Bandwidth (BAND)

We’re cautious of Bandwidth. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bandwidth Will Underperform

Powering communications for tech giants like Microsoft, Google, and Zoom, Bandwidth (NASDAQ:BAND) provides cloud-based communications software and APIs that enable businesses to embed voice, messaging, and emergency services into their applications and platforms.

- Bad unit economics and steep infrastructure costs are reflected in its gross margin of 39.1%, one of the worst among software companies

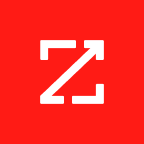

- Operating margin didn’t move over the last year, showing it couldn’t increase its efficiency

- A consolation is that its software platform has product-market fit given the rapid recovery of its customer acquisition costs

Bandwidth doesn’t meet our quality standards. There are more promising alternatives.

Why There Are Better Opportunities Than Bandwidth

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bandwidth

At $16.56 per share, Bandwidth trades at 0.6x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Bandwidth (BAND) Research Report: Q4 CY2025 Update

Cloud communications provider Bandwidth (NASDAQ:BAND) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.1% year on year to $207.7 million. The company expects next quarter’s revenue to be around $201.5 million, coming in 2.9% above analysts’ estimates. Its non-GAAP profit of $0.35 per share was 4.8% above analysts’ consensus estimates.

Bandwidth (BAND) Q4 CY2025 Highlights:

- Revenue: $207.7 million vs analyst estimates of $208.3 million (1.1% year-on-year decline, in line)

- Adjusted EPS: $0.35 vs analyst estimates of $0.33 (4.8% beat)

- Adjusted EBITDA: $24.83 million vs analyst estimates of $22.79 million (12% margin, 9% beat)

- Revenue Guidance for Q1 CY2026 is $201.5 million at the midpoint, above analyst estimates of $195.8 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.70 at the midpoint, missing analyst estimates by 20.7%

- EBITDA guidance for the upcoming financial year 2026 is $120 million at the midpoint, above analyst estimates of $110 million

- Operating Margin: -1.9%, in line with the same quarter last year

- Free Cash Flow Margin: 15%, up from 6.8% in the previous quarter

- Market Capitalization: $396.5 million

Company Overview

Powering communications for tech giants like Microsoft, Google, and Zoom, Bandwidth (NASDAQ:BAND) provides cloud-based communications software and APIs that enable businesses to embed voice, messaging, and emergency services into their applications and platforms.

Bandwidth operates its own global network spanning more than 65 countries, allowing it to control quality and reliability while offering real-time phone number management, voice calling, text messaging, and emergency services connectivity. The company serves three main market segments: cloud communications platforms (like UCaaS and CCaaS providers), programmable services for text messaging solutions, and direct enterprise clients undergoing digital transformation.

What sets Bandwidth apart from competitors is its ownership of the underlying communications infrastructure, rather than just reselling network capacity. This integrated approach enables Bandwidth to offer more reliable service with higher deliverability rates for messaging and calls. For example, a healthcare provider might use Bandwidth's APIs to send appointment reminders via text, while a financial services company could implement two-factor authentication through SMS.

Bandwidth's revenue comes from usage-based fees and recurring charges for its services, with customers typically signing multi-year contracts. Its flagship product Maestro, launched in 2023, helps enterprises integrate various communications tools and AI capabilities across their existing technology stack. The company also provides specialized solutions like its five-carrier redundant toll-free voice network and real-time emergency services routing based on caller location.

4. Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Bandwidth's competitors include traditional telecommunications carriers like AT&T, Verizon, and Lumen Technologies, as well as other cloud communications providers such as Twilio (NYSE:TWLO), Vonage (acquired by Ericsson), and 8x8 (NYSE:EGHT).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Bandwidth grew its sales at a 17% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Bandwidth’s recent performance shows its demand has slowed as its annualized revenue growth of 12% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Bandwidth reported a rather uninspiring 1.1% year-on-year revenue decline to $207.7 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 15.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.2% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Bandwidth is extremely efficient at acquiring new customers, and its CAC payback period checked in at 14.4 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

For software companies like Bandwidth, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Bandwidth’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 39.1% gross margin over the last year. That means Bandwidth paid its providers a lot of money ($60.86 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Bandwidth has seen gross margins decline by 0.1 percentage points over the last 2 year, which is slightly worse than average for software.

Bandwidth produced a 37.6% gross profit margin in Q4, up 1.2 percentage points year on year. Bandwidth’s full-year margin has also been trending up over the past 12 months, increasing by 1.7 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs.

