Astec (ASTE)

We’re skeptical of Astec. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Astec Will Underperform

Inventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ:ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete.

- Cash-burning history makes us doubt the long-term viability of its business model

- Sales pipeline suggests its future revenue growth won’t meet our standards as its backlog averaged 22.1% declines over the past two years

- On the bright side, its earnings per share grew by 13.1% annually over the last five years and topped the peer group average

Astec’s quality is insufficient. There are more appealing investments to be made.

Why There Are Better Opportunities Than Astec

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Astec

Astec’s stock price of $57.91 implies a valuation ratio of 18.9x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Astec (ASTE) Research Report: Q3 CY2025 Update

Construction equipment company Astec (NASDAQ:ASTE) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 20.1% year on year to $350.1 million. Its non-GAAP profit of $0.47 per share was 23.7% above analysts’ consensus estimates.

Astec (ASTE) Q3 CY2025 Highlights:

- Revenue: $350.1 million vs analyst estimates of $330.9 million (20.1% year-on-year growth, 5.8% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.38 (23.7% beat)

- Adjusted EBITDA: $20.6 million vs analyst estimates of $28.4 million (5.9% margin, 27.5% miss)

- Operating Margin: 0.3%, down from 3.4% in the same quarter last year

- Free Cash Flow was -$12.3 million, down from $19.9 million in the same quarter last year

- Backlog: $449.5 million at quarter end

- Market Capitalization: $1.06 billion

Company Overview

Inventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ:ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete.

Astec was founded in 1972 with a vision to combine new technology with traditionally low-tech industries like road construction. The company quickly grew by acquiring various companies and notably acquired Power Flame for $43 million in 2016, enhancing its industrial heating systems capabilities.

Astec makes machines and equipment for building roads, processing raw materials, and producing concrete. Its offerings span from asphalt and concrete plants that mix ingredients to make asphalt or concrete, respectively, to crushers and screeners that crush large rocks into smaller pieces and separate these pieces into different sizes for use in construction.

Astec offers equipment for each stage of construction to construction companies, developers, and mining companies. For example, its asphalt plants create the material needed to pave roads while its crushing and screening equipment processes raw materials like rocks into usable forms for building.

It primarily engages in direct transactions where customers purchase the equipment outright to use. Customers can also engage in service agreements and the duration of the contract depends on the type of equipment, ranging from several years to over a decade.

4. Construction Machinery

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

Competitors offering similar products include Caterpillar (NYSE:CAT), Terex (NYSE:TEX), and Gencor (NASDAQ:GENC).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Astec’s sales grew at a tepid 5.1% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Astec’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Construction Machinery businesses have faced declining sales because of cyclical headwinds. While Astec’s growth wasn’t the best, it did do better than its peers.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Astec’s backlog reached $449.5 million in the latest quarter and averaged 28.2% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Astec reported robust year-on-year revenue growth of 20.1%, and its $350.1 million of revenue topped Wall Street estimates by 5.8%.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Astec has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 23.9% gross margin over the last five years. That means Astec paid its suppliers a lot of money ($76.13 for every $100 in revenue) to run its business.

This quarter, Astec’s gross profit margin was 24.1%, up 1.1 percentage points year on year. Astec’s full-year margin has also been trending up over the past 12 months, increasing by 2.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

