The Ensign Group (ENSG)

We see potential in The Ensign Group. Its estimated revenue growth for the next 12 months is great.― StockStory Analyst Team

1. News

2. Summary

Why The Ensign Group Is Interesting

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ:ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 22.8%

- Earnings per share grew by 15.5% annually over the last five years and trumped its peers

- On a dimmer note, its poor expense management has led to an adjusted operating margin that is below the industry average

The Ensign Group is solid, but not perfect. If you like the stock, the valuation seems reasonable.

Why Is Now The Time To Buy The Ensign Group?

High Quality

Investable

Underperform

Why Is Now The Time To Buy The Ensign Group?

At $173.65 per share, The Ensign Group trades at 24.3x forward P/E. Sure, this is a premium multiple among companies in the healthcare space. However, we still think the valuation is fair given the top-line growth.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. The Ensign Group (ENSG) Research Report: Q4 CY2025 Update

Healthcare services company The Ensign Group (NASDAQ:ENSG). fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 20.2% year on year to $1.36 billion. On the other hand, the company’s full-year revenue guidance of $5.81 billion at the midpoint came in 1.7% above analysts’ estimates. Its GAAP profit of $1.61 per share was 3.4% below analysts’ consensus estimates.

The Ensign Group (ENSG) Q4 CY2025 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.50 billion (20.2% year-on-year growth, 9.1% miss)

- EPS (GAAP): $1.61 vs analyst expectations of $1.67 (3.4% miss)

- Adjusted EBITDA: $167.3 million vs analyst estimates of $160.5 million (12.3% margin, 4.2% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $7.51 at the midpoint, beating analyst estimates by 9.4%

- Operating Margin: 9.1%, in line with the same quarter last year

- Sales Volumes rose 16.2% year on year (10.8% in the same quarter last year)

- Market Capitalization: $9.98 billion

Company Overview

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ:ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

The Ensign Group's business is organized into two main segments: Skilled Services and Standard Bearer. The Skilled Services segment, which generates about 96% of revenue, encompasses 316 skilled nursing facilities with over 33,500 beds. These facilities provide specialized care for patients recovering from strokes, cardiovascular conditions, joint replacements, and other disorders requiring medical attention beyond what can be provided at home but not requiring hospital-level care.

A typical patient at an Ensign facility might be an elderly woman recovering from hip replacement surgery who needs physical therapy and nursing care before returning home, or a middle-aged man requiring ventilator support while recovering from respiratory failure. The company employs interdisciplinary teams of medical professionals to deliver personalized care plans prescribed by physicians.

The Standard Bearer segment represents Ensign's real estate business, consisting of 124 healthcare properties. These properties are leased under triple-net arrangements, where tenants cover property taxes, insurance, and maintenance costs. While most properties are leased to Ensign's own operating subsidiaries, 33 are leased to third-party healthcare operators.

Ensign also offers senior living services through 41 communities with over 3,000 units, providing housing, meals, and varying levels of assistance with daily activities. Additionally, the company operates ancillary services including mobile diagnostics, transportation, and pharmacy services.

Revenue comes primarily from government programs (Medicaid and Medicare), with additional income from managed care, commercial insurance, and private pay sources. The company's operations are heavily regulated by federal and state laws governing healthcare quality, reimbursement, patient privacy, and facility requirements.

4. Specialized Medical & Nursing Services

The skilled nursing services industry provides specialized care for patients requiring medical or rehabilitative support after hospital stays or for chronic conditions. These companies benefit from stable demand driven by an aging population and recurring revenue from Medicare, Medicaid, and private insurance. However, the industry faces challenges such as thin margins due to high labor costs and stringent regulatory requirements. Looking ahead, the industry is supported by tailwinds from an aging population, which means higher chronic disease prevalence. Advances in medical technology, including using AI to better predict, diagnose, and treat illnesses, may reduce hospital readmissions and improve outcomes. However, headwinds such as labor shortages, wage inflation, and potential government reimbursement cuts pose challenges. Adapting to value-based care models may further squeeze margins by requiring investments in training, technology, and compliance.

