Casella Waste Systems (CWST)

Casella Waste Systems doesn’t impress us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Casella Waste Systems Is Not Exciting

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

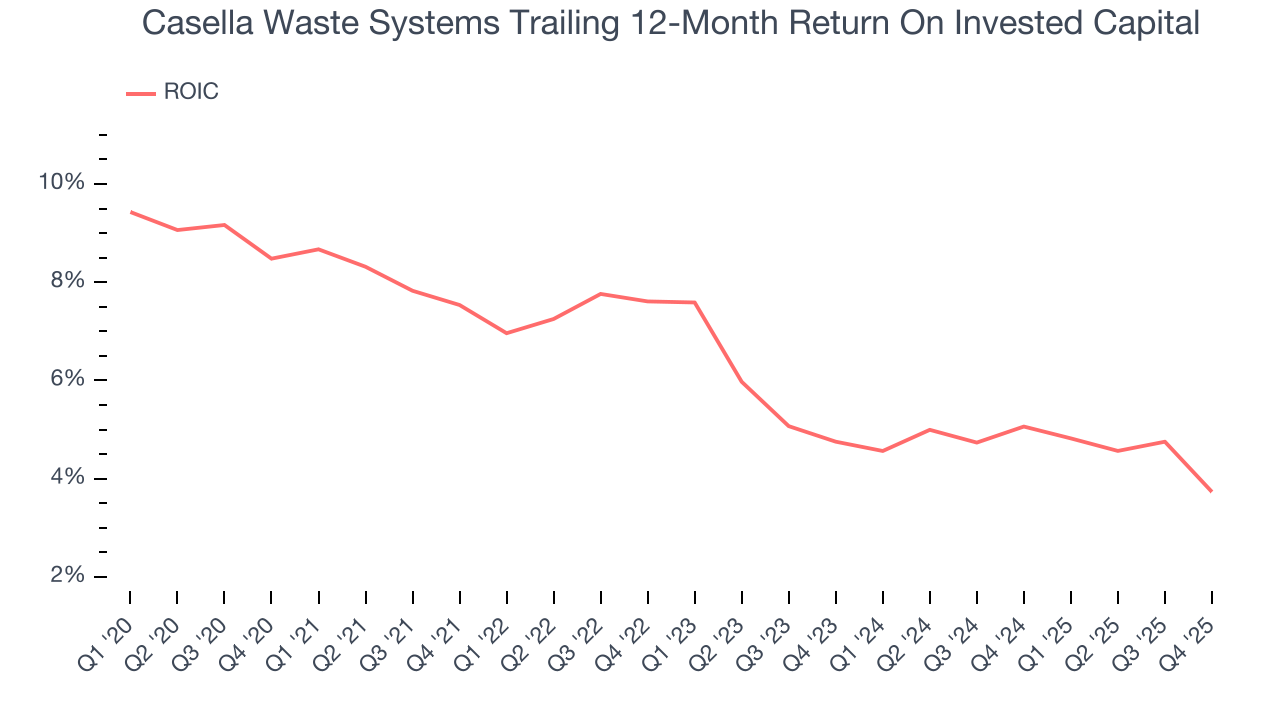

- ROIC of 6% reflects management’s challenges in identifying attractive investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- On the plus side, its annual revenue growth of 18.5% over the past five years was outstanding, reflecting market share gains this cycle

Casella Waste Systems doesn’t satisfy our quality benchmarks. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Casella Waste Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Casella Waste Systems

Casella Waste Systems’s stock price of $102.38 implies a valuation ratio of 83.6x forward P/E. This valuation is extremely expensive, especially for the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Casella Waste Systems (CWST) Research Report: Q4 CY2025 Update

Waste management company Casella (NASDAQ:CWST) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.7% year on year to $469.1 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.98 billion at the midpoint. Its non-GAAP profit of $0.30 per share was 33.6% above analysts’ consensus estimates.