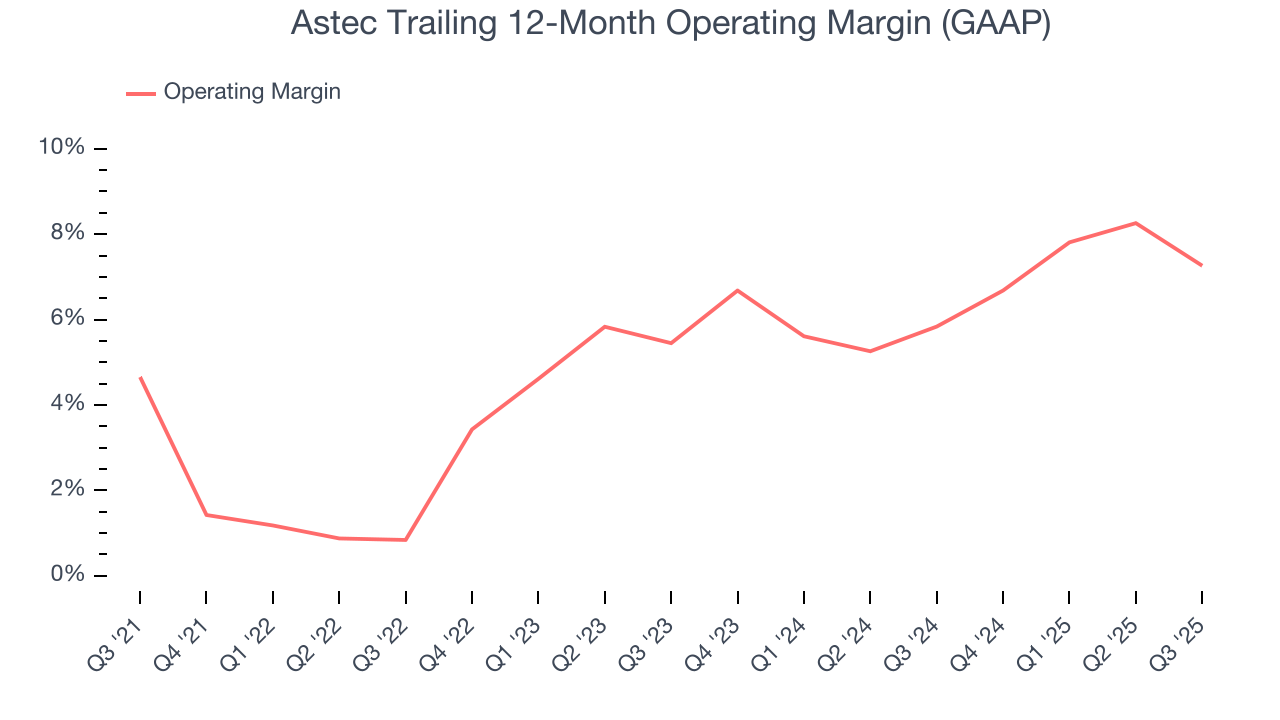

Astec was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Astec’s operating margin rose by 2.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Astec’s breakeven margin was down 3.1 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