The Ensign Group competes with other skilled nursing facility operators such as Genesis Healthcare, The Pennant Group (NASDAQ:PNTG), Brookdale Senior Living (NYSE:BKD), and Encompass Health (NYSE:EHC), as well as regional providers in its various markets.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.21 billion in revenue over the past 12 months, The Ensign Group has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

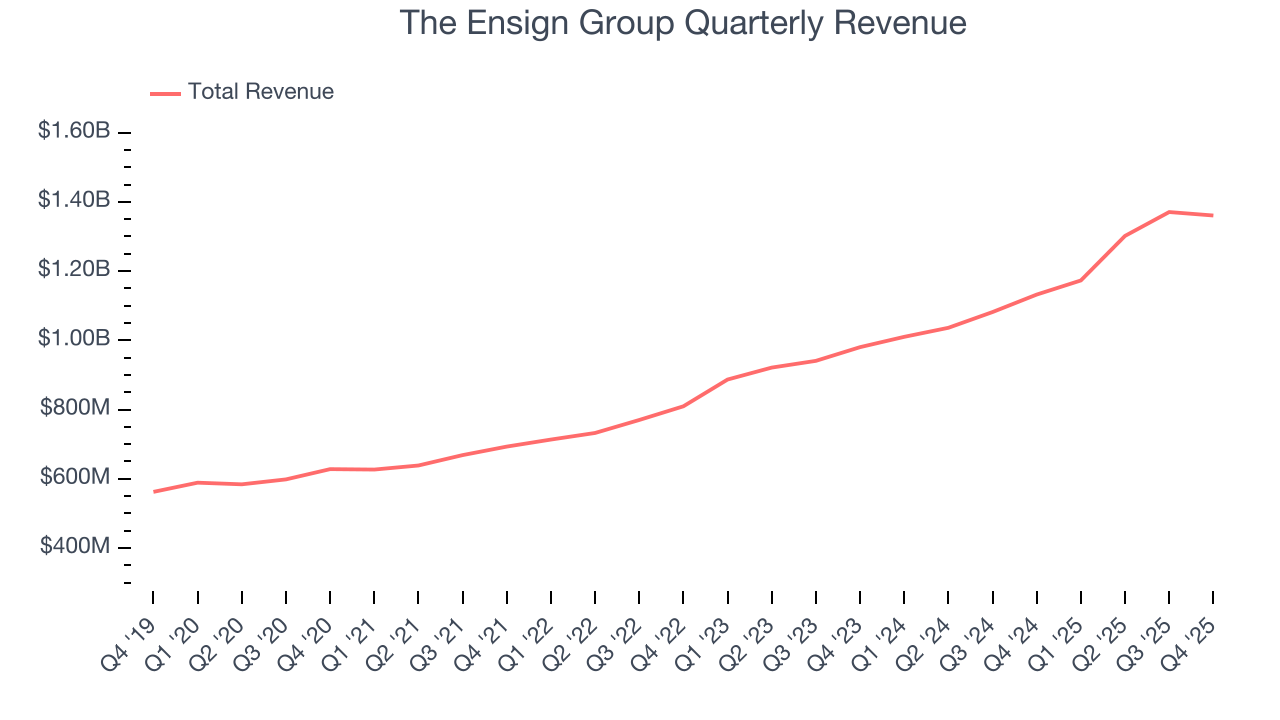

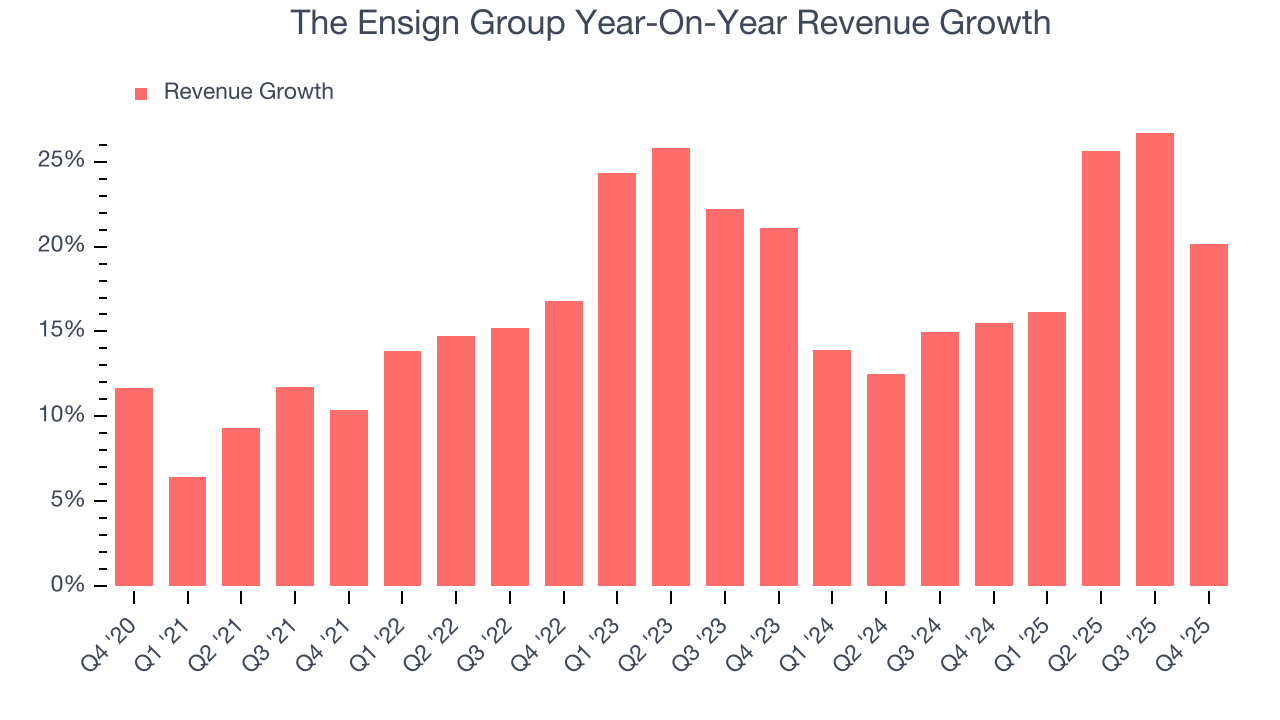

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, The Ensign Group’s 16.8% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. The Ensign Group’s annualized revenue growth of 18.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

