin, 5.3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $9.09 at the midpoint, beating analyst estimates by 5.1%

- EBITDA guidance for the upcoming financial year 2026 is $282.5 million at the midpoint, above analyst estimates of $260.7 million

- Operating Margin: 14.1%, up from -2.3% in the same quarter last year

- Market Capitalization: $1.61 billion

Company Overview

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ:ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

ANI operates through three main business segments: rare disease treatments, generic pharmaceuticals, and established branded products. The company's flagship rare disease product is Purified Cortrophin Gel, a hormone therapy used to treat various conditions including multiple sclerosis flares, rheumatic disorders, and certain allergic states. This product represents a key growth driver for the company as it expands its presence in the high-margin rare disease market.

The company's generic business forms the backbone of its operations, with a robust development pipeline supported by its Novitium subsidiary, which has established expertise in obtaining Competitive Generic Therapy (CGT) designations from the FDA. These designations can provide 180-day market exclusivity for generic drugs that address inadequate market competition, creating valuable opportunities in niche markets.

ANI manufactures its products at three facilities located in Minnesota and New Jersey, which are capable of producing various pharmaceutical formulations including oral solids, liquids, topicals, and controlled substances. This manufacturing capability gives ANI flexibility to produce complex formulations that may have limited competition.

The company distributes its products through major pharmaceutical channels including national wholesalers like Cencora (formerly AmerisourceBergen), Cardinal Health, and McKesson, as well as retail pharmacy chains, specialty pharmacies, and group purchasing organizations. For its rare disease products, ANI works with specialty pharmacies and hospital systems to ensure patients can access these more specialized treatments.

ANI's business model balances the steady revenue from established generic and branded products with growth opportunities in rare disease treatments and niche generic markets where competition is limited due to manufacturing complexity or market size.

4. Generic Pharmaceuticals

The generic pharmaceutical industry operates on a volume-driven, low-cost business model, producing bioequivalent versions of branded drugs once their patents expire. These companies benefit from consistent demand for affordable medications, as they are critical to reducing healthcare costs. Generics typically face lower R&D expenses and shorter regulatory approval timelines compared to branded drug makers, enabling cost efficiencies. However, the industry is highly competitive, with intense pricing pressures, thin margins, and frequent legal challenges from branded pharmaceutical companies over patent disputes. Looking ahead, the industry is supported by tailwinds such as the role of AI in streamlining drug development (reverse engineering complex formulations) and manufacturing efficiency (optimize processes and remove inefficiencies). Governments and insurers' focus on reducing drug costs can also boost generics' adoption. However, headwinds include escalating pricing pressure from large buyers like pharmacy chains and healthcare distributors as well as evolving regulatory hurdles.

ANI Pharmaceuticals competes with larger pharmaceutical companies including Amneal Pharmaceuticals, Teva Pharmaceuticals USA, Sun Pharmaceutical Industries, and Viatris Inc. In the rare disease space, competitors include Mallinckrodt Pharmaceuticals and other specialty pharmaceutical companies focused on similar therapeutic areas.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $883.4 million in revenue over the past 12 months, ANI Pharmaceuticals is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, ANI Pharmaceuticals’s sales grew at an incredible 33.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. ANI Pharmaceuticals’s annualized revenue growth of 34.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, ANI Pharmaceuticals reported robust year-on-year revenue growth of 29.6%, and its $247.1 million of revenue topped Wall Street estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market sees success for its products and services.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

ANI Pharmaceuticals was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.3% was weak for a healthcare business.

On the plus side, ANI Pharmaceuticals’s operating margin rose by 31 percentage points over the last five years, as its sales growth gave it immense operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 2.9 percentage points on a two-year basis.