Casella Waste Systems (CWST) Q4 CY2025 Highlights:

- Revenue: $469.1 million vs analyst estimates of $470.8 million (9.7% year-on-year growth, in line)

- Adjusted EPS: $0.30 vs analyst estimates of $0.22 (33.6% beat)

- Adjusted EBITDA: $107 million vs analyst estimates of $105.2 million (22.8% margin, 1.7% beat)

- EBITDA guidance for the upcoming financial year 2026 is $460 million at the midpoint, in line with analyst expectations

- Operating Margin: 2.5%, down from 4.3% in the same quarter last year

- Free Cash Flow Margin: 8.4%, down from 13.9% in the same quarter last year

- Market Capitalization: $6.50 billion

Company Overview

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

Casella was founded in 1975 with a focus on waste hauling and expanded by targeting smaller, regional waste management firms and recycling operations. By integrating these companies, it has been able to achieve greater operational efficiency (ex. picking up trash from more homes throughout one route) and decrease its cost per unit of service.

For example, Casella acquired Advanced Disposal Services' assets in Rochester, NY which included a landfill, transfer stations, and various collection routes. This 2017 acquisition significantly boosted its infrastructure and operational capacity in the area.

Casella provides curbside collection services for household waste and recyclables while commercial/industrial companies use dumpsters or compactors. These containers are regularly emptied on a set schedule, typically weekly or bi-weekly. Once collected, the waste and recyclables are transported to transfer stations, which serve as temporary holding facilities. Here, waste is consolidated and sorted into categories like paper, plastic, or glass. It then processes the sorted recyclables for resale and repurposing, while non-recyclable waste is transported to disposal sites, such as landfills or waste-to-energy plants.

In addition to its waste collection services, the company also offers dumpster rentals, hazardous waste management, and compactor services (provide businesses with machines that compress waste).

Casella engages in long-term contracts with both commercial and municipal clients. These contracts often include service level agreements (SLAs) and range from shorter contracts lasting a couple of years to longer term agreements spanning 10+ years.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Competitors offering similar products include Waste Management (NYSE:WM), Republic Services (NYSE:RSG), and Waste Connections (NYSE:WCN).