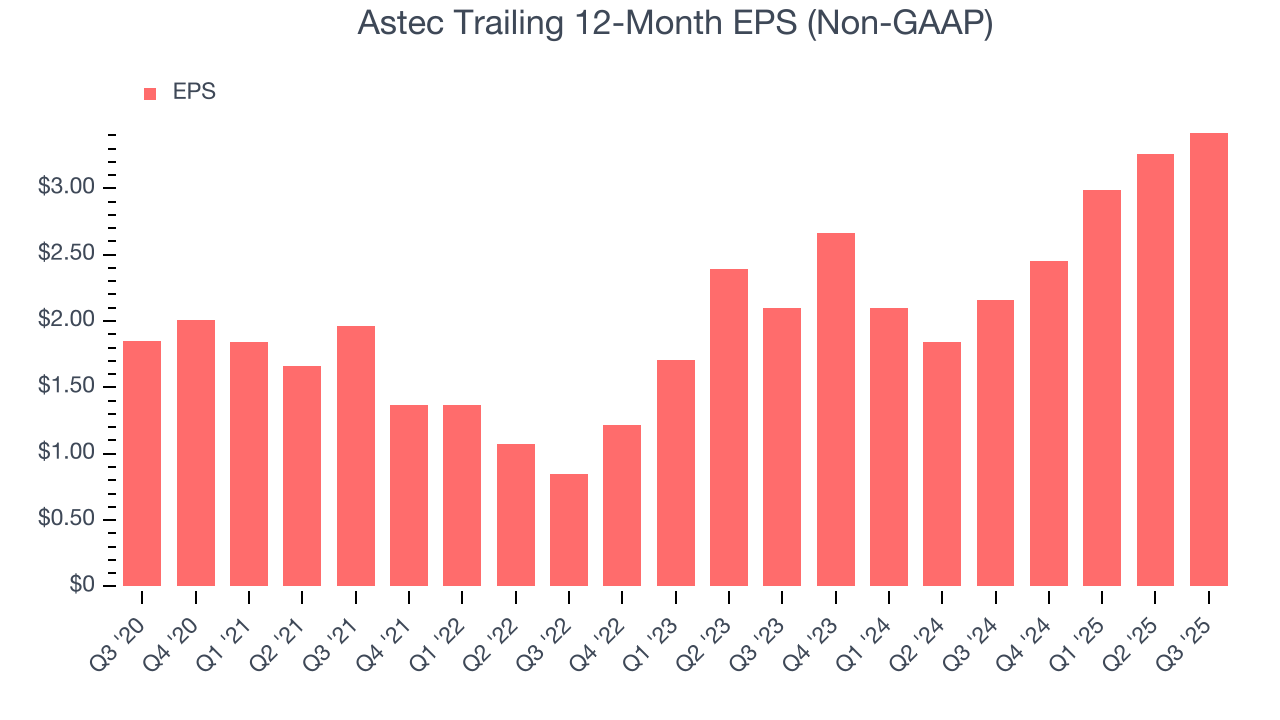

Astec’s EPS grew at a remarkable 13.1% compounded annual growth rate over the last five years, higher than its 5.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Astec’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Astec’s operating margin declined this quarter but expanded by 2.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Astec, its two-year annual EPS growth of 27.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Astec reported adjusted EPS of $0.47, up from $0.31 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Astec’s full-year EPS of $3.42 to shrink by 11.8%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Astec’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.32 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Astec’s margin dropped by 1.5 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business.

Astec burned through $12.3 million of cash in Q3, equivalent to a negative 3.5% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Astec historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Astec’s ROIC averaged 4.8 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Assessment

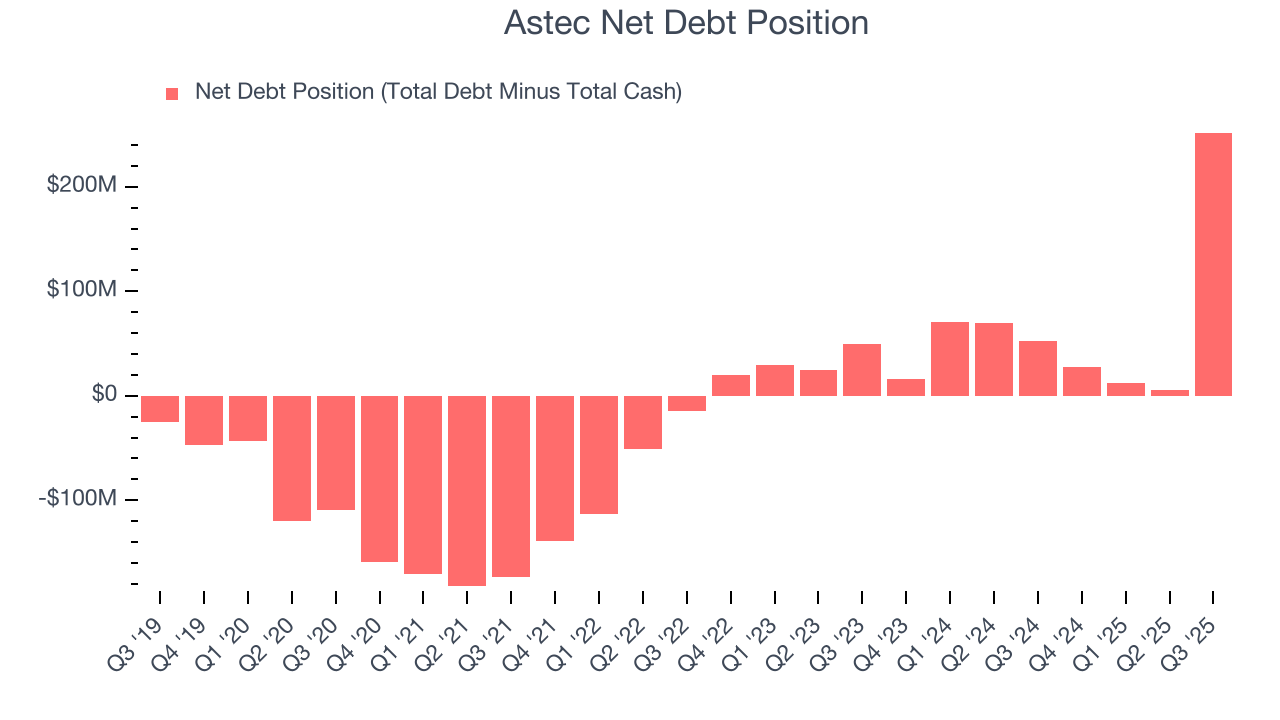

Astec reported $71.8 million of cash and $323.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $137.4 million of EBITDA over the last 12 months, we view Astec’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $10.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Astec’s Q3 Results

We were impressed by how significantly Astec blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $46.41 immediately after reporting.

13. Is Now The Time To Buy Astec?

Updated: February 23, 2026 at 11:07 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Astec.

Astec isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was uninspiring over the last five years. While its expanding operating margin shows the business has become more efficient, the downside is its projected EPS for the next year is lacking. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Astec’s P/E ratio based on the next 12 months is 18.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $56.50 on the company (compared to the current share price of $57.91).