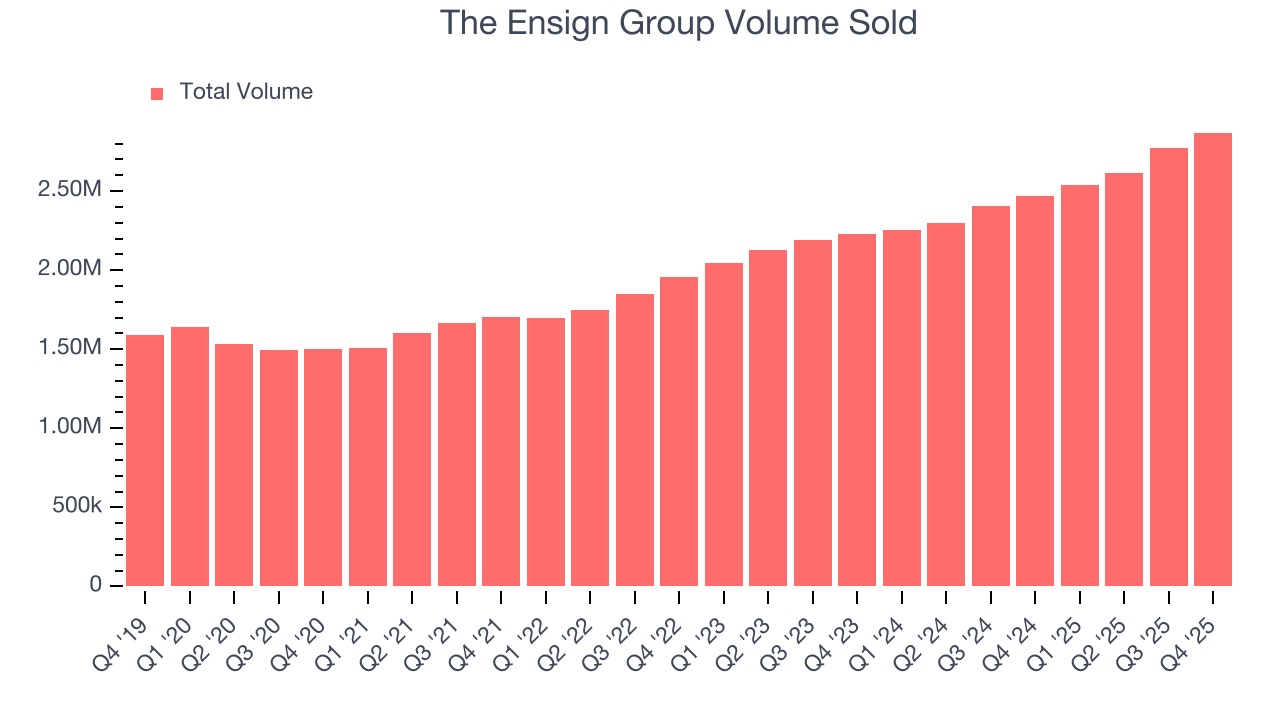

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 2.87 million in the latest quarter. Over the last two years, The Ensign Group’s units sold averaged 12.1% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, The Ensign Group generated an excellent 20.2% year-on-year revenue growth rate, but its $1.36 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will catalyze better top-line performance.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

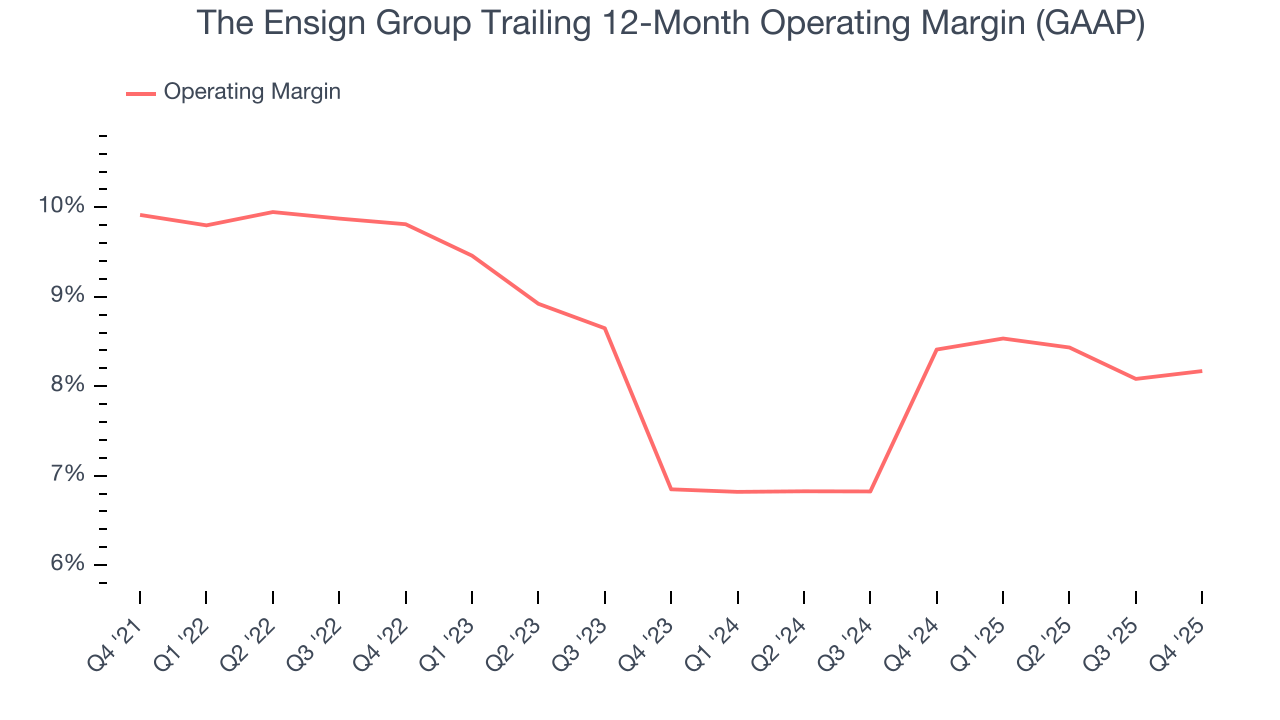

The Ensign Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.5% was weak for a healthcare business.