5. Revenue Growth

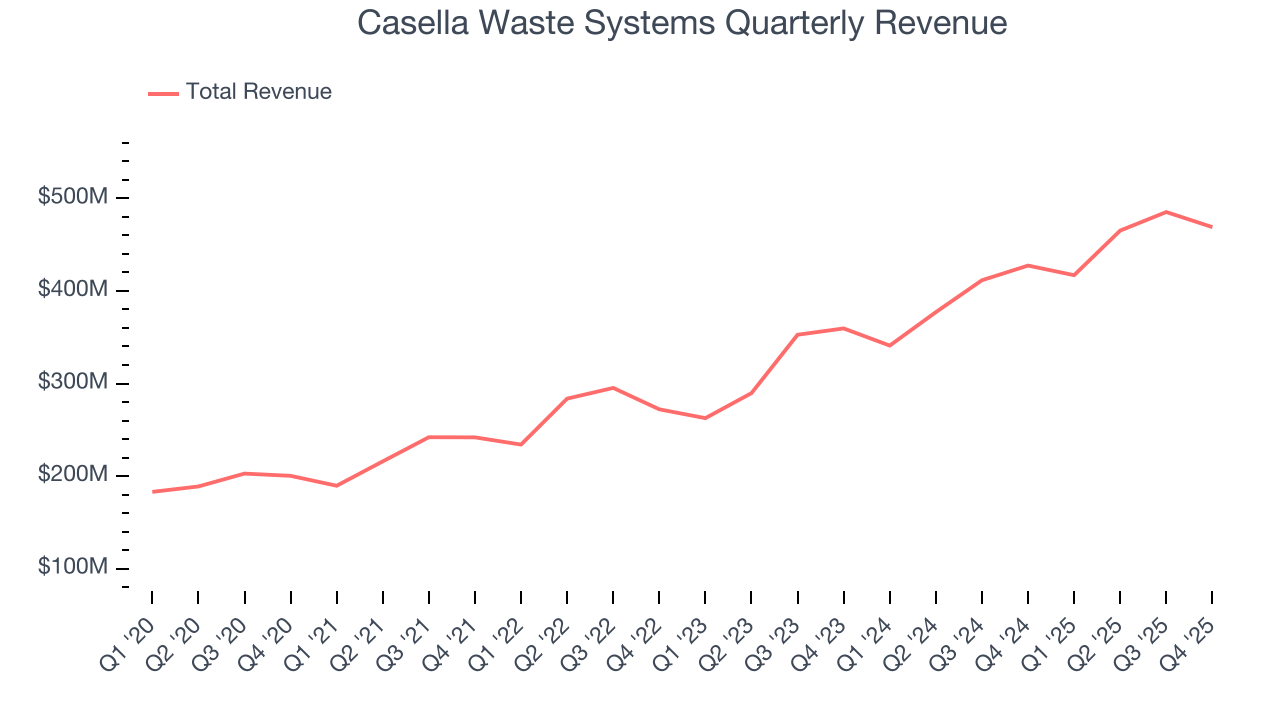

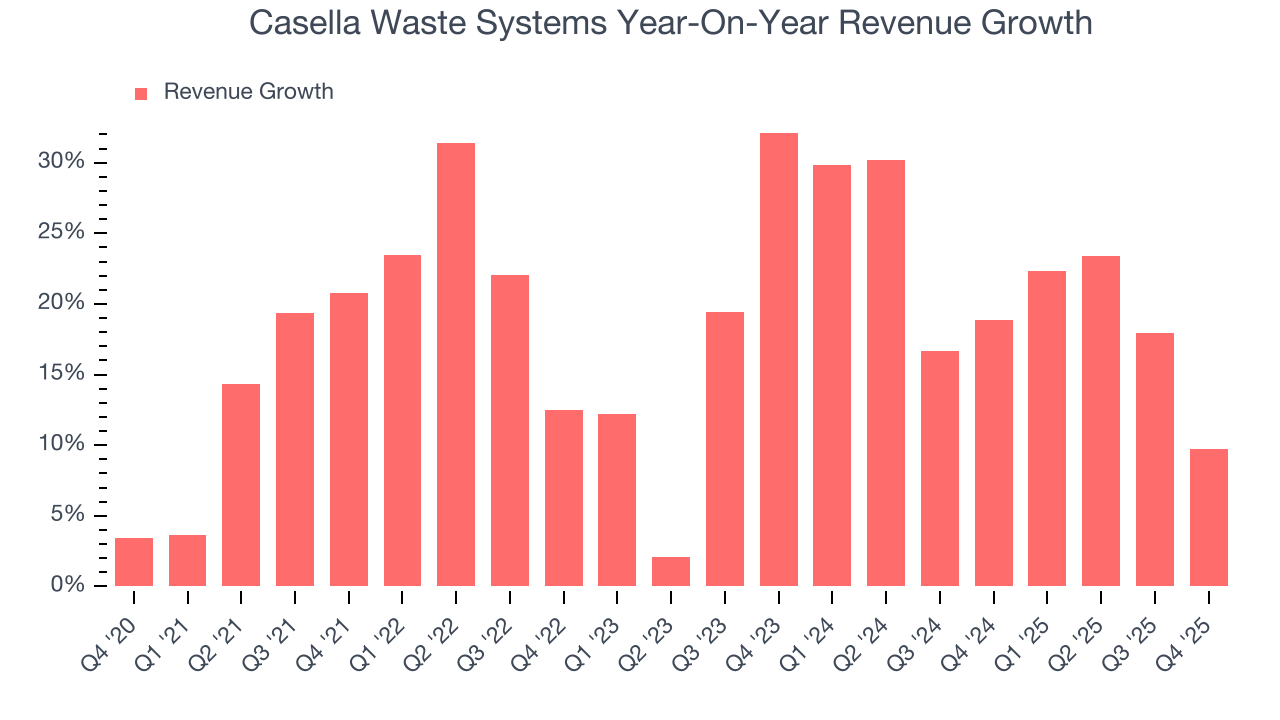

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Casella Waste Systems’s 18.9% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Casella Waste Systems’s annualized revenue growth of 20.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Casella Waste Systems grew its revenue by 9.7% year on year, and its $469.1 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and indicates the market is forecasting some success for its newer products and services.