This quarter, ANI Pharmaceuticals generated an operating margin profit margin of 14.1%, up 16.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

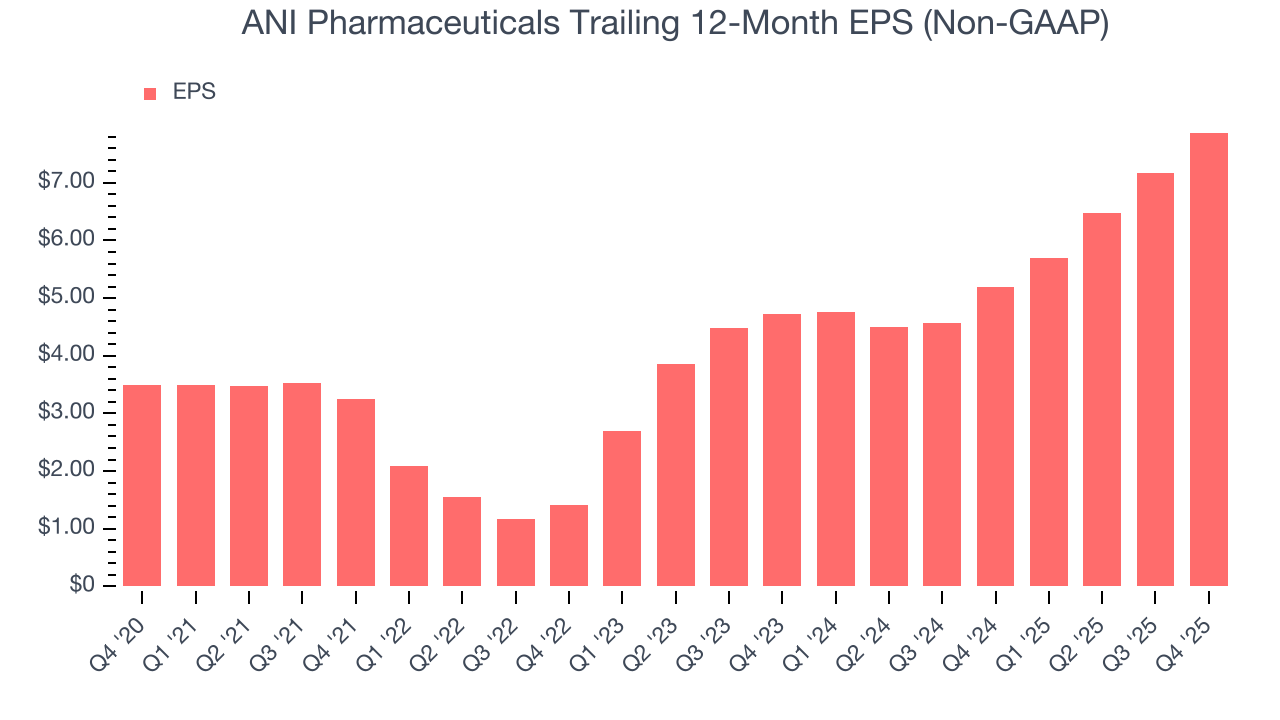

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

ANI Pharmaceuticals’s EPS grew at an astounding 17.6% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 33.5% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

We can take a deeper look into ANI Pharmaceuticals’s earnings quality to better understand the drivers of its performance. A five-year view shows ANI Pharmaceuticals has diluted its shareholders, growing its share count by 81.5%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, ANI Pharmaceuticals reported adjusted EPS of $2.33, up from $1.63 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ANI Pharmaceuticals’s full-year EPS of $7.87 to grow 8.1%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

ANI Pharmaceuticals has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.5% over the last five years, better than the broader healthcare sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that ANI Pharmaceuticals’s margin expanded by 13.8 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ANI Pharmaceuticals’s five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ANI Pharmaceuticals’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

ANI Pharmaceuticals reported $285.6 million of cash and $617 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $229.8 million of EBITDA over the last 12 months, we view ANI Pharmaceuticals’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $20.06 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from ANI Pharmaceuticals’s Q4 Results

We were impressed by how significantly ANI Pharmaceuticals blew past analysts’ revenue expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 12.4% to $86.71 immediately following the results.

13. Is Now The Time To Buy ANI Pharmaceuticals?

Updated: March 1, 2026 at 11:56 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ANI Pharmaceuticals.

ANI Pharmaceuticals isn’t a bad business, but we have other favorites. To kick things off, its revenue growth was exceptional over the last five years. And while ANI Pharmaceuticals’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality.

ANI Pharmaceuticals’s P/E ratio based on the next 12 months is 8.6x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $110.63 on the company (compared to the current share price of $73.91).