Phibro Animal Health (PAHC)

We aren’t fans of Phibro Animal Health. It not only barely produces cash but also has been less efficient lately, as seen by its falling margins.― StockStory Analyst Team

1. News

2. Summary

Why Phibro Animal Health Is Not Exciting

With a portfolio of approximately 800 product lines serving farmers and veterinarians in 90 countries, Phibro Animal Health (NASDAQ:PAHC) develops, manufactures, and markets health products for livestock and companion animals, including antibacterials, vaccines, nutritional supplements, and mineral additives.

- Subscale operations are evident in its revenue base of $1.46 billion, meaning it has fewer distribution channels than its larger rivals

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- One positive is that its incremental sales over the last five years have been highly profitable as its earnings per share increased by 17.1% annually, topping its revenue gains

Phibro Animal Health falls short of our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Phibro Animal Health

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Phibro Animal Health

Phibro Animal Health’s stock price of $52.26 implies a valuation ratio of 16.3x forward P/E. This multiple is lower than most healthcare companies, but for good reason.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Phibro Animal Health (PAHC) Research Report: Q2 CY2026 Update

Animal health products manufacturer Phibro Animal Health (NASDAQ:PAHC) fell short of the markets revenue expectations in Q2 CY2026, with sales flat year on year at $378.7 million. Its non-GAAP profit of $0.57 per share was 13.2% below analysts’ consensus estimates.

Phibro Animal Health (PAHC) Q2 CY2026 Highlights:

- Revenue: $378.7 million vs analyst estimates of $386.6 million (flat year on year, 2% miss)

- Adjusted EPS: $0.57 vs analyst expectations of $0.66 (13.2% miss)

- Operating Margin: 10.1%, up from 8.9% in the same quarter last year

- Free Cash Flow Margin: 2.1%, similar to the same quarter last year

- Market Capitalization: $1.67 billion

Company Overview

With a portfolio of approximately 800 product lines serving farmers and veterinarians in 90 countries, Phibro Animal Health (NASDAQ:PAHC) develops, manufactures, and markets health products for livestock and companion animals, including antibacterials, vaccines, nutritional supplements, and mineral additives.

Phibro operates through three business segments: Animal Health, Mineral Nutrition, and Performance Products. The Animal Health segment is the company's core business, offering medicated feed additives, vaccines, and nutritional specialty products that help prevent and treat diseases in food animals like poultry, swine, cattle, and aquaculture. These products also help improve overall animal nutrition and health, which enables more efficient livestock production.

Key products include antibacterials like virginiamycin (marketed as Stafac) and carbadox (Mecadox), anticoccidials that prevent parasitic infections, and nutritional specialty products such as OmniGen, which helps maintain healthy immune systems in dairy cows. Phibro also produces vaccines against viral and bacterial diseases for poultry, swine, and cattle, including both off-the-shelf and customized "autogenous" vaccines tailored to specific farm conditions.

The Mineral Nutrition segment provides essential trace minerals like zinc, copper, and iron that are added to animal feed to maintain optimal health and performance. Meanwhile, the smaller Performance Products segment manufactures specialty ingredients for the personal care, industrial chemical, and chemical catalyst industries.

A typical customer might be a large integrated poultry producer who uses Phibro's anticoccidial products to prevent parasitic infections in their flocks, their nutritional additives to improve feed efficiency, and their vaccines to prevent viral diseases—all working together to maintain healthier birds and improve production efficiency. Phibro sells either directly to these producers or through distributors, feed manufacturers, and veterinarians who serve as important intermediaries in the animal health market.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Phibro Animal Health competes with several larger global animal health companies, including Zoetis, Elanco Animal Health, Merck Animal Health (a division of Merck & Co.), Boehringer Ingelheim Animal Health, and Ceva Santé Animale. In the mineral nutrition space, they compete with specialty minerals companies like Southeastern Minerals and other feed ingredient suppliers.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.4 billion in revenue over the past 12 months, Phibro Animal Health is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