6. Gross Margin & Pricing Power

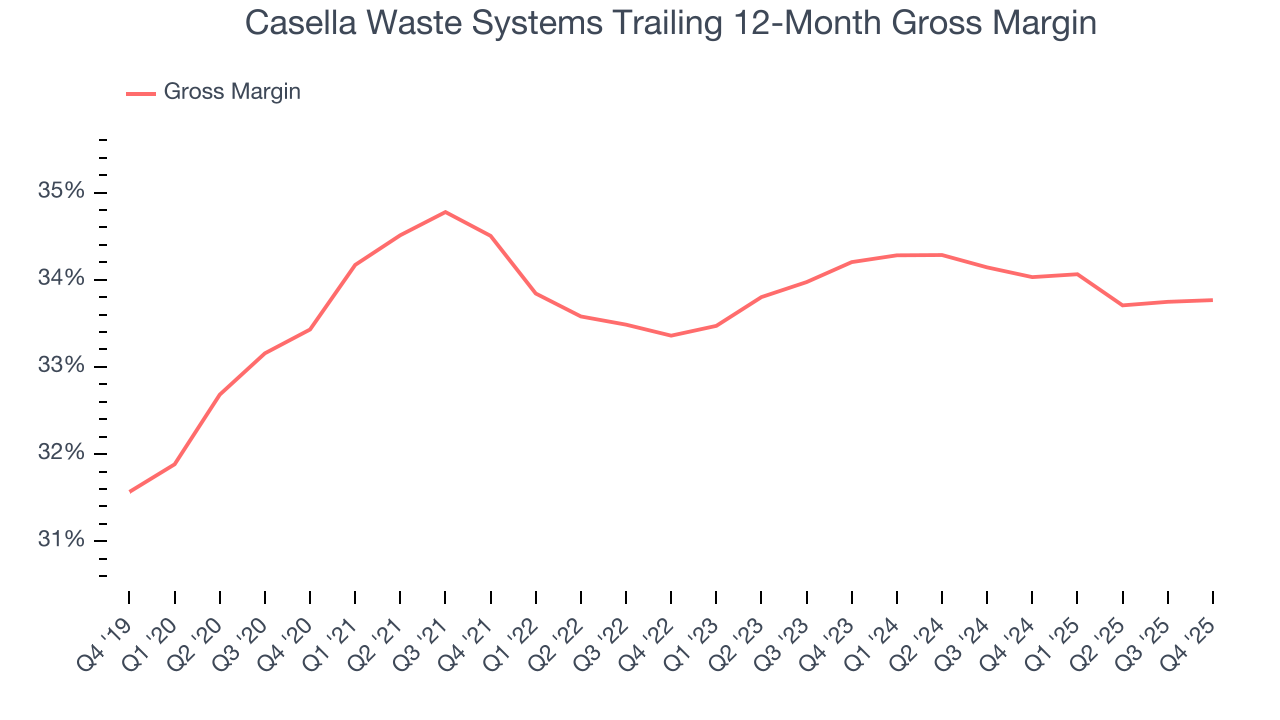

Casella Waste Systems’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.9% gross margin over the last five years. Said differently, Casella Waste Systems paid its suppliers $66.06 for every $100 in revenue.

Casella Waste Systems produced a 33.3% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