Analyzing the trend in its profitability, The Ensign Group’s operating margin decreased by 1.7 percentage points over the last five years, but it rose by 1.3 percentage points on a two-year basis. We like The Ensign Group and hope it can right the ship.

In Q4, The Ensign Group generated an operating margin profit margin of 9.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

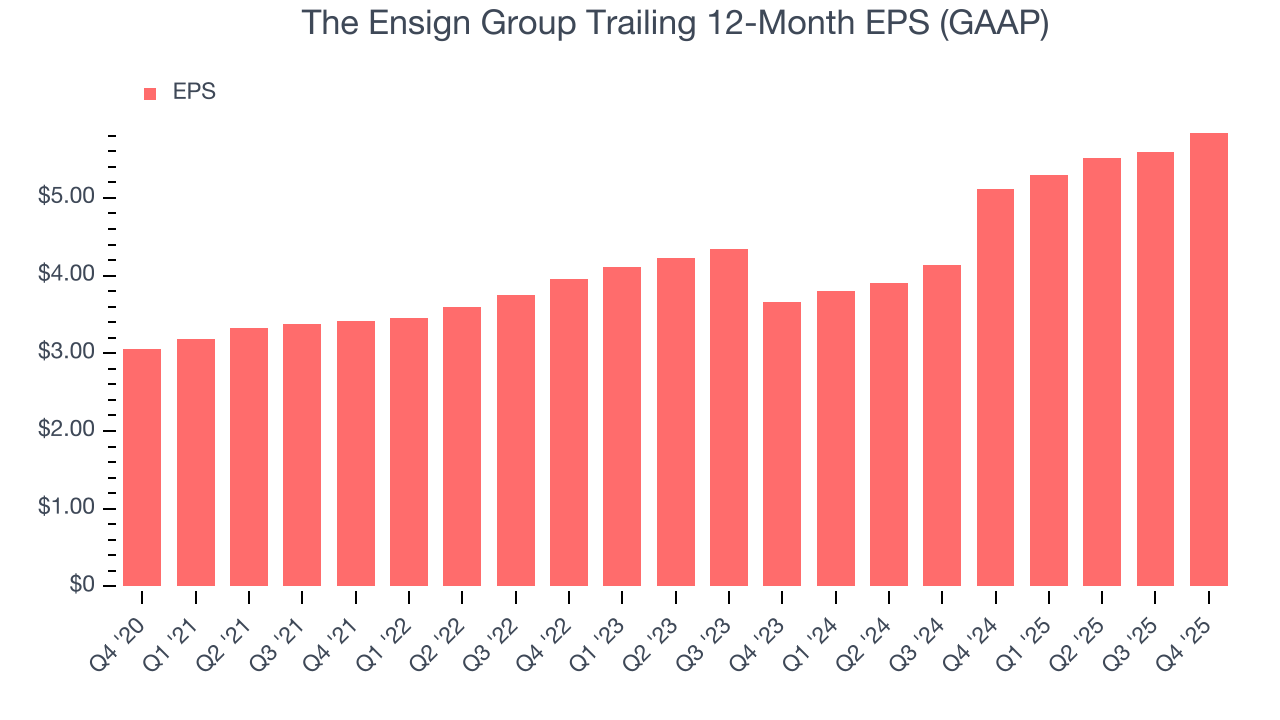

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

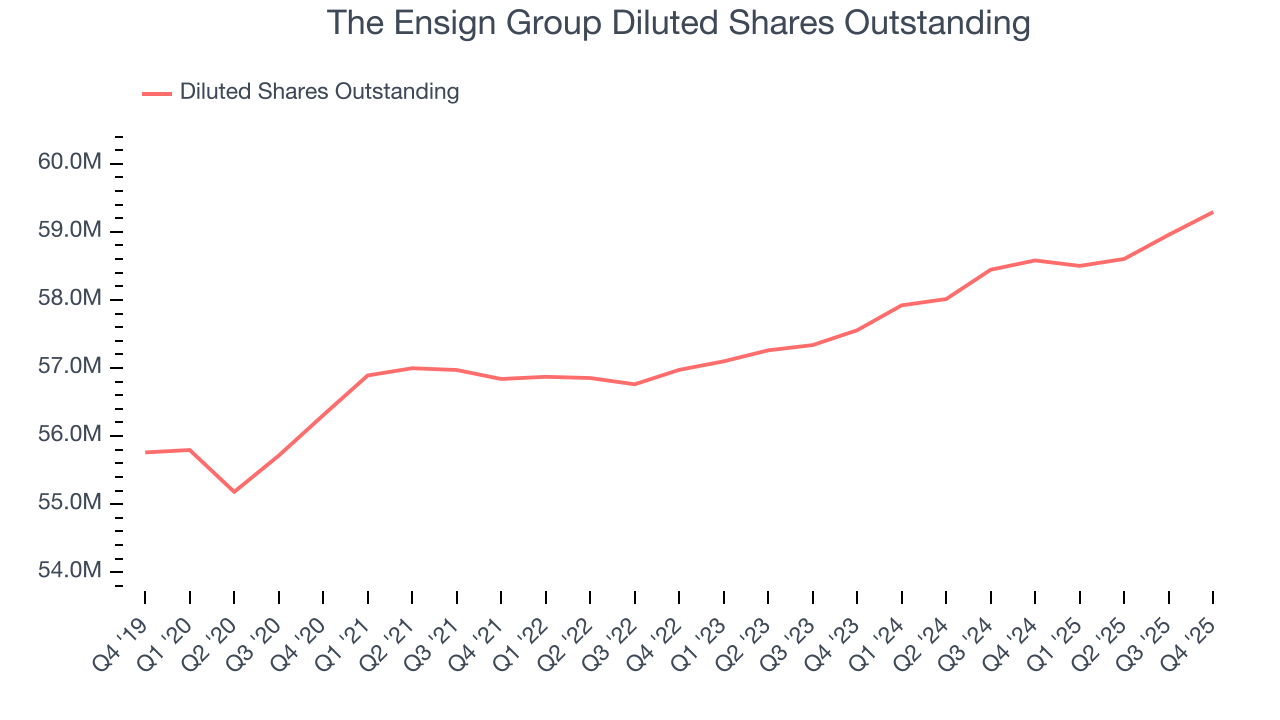

The Ensign Group’s EPS grew at a spectacular 13.9% compounded annual growth rate over the last five years. However, this performance was lower than its 16.8% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into The Ensign Group’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, The Ensign Group’s operating margin was flat this quarter but declined by 1.7 percentage points over the last five years. Its share count also grew by 5.3%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, The Ensign Group reported EPS of $1.61, up from $1.36 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects The Ensign Group’s full-year EPS of $5.84 to grow 17.5%.