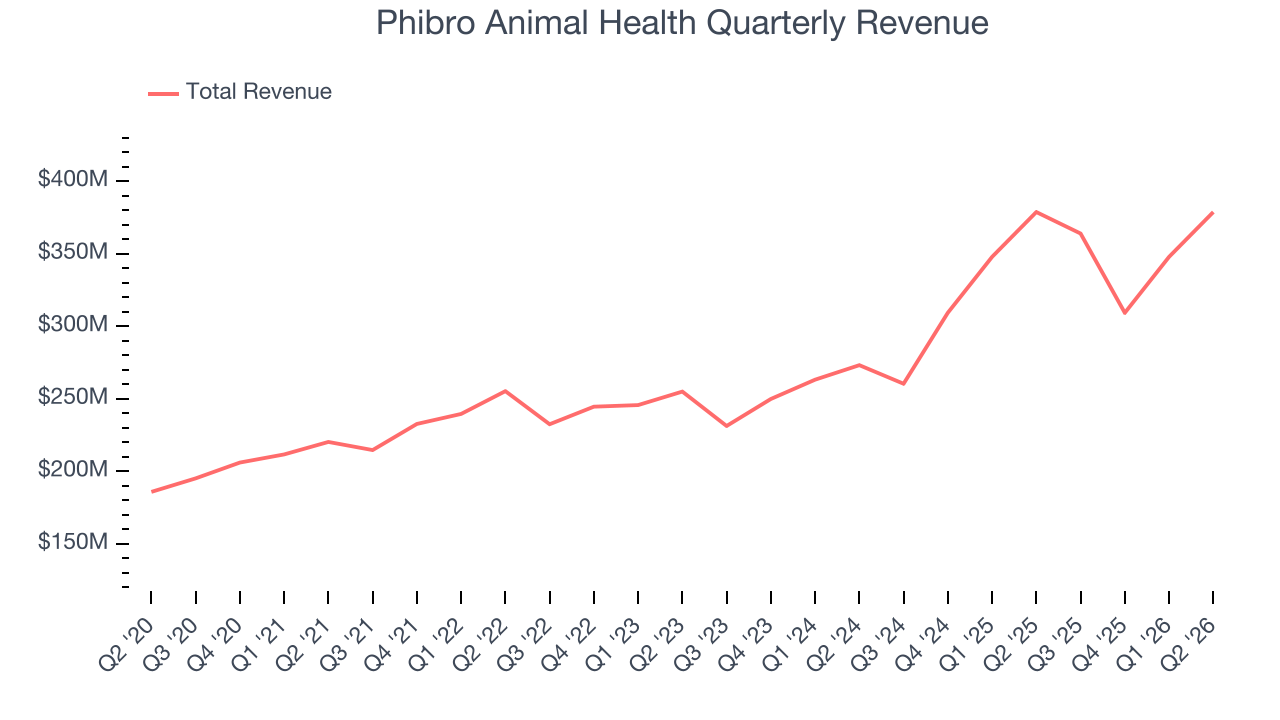

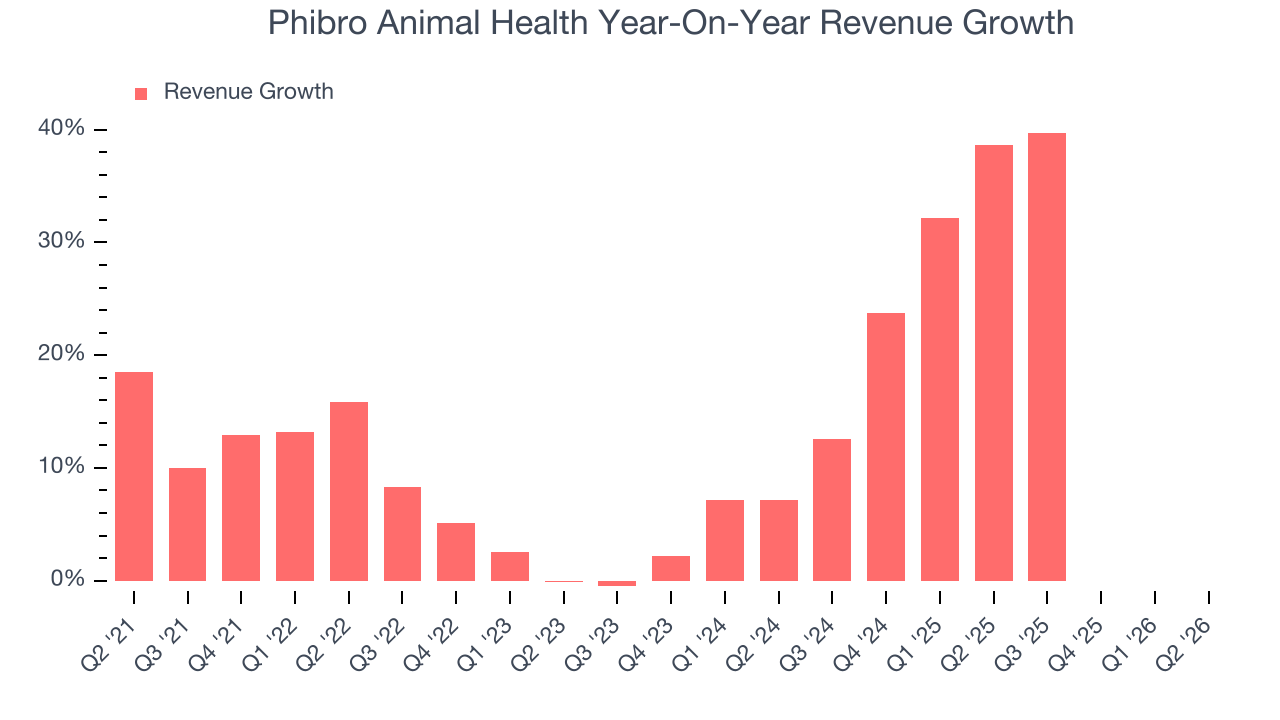

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Phibro Animal Health grew its sales at a decent 10.9% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Phibro Animal Health’s annualized revenue growth of 17.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Phibro Animal Health missed Wall Street’s estimates and reported a rather uninspiring 0% year-on-year revenue decline, generating $378.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is baking in some success for its newer products and services.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