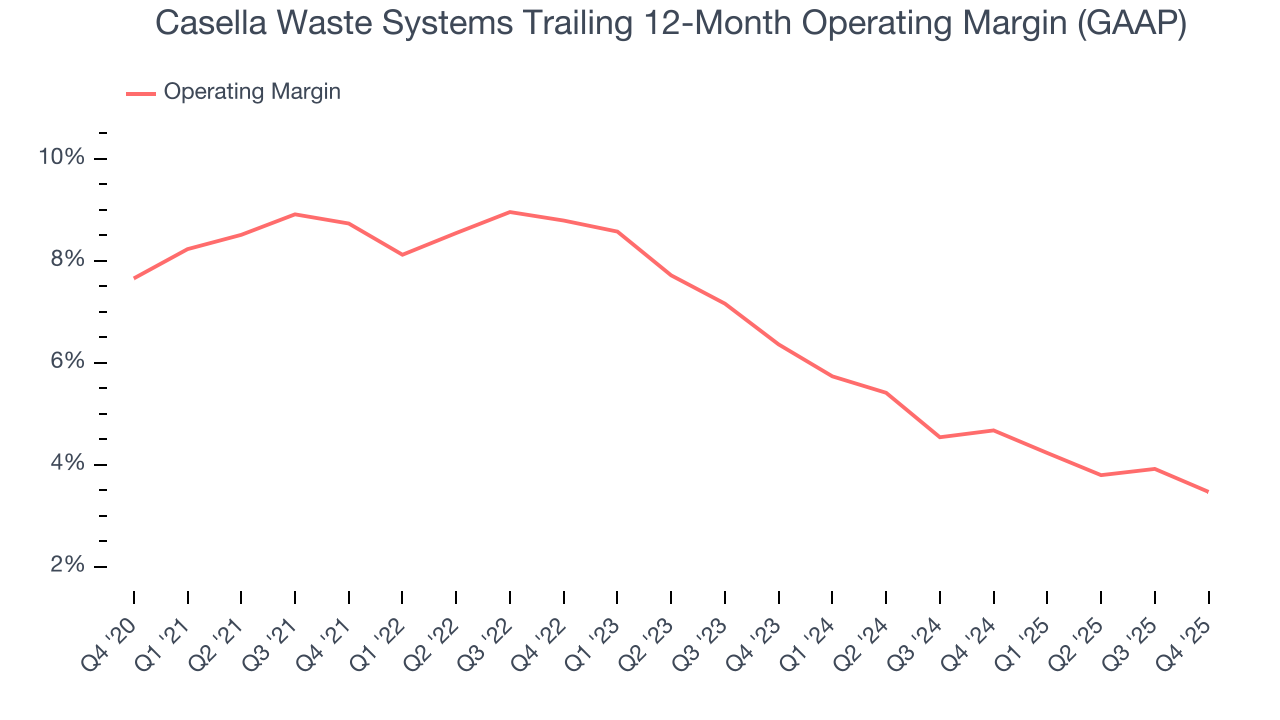

Casella Waste Systems was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.9% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Casella Waste Systems’s operating margin decreased by 5.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Casella Waste Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Casella Waste Systems generated an operating margin profit margin of 2.5%, down 1.8 percentage points year on year. Since Casella Waste Systems’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