8. Operating Margin

Bandwidth’s expensive cost structure has contributed to an average operating margin of negative 1.9% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Bandwidth reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Looking at the trend in its profitability, Bandwidth’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

Bandwidth’s operating margin was negative 1.9% this quarter. The company's consistent lack of profits raise a flag.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Bandwidth has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a software business.

Bandwidth’s free cash flow clocked in at $31.08 million in Q4, equivalent to a 15% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Bandwidth’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 7.5% for the last 12 months will increase to 10.6%, it options for capital deployment (investments, share buybacks, etc.).

10. Balance Sheet Assessment

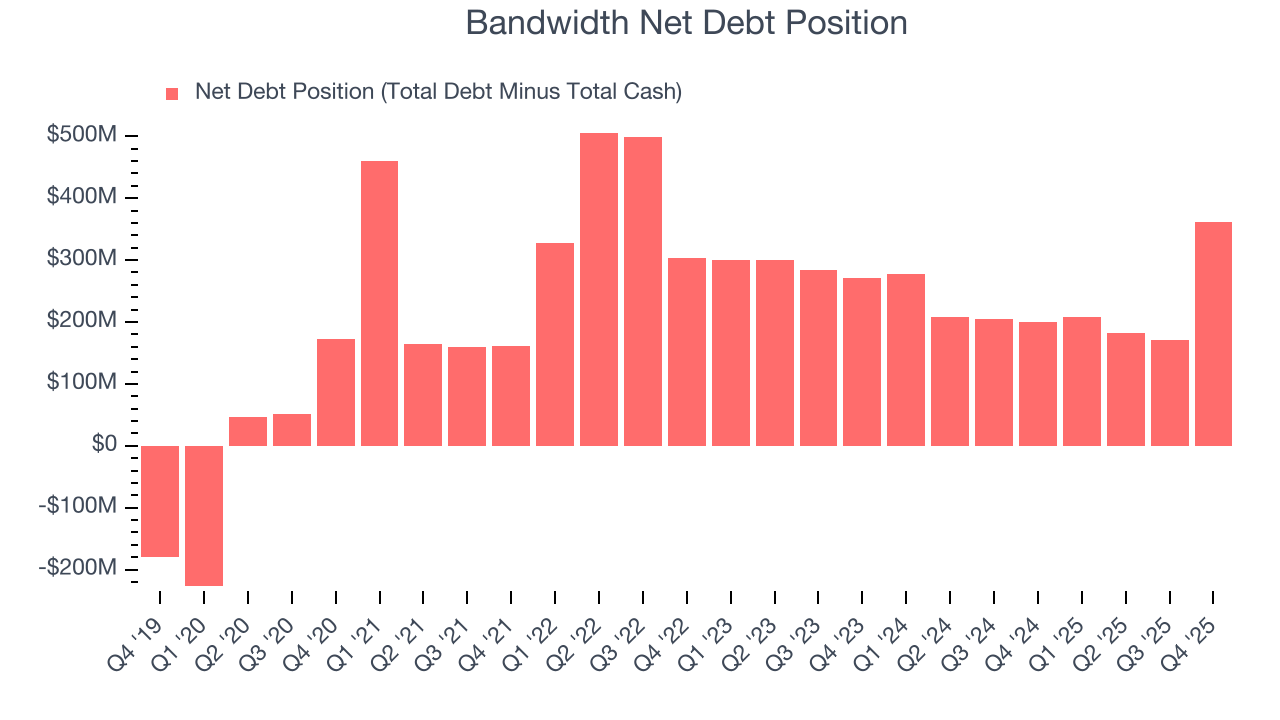

Bandwidth reported $111.3 million of cash and $472.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $93.27 million of EBITDA over the last 12 months, we view Bandwidth’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $1.43 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Bandwidth’s Q4 Results

We were impressed by Bandwidth’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue was in line. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $12.99 immediately after reporting.

12. Is Now The Time To Buy Bandwidth?

Updated: March 8, 2026 at 10:21 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Bandwidth, you should also grasp the company’s longer-term business quality and valuation.

Bandwidth isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its efficient sales strategy allows it to target and onboard new users at scale, the downside is its gross margins show its business model is much less lucrative than other companies. On top of that, its operating margin hasn't moved over the last year.

Bandwidth’s price-to-sales ratio based on the next 12 months is 0.6x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $22.75 on the company (compared to the current share price of $16.56).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.