Cisco (CSCO)

Cisco doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Cisco Will Underperform

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ:CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 4.9% annually

- Annual sales growth of 4.2% over the last five years lagged behind its business services peers as its large revenue base made it difficult to generate incremental demand

- A positive is that its dominant market position is represented by its $59.05 billion in revenue and gives it fixed cost leverage when sales grow

Cisco is in the doghouse. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Cisco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cisco

Cisco is trading at $79.22 per share, or 18.3x forward P/E. This multiple is high given its weaker fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Cisco (CSCO) Research Report: Q4 CY2025 Update

Networking technology giant Cisco (NASDAQ:CSCO) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.7% year on year to $15.35 billion. Guidance for next quarter’s revenue was optimistic at $15.5 billion at the midpoint, 2.2% above analysts’ estimates. Its non-GAAP profit of $1.04 per share was 1.7% above analysts’ consensus estimates.

Cisco (CSCO) Q4 CY2025 Highlights:

- Revenue: $15.35 billion vs analyst estimates of $15.12 billion (9.7% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.04 vs analyst estimates of $1.02 (1.7% beat)

- Q1 Adjusted gross margin guidance of 66.0% at the midpoint (miss)

- Q1 Adjusted EPS guidance of $1.03 at the midpoint (in line)

- Operating Margin: 24.6%, up from 22.3% in the same quarter last year

- Free Cash Flow Margin: 10%, down from 14.5% in the same quarter last year

- Market Capitalization: $340.9 billion

Company Overview

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ:CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

Cisco's products form the backbone of modern internet infrastructure, with its routers and switches directing traffic across networks of all sizes—from small businesses to global enterprises and internet service providers. The company organizes its business into four main categories: Networking, Security, Collaboration, and Observability.

In the Networking segment, Cisco offers switches that connect devices within local networks and routers that direct traffic between networks. For example, a university might use Cisco switches to connect thousands of computers across campus while using Cisco routers to manage connections to the broader internet. The company's networking portfolio also includes wireless access points, servers, and software to manage these systems.

The Security portfolio helps organizations protect their networks from cyber threats. A hospital, for instance, might use Cisco's security solutions to safeguard patient data from unauthorized access while ensuring doctors can still access critical information quickly. With its acquisition of Splunk in 2024, Cisco strengthened its ability to detect and respond to sophisticated cyber attacks.

Through its Collaboration offerings, which include the Webex platform, Cisco enables remote work and virtual meetings. A global consulting firm might use these tools to connect teams across continents, combining video conferencing, messaging, and document sharing in one integrated experience.

The Observability segment provides tools that monitor network performance and application behavior. An e-commerce company could use these solutions to identify why their website is loading slowly during peak shopping periods, pinpointing whether the issue lies in their network, servers, or application code.

Cisco generates revenue through hardware sales, software licenses, subscriptions, and service contracts. The company serves customers globally through direct sales and a network of channel partners, including systems integrators, service providers, and distributors.

4. Enterprise Networking

The Enterprise Networking subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products and services like switches, firewalls, and datacenter hosting services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

Cisco competes with networking equipment providers like Juniper Networks (NYSE:JNPR), Arista Networks (NYSE:ANET), and Huawei; security vendors such as Palo Alto Networks (NASDAQ:PANW), Fortinet (NASDAQ:FTNT), and CrowdStrike (NASDAQ:CRWD); and collaboration tool makers including Microsoft (NASDAQ:MSFT) with Teams and Zoom (NASDAQ:ZM).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $59.05 billion in revenue over the past 12 months, Cisco is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, Cisco likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, Cisco grew its sales at a mediocre 4.2% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Cisco’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Cisco reported year-on-year revenue growth of 9.7%, and its $15.35 billion of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

6. Operating Margin

Cisco has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.4%.

Looking at the trend in its profitability, Cisco’s operating margin decreased by 4.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Cisco generated an operating margin profit margin of 24.6%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