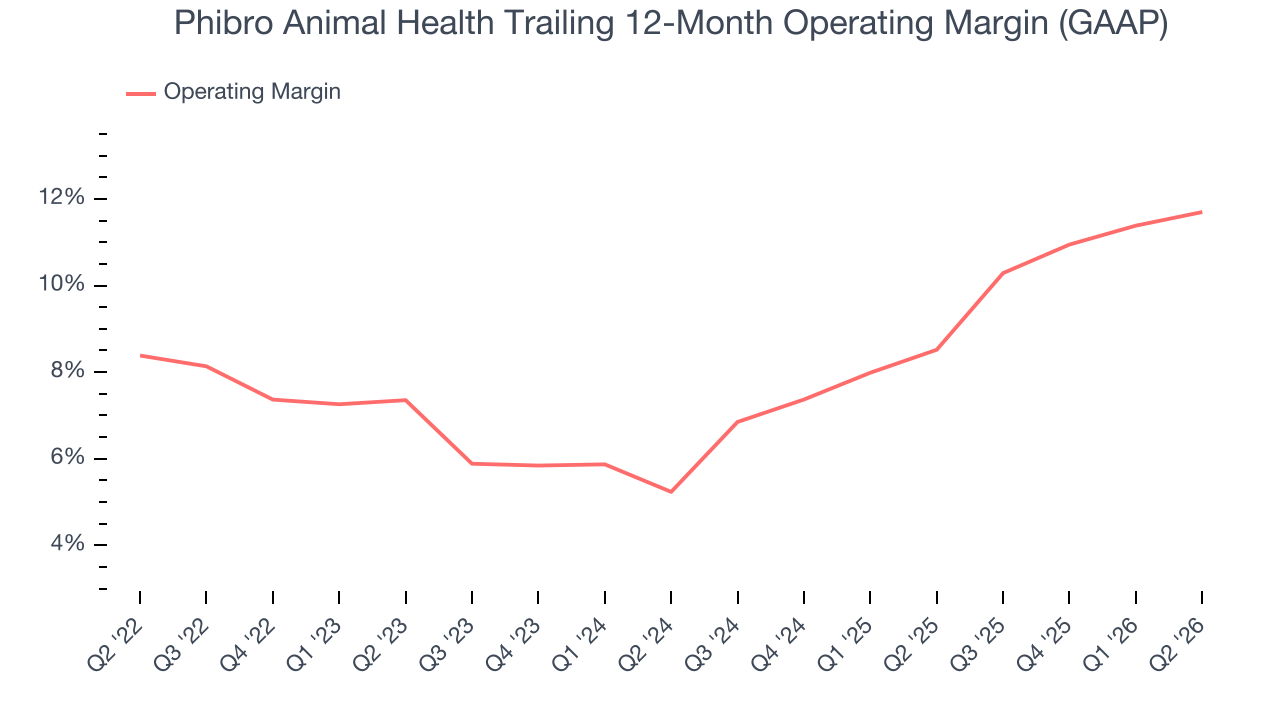

Phibro Animal Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.5% was weak for a healthcare business.

On the plus side, Phibro Animal Health’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6.5 percentage points on a two-year basis.

In Q2, Phibro Animal Health generated an operating margin profit margin of 10.1%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