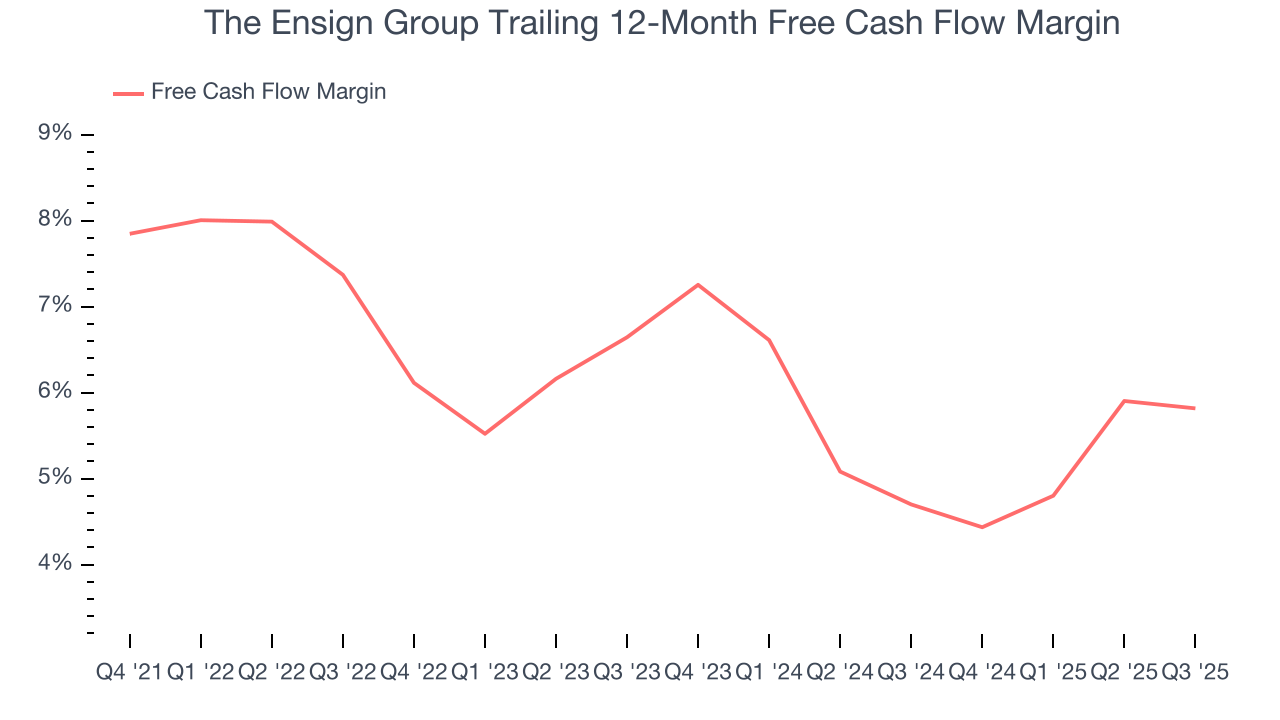

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

The Ensign Group has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.2% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that The Ensign Group’s margin dropped by 1.8 percentage points during that time. We’re willing to live with its performance for now but hope its cash conversion can rise soon. Continued declines could signal it is in the middle of an investment cycle.

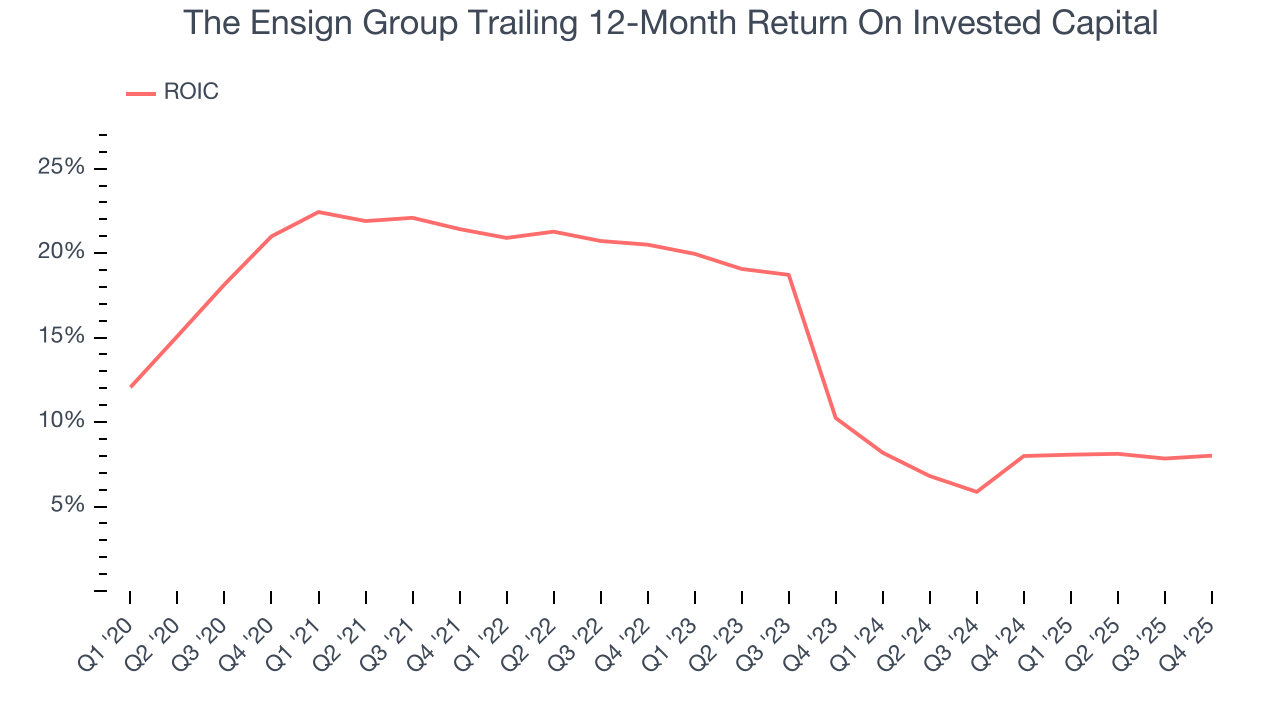

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

The Ensign Group’s five-year average ROIC was 13.6%, higher than most healthcare businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, The Ensign Group’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