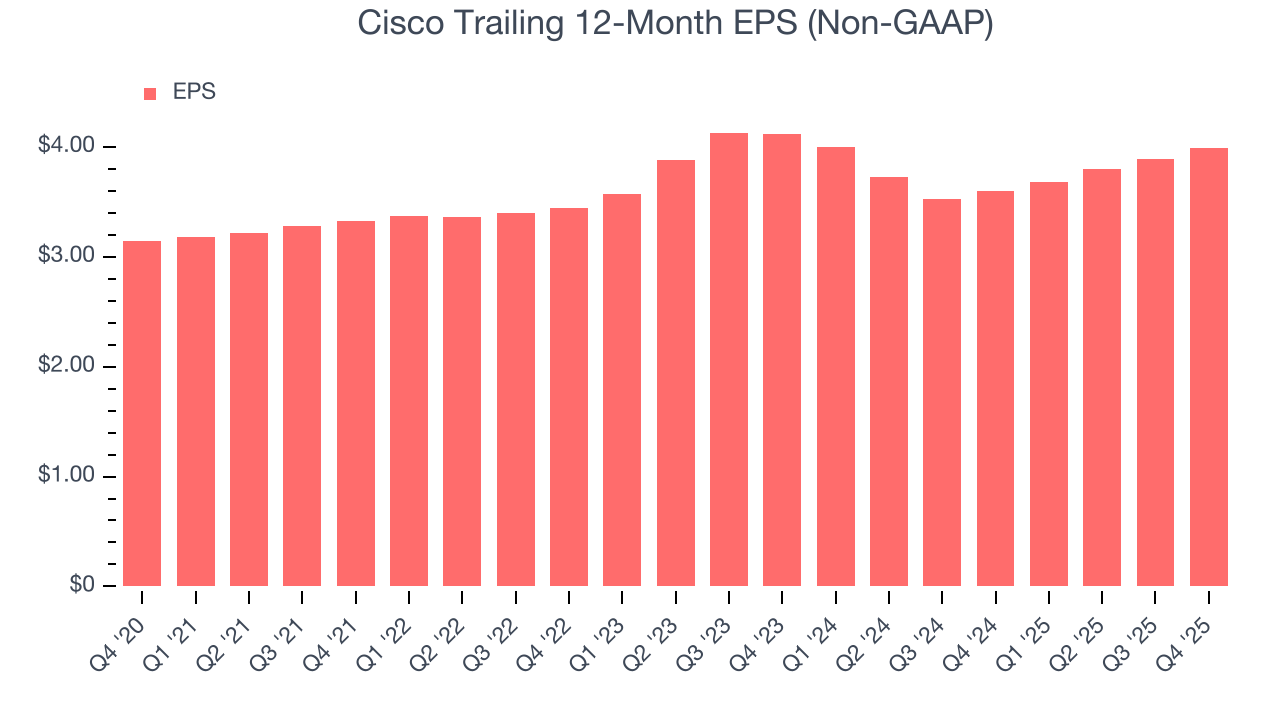

Cisco’s unimpressive 4.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Cisco, its two-year annual EPS declines of 1.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Cisco reported adjusted EPS of $1.04, up from $0.94 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Cisco’s full-year EPS of $3.99 to grow 7.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Cisco has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 24.6% over the last five years.

Taking a step back, we can see that Cisco’s margin dropped by 5.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Cisco’s free cash flow clocked in at $1.54 billion in Q4, equivalent to a 10% margin. The company’s cash profitability regressed as it was 4.5 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Cisco hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 29.5%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Cisco’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

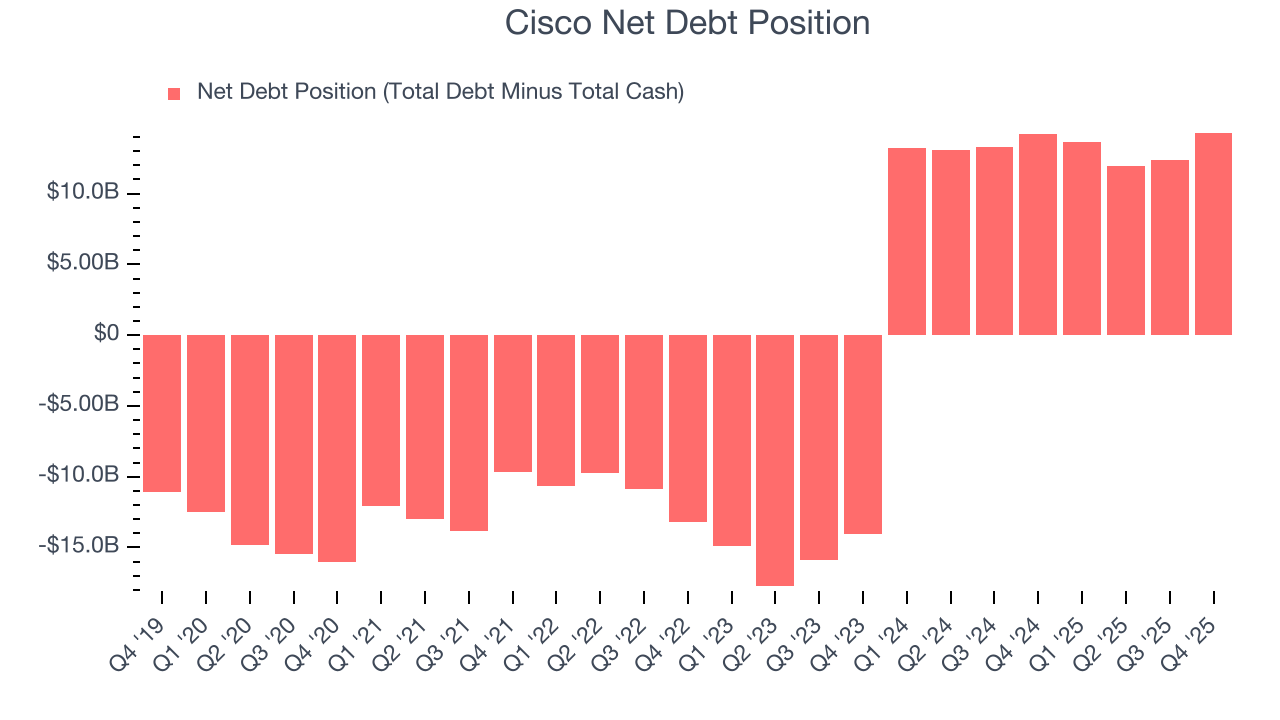

10. Balance Sheet Assessment

Cisco reported $15.78 billion of cash and $30.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $22.27 billion of EBITDA over the last 12 months, we view Cisco’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $557 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cisco’s Q4 Results

Revenue and EPS in the quarter beat expectations. It was also great to see Cisco’s revenue guidance for next quarter top analysts’ expectations. On the other hand, gross margin guidance for the upcoming quarter missed. Overall, this print was mixed. Investors were likely hoping for more, and shares traded down 5.5% to $80.92 immediately following the results.

12. Is Now The Time To Buy Cisco?

Updated: February 22, 2026 at 11:15 PM EST

Before making an investment decision, investors should account for Cisco’s business fundamentals and valuation in addition to what happened in the latest quarter.

Cisco isn’t a terrible business, but it isn’t one of our picks. For starters, its revenue growth was mediocre over the last five years. While its scale makes it a trusted partner with negotiating leverage, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its cash profitability fell over the last five years.

Cisco’s P/E ratio based on the next 12 months is 18.3x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $88.81 on the company (compared to the current share price of $79.22).