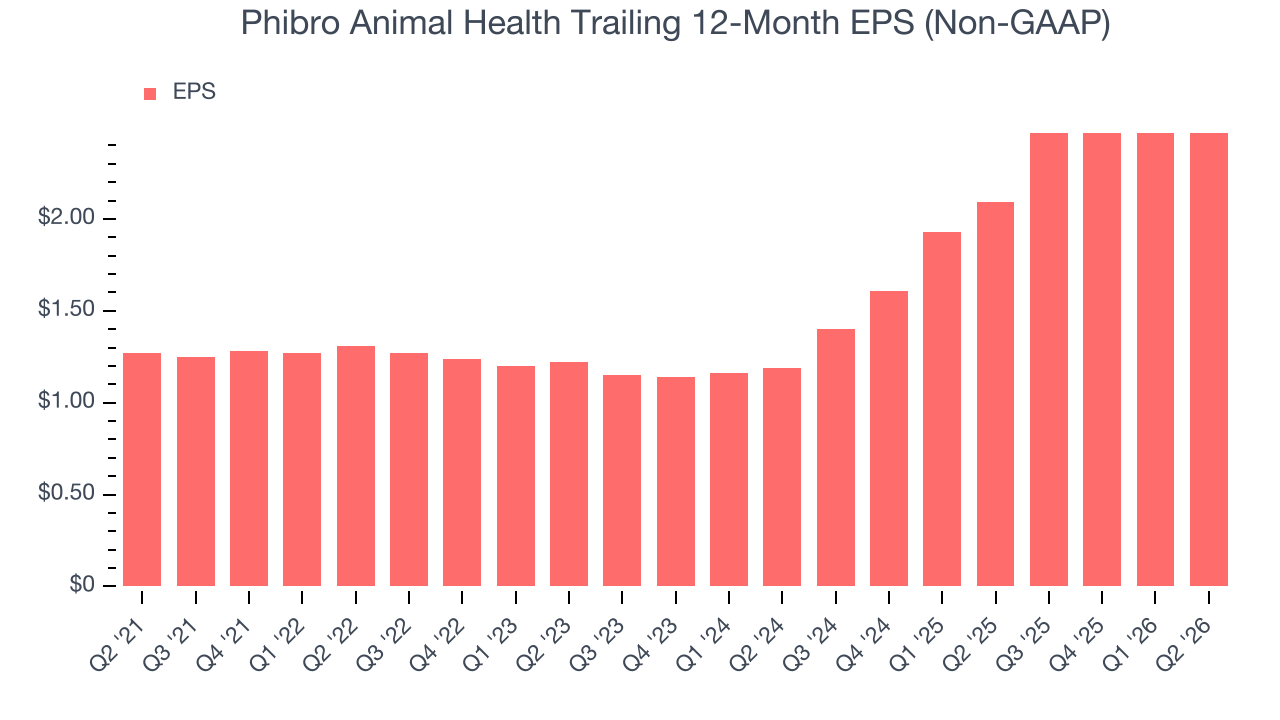

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Phibro Animal Health’s EPS grew at a spectacular 14.2% compounded annual growth rate over the last five years, higher than its 10.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Phibro Animal Health’s earnings to better understand the drivers of its performance. As we mentioned earlier, Phibro Animal Health’s operating margin expanded by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Phibro Animal Health reported adjusted EPS of $0.57, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Phibro Animal Health’s full-year EPS of $2.47 to grow 17.4%.

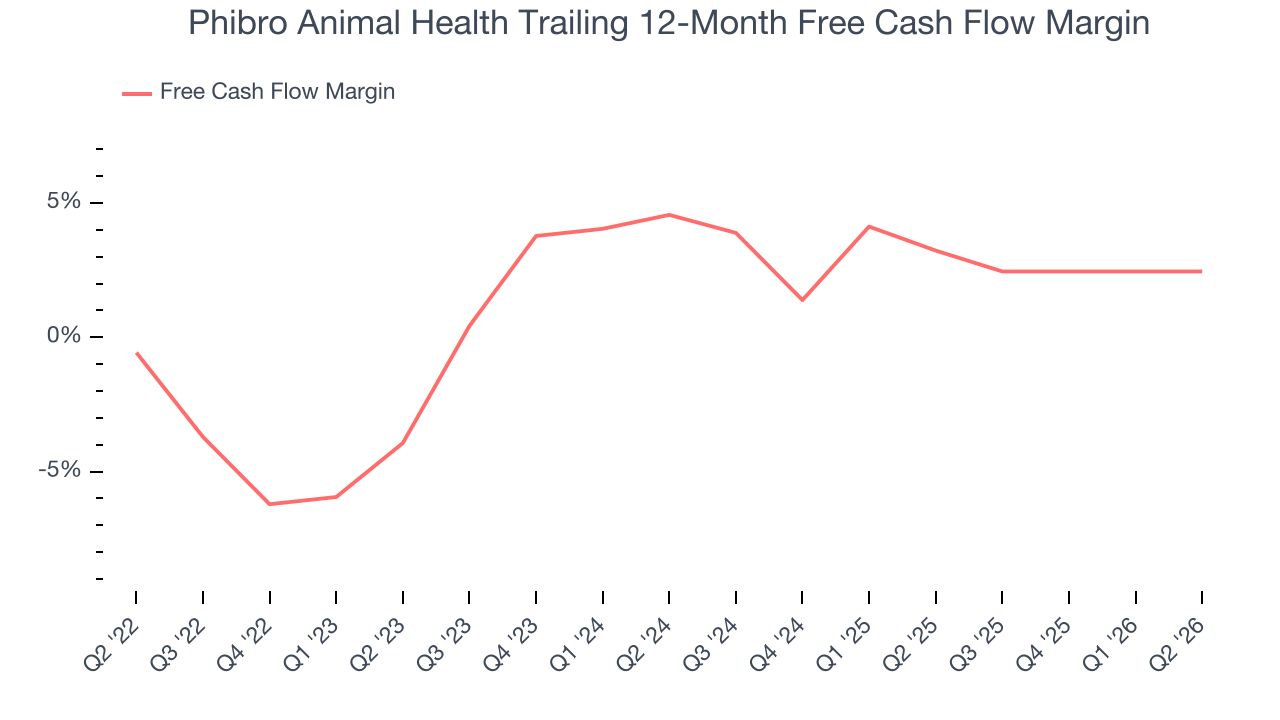

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Phibro Animal Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Phibro Animal Health’s margin expanded by 3 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Phibro Animal Health’s free cash flow clocked in at $8.13 million in Q2, equivalent to a 2.1% margin. This cash profitability was in line with the comparable period last year and its five-year average.