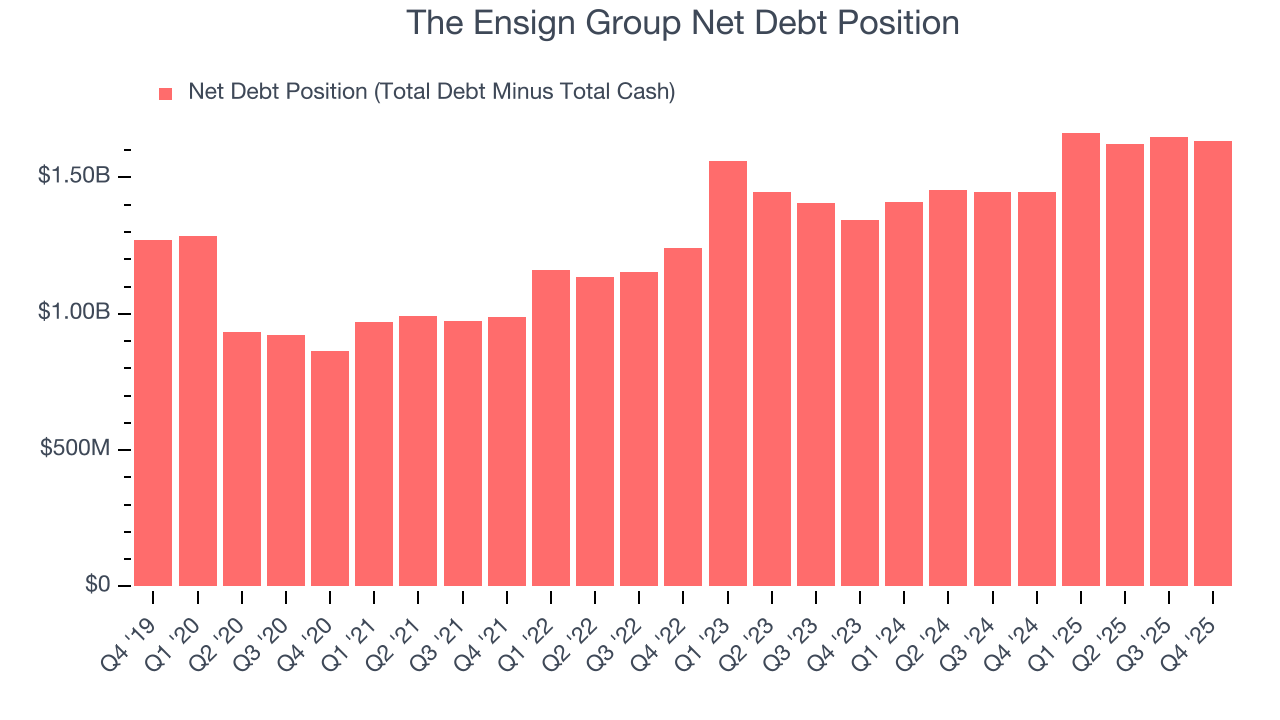

The Ensign Group reported $572.4 million of cash and $2.21 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $602.4 million of EBITDA over the last 12 months, we view The Ensign Group’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $7.99 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from The Ensign Group’s Q4 Results

We were impressed by how significantly The Ensign Group blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $173.19 immediately following the results.

13. Is Now The Time To Buy The Ensign Group?

Updated: February 4, 2026 at 10:47 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in The Ensign Group.

We think The Ensign Group is a solid business. First off, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its diminishing returns show management's recent bets still have yet to bear fruit, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its growth in unit sales was splendid.

The Ensign Group’s P/E ratio based on the next 12 months is 23.4x. When scanning the healthcare space, The Ensign Group trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $208.20 on the company (compared to the current share price of $173.19), implying they see 20.2% upside in buying The Ensign Group in the short term.