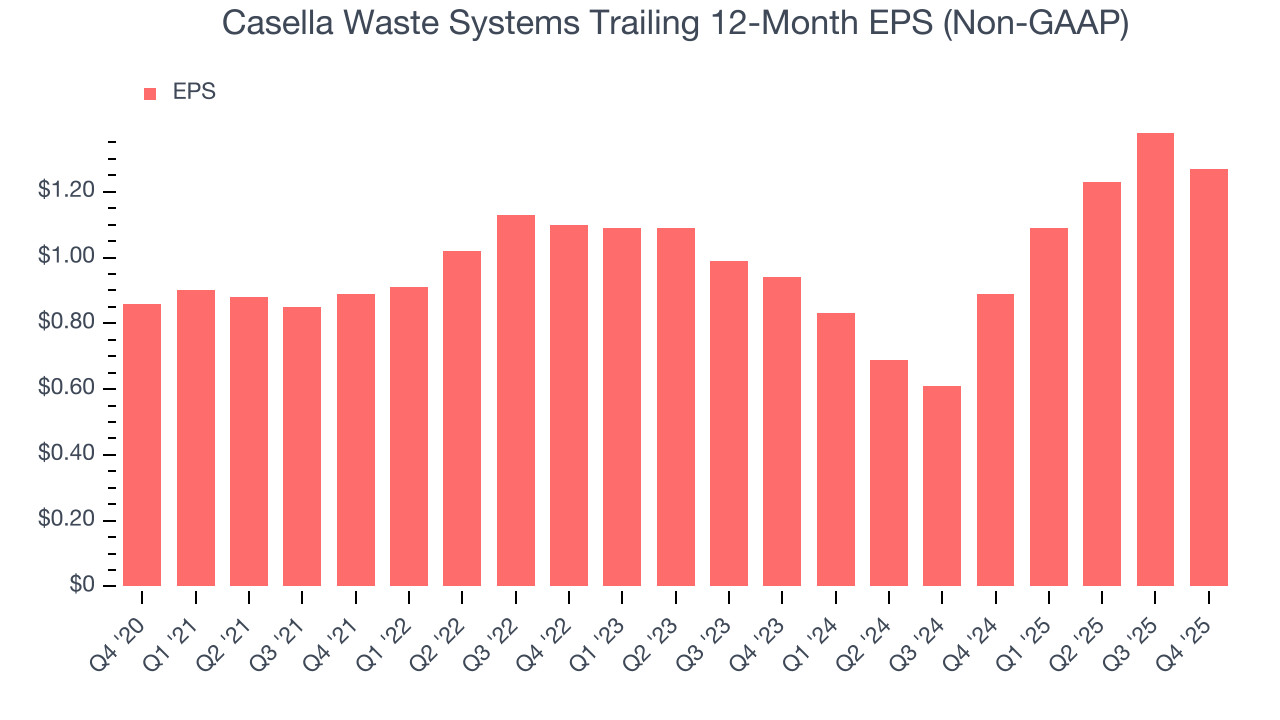

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Casella Waste Systems’s EPS grew at a decent 8.1% compounded annual growth rate over the last five years. However, this performance was lower than its 18.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