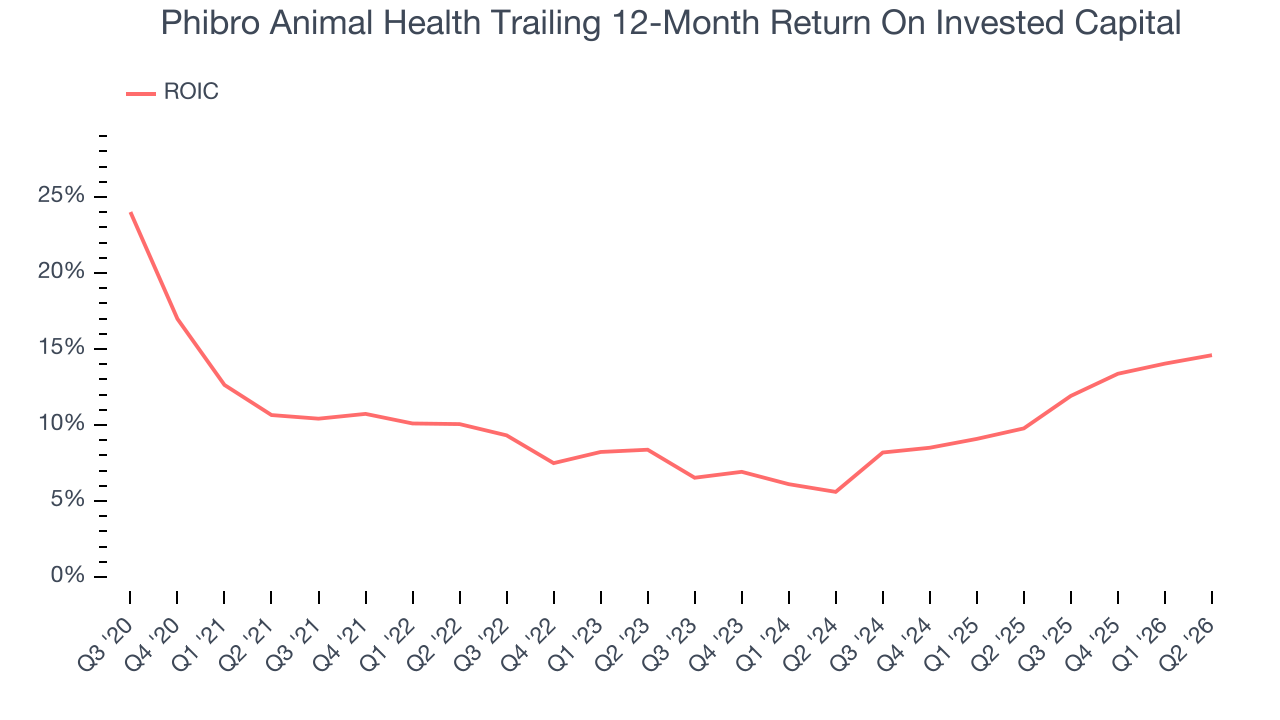

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Phibro Animal Health’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 9.7%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Phibro Animal Health’s ROIC averaged 3 percentage point increases each year. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Key Takeaways from Phibro Animal Health’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. Still, the stock traded up 5.5% to $43.24 immediately after reporting.

12. Is Now The Time To Buy Phibro Animal Health?

Updated: February 17, 2026 at 12:10 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are some bright spots in Phibro Animal Health’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was good over the last five years. And while Phibro Animal Health’s subscale operations give it fewer distribution channels than its larger rivals, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Phibro Animal Health’s P/E ratio based on the next 12 months is 16.3x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $48.50 on the company (compared to the current share price of $52.26).