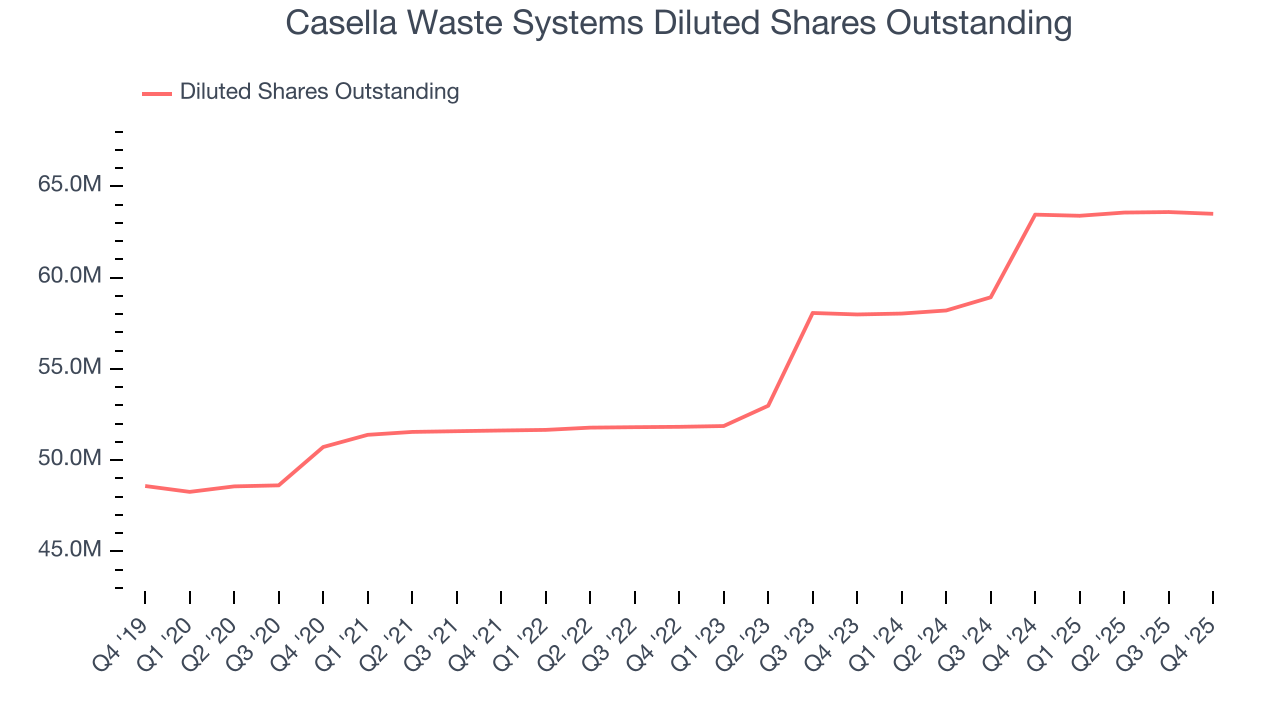

Diving into Casella Waste Systems’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Casella Waste Systems’s operating margin declined by 5.3 percentage points over the last five years. Its share count also grew by 25.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Casella Waste Systems, its two-year annual EPS growth of 16.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Casella Waste Systems reported adjusted EPS of $0.30, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Casella Waste Systems’s full-year EPS of $1.27 to grow 6%.

9. Cash Is King

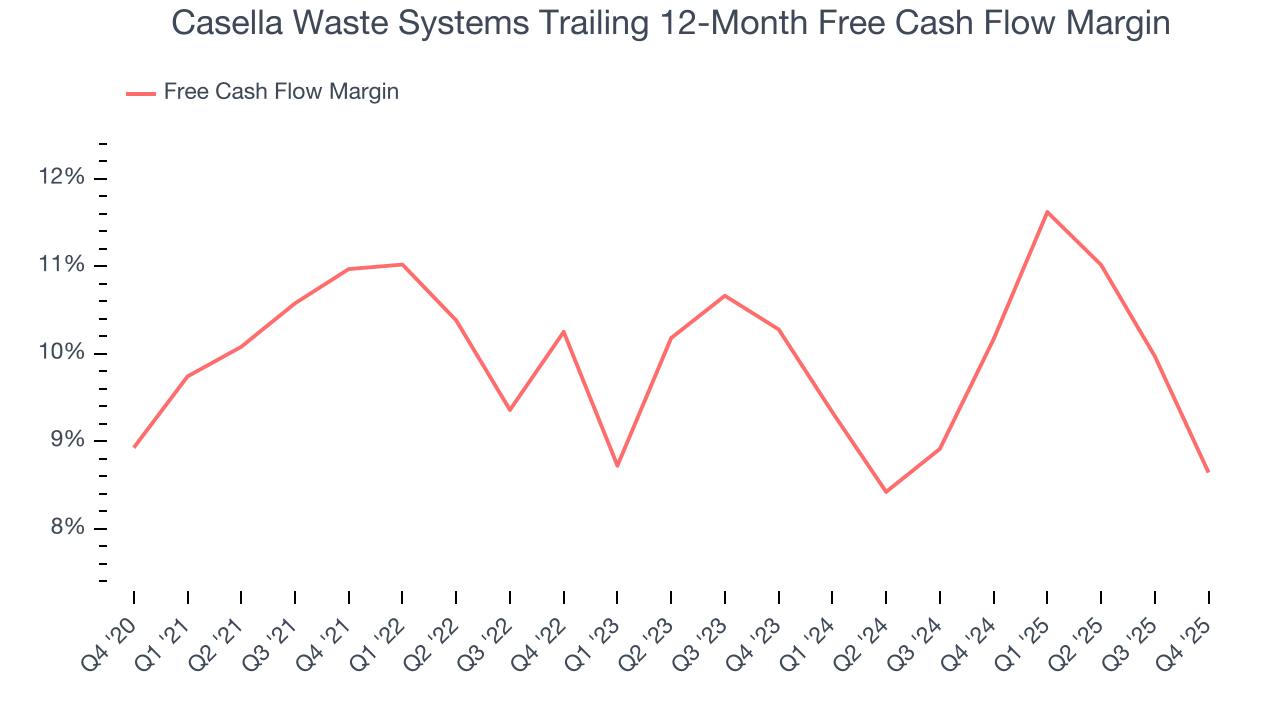

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Casella Waste Systems has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 9.9% over the last five years, quite impressive for an industrials business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Casella Waste Systems’s margin dropped by 2.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Casella Waste Systems’s free cash flow clocked in at $39.3 million in Q4, equivalent to a 8.4% margin. The company’s cash profitability regressed as it was 5.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Casella Waste Systems historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Casella Waste Systems’s ROIC decreased by 3.2 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

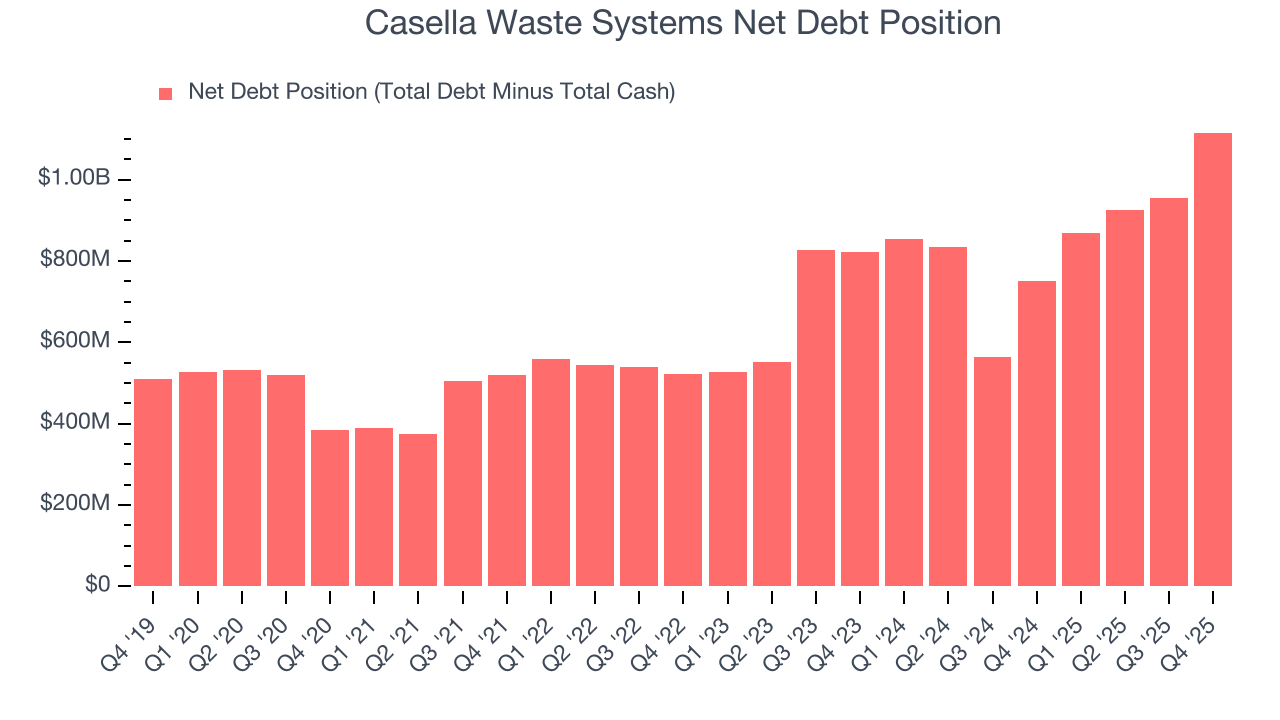

11. Balance Sheet Assessment

Casella Waste Systems reported $123.8 million of cash and $1.24 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $402.7 million of EBITDA over the last 12 months, we view Casella Waste Systems’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $24.43 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Casella Waste Systems’s Q4 Results

It was good to see Casella Waste Systems beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue was in line and its full-year EBITDA guidance was in line with Wall Street’s estimates. Overall, this print was mixed but still had some key positives. Investors were likely hoping for more, and shares traded down 3% to $98.23 immediately after reporting.

13. Is Now The Time To Buy Casella Waste Systems?

Updated: February 19, 2026 at 4:37 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Casella Waste Systems.

Casella Waste Systems isn’t a bad business, but we’re not clamoring to buy it here and now. First off, its revenue growth was exceptional over the last five years. And while Casella Waste Systems’s declining operating margin shows the business has become less efficient, its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion.

Casella Waste Systems’s P/E ratio based on the next 12 months is 75.2x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $115.33 on the company (compared to the current share price of $98.23).